Decomposing the Effect of Domestic and Foreign Economic Policy Uncertainty Shocks on Real and Financial Sectors: Evidence from BRIC Countries

Abstract

1. Introduction

- To what extent do shocks of EPU create an impact on the real and financial variables of BRIC economies?

- Which EPU (foreign or domestic) has a more significant impact on these countries’ economies?

- How may the domestic credit growth affect the response of the real variables of BRIC countries toward the uncertainty shocks?

2. Literature Review

3. Methodology

4. Results

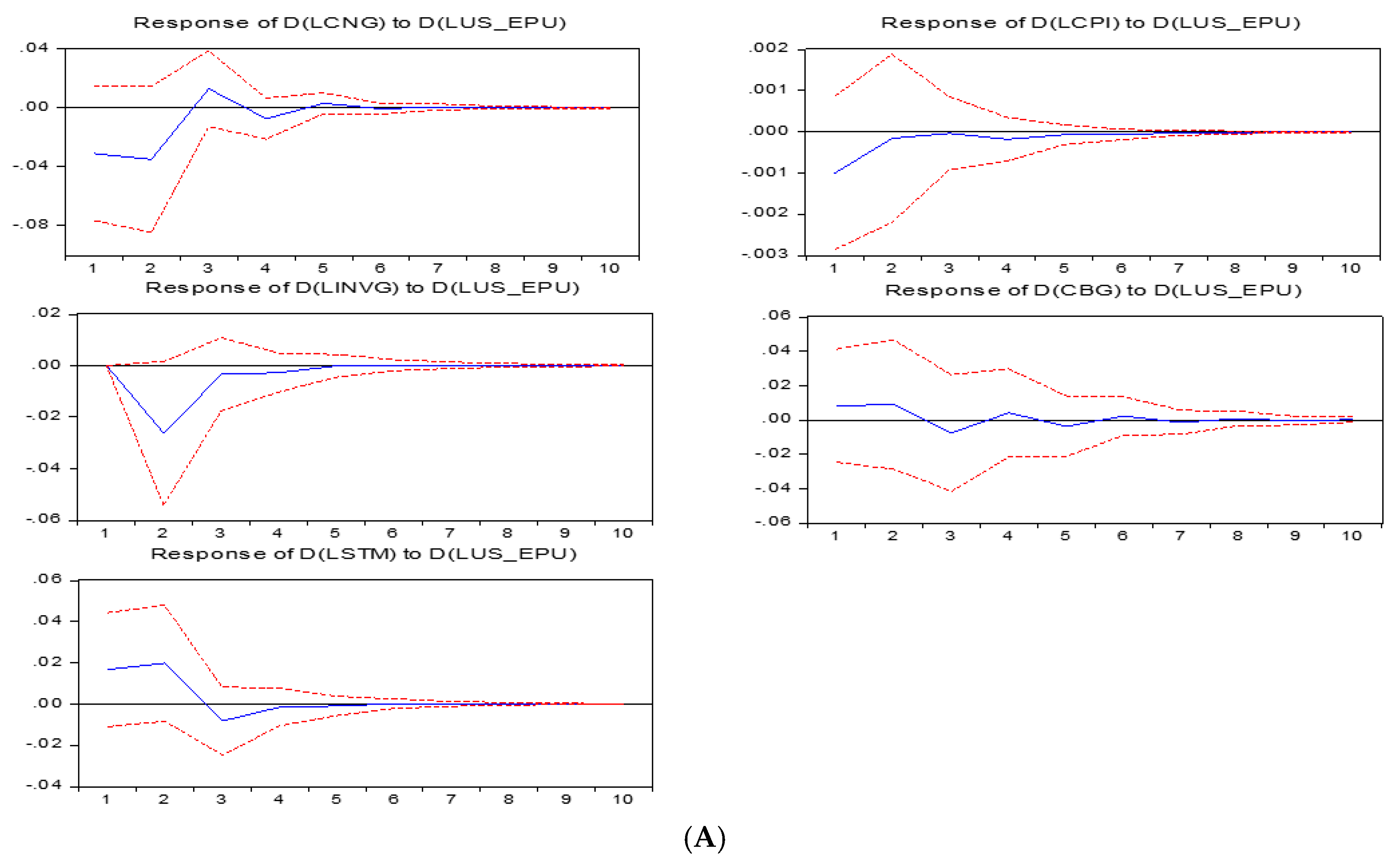

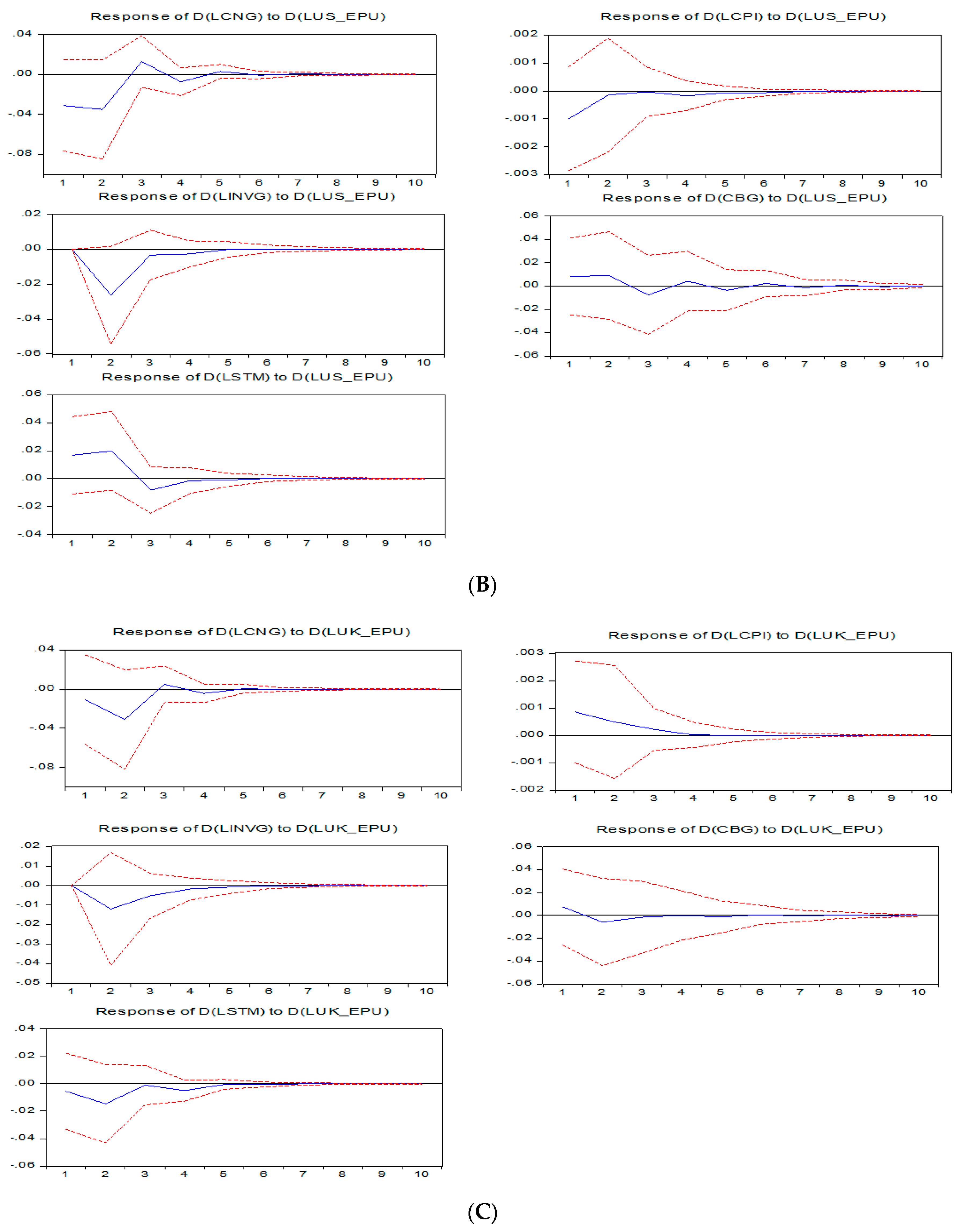

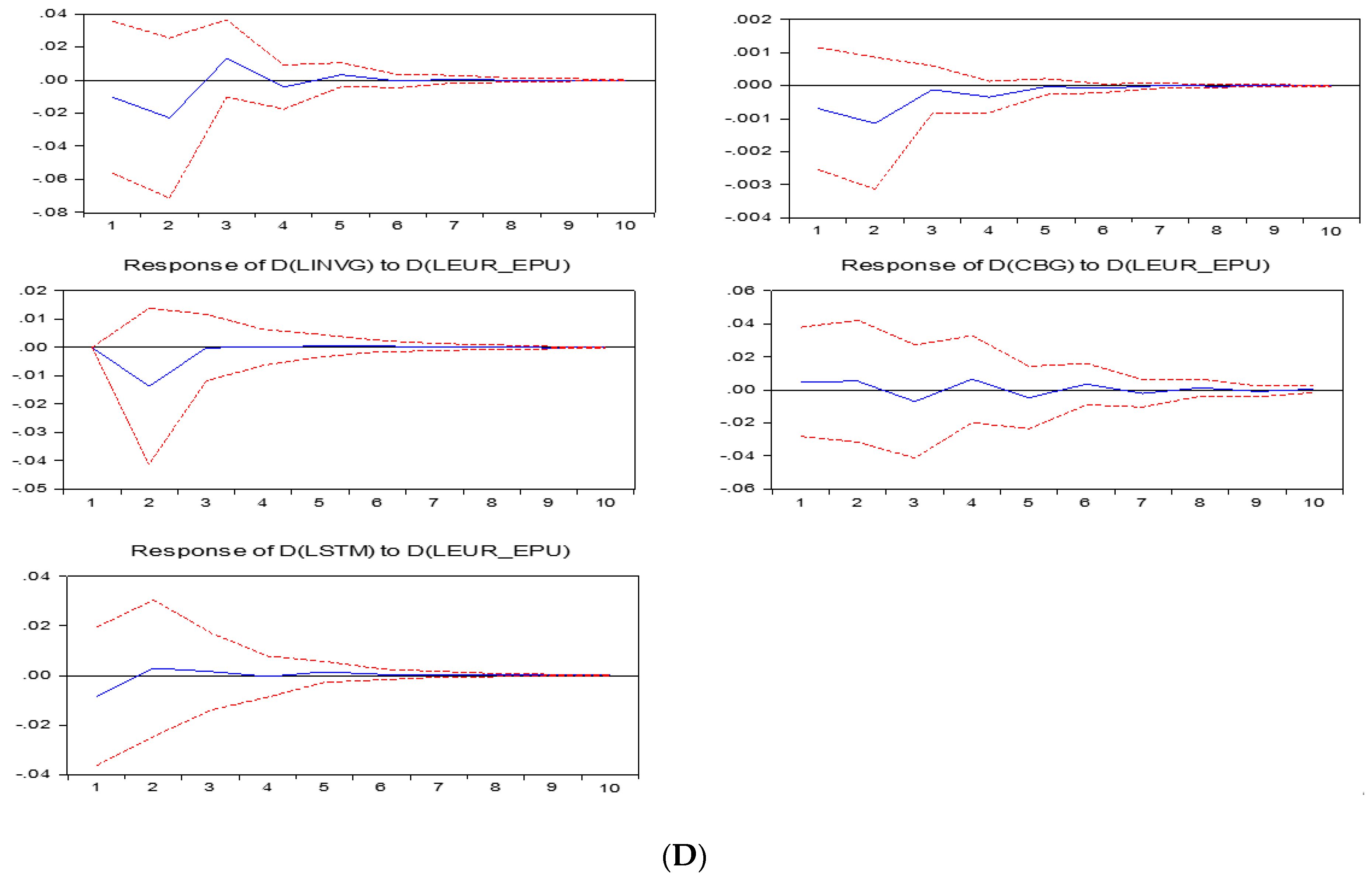

4.1. Impact of Domestic and Foreign EPU on Brazil

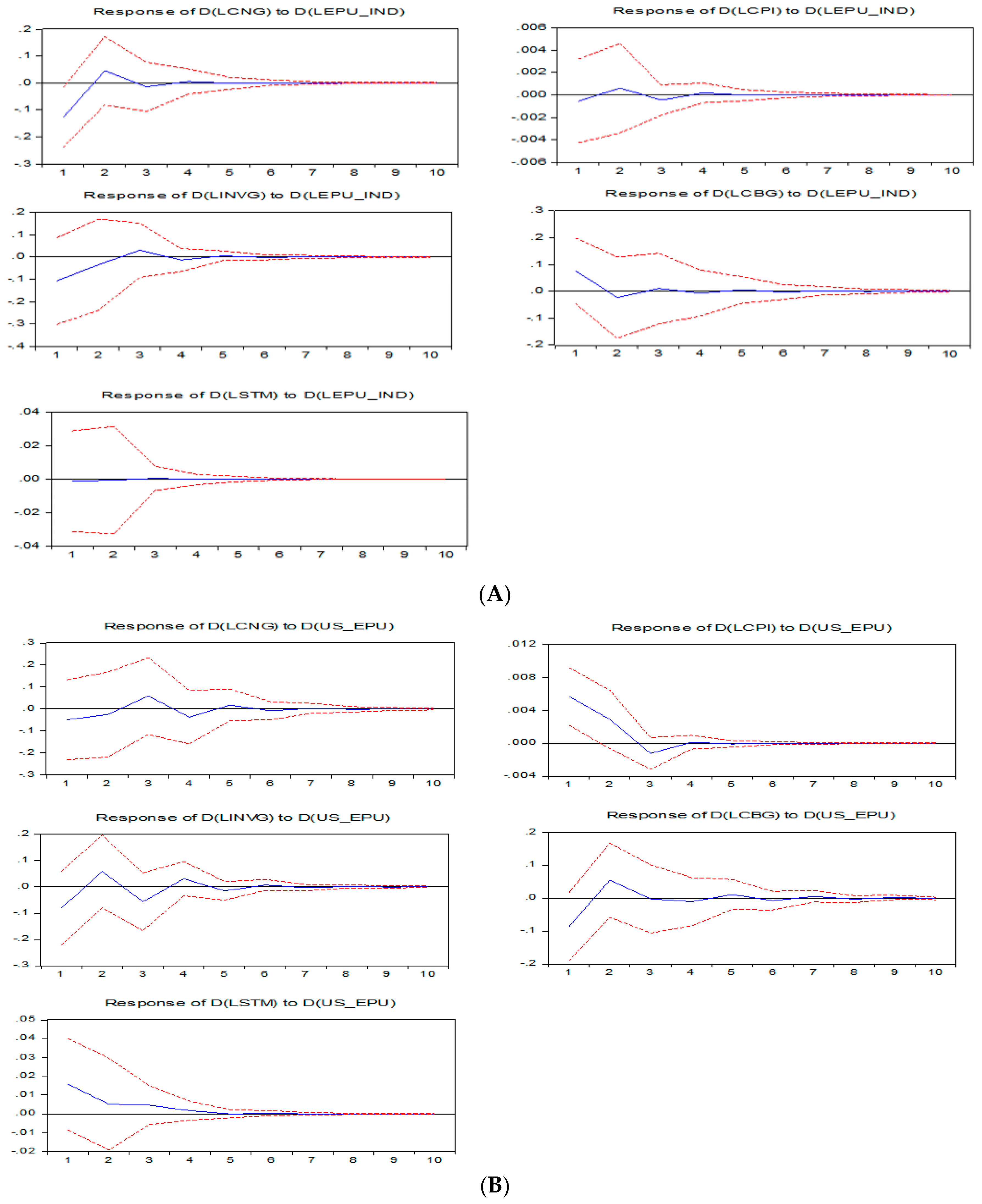

4.2. Impact of Domestic and Foreign EPU on India

