Stock Investment and Excess Returns: A Critical Review in the Light of the Efficient Market Hypothesis

Abstract

1. Introduction

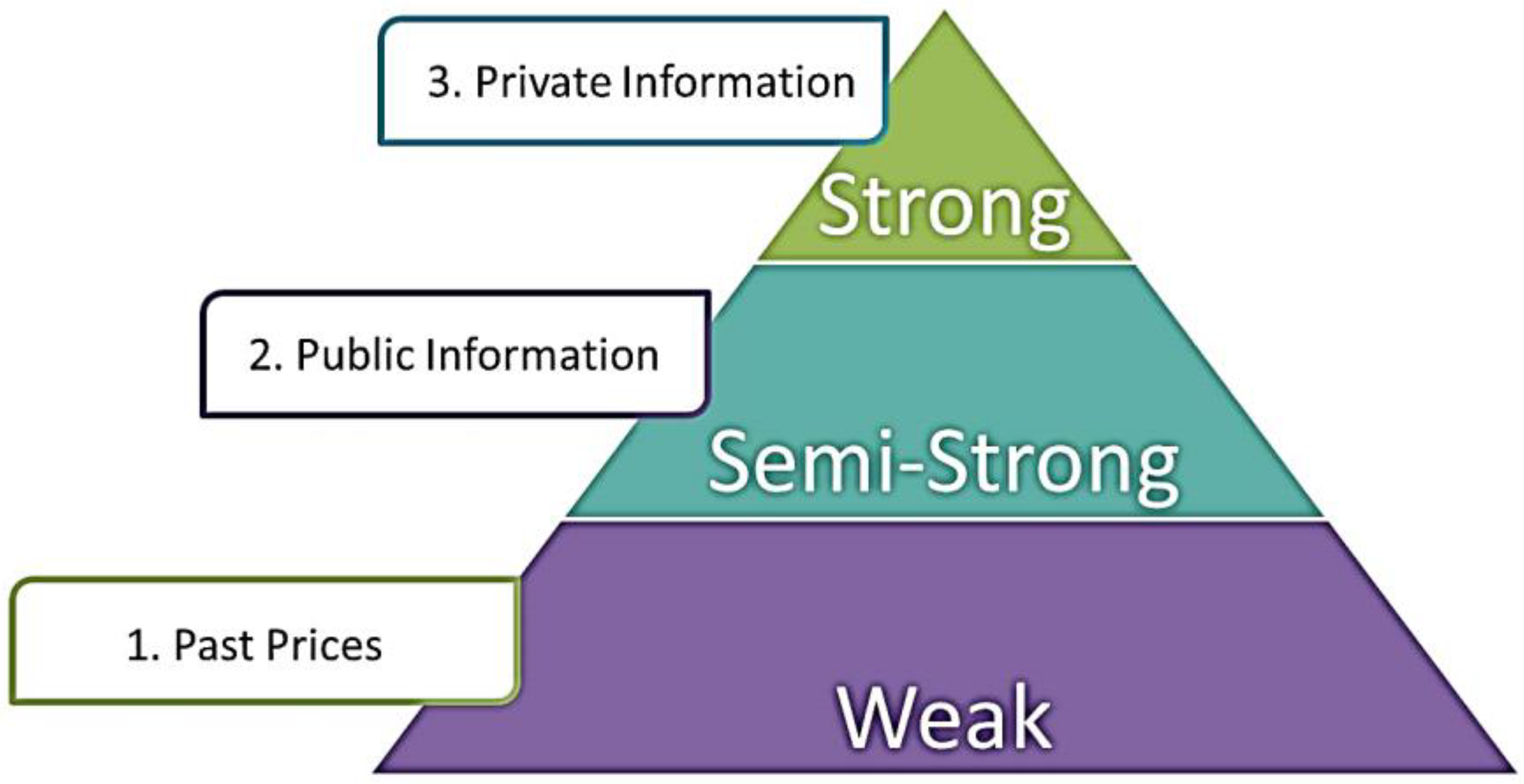

2. The Efficient Market Hypothesis

2.1. Early Developments of the Efficient Market Hypothesis

2.2. Modern Era of Efficient Market Hypothesis and Its Critics

3. Early Valuation Parameters and Models Used to Predict Excess Returns

3.1. Early Valuation Parameters

3.1.1. Dividend Yield and Excess Returns

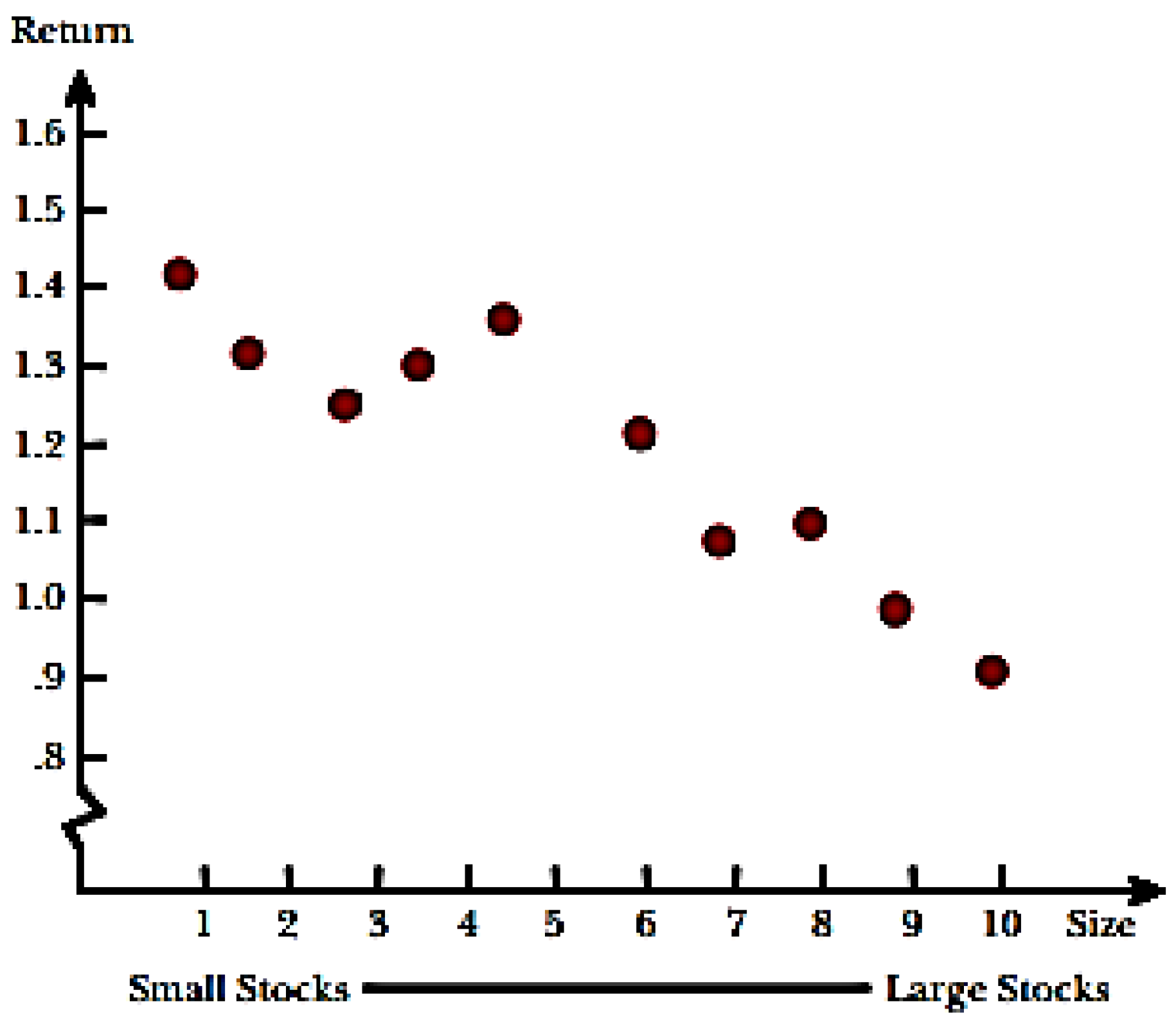

3.1.2. Firm Size and Excess Returns

3.1.3. Value Stocks and Excess Returns

3.2. Excess Returns and Valuation Models

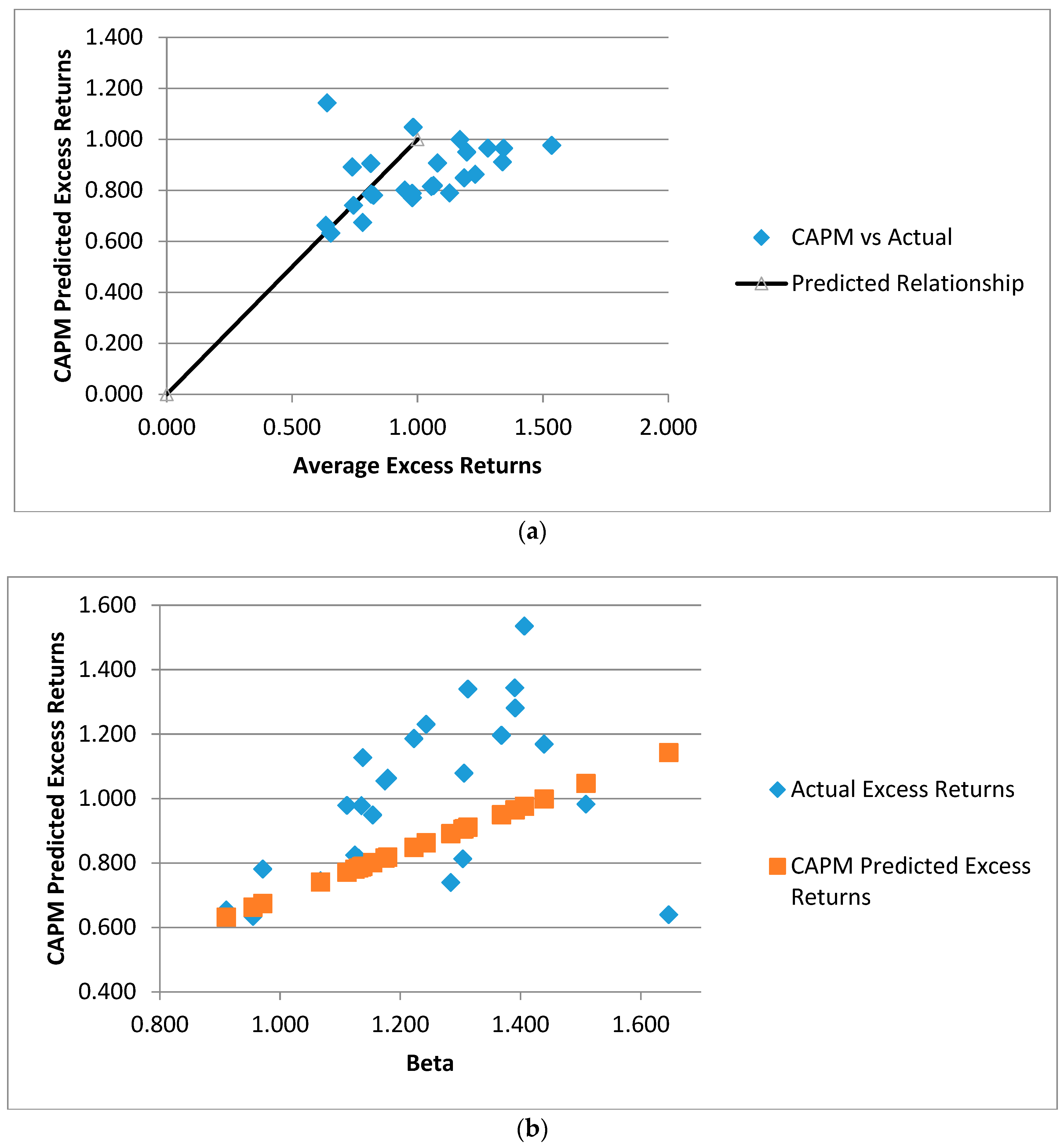

3.2.1. Capital Assets Pricing Model

3.2.2. Three-Factor Model of Fama and French

4. Reasons behind Cross-Sectional Excess Returns

4.1. Risk Differences Approach

4.2. Behavioural Bias and Mispricing

4.3. Data Mining

5. Replication: A Futuristic Approach

6. Conclusions and Limitations

Author Contributions

Funding

Conflicts of Interest

References

- Alexander, Sidney S. 1961. Price Movements in Speculative Markets: Trends or Random Walks. Industrial Managment Review 2: 7–21. [Google Scholar]

- Alexander, Sidney S. 1964. Price Movements in Speculative Markets: Trends or Random walks. Industrial Management Review 5: 25–46. [Google Scholar]

- Ariel, Robert A. 1990. High Stock Returns Before Holidays: Existence and Evidence on Possible Causes. Journal of Finance 45: 1611–25. [Google Scholar] [CrossRef]

- Bagwell, Laurie Simon, and John B. Shoven. 1989. Cash Distributions to Shareholders. Journal of Economic Perspectives 3: 129–40. [Google Scholar] [CrossRef]

- Baker, Monya. 2016. Is there a Reproducibility Crisis? Nature 533: 452–54. [Google Scholar] [CrossRef] [PubMed]

