Consideration of Risk Factors in Corporate Property Portfolio Management

Abstract

1. Introduction

2. Materials and Methods

3. Results

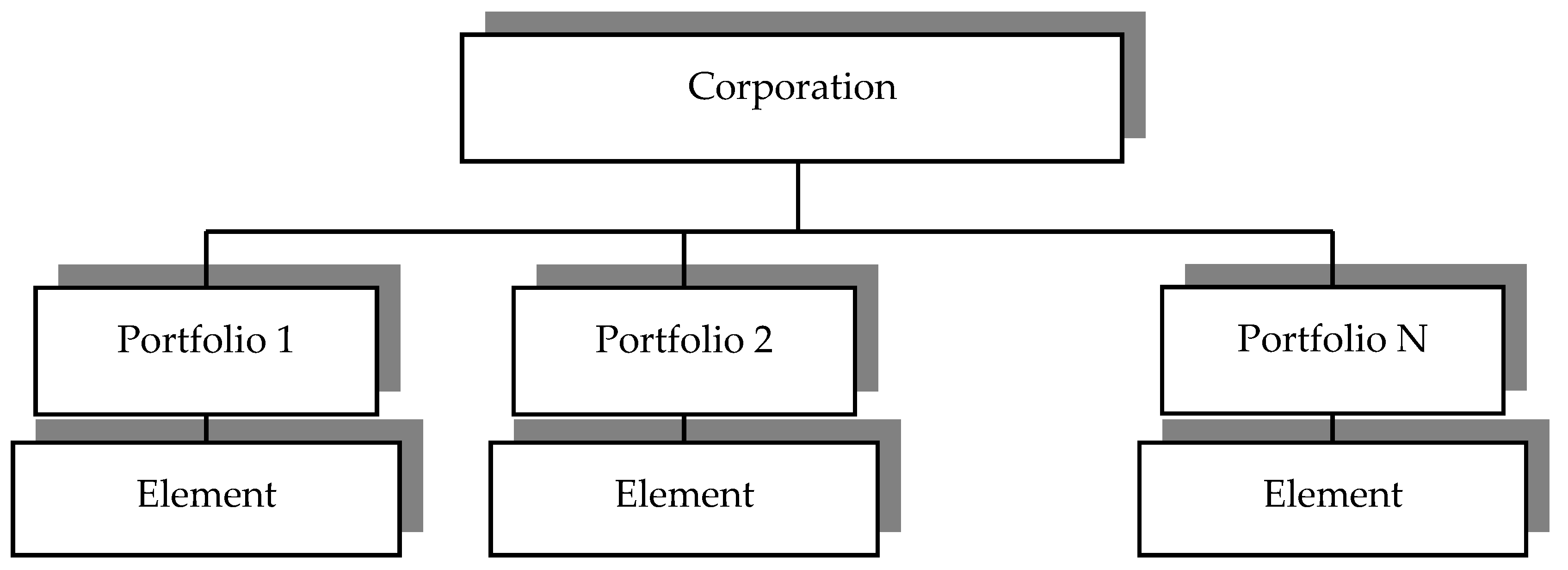

3.1. Leading Approaches to the Building of the Corporate Property Packages

- The Pareto principle. The idea of this principle, regarding the cluster theory, resides in the fact that only 20% of the total number of the control objects of the corporation is the economic foundation (80%) of this cluster. Thus, the concentration of attention and management efforts (i.e., 80% of management activity) on the most important elements of the corporate activity (20% of the property units) is the key to effective management activity at any level of management of the corporation, which makes it possible to act with minimal losses and obtain the maximum effect (Stoll 2014; Chehabeddine and Tvaronavičienė 2020).

- The principle of the importance of the management object. It can be presented through the following rule: the amount of time, allocated for solving a problem, should be adequate to the problem, while the level of the leader to the level of the problem. The determination of the proportion of working time, as well as the level of solving this problem, can be carried out through the use of the criterion of the importance of the problem (Vogiazas 2015). The criteria of the importance of a problem (object of management) are formed as sets of values of the corresponding estimates. In the article, we propose the use of two criteria:

- (1)

- A relative criterion, which makes it possible to compare the level of criticality of the objects in pairs and choose the priority one for generating a control action;

- (2)

- An absolute criterion, which makes it possible to rank all objects upon their importance.

- A cluster falls into management objects moj (j = 1, …, n), where j is the number of controlled objects.