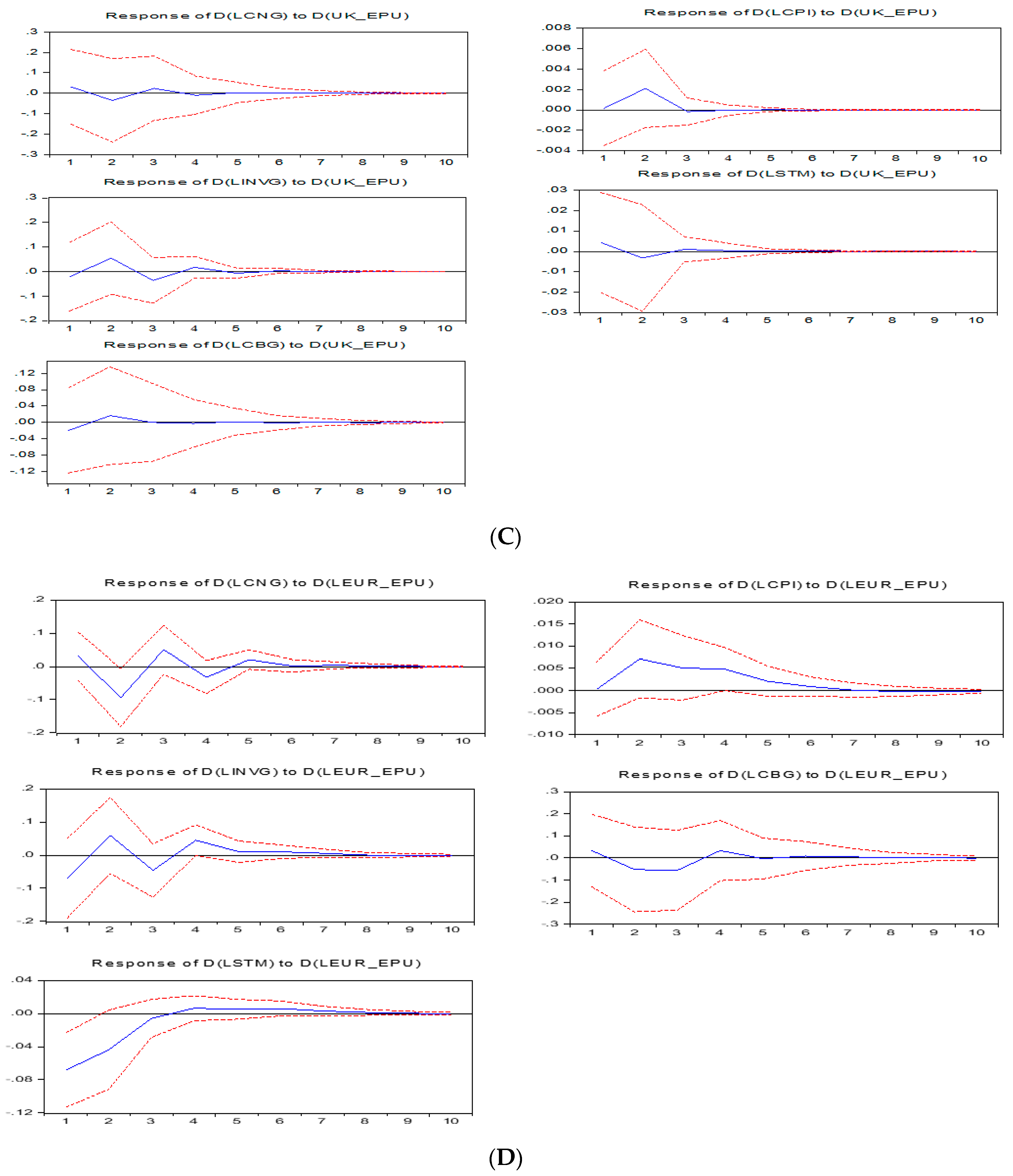

4.3. Impact of Domestic and Foreign EPU on China

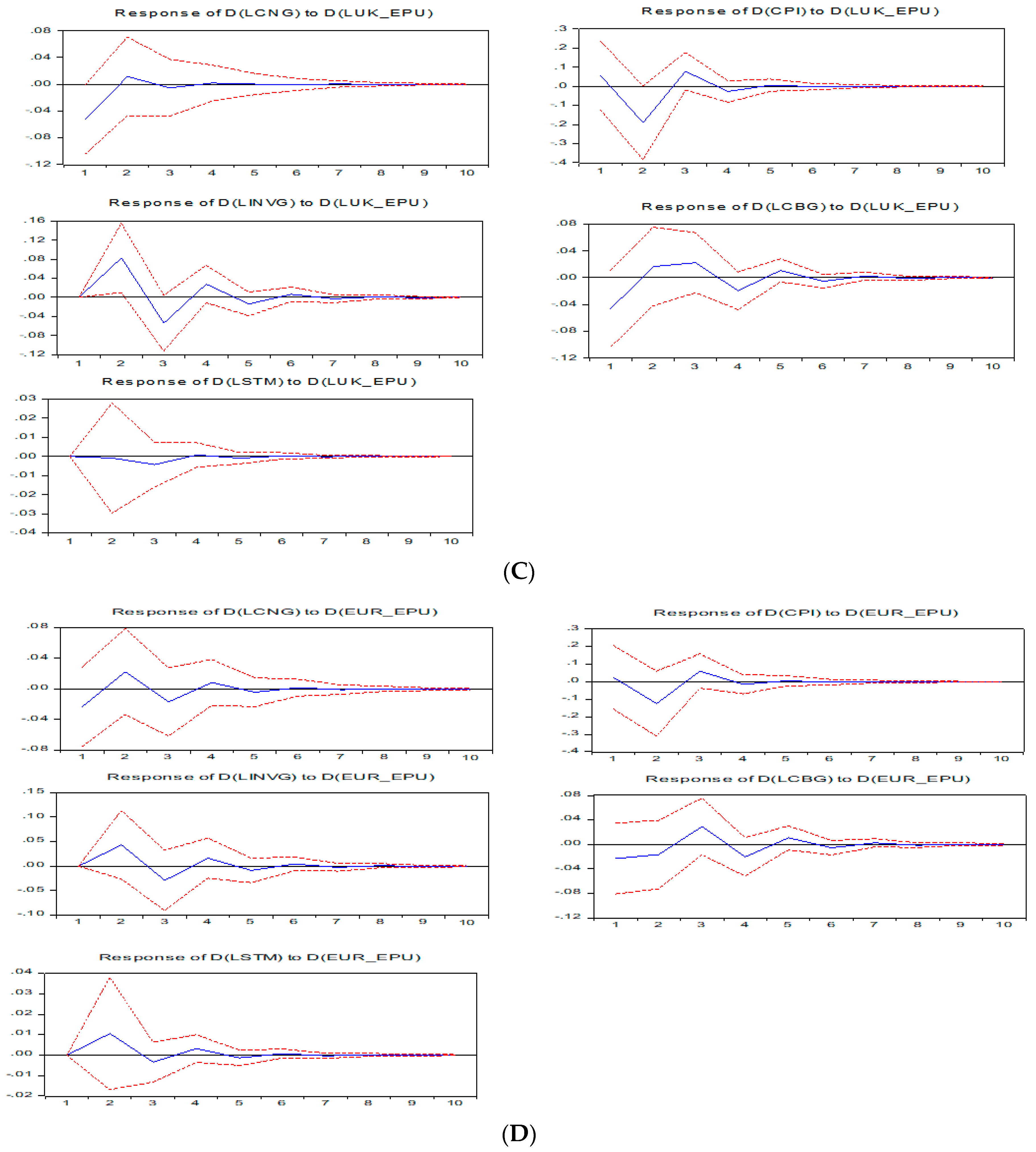

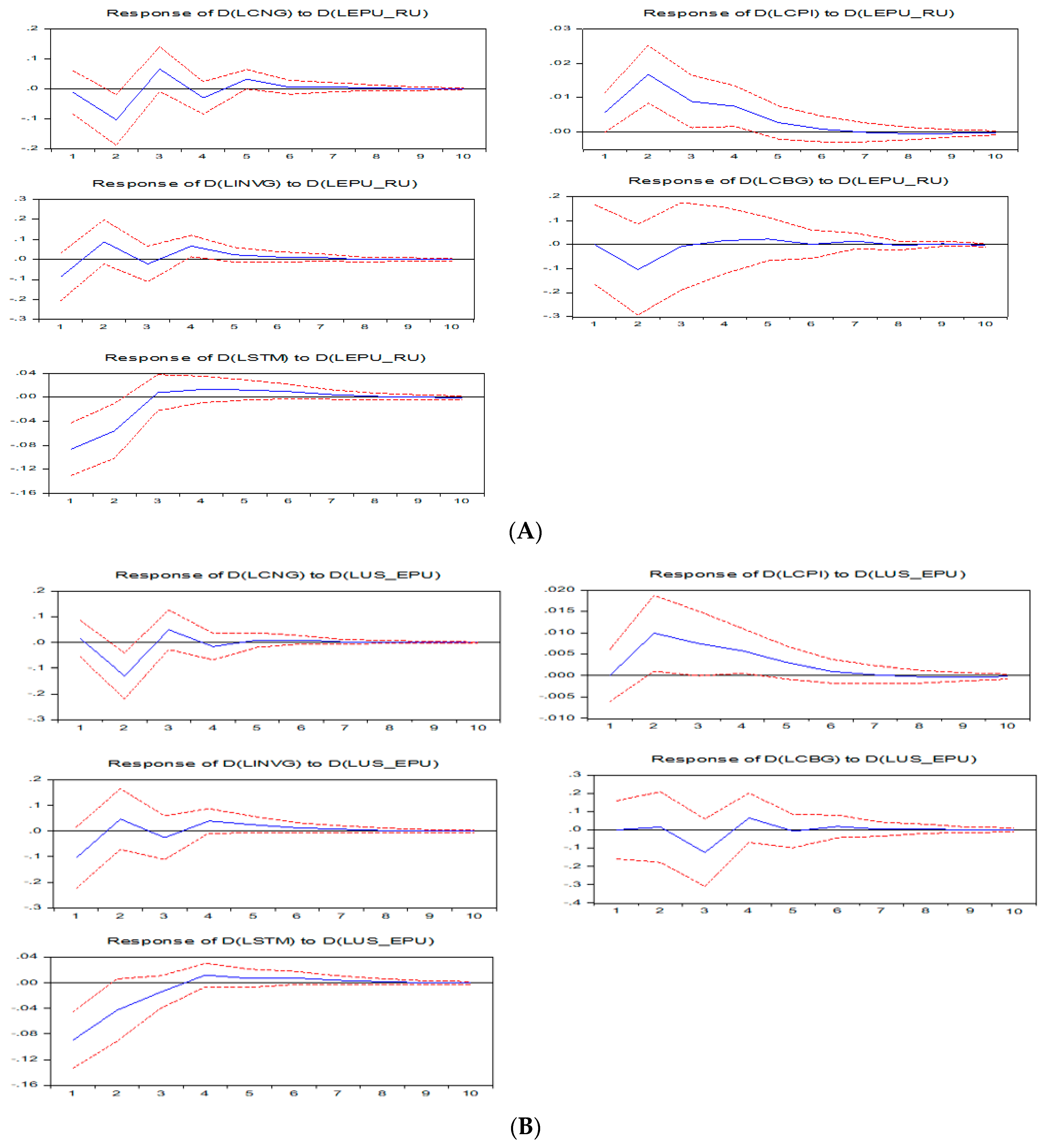

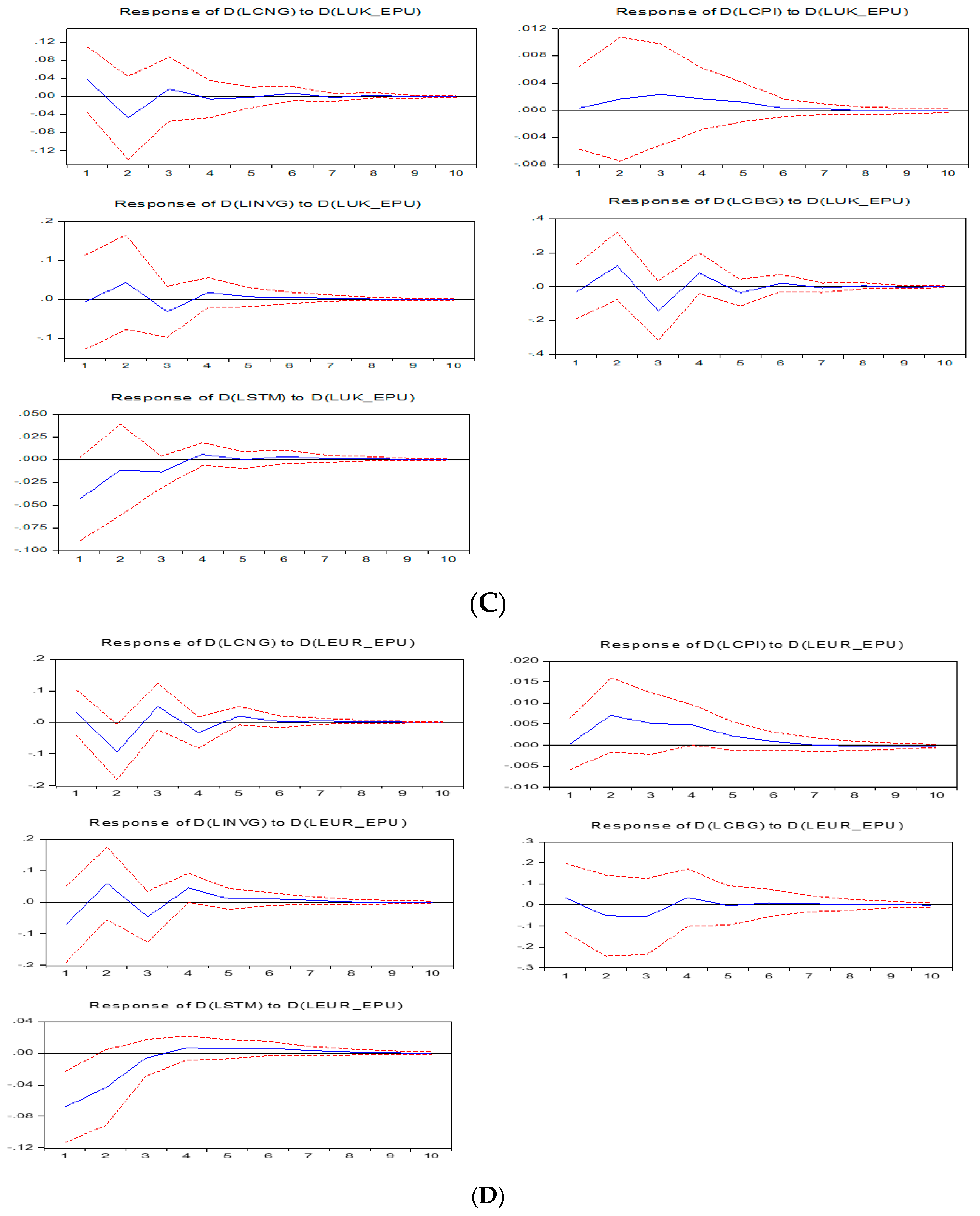

4.4. Impact of Domestic and Foreign EPU on Russia

5. Variance Decomposition

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Alessandri, Piergiorgio, and Haroon Mumtaz. 2014. Financial Regimes and Uncertainty Shocks. Available online: https://eprints.bbk.ac.uk/id/eprint/26589/ (accessed on 30 September 2019).

- Alfaro, Ivan, Nicholas Bloom, and Xiaoji Lin. 2016. The Finance-Uncertainty Multiplier. Stanford: Economics Department, Stanford University. [Google Scholar]

- Baker, Scott R., Nicholas Bloom, and Steven J. Davis. 2016. Measuring economic policy uncertainty. The Quarterly Journal of Economics 131: 1593–636. [Google Scholar] [CrossRef]

