The Effect and Impact of Signals on Investing Decisions in Reward-Based Crowdfunding: A Comparative Study of China and the United Kingdom

Abstract

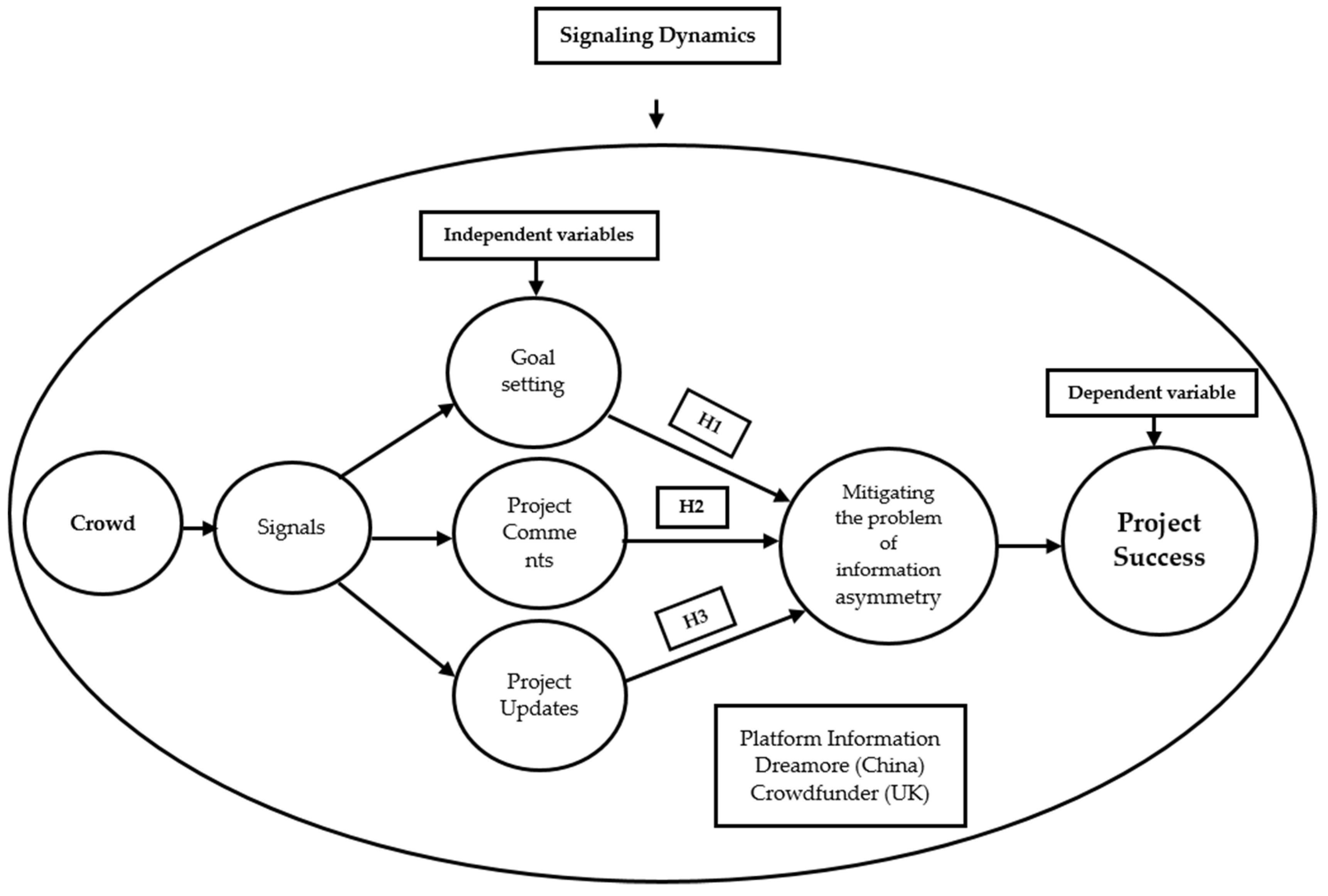

:1. Introduction

- A large number of online users (FSDC 2016). In 2018, the Chinese market had around 1.12 million mobile subscribers, together with 751 million internet users. At the same time, this great market also had 911 million social media mobile users, the majority of which are users who have used and which have possessed digital currency (Huang et al. 2018).

- The effects that the 2008 financial crisis has had on the world economy, including the Chinese market.

- Initiation/creation and launch of a large number of social media platforms through constant technological development.

