Abstract

This paper tests whether the traditional futures hedge ratio (hT) and the carry cost rate futures hedge ratio (hc) vary in accordance with the Sercu and Wu (2000) and Leistikow et al. (2019) “hc” theory. It does so, both within and across high and low spot asset carry cost rate (c) regimes. The high and low c regimes are specified by asset across time and across currency denominations. The findings are consistent with the theory. Within and across c regimes, hT is inefficient and hc is biased. Across c regimes, hc’s Bias Adjustment Multiplier (BAM) does not vary significantly. Even though hc’s bias-adjusted variant’s BAM is restricted to old data that is from a different c regime, the hedging performance of hc and its bias-adjusted variant (=hc × BAM), are superior to that for hT. Variation in c may account for the hT variation noted in the literature and variation in c should be incorporated into ex ante hedge ratios.

1. Introduction

Empirical studies find that risk management practices can increase firm value (Bartram et al. (2011); Anton (2018); and Aretz et al. (2007)). For example, when markets are imperfect, hedging can increase firm value by lowering agency costs, costly external financing, bankruptcy costs, and taxes (Aretz et al. 2007).

Surveys concerning firms’ financial risk management practices typically show that about half of the respondents use derivatives for hedging and that futures are among the most commonly used commodity hedging instruments, e.g., Berkman et al. (1997) and Bodnar et al. (1998).

Futures hedging is substantial. In 2017, over 25 Billion futures contracts were traded world-wide (Futures Industry Association 2018, FIA.org).

Futures hedgers have to address two questions. Is the hedge expected to reduce their risk sufficiently? If so, then what should they use as their hedge ratio (the size of the short futures position relative to the long spot position)? For reasons discussed below, we focus mainly on the traditional and carry cost rate hedge ratio determination methods and their relative abilities to reduce risk.

The economically structure-less Traditional futures hedge ratio (hT) is the most popular method for determining hedge ratios. It was derived by Ederington (1979), is discussed in mainstream finance texts (e.g., Hull (2015)) and is the benchmark against which others are compared.

It is calculated ex post (in an OLS regression of ΔS on ∆F it is the coefficient of ∆F) and, typically, is implemented ex ante in the immediately subsequent period without adjustment as:

where Cov and Var are the covariance and variance, respectively, and ΔS and ∆F are the spot and futures price changes, respectively. hT minimizes the variance of the inventory-carrying hedger’s profit, where profit = ΔS − hT × ∆F. However, the ΔS term should be carry cost adjusted (Ferguson and Leistikow (1999)). For the rest of the paper, ΔS is defined as the carry cost adjusted spot price change.

hT = Cov(∆S, ∆F)/Var(∆F),

Sercu and Wu (2000) and Leistikow et al. (2019) noted problems associated with using hT. Leistikow et al. (2019) derived the general (multi-asset class) ex ante futures carry cost rate hedge ratio hc, while Sercu and Wu (2000) derived it in the context of currencies. Among other advantages relative to hT, hc lacks the long estimation period that increases the likelihood that the hedge ratio estimate will be distorted by c regime shifts (where it is estimated under one c regime and applied under another) and significant data collection/organization effort. hc is calculated as:

where c is the (decimal form) annualized c to the futures contract’s maturity, T is years to the futures contract’s maturity at the initiation of the hedge, and ∆t is the hedge period length (in years).

hc = (1 + c)−(T − ∆t),

Leistikow et al. (2019) noted that hc is biased and defined the Bias-Adjusted hc (hc-BA) as:

where: BAM is the Bias Adjustment Multiplier and it is defined as hT/hc.

hc-BA = (1 + c)−(T − ∆t) × BAM,

The BAM’s numerator and denominator hedge ratios (HRs) should be derived from the same prior period, or the BAM should be the average ratio from several such non-overlapping prior periods. For example, suppose the 2000–2005 average hT was 0.95, while the average hc was 1, so that the 2000–2005 BAM was (0.95/1) = 0.95. If the current hc is 0.97, then the current hc-BA is 0.97 × 0.95 ≈ 0.92. While hT and hc change with c, the BAM does not because c underlies and drives similar changes to both hT and hc that leave the ratio insignificantly changed.

Given the simplicity of calculating hc and the fact that the BAM only needs to be estimated once, the data gathering and manipulation effort for hc-BA becomes increasingly relatively less onerous over time than that for hT since hT is recalculated with each new hedge.

Like Sercu and Wu (2000) for their “hc”, Leistikow et al. (2019) showed that hc and hc-BA both generate hedge results superior to those generated by hT. Economically structure-less historic data based HRs (i.e., hT and its variants, e.g., conditional OLS, GARCH, error-correction, regime-switching, and Mean-Gini) have been extensively discussed, tested, and utilized in industry and academia in the past 40 years. They are discussed in Alexander and Barbosa (2007); Sarno and Valente (2000); Alizadeh et al. (2008), Harris et al. (2010), Lien (2009), Lien and Shrestha (2008), Shaffer and Demaskey (2005), and Lee et al. (2009) for example.

Like Sercu and Wu (2000) and Leistikow et al. (2019), hT is used here as the sole hedging performance benchmark. This is justified empirically by the Harris et al. (2010), Lien (2009), and Lien and Shrestha (2008), findings that hT performs as well as its conditional OLS, GARCH, and error correction HR variants, respectively. This may be justified theoretically in that hT and its variants are similarly based on statistical analysis of past data, so their utility may diminish about equally when there are carry cost rate regime shifts between their HRs’ estimation and use.

Because hc and hc-BA are structurally radically different from the economically structure-less historic data based HRs and their testing has been very limited (to the assets and time periods studied in these two papers), further testing is warranted. Their testing is further limited in that in the Sercu and Wu (2000) testing of hc’s relative hedging performance, the hedging instrument prices are nominal (i.e., manufactured via the spot price and the carry cost hypothesis) and the measured hedge profits are overlapping and ignore the spot asset carry cost. Also Sercu and Wu (2000) studies currency pairs (mainly to European currencies); it does not address commodities or equities, either theoretically or empirically, nor does it test the results for statistical significance.

