Abstract

These notes are based on parts of a keynote address to the Fourth Annual Conference on Money and Finance at Chapman University on 6–7 September 2019. Quantitative easing (QE) policies have been pushed to extremes and extended well beyond their use-by dates to little plausible effect in achieving the goal of raising inflation and growth. Instead, they are damaging the interbank market (as exemplified by the liquidity crisis in September 2019), adding to the risk of financial crises in the future and taking pressure off policy-makers to deal with the real causes of poor investment, growth and deflation pressure. The shift in where investment is occurring and the special problems of Europe and Brexit are focused upon.

1. Introduction

Providing liquidity to banks and preventing runs on deposits was essential in 2008–2009 to avoid economic collapse. The need for subsequent re-regulation to correct some of the capture-driven laxity of the past is also beyond question. However, extending the lender-of-last-resort phase into a permanent feature, and doubling and tripling down on it, is an error. Unconventional monetary policies in the form of record low interest rates and quantitative easing (QE) over the past decade are the outcome of not knowing what else to do in the face of a very weak recovery and deflation pressure. Since these issues are not due to a shortage of finance, the monetary tool has been inefficient and has taken pressure off policy-makers to address the real problems.

It is worth recalling the total lack of foresight and understanding of the forces at work in the lead up to 2008. While risk was being underpriced on an industrial scale, the key policy-makers had no idea about what was building right up until the crisis hit. This is worth recalling as it goes into the issue of the fallibility of policy-makers which may, once more, be in play.

The IMF (2007) Financial Stability Report, in the conclusions in its global assessment stated:

“This weakness has been contained to certain portions of the subprime market (and, to a lesser extent, the Alt-A market), and is not likely to pose a serious systemic threat. Stress tests conducted by investment banks show that, even under scenarios of nationwide house price declines that are historically unprecedented, most investors with exposure to subprime mortgages through securitized structures will not face losses.”(p. 7)1

The Bank for International Settlements (2007), in its Annual Report, opined:

“The rally in credit markets was twice interrupted by periods of market turbulence, which turned out to be relatively brief in duration. Sound corporate fundamentals, as well as strong investor demand for structured credit products and greater investor risk appetite, seemed to be important forces behind the rally […] Whether and how the problems in the US subprime mortgage market may spill over into other markets remains unclear. In part, the risks are limited because of the relatively small size of the subprime market.”(pp. 108–10)

In a speech in Chicago in May 2007 the Chairman of the Federal Reserve Board, Ben Bernanke, confided:

“Importantly, we see no serious broader spillover to banks or thrift institutions from the problems in the subprime market; the troubled lenders, for the most part, have not been institutions with federally insured deposits.”2

In March 2007 the Financial Stability Forum (later to become the Financial Stability Board (FSB)) met just after a strong bout of market volatility in February. The consensus was that the markets had worked well, as liquidity providers had entered the market in an elastic manner. There was little concern about subprime defaults, which were thought to be a worry for the borrowers, not the lenders. Easily the biggest concern was the work being done on highly levered financial institutions, which were taken to be the unregulated hedge funds and private equity partnerships3. No one was concerned about the regulated (and vastly more leveraged) banking system.

There was a strong ‘groupthink’ element to policy making prior to 2008 and, ten years later, these similarities remain. No central banker wants to be different and wrong. This is often enforced by process. For example, the Basel Committee of Bank Supervisors has a consensus approach. At the FSB, vulnerabilities meeting lead presentations are carefully chosen, with US representatives always first, followed by the ECB, and so on. Many of its other members appear to accept the greater wisdom of the most well-known persons or, if not, avoid rocking the boat and being marginalised by a non-consensus view. This leads to inertia and similarity in policy making. Outside forces also condition decisions in central banks: commentary from politicians, lobbying, and a need to avoid a market-vigilante response from equity and bond markets.

There has never been a collective mea culpa about the very bad regulation and dangerous monetary policy consensus that led to the global crisis. Nor has there since been a fundamental change in the processes involved—other than at the margin (more standing committees, more regulatory complexity, and changes in central bank communication methods). The same institutions are now nodding approval to each other’s correlated low interest rates and unprecedented QE policies, which have pushed their joint balance sheets to unprecedented levels. In recent years this has not been in the name of crisis management but, instead, is sold as an attempt to drive economic recovery. But it is not working. The post-recession recovery has been the weakest in the post-War period and, in 2019, there has been talk of the risk of a renewed recession.

