Cross-Border Venture Capital Investments: What Is the Role of Public Policy?

Abstract

1. Introduction

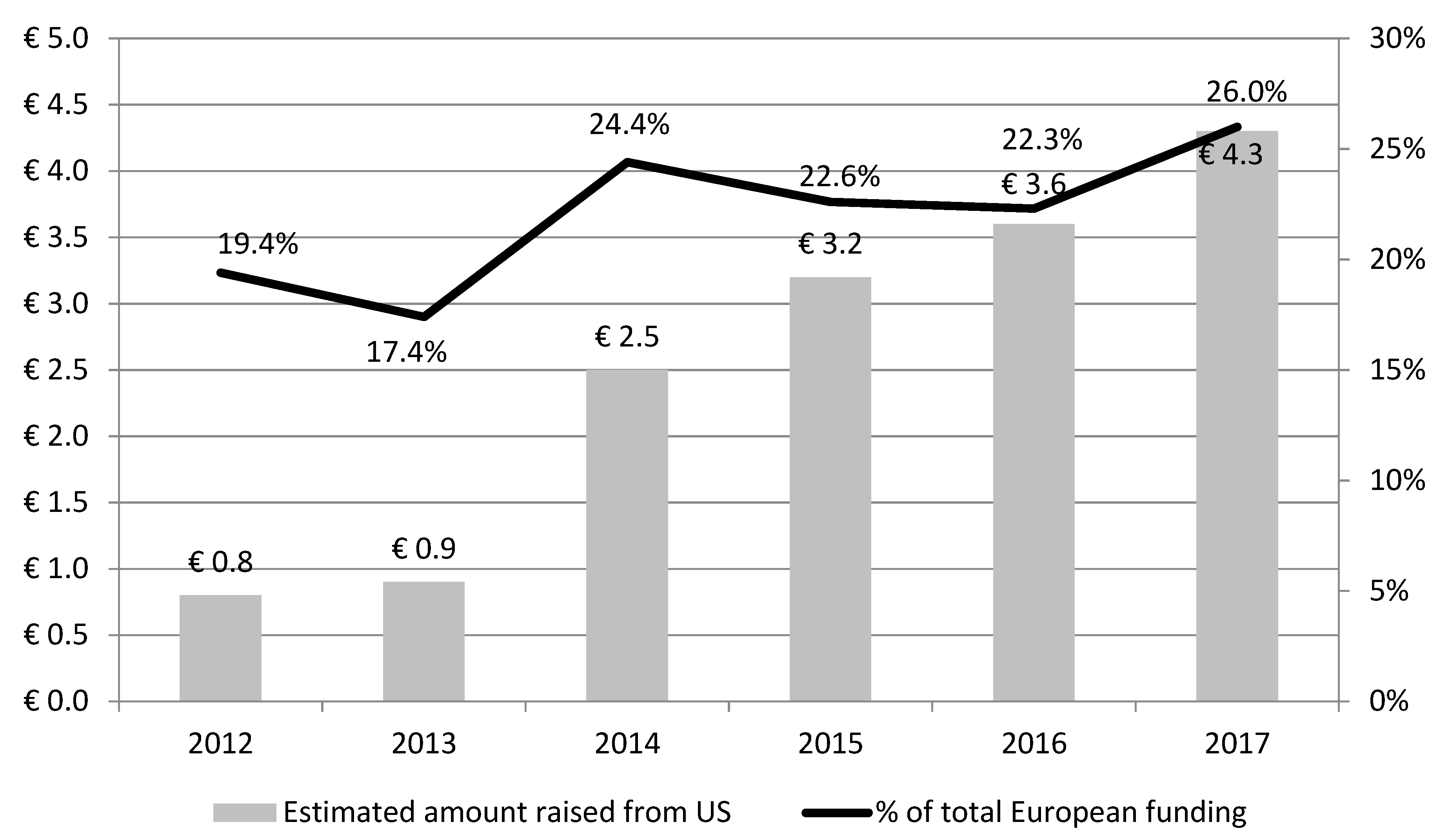

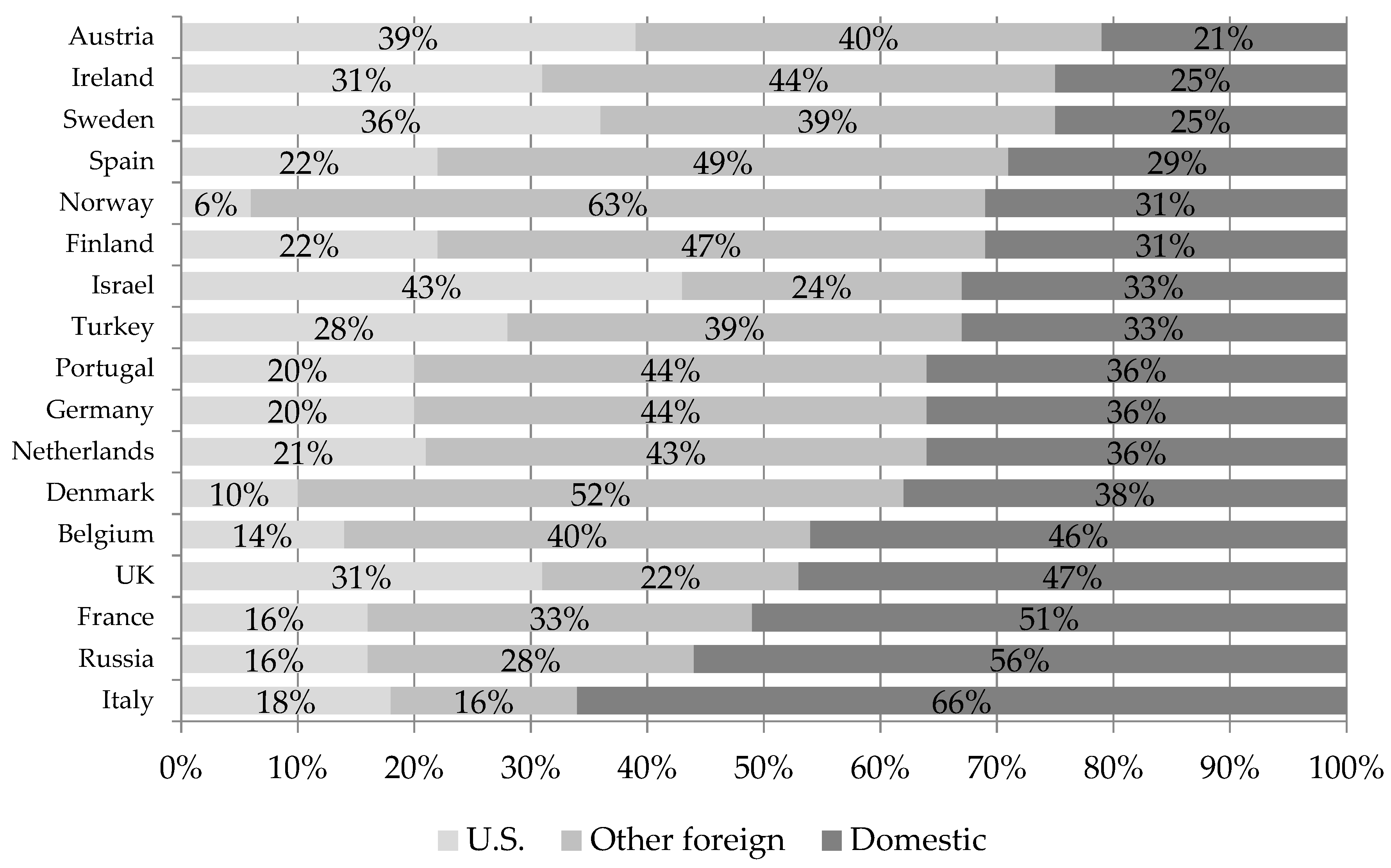

2. Trends in Cross-Border Venture Capital Investments

2.1. Data from Industry Publications

2.2. Empirical Evidence from Academic Papers

2.3. Country Experiences

2.3.1. Israel

2.3.2. Canada

2.3.3. The United Kingdom

2.3.4. France

3. Framework for Understanding Cross-Border Venture Capital Investments

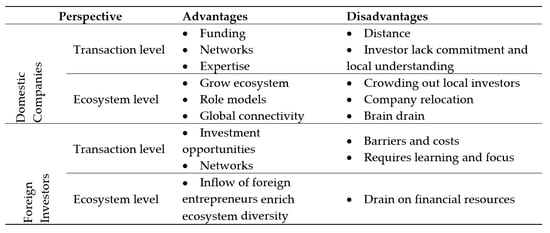

3.1. Advantages and Disadvantages of Cross-Border VC Investments

3.2. Flow of Talent across Borders

4. Policy Options

4.1. Rationale for Public Support of Cross-Border VC

4.2. Policy Options

5. Discussion

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Acevedo, Miguel F., Matt Adey, Claudio Bruno, Gino del Bufalo, Alexandre Gazaniol, Vivien Lo, Georg Metzger, Blanca N. Perez, and Baptiste Thornary. 2016. Building Momentum in Venture Capital across Europe: France, Germany, Italy, Spain and the United Kingdom. Maisons-Alfort: Bpifrance. Rome: Cassa depositi e prestiti. Madrid: Instituto de Credito Oficial. Sheffield: British Business Bank. Frankfurt am Main: KfW Bankengruppe. Available online: https://www.kfw.de/PDF/Download-Center/Konzernthemen/Research/PDF-Dokumente-Studien-und-Materialien/Building-Momentum-in-Venture-Capital-across-Europe.pdf (accessed on 1 June 2018).

