The Good and Bad News about the New Liquidity Rules of Basel III in Islamic Banking of Malaysia

Abstract

1. Introduction

2. Literature Review

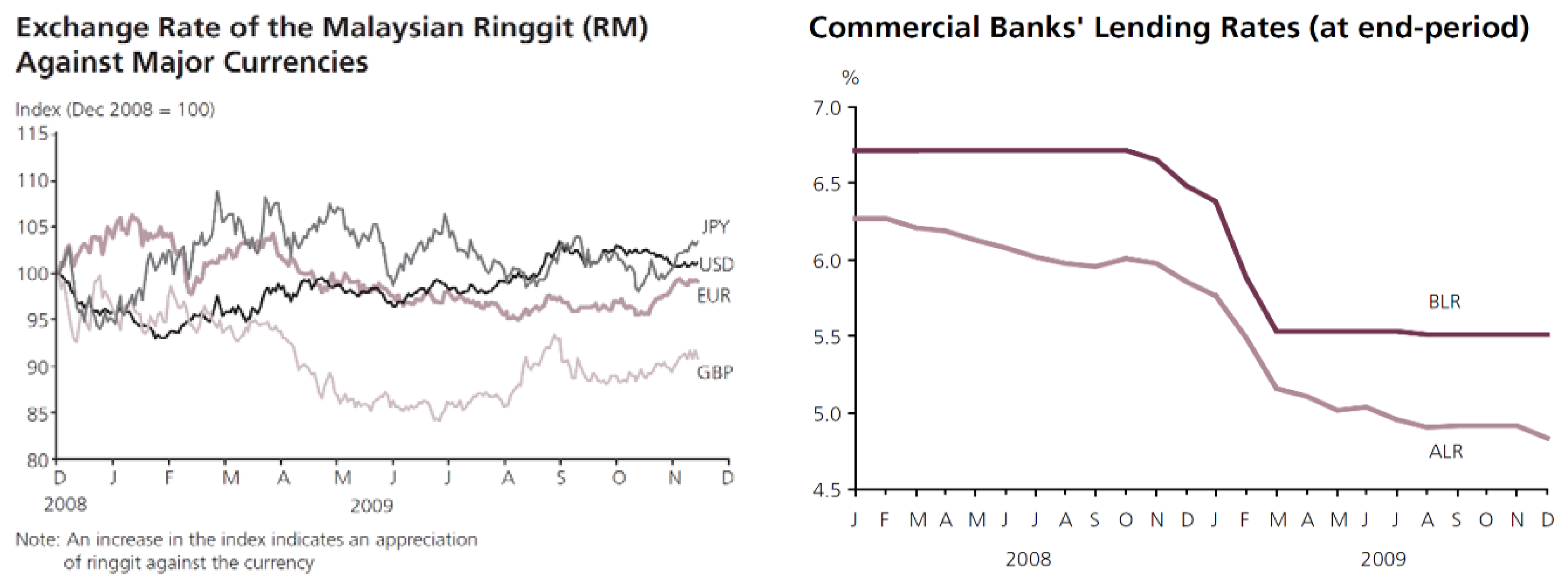

2.1. Financial/Liquidity Crisis 2008

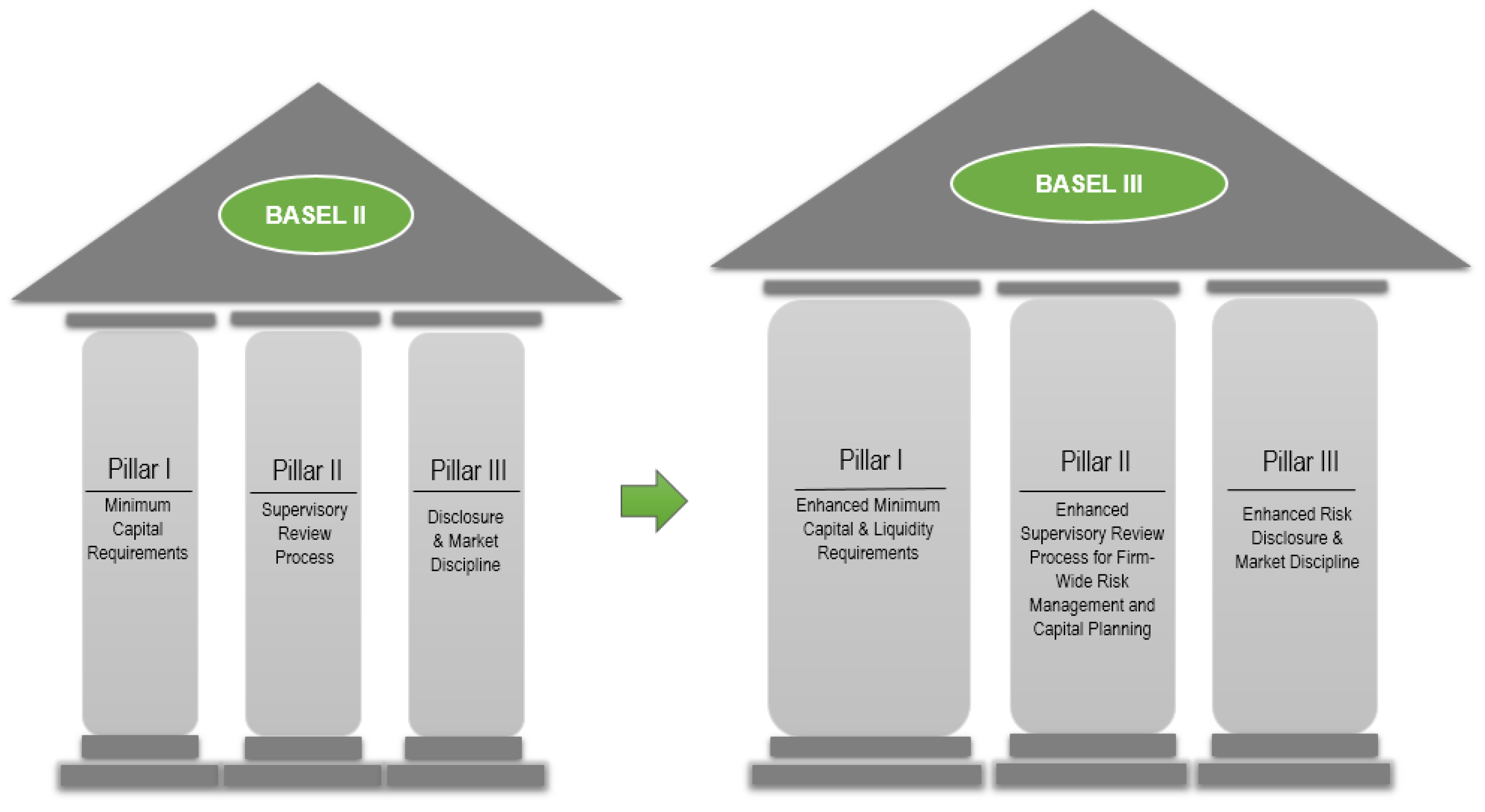

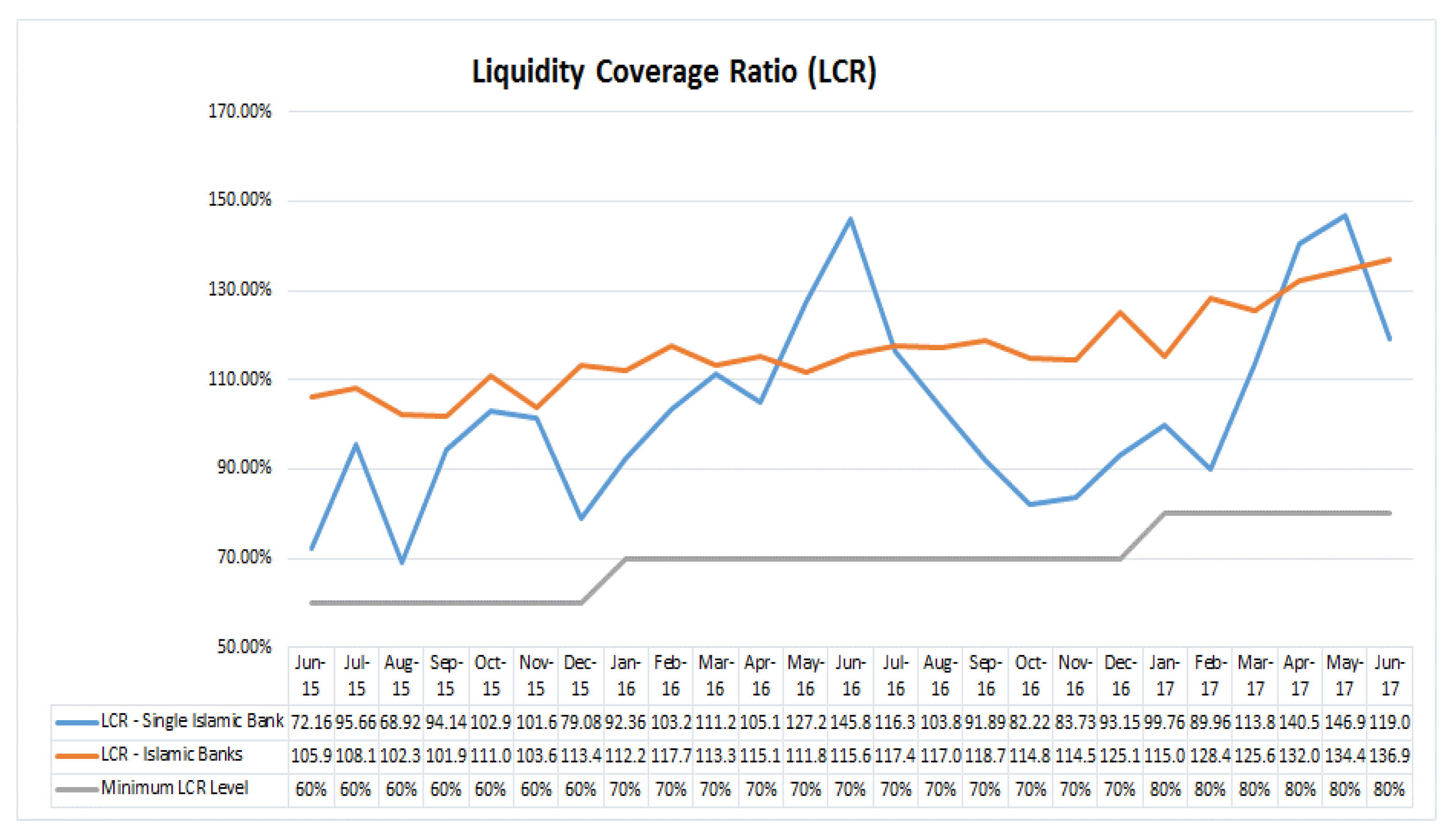

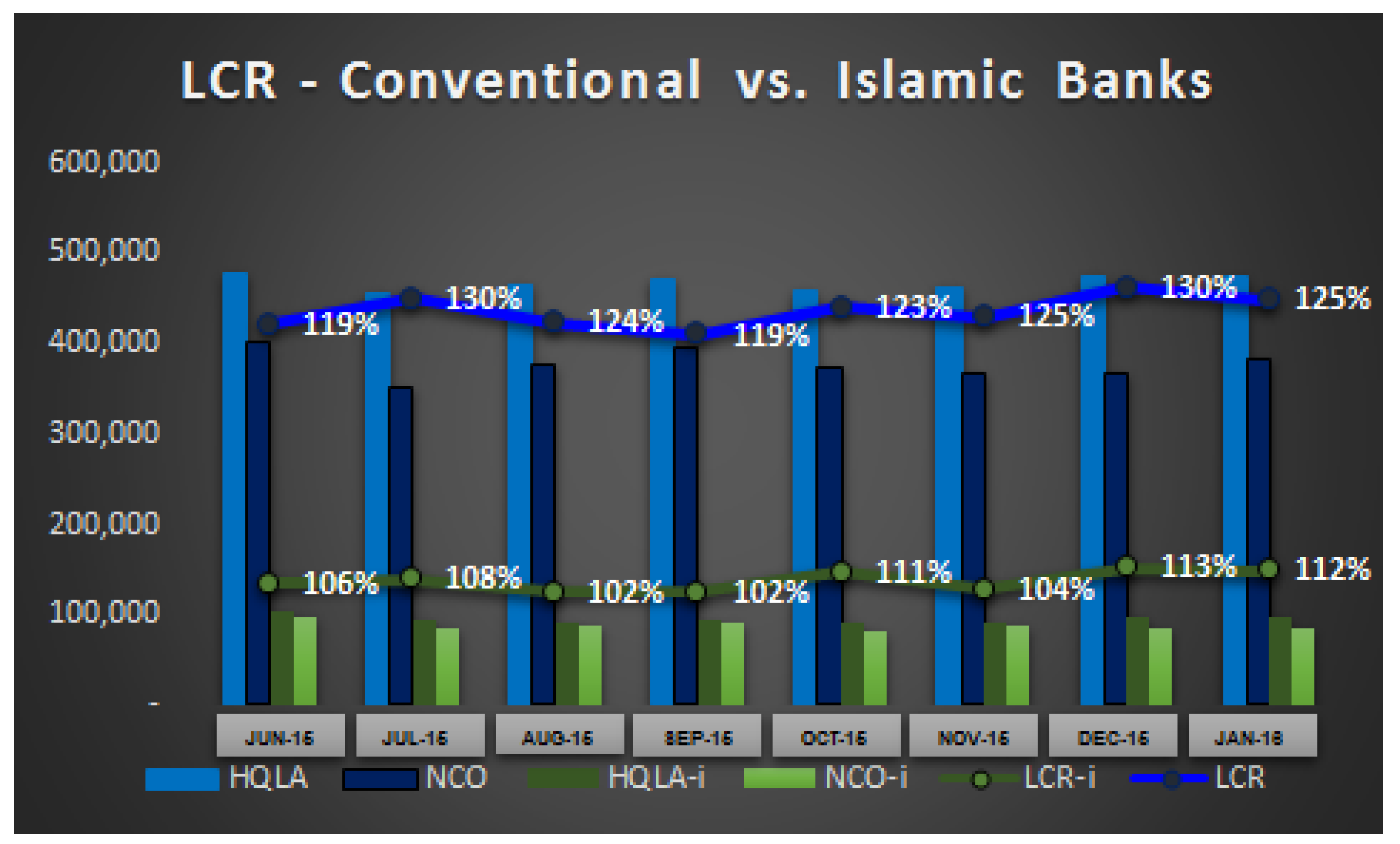

2.2. The Liquidity Coverage Ratio (LCR)

2.3. Origins of the Basel Committee and Revisions Made to the LCR by Basel Since Its Introduction in 2010

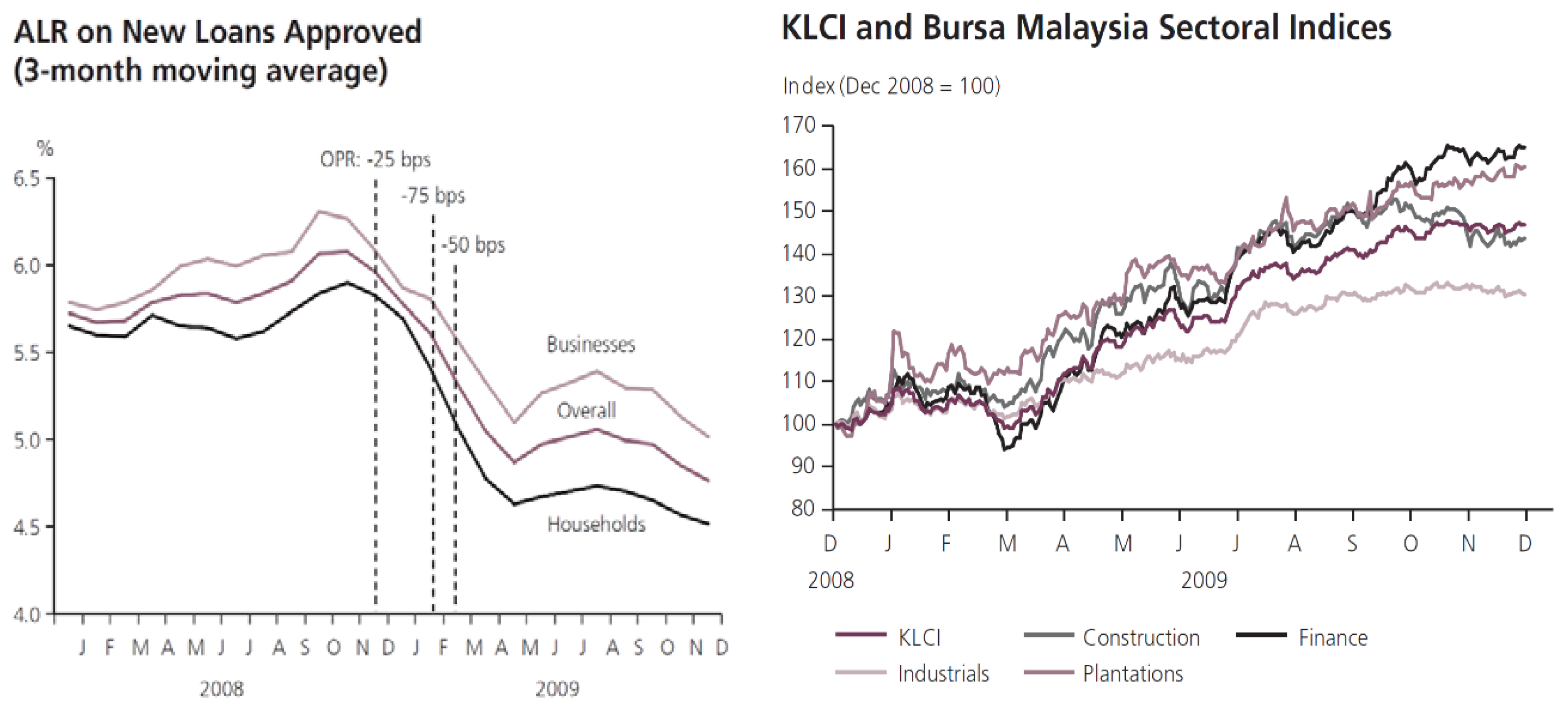

2.4. Why Is Basel III Different to Basel II?

3. Discussion of the Challenges of the LCR