In the side-lines of an FSB meeting, one very senior central banker’s retort to the critique that business investment in QE countries was not responding to extreme monetary policy was the following: ‘But what would you like us to do in the face of slow growth and deflation pressures? Would you have us tighten policy now?’

He had a point. But the world ten years later should not be starting from this point. Four vastly different jurisdictions—the United States, the Euro Area, the United Kingdom and Japan—all facing very different domestic economic problems are dealing with them in pretty much the same way. It is as though QE and low rates are taken as a possible solution for problems as diverse as global saving and investment imbalances, dysfunction caused by the euro, asymmetries in fiscal policy, Japan’s long-term structural issues (population and debt), and even Brexit4.

This note discusses these global economic issues and suggests they cannot be addressed by QE. In trying to do so, it is also argued that QE is having the unintended consequence of damaging the interbank market’s role as a liquidity provider (including the example of the mid-September United States crisis).

2. ‘Copy-Cat’ QE

At the end of 2006 the balance sheets of the four central banks was in the vicinity of $3.4tn, and this was perfectly adequate for the interbank market to function smoothly. Banks trusted each other over short horizons and were prepared to lend in the repo markets, accepting each other’s collateral. This trust was first questioned after the Bank Nationale de Paris hedge funds froze funds exposed to US subprime mortgages in August 2007. Trust was completely broken from the ‘Lehman moment’ in September 2008, when the extreme nature of the crisis became apparent to everyone. At this time central banks exercised their lender-of-last-resort tools and guaranteed deposits, both quite standard procedures for a banking crisis5.

This crisis liquidity management was followed up by QE in the United States (under the Bernanke Fed). It then spread elsewhere as a response to the euro crisis in Europe, and to help boost Japan’s competitiveness.

The general narrative goes something like this: having dealt with the liquidity crisis, central banks now are trying to stimulate growth via low interest rates (which are even negative in Europe and Japan) while flooding the interbank market with liquidity by buying up credit risks of all varieties. This will force greater investment in risky assets thereby reflating the economy. Normalisation will proceed once this is achieved.

3. QE Does Not Work and Pushes Up Risk

One decade later this goal has not been achieved, so the policy has been maintained and then doubled and tripled up. At the very minimum one would have expected to see a marked positive outcome of the unprecedented monetary stimulus (certainly after ten years). Some combination of growth and/or inflation—nominal GDP—should have been equally impressive were finance the cause of the malaise.

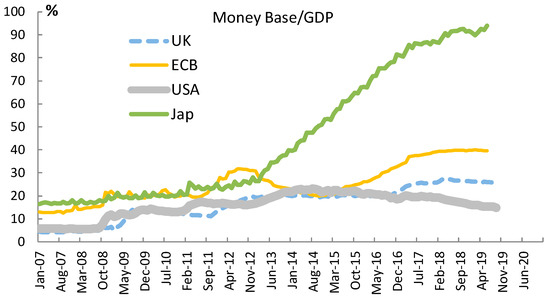

Figure 1 shows the monetary base for the four central banks as a share of nominal GDP from January 2007. Only the United States was showing some signs of a return to stability between base money and nominal GDP (via economic growth and the use of reinvestment caps to reduce the size of the Fed balance sheet). In the Euro Area, the United Kingdom, and Japan, there is no sign of any stability between the monetary base and nominal economic activity, and particularly so for Japan. Indeed, the nominal GDP profiles of these four jurisdictions since 2007 are in an inverse ordering to the money base ratios shown—suggestive of ineffective reverse causation (pouring in more money for growth problems arising from other causes).

Figure 1.

Money Base-to-GDP Ratios. Source: Thomson Reuters.

Nor is there any compelling reason to believe QE should drive the economy, since the two transmission mechanisms (the exchange rate and interest rates) are unlikely to have beneficial effects. Ben Bernanke, an early advocate of QE, was influenced by his studies of the Great Depression6. But the turnaround in the US economy in 1933 was accomplished by a combination of policies orchestrated by the newly elected Franklin D. Roosevelt (FDR), against the advice of the policy mandarins that favoured the Gold Standard and sound finance. FDR devalued by 40% against gold, which saw the effective exchange rate fall by a similar amount because other countries did not follow suit. Printing money, public works, and separating banking from securities market activities via the Glass–Steagall Act were other parts of the package.