- After that, one determines the set of indicators for the evaluation of the importance of an object, which can be represented by a decisive nonempty set D, the elements of which are the properties of the object of the importance di (i = 1, …, m), where i is the number of important properties. As indicators, characterizing the importance of an object, one should use the main financial and economic indicators of the corporate activity.

- Each of the elements of di is provided with a level of importance (weight pi). After that, they are ranked by the level of importance.

- Each controllable object of the infinity of properties is given an importance value vij.

- After that, one builds a fuzzy set Dj for each controlled object. Herewith:where is an importance function, showing the grade of the importance of this property for a particular object of management:

- For all Dj, one determines the height , in other words, the biggest value of all acquired indicators of the importance function:

- All values of a function of importance are normalized:herewith:where Dk is the function of the importance of the normalized fuzzy set.

- The objects of management are ranked through the comparison of the normalized importance functions. Herewith, one can mention that the Dj indicator is more important than the Dk indicator under the following condition:where is the number of pairs of functions of importance, in which normalized values of these functions of the set Dj are bigger than the corresponding values of the importance function of the Dk set; is the number of pairs of functions of importance, in which the normalized values of these functions of the set Dj are smaller than the corresponding of the importance function of the Dk set.

3.2. Portfolio Property Management

- –

- The initial cost Wi0 of acquisition or setting of business before its transference in the portfolio;

- –

- The number of participants ni in the business direction;

- –

- The initial investments Si0 in the given portfolio segment, under the condition that:Si0 = Wi0 × ni;

- –

- Expected profitability of the business direction ri;

- –

- The standard deviation of income σi from the average income of a corporation.

- –

- The total amount of portfolio investment at a specific point of time t − St;

- –

- The share price distribution of businesses in the portfolio {xi}, and for the initial portfolio the following procedure is true:

- –

- The correlation matrix {ρij}, the coefficients of which characterize the relationship between the profitability of the i- and j-business directions.