- Ball, Ray. 1978. Anomalies in relationships between securities’ yields and yield-surrogates. Journal of Financial Economics 6: 103–26. [Google Scholar] [CrossRef]

- Ball, Ray, and Philip Brown. 1968. An empirical evaluation of accounting income numbers. Journal of Accounting Research 6: 159–78. [Google Scholar] [CrossRef]

- Ball, Ray, Joseph J. Gerakos, Juhani T. Linnainmaa, and Valeri V. Nikolaev. 2019. Earnings, retained earnings, and book-to-market in the cross section of expected returns. Journal of Financial Economics (JFE). Forthcoming. [Google Scholar] [CrossRef]

- Banz, Rolf W. 1981. The Relationship between Return and Market Value of Common Stocks. Journal of Financial Economics 9: 3–18. [Google Scholar] [CrossRef]

- Barberis, Nicholas, and Richard Thaler. 2003. A Survey of Behavioral Finance. In Handbook of the Economics of Finance. Edited by Milton Harris, Rene M. Stulz and George M. Constantinides. Amsterdam: Elsevier Science B.V. [Google Scholar]

- Barberis, Nicholas, Andrei Shleifer, and Robert Vishny. 1998. A model of investor sentiment. Journal of Financial Economics 49: 307–43. [Google Scholar] [CrossRef]

- Basu, Sanjoy. 1977. Investment Performance of Common Stocks In Relation to their Price-Earning Ratios: A Test of the Efficient Market Hypothesis. The Journal of Finance 32: 663–82. [Google Scholar] [CrossRef]

- Basu, Sanjoy. 1983. The Relationship between Earnings’ Yield, Market Value and the Returns for NYSE Common Stocks: Further Evidence. Journal of Financial Economics 12: 129–56. [Google Scholar] [CrossRef]