The current QE is occurring under floating exchange rates. While QE in a single country should lead to depreciation (since it is the relative price of two monies), this does not work if everyone does it. QE policies in Europe and Japan were in some measure aimed at avoiding appreciation against the US dollar.

The idea that low interest rates might stimulate investment is equally flawed. Investors will be driven into more risky assets in the search for better yields, driving down bond yields and stimulating the share market. However, this is secondary market price action. Buying shares and bonds in the secondary market does not fund any new investment—only Initial Public Offerings (IPOs) can do that. In the main, companies do not borrow for long-term investment, but they use retained earnings7. Corporate borrowing, particularly from banks, is associated with short-term working capital needs (e.g., managing the inventory cycle) and, if interest rates are low enough, borrowing to carry out share buybacks.

Households of course will be induced to borrow for consumption and mortgages if credit is almost free. However, asset price inflation and leverage played a key role in the crisis of 2008. The risk is that monetary policy will encourage banks, still not separated from securities market activities as with FDR in 1933, to once more underprice risk.

The collective conclusion of policy-makers concerning the general failure of QE to stimulate investment and growth, somewhat surprisingly, is that even more monetary stimulus must be needed. At the start of 2019 the Fed halted its previously flagged program of rate rises and gradual balance sheet reduction. It has since cut interest rates three times. Mr Draghi laid the groundwork for doing the same in Europe. In September rates were cut to −0.5% and, at the end of October, the bond buying program recommenced. In the United Kingdom the QE balance sheet remains on hold. The Bank of Japan’s large expansion of its balance sheet remains in place, with bond purchases only set to fall behind redemptions from the second half of 2020—though that surely remains a work in progress depending how exchange rate pressures evolve.

4. Global Investment Shifts

The inefficacity of monetary policy arises because the observed problems that it is trying to deal with have their origins in saving and investment decisions in the global economy that have been building for some time, particularly since China’s entry into WTO in December 2001. There is no shortage of investment in the world, it is just that it is happening in the wrong places from a Western perspective. World gross fixed investment has risen from around 22% of world GDP in 2001, to 27% by 2018. This has been achieved through rapid investment growth in emerging markets, primarily in China. China is now responsible for 26% of all world investment. Savings in China have risen even more, leading to a savings glut and downward pressure on real interest rates8.

China has refused to carry out policies to bring it into alignment with other large successful countries, i.e., the need to consume a large share of its own production. Instead, China has seen its consumption fall as a share of their economy from 62% in 2001 to 52% in 2018, compared to 85% of GDP in the United States and large percentages in other Western economies.

Excess investment in China brings with it pressure to export. Global market share is critical to a large economy that consumes little of its own production. Since WTO entry China has become the biggest exporter of manufactures (18% of the world total). To achieve this, it uses whatever means are necessary.

The so-called ‘China price’ to sustain a high export market share is brought about with an unlevel playing field based largely on the role of the state: subsidised production through state-owned enterprises (SOEs), particularly the role of funding via SOE banks; and mechanisms that have been the source of dispute with Western countries.

There is a large literature on such disputes since China’s WTO entry—official, academic and judicial. Topic headings include: technology transfer requirements when investing in joint ventures with Chinese companies; violations of the Trade Related Aspects of Intellectual Property Rights (TRIPS), including IP theft, copyright infringement and counterfeiting; use of taxation as a trade weapon; rare earth export quotas; import restrictions (including via technical barriers to trade); dumping; absence of national treatment for foreign banks and payment companies; non-participation in the Government Procurement Agreement in any meaningful way; and capital controls and related exchange rate manipulation techniques. Other than the United States, to their credit, most Western leaders refuse to take China on, preferring not to be excluded from key markets now and hoping for more openness and equality of treatment later.

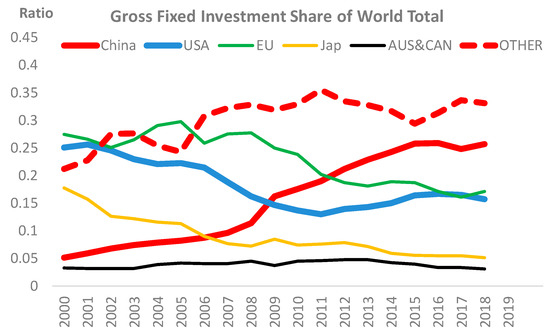

The macroeconomic outcomes of excess investment and penetration of Chinese imports include global excess supply, downward pressure on inflation, and weak investment in the West due to the re-arrangement of where and in what form investment occurs. The investment curve in the West is in a sense shifting to the left while that for emerging markets shifts to the right. Falling prices associated with greater use of digitalisation and a greater focus on high technology in the West accentuate this picture. None of this has anything to do with monetary policy. This picture can be seen in Figure 2, which shows the shares of world investment in all regions. The share of China and other emerging countries has risen continuously since 2000, and now accounts for 59% of all world investment, while that in the West has declined.