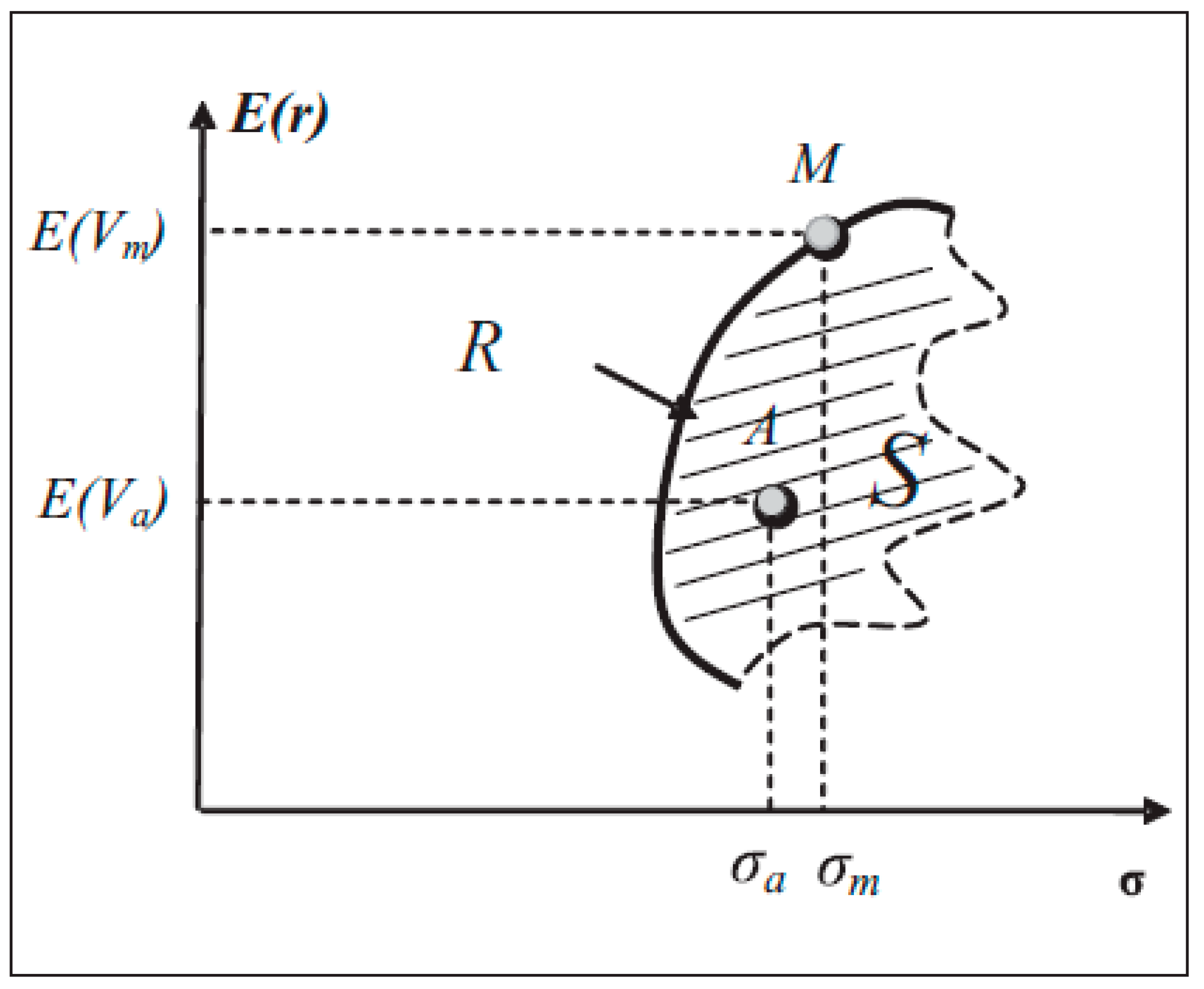

3.3. Portfolio Risk Management on the Base of a Fuzzy Model of Analysis

4. Discussion

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Ballou, Brian, and Dan L. Heitger. 2005. A building-block approach for implementing COSO: Enterprise risk management–Integrated framework. Management Accounting Quarterly 6: 1–10. [Google Scholar]

- Belaid, Aouni, Doumpos Michalis, Pérez-Gladish Blanca, and E. Steuer Ralph. 2018. On the increasing importance of multiple criteria decision aid methods for portfolio selection. Journal of the Operational Research Society 69: 1525–42. [Google Scholar]

- Blessy, Nkoko Sekome, and Lemma Tesfaye Taddesse. 2014. Determinants of voluntary formation of risk management committees. Managerial Auditing Journal 29: 649–71. [Google Scholar] [CrossRef]

- Bromiley, Philip, Michael McShane, Anil Nair, and Elzotbek Rustambekov. 2015. Enterprise Risk Management: Review, Critique, and Research Directions. Long Range Planning 48: 265–76. [Google Scholar] [CrossRef]

- Cakici, Nusret, Sris Chatterjee, and Ren-Raw Chen. 2019. Default Risk and Cross Section of Returns. Journal of Risk and Financial Management 12: 95. [Google Scholar] [CrossRef]

- Carpenter, Jennifer N. 2000. Does Option Compensation Increase Managerial Risk Appetite? The Journal of Finance 55: 2311–32. [Google Scholar] [CrossRef]

- Chehabeddine, Mohammad, and Manuela Tvaronavičienė. 2020. Securing regional development. Insights into Regional Development 2: 430–42. [Google Scholar] [CrossRef]

- Dionne, Georges, and Martin Garand. 2003. Risk Management Determinants Affecting Firms’ Values in the Gold Mining Industry: New Empirical Evidence. Economics Letters 79: 43–52. [Google Scholar] [CrossRef]

- Durmanov, Akmal, Viera Bartosova, Svetlana Drobyazko, Oksana Melnyk, and Volodymyr Fillipov. 2019. Mechanism to ensure sustainable development of enterprises in the information space. Entrepreneurship and Sustainability 7: 1377–86. [Google Scholar] [CrossRef]

- Froot, Kenneth A., David S. Scharfstein, and Jeremy C. Stein. 1993. Risk management: Coordinating corporate investment and financing policies. Journal Finance 48: 1629–58. [Google Scholar] [CrossRef]

- Holmstrom, Bengt, and Steven N. Kaplan. 2003. The State of US Corporate Governance: What’s Right and What’s Wrong? Working Paper No. 23/2003. Brussels: European Corporate Governance Institute Finance. [Google Scholar]

- Hoyt, Robert E., and Andre P. Liebenberg. 2009. The Value of Enterprise Risk Management. Working Paper. Athens: University of Georgia. [Google Scholar]

- Kiel, Geofirey, and Gavin Nicholson. 2002. Real world governance: Driving business success through effective corporate governance. Mt Eliza Business Review 5: 17–28. [Google Scholar]