2. Literature and Hypothesis Development

2.1. Cultural Differences Between China and UK

2.2. Online Alternative-Financing Market Dynamics between China and UK

2.3. Hypotheses Development

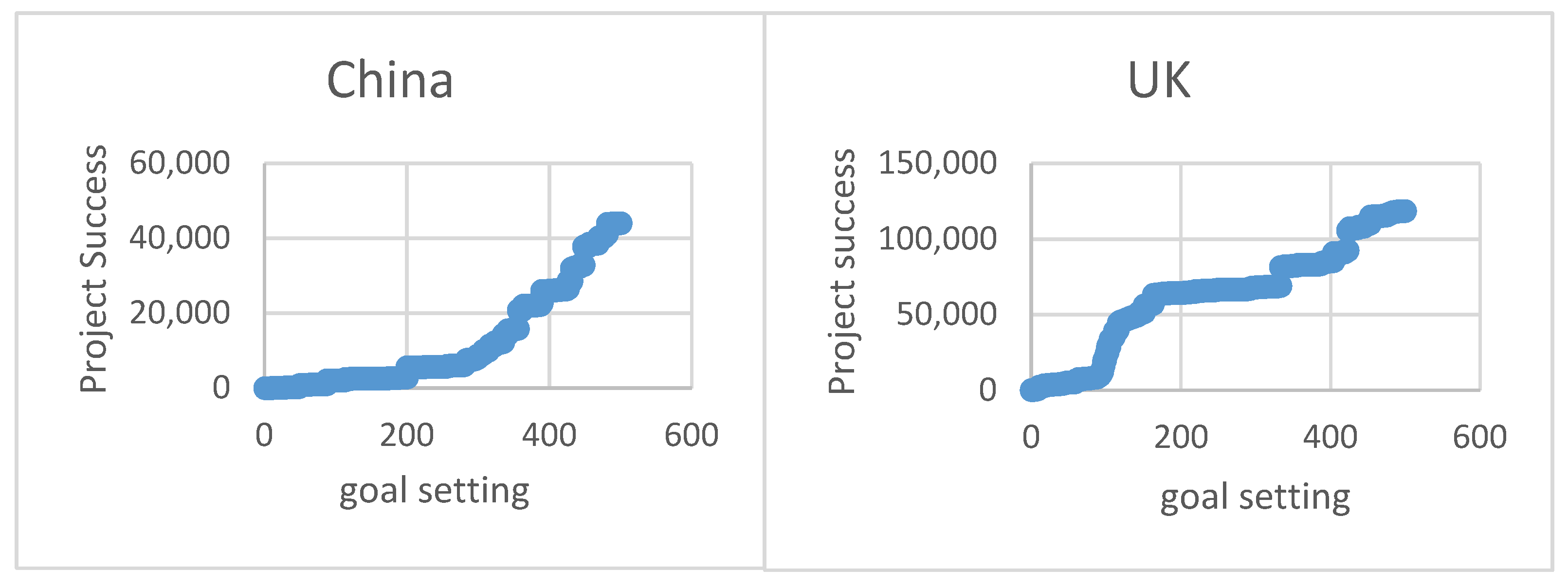

2.3.1. Goal Setting

2.3.2. Project Comments

2.3.3. Project Updates

3. Methods and Data

3.1. Measures

3.1.1. Dependent Variables

3.1.2. Independent Variables

3.1.3. Control Variables

3.2. Data Collection

3.3. Methods

4. Data Analysis and Results

4.1. Descriptive Statistics

4.2. Multivariate Analysis

4.3. Robustness Check

5. Discussion and Conclusions

5.1. Theoretical and Practical Implications

5.2. Limitations and Future Research

Author Contributions

Funding

Conflicts of Interest

References

- Abraham, Facundo, and Sergio L. Schmukler. 2017. Addressing the SME Finance Problem. Research & Policy Briefs 9: 1–4. Available online: http://documents.worldbank.org/curated/en/809191507620842321/pdf/120333-RPB-No9-Addressing-the-SME-Finance-Problem.pdf (accessed on 1 August 2020).

- Ahlers, Gerrit K. C., Douglas Cumming, Christina Günther, and Denis Schweizer. 2015. Signaling in Equity Crowdfunding. Entrepreneurship: Theory and Practice 39: 955–80. [Google Scholar] [CrossRef]

- Amankwah, George, and Harrison Abonge Viyu. 2011. Investigating Environmental, Social and Governance (ESG) Considerations in Venture Capital & Private Equity firms: A Study in US and UK Venture Capital Industry. Available online: http://umu.diva-portal.org/smash/get/diva2:428672/FULLTEXT02.pdf (accessed on 15 August 2020).

- Alfiero, S., C. Casalegno, A. Indelicato, C. Rainero, S. Secinaro, V. Tradori, and F. Venuti. 2014. Communication as the Basis for a Sustainable Crowdfunding: The Italian Case. International Journal of Humanities and Social Science 4: 46–55. Available online: http://www.ijhssnet.com/journals/Vol_4_No_5_1_March_2014/7.pdf (accessed on 18 December 2020).

- Anglin, Aaron H., Jeremy C. Short, Will Drover, Regan M. Stevenson, Aaron F. McKenny, and Thomas H. Allison. 2018. The Power of Positivity? The Influence of Positive Psychological Capital Language on Crowdfunding Performance. Journal of Business Venturing 33: 470–92. [Google Scholar] [CrossRef]

- Antonenko, Pavlo D., Brenda R. Lee, and Amanda Joy Kleinheksel. 2014. Trends in the crowdfunding of educational technology startups. TechTrends 58: 36–41. [Google Scholar] [CrossRef]

- Ashta, Divya. 2018. A Critical Comparative Analysis of the Emerging and Maturing Regulatory Frameworks: Crowdfunding in India, USA, UK. Journal of Innovation Economics 26: 113. [Google Scholar] [CrossRef]

- Baeck, Peter, Liam Collins, and Bryan Zhang. 2014. Understanding Alternative Finance—the UK Alternative Finance Industry Report 2014. Cambridge: University of Cambridge, Available online: https://econpapers.repec.org/bookchap/tkpmklp14/1079-1088.htm (accessed on 10 June 2020).