Figure 2.

Gross Fixed Investment by Country as a Share of the World Total. Source: Thomson Reuters.

Chinese import penetration in the West, together with its own failure to consume, come at a cost to the West in the form of loss of jobs and downward pressure on real wages for workers at the lower end of the education and skill distribution. Companies in the West have adapted to the unlevel playing field transformation of global supply chains, while moving up the value-added chain and cutting costs through digitalisation.

Workers in the West are being squeezed from all sides: import penetration; the rearrangement of global supply chains to use emerging markets for easy-to-replicate processes; and digitalisation to further reduce costs in advanced country large companies. The impact on jobs can be seen in Figure 3. This shows changes in the share of employment from 2000 to 2017 for three categories of worker education standards. In every country the share of those with only primary and lower secondary education has fallen. This is putting enormous pressure on the living standards of this group and, since they vote, is creating political pressures everywhere: the election of populist presidents and governments, Brexit in the UK, and protests which often turn violent (as with the yellow vest movement in France).

Figure 3.

Change in the Share of Employment by Education Category, between 2000 and 2017. Source: National sources.

It is against these structural trends in the world economy that monetary policy via low rates and QE in four jurisdictions is trying to operate. It is not well-suited to the task because the fundamental causes are not monetary in nature. Instead, disproportionate and inappropriate monetary policy has unintended consequences. Asset price inflation and leverage (like the subprime crisis) risk new instability. All these problems are bound to arise when risk is being underpriced.

5. Damage to the Interbank Market and the US September 2019 Liquidity Crisis

Nowhere is the mispricing of risk clearer than in the functioning of the interbank market. A post-crisis return to normalcy should mean that the mountain of cash sitting on central bank balance sheets (earning little or negative interest rates) is not required.

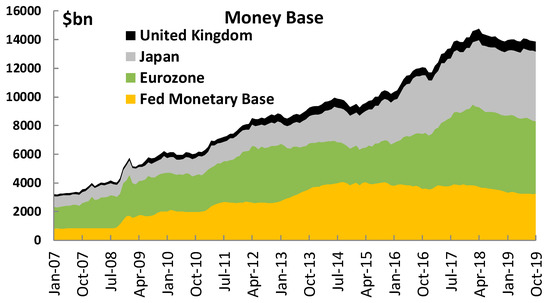

The world should be well past the need for lender-of-last-resort liquidity demand for central bank cash in 2019—one would think. Yet today, there is some $14.5tn in liabilities of the four central banks, when $3.4tn sufficed at the end of 2006 (see Figure 4).

Figure 4.

Money Base ($bn) by Country of Region. Source: Thomson Reuters.

The events in the United States in mid-September 2019 are alarming in this respect—that there was a need to put even more cash into the system. With the Fed balance sheet sitting at around $3.8tn, emergency Fed lending via repos was required to prevent overnight rates rising sharply. Market economists have put forward possible reasons: tougher capital and liquidity coverage rules, the prior attempt to reverse QE, the Trump budget deficit bond auctions and final company tax payment deadlines in September. These factors may have been the catalyst, but they are not the primary issue here. In the US the functioning of the interbank market appears to be impaired, because it has been essentially nationalised.

There is no reason to believe this would be substantively different in Europe or Japan. No private financial firm can compete with the backing of the full faith and credit of governments and their central banks9. If a bank has liabilities it has to meet, why would one bother borrowing from other banks which, in uncertain times, might let you down? And why bother lending much to the other banks on uncertain collateral, particularly since leverage and liquidity reforms make this more costly?

An example is illustrative. When a company settles taxes with the government it’s bank must acquire central bank liabilities. These can be borrowed from other banks with excess reserves via overnight or term repos, or by dealing directly with the central bank itself. If central banks will always come in with repos close to their target rates as interbank rates move higher (due to the near-term demand requirements), then interbank transactions will be marginalised. Banks learn this policy reaction in much the same way that a baby learns to cry frequently at night if parents will respond willingly each time it makes a noise. The central bank displaces the market. The central bank rate must be above the private rates, not the other way around, if there is to be a private interbank market.

