2.2. The Modified Monti-Klein

The original Monti-Klein model as described by

Freixas and Rochet (

2008) is a constrained optimisation problem in which a monopolistic bank maximises its end of period net value by selecting the appropriate level of equity to raise as well as the rates it offers to depositors and prospective debtors. The main modification we make concerns how to calculate the bank’s rates which are different from conventional interest rates of deposits and loans. First, we take a look at the Islamic bank’s balance sheet. Originally, its exact composition varies depending on a particular bank’s business and market orientation. The funding structure of a bank directly affects its cost of operation and therefore determines a bank’s potential profit and level of risk.

Harahap and Yusuf (

2010) adds a third source of financing, a pool of funds for unrestricted investment, as it has features to distinguish it from conventional debt-based and equity-based financing. Specifically, it is a pool of funds raised through a

Mudarabah Mutlaqah arrangement which basically makes it a dedicated investment account to be used at the bank’s discretion. The accounting equation is therefore now expressed as:

Next, the model of an Islamic bank balance sheet is constructed based on

Muljono (

2015) and

Sumarti (

2019), which is shown in

Table 1. Let

D be the size of the Islamic bank’s total pool of funds, which is called Funding. As per regulations, a part of it is deposited into a reserve fund

R while the rest

L is used to finance projects such that:

We shall refer to

L as the financing funds; the term “financing” is used instead of “investment”. Islamic banks also offer simple zero-interest loans referred to as

Qard, which is only used as a supplement of investment funds without generating any profit. Regulations also require a portion of the reserve funds

S must be held by the central bank and the remaining amount

M as the net position in the interbank market due to some fund placement and liabilities in other banks. We therefore have:

In accordance with the Monti-Klein model, funds (1) and (2) have associated returns and costs of financing. We introduce a cost function

C(

D,

L) which represents a general cost of raising funds and putting them to use. This results in the following equation for a bank’s end of period net value, modified to reflect the circumstances of an Islamic bank:

where

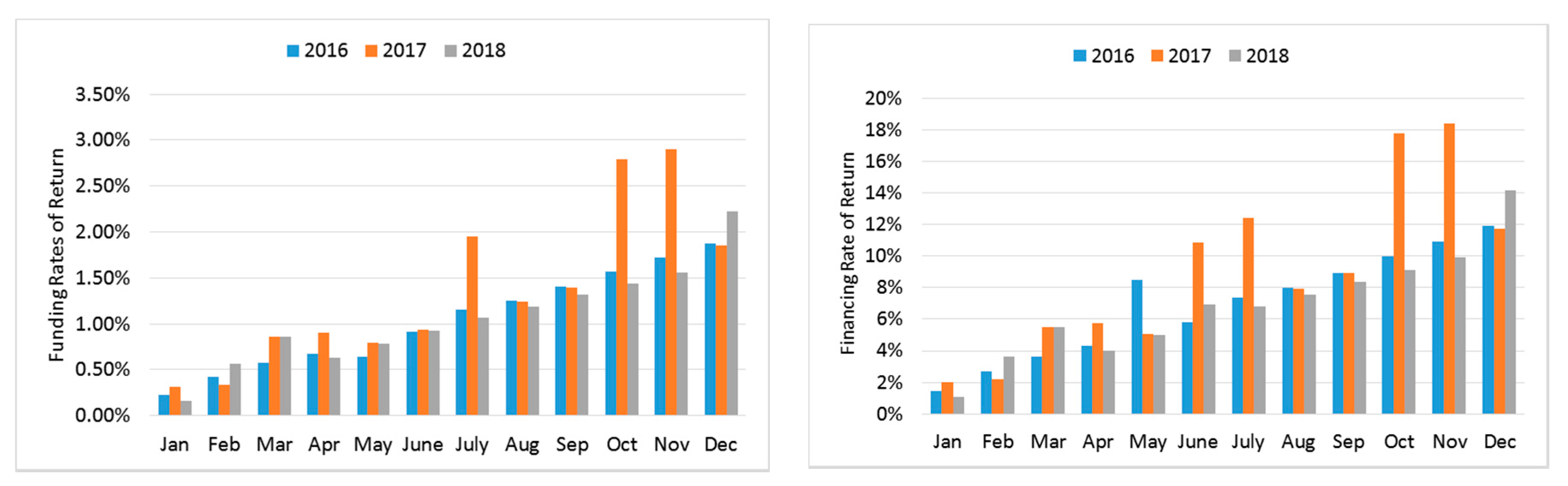

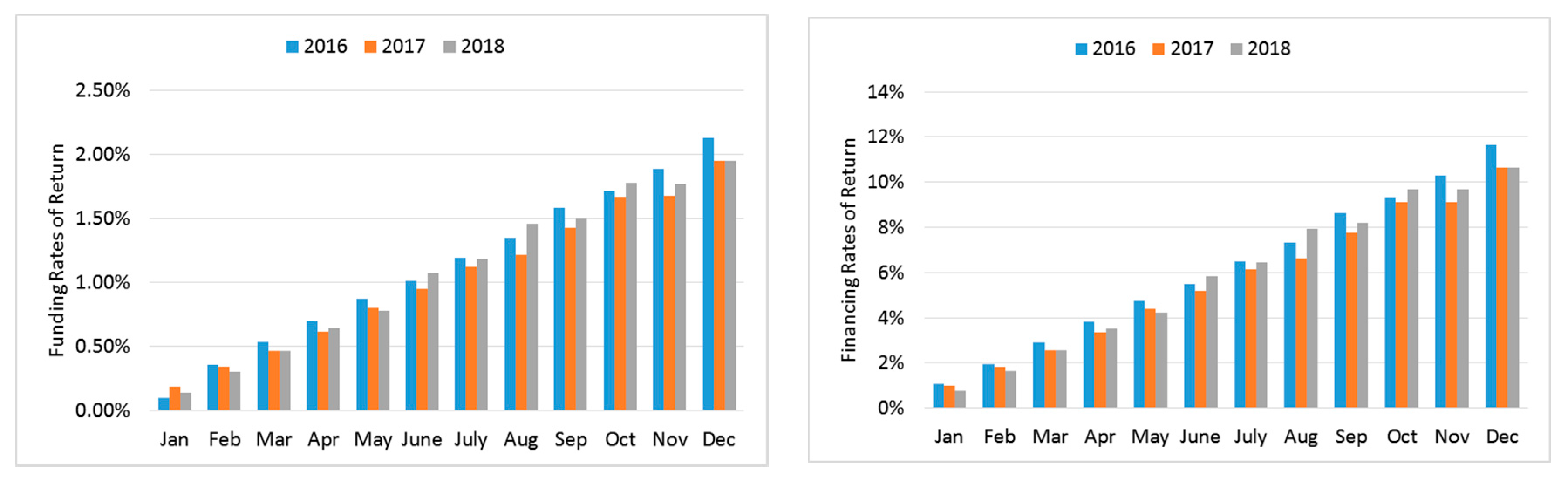

reflects the rate of the interbank market, and equivalent rates of returns for funding

and financing

will be formulated in Equations (9) and (12).