- Bao, Zheshi, and Taozhen Huang. 2017. External supports in reward-based crowdfunding campaigns: A comparative study focused on cultural and creative projects. Online Information Review 41: 626–42. [Google Scholar] [CrossRef]

- Bargain, Olivier, Jean-Marie Cardebat, and Alexandra Vignolles. 2018. Crowdfunding in the Wine Industry. Journal of Wine Economics 13: 57–82. [Google Scholar] [CrossRef]

- Barnes, Bradley R., Dorothy Yen, and Lianxi Zhou. 2011. Investigating guanxi dimensions and relationship outcomes: Insights from Sino-Anglo business relationships. Industrial Marketing Management 40: 510–21. [Google Scholar] [CrossRef]

- BBC. 2017. Reality Check: Is Britain the Most Global Developed Economy—BBC News. Available online: https://www.bbc.com/news/uk-politics-39121530 (accessed on 11 April 2019).

- Belleflamme, Paul, Thomas Lambert, and Armin Schwienbacher. 2014. Crowdfunding: Tapping the right crowd. Journal of Business Venturing 29: 585–609. [Google Scholar] [CrossRef] [Green Version]

- Block, Jörn, Lars Hornuf, and Alexandra Moritz. 2018. Which updates during an equity crowdfunding campaign increase crowd participation? Small Business Economics 50: 3–27. [Google Scholar] [CrossRef]

- Borst, Irma, Christine Moser, and Julie Ferguson. 2017. From friendfunding to crowdfunding: Relevance of relationships, social media, and platform activities to crowdfunding performance. New Media and Society 20: 1396–414. [Google Scholar] [CrossRef] [Green Version]

- Buchan, Nancy R., Rachel TA Croson, and Robyn M. Dawes. 2002. Swift neighbors and persistent strangers: A cross-cultural investigation of trust and reciprocity in social exchange. American Journal of Sociology 108: 168–206. [Google Scholar] [CrossRef] [Green Version]

- Bukhari, Farasat Ali Shah, Sardar Muhammad Usman, Muhammad Usman, and Khalid Hussain. 2019. The effects of creator credibility and backer endorsement in donation crowdfunding campaigns success. Baltic Journal of Management 15: 215–35. [Google Scholar] [CrossRef]

- Burtch, Gordon, Anindya Ghose, and Sunil Wattal. 2013. An Empirical Examination of the Antecedents and Consequences of Contribution Patterns in Crowd-Funded Markets. Information Systems Research 24: 499–519. [Google Scholar] [CrossRef] [Green Version]

- Buttice, Vincenzo, Massimo G. Colombo, and Mike Wright. 2017. Serial Crowdfunding, Social Capital, and Project Success. Entrepreneurship: Theory and Practice 41: 183–207. [Google Scholar] [CrossRef]

- Chernev, Alexander, Ulf Böckenholt, and Joseph Goodman. 2015. Choice overload: A conceptual review and meta-analysis. Journal of Consumer Psychology 25: 333–58. [Google Scholar] [CrossRef]

- Cho, Moonhee, and Gawon Kim. 2017. A cross-cultural comparative analysis of crowdfunding projects in the United States and South Korea. Computers in Human Behavior 72: 312–20. [Google Scholar] [CrossRef]

- Chu, Duyen Dai. 2017. A Comparative Study on Crowdfunding in the United States and the United Kingdom. Emporium 1: 11–26. [Google Scholar] [CrossRef]

- Chua, Roy Y. J., Michael W. Morris, and Paul Ingram. 2009. Guanxi vs. networking: Distinctive configurations of affect- and cognition-based trust in the networks of Chinese vs. American managers. Journal of International Business Studies 40: 490–508. [Google Scholar] [CrossRef]

- Clauss, Thomas, Robert J. Breitenecker, Sascha Kraus, Alexander Brem, and Chris Richter. 2017. Directing the wisdom of the crowd: The importance of social interaction among founders and the crowd during crowdfunding campaigns. Economics of Innovation and New Technology 27: 731–51. [Google Scholar] [CrossRef] [Green Version]

- Cordova, Alessandro, Johanna Dolci, and Gianfranco Gianfrate. 2015. The Determinants of Crowdfunding Success: Evidence from Technology Projects. Procedia Social and Behavioral Sciences 181: 115–24. [Google Scholar] [CrossRef] [Green Version]

- Courtney, Christopher, Supradeep Dutta, and Yong Li. 2017. Resolving Information Asymmetry: Signaling, Endorsement, and Crowdfunding Success. Entrepreneurship: Theory and Practice 41: 265–90. [Google Scholar] [CrossRef]

- Cumming, Douglas J., Gaël Leboeuf, and Armin Schwienbacher. 2020. Crowdfunding models: Keep-it-all vs. all-or-nothing. Financial Management 49: 331–60. [Google Scholar] [CrossRef]

- Cumming, Douglas J., Sofia A. Johan, and Yelin Zhang. 2019. The role of due diligence in crowdfunding platforms. Journal of Banking & Finance 108: 105661. [Google Scholar]

- de Larrea, Gabriela Lelo, Mehmet Altin, and Dipendra Singh. 2019. Determinants of success of restaurant crowdfunding. International Journal of Hospitality Management 78: 150–58. [Google Scholar] [CrossRef]

- Dwyer, Paul. 2007. Building Trust with Corporate Blogs. Paper presented at the International Conference on Weblogs and Social Media (ICWSM 2007), Boulder, CO, USA, March 26–28; pp. 1–8. Available online: http://icwsm.org/papers/2--Dwyer.pdf (accessed on 10 April 2020).

- Fall. 2008. Heteroskedasticity and Autocorrelation. Available online: http://www.homepages.ucl.ac.uk/~uctpsc0/Teaching/GR03/Heter&Autocorr.pdf (accessed on 14 January 2020).