- Kleffner, Anne E., Ryan B. Lee, and Bill McGannon. 2003. The effect of corporate governance on the use of enterprise risk management: Evidence from Canada. Risk Management and Insurance Review 6: 53–73. [Google Scholar] [CrossRef]

- Kumar, Praveen, and Alessandro Zattoni. 2019. Farewell editorial: Exiting editors’ perspective on current and future challenges in corporate governance research. Corporate Governance: An International Review 27: 2–11. [Google Scholar] [CrossRef]

- Liebenberg, Andre, and Robert Hoyt. 2003. The determinants of enterprise risk management: Evidence from the appointment of Chief Risk Officers. Risk Management and Insurance Review 6: 37–52. [Google Scholar] [CrossRef]

- Lingel, Anna, and Elizabeth A. Sheedy. 2012. The Influence of Risk Governance on Risk Outcomes—International Evidence. Working Paper. Sydney: Macquarie University. [Google Scholar]

- Mehran, Hamid, and Lindsay Mollineaux. 2012. Corporate governance of financial institutions. Annual Review of Financial Economics 4: 215–32. [Google Scholar] [CrossRef]

- Nocco, Brian W., and René M. Stulz. 2006. Enterprise risk management: Theory and practice. Journal of Applied Corporate Finance 18: 8–20. [Google Scholar] [CrossRef]

- Panfilo, Silvia. 2019. (In)Consistency Between Private and Public Disclosure on Enterprise Risk Management and Its Determinants. Multiple Perspectives in Risk and Risk Management 4: 87–123. [Google Scholar]

- Polac, Janka. 2019. Use of stress testing in anti-crisis management of banking institutions. Economics and Finance 10: 16–21. [Google Scholar]

- Robin, Ceed Paul, and Luis Andre Stephen. 2006. Company Director Manual. Sydney: Thomson Reuters, pp. 10001–10129. [Google Scholar]

- Rogers, Daniel A. 2002. Does Executive Portfolio Structure Affect Risk Management? CEO Risk-taking Incentives and Corporate Derivatives Usage. Journal of Banking & Finance 26: 271–95. [Google Scholar]

- Rosenberg, Joshua V., and Til Schuermann. 2006. A general approach to integrated risk management with skewed, fat-tailed risks. Journal of Financial Economics 79: 569–614. [Google Scholar] [CrossRef]

- Seville, Martine, and Christine Teyssier. 2017. Role of the Governance System in Strategic Risk Management. Risk Management 4: 1–23. [Google Scholar]

- Smith, Clifford W., and Rene M. Stulz. 1985. The Determinants of Firms’ Hedging Policies. Journal of Financial and Quantitative Analysis 20: 391–405. [Google Scholar] [CrossRef]

- Sobel, Paul J., and Kurt F. Reding. 2004. Aligning corporate governance with enterprise risk management. Management Accounting Quarterly 5: 29–37. [Google Scholar]

- Stoll, Margareth. 2014. From Information Security Management to Enterprise Risk Management. Innovations and Advances in Computing, Informatics, Systems Sciences, Networking and Engineering. Cham: Springer, pp. 9–16. [Google Scholar]

- Stulz, Rene Marck. 2014. Governance, Risk Management, and Risk-Taking in Financial Institutions. Working Paper. Columbus: The Ohio State University. [Google Scholar]

- Vogiazas, Sofoklis. 2015. Determinants of Credit Risk in the Bulgarian and the Romanian Banking Systems and the Role of the Greek Crisis. Ph.D. dissertation, University of Sheffield, Sheffield, UK. [Google Scholar]