6. The Europe Problem

QE in Japan seems to be straightforward case of beggar my neighbour: an all-out effort to keep the yen as low as possible given all the other problems that Japan faces. Europe, however, is complicated by two issues that are specific to that jurisdiction: the existence of the euro, and Brexit.

Like other major central banks, the ECB appears to have taken the attitude that if there is a strong demand for short-term safe securities in the financial system, then perhaps its best that the authorities should provide them. There is no need to restore the interbank market to its pre-crisis role and to reduce central bank balance sheets.

Mario Draghi’s signature achievement was saving the euro, by taking unwanted securities onto the central bank balance sheet10. An analogy for this might be saving the Gold Standard in the 20th Century, a damaging straight-jacket on economic performance at the time. The euro forces competitive adjustment within Europe through labour markets, and the Euro Area is in relative economic decline mainly because of this.

China’s strong growth has an asymmetric real impact on Europe. The north (particularly Germany), sells high-tech investment goods to emerging countries, which in turn compete with the south of Europe. Asymmetric real shocks of this nature make the standard case for devaluation, but southern countries do not have their own currencies. Since there is no fiscal union to facilitate cross-country compensation for losing households, these countries are forced to cut wages along with other structural adjustments to gain EU debt support and to avoid even greater penalties. The south is pushed further into decline, undermining its benefit as a trading partner.

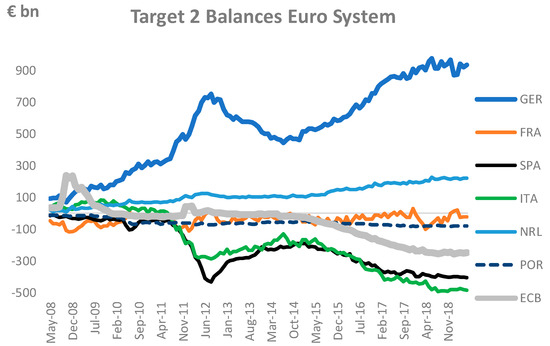

This poses significant problems for the banking system and the role of central banks. Germany does not want to expand fiscal policy and issue deficit bonds. It runs budget surpluses. Its current account surplus and capital inflows from other European countries (that want to hold safe German assets) is not matched by any equal German demand to acquire foreign assets. With no exchange rates to adjust supply and demand, the gap is plugged by Germany via official financing between central banks (so-called Target 2).

This has resulted in the Bundesbank acquiring claims on other euro central banks to the tune of €900bn (and rising; see Figure 5). They earn nothing or even negative returns on these balances. They also risk not getting their money back were some members to leave the euro one day. This state-of-affairs is one of the main sources of tension inside the ECB Governing Council.

Figure 5.

Target 2 Balances in the European System of Central Banks. Source: Thomson Reuters.

Thus, in addition to the problems with QE already noted (asset prices, leverage, damage to the interbank market), it has also taken pressure off European governments (particularly the German government) to act on fiscal policy. The tensions are reflected in central bank imbalances and poor economic growth.

7. Brexit

These euro-related problems favour the UK breaking away from the EU and saving the euro via QE without fiscal reform has contributed to this outcome. Growth outside of Europe is more dynamic. Non-OECD countries increased their share of world GDP from 17% in 1990 to 38% in 2018. The USA and several non-euro OECD countries have held or raised their shares. It is the Euro Area and Japan that have provided most of the room for a larger emerging country share.

UK exports to Europe did rise moderately immediately after joining the European Union (EU) in 1973. Figure 6 shows UK merchandise exports to the original EU 14 and to all countries as a share of UK GDP. It also shows total goods and services exports. Gains in Europe from 1973 are reflected in the total suggesting net gains. This was another era. The OECD was 82% of the world and Europe was 25% (about the same as the USA). Britain’s export share did not rise in subsequent years, and Europe is now only 15% of the world and falling.

Figure 6.

UK and Swiss Exports to the Original EU Countries and to the World (%GDP), Compared. Source: Thomson Reuters.