- Fan, Pan, and Zhang Zigang. 2004. Cross-cultural challenges when doing business in China. Singapore Management Review 26: 81–91. [Google Scholar]

- Fang, Eric, Robert W. Palmatier, and Jan-Benedict E. M. Steenkamp. 2008. Effect of service transition strategies on firm value. Journal of Marketing 72: 1–14. [Google Scholar] [CrossRef]

- Fong, Eric A., Xuejing Xing, Wafa Hakim Orman, and William I. Mackenzie Jr. 2015. Consequences of deviating from predicted CEO labor market compensation on long-term firm value. Journal of Business Research 68: 299–305. [Google Scholar] [CrossRef]

- FSDC. 2016. Introducing a Regulatory Framework for Equity Crowdfunding in Hong Kong. Available online: https://www.fsdc.org.hk/sites/default/files/Final_Report.pdf (accessed on 10 April 2020).

- Giudici, Giancarlo, Massimiliano Guerini, and Cristina Rossi-Lamastra. 2018. Reward-based crowdfunding of entrepreneurial projects: The effect of local altruism and localized social capital on proponents’ success. Small Business Economics 50: 307–24. [Google Scholar] [CrossRef]

- Goraya, Muhammad Imran, and Sardar Muhammad Usman. 2011. How Do Venture Capital Firms Incorporate ESG (Environmental, Social and Governance) Criteria into Investment Decision Making; Umea University. Available online: https://www.diva-portal.org/smash/record.jsf?pid=diva2%3A439686&dswid=-7068 (accessed on 20 April 2020).

- Hakenes, Hendrik, and Friederike Schlegel. 2014. Exploiting the Financial Wisdom of the Crowd—Crowdfunding as a Tool to Aggregate Vague Information. pp. 1–31, Working Paper. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2475025 (accessed on 22 April 2020).

- Henderson, Andrew D., and James W. Fredrickson. 2001. Top Management Team Coordination Needs and Test of the Ceo Pay Gap: A Competitive Economic and Behavioral Views. Academy of Management Journal 44: 96–117. [Google Scholar] [CrossRef]

- Herzenstein, Michal, Utpal M. Dholakia, and Rick L. Andrews. 2011. Strategic Herding Behavior in Peer-to-Peer Loan Auctions. Journal of Interactive Marketing 25: 27–36. [Google Scholar] [CrossRef]

- Hofstede, Geert. 2007. A European in Asia. Asian Journal of Social Psychology 10: 16–21. [Google Scholar] [CrossRef]

- Hong, Yili, Yuheng Hu, and Gordon Burtch. 2018. Embeddedness, Prosociality, and Social Influence: Evidence from Online Crowdfunding. MIS Quaterly 42: 1211–24. [Google Scholar] [CrossRef]

- Huang, Zaiyu, Candy Lim Chiu, Sha Mo, and Rob Marjerison. 2018. The nature of crowdfunding in China: Initial evidence. Asia Pacific Journal of Innovation and Entrepreneurship 12: 300–22. [Google Scholar] [CrossRef]

- Hui, Wei You. 2017. The Moderating Role of Corporate Internet Reporting (CIR) on Relationship between Corporate Social Responsibility (CSR) and Cost of Equity: Evidence from Malaysia. Kota Samarahan: Universiti Malaysia Sarawak. [Google Scholar]

- Jack, Sarah, Sarah Drakopoulou Dodd, and Alistair R. Anderson. 2008. Change and the development of entrepreneurial networks over time: A processual perspective. Entrepreneurship and Regional Development 20: 125–59. [Google Scholar] [CrossRef]

- Kennedy, Peter. 2008. A Guide to Econometrics. Oxford: Blackwell Publishing, vol. 91. [Google Scholar]

- Koch, Jascha-Alexander, and Michael Siering. 2015. Crowdfunding Success Factors: The Characteristics of Successfully. ECIS 2015 Completed Research Papers 106. Available online: http://aisel.aisnet.org/ecis2015_cr (accessed on 20 April 2020).

- Kohtamäki, Marko, Jukka Partanen, Vinit Parida, and Joakim Wincent. 2013. Non-linear relationship between industrial service offering and sales growth: The moderating role of network capabilities. Industrial Marketing Management 42: 1374–85. [Google Scholar] [CrossRef] [Green Version]

- Kunz, Michael Marcin, Ulrich Bretschneider, Max Erler, and Jan Marco Leimeister. 2017. An empirical investigation of signaling in reward-based crowdfunding. Electronic Commerce Research 17: 425–61. [Google Scholar] [CrossRef] [Green Version]

- Kuppuswamy, Venkat, and Barry L. Bayus. 2013. Crowdfunding Creative Ideas: The Dynamics of Project Backers in Kickstarter. SSRN Research Paper, 151–82. [Google Scholar] [CrossRef] [Green Version]

- Lagazio, Corrado, and Francesca Querci. 2018. Exploring the multi-sided nature of crowdfunding campaign success. Journal of Business Research 90: 318–24. [Google Scholar] [CrossRef]

- Li, Zhuoxin, and Jason A. Duan. 2014. Dynamic Strategies for Successful Online Crowdfunding. NET Institute Working Papers 14-09. Available online: https://ideas.repec.org/p/net/wpaper/1409.html (accessed on 25 April 2020).