- Ben-David, Itzhak, Francesco Franzoni, and Rabih Moussawi. 2017. Exchange Traded Funds (Etfs). National Bureau of Economic Research Working Paper 22829. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Bhandari, Laxmi Chand. 1988. Debt/Equity Ratio and Expected Common Stock Returns: Empirical Evidence. Journal of Finance 43: 507–28. [Google Scholar] [CrossRef]

- Black, Fisher, Micheal C. Jensen, and Myron Scholes. 1972. The Capital Asset Pricing Model: Some Empirical Tests. In Studies in the Theory of Capital Markets. Edited by Michael Cole Jensen. New York: Praeger, vol. I, pp. 79–121. [Google Scholar]

- Blume, Marshall E., and Frank Husic. 1973. Price, Beta, and Exchange Listing. Journal of Finance 28: 283–99. [Google Scholar] [CrossRef]

- Bollen, Johan, Huina Mao, and Xiaojun Zeng. 2011. Twitter mood predicts the stock market. Journal of Computational Science 2: 1–8. [Google Scholar] [CrossRef]

- Brealey, Richard A., Stewart C. Myers, and Franklin Allen. 2011. Principles of Corporate Finance, 10th ed. New York: McGraw-Hill/Irwin. [Google Scholar]

- Brodeur, Abel, Mathias Lé, Marc Sangnier, and Yanos Zylberberg. 2016. Star Wars: The Empirics Strike Back. American Economic Journal: Applied Economics 8: 1–32. [Google Scholar] [CrossRef]

- Brounen, Dirk, Abe De Jong, and Kees Koedijik. 2004. Corporate Finance in Europe Confronting Theory with Practice. Financial Management 33: 71–101. [Google Scholar] [CrossRef]

- Campbell, John Y. 1987. Stock returns and the term structure. Journal of Financial Economics 18: 373–99. [Google Scholar] [CrossRef]

- Campbell, John Y., and Rober J. Shiller. 1988. Stock Prices, Earnings, and Expected Dividents. Journal of Finance 43: 661–76. [Google Scholar] [CrossRef]

- Conrad, Jennifer, Michael Cooper, and Gautam Kaul. 2003. Value versus Glamour. The Journal of Finance 58: 1969–95. [Google Scholar] [CrossRef]