- Aizenman, Joshua, and Jake Kendall. 2008. The Internationalization of Venture Capital and Private Equity. Cambridge: National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Akerlof, George A. 1970. The Market for “Lemons”: Quality Uncertainty and the Market Mechanism. The Quarterly Journal of Economics 84: 488. [Google Scholar] [CrossRef]

- Alhorr, Hadi S., Curt B. Moore, and G. Tyge Payne. 2008. The Impact of Economic Integration on Cross-Border Venture Capital Investments: Evidence from the European Union. Entrepreneurship Theory and Practice 32: 897–917. [Google Scholar] [CrossRef]

- Arrow, Kenneth J. 1985. The economics of agency. In Principals and Agents: The Structure of Business. Edited by J. W. Pratt and R. Zeckhauser. Boston: Harvard Business School Press. [Google Scholar]

- Autorité des Marchés Financiers. 2014. BPI France, Annual Report. Paris: Autorité des Marchés Financiers. [Google Scholar]

- Batista, Catia, Aitor Lacuesta, and Pedro C. Vicente. 2007. Brain Drain or Brain Gain? Micro Evidence from an African Success Story. Bonn: IZA. [Google Scholar]

- Beine, Michel, Frédéric Docquier, and Hillel Rapoport. 2001. Brain drain and economic growth: Theory and evidence. Journal of Development Economics 64: 275–89. [Google Scholar] [CrossRef]

- Bertoni, Faio, and Alexander Peter Groh. 2014. Cross-Border Investments and Venture Capital Exits in Europe: Mode of Exit and Cross-Border VC Investments. Corporate Governance: An International Review 22: 84–99. [Google Scholar] [CrossRef]