This paper’s main innovation is to compare hT and hc results within and across carry cost rate (c) regimes. If the theory is correct, variation in c may explain the hT variation noted in the literature, e.g., Kroner and Sultan (1993) and Alizadeh et al. (2008). Likewise, if hT varies over c regimes as predicted, the likelihood that the hT will be based on data from a c regime that differs from the one in which it is to be used rises with the length of the data used in the estimation (This is problematic for the other HRs calculated based on statistical analysis of historic data as well.). Correspondingly, the relative value of the hc approach rises and the issues of its bias and whether the BAM changes insignificantly over c regimes gain importance. Moreover, even if hT varies over c regimes as predicted and the BAM used in the hc-BA method changes insignificantly over c regimes, the ultimate issue, which needs to be tested and is tested here, is whether the hc-BA method improves on the hc and hT approaches and whether it does so even if the BAM is calculated in its most disadvantageous circumstances (i.e., when it is estimated from a different c regime using very stale data). Finally, the tests of whether hT inefficiently recovers its relation to c seeks to account for and add credence to our explanation for why hT’s hedging performance is low.

To test the theory, by asset, we specify low and high c regime pairs in two ways. First, across time (for c denominated in US $s), where the low c regime is roughly the post 2008 recession period and the high c regime is roughly the pre 2008 recession period. Second, across currency denominations (for roughly the post 2008 recession period), where the low c regime is denominated in US $s and the high c regime is denominated in Indian Rupees.

The findings are consistent with the hc theory. Within and across c regimes, hc is biased and hT is inefficient. Across c regimes, hc’s BAM does not differ significantly. The hedging performance of hc and its bias-adjusted variant (even though its BAM is about 10 years old and from a different c regime) are superior to that for hT. Unlike previous studies, this study tests whether hc-BA generates hedge results that are superior to those generated by hc (and finds that it does). Like Sercu and Wu (2000), hc’s hedging performance is superior to hT’s. Unlike Sercu and Wu (2000), this paper also tests hc for an equity index and a commodity and measures spot profits as carry cost adjusted.

2. Hypotheses Tested

- The null hypothesis, that the difference between hc and hT = 0, is tested against the alternative hypothesis, that hc > hT. This test is performed separately in both the “high” and “low” c periods. The theory holds that hc > hT regardless of the c regime, i.e., hc is biased upwards relative to hT.

- The null hypothesis, that the ratio of hT’s standard deviation over hc’s standard deviation = 1, is tested against the alternative hypothesis, that the ratio > 1. This test is performed separately in both the “high” and “low” c periods. The theory holds that the ratio > 1, regardless of the c regime, i.e., the economically structure-less hT is inefficient (has a high standard deviation).

- A. The null hypothesis, that hT is the same in “low” and “high” c periods, is tested against the alternative hypothesis, that hT is lower in the “high” c period. B. The null hypothesis, that there is no correlation between the mean hT and the mean c across c regimes, is tested against the alternative hypothesis, that there is an inverse relation between the mean hT and the mean c across c regimes. The theory holds that hT is lower in the “high” c period, i.e., that hT uncovers, albeit inefficiently, c’s underlying fundamental economic link between spot and futures prices.

- The null hypothesis that hc’s BAM is no different in the “high” and the “low” (US $) c periods is tested against the alternative hypothesis that it differs. The theory holds that the BAM does not significantly change because c underlies and drives similar changes to both the BAM’s numerator and denominator.

- The null hypothesis that hc and hc-BA generate hedge results that are not different from those generated by hT is tested against the alternative hypothesis that hc and hc-BA both generate hedge results superior to those generated by hT.

- The null hypothesis that hc and hc-BA generate hedge results that are not different is tested against the alternative hypothesis that hc-BA generates hedge results that are superior to those generated by hc.

3. Results and Discussion

3.1. US $ Denominated “High” and “Low” c Regimes

The following US $ denominated asset/futures pairs are studied: the S&P500 (CME futures), Japanese Yen (CME futures), and gold (COMEX futures). They represent diverse economic sectors where both the spot assets and their futures actively trade in mature markets.

Table 1 below shows statistics on hc − hT for each asset in its “high” and “low” c periods. Consistent with the theory that hc is biased upwards, hc > hT in both the “high” and “low” c periods for both gold and the S&P500, where the differences are statistically significant at about the 1% (or lower) confidence level. However, the JY hc − hT difference is not statistically significant in the “high” c period; even more surprisingly, its mean is negative in the “low” c period. Nevertheless, such a seemingly anomalous result can occur for a short time period.

Table 1.

hc − hT (HRs based on US $s).

Table 2 below shows statistics on the ratio of the standard deviations (hT standard deviation/hc standard deviation) for each asset in its “high” and “low” c periods. Consistent with the theory that hT inefficiently, via statistical analysis, uncovers its economic foundational link to c, hT’s standard deviation statistically significantly exceeds (at the 0.001% level) the hc’s standard deviation in both the “high” and “low” c periods for each asset. The extremely high ratios in the low c period seem to be due to the hc’s very low standard deviation in the “low” c period.

Table 2.

hT Standard Deviation/hc Standard Deviation (HRs based on US $s).

Table 3 shows hT statistics in the “high” and “low” c periods (and their pooled difference) by asset. As the theory suggests, for each asset, the mean hT is higher in the “low” c period than in the “high” c period. That is, hT does, to some extent, uncover its underlying fundamental economic link to c. However, the Japanese Yen is the only asset for which the differences are statistically significant at the 5% confidence level.

Table 3.

High and low c period (US $) hTs (and their low–high period difference).

Similar tests were performed (but are not presented) that show, for each asset, hc is statistically significantly higher in the “low” c period than it is in the “high” c period (at very high confidence levels due to the very low HR standard deviations) as is nearly tautologically expected.

3.2. Indian Rupee (Rp) Denominated c Regime

Table 4 below shows statistics on hc − hT for each asset denominated in Indian Rps. As with the above Table 1 US $denominated HRs, hc is biased upwards relative to hT.

Table 4.

hc − hT (HRs based on Indian Rps).