- Liang, Xiaobei, Xiaojuan Hu, and Jiang Jiang. 2020. Research on the Effects of Information Description on Crowdfunding Success within a Sustainable Economy—The Perspective of Information Communication. Sustainability 12: 650–86. [Google Scholar] [CrossRef] [Green Version]

- Lin, Mingfeng, Nagpurnanand R. Prabhala, and Siva Viswanathan. 2013. Judging Borrowers by the Company They Keep: Friendship Networks and Information Asymmetry in Online Peer-to-Peer Lending. Management Science 59: 17–35. [Google Scholar] [CrossRef]

- Luo, Yadong. 1997. Guanxi: Principles, Philosophies, and implications. Human Systems Management 16: 43–52. [Google Scholar] [CrossRef]

- Makysova, Bc. Lucia. 2017. Crowdfunding as An Alternative Way of Raising Funds for NGOs. Brno: Masaryk University, Available online: https://is.muni.cz/th/z20q5/Diploma_Thesis_Makysova.pdf (accessed on 10 April 2020).

- Mollick, Ethan R. 2015. Delivery Rates on Kickstarter. SSRN Electronic Journal. [Google Scholar] [CrossRef] [Green Version]

- Mollick, Ethan. 2014. The dynamics of crowdfunding: An exploratory study. Journal of Business Venturing 29: 1–16. [Google Scholar] [CrossRef] [Green Version]

- Moss, Todd W., Donald O. Neubaum, and Moriah Meyskens. 2015. The Effect of Virtuous and Entrepreneurial Orientations on Microfinance Lending and Repayment: A Signaling Theory Perspective. Entrepreneurship Theory and Practice 39: 27–52. [Google Scholar] [CrossRef]

- Moysidou, Krystallia, and J. Piet Hausberg. 2020. In crowdfunding we trust: A trust-building model in lending crowdfunding. Journal of Small Business Management 58: 511–43. [Google Scholar] [CrossRef]

- Nguyen, T. 2017. Crowdfunding in Vietnam: The Impact of Project and Founder Quality on Funding Success; Enschede: University of twente. Available online: https://essay.utwente.nl/73270/ (accessed on 10 April 2020).

- Oba, Beyza, Serap Atakan, and Ozge Kirezli. 2018. Value Creation in Crowdfunding Projects-Evidence from an Emerging Economy. Journal of Innovation Economics 26: 37. [Google Scholar] [CrossRef]

- Pariona, Amber. 2017. The Economy of the United Kingdom—WorldAtlas.com. Available online: https://www.worldatlas.com/articles/the-economy-of-the-united-kingdom.html (accessed on 11 April 2019).

- Petitjean, Mikael. 2017. What explains the success of reward-based crowdfunding campaigns as they unfold? Evidence from the French crowdfunding platform KissKissBankBank. Finance Research Letters 26: 9–14. [Google Scholar] [CrossRef]

- Piva, Evila, and Cristina Rossi-Lamastra. 2018. Human capital signals and entrepreneurs’ success in equity crowdfunding. Small Business Economics 51: 667–86. [Google Scholar] [CrossRef]

- Popescu, Cristina Raluca Gh, and Gheorghe N. Popescu. 2019. An exploratory study based on a questionnaire concerning green and sustainable finance, corporate social responsibility, and performance: Evidence from the Romanian business environment. Journal of Risk Financial Management 12: 162. [Google Scholar] [CrossRef] [Green Version]

- Prescott, Cecil. 2019. Internet Users, UK: 2019. Office for National Statistics. Available online: https://www.ons.gov.uk/peoplepopulationandcommunity/householdcharacteristics/homeinternetandsocialmediausage/bulletins/internetaccesshouseholdsandindividuals/2019 (accessed on 10 April 2020).

- Raab, Maximilian, Thomas Friedrich, Sebastian Schlauderer, and Sven Overhage. 2017. Understanding the role of social presence in crowdfunding: Evidence from leading U.S. and German platforms. Paper presented at the 25th European Conference on Information Systems, ECIS 2017, Guimarães, Portugal, June 5–10 2017; pp. 1758–74. [Google Scholar]

- Ralcheva, Aleksandrina, and Peter Roosenboom. 2019. Forecasting success in equity crowdfunding. Small Business Economics, 1–18. [Google Scholar] [CrossRef] [Green Version]

- Reis, Joana Sofia Batista dos. 2015. Crowdfunding: What Factors Influence Your Success? Lisbon: ISCTE Business School. [Google Scholar]

- Shahab, Yasir, Zhiwei Ye, Yasir Riaz, and Collins G. Ntim. 2018. Individual’s financial investment decision-making in reward-based crowdfunding: Evidence from China. Applied Economics Letters 26: 261–66. [Google Scholar] [CrossRef]

- Statista. 2018. Crowdfunding—United Kingdom|Statista Market Forecast. Available online: https://www.statista.com/outlook/335/156/crowdfunding/united-kingdom (accessed on 15 December 2019).

- Statista. 2019. Crowdfunding—China|Statista Market Forecast. Available online: https://www.statista.com/outlook/335/117/crowdfunding/china (accessed on 9 January 2020).

- Steigenberger, Norbert, and Hendrik Wilhelm. 2018. Extending Signaling Theory to Rhetorical Signals: Evidence from Crowdfunding. Organization Science 29: 529–46. [Google Scholar] [CrossRef]

- Torchio, Marco Filippo, Umberto Lucia, and Giulia Grisolia. 2020. Economic and human features for energy and environmental indicators: A tool to assess countries’ progress towards sustainability. Sustainability 12: 9716. [Google Scholar] [CrossRef]

- Tsai, Kellee S., and Qingyan Wang. 2019. Charitable Crowdfunding in China: An Emergent Channel for Setting Policy Agendas? The China Quarterly 240: 936–66. [Google Scholar] [CrossRef] [Green Version]

- UpEffect. 2018. Updates on the Crowdfunding Industry from the UK Alternative Finance Report—UpEffect Blog. Available online: https://www.theupeffect.com/blog/crowdfunding-industry-alt-uk/ (accessed on 15 December 2018).