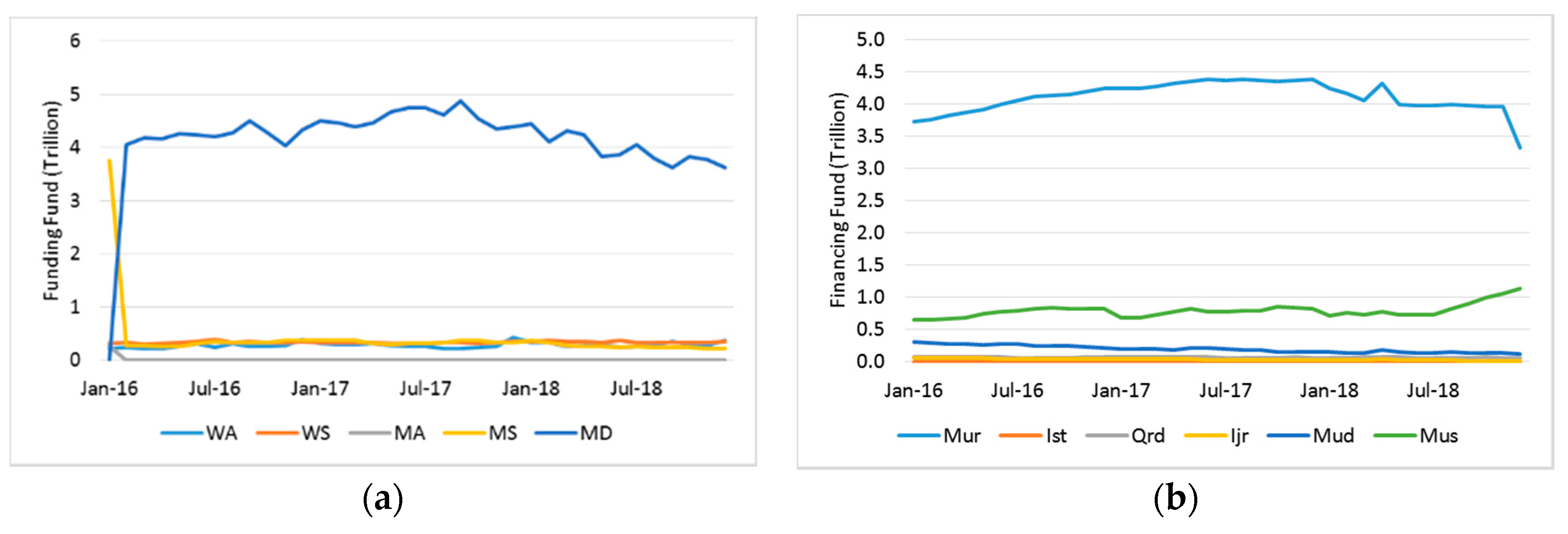

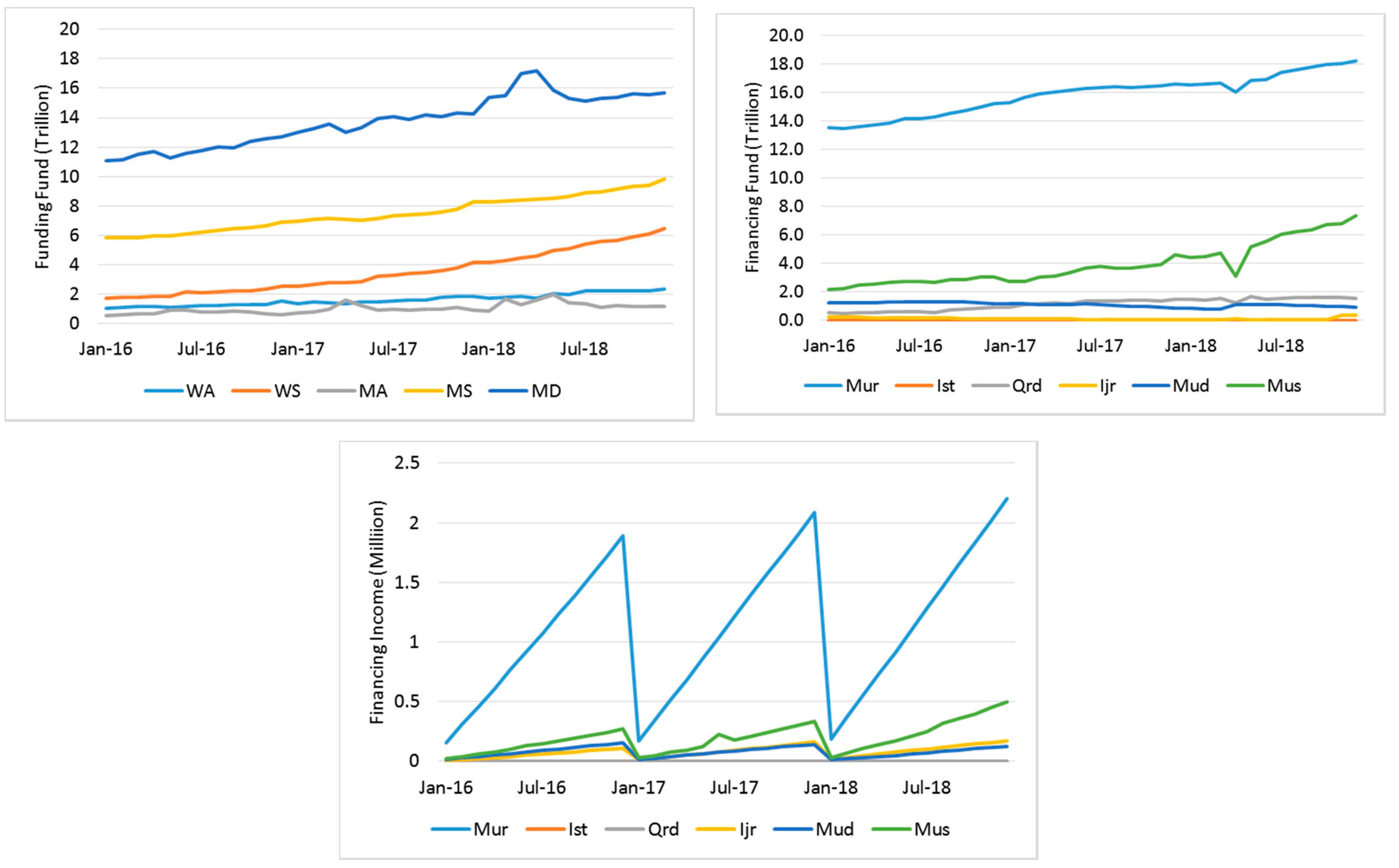

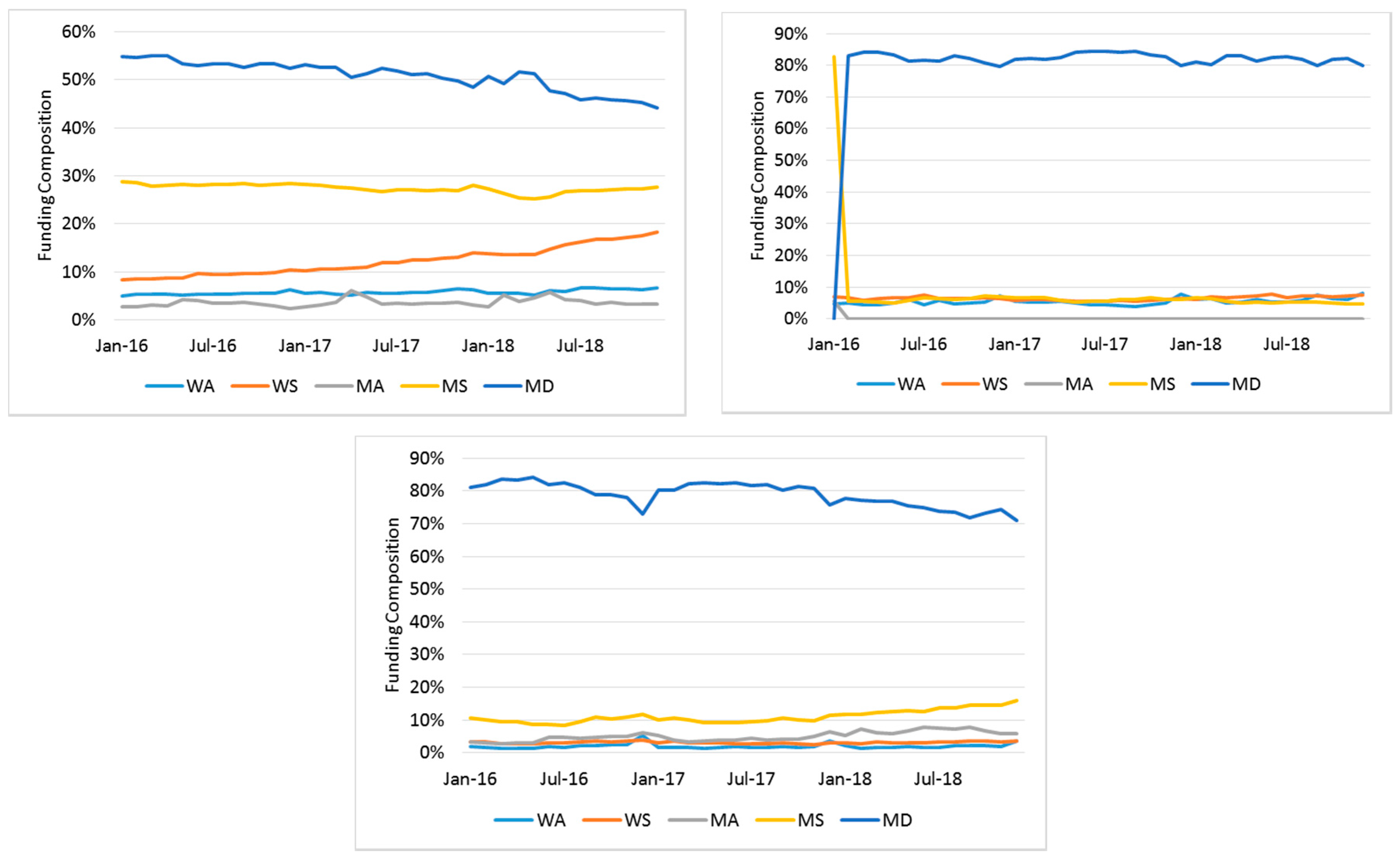

As we have discussed above, Islamic banks can raise funds through various financial contracts. In practice, the main modes of fundraising are through