- Bernanke, Ben S. 1983. Irreversibility, uncertainty, and cyclical investment. The Quarterly Journal of Economics 98: 85–106. [Google Scholar] [CrossRef]

- Bhagat, Pulak Ghosh, and Srinivasan P. Rangan. 2013. Economic Policy Uncertainty and Economic Growth in India. IIM Bangalore Research Paper No. 407. Bengaluru: Indian Institute of Management Bangalore. [Google Scholar]

- Bloom, Nicholas. 2009. The impact of uncertainty shocks. Econometrica 77: 623–85. [Google Scholar]

- Bodie, Zvi. 1976. Common stocks as a hedge against inflation. The Journal of Finance 31: 459–70. [Google Scholar] [CrossRef]

- Bordo, Michael D., John V. Duca, and Christoffer Koch. 2016. Economic policy uncertainty and the credit channel: Aggregate and bank level US evidence over several decades. Journal of Financial Stability 26: 90–106. [Google Scholar] [CrossRef]

- Caballero, Ricardo J. 1990. Consumption puzzles and precautionary savings. Journal of Monetary Economics 25: 113–36. [Google Scholar] [CrossRef]

- Caggiano, Giovanni, Efrem Castelnuovo, and Nicolas Groshenny. 2014. Uncertainty shocks and unemployment dynamics in US recessions. Journal of Monetary Economics 67: 78–92. [Google Scholar] [CrossRef]

- Caldara, Dario, Cristina Fuentes-Albero, Simon Gilchrist, and Egon Zakrajšek. 2016. The macroeconomic impact of financial and uncertainty shocks. European Economic Review 88: 185–207. [Google Scholar] [CrossRef]

- Campbell, John Y., and Robert J. Shiller. 1988. Stock prices, earnings, and expected dividends. The Journal of Finance 43: 661–76. [Google Scholar] [CrossRef]

- Carrière-Swallow, Yan, and Luis Felipe Céspedes. 2013. The impact of uncertainty shocks in emerging economies. Journal of International Economics 90: 316–25. [Google Scholar] [CrossRef]

- Cheng, Chak Hung Jack. 2017. Effects of foreign and domestic economic policy uncertainty shocks on South Korea. Journal of Asian Economics 51: 1–11. [Google Scholar] [CrossRef]

- Cheng, Hui Fang, Margarida Gutierrez, Arvind Mahajan, Yochanan Shachmurove, and Manuchehr Shahrokhi. 2007. A future global economy to be built by BRICs. Global Finance Journal 18: 143–56. [Google Scholar] [CrossRef]

- Christiano, Lawrence, Roberto Motto, and Massimo Rostagno. 2007. Financial Factors in Business Cycles. Available online: http://citeseerx.ist.psu.edu/viewdoc/summary?doi=10.1.1.192.5766 (accessed on 5 October 2019).

