The Challenges and Opportunities for ERM Post-COVID-19: Agendas for Future Research

Abstract

1. Introduction

2. The Features of Pandemic Risk

3. ERM and Pandemic Risk and Suggestions for Further Research

3.1. ERM Concept: Origins and Philosophy

3.2. ERM Post-COVID-19

- How have organizations identified, assessed, and evaluated the risks associated with pandemics, such as COVID-19 and the derivative risks caused by pandemic?

- What has been the role of ERM in identifying and monitoring specific high-impact low-probability risks? Did organizations with more mature ERM processes fare better in identifying the pandemic risk?

- What methodologies might organizations use or have used to consider and monitor long-term trends and the risks that they pose? Which methodologies are best practices?

- What additional challenges has COVID-19 brought to ERM? What new risk management methods and risk response strategies could help firms better endure COVID-19 disruptions in operating activity?

- How have the effects of COVID-19 been disclosed and communicated?

- Have organizations that disclosed pandemic risk factors better responded and prevailed during the COVID-19 pandemic?

- How can ERM provide better risk reporting and communication during a crisis?

- Have organizations’ disclosure processes adequately identified COVID-19 issues that may arise and ensured that this information is disclosed?

With respect to risk strategy, we believe that the following areas of research would provide insight into how ERM can be more effective in a post-COVID-19 environment:Enterprise risk management is defined as “The culture, capabilities, and practices, integrated with strategy-setting and performance, that organizations rely on to manage risk in creating preserving, and realizing value”.

- What role did the importance of ERM maturity play in understanding and responding to COVID-19 risk?

- What is the role of culture in implementing a successful ERM response to COVID-19?

- What is the role of ERM in providing a framework for organizations to understand the effect that the COVID-19 pandemic has in transforming inherent risks?

- What is the extent of COVID-19 pandemic impacts on the redefinition of risk appetite strategies?

- What is the role of ERM in responding to COVID-19 challenges, development of new risk management methods, and new risk response strategies in response to continued disruptions in operating activity?

4. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Ai, Jing, Patrick L. Brockett, William W. Cooper, and Linda L. Golden. 2012. Enterprise risk management through strategic allocation of capital. Journal of Risk and Insurance 79: 29–56. [Google Scholar] [CrossRef]

- Anton, Sorin Gabriel, and Anca Elena Afloarei Nucu. 2020. Enterprise Risk Management: A Literature Review and Agenda for Future Research. Journal of Risk and Financial Management 12: 281. [Google Scholar] [CrossRef]

- AS/NZS. 2004. Australia/New Zealand’s 4360 Risk Management Standard; Sydney: Standards Australia International Ltd., Wellington: Standards New Zealand. Available online: http://mkidn.gov.pl/media/docs/pol_obronna/20150309_3-NZ-AUST-2004.pdf (accessed on 15 December 2020).

- Aven, Tierie. 2016. Risk assessment and risk management: Review of recent advances on their foundation. European Journal of Operational Research 253: 1–13. [Google Scholar] [CrossRef]

- Barro, Robert, Jose Ursúa, and Joanna Weng. 2020. The Coronavirus and the Great Influenza Pandemic: Lessons from the “Spanish Flu” for the Coronavirus’s Potential Effects on Mortality and Economic Activity. NBER Working Paper No. 26866 March 2020, Revised April 2020. Available online: https://www.nber.org/papers/w26866 (accessed on 20 October 2020).

- Baumgart, Claus, Robert Lempertseder, Ashutosh Riswadkar, Keith Woolnough, and Manuela Zweimüller. 2007. Influenza Pandemics. CRO Briefing, Emerging Risks Initiative—Position Paper. Available online: https://www.thecroforum.org/wp-content/uploads/2012/10/cro_pandemie_final-2.pdf (accessed on 20 October 2020).