Wadiah and

Mudarabah contracts. These collectively come in five different categories:

Wadiah savings (

),

Wadiah accounts (

),

Mudarabah savings (

),

Mudarabah accounts (

) and

Mudarabah certificate of deposit (

). Note that

Wadiah are pure deposit contracts which cannot be utilized for financing without permission from the owner. There is no permission in

and there exists one in

, but the return of financing in

is usually in a form of uncertain bonuses, which is not discussed here. Therefore, we define the following:

In relation to the requirement that a portion of

D must be held in reserve,

Table 2 demonstrates the portions of the constituents of

D that are generally available for financing based on

Sumarti (

2019). For example, the weighted amount of

Mudarabah savings that can be used as financing fund is 90%

. We denote

to be the portion of a given

that may be used for financing.

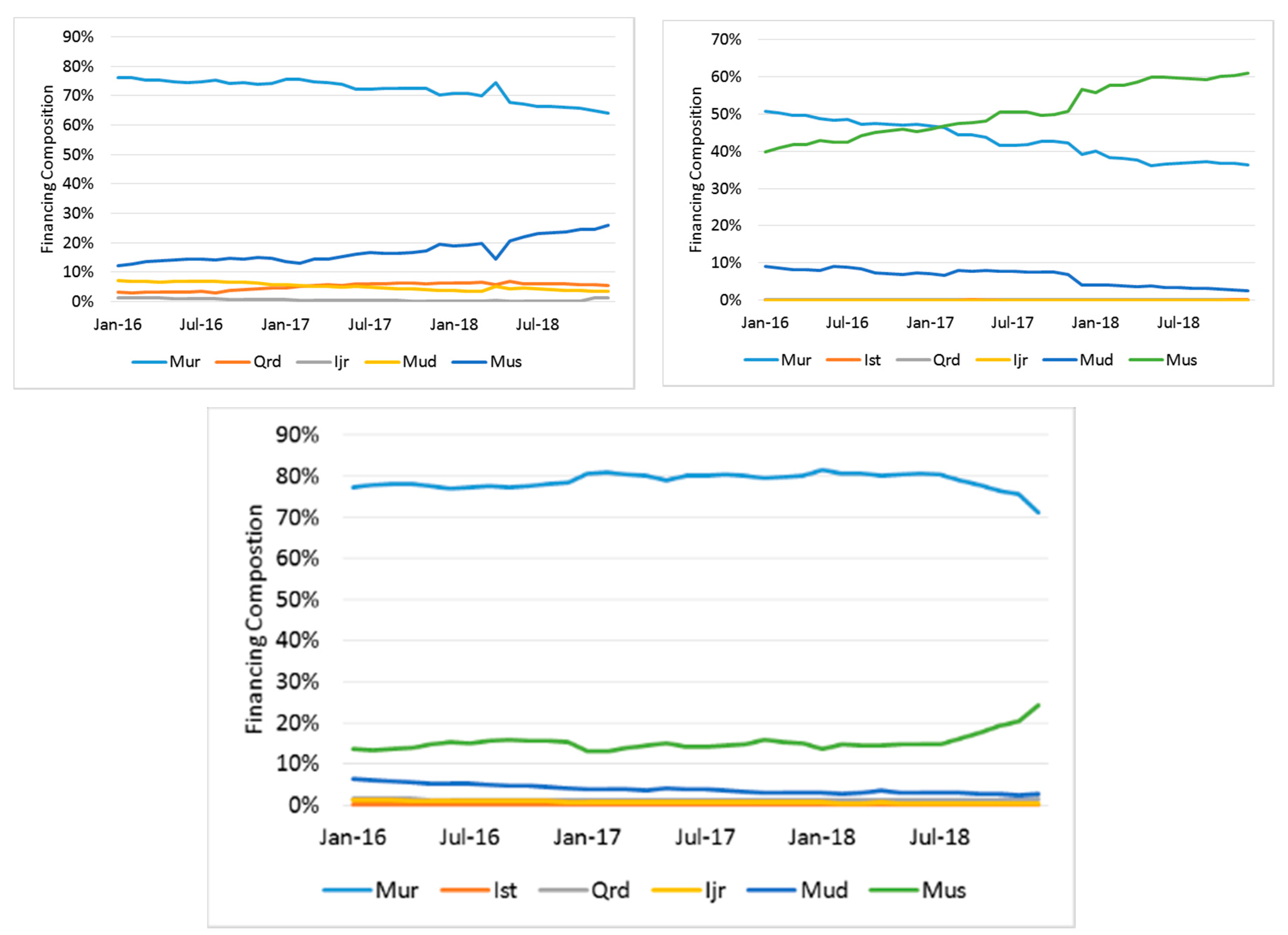

The financing fund

L is allocated to the following contracts:

Murabahah (

),

Istisna (

),

Qard (

),

Ijarah (

),

Mudarabah (

) and

Musharakah (

) contracts. There is also a defined

ε which accounts for any discrepancies between the total amount available for financing

and the total value of the financing funds

. The financing fund L can be written as follows

The weighted deposit

is supposed to be entirely distributed into financing fund

. This can be true if

, which is not always happening. We define

to be the real amount of funding being distributed to the financing

, which can be written as follows:

We consider two possibilities on the discrepancy between two funds,

and

.

This means there is a remaining fund from the weighted deposit that is not applied to the financing fund. We assume this remaining fund is used in another project

ε(

t), so

Consequently, we observe that the financing fund is all sourced from the weighted deposit.

The weighted deposit is not enough to finance all financing fund and consequently . We assume the weighted D is distributed evenly on all financing fund . Financing fund which is not sourced from the weighted deposit is obtained from the bank’s other source not considered in this research.