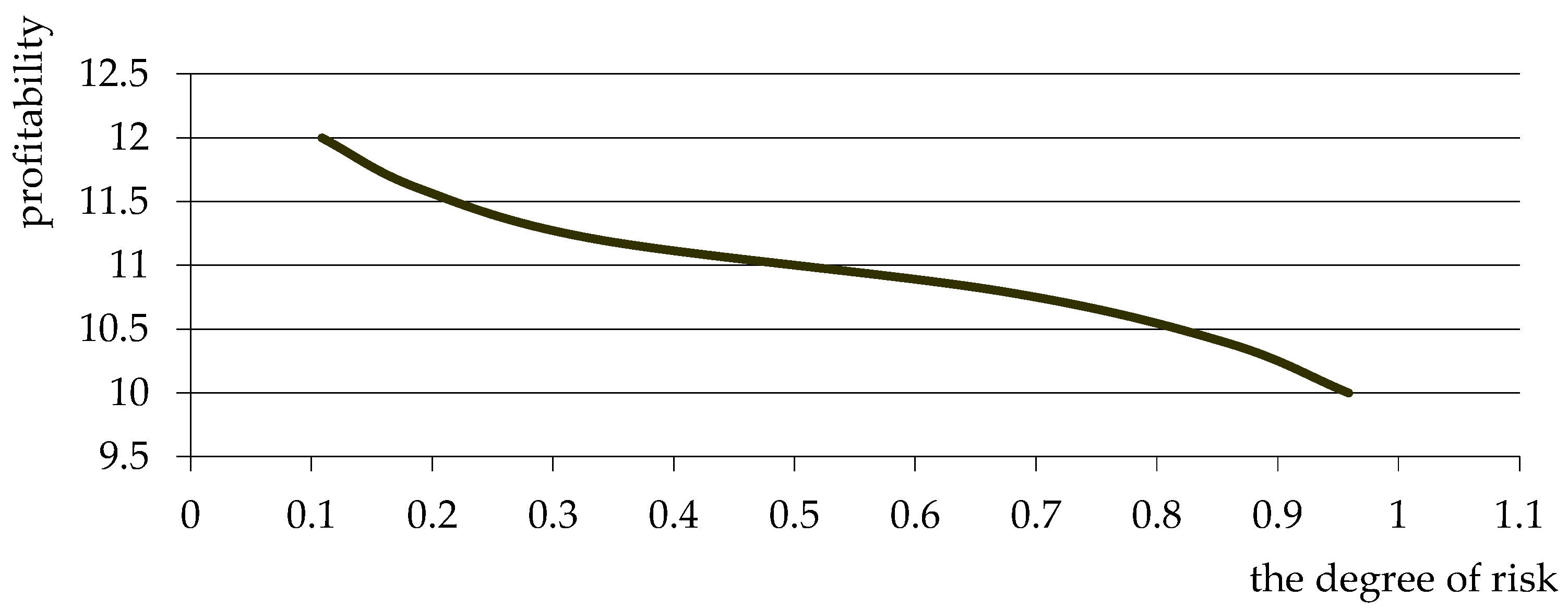

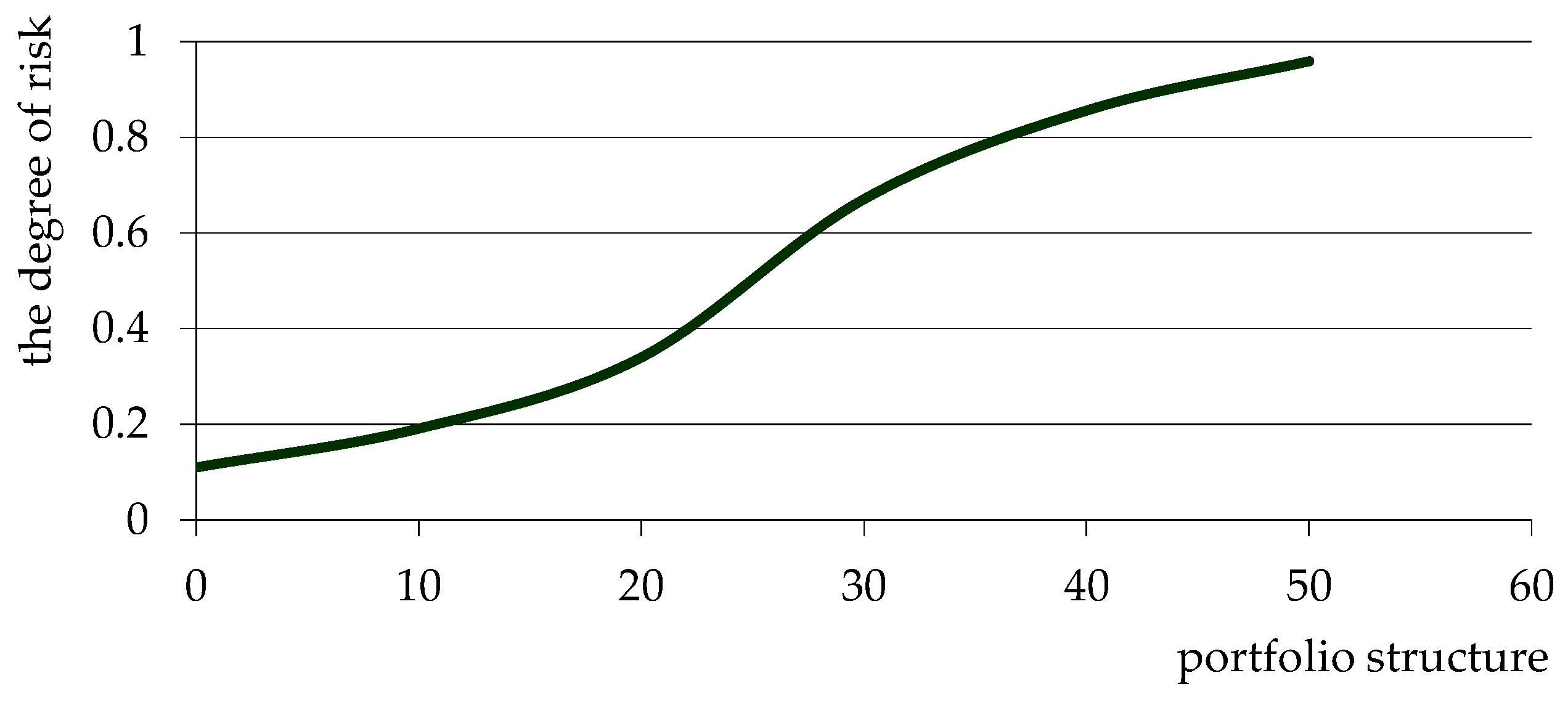

| № | BD1 Share | BD2 Share | Expected Portfolio Profitability, % | Lower Profit Limit, % | Upper Profit Limit, % | Degree of Risk |

|---|---|---|---|---|---|---|

| 1 | 0.0 | 1.0 | 12.0 | 9.6 | 14.4 | 0.109 |

| 2 | 0.1 | 0.9 | 11.6 | 9.4 | 13.8 | 0.190 |

| 3 | 0.2 | 0.8 | 11.2 | 9.1 | 13.3 | 0.339 |

| 4 | 0.3 | 0.7 | 10.8 | 8.9 | 12.7 | 0.670 |

| 5 | 0.4 | 0.6 | 10.4 | 8.6 | 12.2 | 0.854 |

| 6 | 0.5 | 0.5 | 10.0 | 8.4 | 11.6 | 0.959 |

| Parameters | Package 1 | Package 2 | Package 3 | Package 4 | Package 5 |

|---|---|---|---|---|---|

| E(Ri) | −0.05 | −0.072 | −0.056 | −0.061 | −0.0009 |

| E(Rp) | 0.029877 | 0.034 | 0.0333 | 0.029 | 0.000 |

| R, probabilistic model | 0.00688 | 0.00099 | 0.00099 | 0.00199 | 0.0029 |

| σij | 0.024 | 0.02877 | 0.02877 | 0.02432 | 0.026668 |

| σ, probabilistic model | 0.049 | 0.0455 | 0.04602 | 0.03988 | 0.036799 |

| Parameter | Fuzzy Model | Probabilistic Model |

|---|---|---|

| Portfolio return | 0.059933 | 0.003945456 |

| Portfolio risk | 0.000498 | 0.00089243245 |

