Social and Financial Inclusion through Nonbanking Institutions: A Model for Rural Romania

Abstract

1. Introduction

2. Literature Review

3. Methodology

3.1. Descriptive Data and Statistics

3.2. Indicators and Models

3.2.1. Credit Constraints Model (Model 1)

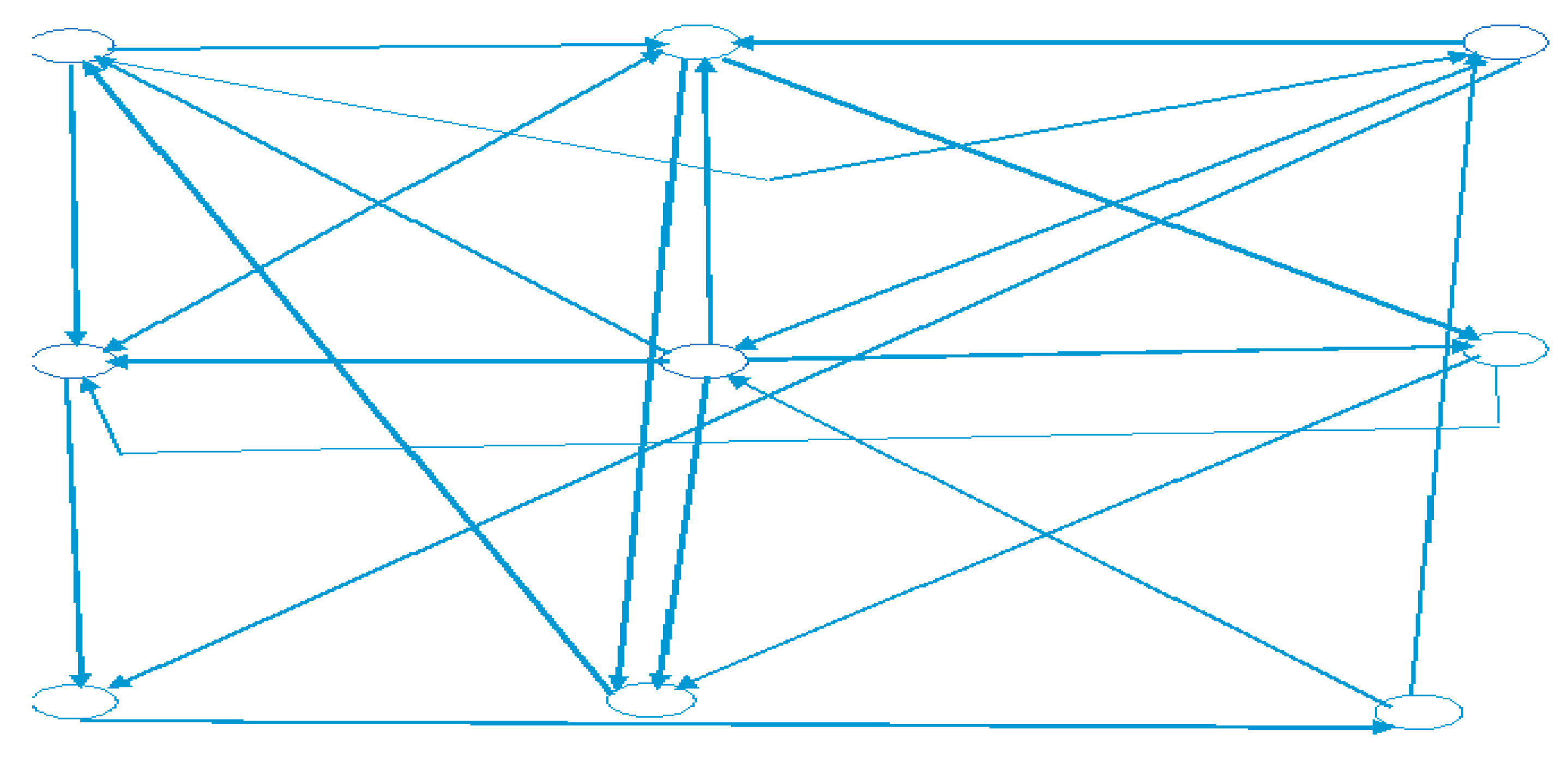

3.2.2. Network Model of Nonbank Financial Institutions (Including Digital Ones)

4. Results

4.1. Empirical Evaluation of NFI (Calculation of Indicators)

4.1.1. Relevant Indicators for NFI Sector Development

Indicator 1: Asset Formation Indicator (IF)