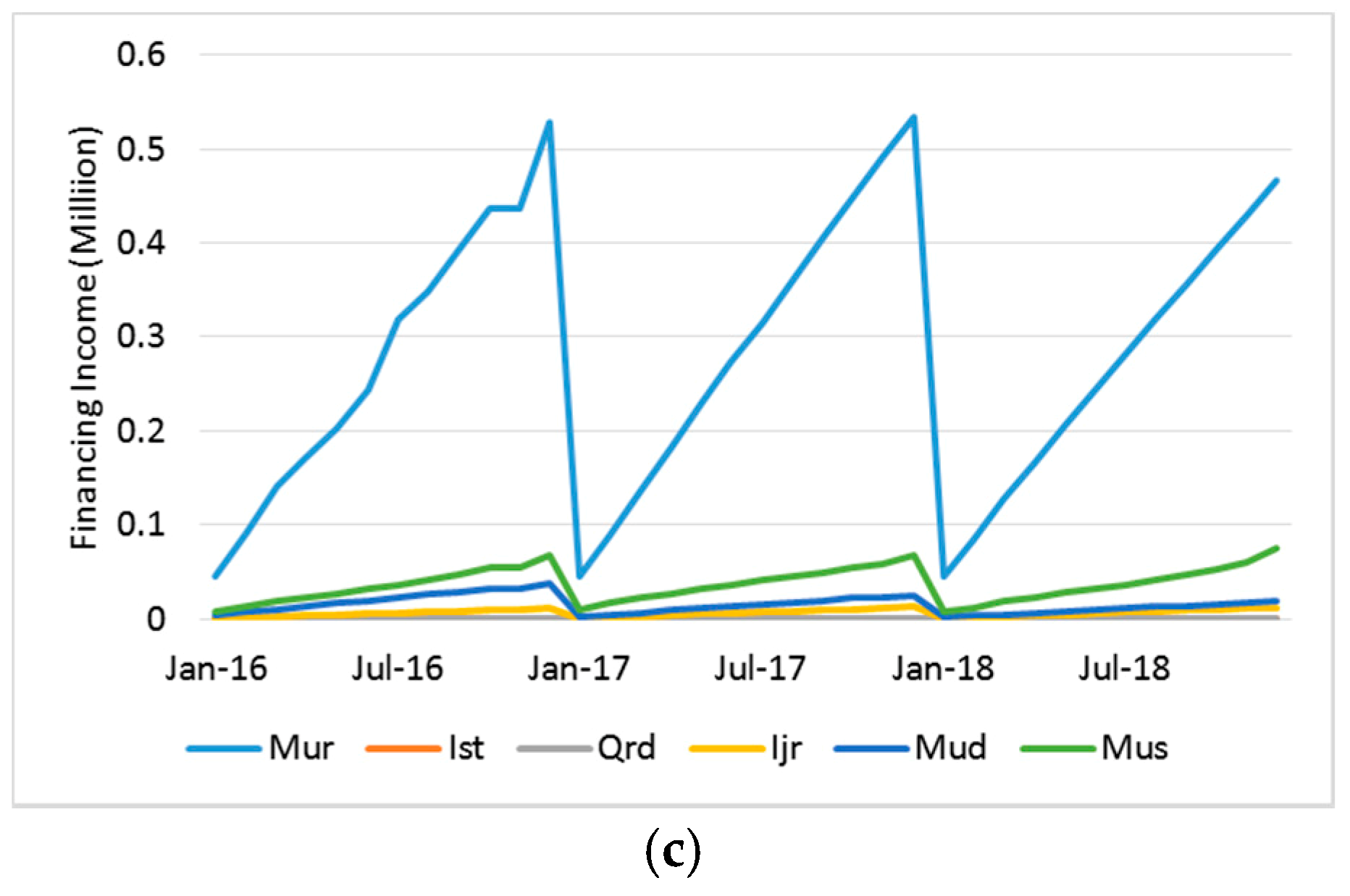

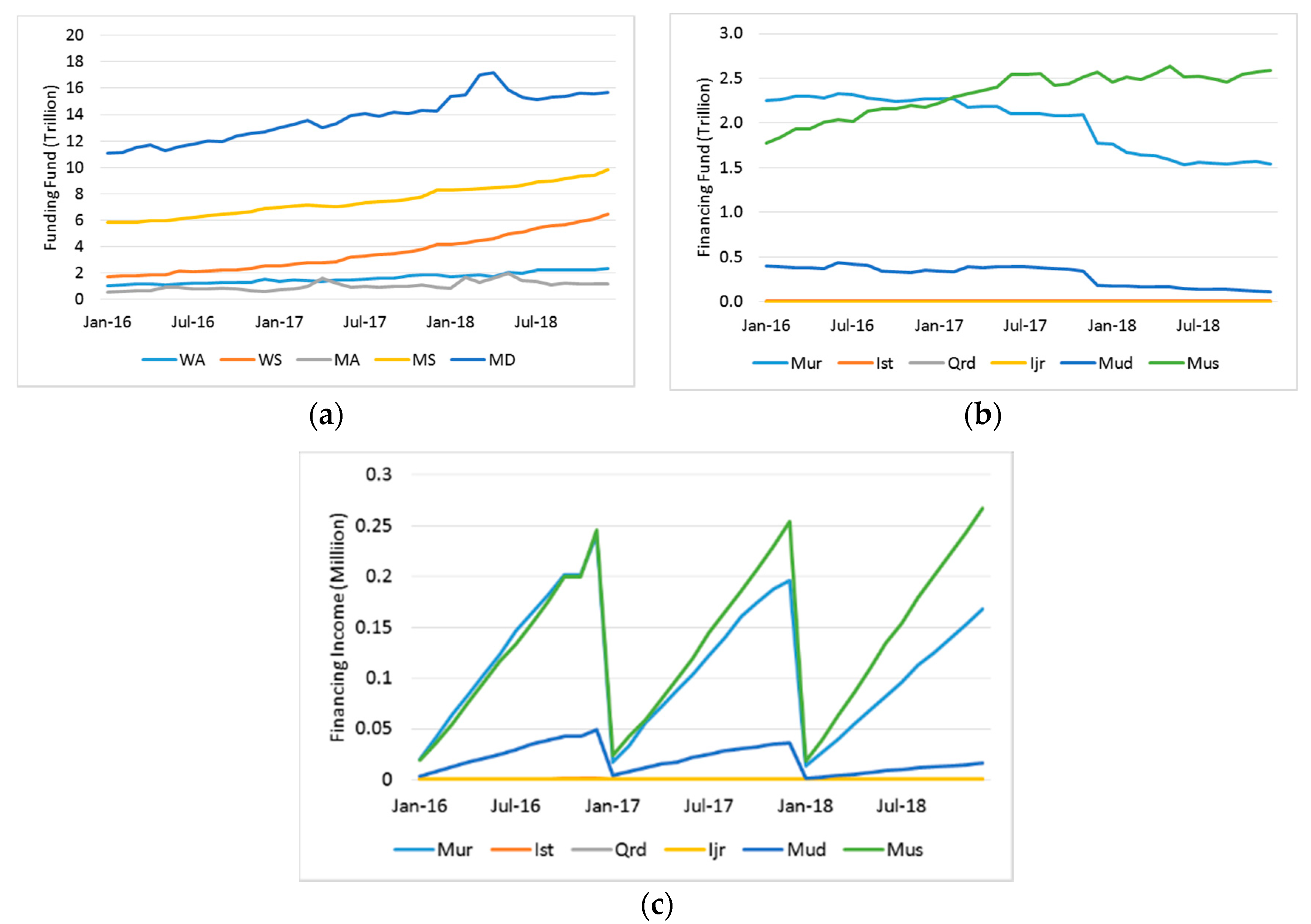

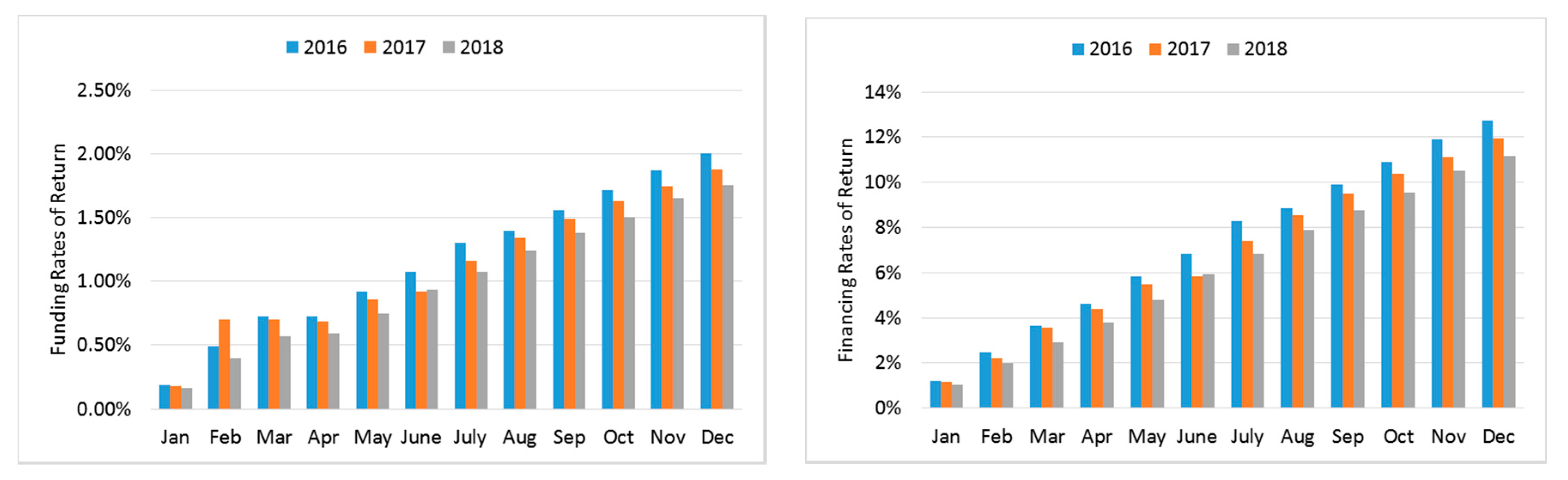

The equations being constructed above define a given Islamic bank’s financing and funding funds and their financial constraints in accordance with the original Monti-Klein model. To complete the setup, we formulate the equivalent rates of return for all of the bank’s associated financial contracts. As explained before, Islamic banks obtain their income by participating in profitable projects. It requires data of financing income from the monthly income statement and other comprehensive income reported in the balance sheet. Let

be income at time-

t from

j-th contract in financing fund. For example,

is the total income shared from the entrepreneurs in the Mudarabah contract at time-

t. This shared income is distributed to all depositors in the funding funds in a certain proportion, which is defined as follows:

where

is the profit share from financing fund

,

For case 1 above,

. The equivalent rate of return

for the financing fund

is simply defined as follows,

Profit shared

will be distributed to the depositors for each funding fund and to the bank itself based on the profit shared proportion (

nisbah). The gross profit share for

i-th funding contract is defined as follows, for

The share proportion (

nisbah) might be varied among Islamic banks. We used

nisbah guidelines set by the Indonesian central bank, Bank Indonesia (BI), which is shown in

Table 3. Here we assume the bonus for

Wadiah contract is available and constant. Note that theoretically, the bonus is fluctuated depending on each bank policy.