- Colombo, Valentina. 2013. Economic policy uncertainty in the US: Does it matter for the Euro area? Economics Letters 121: 39–42. [Google Scholar] [CrossRef]

- Enders, Walter. 2004. Applied econometric time series, by walter. Technometrics 46: 264. [Google Scholar]

- Fama, Eugene F., and G. William Schwert. 1977. Asset returns and inflation. Journal of Financial Economics 5: 115–46. [Google Scholar] [CrossRef]

- Forbes, Kristin J., and Menzie D. Chinn. 2004. A decomposition of global linkages in financial markets over time. The Review of Economics and Statistics 86: 705–22. [Google Scholar] [CrossRef]

- Gilchrist, Simon, Jae W. Sim, and Egon Zakrajšek. 2014. Uncertainty, financial frictions, and investment dynamics. National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Gourio, Francois, Michael Siemer, and Adrien Verdelhan. 2013. International risk cycles. Journal of International Economics 89: 471–84. [Google Scholar] [CrossRef]

- Handley, Kyle, and Nuno Limao. 2015. Trade and investment under policy uncertainty: Theory and firm evidence. American Economic Journal: Economic Policy 7: 189–222. [Google Scholar] [CrossRef]

- Jawadi, Fredj, Sushanta K. Mallick, and Ricardo M. Sousa. 2011. Monetary policy rules in the BRICS: How important is nonlinearity? NIPE Working Paper 18: 1–33. [Google Scholar]

- Keynes, John Maynard. 1937. The general theory of employment. The Quarterly Journal of Economics 51: 209–23. [Google Scholar] [CrossRef]

- Knight, Frank H. 1921. Risk, Uncertainty and Profit. New York: Hart, Schaffner and Marx. [Google Scholar]

- Leduc, Sylvain, and Zheng Liu. 2013. Uncertainty and the slow labor market recovery. FRBSF Economic Letter 21: 22. [Google Scholar]

- Mensi, Walid, Shawkat Hammoudeh, Juan Carlos Reboredo, and Duc Khuong Nguyen. 2014. Do global factors impact BRICS stock markets? A quantile regression approach. Emerging Markets Review 19: 1–17. [Google Scholar] [CrossRef]

- Moro, Beniamino. 2014. Lessons from the European economic and financial great crisis: A survey. European Journal of Political Economy 34: S9–S24. [Google Scholar] [CrossRef]

- Mumtaz, Haroon, and Konstantinos Theodoridis. 2015. The international transmission of volatility shocks: An empirical analysis. Journal of the European Economic Association 13: 512–33. [Google Scholar] [CrossRef]

- Nodari, Gabriela. 2014. Financial regulation policy uncertainty and credit spreads in the US. Journal of Macroeconomics 41: 122–32. [Google Scholar] [CrossRef]

- Park, Chuhwan, Mo Chung, and Sukgyu Lee. 2011. The effects of oil price on regional economies with different production structures: A case study from Korea using a structural VAR model. Energy Policy 39: 8185–95. [Google Scholar] [CrossRef]

- Pfaff, Bernhard. 2008. VAR, SVAR and SVEC models: Implementation within R package vars. Journal of Statistical Software 27: 1–32. [Google Scholar] [CrossRef]

- Sharpe, Steven A. 2002. Reexamining stock valuation and inflation: The implications of analysts’ earnings forecasts. Review of Economics and Statistics 84: 632–48. [Google Scholar] [CrossRef]

- Sheng, Xuguang Simon, and Yang Liu. 2017. The Measurement and Transmission of Macroeconomic Uncertainty: Evidence from the US and BRIC Countries. International Journal of Forecasting 35: 967–79. [Google Scholar]

- Schwert, G. William. 1981. The adjustment of stock prices to information about inflation. The Journal of Finance 36: 15–29. [Google Scholar] [CrossRef]

- Sum, Vichet. 2012. The Reaction of Stock Markets in the BRIC Countries to Economic Policy Uncertainty in the United States. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2094697 (accessed on 20 September 2019).

- Yang, Yongzheng, and Issouf Samaké. 2011. Low-Income Countries’ BRIC Linkage: Are There Growth Spillovers? Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1974835 (accessed on 25 September 2019).