3.1. Challenges of Implementing the LCR

3.2. Challenges of Maintaining the LCR in Islamic Banks

3.3. Proposed Solutions

4. Discussion of Challenges of the LCR

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Ab-Rahim, Rossazana, and Sheen Nie Chiang. 2016. Market structure and performance of Malaysian banking industry. Journal of Financial Reporting and Accounting 14: 158–77. [Google Scholar] [CrossRef]

- Admati, Anat R., Franklin Allen, Richard Brealey, Michael Brennan, Markus K. Brunnermeier, Arnoud Boot, John H. Cochrane, Peter M. DeMarzo, Eugene F. Fama, Michael Fishman, and et al. 2010. Healthy banking system is the goal, not profitable banks. Financial Times, November 9. [Google Scholar]

- Ahmed, Adel. 2010. Global financial crisis: An Islamic finance perspective. International Journal of Islamic and Middle Eastern Finance and Management 3: 306–20. [Google Scholar] [CrossRef]

- Allen, Bill, Ka Kei Chan, Alistair Milne, and Steve Thomas. 2012. Basel III: Is the cure worse than the disease? International Review of Financial Analysis 25: 159–66. [Google Scholar] [CrossRef]

- Atik, Jeffery. 2011. Basel II: A Post-Crisis Post-Mortem. Transnational Law & Contemporary Problems 19: 731–49. [Google Scholar]