The net profit share for the depositors of

i-th funding fund

is defined as follows

Here

is the

nisbah for

i-th contract. Consequently, the net profit share for the bank is

. The equivalent rate

is simply defined as the average of the rates of return of all deposits.

In Equation (12) above, the net profit is divided by the deposit, not the weighted deposit, because the rate should be calculated with respect to the real amount written in depositors’ account balance.

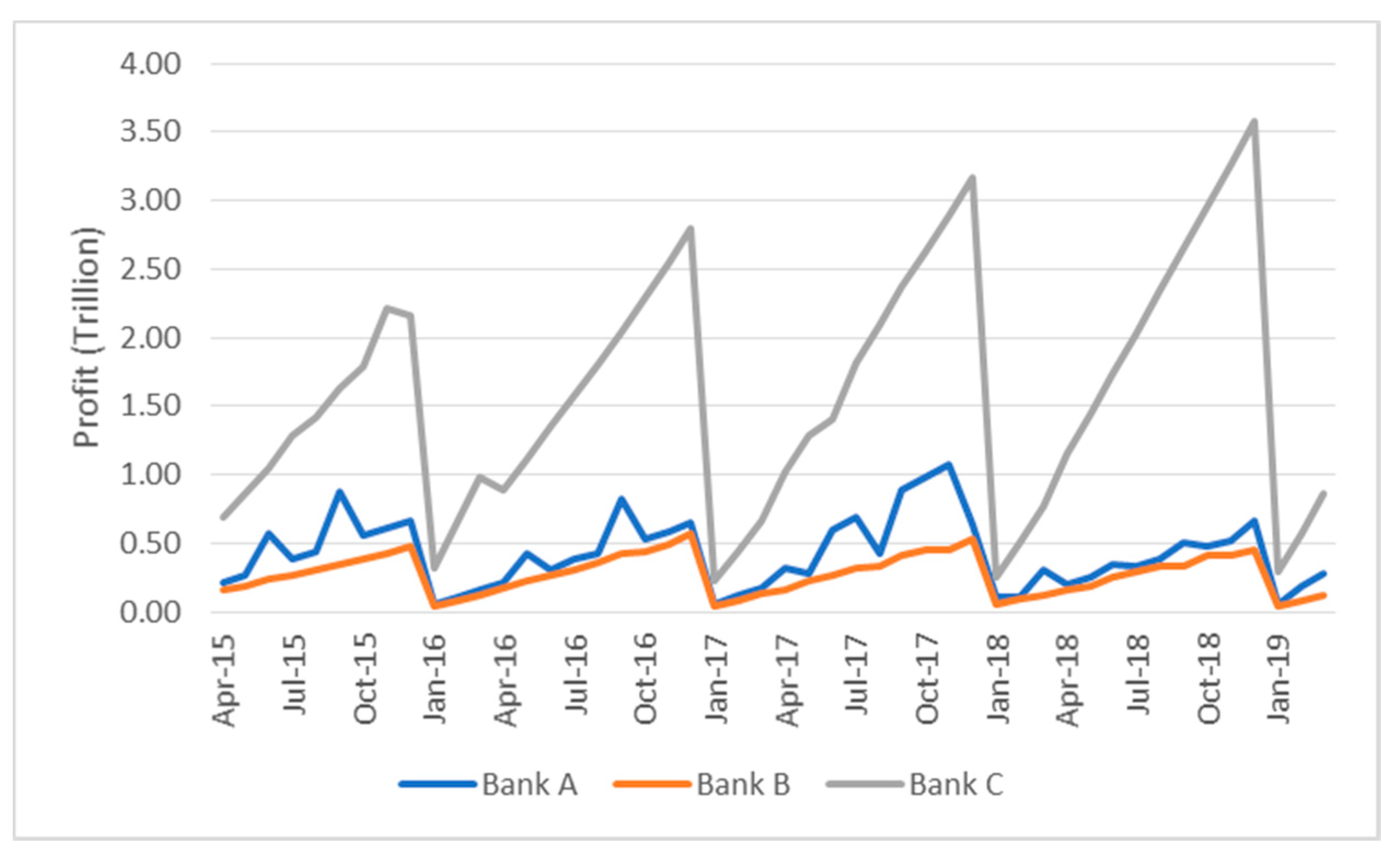

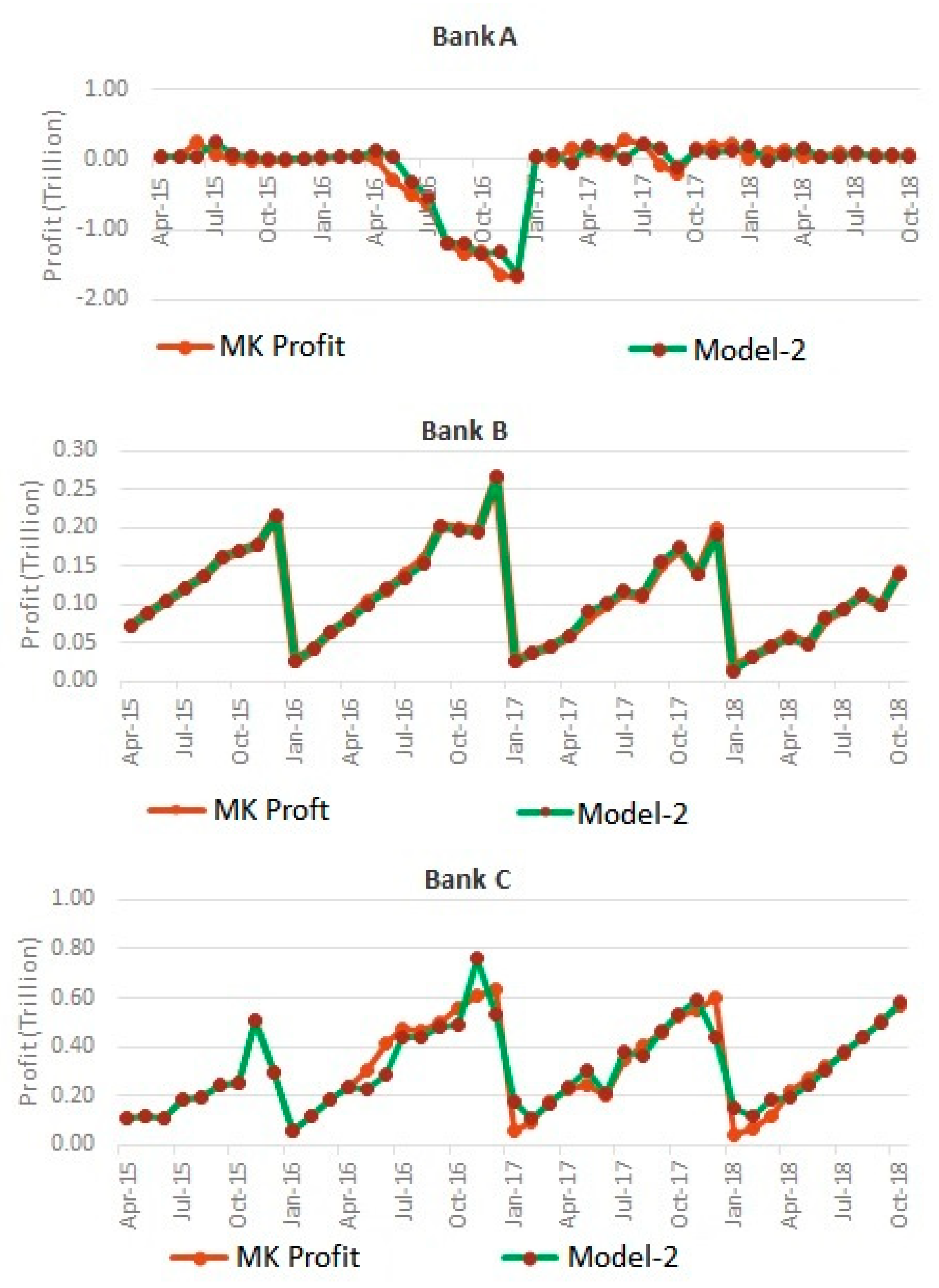

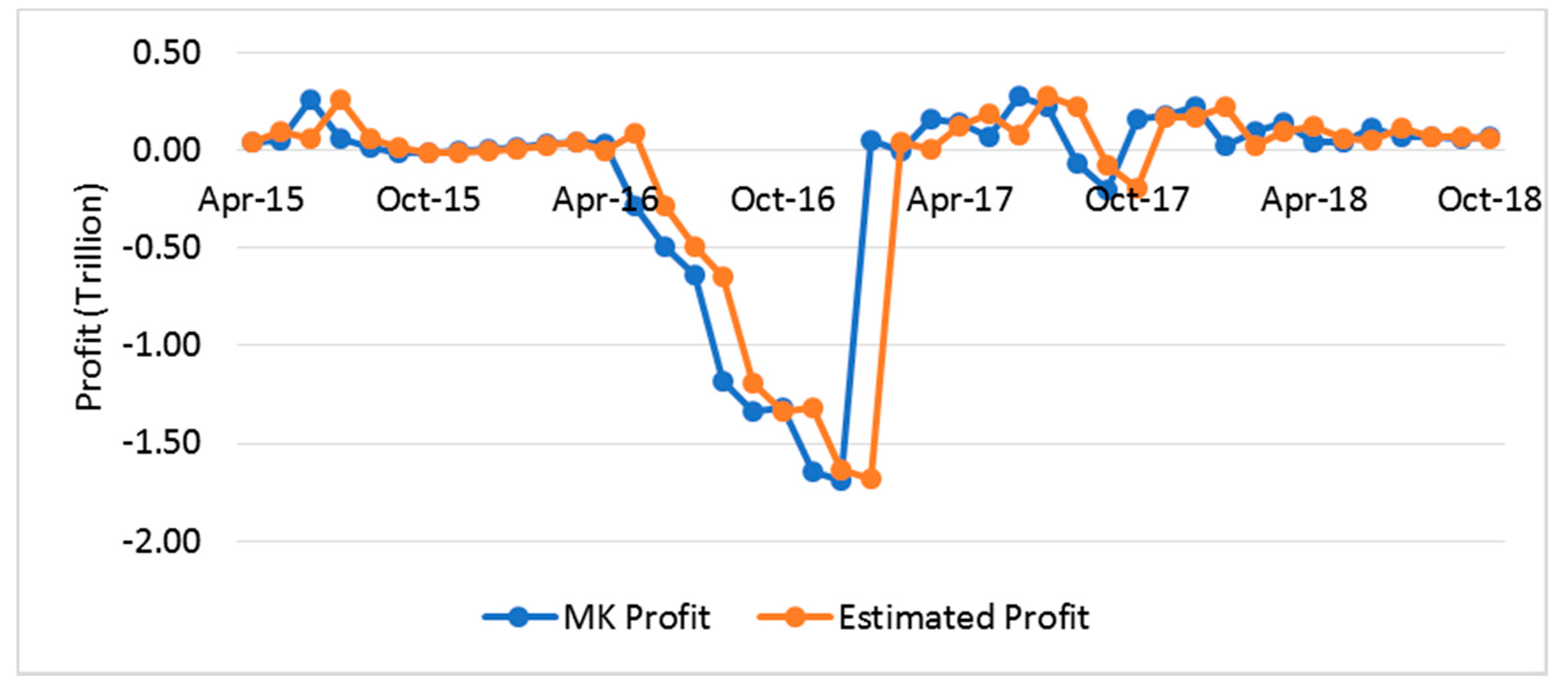

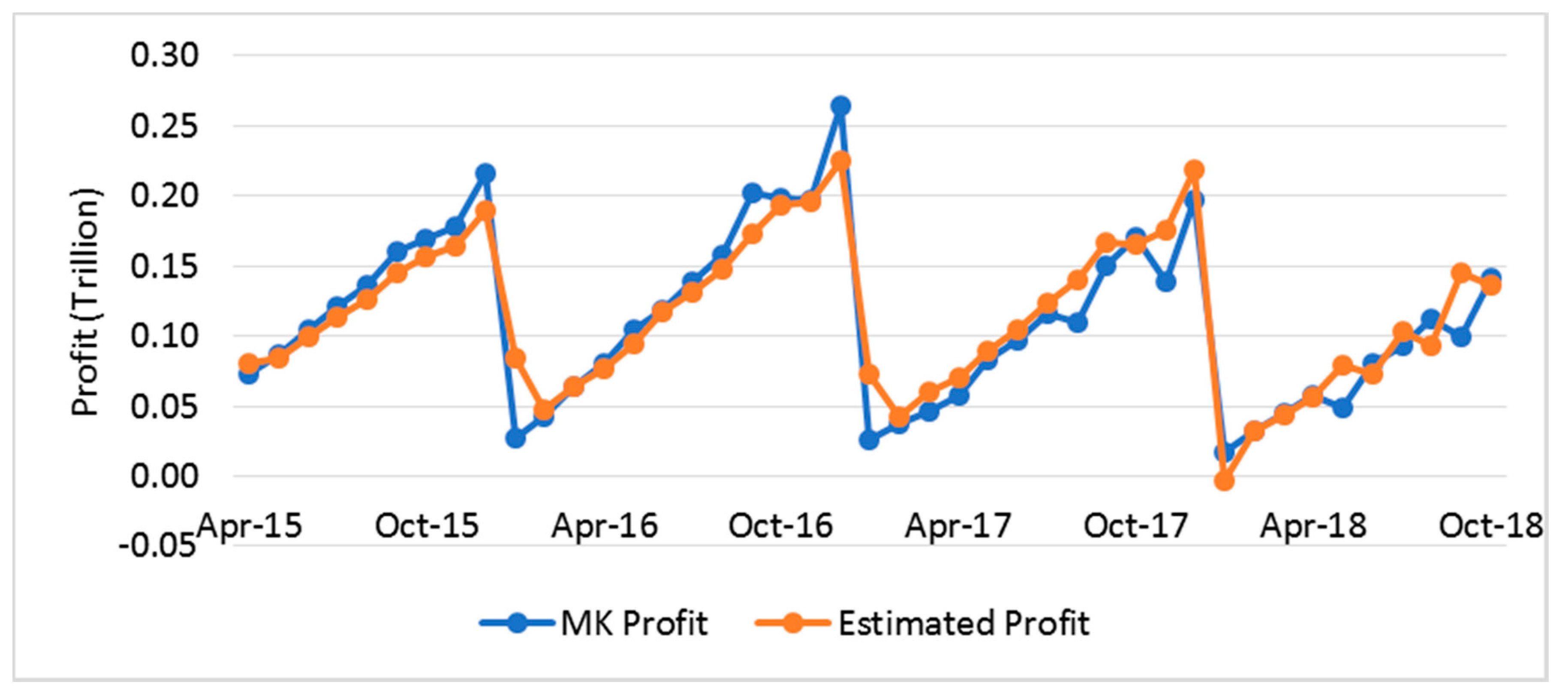

Now we calculate the bank’s profit or loss using Monti Klein model as in the Equation (3), which can be expressed as

where

is total funding fund distributed to the financing fund. Rate

r is the equivalent rate of return from the interbank market. We assume its value is the same as Central Bank’s monthly interest rate. The term is the total fund borrowed by the bank at the time

t, and its value is collected from the balance sheet. The variable

S(

t) is the cash reserves, which in this case is securities owned by the bank at the time

t.

is total financing fund borrowed by other banks at time

t. Management cost

is taken from the reported profit and loss statement and other comprehensive incomes in the monthly report.