- Cowles, Alfred. 1933. Can Stock Market Forecasters Forecast? Econometrica 1: 309–24. [Google Scholar] [CrossRef]

- Coy, Peter. 2017. Lies, damn lies, and financial statistics. Bloomberg Business Week, April 7. [Google Scholar]

- Daniel, Kent, David Hirshleifer, and Avanidhar Subrahmanyam. 1988. Investor Psychology and Security Market Under- and Overreactions. The Journal of Finance 53: 1839–85. [Google Scholar] [CrossRef]

- Daniel, Kent D., David Hirshleifer, and Avanidhar Subrahmanyam. 2001. Overconfidence, Arbitrage, and Equilibrium Asset Pricing. The Journal of Finance 56: 921–65. [Google Scholar] [CrossRef]

- Degutis, Augustas, and Lina Novickytė. 2014. The Efficient Market Hypothesis: A Critical Review of Literature and Methodology. Ekonomika 93: 7–23. [Google Scholar] [CrossRef]

- Dewald, William G., Jerry G. Thursby, and Richard G. Anderson. 1986. Replication in Empirical Economics. The Journal of Money, Credit and Banking Project 76: 587–603. [Google Scholar]

- Dimson, Elroy, and Massoud Mussavain. 1999. Three centuries of asset pricing. Journal of Banking and Finance 23: 1745–69. [Google Scholar] [CrossRef]

- Donangelo, Andres, Francois Gourio, Matthias Kehrig, and Miguel Palacios. 2019. The cross-section of labor leverage and equity returns. Journal of Financial Economics 132: 497–518. [Google Scholar] [CrossRef]

- Durlauf, Steven N., and Lawrence E. Blume. 2008. The New Palgrave Dictionary of Economics. New York: Palgrave Macmillan. [Google Scholar]

- Engelberg, Joseph, R. David McLean, and Jeffrey Pontiff. 2016. Anomalies and News. The Journal of Finance 73: 1971–2001. [Google Scholar] [CrossRef]

- Fama, Eugene F. 1965. The behavior of Stock-Market Prices. Journal of Business 38: 34–105. [Google Scholar] [CrossRef]

- Fama, Eugene F. 1970. Efficient Capital Markets: A Review of Theory and Emperical Work. Journal of Finance 25: 383–417. [Google Scholar] [CrossRef]

- Fama, Eugene F. 1998. Market efficiency, long-term returns, and behavioral finance. Journal of Financial Economics 49: 283–306. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 1991. Efficient capital markets: II. Journal of Finance 45: 1575–617. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 1992. The Cross-Section of Expected Stock Returns. Journal of Finance 47: 427–65. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth French. 1993. Common Risk Factors in the Returns on Stocks and Bonds. Journal of Financial Economics 33: 3–56. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 1995. Size and book-to-market factors in earnings and returns. Journal of Finance 50: 131–55. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 1996. Multifactor Explanations of assest Pricing Anomalies. Journal of Finance 51: 55–84. [Google Scholar] [CrossRef]

- Fama, Eugene, and Kenneth French. 1997. Value vs. Growth: The International Evidence. Journal of Finance 53: 1975–99. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 2001. Disappearing dividends: Changing “Changing Firm characteristics or lower propensity to pay? Journal of Financial Economics 60: 3–43. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 2004. The Capital Asset Pricing Model: Theory and Evidence. Journal of Economic Perspectives 18: 25–46. [Google Scholar] [CrossRef]

- Fama, Eugene F., and James D. MacBeth. 1973. Risk, Return, and Equilibrium: Empirical Tests. The Journal of Political Economy 81: 607–36. [Google Scholar] [CrossRef]

- Fama, Eugene, and G. William Schwert. 1977. Asset Returns and Inflation. Journal of Financial Economics 5: 55–69. [Google Scholar] [CrossRef]

- Favilukis, Jack Y., Xiaoji Lin, and Xiaofei Zhao. 2019. The Elephant in the Room: The Impact of Labor Obligations on Credit Markets. Available online: https://ssrn.com/abstract=2648763 (accessed on 26 January 2017).

- Fluck, Zsuzsanna, Burton G. Malkiel, and Richard E. Quandt. 1997. The Predictability of Stock Returns: A Cross-Sectional Simulation. Review of Economics and Statistic 79: 176–83. [Google Scholar] [CrossRef]

- Francis, Nicholson S. 1960. Price-Earnings Ratios. Financial Analysts Journal 16: 43–50. [Google Scholar]

- Frazzini, Andrea, and Owen Lamont. 2006. The Earnings Announcement Premium and Trading Volume. NBER Working Paper 13090. Cambridge: National Bureau of Economic Research. [Google Scholar]

- French, Kenneth. 1980. Stock Returns and the Weekend Effect. Journal of Financial Economics 8: 55–69. [Google Scholar] [CrossRef]

- Graham, John R., and Campbell R. Harvey. 2001. The theory and practice of corporate finance: evidence from the field. Journal of Financial Economics 60: 187–243. [Google Scholar] [CrossRef]

- Harvey, Campbell R. 2017. Presidential Address: The Scientific Outlook in Financial Economics. Journal of Finance 72: 1399–440. [Google Scholar] [CrossRef]

- Harvey, Campbell R., Yan Liu, and Heqing Zhu. 2016. …and the Cross-Section of Expected Returns. National Bureau of Economic Research Working Paper 20592. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Haugen, Robert A., and Josef Lakonishok. 1988. The Incredible Januray Effect. Homewood: Dou Jones-Irwin. [Google Scholar]

- Hawawini, Gabriel A., and Donald B. Keim. 1995. On the Predictability of Common Stock Returns: World wide Evidence. In Handbooks in Operations Research and Management Sciences. Edited by Robert Jarrow, Vojislav Maksimovic and William T. Ziemba. Amsterdam: Elsevier, pp. 497–544. [Google Scholar]