- Bordo, Matan. 2018. Israeli Tech’s Identity Crisis: Startup Nation or Scale Up Nation? Available online: https://www.forbes.com/sites/startupnationcentral/2018/05/14/israeli-techs-identity-crisis-startup-nation-or-scale-up-nation/ (accessed on 14 May 2018).

- Bottazzi, Laura, Marco Da Rin, and Thomas Hellmann. 2009. What is the role of legal systems in financial intermediation? Theory and evidence. Journal of Financial Intermediation 18: 559–98. [Google Scholar] [CrossRef]

- Bottazzi, Laura, Marco Da Rin, and Thomas Hellmann. 2016. The Importance of Trust for Investment: Evidence from Venture Capital. Review of Financial Studies 29: 2283–318. [Google Scholar] [CrossRef]

- Brander, James A., Qianqian Du, and Thomas Hellmann. 2015. The Effects of Government-Sponsored Venture Capital: International Evidence. Review of Finance 19: 571–618. [Google Scholar] [CrossRef]

- Brander, Luke M., Andrea Ghermandi, Onno Kuik, Anil Markandya, Paulo A. L. D. Nunes, Marije Schaafsma, and Alfred Wagtendonk. 2010. Scaling Up Ecosystem Services Values: Methodology, Applicability and a Case Study. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- BDC Capital. 2017. BDC Capital Canada’s Venture Capital Landscape: Challenges and Opportunities. Wakefield: BDC Capital Database. [Google Scholar]

- Chahine, Salim, and Samer Saade. 2011. Shareholders’ Rights and the Effect of the Origin of Venture Capital Firms on the Underpricing of US IPOs: Shareholders’ Rights and the Origin of Venture Capital Firms. Corporate Governance: An International Review 19: 601–21. [Google Scholar] [CrossRef]