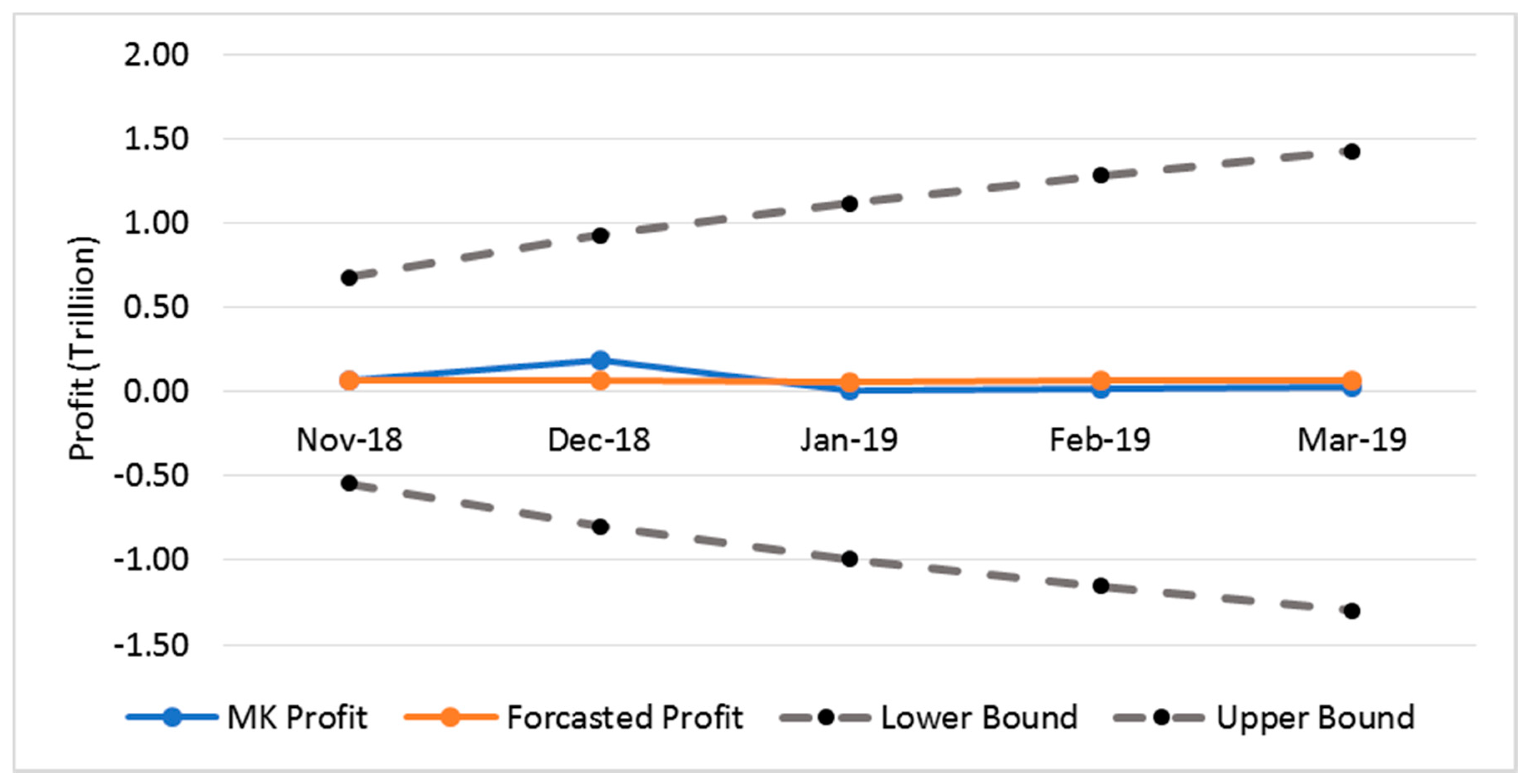

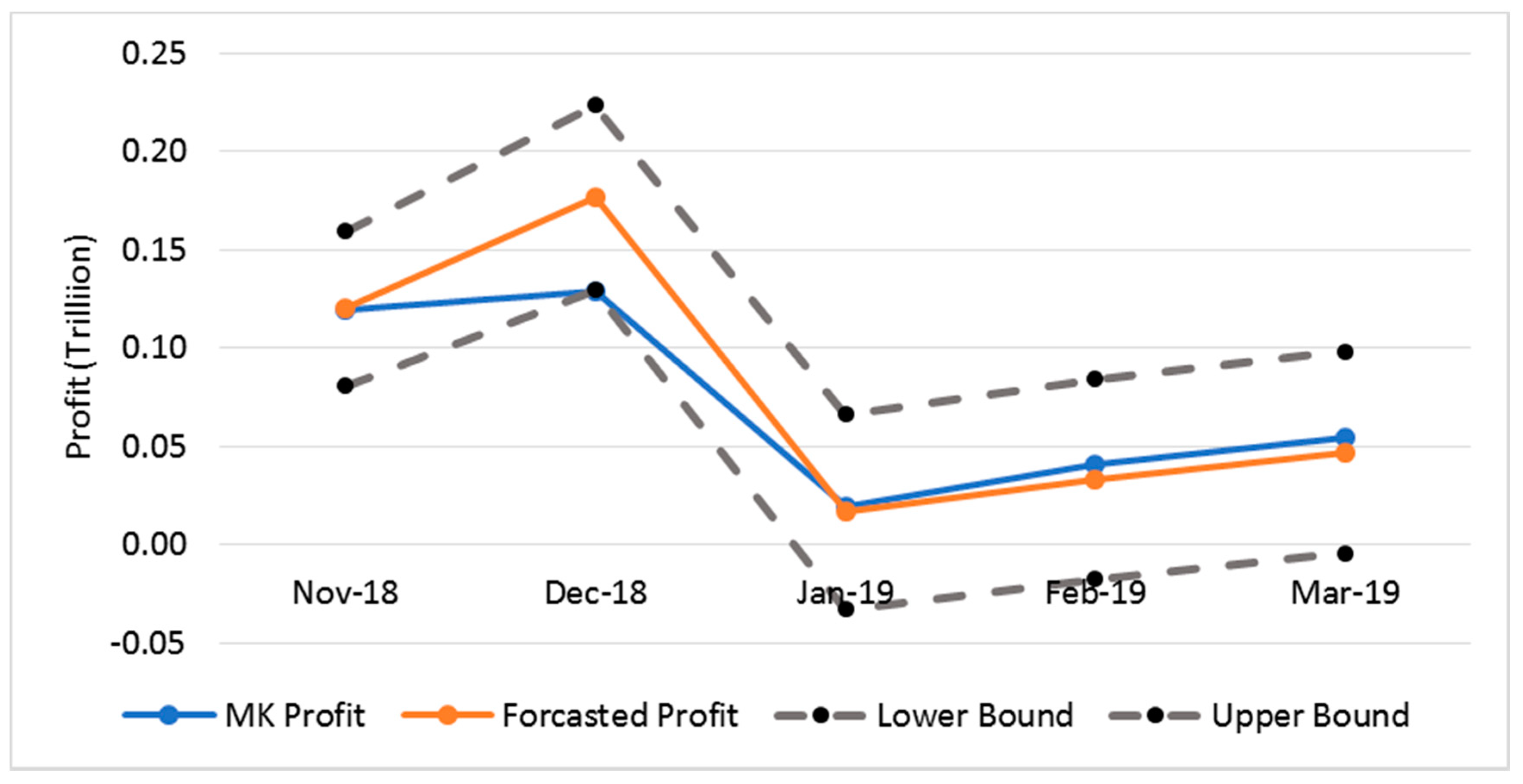

2.3. Regression Model

Having constructed formulae for a given Islamic bank’s size of funding, financial assets, associated rates of return and profit, we use the resulting data to estimate ARIMA models for selected Islamic banks. The model finds a causal relationship between a variable of response (dependent) and a predictor variable (independent). The causal relationship is demonstrated by the correlation values describing the linear relationship between two random variables where the value is between −1 and 1. Detailed explanation on time series models can be found in

Wei (

2006);