Indicator 2: Asset Use Indicator (IU)

Indicator 3: NFI (IS) Expansion Indicator

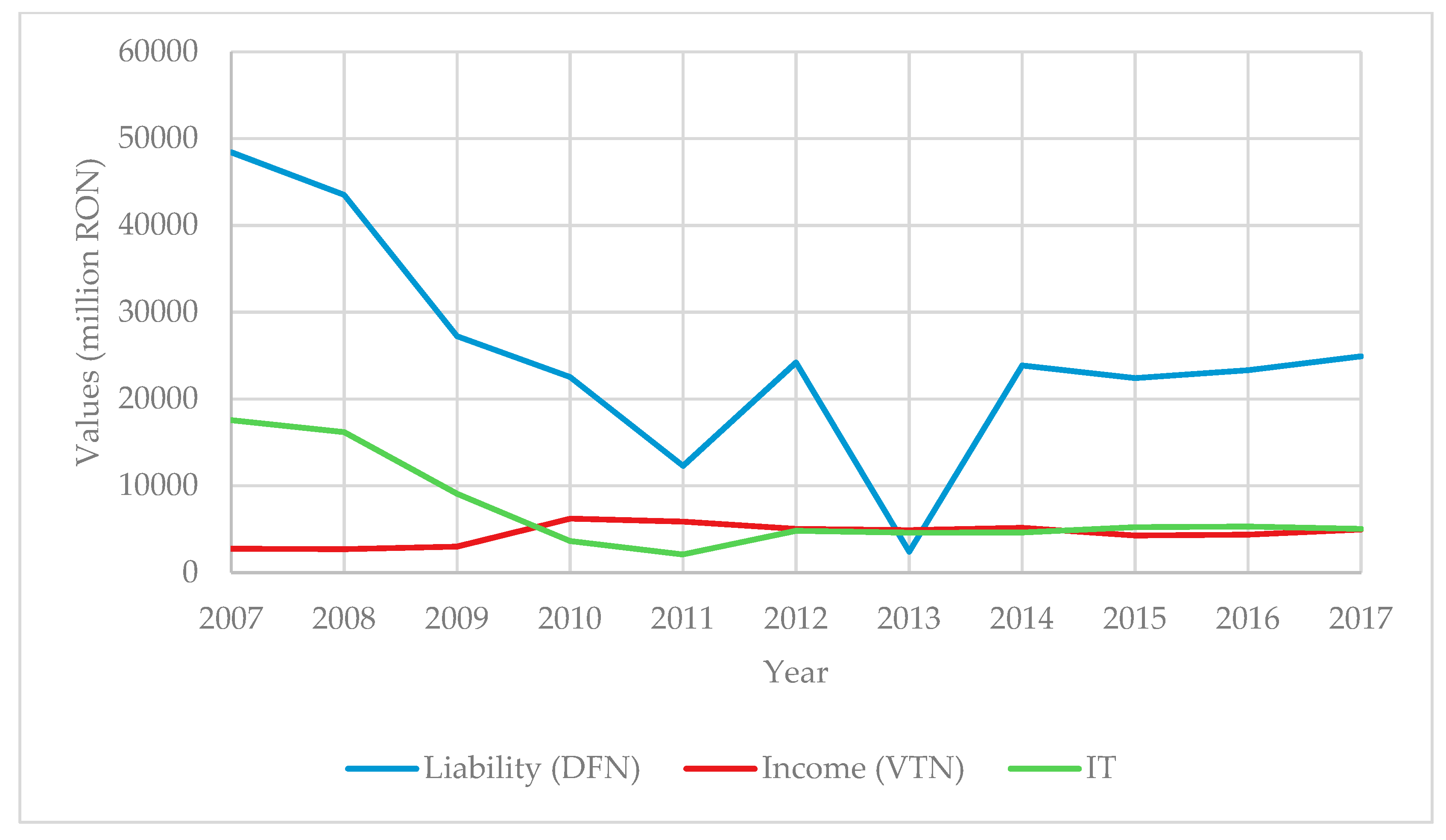

Indicator 4: Debt Sustainability Indicator

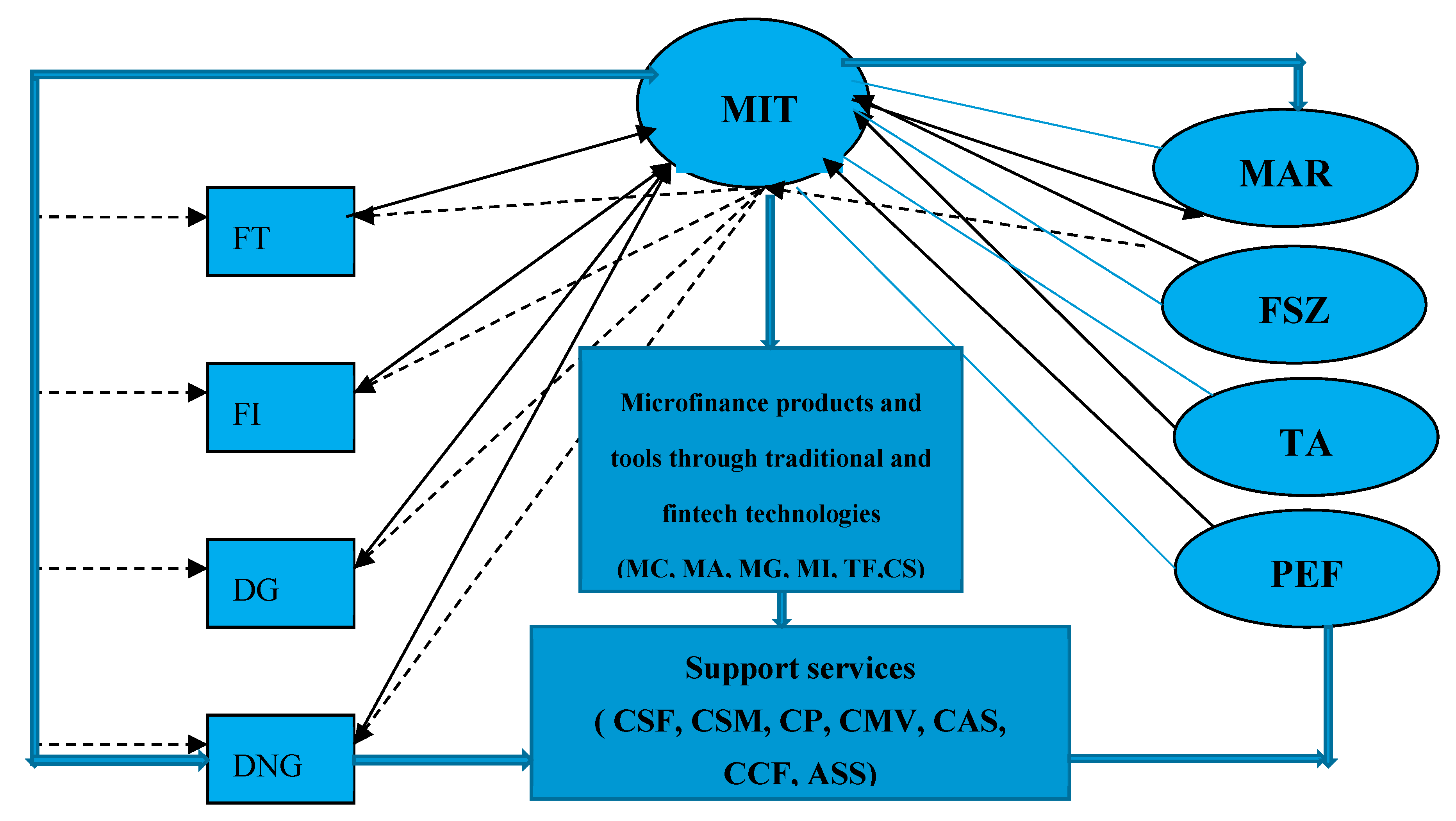

4.2. The Microinnovation and Entrepreneurship (MIT) Model

- Microcredit MC;

- MA—microinsurance;

- MG—microguarantee;

- MI—microinvestment/microeconomics;

- TF—transfer of funds;

- CS—social credit.