As seen below in Table 5, consistent with the earlier Table 2 US $ denominated HR results, hT’s standard deviation statistically significantly exceeds hc’s, for Indian Rp denominated HRs.

Table 5.

Ratio of the HRs’ Standard Deviations (HRs based on Indian Rps).

3.3. Indian Rp Denominated (“High”) vs. US $ Denominated (“Low”) c Regimes

While US $ and Indian Rp hedge roll dates match well for the JY, for gold the match is less clean. Thus, each $ denominated gold HR is matched with two Rp denominated HRs: one where the Rp hedges are rolled on the same day as the $ hedges are rolled (seen on the left side of Table 6) and the other where the Rp hedge is rolled 1 week after the $ hedges are rolled (seen on the right side of Table 6). On the grounds that the $ and Rp HRs should be matched contemporaneously, the left side provides a better match; on the grounds that the HRs should be calculated using more liquid futures price data, the right side provides a better match (also the short HR calculation mismatch should be immaterial as the gold HRs are averaged over 6.25 years). Conveniently, the gold results are similar across roll dates.

Table 6.

US $ (low c) hT − Rp (high c) hT.

The Table 6 results below are consistent with the earlier Table 2 results: the hT is higher in the “low” c denomination. The differences are statistically significant at least at the 5% confidence level.

Similar tests were performed (but are not presented) that show, for each asset, hc is statistically significantly higher in the “low” c period than it is in the “high” c period (at very high confidence levels due to the very low HR Standard Deviations) as expected.

Table 7 below shows the mean: c and hT for different assets, cs, and c denominations. The correlation between the mean c and the mean hT is −0.713. The correlation’s T-value is −2.493, which is significant at the 5% confidence level. As predicted, there is a negative relation between c and hT; hT does uncover the fundamental underlying economic link between c and hT.

Table 7.

Mean c and Mean hT.

For the different assets, Table 8 below shows: (1) the BAM in “high” and the “low” (US $) c periods and (2) the T-value for the pooled excess of the “low” c period over the “high” c period BAM. The difference is not statistically significant for any of the assets. The BAM’s stability across c regimes is convenient; the BAM need not be revised ex ante for different c regimes. Interestingly, the BAM varies somewhat by asset—it is lowest for gold and highest for the JY; this ordering holds for both the “low” and “high” c periods.

Table 8.

The ($) BAM and its Difference Across high and low ($) c Periods.

The out-of-sample Hedge Effectiveness (HE) measures the HRs’ hedging performances, where the HE is the percentage profit variance reduction, i.e.,

and

where N is the hedge ratio, i.e., the number of (1 unit) futures sold.

HE = 1 − [Var(hedged profits)]/Var(unhedged profits)]

Hedge Profit (per unit long) = ∆S − N × ∆F,

Unlike Leistikow et al. (2019) who calculated the BAM on a rolling basis without regard to the c regime, given our c regime focus, we calculate the out of sample HE for $ denominated assets in the chronologically later “low” c periods. The HEs for Rp denominated JY and gold are not studied due to their limited data availability; after calculating their BAMs for their hc-BA’s, too little data would remain to get a reasonable sample size of HEs to compare. For the hTs, the HR employed in the “low” c period for futures maturity i hedge uses the HR calculated in the “low” c period for futures maturity i-1, e.g., for the S&P500, the hT hedges where the Jun 09 futures is used as the hedging instrument uses the HR calculated from hedges where the Mar 09 futures was the hedging instrument. Thus, the out of sample hT hedges do not use any of the prior “high” c period hTs. This is what an hT hedger might do if he realized that: (1) there would be an ex post—ex ante hedge c regime shift and (2) the shift would impact the optimal ex ante hT. This c regime shift screening makes the subsequent result, that hT has a lower HE than does hc, stronger.

Also, to constrain the hc-BA approach, its ex ante BAM used for the out of sample “low” c period hedges is the average BAM calculated from the earlier “high” c period. Thus, the BAM used in the S&P500, JY, and Gold hc-BA hedges is calculated, on average, from data that has been stale for 10.9, 9.1, and 13.6 years, respectively and was calculated from a different c regime; this makes the subsequent result, that the hT yields a lower HE than that for hc-BA, stronger.

Table 9 below shows that the out-of-sample HE is higher for hc than it is for hT for each asset. Thus, hc’s forward looking benefit seems to outweigh its upward bias cost. However, the HE difference is only statistically significant for the S&P500 and the JY; also the differences are only significant at about the 5% confidence level.

Table 9.

The ($) hT’s HE— the ($) hc’s HE.

The below Table 10 results show that incorporating the BAM (despite its extreme staleness) increases the HE for gold and the S&P500, while it (somewhat surprisingly) reduces it (though insignificantly) for the JY; for gold, the increase is statistically significant at the 5% confidence level. For the S&P 500, the increase is statistically significant only at about the 10% confidence level.

Table 10.

The ($) hc-BA’s HE—the ($) hc’s HE.

As expected, the Table 11 results below show that the out-of-sample HE is higher for hc-BA than for hT. However, the HE difference is only statistically significant for gold and the S&P500 (where for them the significance levels are 1% and 5%, respectively). This suggests that the one time effort to calculate the BAM is worth it.

Table 11.

The ($)hc-BA’s HE—the ($) hT’s HE.

The results in all the above Tables were for weekly profit periods. As an empirical robustness check, similar tests were performed and similar results were found for biweekly profit periods. The biweekly profit period results are presented in the Appendix A.

4. Methods

4.1. The US $ Interest Rate and Spot Asset cs: Their Values and Co-Movements

A spot asset’s financing cost rate is the interest income rate foregone by investing in it rather than the risk-free asset. To the extent the risk-free interest rate is nonzero, the financing cost rate is typically an important component of a spot asset’s c (See Brennan (1958) for a discussion of a spot asset’s c components. The risk-free interest rate is used since the carry cost hypothesis that links spot and futures prices is established by nearly risk-free arbitrage.). This is especially true for gold, though it is an atypical nonfinancial asset. We assume that gold’s financing cost rate is its c since its other c components: storage cost rate and convenience yield (a negative c component), are both near 0, so their net value is even closer to zero (Gold’s storage cost rate per $ is atypically small since: gold doesn’t spoil and its volume per $ is small. Gold’s convenience yield is also small since its net production (production – consumption) rate is small and stable relative to the amount of gold outstanding.). Unlike nonfinancial assets like gold, financial assets may explicitly pay income; their c is the interest rate—the asset’s income payout rate.