- Usman, Sardar Muhammad, Farasat Ali Shah Bukhari, Muhammad Usman, Daniel Badulescu, and Muhammad Safdar Sial. 2019. Does the role of media and founder’s past success mitigate the problem of information asymmetry? Evidence from a UK crowdfunding platform. Sustainability 11: 692. [Google Scholar] [CrossRef] [Green Version]

- Vismara, Silvio. 2018. Sustainability in equity crowdfunding. Technological Forecasting and Social Change 141: 98–106. [Google Scholar] [CrossRef]

- Vulkan, Nir, Thomas Åstebro, and Manuel Fernandez Sierra. 2016. Equity crowdfunding: A new phenomena. Journal of Business Venturing Insights 5: 37–49. [Google Scholar] [CrossRef]

- Wang, Nianxin, Qingxiang Li, Huigang Liang, Taofeng Ye, and Shilun Ge. 2018. Understanding the importance of interaction between creators and backers in crowdfunding success. Electronic Commerce Research and Applications 27: 106–17. [Google Scholar] [CrossRef]

- Wardrop, Robert, Bryan Zhang, Raghavendra Rau, and Mia Gray. 2015. The European Alternative Finance Benchmarking Report; London: University of Cambridge. Available online: http://www.jbs.cam.ac.uk/index.php?id=6481#.VTOtICGqpBd (accessed on 8 January 2020).

- Westwood, Robert G., and James E. Everett. 1987. Culture’s consequences: A methodology for comparative management studies in Southeast Asia? Asia Pacific Journal of Management 4: 187–202. [Google Scholar] [CrossRef]

- World Bank. 2013. Crowdfunding’s Potential for the Developing World. Available online: https://openknowledge.worldbank.org/handle/10986/17626 (accessed on 8 January 2020).

- Xiao, Shengsheng, Xue Tan, Ming Dong, and Jiayin Qi. 2014. How to design your project in the online crowdfunding market? Evidence from Kickstarter. Paper presented at the 35th International Conference on Information Systems “Building a Better World Through Information Systems”, ICIS 2014, Auckland, New Zealand, December 14–17; pp. 1–8. [Google Scholar]

- Xu, Anbang, Xiao Yang, Huaming Rao, Wai-Tat Fu, Shih-Wen Huang, and Brian P. Bailey. 2014. Show me the money: An analysis of project updates crowdfunding campaigns. Paper presented at the 32nd Annual ACM Conference on Human Factors in Computing System, Toronto, ON, Canada, April 26–May 1; pp. 591–600. [Google Scholar] [CrossRef]

- Yang, Jinbi, Libo Liu, and Chunxiao Yin. 2019. A non-liner decision model for green crowdfunding project success: Evidence from China. International Journal of Environmental Research and Public Health 16: 187. [Google Scholar] [CrossRef] [Green Version]

- Yin, Chunxiao, Libo Liu, and Kristijian Mirkovski. 2019. Does more crowd participation bring more value to crowdfunding projects? The perspective of crowd capital. Internet Research 29: 1149–70. [Google Scholar] [CrossRef]

- Zhang, Bryan, Tania Ziegler, Leyla Mammadova, Daniel Johanson, Mia Gray, and Nikos Yerolemou. 2018. The 5th Uk Alternative Finance Industry Report. Cambridge: Cambridge Centre for Alternative Finance. [Google Scholar]

- Zhang, Na, Sumon Datta, and Karthik Natarajan Kannan. 2015. An Analysis of Incentive Structures in Collaborative Economy: An Application to Crowdfunding Platform. Working Paper. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2518662 (accessed on 25 April 2020).

- Zheng, Haichao, Dahui Li, Jing Wu, and Yun Xu. 2014. The role of multidimensional social capital in crowdfunding: A comparative study in China and US. Information & Management 51: 488–96. [Google Scholar] [CrossRef]

- Ziegler, Tania, Rotem Shneor, Kieran Garvey, Karsten Wenzlaff, Nikos Yerolemou, Rui Hao, and Bryan Zhang. 2018. The 3rd European Alternative Finance Industry Report. Cambridge: Cambridge Centre for Alternative Finance, Available online: https://www.jbs.cam.ac.uk/faculty-research/centres/alternative-finance/publications/expanding-horizons (accessed on 8 January 2020).

| Crowdfunding Prototypes | China | UK |

|---|---|---|

| Overall market growth | China’s online alternative-financing market volume accounted for 99% in total of the Asia-Pacific region, reaching USD 358 billion in 2017. | The UK online alternative-financing market volume grew by 35% year-on-year and has reached a value of USD 9.07 billion in 2017. |

| Crowdfunding market size | It is estimated that the transaction value of the Crowdfunding segment amounts to USD 7048.9M in 2020. | It is estimated that the transaction value of the Crowdfunding segment amounts to USD 99.5M in 2020. |

| Reward-based Crowdfunding | Reward-based CF raised a total of USD 16M in 2016 and USD 540M in 2017. | The total volume of reward-based CF between 2011 to 2017 has amounted to USD 243 million; 24% (USD 58M) of this value was obtained in 2017. |

| Donation-based Crowdfunding | In 2017, the volume of Donation based CF reached USD 22.1M. In comparison to 2016, this represents an increase of 7.68%. | Donation-based CF has raised a total of USD 126M between 2011–2017, out of which 43% (USD 54.1M) is attributable to 2017. |