- Baxter, Ryan, Jean Bedard, Rani Hoitash, and Ari Yezegel. 2013. Enterprise risk management program quality: Determinants, value relevance, and the financial crisis. Contemporary Accounting Research 30: 1264–95. [Google Scholar] [CrossRef]

- Beasley, Mark, Bruce Branson, and Don Pagach. 2015. An analysis of the maturity and strategic impact of investments in ERM. Journal of Accounting and Public Policy 34: 2019–243. [Google Scholar] [CrossRef]

- Beretta, Sergio. 2019. Directors’ Duties and Risk Governance. In Multiple Perspectives in Risk and Risk Management. Edited by Philip Linsley, Philip Shrives and Monika Wieczorek-Kosmala. Berlin/Heidelberg: Springer. [Google Scholar] [CrossRef]

- Broekhoven, Henk, Erik Alm, Tapani Tuominen, Anni Hellman, and Wojciech Dziworski. 2006. Actuarial Reflections on Pandemic Risk and Its Consequences. Report of the European Actuarial Consultation Group. Available online: https://actuary.eu/documents/pandemics_web.pdf (accessed on 20 October 2020).

- Bromiley, Philip, and Devaki Rau. 2016. A better way of managing major risks: strategic risks management. IESE Insight 28: 15–22. [Google Scholar] [CrossRef]

- Bromiley, Philip, Michael McShane, Anil Nair, and Elzotbek Rustambekov. 2015. Enterprise risk management: Review, Critique and Research Directions. Long Range Planning 48: 265–76. [Google Scholar] [CrossRef]

- CAS. 2003. Overview of Enterprise Risk Management. Arlington County: Casualty Actuarial Society. [Google Scholar]

- COSO. 2004. Enterprise Risk Management-Integrated Framework. New York: Committee of Sponsoring Organizations of the Treadway Commission (COSO). [Google Scholar]

- COSO. 2017. Enterprise Risk Management—Integrating with Strategy and Performance. New York: Committee of Sponsoring Organizations of the Treadway Commission (COSO). [Google Scholar]

- Crockford, G. Neil. 1982. The Bibliography and History of Risk Management: Some Preliminary Observations. The Geneva Papers on Risk and Insurance 7: 169–79. [Google Scholar] [CrossRef]

- Dardis, Tony, Chloe Lau, and Ariel Weis. 2020. COVID-19 and Enterprise Risk Management. Milliman White Paper, 30 March 2020. Available online: https://www.milliman.com/en/insight/covid-19-and-enterprise-risk-management (accessed on 15 November 2020).

- Deans, Peter. 2020. The Big COVID-19 Blind Spot: Lack of Risk Management Is Leaving Us Wanting, 24 April 2020. Available online: https://singularityhub.com/2020/04/24/the-big-covid-19-blind-spot-lack-of-risk-management-is-leaving-us-wanting/ (accessed on 20 October 2020).

- Dickinson, Gerry. 2001. Enterprise risk management: Its origins and conceptual foundations. The Geneva Papers on Risk and Insurance—Issues and Practice 26: 360–66. [Google Scholar] [CrossRef]

- Dionne, Georges. 2013. Risk Management: History, Definition and Critique. Risk Management and Insurance Review 16: 147–66. [Google Scholar] [CrossRef]

- Estrada, Rachel, Andrew Griffith, Colbye Prim, and Jeongsu Sinn. 2016. Pandemics in a Changing Climate—Evolving Risk and the Global Response. Zurich: Swiss Re. Available online: https://www.swissre.com/dam/jcr:552d59b2-76c6-4626-a91a-75b0ed58927e/Pandemics_in_a_changing_climate_Full_report_FINAL.pdf (accessed on 15 November 2020).