Ruppert (

2010) and

Cryer and Chan (

2018). If the regression equation with one independent variable involves a

p-order autoregressive error structure (AR), meaning

p times differencing process, the equation will be the form of

where

is a constant parameter,

are parameters respectively related to the response variable at time lags

and

are parameters respectively related to the predictor variable at time lags

. For example, ARIMA (1,1,0) has the equation with the form of

The data also strongly suggests that there are seasonal effects, which makes it more appropriate to use a more generalised form of the ARIMA model. This form combines seasonal factors in a multiplicative and is denoted as ARIMA

where nonseasonal parameters

are respectively the order of AR, differencing process and MA, and parameters

are respectively their related seasonal parameters;

is the number of time lags until the pattern repeats itself. For example, a yearly pattern data with ARIMA

without a predictor variable has the equation with the form of

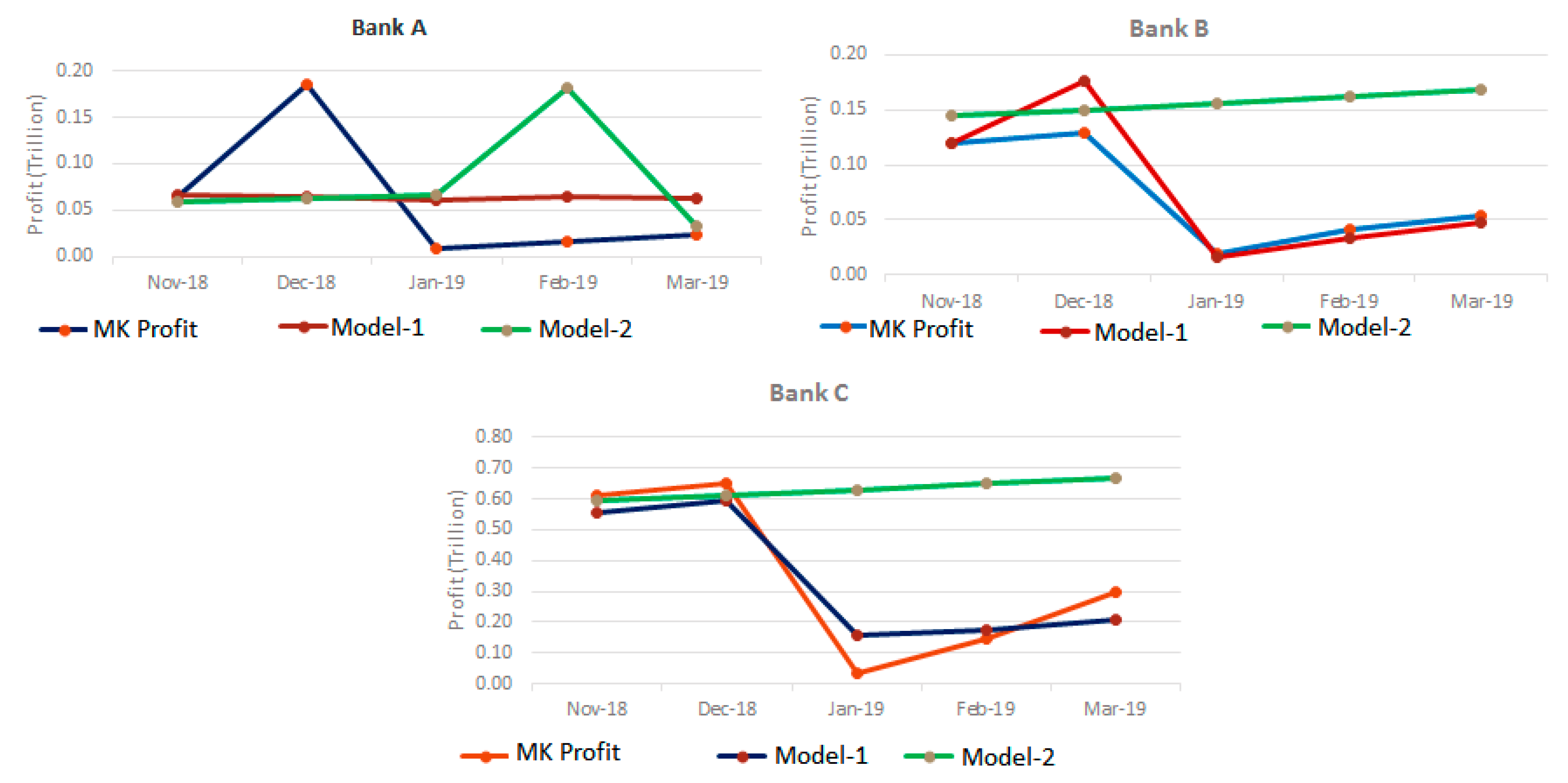

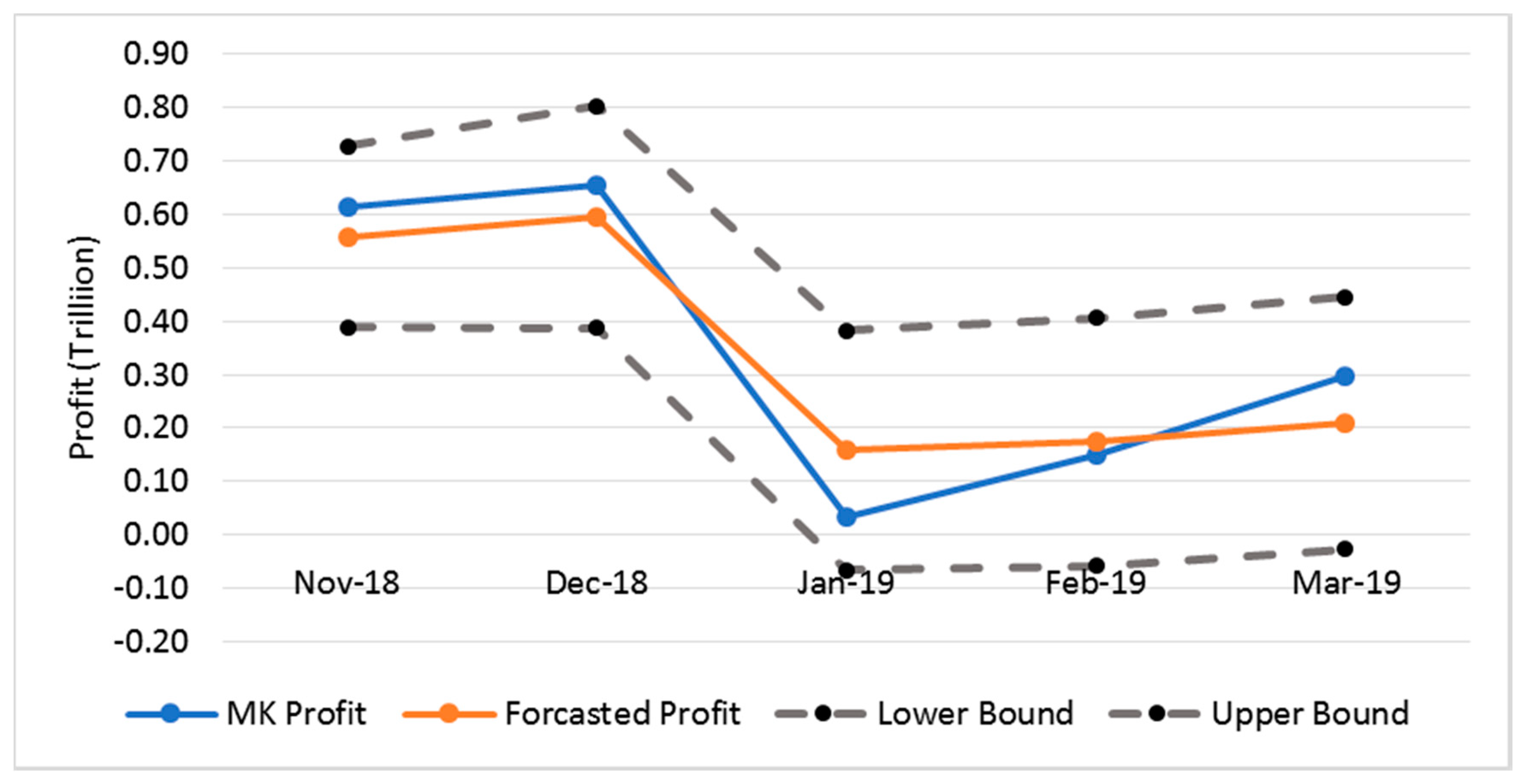

In the implementation, the formulae and statistical models are used for forecasting. To this end, we use the first 43 months as training data and the remaining 5 months as validating data. Lastly, there is the issue of controlling for bank and/or asset size. The Indonesian central bank has established the Bank Umum Kelompok Usaha or Commercial Bank Group (BUKU) classification (to be elaborated upon in

Section 3) for banks based on the size of their primary equity. More specifically, our sample comes from selecting a bank from each of the three (out of four) classification tiers. We then apply our tools of analysis to each in separation and compare the results. We consider ourselves justified in this approach as our main goal is to construct measures of performance that can better accommodate the idiosyncrasies of Islamic banks.