- Ioannidis, John P. A. 2005. Why Most Published Research Findings Are False. PLoS Medicine 2: e124. [Google Scholar] [CrossRef]

- Jianu, Ionel, and Iulia Jianu. 2018. The share price and investment: Current footprints for future oil and gas industry performance. Energies 11: 448. [Google Scholar] [CrossRef]

- Jianu, Ionel, Iulia Jianu, and Carmen Țurlea. 2017. Measuring the company’s real performance by physical capital maintenance. Economic Computation and Economic Cybernetics Studies and Research 51: 37–57. [Google Scholar]

- Kahneman, Daniel, and Mark W. Riepe. 1988. Aspects of Investor Psychology. Journal of Portfolio Management 24: 52–65. [Google Scholar] [CrossRef]

- Keim, Donald B. 1983. Size-Related Anomalies and Stock Return Seasonality: Further Empirical Evidence. Journal of Financial Economics 12: 13–32. [Google Scholar] [CrossRef]

- Kendall, Maurice George, and A. Bradford Hill. 1953. The Analysis of Economic Time-Series-Part 1: Prices. Journal of the Royal Statistical Society 116: 11–34. [Google Scholar] [CrossRef]

- Keynes, John Maynard. 1923. Some Aspects of Commodity Markets. European Reconstruction Series: CWK XII; Manchester: The Manchester Guardian Commercial. [Google Scholar]

- Kuhn, Thomas. 1970. The Structure of Scientific Revolutions, 2nd ed. Chicago: University of Chicago Press. [Google Scholar]

- Lakonishok, Josef, and Seymour Smidt. 1988. Are Seasonal Anomalies Real? A Ninety-Year Perspective. Review of Financial Studies 1: 403–23. [Google Scholar] [CrossRef]

- Lakonishok, Josef, Andrei Shleifer, and Robert Vishny. 1994. Contrarian Investment, Extrapolation, and Risk. Journal of Finance 49: 1541–78. [Google Scholar] [CrossRef]

- Linnainmaa, Juhani T., and Michael R. Roberts. 2016. The History of the Cross Section of Stock Returns. National Bureau of Economic Research Working Paper 22894. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Lintner, John. 1965. The Valuation of Risk Assets and the Selection of Risky Investment in Stock Portfolios and Capital Budgets. The Review of Economics and Statistics 47: 13–37. [Google Scholar] [CrossRef]

- Liu, Bing, and Lei Zhang. 2012. A survey of opinion mining and sentiment analysis. In Mining Text Data. New York: Springer, pp. 415–63. [Google Scholar]

- Liu, Laura Xiaolei, and Lu Zhang. 2014. A neoclassical interpretation of momentum. Journal of Monetary Economics 67: 109–28. [Google Scholar] [CrossRef]

- Lo, Andrew W., and A. Craig MacKinlay. 1990. When are Contrarian Profits Due to Stock Market Overreaction? The Review of Financial Studies 3: 175–205. [Google Scholar] [CrossRef]

- Malkeil, Burton G. 1973. A-Random-Walk-Down-Wall-Street. New York: Norton. [Google Scholar]

- Malkiel, Burton G. 2003. The Efficient Market Hypothesis and Its Critics. The Journal of Economic Perspectives 17: 59–82. [Google Scholar] [CrossRef]

- Malkiel, Burton G. 2011. The Efficient-Market Hypothesis and the Financial Crisis. Rethinking Finance: Perspectives on the Crisis. Available online: https://www.russellsage.org/sites/all/files/Rethinking-Finance/Malkiel.%20The%20Efficient-Market%20Hypothesis%20and%20the%20Financial%20Crisis%20102611.pdf (accessed on 26 November 2010).

- Markowitz, Harry M. 1959. Porfolio Selection: Efficient Diversification of Investments. Edited by Cowles Foundation for Research in Economics. New Haven: Yale University Press. [Google Scholar]

- Mccullough, Bruce D., and Hrishikesh D. Vinod. 2003. Verifying the Solution from a Nonlinear Solver: A Case Study. American Economic Review 93: 873–92. [Google Scholar] [CrossRef]

- Mclean, R. David, and Jeffrey Pontiff. 2016. Does Academic Research Destroy Stock Return Predictability? Journal of Finance 71: 5–32. [Google Scholar] [CrossRef]

- Mishkin, Frederic S., and Stanley G. Eakins. 2012. Financial Markets and Institutions. Boston: Prentice Hall. [Google Scholar]

- Nagel, Stefan. 2005. Short sales, institutional investors and the cross-section of stock returns. Journal of Financial Economics 78: 277–309. [Google Scholar] [CrossRef]

- Parks, Rowan W., and Eric Zivot. 2006. Financial market efficiency and its implications. In Investment, Capital and Finance. Seattle: University of Washington. [Google Scholar]

- Pearson, Karl. 1905. The Problem of the Random Walk. Nature 72: 294. [Google Scholar] [CrossRef]

- Poterba, James M., and Lawrence H. Summers. 1988. Mean Reversion in Stock Returns: Evidence and Implications. Journal of Financial Economics 22: 27–59. [Google Scholar] [CrossRef]

- Rasheed, Muhammad Shahid, Umara Noreen, Muhammad Fayyaz Sheikh, and Tahir Yousaf. 2016. CAPM and Idiosyncratic Risk using Two-Pass Model: Evidence from the Karachi Stock Market. The Journal of Commerce 8: 25. [Google Scholar]

- Roberts, Harry V. 1959. Stock-Market “Pattern” and Financial Analysis:Methodological suggestions. The Journal of Finance 14: 1–10. [Google Scholar]

- Savor, Pavel, and Mungo Wilson. 2016. Earnings Announcements and Systematic Risk. The Journal of Finance 71: 83–138. [Google Scholar] [CrossRef]

- Savor, Pavel, and Mungo Wilsony. 2013. How Much Do Investors Care About Macroeconomic Risk? Evidence from Scheduled Economic Announcements. Journal of Financial and Quantitative Analysis 48: 343–75. [Google Scholar] [CrossRef]