- Chemmanur, Thomas J., Tyler J. Hull, and Karthik Krishnan. 2016. Do local and international venture capitalists play well together? The complementarity of local and international venture capitalists. Journal of Business Venturing 31: 573–94. [Google Scholar] [CrossRef]

- Chen, Victor Zitian, and Sunny Li Sun. 2019. Barbarians at the gate of the middle kingdom: The international mobility of financial contracting and governance. Entrepreneurship Theory and Practice 43: 802–37. [Google Scholar] [CrossRef]

- Dealroom.co. 2017. Annual European Venture Capital Report, European ed. Amsterdam: Dealroom.co Database. [Google Scholar]

- Dealroom.co. 2018. Capital Investment Flows in Europe. Amsterdam: Dealroom.co Database. [Google Scholar]

- Devigne, David, Tom Vanacker, Sophie Manigart, and Ine Paeleman. 2013. The role of domestic and cross-border venture capital investors in the growth of portfolio companies. Small Business Economics 40: 553–73. [Google Scholar] [CrossRef]

- Devigne, David, Sophie Manigart, and Mike Wright. 2016. Escalation of commitment in venture capital decision making: Differentiating between domestic and international investors. Journal of Business Venturing 31: 253–71. [Google Scholar] [CrossRef]

- Devigne, David, Sophie Manigart, Tom Vanacker, and Klaas Mulier. 2018. Venture capital internationalization: Synthesis and future research directions. Journal of Economic Surveys 32: 1414–45. [Google Scholar] [CrossRef]

- Duruflé, Gilles. 2018. 2018 Main Conclusions. Presented at the Tech Innovation Platform, Quebec City Conference, Quebec City, QC, Canada; Available online: https://qcconference.com/archives/tip/ (accessed on 15 November 2018).

- Duruflé, Gilles, Thomas Hellmann, and Karen Wilson. 2018. Catalysing entrepreneurship in and around universities. Oxford Review of Economic Policy 34: 615–36. [Google Scholar] [CrossRef]

- Gilder, G. 2009. Silicon Israel: How Market Capitalism Saved the Jewish State. City Journal 19. Available online: https://www.city-journal.org/html/silicon-israel-13208.html (accessed on 1 June 2018).

- Goodhart, Charles, and Dirk Schoenmaker. 2016. The Global Investment Banks are now all Becoming American: Does that Matter for Europeans? Journal of Financial Regulation 2: 163–81. [Google Scholar] [CrossRef]

- Groh, Alexander P., and Heinrich Liechtenstein. 2011. International allocation determinants for institutional investments in venture capital and private equity limited partnerships. International Journal of Banking, Accounting and Finance 3: 176–206. [Google Scholar] [CrossRef]

- Groh, Alexander P., Heinrich Liechtenstein, and Miguel A. Canela. 2008. International Allocation Determinants of Institutional Investments in Venture Capital and Private Equity Limited Partnerships. IESE Research Papers D/726. Barcelona: IESE Business School. [Google Scholar] [CrossRef]

- Gu, Qian, and Jane W. Lu. 2010. Effects of inward investment on outward investment: The venture capital industry worldwide 1985–2007. Journal of International Business Studies 42: 263–84. [Google Scholar] [CrossRef]

- Guler, Isin, and Mauro F. Guillén. 2010. Institutions and the internationalization of US venture capital firms. Journal of International Business Studies 41: 185–205. [Google Scholar] [CrossRef]

- Hellmann, Thomas, Denis Frydrych, Carolyn Hicks, Christian Rauch, Francisco Brahm, Christoph Loch, Stelios Kavadias, and Peter Hiscocks. 2016. Financing UK Scale-Ups: Challenges and Recommendations. Available online: http://eureka.sbs.ox.ac.uk/id/eprint/6148 (accessed on 1 June 2018).

- Hellmann, Thomas F., and Veikko Thiele. 2019. Fostering Entrepreneurship: Promoting Founding or Funding? Management Science 65: 2445–2945. [Google Scholar] [CrossRef]

- Huang, Eustance. 2018. Chinese Investment in Israeli TECH Is Growing, and It’s “Quite Welcome” for Some. CNBC. Available online: https://www.cnbc.com/2018/07/19/chinese-investment-in-israel-technology-is-growing-expert-says.html (accessed on 1 June 2018).