- Balasubramanyan, Lakshmi, and David D. VanHoose. 2013. Bank balance sheet dynamics under a regulatory liquidity-coverage-ratio constraint. Journal of Macroeconomics 37: 53–67. [Google Scholar] [CrossRef]

- Balthazar, Laurent. 2006. From Basel 1 to Basel 3: The Integration of State-of-the-Art Risk Modeling in Banking Regulation. Berlin: Springer, pp. 209–13. [Google Scholar]

- Bank Negara Malaysia. 2009. Monetary and Financial Conditions. Kuala Lumpur: Bank Negara Malaysia. [Google Scholar]

- Basel I. 1994. Basel Capital Accord: the Treatment of the Credit Risk Associated with Certain Off-Balance-Sheet Items. Basel: Bank for International Settlements. [Google Scholar]

- Basel III. 2013. The Liquidity Coverage Ratio and Liquidity Risk Monitoring Tools. Basel: Bank for International Settlements. [Google Scholar]

- BIS. 2010. Basel III: A Global Regulatory Framework for More Resilient Banks and Banking Systems. Available online: https://www.bis.org/publ/bcbs189.pdf (accessed on 1 May 2019).

- Blundell-Wignall, Adrian, and Paul Atkinson. 2010. Thinking beyond Basel III. OECD Journal: Financial Market Trends 2010: 9–33. [Google Scholar] [CrossRef]

- BNM. 2015. Liquidity Coverage Ratio. Available online: http://www.bnm.gov.my/index.php?ch=57&pg=137&ac=285&bb=file (accessed on 11 April 2019).