- Schwert, G. William. 2001. Stock Volatility in the New Millennium: How Wasky Is NASDAQ? National Bureau of Economic Research Working Paper 8436. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Schwert, G. William. 2003. Anomalies and Market Efficiency. In Handbook of the Economics of Finance. Amsterdam: Elsevier, pp. 939–74. [Google Scholar]

- Sewel, Martin. 2011. A History of the Efficient Market Hypothesis. Research Note RN/11/04. London: University College of London. [Google Scholar]

- Sharpe, William F. 1964. Capital Asset Prices: A Theory of Market Equilibrium under Conditions of Risk. The Journal of Finance 19: 425–42. [Google Scholar]

- Shiller, Robert J. 2003. From Efficient Markets Theory to Behavioral Finance. The Journal of Economic Perspectives 17: 83–103. [Google Scholar] [CrossRef]

- Shleifer, Andrei. 2000. Inefficient Markets: An Introduction to Behavioral Finance. Oxford: Oxford University Press. [Google Scholar]

- Steiger, James H. 2004. Beyond the F test: Effect size confidence intervals and tests of close fit in the analysis of variance and contrast analysis. Psychol Methods 9: 164–82. [Google Scholar] [CrossRef]

- Tobin, James. 1958. Estimation of Relationships for Limited Dependent Variables. Econometrica 26: 24–36. [Google Scholar] [CrossRef]

- Verheyden, Tim, Lieven De Moor, and Filip Van den Bossche. 2013. A Tale of Market Efficiency. Review of Business and Economic Literature 58: 140–58. [Google Scholar]

- Wang, Jun, Zhilong Xie, Qing Li, Jinghua Tan, Rong Xing, Yuanzhu Chen, and Fengyun Wu. 2019. Effect of Digitalized Rumor Clarification on Stock Markets. Emerging Markets Finance and Trade 55: 450–74. [Google Scholar] [CrossRef]

- Wu, Jin (Ginger), Lu Zhang, and X. Frank Zhang. 2010. Theq-Theory Approach to Understanding the Accrual Anomaly. Journal of Accounting Research 48: 177–223. [Google Scholar] [CrossRef]

- Yan, Xuemin (Sterling), and Lingling Zheng. 2017. Fundamental Analysis and the Cross-Section of Stock Returns:AData-Mining Approach. Review of Financial Studies 30: 1382–423. [Google Scholar] [CrossRef]

| Author | Year | Paper/Book/Thesis Title (Please See References for Details) |

|---|---|---|

| Pearson | 1905 | The Problem of the Random Walk (Pearson 1905) |

| Keynes | 1923 | Some Aspects of Commodity Markets (Keynes 1923) |

| Cowles | 1933 | Can Stock Market Forecasters Forecast? (Cowles 1933) |

| G. Kendall and Hill | 1953 | The Analysis of Economic Time-Series-Part 1: Prices (Kendall and Hill 1953) |

| Roberts | 1959 | Stock-Market “Pattern” and Financial Analysis: Methodological suggestions (Roberts 1959) |

| Alexandar | 1961 | Price Movements in Speculative Markets: Trends or Random Walks (Alexander 1961) |

| Alexandar | 1964 | Price Movements in Speculative Markets: Trends or Random Walks (Alexander 1964) |

| Fama | 1965 | The behaviour of Stock-Market Prices (Fama 1965) |

| Fama | 1970 | Efficient Capital Markets: A Review of Theory and Empirical Work (Fama 1970) |

| G. Malkeil | 1973 | A-Random-Walk-Down-Wall-Street (Malkeil 1973) |

| Dimson and Mussavin | 1999 | Three centuries of asset pricing (Dimson and Mussavain 1999) |

| Shiller | 2003 | From Efficient Markets Theory to Behavioral Finance (Shiller 2003) |

| Steiger | 2004 | Beyond the F test: Effect size confidence intervals and tests of close fit in the analysis of variance and contrast analysis (Steiger 2004) |

| Durlauf and Blume | 2008 | The New Palgrave Dictionary of Economics (Durlauf and Blume 2008) |

| Sewel | 2011 | A History of the Efficient Market Hypothesis (Sewel 2011) |

| Verheyden et al. | 2013 | A Tale of Market Efficiency (Verheyden et al. 2013) |

| Author | Year | Paper/Book/Thesis Title (Please See References for Details) |

|---|---|---|

| French | 1980 | Stock Returns and the Weekend Effect (French 1980) |

| Keim | 1983 | Size-Related Anomalies and Stock Return Seasonality (Keim 1983) |

| Haugen and Lakonishok | 1988 | The Incredible January Effect Homewood (Haugen and Lakonishok 1988) |

| Fama | 1988 | Market Efficiency, Long-Term Returns, and Behavioral Finance (Fama 1998) |

| Lakonishok and Smidt | 1988 | Are Seasonal Anomalies Real? A Ninety-Year Perspective (Lakonishok and Smidt 1988) |

| M. Poterba and Summers | 1988 | Mean Reversion in Stock Returns: Evidence and Implications (Poterba and Summers 1988) |

| Ariel | 1990 | High Stock Returns Before Holidays: Existence and Evidence on Possible Causes (Ariel 1990) |

| Lo and MacKinlay | 1990 | When are Contrarian Profits Due to Stock Market Overreaction? (Lo and MacKinlay 1990) |

| Hawawini and Keim | 1995 | On the Predictability of Common Stock Returns (Hawawini and Keim 1995) |

| Fluck et al. | 1997 | The Predictability of Stock Returns: A Cross-Sectional Simulation (Fluck et al. 1997) |

| Shleifer | 2000 | Inefficient Markets: An Introduction to Behavioral Finance (Shleifer 2000) |

| Schwert | 2001 | Stock Volatility In The New Millennium: How Wasky Is NASDAQ? (Schwert 2001) |