- Humphery-Jenner, Mark, and Jo-Ann Suchard. 2013. Foreign VCs and venture success: Evidence from China. Journal of Corporate Finance 21: 16–35. [Google Scholar] [CrossRef]

- Hursti, Jani, and Markku V. J. Maula. 2008. Acquiring Financial Resources from Foreign Equity Capital Markets: An Examination of Factors Influencing Foreign Initial Public Offerings. Journal of Business Venturing 22: 833–51. [Google Scholar] [CrossRef]

- Isenberg, Daniel. 2011. Start-up Notions: Where Israeli Entrepreneurship Really Came From. Jersey City: Forbes. [Google Scholar]

- Jääskeläinen, Mikko, and Maula Maula. 2014. Do networks of financial intermediaries help reduce local bias? Evidence from cross-border venture capital exits. Journal of Business Venturing 29: 704–21. [Google Scholar] [CrossRef]

- Jaffee, Dwight M., and Thomas Russell. 1976. Imperfect Information, Uncertainty, and Credit Rationing. The Quarterly Journal of Economics 90: 651. [Google Scholar] [CrossRef]

- Klette, Tor, Jarle Møen, and Zvi Griliches. 1999. Do Subsidies to Commercial R&D Reduce Market Failures? Microeconometric Evaluation Studies. NBER Working Paper, (w6947). Cambridge: National Bureau of Economic Research, Inc., p. 37. [Google Scholar]

- Kraemer-Eis, Helmut, and Frank Lang. 2012. The Importance of Leasing for SME Financing. Working Paper. p. 36. Available online: http://www.eif.org/news_centre/research/eif_wp_2012_15_The%20importance%20of%20leasing%20for%20SME%20finance_August_2102.pdf (accessed on 1 June 2018).

- Lee, Georgina. 2018. Canada’s Tech Firms Drawing Increasing Interest from Chinese Venture Capital Firms. South China Morning Post. Available online: https://www.scmp.com/business/article/2130409/canadas-tech-firms-drawing-increasing-interest-chinese-venture-capital (accessed on 25 January 2018).

- Lerner, Josh. 2010. The future of public efforts to boost entrepreneurship and venture capital. Review of Finance 571. [Google Scholar] [CrossRef]

- Mäkelä, Markus M., and Markku V. J. Maula. 2005. Cross-border venture capital and new venture internationalization: An isomorphism perspective. Venture Capital 7: 227–57. [Google Scholar] [CrossRef]

- Mäkelä, Markus M., and Markku V. J. Maula. 2006. Interorganizational Commitment in Syndicated Cross-Border Venture Capital Investments. Entrepreneurship Theory and Practice 30: 273–98. [Google Scholar] [CrossRef]

- Mäkelä, Markus M., and Markuu V. J. Maula. 2008. Attracting cross-border venture capital: the role of a local investor. Entrepreneurship & Regional Development 20: 237–57. [Google Scholar] [CrossRef]

- Meeker, Mary. 2018. Internet Trends. Menlo Park: Kleiner, Perkins, Caufield & Byers Partner. [Google Scholar]

- Meuleman, Miguel, and M. Wright. 2009. Determinants of Cross-Border Syndication: Cultural Barriers, Legal Context, and Learning. Available online: https://ssrn.com/abstract=1348206 (accessed on 1 June 2018).

- Nougayrède, Delphine. 2018. Towards a Global Financial Register? The Case for End Investor Transparency in Central Securities Depositories. Journal of Financial Regulation 4: 276–313. [Google Scholar] [CrossRef]

- OECD Publishing. 2018. OECD Time-Series Estimates of Government Tax Relief for Business R&D: Technology and Industry Policy Papers. Paris: OECD Publishing. Available online: https://www.oecd.org/sti/rd-tax-stats-tax-expenditures.pdf (accessed on 1 June 2018).

- Papayannakis, L., I. Kastelli, D. Damigos, and G. Mavrotas. 2008. Fostering entrepreneurship education in engineering curricula in Greece. Experience and challenges for a Technical University. European Journal of Engineering Education 33: 199–210. [Google Scholar] [CrossRef]

- Pierrakis, Y., and G. Saridakis. 2019. The role of venture capitalists in the regional innovation ecosystem: A comparison of networking patterns between private and publicly backed venture capital funds. The Journal of Technology Transfer 44: 850–73. [Google Scholar] [CrossRef]

- PitchBook. 2015. Canada Breakdown Report. Seattle: PitchBook. [Google Scholar]

- PitchBook. 2017. Canadian PE & VC Breakdown Report. Seattle: PitchBook. [Google Scholar]