- Chorafas, Dimitros. 2011. Basel III, the Devil and Global Banking. London: Springer. [Google Scholar]

- Committee on Banking Supervision. 2013. Committee on Banking Supervision Basel III: The Liquidity Coverage Ratio and Liquidity Risk Monitoring Tools. Available online: www.bis.org (accessed on 11 April 2019).

- Committee on Banking Supervision. 2015a. Basel Committee on Banking Supervision: A Brief History of the Basel Committee. Available online: https://www.bis.org/bcbs/history.htm (accessed on 11 April 2019).

- Committee on Banking Supervision. 2015b. Revised Pillar 3 Disclosure Requirements. Available online: https://www.bis.org/bcbs/publ/d309.pdf (accessed on 11 April 2019).

- Cosimano, Thomas F., and Dalia Hakura. 2011. Bank Behavior in Response to Basel III: A Cross-Country Analysis. Washington: International Monetary Fund (IMF). [Google Scholar]

- Dermine, Jean. 2013. Bank regulations after the global financial crisis: Good intentions and unintended evil. European Financial Management 19: 658–74. [Google Scholar] [CrossRef]

- Elky, Steve. 2006. An Introduction to Information System Risk Management. SANS Institute InfoSec Reading Room. Available online: https://www.sans.org/reading-room/whitepapers/auditing/introduction-information-system-risk-management-1204 (accessed on 11 March 2019).

- Flores, Francisco, Enrique Bonson-Ponte, and Tomas Escobar-Rodriguez. 2006. Operational risk information system: A challenge for the banking sector. Journal of Financial Regulation and Compliance 14: 383–401. [Google Scholar] [CrossRef]

- Giustiniani, Alessandro, and John Thornton. 2011. Post-crisis financial reform: Where do we stand? Journal of Financial Regulation and Compliance 19: 323–36. [Google Scholar] [CrossRef]

- Grosse, Robert. 2012. Bank regulation, governance and the crisis: A behavioral finance view. Journal of Financial Regulation and Compliance 20: 4–25. [Google Scholar] [CrossRef]

- Haldane, Andreiv G., and Vasileios Madouros. 2012. The dog and the frisbee. Revista de Economía Institucional 14: 13–56. [Google Scholar]

- Härle, Philipp, Erik Lüders, Theo Pepanides, Sonja Pfetsch, Thomas Poppensieker, and Uwe Stegemann. 2010. Basel III and European Banking: Its Impact, How Banks Might Respond, and the Challenges of Implementation. New York: McKinsey & Company, pp. 16–17. [Google Scholar]

- Hendricks, Bradley E., Jed J. Neilson, Catherine Shakespeare, and Christopher D. Williams. 2016. Responding to Regulatory Uncertainty: Evidence from Basel III. University of North Carolina and University of Michigan Working Paper. Rochester: SSRN. [Google Scholar]

- Hoenig, Thomas. 2012. Back to basics: A better alternative to Basel capital rules. Paper presented at American Banker Regulatory Symposium, Washington, DC, USA, September 14; pp. 13–14. [Google Scholar]

- IFSB. 2017. Islamic Financial Services Industry Stability Report. Available online: https://www.ifsb.org/docs/IFSB%20IFSI%20Stability%20Report%202017.pdf (accessed on 1 May 2019).

- Kabir, Md Nurul, and Andrew C. Worthington. 2017. The ‘competition–stability/fragility’nexus: A comparative analysis of Islamic and conventional banks. International Review of Financial Analysis 50: 111–28. [Google Scholar] [CrossRef]

- Kassim, Salina H., and M. Shabri Abd. Majid. 2010. Impact of financial shocks on Islamic banks: Malaysian evidence during 1997 and 2007 financial crises. International Journal of Islamic and Middle Eastern Finance and Management 3: 291–305. [Google Scholar] [CrossRef]

- Kaur, Mandeep, and Samriti Kapoor. 2015. Adoption of Basel norms: A review of empirical evidences. Journal of Financial Regulation and Compliance 23: 271–84. [Google Scholar] [CrossRef]

- KPMG International. 2011. Basel III: Issues and Implications. Amstelveen: KPMG LLP. [Google Scholar]

- Mohammed Ahmed, Jaffar. 2016. A conceptual framework for the Basel accords-based regulation. Journal of Financial Regulation and Compliance 24: 90–103. [Google Scholar] [CrossRef]

- Moosa, Imad A. 2010. Basel II as a casualty of the global financial crisis. Journal of Banking Regulation 11: 95–114. [Google Scholar] [CrossRef]

- Morrison and Foerster. 2010. The New Global Minimum Capital Standards Under Basel III. Available online: http://www.bis.org/publ/bcbs174.pdf?noframes=1 (accessed on 11 April 2019).