| Malkiel | 2003 | The Efficient Market Hypothesis and Its Critics. (Malkiel 2003) |

| Parks R.W. and Zivot | 2006 | Financial market efficiency and its implications (Parks and Zivot 2006) |

| Brealy et al | 2011 | Principles of Corporate Finance (Brealey et al. 2011) |

| Malkeil | 2011 | The Efficient-Market Hypothesis and the Financial Crisis (Malkiel 2011) |

| Bollen, Mao, and Zeng 2011 | 2011 | Twitter mood predicts the stock market (Bollen et al. 2011) |

| Liu and Zhang | 2012 | A survey of opinion mining and sentiment analysis (Liu and Zhang 2012) |

| Mishkin et al. | 2012 | Financial markets and institutions. Boston: Prentice Hall. (Mishkin and Eakins 2012) |

| Wang et al. | 2019 | Effect of Digitalized Rumor Clarification on Stock Markets (Wang et al. 2019) |

| Author | Year | Paper/Book/Thesis Title (Please See References for Details) |

|---|---|---|

| Francis | 1960 | Price-Earnings Ratios (Francis 1960) |

| Fama and Schwert | 1977 | Asset Returns and Inflation (Fama and Schwert 1977) |

| Ball | 1978 | Anomalies in relationships between securities’ yields and yield-surrogates (Ball 1978; Basu 1983) |

| Basu | 1983 | The Relationship Between Earnings’ Yield, Market Value and the Returns for NYSE Common Stocks (Ball 1978; Basu 1983) |

| Keim | 1983 | Size-Related Anomalies and Stock Return Seasonality (Keim 1983) |

| Campbel | 1987 | Stock returns and the term structure (Campbell 1987) |

| Fama | 1988 | Market Efficiency, Long-Term Returns, and Behavioral Finance (Fama 1998) |

| Campbell and Schiller | 1988 | Stock Prices, Earnings, and Expected Dividends (Campbell and Shiller 1988) |

| Kahneman and Reipe | 1988 | Aspects of Investor Psychology (Kahneman and Riepe 1988) |

| Bagwell and Shoven | 1989 | Cash Distributions to Shareholders (Bagwell and Shoven 1989) |

| Fama and French | 1993 | Common Risk Factors in the Returns on Stocks and Bonds (Fama and French 1993) |

| Lakonishok et al. | 1994 | Contrarian Investment, Extrapolation, and Risk (Lakonishok et al. 1994) |

| Hawawini and Keim | 1995 | On the Predictability of Common Stock Returns: World wide Evidence (Hawawini and Keim 1995) |

| Fluck et al. | 1997 | The Predictability of Stock Returns: A Cross-Sectional Simulation (Fluck et al. 1997) |

| Fama and French | 1997 | Multifactor Explanations of asset Pricing Anomalies (Fama and French 1997) |

| Fama and French | 2001 | Disappearing dividends: changing “Changing Firm characteristics or lower propensity to pay? (Fama and French 2001) |

| Schwert | 2001 | Stock Volatility In The New Millennium: How Wacky Is NASDAQ? (Schwert 2001) |

| Ball et al. | 2019 | Earnings, retained earnings, and book-to-market in the cross section of expected returns (Ball et al. 2019) |

| Author | Year | Paper/Book/Thesis Title (Please See References for Details) |

|---|---|---|

| Tobin | 1958 | Estimation of Relationships for Limited Dependent Variables (Tobin 1958) |

| Markowitz | 1959 | Portfolio Selection: Efficient Diversification of Investments (Markowitz 1959) |

| Sharpe | 1964 | Capital Asset Prices: A Theory of Market Equilibrium under Conditions of Risk (Sharpe 1964) |

| Lintner | 1965 | The Valuation of Risk Assets and the Selection of Risky Investment in Stock Portfolios and Capital Budgets (Lintner 1965) |

| Black et al. | 1972 | The Capital Asset Pricing Model: Some Empirical Tests (Black et al. 1972) |

| Fama and Macbeth | 1973 | Risk, Return, and Equilibrium: Empirical Tests. (Fama and MacBeth 1973) |

| Basu | 1977 | Investment Performance of Common Stocks in Relation to their Price-Earning Ratios: A Test of the Efficient Market Hypothesis (Basu 1977) |

| Banz | 1981 | The Relationship between Return and Market Value of Common Stocks (Banz 1981) |

| Bandari | 1988 | Debt/Equity Ratio and Expected Common Stock Returns: Empirical Evidence (Bhandari 1988) |

| Fama and French | 1992 | The Cross-Section of Expected Stock Returns (Fama and French 1992) |

| Fama and French | 1993 | Common Risk Factors in the Returns on Stocks and Bonds. (Fama and French 1993, 1996) |

| Fama and French | 1995 | Size and book-to-market factors in earnings and returns (Fama and French 1995) |

| Fama and French | 1996 | Multifactor Explanations of asset Pricing Anomalies (Fama and French 1993, 1996) |

| Graham and Harvey | 2001 | The theory and practice of corporate finance: evidence from the field (Graham and Harvey 2001) |

| Brounen et al. | 2004 | Corporate Finance in Europe Confronting Theory with Practice (Brounen et al. 2004) |

| Fama and French | 2004 | The Capital Asset Pricing Model: Theory and Evidence (Fama and French 2004) |

| Degutis and Novickeyte | 2014 | The Efficient Market Hypothesis: A Critical Review of Literature and Methodology (Degutis and Novickytė 2014) |

| Liu and Zhang | 2014 | A neoclassical interpretation of momentum (Mclean and Pontiff 2016; Liu and Zhang 2014) |

| Mclean and Pontiff | 2016 | Does Academic Research Destroy Stock Return Predictability? (Mclean and Pontiff 2016; Liu and Zhang 2014) |