- Prencipe, Dario. 2017. The European Venture Capital Landscape: An EIF Perspective. Volume III: Liquidity Events and Returns of EIF-Backed VC Investments. Luxembourg: European Investment Fund. [Google Scholar]

- PwC/CB Insights Canada. 2018. MoneyTree Canada Report (PwC/CB Insights Quarterly Report, Q4,2017). Toronto: PwC/CB Insights. [Google Scholar]

- Razin, Assaf. 2018. High Tech and Venture Capital Inflows: The Case of Israel. Cambridge: National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Saxenian, Anna Lee. 2002. Silicon Valley’s New Immigrant High-Growth Entrepreneurs. Economic Development Quarterly 16: 20–31. [Google Scholar] [CrossRef]

- Signore, Simone, and Wouter Torfs. 2017. The European Venture Capital Landscape: An EIF Perspective. Volume IV: The Value of Innovation for EIF-Backed Startups. EIF Working Paper Series. Available online: https://EconPapers.repec.org/RePEc:zbw:eifwps:201745 (accessed on 1 June 2018).

- Sorenson, Olav, and Toby E. Stuart. 2001. Syndication Networks and the Spatial Distribution of Venture Capital Investments. American Journal of Sociology 106: 1546–88. [Google Scholar] [CrossRef]

- Startup Genome. 2017. Global Startup Ecosystem Report. San Francisco: Startup Genome. [Google Scholar]

- Stiglitz, Joseph, and Andrew Weiss. 1981. Credit Rationing in Markets with Imperfect Information. American Economic Review 71: 393–410. [Google Scholar]

- Sun, S. L., V. Z. Chen, S. Sunny, and J. Chen. 2018. Venture capital as an ecosystem engineer for regional innovation co-evolution in an emerging market. International Business Review. forthcoming. [Google Scholar] [CrossRef]

- Sun, Sunny Li, and Hao Liang. 2014. Morphing: The linkage of inward private equity and outward venture. Thunderbird International Business Review 56: 421–38. [Google Scholar] [CrossRef]

- The Economist. 2017. Startup nation or left-behind nation? Israel’s economy is a study in contrasts. The Economist, May 18. [Google Scholar]

- Twaalfhoven, Bert, and Karen E. Wilson. 2004. Breeding More Gazelles: The Role of European Universities. Available online: http://www.gvpartners.com/web/pdf/Breeding_Gazelles_-_The_Role_of_Universities.pdf (accessed on 1 June 2018).

- Tykvová, Tereza, Mariela Borell, and Tim-Alexander Kroencke. 2012. Potential of Venture Capital in the European Union. Brussels: European Parliament. [Google Scholar]

- Tykvová, Tereza, and Andrea Schertler. 2008. Syndication to Overcome Transaction Costs of CROSS-border Investments? Evidence from a Worldwide Private Equity Deals’ Dataset. Working Paper. Available online: https://pdfs.semanticscholar.org/85ab/01f03d2614330b485ad951de6379a5ba88be.pdf?_ga=2.105797699.155263369.1561955345-1609756567.1536308798 (accessed on 1 June 2018).

- Tykvová, Tereza, and Andrea Schertler. 2011. Cross-border venture capital flows and local ties: Evidence from developed countries. The Quarterly Review of Economics and Finance 51: 36–48. [Google Scholar] [CrossRef]

- Vuong, Quan-Hoang. 2018. The (ir)rational consideration of the cost of science in transition economies. Nature Human Behaviour 2: 5. [Google Scholar] [CrossRef]

- Weinland, Don. 2018. Chinese VC Funds Pour $2.4bn into Silicon Valley Start-Ups. Financial Times. Available online: https://www.scmp.com/business/article/2130409/canadas-tech-firms-drawing-increasing-interest-chinese-venture-capital (accessed on 18 July 2018).

- Wilson, Karen, and Filipe Silva. 2013. Policies for Seed and Early Stage Finance: Findings from the 2012 OECD Financing Questionnaire. OECD Science, Technology and Industry Policy Papers. Paris: OECD Publishing. [Google Scholar] [CrossRef]

- Wilson, Karen E., Shai Vyakarnam, Christine Volkmann, Steve Mariotti, and Daniel Rabuzzi. 2009. Educating the Next Wave of Entrepreneurs: Unlocking Entrepreneurial Capabilities to Meet the Global Challenges of the 21st Century. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Wilson, Karen E. 2015. Policy Lessons from Financing Innovative Firms. OECD Science, Technology and Industry Policy Papers 24. Paris: OECD Publishing. [Google Scholar] [CrossRef]