| (a) | |||||

| Period | |||||

| 1 | 0.208 | 4.695 | 0.048 | 0.593 | 1.357 |

| 2 | 3.307 | 7.550 | 1.091 | 0.530 | 5.944 |

| 3 | 3.421 | 7.698 | 1.160 | 0.537 | 6.727 |

| 4 | 3.502 | 7.855 | 1.156 | 0.620 | 6.663 |

| 5 | 3.502 | 7.864 | 1.154 | 0.626 | 6.691 |

| 6 | 3.503 | 7.866 | 1.154 | 0.634 | 6.686 |

| 7 | 3.503 | 7.867 | 1.155 | 0.636 | 6.685 |

| 8 | 3.503 | 7.866 | 1.155 | 0.636 | 6.685 |

| 9 | 3.503 | 7.866 | 1.155 | 0.637 | 6.685 |

| 10 | 3.503 | 7.866 | 1.155 | 0.637 | 6.685 |

| (b) | |||||

| Period | |||||

| 1 | 0.000 | 1.932 | 1.497 | 0.322 | 1.895 |

| 2 | 3.731 | 4.188 | 1.174 | 0.514 | 3.780 |

| 3 | 3.675 | 4.440 | 1.115 | 0.654 | 3.935 |

| 4 | 3.680 | 4.523 | 1.136 | 0.691 | 3.894 |

| 5 | 3.673 | 4.537 | 1.138 | 0.726 | 3.883 |

| 6 | 3.671 | 4.537 | 1.142 | 0.740 | 3.880 |

| 7 | 3.671 | 4.538 | 1.142 | 0.745 | 3.880 |

| 8 | 3.671 | 4.537 | 1.142 | 0.748 | 3.880 |

| 9 | 3.671 | 4.537 | 1.142 | 0.748 | 3.880 |

| 10 | 3.671 | 4.537 | 1.142 | 0.749 | 3.880 |

| (c) | |||||

| Period | |||||

| 1 | 0.000 | 0.218 | 1.093 | 0.253 | 0.198 |

| 2 | 0.766 | 2.023 | 1.106 | 0.303 | 1.350 |

| 3 | 0.888 | 2.054 | 1.099 | 0.288 | 1.278 |

| 4 | 0.899 | 2.083 | 1.086 | 0.281 | 1.387 |

| 5 | 0.901 | 2.083 | 1.084 | 0.283 | 1.384 |

| 6 | 0.901 | 2.083 | 1.084 | 0.283 | 1.385 |

| 7 | 0.901 | 2.083 | 1.084 | 0.283 | 1.385 |

| 8 | 0.901 | 2.083 | 1.084 | 0.284 | 1.384 |

| 9 | 0.901 | 2.083 | 1.084 | 0.284 | 1.384 |

| 10 | 0.901 | 2.083 | 1.084 | 0.284 | 1.384 |

| (d) | |||||

| Period | |||||

| 1 | 0.000 | 0.209 | 0.738 | 0.112 | 0.479 |

| 2 | 0.999 | 1.196 | 2.049 | 0.183 | 0.449 |

| 3 | 0.973 | 1.509 | 1.967 | 0.323 | 0.438 |

| 4 | 0.967 | 1.538 | 2.070 | 0.448 | 0.433 |

| 5 | 0.967 | 1.557 | 2.066 | 0.509 | 0.443 |

| 6 | 0.969 | 1.557 | 2.072 | 0.546 | 0.443 |

| 7 | 0.969 | 1.558 | 2.072 | 0.559 | 0.445 |

| 8 | 0.969 | 1.558 | 2.072 | 0.565 | 0.445 |

| 9 | 0.969 | 1.558 | 2.072 | 0.567 | 0.445 |

| 10 | 0.969 | 1.558 | 2.072 | 0.568 | 0.445 |

| (a) | |||||

| Period | |||||

| 1 | 2.256 | 9.259 | 0.158 | 2.842 | 0.010 |

| 2 | 2.237 | 8.272 | 0.303 | 2.058 | 0.012 |

| 3 | 2.375 | 8.145 | 0.391 | 1.904 | 0.013 |

| 4 | 2.402 | 8.111 | 0.403 | 1.870 | 0.013 |

| 5 | 2.404 | 8.105 | 0.403 | 1.863 | 0.013 |

| 6 | 2.404 | 8.104 | 0.403 | 1.861 | 0.013 |

| 7 | 2.404 | 8.103 | 0.403 | 1.861 | 0.013 |

| 8 | 2.404 | 8.103 | 0.403 | 1.861 | 0.013 |

| 9 | 2.404 | 8.103 | 0.403 | 1.861 | 0.013 |

| 10 | 2.404 | 8.103 | 0.403 | 1.861 | 0.013 |

| (b) | |||||

| Period | |||||

| 1 | 1.722 | 0.376 | 13.108 | 3.634 | 2.158 |

| 2 | 2.341 | 0.374 | 14.602 | 3.835 | 2.099 |

| 3 | 3.057 | 0.770 | 14.964 | 3.625 | 2.220 |

| 4 | 3.266 | 0.920 | 14.956 | 3.612 | 2.236 |

| 5 | 3.318 | 0.957 | 14.955 | 3.634 | 2.235 |

| 6 | 3.329 | 0.964 | 14.954 | 3.650 | 2.236 |

| 7 | 3.332 | 0.966 | 14.954 | 3.657 | 2.236 |

| 8 | 3.332 | 0.966 | 14.954 | 3.660 | 2.236 |

| 9 | 3.332 | 0.966 | 14.954 | 3.661 | 2.236 |

| 10 | 3.332 | 0.966 | 14.954 | 3.661 | 2.236 |

| (c) | |||||

| Period | |||||

| 1 | 0.124 | 0.159 | 0.010 | 0.183 | 0.165 |

| 2 | 0.822 | 0.277 | 1.586 | 0.239 | 0.225 |

| 3 | 1.126 | 0.332 | 1.584 | 0.226 | 0.229 |

| 4 | 1.187 | 0.340 | 1.584 | 0.224 | 0.229 |

| 5 | 1.198 | 0.340 | 1.584 | 0.225 | 0.229 |

| 6 | 1.200 | 0.340 | 1.584 | 0.225 | 0.229 |

| 7 | 1.200 | 0.340 | 1.584 | 0.225 | 0.229 |

| 8 | 1.200 | 0.340 | 1.584 | 0.225 | 0.229 |

| 9 | 1.200 | 0.340 | 1.584 | 0.225 | 0.229 |

| 10 | 1.200 | 0.340 | 1.584 | 0.225 | 0.229 |

| (d) | |||||

| Period | |||||

| 1 | 1.149 | 1.127 | 4.914 | 0.308 | 0.345 |

| 2 | 1.028 | 2.535 | 6.671 | 1.241 | 0.310 |

| 3 | 1.017 | 4.851 | 7.024 | 3.151 | 0.309 |

| 4 | 1.016 | 5.732 | 7.036 | 4.446 | 0.345 |

| 5 | 1.016 | 5.909 | 7.033 | 5.007 | 0.353 |

| 6 | 1.015 | 5.924 | 7.033 | 5.191 | 0.357 |

| 7 | 1.016 | 5.923 | 7.034 | 5.240 | 0.358 |

| 8 | 1.016 | 5.924 | 7.034 | 5.251 | 0.358 |

| 9 | 1.016 | 5.924 | 7.034 | 5.254 | 0.358 |

| 10 | 1.016 | 5.924 | 7.034 | 5.254 | 0.358 |

| (a) | |||||

| Period | |||||

| 1 | 0.000 | 0.368 | 0.012 | 0.871 | 0.000 |

| 2 | 0.343 | 0.546 | 1.853 | 4.362 | 0.156 |

| 3 | 0.552 | 0.670 | 2.285 | 4.497 | 0.194 |

| 4 | 0.609 | 0.726 | 2.399 | 4.497 | 0.194 |

| 5 | 0.626 | 0.740 | 2.415 | 4.498 | 0.195 |

| 6 | 0.631 | 0.744 | 2.420 | 4.499 | 0.196 |

| 7 | 0.633 | 0.745 | 2.421 | 4.499 | 0.196 |

| 8 | 0.633 | 0.745 | 2.421 | 4.499 | 0.196 |

| 9 | 0.633 | 0.745 | 2.421 | 4.499 | 0.196 |

| 10 | 0.633 | 0.745 | 2.421 | 4.499 | 0.196 |

| (b) | |||||

| Period | |||||

| 1 | 12.146 | 1.215 | 1.565 | 0.927 | 2.134 |

| 2 | 10.346 | 3.036 | 1.467 | 0.996 | 2.998 |

| 3 | 10.368 | 4.042 | 2.108 | 1.152 | 3.042 |