- Falkner, Eva M., and Martin R. W. Hiebl. 2015. Risk management in SMEs: A systematic review of the available evidence. The Journal of Risk Finance 16: 122–44. [Google Scholar] [CrossRef]

- Fan, Victoria Y., Dean T. Jamison, and Lawrence H. Summers. 2018. Pandemic risk: How large are the expected losses? Bulletin of the World Health Organisation 96: 129–34. [Google Scholar] [CrossRef] [PubMed]

- Farrell, Mark, and Ronan Gallagher. 2015. The valuation implications of enterprise risk management maturity. Journal of Risk and Insurance 82: 625–57. [Google Scholar] [CrossRef]

- Florio, Cristina, and Giulia Leoni. 2017. Enterprise risk management and firm performance: The Italian case. The British Accounting Review 49: 56–74. [Google Scholar] [CrossRef]

- Gordon, Lawrence A., Martin P. Loeb, and Chih-Yang Tseng. 2009. Enterprise risk management and firm performance: A contingency perspective. Journal of Accounting and Public Policy 28: 301–27. [Google Scholar] [CrossRef]

- Hopkin, Paul. 2015. Fundamentals of Risk Management: Understanding, Evaluating and Implementing Effective Risk Management, 3rd ed. London: Kogan Page. [Google Scholar]

- Hoyt, Robert E., and Andre P. Liebenberg. 2011. The value of enterprise risk management. Journal of Risk and Insurance 78: 795–822. [Google Scholar] [CrossRef]

- ISO 31000:2009. 2009. Risk Management—Principles and Guidelines. Geneva: The International Organization for Standardization. Available online: www.iso.org/iso/home/standards/iso31000.html (accessed on 20 October 2020).

- ISO 31000:2018. 2018. Risk Management—Guidelines. Geneva: The International Organization for Standardization. Available online: https://www.iso.org/standard/65694.html (accessed on 20 October 2020).

- Jackson, James, Martin A. Weiss, Andreas Schwarzenberg, Rebecca Nelson, Karen Sutter, and Michael Sutherland. 2020. Global Economic Effects of COVID-19, Congressional Research Service, Report No. R46270, Updated 21 August 2020. Available online: https://fas.org/sgp/crs/row/R46270.pdf (accessed on 20 October 2020).

- Jonas, Olga B. 2014. Pandemic Risk. World Development Report, The World Bank. Available online: https://www.worldbank.org/content/dam/Worldbank/document/HDN/Health/WDR14_bp_Pandemic_Risk_Jonas.pdf (accessed on 5 June 2020).

- Keogh-Brown, Marcus R., Richard D. Smith, John W. Edmunds, and Philippe Beutels. 2010. The macroeconomic impact of pandemic influenza: Estimates from models of the United Kingdom, France, Belgium and The Netherlands. European Health Economics 11: 543–54. [Google Scholar] [CrossRef]

- Kloman, Felix H. 2010. A Brief History of Risk Management. In Enterprise Risk Management. Today’s Leading Research and Best Practices for Tomorrow’s Executives. New York: John Wiley & Sons. [Google Scholar]

- Linkov, Igor, and Benjamin Trump. 2019. The Science and Practice of Resilience. Cham: Springer. [Google Scholar] [CrossRef]

- Lundqvist, Sara A. 2014. An exploratory study of enterprise risk management: pillars of ERM. Journal of Accounting, Auditing and Finance 29: 393–429. [Google Scholar] [CrossRef]

- Madhav, Nita, Ben Oppenheim, Mark Gallivan, Prime Mulembakani, Edward Rubin, and Nathan Wolfe. 2017. Pandemics: Risks, impacts, and mitigation. In Disease Control Priorities. Improving Health and Reducing Poverty. Edited by Jamison Dean, Gelband Hellen, Horton Susan, Jha Prabhat, Laxminarayan Ramanan, Mock Charkes and Rachel Nugent. Washington, DC: World Bank Group, vol. 9, pp. 315–45. [Google Scholar] [CrossRef]

- McShane, Michael. 2018. Enterprise risk management: history and a design science proposal. The Journal of Risk Finance 19: 137–53. [Google Scholar] [CrossRef]

- Miccolis, Jerry, and Samir Shah. 2000. Enterprise Risk Management: An Analytic Approach. Tillinghast-Towers Perrin. Available online: https://www.irmi.com/docs/default-source/expert-commentary-documents/miccolis05a.pdf?sfvrsn=4 (accessed on 5 June 2020).