- PIDM. 2016. Deposit Insurance System (DIS). Available online: https://www.pidm.gov.my/en/ (accessed on 11 April 2019).

- PwC. 2013. PwC Briefing Note Basel III and beyond Revised Liquidity Coverage Ratio. London: PwC Network. [Google Scholar]

- Sahut, Jean-Michel, Mehdi Mili, Maroua Ben Krir, and Frédéric Teulon. 2011. Factors of competitiveness of Islamic banks in the new financial order. Paper Presented at 8th International Conference on Islamic Economics and Finance, Doha, Qatar, December 19–21; Available online: http://conference.qfis. edu.qa/app/media/261 (accessed on 11 May 2019).

- Sairally, Beebee Salma, Marjan Muhammad, and Madaa Munjid Mustafa. 2015. Structuring Innovative Tier 2 (T2) Capital Instruments Under Basel III: A Shari’ah Perspective. ISRA International Journal of Islamic Finance 7: 163. [Google Scholar]

- Schwerter, Stefan. 2011. Basel III’s ability to mitigate systemic risk. Journal of Financial Regulation and Compliance 19: 337–54. [Google Scholar] [CrossRef]

- Song, Guoxiang. 2014. The Pro-Cyclical Impact of Basel III Regulatory Capital on Bank Capital Risk. In Risk Management Post Financial Crisis: A Period of Monetary Easing. Bingley: Emerald Group Publishing Limited, pp. 59–81. [Google Scholar]

- SunGard. 2015. Operationalizing the LCR and NSFR: Embedding Liquidity Risk Management Culture in Banking. Available online: https://www.fisglobal.com/solutions/institutional-and-wholesale/commercial-and-investment-banking/-/media/fisglobal/files/whitepaper/operationalizing-the-lcr-and-nsfr.pdf (accessed on 4 April 2019).

- The Malaysian Reserve. 2018. Malaysia Remains Lead in Islamic Finance. Available online: https://themalaysianreserve.com/2018/04/05/malaysia-remains-lead-in-islamic-finance/ (accessed on 7 July 2019).

- Tonveronachi, Mario. 2007. Implications of Basel II for Financial Stability-Clouds are Darker for Developing Countries. PSL Quarterly Review 60: 111–35. [Google Scholar]

- World News Media. 2013. Basel III|World Finance on the Basel II Banking Reforms. Available online: http://www.basel-iii.worldfinance.com/ (accessed on 6 November 2018).

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zainudin, S.M.; Abdul Rasid, S.Z.; Omar, R.; Hassan, R. The Good and Bad News about the New Liquidity Rules of Basel III in Islamic Banking of Malaysia. J. Risk Financial Manag. 2019, 12, 120. https://doi.org/10.3390/jrfm12030120

Zainudin SM, Abdul Rasid SZ, Omar R, Hassan R. The Good and Bad News about the New Liquidity Rules of Basel III in Islamic Banking of Malaysia. Journal of Risk and Financial Management. 2019; 12(3):120. https://doi.org/10.3390/jrfm12030120

Chicago/Turabian StyleZainudin, Shazleena Mohamed, Siti Zaleha Abdul Rasid, Rosmini Omar, and Rohail Hassan. 2019. "The Good and Bad News about the New Liquidity Rules of Basel III in Islamic Banking of Malaysia" Journal of Risk and Financial Management 12, no. 3: 120. https://doi.org/10.3390/jrfm12030120

APA StyleZainudin, S. M., Abdul Rasid, S. Z., Omar, R., & Hassan, R. (2019). The Good and Bad News about the New Liquidity Rules of Basel III in Islamic Banking of Malaysia. Journal of Risk and Financial Management, 12(3), 120. https://doi.org/10.3390/jrfm12030120