Whether an asset is financial or nonfinancial in character, its c may be >, <, or = 0. Furthermore, c typically varies across time, assets, and currency denominations.

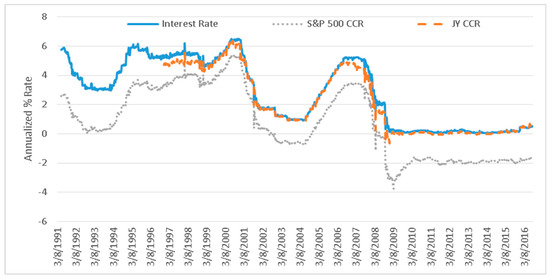

Figure 1 below shows the (US $) annualized 1 week interest rate and c observed weekly on Fridays for the S&P500 and JY over the 25 year period (Mid 1991–Mid 2016). The Figure also implicitly shows gold’s c since, as discussed above, we rationalized and assumed it is the interest rate. All of the paper’s data come from Bloomberg. The choice of Friday is arbitrary and matches the weekday for the spot and futures prices subsequently employed in 1week hedges. If the Friday data is missing, e.g., if it is a holiday so the market is closed, the preceding Thursday’s data is used; if Thursday’s data is also missing, the following Monday’s data is used. For the $ interest rate, we use the $ 1 week repo rate. For the Japanese Yen (JY) interest rate, we use the JY 1 week Libor rate back to 12/5/97; at this point its data becomes unavailable and we use the JY 1 week deposit rate back to 11/29/1996. Since Bloomberg has no pre-11/29/96 1 week (or close to 1 week) JY relatively risk free interest rate data, our JY c data series begins on 11/29/96. The interest rate and the spot asset cs move together as expected. The interest rate’s correlation with the spot asset’s c is 0.974, 0.996, and 1 (by definition as discussed above) for the S&P500, the Japanese Yen, and gold, respectively.

Figure 1.

(US $ denominated) Interest Rate and Spot Asset Carry Cost Rates.

The 2008 recession coincided with about 5% annual (US $) risk-free interest rate and c drops. The (US $) c for the 2008–2016 period, the “low” US $ c period, are lower than they are for any of the prior years. The “high” US $ c period consists of 2 sub-periods: roughly, 1995–2000 and 2005–2007.

The tests are for direct hedges using weekly data. Weekly is preferred to daily data as weekly data is immune to day of the week effects and is less distorted by noise. In the Appendix A, the tests are repeated for biweekly periods to test whether the results are robust.

4.2. Assets Tested and Their Futures Hedging Instruments’ Times to Maturities

For now, we focus on the following US $ denominated spot assets and their futures: the S&P500 (using CME futures), Japanese Yen (using CME futures), and gold (using COMEX futures). They are to be tested using the data discussed earlier and below. Before the analysis is restricted to the “high” and “low” c sub-periods, the US $ denominated data under consideration is the same as in Leistikow et al. (2019) though it does not consider the Indian Rupee denominated assets that we study later in this paper.

4.2.1. S&P500

CME S&P500 futures contracts mature on the 3rd Friday of their maturity month. The Mar, Jun, Sep, and Dec S&P500 futures maturities are liquid (except when they are far from and very near to their maturities) and are alternatingly used as the hedging instrument. To avoid overlap, to hedge with the most liquid maturity, and to hedge with the same distribution of hedging instrument times to maturity, each contract is used as the hedging instrument when its time to maturity is between 15 and 2 weeks. For example, since the Mar 95 S&P500 futures matured on 3/17/95, the 3rd Friday of Mar 95, its HR is calculated for the 13 week period from 12/2/94 to 3/3/95. Via similar calculations, the next maturing S&P500 futures contract, the Jun 95 futures, is used as the hedging instrument for the period beginning on 3/3/95 (thereby coinciding with the end of the Mar 95 maturity’s usage as the hedging instrument), so that the Mar 95 and Jun 95 HRs are calculated with non-overlapping liquid futures price change data.

The S&P500 “high” c period is composed of two discontinuous sub-periods. The first is when the Mar 95 through Sep 01 futures are used as the hedging instrument. The second is when the Mar 06 through Dec 07 futures are used as the hedging instrument. In each “high” c sub-period, c > 2%. The S&P500 “low” c period is when the Mar 09 through Jun 16 futures are used as the hedging instrument; for this period, c is about −2% (though it drops to ≈ −3.5% for a short time in 2009).

4.2.2. Japanese Yen

CME Japanese Yen (JY) futures contracts mature 2 business days immediately preceding the 3rd Wednesday of the maturity month. Thus, each JY futures’ maturity is close to its corresponding S&P500 futures’ maturity. Also as was the case for the S&P500 futures, the Mar, Jun, Sep, and Dec JY futures maturities are liquid (except when they are far from and very near to their maturities) and are alternatingly used as the hedging instrument. For consistency and because it results in using the most liquid futures maturity as the hedging instrument, the S&P500’s approach to specifying the hedging instrument’s maturity is also used for the JY. That is, for the JY, the Mar, Jun, Sep, and Dec futures maturities are alternatingly used as the hedging instrument when their times to their maturity month’s 3rd Friday are between 15 and 2 weeks.

The JY “high” c period is composed of two discontinuous sub-periods. The first is when the Mar 97 through Sep 01 futures are used as the hedging instrument. The second sub-period is when the Jun 05 through Dec 07 futures are used as the hedging instrument. In each “high” c sub-period, c > 2.5%. The “low” c period corresponds to the period when the Mar 09 through Jun 16 futures are used as the hedging instrument; for this period, the JY c is ≈ 0%.