| Rasheed et al. | 2016 | CAPM and Idiosyncratic Risk using Two-Pass Model: Evidence from the Karachi Stock Market (Rasheed et al. 2016) |

| Jianu, Jianu, and Țurlea | 2017 | Measuring the company’s real performance by physical capital maintenance (Jianu et al. 2017) |

| Author | Year | Paper/Book/Thesis Title (Please See References for Details) |

|---|---|---|

| Ball and Brown | 1968 | An empirical evaluation of accounting income numbers (Ball and Brown 1968) |

| Blume and Husic | 1973 | Price, Beta, and Exchange Listing (Blume and Husic 1973) |

| Fama | 1989 | Market Efficiency, Long-Term Returns, and Behavioral Finance (Fama 1998) |

| Daniel et al. | 1988 | Investor Psychology and Security Market Under- and Overreactions (Daniel et al. 1988, 2001) |

| Fama and French | 1991 | Efficient capital markets: II (Fama and French 1991; Fama 1998) |

| Fama | 1998 | Market efficiency, long-term returns, and behavioral finance (Fama and French 1991; Fama 1998) |

| Barberis et al. | 1998 | A model of investor sentiment (Barberis et al. 1998), |

| Daniel et al. | 2001 | Overconfidence, Arbitrage, and Equilibrium Asset Pricing (Daniel et al. 1988, 2001) |

| Barberis and Thaler | 2003 | A Survey of Behavioral Finance (Barberis and Thaler 2003) |

| Nagel | 2005 | Short sales, institutional investors and the cross-section of stock returns (Nagel 2005) |

| Frazzini and Lamont | 2006 | The earnings announcement premium and trading volume (Frazzini and Lamont 2006) |

| Wu et al. | 2010 | The q-Theory Approach to Understanding the Accrual Anomaly (Wu et al. 2010) |

| Savor and Wilson | 2013 | How Much Do Investors Care About Macroeconomic Risk? Evidence from Scheduled Economic Announcements (Savor and Wilsony 2013) |

| Liu and Zhang | 2014 | A neoclassical interpretation of momentum (Liu and Zhang 2014) |

| Savor and Wilson | 2016 | Earnings Announcements and Systematic Risk (Savor and Wilson 2016) |

| Harvey et al. | 2016 | The Cross-Section of Expected Returns |

| Engelberg et al. | 2016 | Anomalies and News (Engelberg et al. 2016) |

| Jianu and Jianu | 2018 | The share price and investment: Current footprints for future oil and gas industry performance (Jianu and Jianu 2018) |

| Donangelo et al. | 2019 | The cross-section of labor leverage and equity returns (Donangelo et al. 2019) |

| Favilukis et al. | 2019 | The Elephant in the Room: the Impact of Labor Obligations on Credit Market (Favilukis et al. 2019) |

| Author | Year | Paper/Book/Thesis Title (Please See References for Details) |

|---|---|---|

| Dewald et al. | 1986 | Replication in Empirical Economics (Dewald et al. 1986) |

| Lo and Mackinlay | 1990 | When are Contrarian Profits Due to Stock Market Overreaction? (Lo and MacKinlay 1990) |

| Fama | 1998 | Market efficiency, long-term returns, and behavioral finance (Fama 1998) |

| Mccullough and Vinod | 2003 | Verifying the Solution from a Nonlinear Solver: A Case Study (Mccullough and Vinod 2003) |

| Schwert | 2003 | Anomalies and Market Efficiency (Schwert 2003) |

| Conrad et al. | 2003 | Value versus Glamour (Conrad et al. 2003) |

| Ioannidis | 2005 | Why Most Published Research Findings Are False (Ioannidis 2005) |

| Harvey et al. | 2016 | The Cross-Section of Expected Returns (Harvey et al. 2016) |

| Mclean and Pontiff | 2016 | Does Academic Research Destroy Stock Return Predictability? (Mclean and Pontiff 2016) |

| Baker | 2016 | Is there a Reproducibility Crisis? (Baker 2016) |

| Brodeur et al. | 2016 | Star Wars: The Empirics Strike Back. (Brodeur et al. 2016) |

| Ben-David et al. | 2017 | Exchange Traded Funds (Etfs) (Ben-David et al. 2017) |

| Coy | 2017 | Lies, damn lies, and financial statistics (Coy 2017) |

| Harvey | 2017 | Presidential Address: The Scientific Outlook in Financial Economics (Harvey 2017) |

| Yan and Zheng | 2017 | Fundamental Analysis and the Cross-Section of Stock Returns: A Data-Mining Approach (Yan and Zheng 2017) |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ying, Q.; Yousaf, T.; Ain, Q.u.; Akhtar, Y.; Rasheed, M.S. Stock Investment and Excess Returns: A Critical Review in the Light of the Efficient Market Hypothesis. J. Risk Financial Manag. 2019, 12, 97. https://doi.org/10.3390/jrfm12020097

Ying Q, Yousaf T, Ain Qu, Akhtar Y, Rasheed MS. Stock Investment and Excess Returns: A Critical Review in the Light of the Efficient Market Hypothesis. Journal of Risk and Financial Management. 2019; 12(2):97. https://doi.org/10.3390/jrfm12020097

Chicago/Turabian StyleYing, Qianwei, Tahir Yousaf, Qurat ul Ain, Yasmeen Akhtar, and Muhammad Shahid Rasheed. 2019. "Stock Investment and Excess Returns: A Critical Review in the Light of the Efficient Market Hypothesis" Journal of Risk and Financial Management 12, no. 2: 97. https://doi.org/10.3390/jrfm12020097

APA StyleYing, Q., Yousaf, T., Ain, Q. u., Akhtar, Y., & Rasheed, M. S. (2019). Stock Investment and Excess Returns: A Critical Review in the Light of the Efficient Market Hypothesis. Journal of Risk and Financial Management, 12(2), 97. https://doi.org/10.3390/jrfm12020097