EU membership did not confer any special advantages for the UK that some other non-EU Europeans were getting anyway. For example, Switzerland is not an EU member but has free trade agreements with individual EU countries. Its exports as a share of GDP were already ahead of the UK prior to EU membership. What is more interesting, however, is that Swiss exports have leapt further ahead in other regions at each acceleration of global growth. Being ‘out’ seems to have been more beneficial than being ‘in’. The UK, seemingly hamstrung by the EU, has seen exports as a share of the economy move sideways since 1973.

Nor is Britain going to be shut out of trade with Europe if Brexit occurs. The most important influence on trade is ‘gravity’: the size of a country’s trading partners and their closeness in geographical proximity. Britain is the second biggest trading nation in Europe and is right next door. Europe cannot afford to see its trade with the UK hit roadblocks. While professional politicians in the Commission seem to want to make an example of the UK to stop others putting their hand up to leave (like Italy), European businesses will see to it that their best interests are served in the end. Gravity will prevail.

Prediction of doom for finance in London (the City) are also misplaced. The key to understanding this issue is “agglomeration”: scale, liquidity and efficiency. Many factors come together to make for large liquid collateralised trading: size, a long history of broker-dealer market-oriented finance, language, contract law, and more. This goes back a long way. In the 1700s Amsterdam and London vied for financial leadership in Europe. The centralised joint-stock companies of the Bank of England and the East India Company continually raised new capital and expanded. The large supply of centralised British government debt provided a liquid collateral pool. Dutch merchants often used London, because agglomeration was not matched in Holland (and the Dutch wars with Spain and Britain did not help)—it was both safer and more efficient.

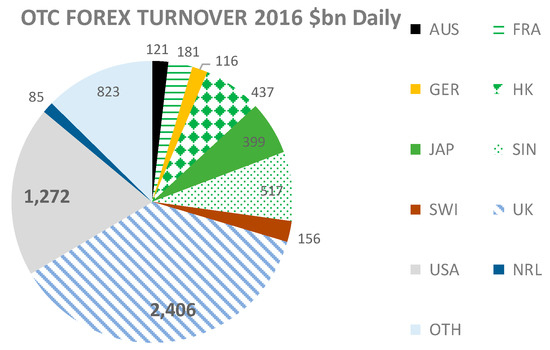

Since the 1700s the dominance of London has remained strong. The demise of the City has been called many times, most recently when the UK decided it would not join EMU. Figure 7 shows daily foreign exchange turnover in the City compared to other global centres.

Figure 7.

Over the Counter Foreign Exchange Turnover by Region, 2016. Source: Bank for International Settlements.

The $2.4tn daily turnover is double that of New York. Regional agglomerations in Asia, while important there, are much smaller. The UK share of forex turnover was 32% in 2001, when the demise of London was supposed to begin. Today the UK share is 37%. For turnover in the huge OTC interest rate swaps market New York and London are on a par with about 38% each and everyone else is tiny in comparison. This London dominance has survived wars, revolutions and far-reaching financial innovations long before the EU was born. Brexit will not change that.

8. Conclusions

QE policies have been pushed to extremes and extended well beyond their use-by date to little plausible effect in achieving the goal of raising inflation and growth. Instead, it is adding to the risk of financial crises in the future and damaging the pricing of risk.

In this respect, it needs to be borne in mind that China too is now facing potential financial difficulties. This is the inevitable outcome of excessive investment, declining returns, and funding via bank credit. Since entering the WTO, total debt in the Chinese economy has risen by 128% of GDP and now exceeds that of the United States at 250%. For this reason alone, monetary policy in advanced countries should be keeping its monetary policy powder dry for use in the event of renewed financial instability.

Central bankers do not seem to appreciate that there is no shortage of finance for private investment in the world economy. Investment always finds funding from retained earnings and IPOs when profitable investment opportunities are available. One needs to look no further than the speed with which the fracking industry, Silicon Valley and other successful industries were established in the United States. The world is swimming with investable funds. Profitable investment opportunities, on the other hand, are scarcer, due in part to over-investment in certain parts of the world economy.