- Zemer, Manor. 2018. Funding for Israeli High-Tech Hits All-Time High. Available online: http://www.israel-vc.com/2016/02/2015-funding-for-israeli-high-tech-hits.html (accessed on 15 November 2018).

| 1 | To be more specific, Improbable received funding from Japanese SoftBank https://www.independent.co.uk/news/business/news/japan-softbank-improbably-invest-500m-uk-tech-startup-a7732031.html, Farfetch from Chinese JD.com: https://techcrunch.com/2017/06/21/jd-com-invests-397m-into-luxury-marketplace-farfetch-as-part-of-a-new-strategic-partnership/, Deliveroo from a syndicate including Fidelity and T. Rowe Price: https://techcrunch.com/2017/09/24/deliveroo-raises-385m/, Truphone from a syndicate that included Russian investors: https://www.cnbc.com/2017/10/03/truphone-raises-338-million-in-funding-backed-by-roman-abramovich.html, and Soundcloud from a syndicate of The Raine Group and Singapore-based Temasek: https://www.musicbusinessworldwide.com/soundcloud-posted-a-82m-loss-in-2016-but-took-on-170m-in-investment-last-year/. |

| 2 | These funds supported by tax credits to retail investors were called Labor Sponsored Venture Capital Corporations (LSVCC). |

| 3 | The pooled average for the private independent funds was not any better than for government funds and LSVCCs. However, the dispersion of returns was much larger for private sector funds. There was a first quartile of private sector funds that had acceptable returns, but most private sector funds had poor to very poor returns (see Duruflé 2018). |

| 4 | From discussions with representatives of The British Private Equity & Venture Capital Association. |

| 5 | |

| 6 | This section is based on conversations with Atomico. Atomico is a leading international technology investment firm headquartered in London. Atomico’s founder and CEO is Niklas Zennström, who co-founded Skype and Kazaa. |

| 7 | Innovation clusters are a dense area of business activity containing a critical mass of large and small companies, post-secondary and other research institutions that act as engines of growth. Superclusters build on the advantages of a cluster via stronger connections, a long-term competitive advantage, and global brand recognition. The Innovation Superclusters Initiative in Canada is investing up to $950 million to support business-led innovation superclusters with the greatest potential to energize the economy and become engines of growth (https://www.ic.gc.ca/eic/site/093.nsf/eng/home). |

| 8 | |

| 9 | |

| 10 | |

| 11 |

| (a) | |||||||||

| Origin of Funds by Investor Location (2017) | |||||||||

| Invest into: *HQ Location | UK Investors | German Investors | France Investors | Swedish Investors | Spanish Investors | Dutch Investors | Swiss Investors | Rest of Europe Investors | European Investors |

| Total Europe | 817 | 433 | 591 | 241 | 148 | 155 | 99 | 454 | 2650 |

| UK | 588 | 50 | 26 | 9 | 9 | 5 | 12 | 26 | 657 |

| Germany | 51 | 293 | 24 | 14 | 5 | 11 | 35 | 6 | 345 |

| France | 36 | 23 | 505 | 3 | 5 | 5 | 5 | 8 | 531 |

| Sweden | 23 | 7 | -- | 182 | 1 | 3 | 2 | 16 | 213 |

| Spain | 37 | 8 | 11 | 3 | 121 | 6 | -- | 9 | 164 |

| The Netherlands | 16 | 13 | 3 | 1 | 1 | 105 | 1 | 3 | 130 |

| Switzerland | 3 | 6 | 3 | 1 | 3 | 2 | 30 | 2 | 45 |

| Other Europe | 63 | 33 | 19 | 28 | 3 | 18 | 14 | 384 | 565 |

| (b) | |||||||||

| Origin of Funds by Investor Location (2017) | |||||||||

| Invest into: *By HQ Location | European Investors | US and Canada Investors | Asian Investors | Row Investors | Total World Investors | ||||