4.2.3. Gold

For COMEX ($ denominated) gold, the Feb, Apr, Jun, Aug, Oct, and Dec futures maturities are liquid and are alternatingly used as the hedging instrument. Unlike for the S&P500 and JY futures, gold futures contracts have delivery options that cause each near futures contract’s liquidity to dry up starting about a week before its maturity month and ending about a week later. To avoid overlap and to use the most liquid maturity as the hedging instrument, we attempt to use each maturity as the hedging instrument when the time to its delivery month’s 3rd Friday is between 13 and 4 weeks; this would yield 9 weekly changes. However, to avoid overlap with the prior contract maturity, about one third of the time only 8 weekly changes can be used for a futures maturity; in these cases, the subsequent hedging instrument’s use begins when the time to its delivery month’s 3rd Friday is 12, rather than 13, weeks. For example, the Jun 95 futures is used as the hedging instrument for 9 weekly changes (3/24/95–5/26/95) and to avoid overlap, the Aug 95 futures’ use as the hedging instrument is delayed one week to start on 5/26/95 and ends 8 weeks later on 7/21/95.

For the S&P500 and JY, each hedge utilized a unique future’s maturity as the hedging instrument and consisted of 13 weekly profit periods. To increase the number of weekly profit periods involved in a gold hedge (since 8 or 9 is likely too few to generate stable HR and HE values), the price change data for 2 consecutive maturities are combined to constitute a gold hedge. For example, the data for which the Jun 95 and Aug 95 futures are used as the hedging instrument are paired together, so that the Jun/Aug 95 futures hedge is for the (3/24/95–7/21/95) 17 week period.

The gold “high” c period is composed of three discontinuous sub-periods. The first uses the Oct 91 through Apr 92 futures as the hedging instruments. The second uses the Oct 94 through Apr 01 futures as the hedging instruments. The third uses the Jun 06 through Dec 07 futures as the hedging instruments. In each “high” c sub-period, c > 4%. The “low” c period uses the Feb 09 through Aug 16 futures as the hedging instrument; for this period, c ≈ 0%.

4.2.4. Comparing hc and hT: An S&P500 Example

The Jun 95 S&P500 futures’ ex post hT is calculated from its 13 weekly ∆S and ∆F terms; it represents the 1 week hT that is to be statically employed for 13 weeks using the next futures (Sep 95). However, there are 13—one week dynamic hcs, corresponding to hedges lifted at 14, 13, …, and 2 weeks to the futures’ maturity (1 week after their implementation) but all use the c from the start (end) of the Sep (Jun) 95 hedges. To avoid the greater transactions costs that would arise with a dynamic approach, the average of these 13—one week hcs (based on the same initial c but having lift date times to maturities of 14, 13, …, and 2 weeks) is compared to the single Jun 95 hT and statically employed in the Sep 95 hc hedges. By not dynamically updating the initial c to calculate hc, even though it would be easy to do so, the same information is available to both approaches. Thus, hT uses more dated information, while hc only uses information available at the hedge’s inception.

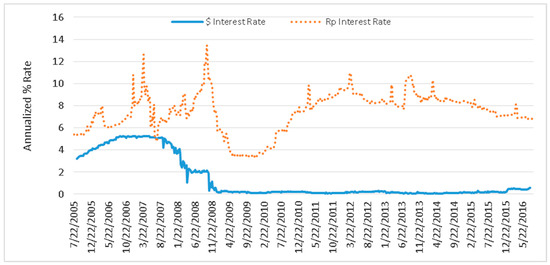

We also compare the JY and gold futures’ hTs across high and low c currency denomination regimes, where the US $ denomination regime represents a low c regime and the Indian Rupee (Rp) denomination represents a high c regime. The S&P500 is not traded denominated in Indian Rupees, so it is not studied. The Rp and $ risk-free annualized 1 week interest rates observed weekly on Fridays are shown in Figure 2 below. Due to the unavailability of 1 week Rp denominated risk-free interest rate data, the annualized 2-week MIBOR (Mumbai Inter-Bank Offer Rate) is used as its proxy. The interest rate data shown only begins in 2005, since, as discussed below, neither JY nor gold Rp denominated price data are available pre-2005. It shows that the Rp interest rate has substantially exceeded the US $ interest rate since late 2007. Along with the high Rp—US $ interest rate differential, the Rp denomination was selected because there are actively traded Rp denominated JY and gold futures. As discussed earlier, the JY and gold currency denominated cs are the currency denominated interest rates reduced by the Japanese Yen interest rate and 0, respectively; thus, the interest rate denomination differentials are also the c denomination differentials.

Figure 2.

US $ denominated vs. Indian Rp denominated Interest Rates.

4.2.5. Japanese Yen HRs (Based on Indian Rps)

Rp denominated NSE (National Stock Exchange of India) JY futures are studied based on their liquidity. As with the CME JY futures, the NSE JY futures are most liquid in the near maturity contract until about a week to its maturity. Accordingly, the NSE JY futures are used as the hedging instrument until a week before their last trading day. However, the NSE JY futures maturities are on a monthly cycle rather than the quarterly cycle used by the CME JY futures. To avoid overlap and to hedge with the most liquid maturity, each NSE futures is used as the hedging instrument for 4 weeks in 2/3 of the cases (and 5 weeks in the others); thus, in both the CME and NSE JY futures, the HRs are calculated using 13 weekly profits that are roughly contemporaneously matched.

4.2.6. Gold HRs (Based on Indian Rps)

Rp denominated MCX (Multi Commodity Exchange based in India) gold futures are studied. As with the $ denominated COMEX gold futures, the Feb, Apr, Jun, Aug, Oct and Dec MCX maturities are liquid (except when they are far from and very near to their maturities), so we study them. The near to maturity MCX gold futures’ liquidity dry up starts (and ends) about a week before the COMEX’s does (even though the Rp contract matures about 4 weeks before the $ contract does). The one week HR calculation mismatch should be immaterial as the HRs are averaged over about a 7 year period. To avoid overlap and to hedge with the most liquid maturity, each Rp gold futures is used as the hedging instrument when the time to its delivery month’s 3rd Friday is between 12 and 3 weeks.