- CSF—financial consultancy;

- CSM—management consulting;

- CP—design consultancy;

- CMV—marketing and sales consultancy;

- CAS—assistance association in associative forms;

- CCF—advisory services for accounting and tax services;

- ASS—other support services.

5. Discussion and Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Accenture. 2019. Global FinTech Investment Growth Continues in 2016 Driven by Europe and Asia, Accenture Study Finds. Edited by Petra Shuttlewood, Melissa Volin and Lara Wozniak. Dublin: Accenture. Available online: https://newsroom.accenture.com/news/global-FinTech-investments-surged-in-2018-with-investments-in-china-taking-the-lead-accenture-analysis-finds-uk-gains-sharply-despite-brexit-doubts.htm (accessed on 11 August 2019).

- Aldridge, Irene, and Steven Krawciw. 2017. Real-Time Risk: What Investors Should Know About FinTech, High-Frequency Trading and Flash Crashes. New York: John Wiley & Sons. [Google Scholar]

- Armenion, Belvin L. 2016. Role of Financial Inclusion in Poverty Reduction. Business World. May 16. Available online: http://www.bworldonline.com/content.php?section=Economy&title=role-of-financial-inclusion-in-poverty-reduction&id=127483 (accessed on 15 August 2019).

- Arp, Frithjof. 2018. The 34 Billion Dollar Question: Is Microfinance the Answer to Poverty? World Economic Forum: Global Agenda. January 12. Available online: https://www.weforum.org/agenda/2018/01/the-34-billion-dollar-question-is-microfinance-the-answer-to-poverty (accessed on 11 August 2019).

- Arp, Frithjof, Alvin Ardisa, and Alviani Ardisa. 2017. Microfinance for poverty alleviation: Do transnational initiatives overlook fundamental questions of competition and intermediation? Transnational Corporations 24: 103–17. [Google Scholar] [CrossRef]

- Australian Government. 2010. Financial Services for the Poor—A Strategy for the Australian aid Program 2010–2015; Canberra: Australian Agency for International Development (AusAID). Available online: https://www.financite.be/sites/default/files/references/files/1026.pdf (accessed on 11 August 2019).

- Bartels, Joachim. 2017. Philippines: The Road Towards Financial Inclusion; Manila: Business Information Industry Association. Available online: http://www.biia.com/philippines-the-road-towards-financial-inclusio (accessed on 15 August 2019).

- BRW. 2014. Sydney FinTech Hub Based on London’s Level39 Coming Next April. The Australian Financial Review. May 25. Available online: https://www.afr.com/leadership/entrepreneurp/tech-gadgets/sydney_fintech_hub_based_on_london_QTbs38ffeIMZOH89UCaftN (accessed on 11 August 2019).

- Chakelian, Anoosh. 2016. Labour Must Get Real about the Economy: Is Corbyn’s Economic Advisory Board Unravelling? New Statesman. January 27. Available online: https://www.newstatesman.com/politics/economy/2016/01/labour-must-get-real-about-economy-corbyn-s-economic-advisory-board (accessed on 15 August 2019).

- Dunbar, Craig G., Zhichuan Frank Li, and Yaqi Shi. 2019. Corporate Social Responsibility and CEO Risk-Taking Incentives. Available online: https://ssrn.com/abstract=2828267 (accessed on 20 October 2019).

- Financial Stability Board. 2019. Global Monitoring Report on Non-Bank Financial Intermediation 2018. Financial Stability Board. February 4. Available online: https://www.fsb.org/wp-content/uploads/P040219.pdf (accessed on 11 August 2019).

- Government and Economy. 2018. Brexit a Boon for Lithuania’s ‘FinTech’ Drive. The Business Times. February 14. Available online: https://www.businesstimes.com.sg/government-economy/brexit-a-boon-for-lithuanias-FinTech-drive (accessed on 11 August 2019).

- Ikram, Atif, Zhichuan Frank Li, and Dylan Minor. 2019. CSR-Contingent Executive Compensation Contracts. Journal of Banking and Finance. [Google Scholar] [CrossRef]

- Kauflin, Jeff. 2019. The 11 biggest FinTech Companies in America 2019. Forbes. February 4. Available online: https://www.forbes.com/sites/jeffkauflin/2019/02/04/the-10-biggest-fintech-companies-in-america-2019/#7162745932b9 (accessed on 11 August 2019).