- Mikes, Anette, and Robert S. Kaplan. 2015. When one size doesn’t fit all: Evolving directions in the research and practice of enterprise risk management. Journal of Applied Corporate Finance 27: 37–41. [Google Scholar] [CrossRef]

- Pagach, Don, and Richard Warr. 2011. The characteristics of firms that hire chief risk officers. Journal of Risk and Insurance 78: 185–211. [Google Scholar] [CrossRef]

- Prager, Fynnwin, Dan Wei, and Adam Rose. 2017. Total Economic Consequences of an Influenza Outbreak in the United States. Risk Analysis 37: 4–19. [Google Scholar] [CrossRef] [PubMed]

- Renn, Ortwin. 2008. Concepts of Risk: An interdisciplinary review. Part 2: Integrative Approaches. GAIA 17: 196–204. [Google Scholar] [CrossRef]

- Smith, Lee, Anne Pifer, and Adam Fennel. 2020. Higher Education COVID-19 Response: Enterprise Risk Management. Huron Consulting Group. Available online: https://www.huronconsultinggroup.com/insights/enterprise-risk-management (accessed on 20 November 2020).

- Smithson, Charles, and Betty J. Simkins. 2005. Does Risk Management Add Value? A Survey of the Evidence. Journal of Applied Corporate Finance 17: 8–17. [Google Scholar] [CrossRef]

- Standard and Poor’s. 2008. Enterprise Risk Management: Standard & Poor’s to Apply Enterprise Risk Analysis to Corporate Ratings. New York: S&P. [Google Scholar]

- Standard and Poor’s. 2012. Methodology: Management and Governance Credit Factors for Corporate Entities and Insurers. New York: S&P. [Google Scholar]

- Trock, Susan C., Burke Stephen A, and Nancy J. Cox. 2015. Development of Framework for Assessing Influenza Virus Pandemic Risk. Emerging Infectious Diseases 21: 1372–78. [Google Scholar] [CrossRef]

- UK. 2012. Corporate Governance Code. Financial Reporting Council. Available online: https://www.frc.org.uk/getattachment/e322c20a-1181-4ac8-a3d3-1fcfbcea7914/UK-Corporate-Governance-Code-(September-2012).pdf (accessed on 5 June 2020).