4.2.7. US $ vs. Indian Rp Denominated HR Results

Based on data availability, the gold hedges begin with the Oct 05 futures, while the JY hedges begin with the Apr 10 futures as the hedging instrument. The gold result is for rolling the Rp denominated futures contract with the $ denominated futures. Similar results hold for rolling the Rp denominated futures contract 1 week after the $ denominated futures is rolled.

In the Table 6 comparison between the Rp (“high” c) and $ (“low” c) denominated hTs, the Feb 09 futures is the 1st futures used as the hedging instrument (this is the $ denominated gold’s “low” c period studied earlier). The JY hedges begin when the Jun 2010 futures is used as the hedging instrument (this is in the $ denominated JY’s “low” c period studied earlier).

The Rp gold results shown in Table 7 are for the hedges beginning when the Feb ’09 futures was the hedging instrument (the gold “low” $ c period), and the hedging instrument is rolled on the same day as the $ gold hedges are rolled. The results are similar if the Rp gold hedges begin when the Oct 05 futures was the hedging instrument and/or whether, for liquidity purposes, the Rp futures hedges are rolled one week after the $ futures hedges are rolled. The average hedging instruments’ time to maturity is about 9 weeks for each asset, except for Rp denominated gold which was 5.5 weeks. The shorter time to maturity for the higher c Rp denominated gold works against its HR being so low.

5. Conclusions

This paper tests whether the traditional futures hedge ratio (hT) and the carry cost rate futures hedge ratio (hc) vary as predicted both within and across spot asset carry cost rate (c) regimes. By asset, it specifies low and high c regime pairs: (1) across time and (2) across currency denominations, ceteris paribus. The results are consistent with the Sercu and Wu (2000) and Leistikow et al. (2019) theories.

The economically structure-less hT is inefficient. First, its variance is greater than the variance of hc in both “high” and “low” c periods. Second, while the statistics-based hT does uncover its inverse relation with c, the strength of its correlation with c is much less statistically significant than that for hc. Similar results are likely for other economically structure-less hedge ratios such as conditional OLS, GARCH, error-correction, regime-switching, and Mean-Gini HRs that, relative to hc, have a greater reliance on statistical analysis of past data whose value is diminished by c regime changes.

Changing c may account for the hT variability over time found in the literature, e.g., Kroner and Sultan (1993) and Alizadeh et al. (2008). Variation in c should be considered in devising ex ante hedge ratios.

The drawback for hc is its biasedness. It is biased in both “high” and “low” c periods. However, it is not a substantial drawback, since the Bias Adjustment Multiplier, BAM (= hT/hc), used in the bias-adjusted version of hc, hc-BA, is not statistically significantly different in “low” and “high” c periods; intuitively since c is the fundamental determinant of both hT and hc, changes in c affect both, but not their ratio. Thus, the BAM can be calculated once and need not be recalculated across c regimes.

Finally, the out-of-sample HE is higher for both hc and hc-BA than it is for hT. The out-of-sample HE is also higher for hc-BA than it is for hc; thus, the one-time effort of calculating the BAM is likely worth the effort. In this study, the performance for hc-BA is particularly compelling because its BAM was calculated from a different c regime and much earlier time period. Specifically, the BAMs employed in the hc-BA were based on data that, on average, had been stale for between 9.1 and 13.6 years and had come from a higher c regime.

Collectively, the results are good news as relative to the hc and hc-BAs, while the hT approach is tedious, inefficient, has a greater likelihood that the estimate will be distorted by c regime shifts, and fails to indicate the HRs dependence on the futures’ time to maturity on the hedge lift date.

Author Contributions

Conceptualization, D.L. and R.-R.C.; Methodology, D.L. and R.-R.C.; Formal Analysis, D.L. and R.-R.C.; Data Curation, D.L. and R.-R.C.; Writing-Original Draft Preparation, D.L. and R.-R.C.; Writing-Review & Editing, D.L. and R.-R.C.

Funding

This research received no external funding.

Acknowledgments

The authors thank Xun Liu, Jingwen Yuan, Xilun Zhu, and Yueying Tang for research assistance and Steve Figlewski and the anonymous referees for their helpful comments. Any errors are the authors’ responsibilities.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A. Biweekly Profit Period Results

The below biweekly profit period results are generated from a subset of the price and c data that generated the 1 week profit period results discussed in the paper.

For the S&P500 and $ denominated JY biweekly cases, each futures contract maturity is used as the hedging instrument when its time to maturity is between 14 and 2 weeks, i.e., for 6 biweekly profit periods. To double the number of biweekly profit periods, since 6 is likely too few to generate stable HR and HE values, the profit data for 2 consecutive maturing futures contracts are combined to constitute a hedge. Thus, the S&P500 and JY HRs and HEs are calculated from 12 (= 6 × 2) observations, which is a decline of 1 from the weekly profit period case. The sample size downside of biweekly profit periods is that there are ≤ half as many biweekly profit period HRs and HEs as there were for weekly profit periods, since the biweekly HRs and HEs use twice as many futures contracts to calculate each HR and HE.

For the $ denominated gold, each futures contract is used as the hedging instrument when its time to maturity is between 12 and 4 weeks, i.e., for 4 biweekly periods. To triple the number of biweekly profit periods, since 4 is likely too few to generate stable HR and HE values, the profit data for 3 consecutive maturing futures contracts are combined to constitute a hedge. Thus, the $ gold HRs and HEs are calculated from 12 (= 4 × 3) observations which is a decline of only ≈ 7 from the weekly profit case. The sample size downside of biweekly profits is that there are ≤ 2/3 as many biweekly profit period HRs and HEs (since the weekly profits were calculated from 2 consecutive maturing futures contracts rather than the 3 consecutive maturing futures contracts used to calculate the biweekly HRs and HEs). The Rp denominated gold biweekly profit periods and hedges are constructed like those for the $ denominated gold discussed above.

The Table A1 biweekly profit results are presented below. Between the weekly and biweekly profit results, only the JY weekly US $ denominated low c period results weren’t strongly consistent with the theory.