| Equity-based Crowdfunding | China’s equity CF market shrank by 51% during 2017, which amounts to USD 225M. Furthermore, the market share is 0.1%. | The total volume of equity-based CF between 2011 to 2017 has amounted to USD 1272.92, 34% (USD 43.7M) in 2017 alone. |

| P2P Lending-based Crowdfunding | The Chinese P2P lending-based CF market grew by 64%, amounting to USD 224 billion in 2017. This P2P market has captured 63% of the Chinese alternative-financing market. | The UK P2P lending-based CF market is considered the fastest growing market in the UK, with an annual growth rate of 66%, amounting to a total value of USD 6.11 billion in 2017. |

| Total number of platforms | Currently, 332 crowdfunding platforms operate on the Chinese market. | According to the CrowdingIn directory, a total of 65 active and operating UK-based CF platforms exist. |

| Variable | China | UK | ||

|---|---|---|---|---|

| Tolerance | Variance Inflation Factor (VIF) | Tolerance | Variance Inflation Factor (VIF) | |

| Goal setting | 0.113 | 1.872 | 0.330 | 3.031 |

| Project comments | 0.826 | 1.210 | 0.748 | 1.338 |

| Project updates | 0.631 | 1.586 | 0.877 | 1.140 |

| Pledged amount | 0.360 | 2.779 | 0.316 | 3.166 |

| Experience as backer | 0.981 | 1.019 | 0.968 | 1.033 |

| Experience as creator | 0.807 | 1.239 | 0.963 | 1.038 |

| Role of media | 0.805 | 1.243 | 0.936 | 1.069 |

| Number of supporters | 0.102 | 1.830 | 0.627 | 1.595 |

| Variables | M(SD) China | M(SD) UK | Project Success | Goal Setting | Project Comments | Project Updates | Pledged Amount | Experience as a Backer | Experience as a Creator | Role of Media | Number of Supporters |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Project success | 80.82 (168.291) | 105.32 (73.81) | 1 | −0.041 (0.363) | 0.103 * (0.022) | −0.157 ** (0.000) | 0.104 * (0.020) | −0.016 (0.721) | 0.102 * (0.023) | −0.022 (0.626) | −0.033 (0.466) |

| Goal setting (USD) | 5721 (14,158.65) | 18,924 (43,344) | −0.175 ** (0.000) | 1 | 0.070 (0.115) | 0.216 ** (0.000) | 0.278 ** (0.000) | −0.004 (0.937) | −0.106 * (0.018) | −0.041 (0.359) | 0.229 ** (0.000) |

| Project comments | 6.89 (29.26) | 7.40 (14.12) | 0.180 ** (0.000) | 0.142 ** (0.001) | 1 | −0.209 ** (0.000) | 0.100 * (0.025) | −0.013 (0.765) | −0.044 (0.321) | 0.185 ** (0.000) | −0.062 (0.166) |

| Project updates | 0.50 (0.501) | 3.27 (4.45) | 0.060 (0.183) | 0.126 ** (0.005) | 0.179 ** (0.000) | 1 | 0.164 ** (0.000) | 0.076 (0.089) | −0.351 ** (0.000) | −0.358 ** (0.000) | 0.321 ** (0.000) |

| Pledged amount (USD) | 3663.14 (11,564.93) | 14,341 (36,002) | 0.079 (0.079) | 0.210 ** (0.000) | 0.206 ** (0.000) | 0.223 ** (0.000) | 1 | 0.008 (0.853) | −0.061 (0.172) | −0.029 (0.514) | 0.277 ** (0.000) |

| Experience as a backer | 0.88 (1.606) | 1.12 (2.205) | 0.147 ** (0.001) | −0.080 (0.074) | 0.066 (0.140) | 0.091 * (0.043) | −0.024 (0.595) | 1 | −0.087 (0.053) | −0.079 (0.076) | 0.024 (0.590) |

| Experience as a creator | 1.74 (2.123) | 1.38 (1.245) | 0.295 ** (0.000) | −0.041 (0.361) | 0.098 * (0.028) | −0.027 (0.540) | 0.011 (0.799) | 0.091 * (0.041) | 1 | −0.090 * (0.044) | −0.113 * (0.011) |

| Role of media | 1.23 (0.643) | 1.33 (0.810) | −0.068 (0.128) | 0.157 ** (0.000) | 0.001 (0.987) | 0.195 ** (0.000) | 0.146 ** (0.001) | −0.041 (0.364) | −0.039 (0.379) | 1 | −0.113 * (0.011) |

| Number of supporters | 4315.18 (13,221.09) | 131.20 (234.87) | 0.183 ** (0.000) | 0.390 ** (0.000) | 0.484 ** (0.000) | 0.217 ** (0.000) | 0.434 ** (0.000) | −0.001 (0.983) | 0.113 * (0.011) | 0.118 ** (0.008) | 1 |

| Independent Variables | China | United Kingdom | ||||

|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | |

| Constant | 96.357 *** (11.155) | 63.606 ** (19.069) | 82.386 *** (20.305) | 112.423 *** (4.514) | 79.592 *** (6.974) | 90.537 *** (6.716) |

| Goal setting | −0.002 (0.001) | −0.005 ** (0.002) | −0.001 *** (0.000) | −0.002 *** (0.000) | ||

| Project comments | 0.596 * (0.217) | 0.531 * (0.274) | 1.078 *** (0.223) | 0.293 (0.229) | ||