- Kuo Chuen, David Lee, and Ernie G. S. Teo. 2015. Emergence of Fintech and the Lasic Principles. Available online: https://ssrn.com/abstract=2668049 (accessed on 11 August 2019).

- Li, Rui, Wei Liu, Yong Liu, and Sang-Bing Tsai. 2018. IPO Underpricing After the 2008 Financial Crisis: A Study of the Chinese Stock Markets. Sustainability 10: 2844. [Google Scholar] [CrossRef]

- Lieber, Ron. 2014. Financial Advice for People Who Aren’t Rich. The New York Times. April 11. Available online: https://www.nytimes.com/2014/04/12/your-money/start-ups-offer-financial-advice-to-people-who-arent-rich.html (accessed on 11 August 2019).

- Liu, Wei, Qiao Wei, Song-Qin Huang, and Sang-Bing Tsai. 2017. Doing Good Again? A Multilevel Institutional Perspective on Corporate Environmental Responsibility and Philanthropic Strategy. International Journal of Environmental Research and Public Health 14: 1283. [Google Scholar] [CrossRef] [PubMed]

- Manta, Otilia. 2017. GlobTech and FinTech in Agriculture and Rural Development. Bucharest: Romanian Academy Publisher, World Economy Institute. [Google Scholar]

- Manta, Otilia. 2018. Microfinance. Concepts and Application in Rural Environment. Bonn: LAP LAMBERT Academic Publishing. [Google Scholar]

- McWaters, R. Jesse. 2015. The Future of Financial Services: How Disruptive Innovations Are Reshaping the Way Financial Services Are Structured, Provisioned and Consumed. Geneva: World Economic Forum, p. 125. [Google Scholar]

- Ministry of Public Finance. 2018. Financial Statements of NFI and National Financial Accounts for 2007–2017; Bucureşti: Ministry of Public Finance. Available online: www.mfinante.ro (accessed on 15 August 2019).

- Nanda, Kajole, and Mandeep Kaur. 2016. Financial Inclusion and Human Development: A Cross-country Evidence. Management and Labour Studies 41: 127–53. [Google Scholar] [CrossRef]

- National Institute of Statistics. 2014. Available online: www.inse.ro (accessed on 15 August 2019).

- Pennathur, Anita K. 2001. “Clicks and bricks”: E-Risk Management for banks in the age of the Internet. Journal of Banking & Finance 25: 2103–23. [Google Scholar]

- Redheering. 2016. FinTech Investments Skyrocket in 2016—Report. Redherring. May 25. Available online: https://www.redherring.com/finance/fintech-investments-skyrocket-2016-report/ (accessed on 11 August 2019).

- Sanicola, Lenny. 2017. What Is FinTech? Huffington Post. February 13. Available online: https://www.huffpost.com/entry/what-is-fintech_b_58a20d80e4b0cd37efcfebaa (accessed on 25 August 2019).

- Sarma, Mandira. 2008. Index of Financial Inclusion. Indian Council for Research on International Economic Relations (ICRIER). Working Paper No. 215. New Delhi: ICRIER. [Google Scholar]

- Sarma, Mandira, and Jesim Pais. 2011. Financial Inclusion and Development. Journal of International Development 23: 613–28. [Google Scholar] [CrossRef]

- Scholten, Ulrich. 2016. Banking-as-a-Service—What You Need to Know. VentureSkies. December 20. Available online: https://www.ventureskies.com/blog/banking-as-a-service-categorizing-the-services (accessed on 16 August 2019).

- Schüffel, Patrick. 2017. Taming the Beast: A scientific definition of FinTech. Journal of Innovation Management 4: 32–54. [Google Scholar] [CrossRef]

- Shaikh, Aijaz A., Richard Glavee-Geo, and Heikki Karjaluoto. 2017. Exploring the nexus between financial sector reforms and the emergence of digital banking culture—Evidences from a developing country. Research in International Business and Finance 42: 1030–39. [Google Scholar] [CrossRef]

- Sunstar Philippines. 2016. 4 Million Unbanked Filipinos to Benefit from Credit Scoring. SunStar Philippines. August 23. Available online: http://www.sunstar.com.ph/cebu/business/2016/08/23/4-million-unbanked-filipinos-benefit-credit-scoring-493261 (accessed on 15 August 2019).