Table A1.

hc − hT (HRs based on US $s).

Table A1.

hc − hT (HRs based on US $s).

| Statistic | S&P500 | Japanese Yen | Gold |

|---|---|---|---|

| Calculated During the US $ “High” c Period | |||

| Mean | 0.02490 | 0.02138 | 0.03410 |

| Stdev | 0.03176 | 0.04980 | 0.04057 |

| Count | 15 | 12 | 14 |

| T-value | 3.03654 | 1.48722 | 3.14455 |

| p-value | 0.00444 | 0.08252 | 0.00388 |

| Calculated During the US $ “Low” c Period | |||

| Mean | 0.02068 | 0.01263 | 0.02686 |

| Stdev | 0.05024 | 0.01919 | 0.03102 |

| Count | 14 | 14 | 14 |

| T-value | 1.53983 | 2.46237 | 3.24004 |

| p-value | 0.07379 | 0.01427 | 0.00323 |

The Table A2 biweekly profit results presented below are consistent with the earlier weekly results and the theory.

Table A2.

Ratio of the HRs’ Standard Deviations (HRs based on US $s).

Table A2.

Ratio of the HRs’ Standard Deviations (HRs based on US $s).

| Calculated During the US $ “High” c Period | S&P500 | JY | Gold |

| hT Standard Deviation/hc Standard Deviation = | 35.72 | 58.28 | 69.13 |

| # of Observations in each Standard Deviation = | 15 | 12 | 14 |

| p-value = | 0.00000 | 0.00000 | 0.00000 |

| Calculated During the US $ “Low” c Period | |||

| hT Standard Deviation/hc Standard Deviation = | 143.94 | 211.46 | 353.60 |

| # of Observations in each Standard Deviation = | 14 | 14 | 14 |

| p-value = | 0.00000 | 0.00000 | 0.00000 |

The Table A3 biweekly profit results below are similar to what they were for weekly profits; however, the biweekly profit results are generally a little less statistically significant since they have about half as many observations.

Table A3.

High and low ($) c period ($) hTs (and their difference).

Table A3.

High and low ($) c period ($) hTs (and their difference).

| Statistic | S&P500 hT | JY hT | Gold hT | |||

|---|---|---|---|---|---|---|

| c Period | High | Low | High | Low | High | Low |

| Mean | 0.97315 | 0.98316 | 0.97111 | 0.99104 | 0.96394 | 0.97192 |

| Stdev | 0.03483 | 0.04864 | 0.04774 | 0.02348 | 0.03943 | 0.03260 |

| Count | 17 | 15 | 14 | 15 | 17 | 15 |

| Pooled Var | 0.00175 | 0.00138 | 0.00133 | |||

| T (clo-chi) | 0.67549 | 1.44188 | 0.61869 | |||

| p-value | 0.25450 | 0.08650 | 0.27241 | |||

The Table A4 biweekly profit results below are similar to, but less statistically significant than, what they were for weekly profits since they have about half as many observations.

Table A4.

hc − hT (HRs based on Indian Rps).

Table A4.

hc − hT (HRs based on Indian Rps).

| Statistic | JY | Gold |

|---|---|---|

| Mean | 0.05576 | 0.02888 |

| Stdev | 0.08461 | 0.12367 |

| Count | 11 | 21 |

| T-value | 2.18553 | 1.07024 |

| p-value | 0.02687 | 0.14863 |

The Table A5 biweekly profit results presented below are consistent with the earlier weekly results and the theory.

Table A5.

Ratio of the HRs’ Standard Deviations (HRs based on Indian Rps).

Table A5.

Ratio of the HRs’ Standard Deviations (HRs based on Indian Rps).

| Statistic | JY | Gold |

|---|---|---|

| hT Standard Deviation/hc Standard Deviation = | 360.19 | 77.01 |

| # of Observations in each Standard Deviation = | 11 | 21 |

| p-value = | 0.00000 | 0.00000 |

The Table A6 biweekly profit results below are similar to, but less statistically significant than, what they were for weekly profits since they have about half as many observations.

Table A6.

$ (low c) hT − Rp (high c) hT.

Table A6.

$ (low c) hT − Rp (high c) hT.

| Statistic | JY | Gold The $ and Rp Hedges Roll the Same Day |

|---|---|---|

| Mean | 0.05212 | 0.02528 |

| Stdev | 0.08187 | 0.14747 |

| Count | 11 | 14 |

| T-value | 2.11146 | 0.64153 |

| p-value | 0.03045 | 0.26616 |

The correlation between the biweekly mean c and hT shown in Table A7 below is −0.842. The correlation’s T-value is 3.823, which is significant at the 1% confidence level. This result is slightly stronger than that for weekly profits.

Table A7.

Mean c and Mean hT.

Table A7.

Mean c and Mean hT.

| Asset and c regime pair | Mean c | Mean hT |

|---|---|---|

| S&P500: “high” c period | 0.03610 | 0.97315 |

| S&P500: “low” c period | −0.01994 | 0.98316 |

| Japanese Yen: “high” c period | 0.04779 | 0.97111 |

| Japanese Yen: “low” c period | 0.00101 | 0.99104 |

| Japanese Yen: Rp denominated c | 0.08161 | 0.93935 |

| Gold: “high” $ c period | 0.05373 | 0.96394 |

| Gold: “low” $ c period | 0.00168 | 0.96957 |

| Gold: Rp denominated c | 0.07444 | 0.92779 |

The Table A8 biweekly profit results below are similar to what they were for weekly profits.

Table A8.

The ($) BAM and its Difference Across high and low ($) c Periods.

Table A8.