The main problems in the global economy are not monetary in nature, and governments will need to take their proper responsibilities in the areas of trade, foreign investment and fiscal policy. It is already well past the time for central banks to begin de-nationalising interbank markets, and thereby forcing banks to price risk appropriately.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Allen, Franklin, Elena Carletti, and Patricio Valenzuela. 2013. Financial Intermediation, Markets and Alternative Financial Sectors. Handbook of the Economics of Finance 2: 759–98. [Google Scholar]

- Bagehot, Walter. 1873. Lombard Street, a Description of the Money Market. Homewood: Richard D. Irwin. [Google Scholar]

- Bank for International Settlements. 2007. Annual Report. Basel: Bank for International Settlements. [Google Scholar]

- Bemanke, Ben, and Harold James. 1990. The Gold Standard, Deflation, and Financial Crisis in the Great Depression: An International Comparison. In Financial Markets and Financial Crises. NBER Working Paper No. 3488. Chicago: University of Chicago Press. [Google Scholar]

- Bernanke, Ben S. 2007. The Subprime Mortgage Market. Paper presented at Federal Reserve Bank of Chicago’s 43rd Annual Conference on Bank Structure and Competition, Chicago, IL, USA, May 17; Available online: https://www.federalreserve.gov/newsevents/speech/bernanke20070517a.htm (accessed on 26 December 2019).

- Bernanke, Ben S., and Vincent R. Reinhart. 2004. Conducting Monetary Policy at Very Low Short-Term Interest Rates. American Economic Review, Paper and Proceedings 94: 85–90. [Google Scholar] [CrossRef]

- Blundell-Wignall, Adrian, and Caroline Roulet. 2013. Long-term investment, the cost of capital and the dividend buyback puzzle. OECD Journal: Financial Market Trends 2013: 39–52. Available online: www.oecd.org/daf/fmt (accessed on 26 December 2019). [CrossRef]

- Blundell-Wignall, Adrian, Paul Atkinson, and Caroline Roulet. 2018. Globalisation and Finance at the Crossroads. London: Palgrave MacMillan. [Google Scholar]

- CBO. 2018. Bi-Partisan Budget Act of 2018. Available online: https://www.cbo.gov/publication/53556 (accessed on 26 December 2019).

- Financial Stability Forum. 2007. Update of the FSF Report on Highly Leveraged Institutions. Basel. Available online: http://www.fsb.org/wp-content/uploads/r_0705.pdf (accessed on 26 December 2019).

- IMF. 2007. Global Financial Stability Report. Washington: IMF. [Google Scholar]

| 1 | The irony of this is that the IMF was placing faith in simulations carried out by none other than Lehman Brothers, the investment bank that fifteen months later would become the most famous casualty of the crisis. |

| 2 | Ben Bernanke (2007). |

| 3 | See Financial Stability Forum (2007). |

| 4 | The US is something of an exception with respect to fiscal policy when compared to Europe. At the end to 2018, in a bi-partisan deal, outlays were increased and taxes were cut, see CBO (2018). |

| 5 | The lender-of-last-resort notion goes back to Bagehot (1873) and has been applied first by the Bank of England and by most other central banks subsequently. The idea is to support general liquidity for sound financial institutions, while letting unsound institutions fail. When the Europe crisis followed a couple of years later, European policy-makers certainly did not allow unsound institutions to fail—a problem still dogging that region today. |

| 6 | See for example Bemanke and James (1990), where it is noted that countries that remained on the gold standard suffered the most. See also Bernanke and Reinhart (2004), where the case is made to engage in unconventional monetary policy, including QE, before interest rates reach the lower bound. |

| 7 | Allen et al. (2013) show that the share of retained earnings for financing investment from 2002–2010 in 15 high income countries is 60% (bank finance 16%, external finance 6% and alternative finance 17%). Data from the Financial Accounts of the United States show retained earnings to be responsible for 75% of investment financing in recent years. Evidence on the choice between retaining earnings for investment or returning funds to shareholders is set in Blundell-Wignall and Roulet (2013). Using company data, they show that the evidence suggests low rates, if anything, work against investment via the buyback route. Corporate bond rates are insignificant in the investment model for 4000 global companies. |

| 8 | See Blundell-Wignall et al. (2018) for an in-depth analysis of this and related issues in this address. |

| 9 | If the demand curve for interbank cash shifts out, rates rise by moving along the supply curve. In an efficient interbank market with the appropriate level of trust this curve should be fairly elastic. With the post-crisis monetary response, the supply curve appears to have become inelastic. Central bank responses shift the curve to the right—QE is difficult to reverse and may need to expand. |

| 10 | Since intra-European exchange rates cannot adjust to ensure expected returns move to equate supply and demand for government and private financing via capital flows, interest rates became the single moving part in the Euro crisis. Unacceptable movements in yields that created default risk on these securities had to be offset by the ECB under Mr Draghi taking them on board. |

© 2020 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).