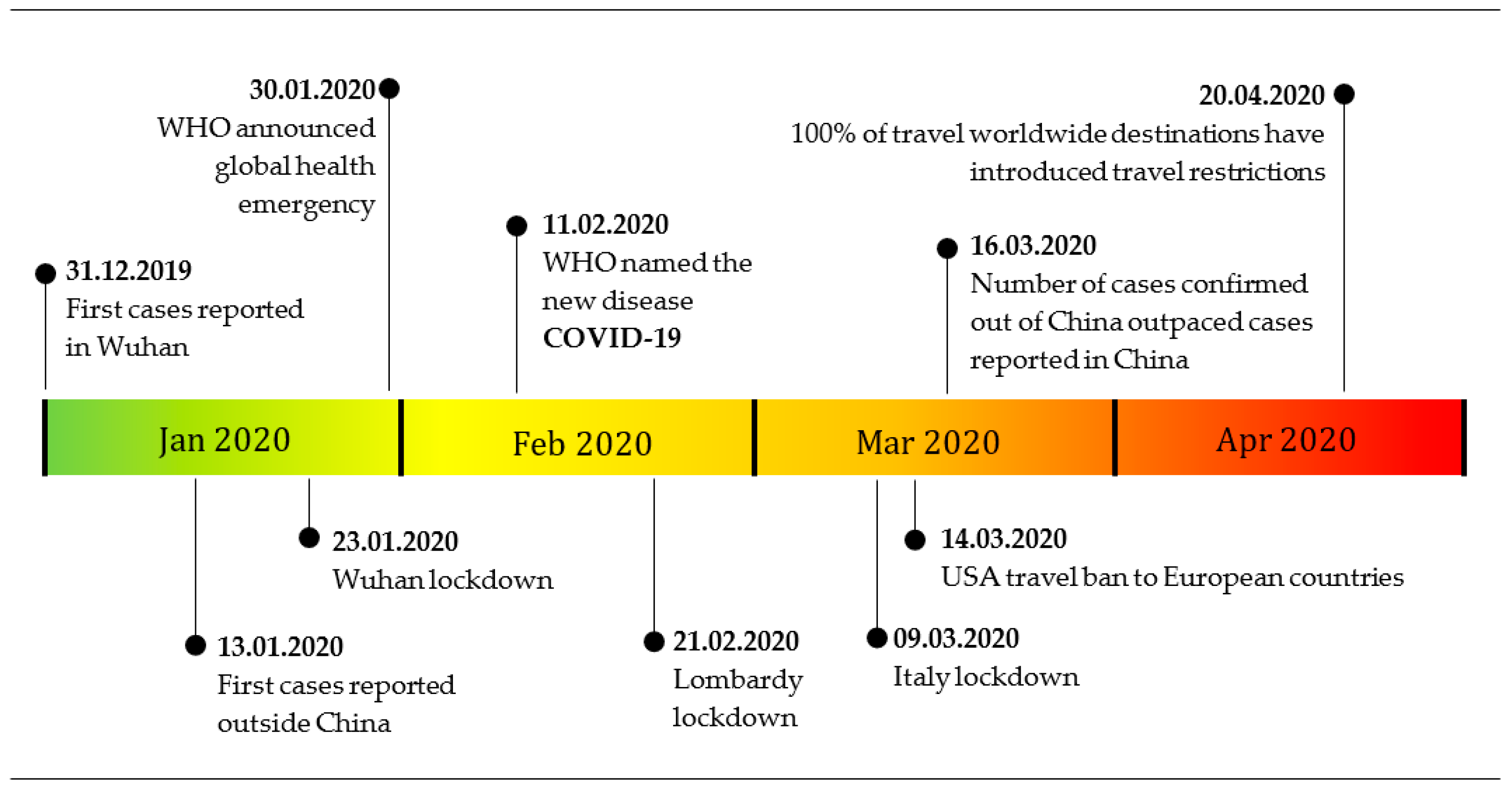

- UNWTO. 2020. UNWTO World Tourism Barometer. Special Focus on the Impact of COVID-19, May 2020. Available online: https://www.e-unwto.org/doi/book/10.18111/9789284421817 (accessed on 20 November 2020).

- Verikios, George, Maura Sullivan, Pane Stojanovski, James Gisecke, and Gordon Woo. 2016. Assessing Regional Risks from Pandemic Influenza: A Scenario Analysis. The World Economy 39: 1225–55. [Google Scholar] [CrossRef]