| Project updates | −8.761 * (4.797) | −7.671 (4.713) | 1.204 * (0.035) | 0.112 * (0.676) | ||

| Goal setting2 | 1.803 (0.000) | −1.741 (0.000) | 1.964 (0.000) | 3.065 *** (0.000) | −1.921 *** (0.000) | 2.002 *** (0.000) |

| Pledged amount | 0.005 *** (0.001) | 0.005 *** (0.001) | 0.001 *** (0.000) | 0.001 *** (0.000) | ||

| Experience as a backer | −0.404 (4.632) | −0.640 (1.289) | 3..735 ** (1.375) | 2.439 * (1.289) | ||

| Experience as a creator | 7.261 * (3.541) | 6.988 * (2.286) | 14.786 *** (2.457) | 13.580 *** (2.286) | ||

| Role of media | 1.792 (10.252) | 0.516 (10.265) | −8.005 * (3.781) | −2.450 (3.599) | ||

| Number of supporters | −0.003 * (0.001) | −3.702 (0.002) | 0.039 ** (0.014) | 0.064 *** (0.016) | ||

| Observations | 500 | 500 | 500 | 500 | 500 | 500 |

| R2 | 0.022 | 0.051 | 0.074 | 0.136 | 0.177 | 0.297 |

| Adj R2 | 0.14 | 0.040 | 0.057 | 0.129 | 0.167 | 0.285 |

| F-test | 2.833 * | 4.458 *** | 4.338 *** | 19.477 *** | 17.655 *** | 23.090 *** |

| Durbin-Watson | 1.936 | 1.946 | 1.925 | 1.805 | 1.994 | 1.852 |

| Independent Variables | China | United Kingdom | ||||

|---|---|---|---|---|---|---|

| Model 7 | Model 8 | Model 9 | Model 10 | Model 11 | Model 12 | |

| Constant | 2.462 *** (0.056) | 2.166 ** (0.087) | 2.140 *** (0.090) | 3.577 *** (0.027) | 3.488 *** (0.036) | 3.435 *** (0.036) |

| Goal setting | 5.939 *** (0.000) | 4.823 *** (0.000) | 8.725 *** (0.000) | 5.076 *** (0.000) | ||

| Project comments | 0.003 ** (0.001) | 0.001 * (0.001) | 0.005 *** (0.001) | 0.001 (0.001) | ||

| Project updates | −0.056 * (0.024) | −0.040 (0.021) | 0.025 *** (0.004) | 0.009 ** (0.004) | ||

| Goal setting2 | 4.112 *** (0.000) | −3.783 *** (0.000) | 3.207 *** (0.000) | 1.316 *** (0.000) | −1.402 *** (0.000) | 2.524 *** (0.000) |

| Pledged amount | 6.360 *** (0.000) | 5.505 *** (0.000) | 1.000 *** (0.000) | 1.036 *** (0.000) | ||

| Experience as a backer | 0.004 (0.021) | 0.013 (0.020) | 3.735 ** (1.375) | −0.001 (0.007) | ||

| Experience as a creator | 0.075 *** (0.016) | 0.081 *** (0.015) | 14.786 *** (2.457) | 0.014 (0.012) | ||

| Role of media | 0.125 ** (0.047) | 0.102 * (0.045) | −8.005 * (3.781) | 0.080 *** (0.019) | ||

| No of supporters | −1.488 * (0.000) | −3.425 (0.000) | 0.039 ** (0.014) | 0.000 *** (0.000) | ||

| Observations | 500 | 500 | 500 | 500 | 500 | 500 |

| R2 | 0.390 | 0.397 | 0.445 | 0.311 | 0.510 | 0.543 |

| Adj R2 | 0.234 | 0.389 | 0.434 | 0.305 | 0.504 | 0.535 |

| F-test | 37.687 *** | 52.031 *** | 41.965 *** | 55.945 *** | 85.5722 *** | 64.809 *** |

| Durbin-Watson | 1.913 | 1.836 | 1.900 | 1.800 | 1.801 | 1.802 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Usman, S.M.; Bukhari, F.A.S.; You, H.; Badulescu, D.; Gavrilut, D. The Effect and Impact of Signals on Investing Decisions in Reward-Based Crowdfunding: A Comparative Study of China and the United Kingdom. J. Risk Financial Manag. 2020, 13, 325. https://doi.org/10.3390/jrfm13120325

Usman SM, Bukhari FAS, You H, Badulescu D, Gavrilut D. The Effect and Impact of Signals on Investing Decisions in Reward-Based Crowdfunding: A Comparative Study of China and the United Kingdom. Journal of Risk and Financial Management. 2020; 13(12):325. https://doi.org/10.3390/jrfm13120325

Chicago/Turabian StyleUsman, Sardar Muhammad, Farasat Ali Shah Bukhari, Huiwei You, Daniel Badulescu, and Darie Gavrilut. 2020. "The Effect and Impact of Signals on Investing Decisions in Reward-Based Crowdfunding: A Comparative Study of China and the United Kingdom" Journal of Risk and Financial Management 13, no. 12: 325. https://doi.org/10.3390/jrfm13120325

APA StyleUsman, S. M., Bukhari, F. A. S., You, H., Badulescu, D., & Gavrilut, D. (2020). The Effect and Impact of Signals on Investing Decisions in Reward-Based Crowdfunding: A Comparative Study of China and the United Kingdom. Journal of Risk and Financial Management, 13(12), 325. https://doi.org/10.3390/jrfm13120325