- UNDP. 2012. Financial Inclusion (2009–2012); New Delhi: UNDP in India. Available online: https://www.in.undp.org/content/india/en/home/operations/projects/closed/financial-inclusion.html (accessed on 11 August 2019).

- Voronkova, Svitlana, and Martin T. Bohl. 2005. Institutional Traders’ Behavior in an Emerging Stock Market: Empirical Evidence on Polish Pension Fund Investors. Journal of Business Finance & Accounting 32: 1537–60. [Google Scholar]

- Wesley-James, Nicholas, Claire Ingram, Carl Kallstrand, and Robin Teigland. 2015. Stockholm FinTech: An Overview of the FinTech Sector in the Greater Stockholm Region. Available online: https://www.slideshare.net/eteigland/stockholm-49722748?related=1 (accessed on 11 August 2019).

- Williams-Grut, Oscar. 2015. Meet the Team Shaping the Labour Party’s ‘New Economics’. Business Insider. September 28. Available online: https://www.businessinsider.com.au/jeremy-corbyn-and-john-mcdonnells-economic-advisors-2015-9 (accessed on 15 August 2019).

- Zhang, Qi, Siwei Sun, Xingshan Zheng, and Wei Liu. 2019. The Role of Cynicism and Personal Traits in the Organizational Political Climate and Sustainable Creativity. Sustainability 11: 257. [Google Scholar] [CrossRef]

| 1 | RON is the national currency of Romania; the average annual rate for 2019 is 1 Euro to 4.7383 RON, according to the National Bank of Romania. |

| Name | Symbol | Data Source | Calculation Formula | |

|---|---|---|---|---|

| Indicator 1 | Asset formation indicator | IF | Nonbanking financial institution (NFI) financial statements and national financial accounts | IF = CHN/AFT = total financial expense/assets |

| Indicator 2 | Asset usage indicator | IU | NFI financial statements and national financial accounts | IU = VTN/AFT = total income/total financial assets |

| Indicator 3 | NFI sector expansion indicator | IS | Financial statements of the NFIs and the statistical yearbook of Romania | IS = AFN/GDP = total financial assets/GDP |

| Indicator 4 | Debt sustainability indicator | IT | NFI financial statements and national financial accounts | IT = DFN/VTN = total financial debt/total income |

| Primary Indicators | Terms |

|---|---|

| AFN | Total financial assets of NFI, comprising total investments, fixed assets, disponible assets, and receivables |

| CHN | Total NFI expenditure, comprising total financial and nonfinancial expenditure |

| GDP | Gross domestic product. It is found that this indicator is determined by comparing two absolute sizes of different natures—a stock size and a flow rate |

| VTN | Total NFI revenue |

| DFN | Total NFI financial liabilities |

| Efficiency (EF) | |

| IF | Asset formation indicator = total expenditure/total financial assets = CHN/AFN |

| Performance (PF) | |

| UI | Asset Use Indicator = total income/fine assets total = VTN/AFN |

| Development (DV) | |

| IS | NFI growth indicator = fine assets total/GDP = AFN/GDP |

| Sustainability (ST) | |

| IT | Debt sustainability indicator = total financial debt/total revenue = DFN/VTN |

| Year | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Income (VTN) | 2756 | 2689 | 3002 | 6206 | 5880 | 5034 | 4882 | 5168 | 4272 | 4382 | 4955 |

| Costs (CHN) | 1617 | 2350 | 1997 | 6120 | 5665 | 4770 | 4748 | 4775 | 3908 | 3913 | 4452 |

| Total financial assets (AFN) | 29,766 | 42,565 | 36,375 | 30,850 | 27,221 | 26,772 | 25,927 | 24,020 | 25,235 | 28,084 | 32,476 |

| Liability (DFN) | 48,410 | 43,502 | 27,216 | 22,527 | 12,300 | 24,189 | 2402 | 23,848 | 22,404 | 23,311 | 24,920 |

| GDP (PIB) | 416,007 | 524,389 | 510,523 | 533,881 | 565,097 | 596,682 | 637,456 | 668,144 | 712,659 | 762,342 | 858,333 |