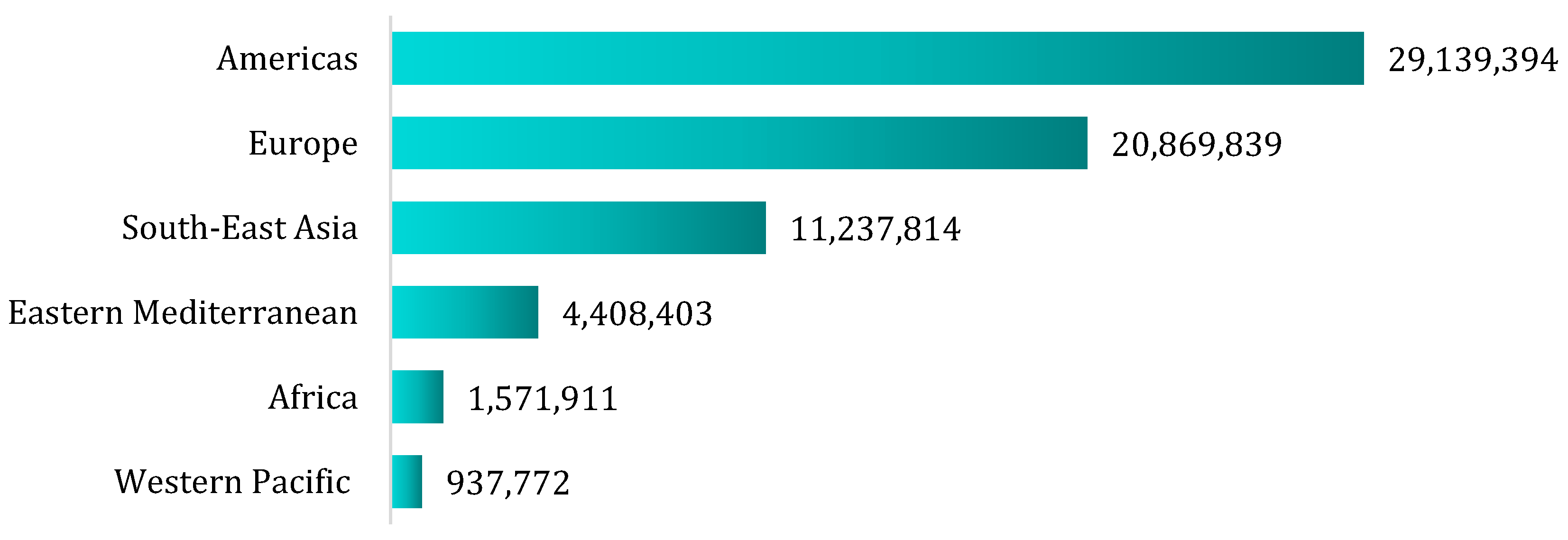

- WHO. 2020. WHO Coronavirus Disease (COVID-19) Dashboard. Available online: https://covid19.who.int/ (accessed on 10 December 2020).

- Woolnought, Keith, and Stephen Kramer. 2007. Influenza Pandemics: Time for a Reality Check? Swiss Re Focus Report. Zurich: Swiss Re. Available online: https://media.swissre.com/documents/influenza_pandemics_time_for_a_reality_check_en.pdf (accessed on 5 June 2020).

| 1 | Originally issued in 1995 and revised in 2004 by Standards New Zealand, the joint Australian/New Zealand Committee decided to not revise that standard in 2009 and instead agreed to promote ISO’s 31000—Risk Management standard. |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pagach, D.; Wieczorek-Kosmala, M. The Challenges and Opportunities for ERM Post-COVID-19: Agendas for Future Research. J. Risk Financial Manag. 2020, 13, 323. https://doi.org/10.3390/jrfm13120323

Pagach D, Wieczorek-Kosmala M. The Challenges and Opportunities for ERM Post-COVID-19: Agendas for Future Research. Journal of Risk and Financial Management. 2020; 13(12):323. https://doi.org/10.3390/jrfm13120323

Chicago/Turabian StylePagach, Don, and Monika Wieczorek-Kosmala. 2020. "The Challenges and Opportunities for ERM Post-COVID-19: Agendas for Future Research" Journal of Risk and Financial Management 13, no. 12: 323. https://doi.org/10.3390/jrfm13120323

APA StylePagach, D., & Wieczorek-Kosmala, M. (2020). The Challenges and Opportunities for ERM Post-COVID-19: Agendas for Future Research. Journal of Risk and Financial Management, 13(12), 323. https://doi.org/10.3390/jrfm13120323