| Europe | US and Canada | Asia | RoW | Total World | |||||

| Total Europe | 2650 | 468 | 141 | 224 | 3681 | ||||

| UK | 657 | 157 | 54 | 14 | 828 | ||||

| Germany | 345 | 59 | 18 | 5 | 417 | ||||

| France | 531 | 64 | 12 | 9 | 705 | ||||

| Sweden | 213 | 28 | 4 | 2 | 359 | ||||

| Spain | 164 | 27 | 6 | 8 | 217 | ||||

| The Netherlands | 130 | 18 | 4 | 1 | 215 | ||||

| Switzerland | 45 | 13 | 7 | 1 | 85 | ||||

| Other Europe | 565 | 102 | 36 | 184 | 855 | ||||

| (a) | |||||||||

| Origin of Funds by Investor Location (2017) | |||||||||

| Invest into: *By HQ Location | UK Investors | German Investors | France Investors | Swedish Investors | Spanish Investors | Dutch Investors | Swiss Investors | Rest of Europe Investors | European Investors |

| Europe | 22% | 9% | 10% | 4% | 2% | 3% | 2% | 4% | 56% |

| UK | 36% | 4% | 3% | 1% | 1% | 0% | 2% | 0% | 48% |

| Germany | 13% | 23% | 6% | 2% | 1% | 2% | 5% | 0% | 51% |

| France | 13% | 6% | 51% | 0% | 0% | 4% | 2% | 0% | 77% |

| Sweden | 12% | 9% | -- | 40% | 0% | 2% | 0% | 5% | 68% |

| Spain | 15% | 4% | 4% | 6% | 21% | 3% | -- | 0% | 53% |

| The Netherlands | 11% | 10% | 5% | 0% | 4% | 48% | 0% | -- | 78% |

| Switzerland | 7% | 7% | 9% | 3% | 1% | 2% | 20% | -- | 48% |

| Other Europe | 12% | 7% | 4% | 4% | 0% | 4% | 2% | 27% | 60% |

| (b) | |||||||||

| Origin of Funds by Investor Location (2017) | |||||||||

| Invest into: *By HQ Location | European Investors | US and Canada Investors | Asian Investors | RoW Investors | Total World Investors | ||||

| Total Europe | 56% | 26% | 13% | 5% | $19.4 B | ||||

| UK | 48% | 30% | 20% | 2% | $7.4 B | ||||

| Germany | 51% | 24% | 11% | 14% | $3.1 B | ||||

| France | 77% | 19% | 4% | 1% | $2.6 B | ||||

| Sweden | 68% | 27% | 3% | 2% | $1.3 B | ||||

| Spain | 53% | 26% | 8% | 13% | $0.9 B | ||||

| The Netherlands | 78% | 20% | 2% | 0% | $0.6 B | ||||

| Switzerland | 48% | 38% | 13% | -- | $0.3 B | ||||

| Other Europe | 60% | 26% | 9% | 5% | $3.1 B | ||||

| Perspective | Advantages | Disadvantages | |

|---|---|---|---|

| Domestic Companies | Transaction level |

|

|

| Ecosystem level |

|

| |

| Foreign Investors | Transaction level |

|

|

| Ecosystem level |

|

| |

| Level | Objective | # | Policy Option |

|---|---|---|---|

| Transaction level | Building domestic base | 1 | Tax credits |

| 2 | Funding programmes | ||

| Attracting foreign investors | 3 | Open up tax credits | |

| 4 | Open up funding programmes | ||

| Ecosystem level | Building domestic base | 5 | Sectoral focus |

| 6 | Attracting talent | ||

| 7 | Human capital development | ||

| Attracting foreign investors | 8 | Harmonization | |

| 9 | Networking | ||

| 10 | Transparency |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bradley, W.A.; Duruflé, G.; Hellmann, T.F.; Wilson, K.E. Cross-Border Venture Capital Investments: What Is the Role of Public Policy? J. Risk Financial Manag. 2019, 12, 112. https://doi.org/10.3390/jrfm12030112

Bradley WA, Duruflé G, Hellmann TF, Wilson KE. Cross-Border Venture Capital Investments: What Is the Role of Public Policy? Journal of Risk and Financial Management. 2019; 12(3):112. https://doi.org/10.3390/jrfm12030112

Chicago/Turabian StyleBradley, Wendy A., Gilles Duruflé, Thomas F. Hellmann, and Karen E. Wilson. 2019. "Cross-Border Venture Capital Investments: What Is the Role of Public Policy?" Journal of Risk and Financial Management 12, no. 3: 112. https://doi.org/10.3390/jrfm12030112

APA StyleBradley, W. A., Duruflé, G., Hellmann, T. F., & Wilson, K. E. (2019). Cross-Border Venture Capital Investments: What Is the Role of Public Policy? Journal of Risk and Financial Management, 12(3), 112. https://doi.org/10.3390/jrfm12030112