| Maximum ratio “return-risk” | 112.2333 | 4.763454326 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Karpenko, L.; Chunytska, I.; Oliinyk, N.; Poprozman, N.; Bezkorovaina, O. Consideration of Risk Factors in Corporate Property Portfolio Management. J. Risk Financial Manag. 2020, 13, 299. https://doi.org/10.3390/jrfm13120299

Karpenko L, Chunytska I, Oliinyk N, Poprozman N, Bezkorovaina O. Consideration of Risk Factors in Corporate Property Portfolio Management. Journal of Risk and Financial Management. 2020; 13(12):299. https://doi.org/10.3390/jrfm13120299

Chicago/Turabian StyleKarpenko, Lidiia, Iryna Chunytska, Nataliia Oliinyk, Nataliia Poprozman, and Olha Bezkorovaina. 2020. "Consideration of Risk Factors in Corporate Property Portfolio Management" Journal of Risk and Financial Management 13, no. 12: 299. https://doi.org/10.3390/jrfm13120299

APA StyleKarpenko, L., Chunytska, I., Oliinyk, N., Poprozman, N., & Bezkorovaina, O. (2020). Consideration of Risk Factors in Corporate Property Portfolio Management. Journal of Risk and Financial Management, 13(12), 299. https://doi.org/10.3390/jrfm13120299