| Year | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Costs (CHN) (million RON) | 1617 | 2350 | 1997 | 6120 | 5665 | 4770 | 4748 | 4775 | 3908 | 3913 | 4452 |

| Total financial assets (AFN), (million RON) | 29,766 | 42,565 | 36,375 | 30,850 | 27,221 | 26,772 | 25,927 | 24,020 | 25,235 | 28,084 | 32,476 |

| IF | 0.054 | 0.055 | 0.549 | 0.198 | 0.208 | 0.178 | 0.183 | 0.198 | 0.155 | 0.139 | 0.137 |

| Year | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Income (VTN) (million RON) | 2756 | 2689 | 3002 | 6206 | 5880 | 5034 | 4882 | 5168 | 4272 | 4382 | 4955 |

| Total financial assets (AFN), (million RON) | 29,766 | 42,565 | 36,375 | 30,850 | 27,221 | 26,772 | 25,927 | 24,020 | 25,235 | 28,084 | 32,476 |

| IU | 0.092 | 0.063 | 0.083 | 0.201 | 0.216 | 0.188 | 0.188 | 0.217 | 0.169 | 0.156 | 0.153 |

| Year | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Total financial assets (AFN) (million RON) | 29,766 | 42,565 | 36,375 | 30,850 | 27,221 | 26,772 | 25,927 | 24,020 | 25,235 | 28,084 | 32,476 |

| GDP (PIB) (million RON) | 416,007 | 524,389 | 510,523 | 533,881 | 565,097 | 596,682 | 637,456 | 668,144 | 712,659 | 762,342 | 858,333 |

| IS | 0.073 | 0.083 | 0.081 | 0.057 | 0.048 | 0.056 | 0.041 | 0.036 | 0.035 | 0.036 | 0.037 |

| Year | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Liability (DFN) (million RON) | 48,410 | 43,502 | 27,216 | 22,527 | 12,300 | 24,189 | 2402 | 23,848 | 22,404 | 23,311 | 24,920 |

| Income (VTN) (million RON) | 2756 | 2689 | 3002 | 6206 | 5880 | 5034 | 4882 | 5168 | 4272 | 4382 | 4955 |

| IT | 17,565 | 16,177 | 9066 | 3630 | 2092 | 4805 | 4589 | 4615 | 5244 | 5319 | 5029 |

| No. | Dimension | Ind. | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| I. | Efficiency | IF | 0.054 | 0.055 | 0.549 | 0.198 | 0.208 | 0.178 | 0.183 | 0.198 | 0.155 | 0.139 | 0.137 |

| II. | Performance | IU | 0.092 | 0.063 | 0.083 | 0.201 | 0.216 | 0.188 | 0.188 | 0.217 | 0.169 | 0.156 | 0.153 |

| III. | Development | IS | 0.073 | 0.083 | 0.081 | 0.057 | 0.048 | 0.056 | 0.041 | 0.036 | 0.035 | 0.036 | 0.037 |

| IV. | Sustainability | IT | 17,565 | 16,177 | 9066 | 3630 | 2092 | 4805 | 4589 | 4615 | 5244 | 5319 | 5029 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yue, X.-G.; Cao, Y.; Duarte, N.; Shao, X.-F.; Manta, O. Social and Financial Inclusion through Nonbanking Institutions: A Model for Rural Romania. J. Risk Financial Manag. 2019, 12, 166. https://doi.org/10.3390/jrfm12040166

Yue X-G, Cao Y, Duarte N, Shao X-F, Manta O. Social and Financial Inclusion through Nonbanking Institutions: A Model for Rural Romania. Journal of Risk and Financial Management. 2019; 12(4):166. https://doi.org/10.3390/jrfm12040166

Chicago/Turabian StyleYue, Xiao-Guang, Yong Cao, Nelson Duarte, Xue-Feng Shao, and Otilia Manta. 2019. "Social and Financial Inclusion through Nonbanking Institutions: A Model for Rural Romania" Journal of Risk and Financial Management 12, no. 4: 166. https://doi.org/10.3390/jrfm12040166

APA StyleYue, X.-G., Cao, Y., Duarte, N., Shao, X.-F., & Manta, O. (2019). Social and Financial Inclusion through Nonbanking Institutions: A Model for Rural Romania. Journal of Risk and Financial Management, 12(4), 166. https://doi.org/10.3390/jrfm12040166