| 4 | 10.390 | 4.429 | 2.116 | 1.402 | 3.033 |

| 5 | 10.387 | 4.520 | 2.116 | 1.456 | 3.044 |

| 6 | 10.385 | 4.535 | 2.117 | 1.460 | 3.045 |

| 7 | 10.385 | 4.536 | 2.117 | 1.460 | 3.046 |

| 8 | 10.386 | 4.536 | 2.117 | 1.460 | 3.046 |

| 9 | 10.386 | 4.536 | 2.117 | 1.460 | 3.046 |

| 10 | 10.386 | 4.536 | 2.117 | 1.460 | 3.046 |

| (c) | |||||

| Period | |||||

| 1 | 0.000 | 4.352 | 0.413 | 3.217 | 0.000 |

| 2 | 5.498 | 4.087 | 4.769 | 3.011 | 0.003 |

| 3 | 7.577 | 4.070 | 5.415 | 3.528 | 0.092 |

| 4 | 8.123 | 4.067 | 5.491 | 3.953 | 0.095 |

| 5 | 8.256 | 4.065 | 5.494 | 4.088 | 0.099 |

| 6 | 8.284 | 4.066 | 5.494 | 4.121 | 0.099 |

| 7 | 8.290 | 4.066 | 5.494 | 4.128 | 0.099 |

| 8 | 8.291 | 4.066 | 5.494 | 4.129 | 0.099 |

| 9 | 8.291 | 4.066 | 5.494 | 4.129 | 0.099 |

| 10 | 8.291 | 4.066 | 5.494 | 4.129 | 0.099 |

| (d) | |||||

| Period | |||||

| 1 | 5.399 | 3.589 | 0.136 | 1.785 | 0.374 |

| 2 | 4.747 | 4.517 | 1.879 | 1.530 | 0.406 |

| 3 | 5.010 | 4.927 | 2.263 | 1.850 | 0.513 |

| 4 | 5.148 | 5.047 | 2.312 | 2.143 | 0.544 |

| 5 | 5.195 | 5.074 | 2.317 | 2.254 | 0.555 |

| 6 | 5.209 | 5.080 | 2.317 | 2.286 | 0.558 |

| 7 | 5.213 | 5.081 | 2.317 | 2.294 | 0.559 |

| 8 | 5.214 | 5.081 | 2.317 | 2.296 | 0.559 |

| 9 | 5.214 | 5.082 | 2.317 | 2.297 | 0.559 |

| 10 | 5.214 | 5.082 | 2.317 | 2.297 | 0.559 |

| (a) | |||||

| Period | |||||

| 1 | 2.808 | 0.132 | 4.901 | 0.000 | 18.540 |

| 2 | 5.101 | 6.571 | 19.160 | 1.334 | 20.828 |

| 3 | 5.083 | 8.723 | 19.275 | 1.244 | 20.370 |

| 4 | 6.320 | 9.117 | 20.215 | 1.253 | 20.362 |

| 5 | 6.398 | 9.542 | 20.228 | 1.297 | 20.346 |

| 6 | 6.429 | 9.530 | 20.210 | 1.296 | 20.417 |

| 7 | 6.451 | 9.532 | 20.202 | 1.321 | 20.415 |

| 8 | 6.451 | 9.537 | 20.204 | 1.322 | 20.416 |

| 9 | 6.451 | 9.537 | 20.205 | 1.323 | 20.415 |

| 10 | 6.452 | 9.536 | 20.206 | 1.324 | 20.415 |

| (b) | |||||

| Period | |||||

| 1 | 3.935 | 0.251 | 0.000 | 0.000 | 19.595 |

| 2 | 4.353 | 10.091 | 6.050 | 0.031 | 19.453 |

| 3 | 4.396 | 11.050 | 7.585 | 1.853 | 19.318 |

| 4 | 4.791 | 11.115 | 8.456 | 2.280 | 19.302 |

| 5 | 4.914 | 11.093 | 8.722 | 2.231 | 19.092 |

| 6 | 4.951 | 11.132 | 8.745 | 2.262 | 19.116 |

| 7 | 4.962 | 11.126 | 8.742 | 2.255 | 19.106 |

| 8 | 4.963 | 11.129 | 8.742 | 2.258 | 19.109 |

| 9 | 4.963 | 11.129 | 8.743 | 2.258 | 19.108 |

| 10 | 4.963 | 11.129 | 8.744 | 2.257 | 19.107 |

| (c) | |||||

| Period | |||||

| 1 | 0.000 | 4.352 | 0.413 | 3.217 | 0.000 |

| 2 | 5.498 | 4.087 | 4.769 | 3.011 | 0.003 |

| 3 | 7.577 | 4.070 | 5.415 | 3.528 | 0.092 |

| 4 | 8.123 | 4.067 | 5.491 | 3.953 | 0.095 |

| 5 | 8.256 | 4.065 | 5.494 | 4.088 | 0.099 |

| 6 | 8.284 | 4.066 | 5.494 | 4.121 | 0.099 |

| 7 | 8.290 | 4.066 | 5.494 | 4.128 | 0.099 |

| 8 | 8.291 | 4.066 | 5.494 | 4.129 | 0.099 |

| 9 | 8.291 | 4.066 | 5.494 | 4.129 | 0.099 |

| 10 | 8.291 | 4.066 | 5.494 | 4.129 | 0.099 |

| (d) | |||||

| Period | |||||

| 1 | 0.018 | 1.433 | 0.019 | 0.212 | 4.598 |

| 2 | 0.649 | 2.181 | 0.180 | 2.066 | 3.977 |

| 3 | 0.950 | 2.268 | 0.408 | 4.203 | 4.200 |

| 4 | 1.022 | 2.271 | 0.501 | 4.794 | 4.208 |

| 5 | 1.024 | 2.247 | 0.560 | 4.875 | 4.141 |

| 6 | 1.025 | 2.273 | 0.563 | 4.916 | 4.138 |

| 7 | 1.027 | 2.272 | 0.564 | 4.915 | 4.132 |

| 8 | 1.027 | 2.276 | 0.564 | 4.918 | 4.132 |

| 9 | 1.027 | 2.276 | 0.564 | 4.918 | 4.132 |

| 10 | 1.027 | 2.276 | 0.565 | 4.918 | 4.132 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kumar, A.; Kalhoro, M.R.; Kumar, R.; Ghumro, N.H.; Dakhan, S.A.; Kumar, V. Decomposing the Effect of Domestic and Foreign Economic Policy Uncertainty Shocks on Real and Financial Sectors: Evidence from BRIC Countries. J. Risk Financial Manag. 2020, 13, 315. https://doi.org/10.3390/jrfm13120315

Kumar A, Kalhoro MR, Kumar R, Ghumro NH, Dakhan SA, Kumar V. Decomposing the Effect of Domestic and Foreign Economic Policy Uncertainty Shocks on Real and Financial Sectors: Evidence from BRIC Countries. Journal of Risk and Financial Management. 2020; 13(12):315. https://doi.org/10.3390/jrfm13120315

Chicago/Turabian StyleKumar, Ameet, Muhammad Ramzan Kalhoro, Rakesh Kumar, Niaz Hussain Ghumro, Sarfraz Ahmed Dakhan, and Vikesh Kumar. 2020. "Decomposing the Effect of Domestic and Foreign Economic Policy Uncertainty Shocks on Real and Financial Sectors: Evidence from BRIC Countries" Journal of Risk and Financial Management 13, no. 12: 315. https://doi.org/10.3390/jrfm13120315

APA StyleKumar, A., Kalhoro, M. R., Kumar, R., Ghumro, N. H., Dakhan, S. A., & Kumar, V. (2020). Decomposing the Effect of Domestic and Foreign Economic Policy Uncertainty Shocks on Real and Financial Sectors: Evidence from BRIC Countries. Journal of Risk and Financial Management, 13(12), 315. https://doi.org/10.3390/jrfm13120315