The ($) BAM and its Difference Across high and low ($) c Periods.

| Statistic | S&P500 BAM | JY BAM | Gold BAM | |||

|---|---|---|---|---|---|---|

| c Period | “High” | “Low | “High” | “Low | “High” | “Low |

| Mean | 0.97498 | 0.97938 | 0.97845 | 0.98737 | 0.96563 | 0.97313 |

| Stdev | 0.03192 | 0.05011 | 0.05018 | 0.01919 | 0.04089 | 0.03103 |

| Count | 15 | 14 | 12 | 14 | 14 | 14 |

| Pooled Var | 0.00174 | 0.00135 | 0.00132 | |||

| T-value (clo-chi) | 0.28425 | 0.61657 | 0.54705 | |||

| p-value | 0.78038 | 0.55006 | 0.59361 | |||

The Table A9 biweekly profit results below are similar to, but less statistically significant than, what they were for weekly profits since they have about half as many observations.

Table A9.

($) hT’s HE − ($) hc’s HE.

Table A9.

($) hT’s HE − ($) hc’s HE.

| Statistic | S&P500 | Japanese Yen | Gold |

|---|---|---|---|

| Mean | −0.00271 | −0.00027 | −0.00060 |

| Stdev | 0.01085 | 0.00143 | 0.00298 |

| Count | 14 | 14 | 14 |

| T-value | −0.93383 | −0.69463 | −0.75353 |

| p-value | 0.36741 | 0.49951 | 0.46456 |

The Table A10 biweekly profit results below are similar to what they were for weekly profits.

Table A10.

The ($) hc-BA’s HE − the ($) hc’s HE.

Table A10.

The ($) hc-BA’s HE − the ($) hc’s HE.

| Statistic | S&P500 | Japanese Yen | Gold |

|---|---|---|---|

| Mean | 0.00069 | −0.00012 | 0.00286 |

| Stdev | 0.00326 | 0.00103 | 0.00237 |

| Count | 14 | 14 | 14 |

| T-value | 0.79133 | −0.43767 | 4.50881 |

| p-value | 0.22148 | 0.66560 | 0.00029 |

The Table A11 biweekly profit results below are similar to, but less statistically significant than, what they were for weekly profits since they have about half as many observations.

Table A11.

The ($)hc-BA’s HE − the ($) hT’s HE.

Table A11.

The ($)hc-BA’s HE − the ($) hT’s HE.

| Statistic | S&P500 | Japanese Yen | Gold |

|---|---|---|---|

| Mean | 0.00340 | 0.00014 | 0.00148 |

| Stdev | 0.01002 | 0.00098 | 0.00234 |

| Count | 14 | 14 | 14 |

| T-value | 1.26961 | 0.55453 | 2.36968 |

| p-value | 0.22648 | 0.58863 | 0.03396 |

References

- Alexander, Carol, and Andreza Barbosa. 2007. Effectiveness of Minimum-Variance Hedging. Journal of Portfolio Management 33: 46–59. [Google Scholar] [CrossRef]

- Alizadeh, Amir H., Nikos K. Nomikos, and Panos K. Pouliasis. 2008. A Markov Regime Switching Approach for Hedging Energy Commodities. Journal of Banking & Finance 32: 1970–83. [Google Scholar]

- Anton, Sorin Gabriel. 2018. The Impact of Enterprise Risk Management on Firm Value: Empirical Evidence from Romanian Non-Financial Firms. Inzinerine Ekonomika-Engineering Economics 29: 151–57. [Google Scholar] [CrossRef]

- Aretz, Kevin, Söhnke M. Bartram, and Gunter Dufey. 2007. Why Hedge? Rationales for Corporate Hedging and Value Implications. The Journal of Risk Finance 8: 434–49. [Google Scholar] [CrossRef]

- Bartram, Söhnke M., Gregory W. Brown, and Jennifer Conrad. 2011. The Effects of Derivatives on Firm Risk and Value. Journal of Financial and Quantitative Analysis 46: 967–99. [Google Scholar] [CrossRef]

- Berkman, Henk, Michael E. Bradbury, and Stephen Magan. 1997. An International Comparison of Derivatives Use. Financial Management 26: 69–73. [Google Scholar] [CrossRef]

- Bodnar, Gordon M., Gregory S. Hayt, and Richard C. Marston. 1998. Wharton Survey of Financial Risk Management by US Non-Financial Firms. Financial Management 27: 70–91. [Google Scholar] [CrossRef]

- Brennan, Michael J. 1958. The Supply of Storage. American Economic Review 48: 50–71. [Google Scholar]

- Ederington, Louis H. 1979. The Hedging Performance of the New Futures Markets. Journal of Finance 34: 157–70. [Google Scholar] [CrossRef]

- Ferguson, Robert, and Dean Leistikow. 1999. Futures Hedge Profit Measurement, Error-Correction Model vs. Regression Approach Hedge Ratios, and Data Error Effects. Financial Management 28: 118–25. [Google Scholar] [CrossRef]

- Futures Industry Association. 2018. Listed under Industry Data, Exchange Volume. Available online: http://fia.org/articles/total-2017-volume-252-billion-contracts-down-01-2016 (accessed on 24 January 2018).

- Harris, Richard D. F., Jian Shen, and Evarist Stoja. 2010. The Limits to Minimum-Variance Hedging. Journal of Business Finance & Accounting 37: 737–61. [Google Scholar]

- Hull, John C. 2015. Options, Futures and Other Derivatives, 9th ed. Upper Saddle River: Pearson Education Inc. [Google Scholar]

- Kroner, Kenneth F., and Jahangir Sultan. 1993. Time-Varying Distributions and Dynamic Hedging with Foreign Currency Futures. Journal of Financial and Quantitative Analysis 28: 535–51. [Google Scholar] [CrossRef]

- Lee, Cheng-Few, Kehluh Wang, and Yan Long Chen. 2009. Hedging and Optimal Hedge Ratios for International Index Futures Markets. Review of Pacific Basin Financial Markets and Policies 12: 593–610. [Google Scholar] [CrossRef]

- Leistikow, D., R. Chen, and Y. Xu. 2019. Spot Asset Carry Cost Rates and Futures Minimum Risk Hedge Ratios, SSRN Working Paper 3373739. In process.

- Lien, Donald. 2009. Note on the Hedging Effectiveness of GARCH Models. International Review of Economics and Finance 18: 110–12. [Google Scholar] [CrossRef]

- Lien, Donald, and Keshab Shrestha. 2008. Hedging effectiveness comparisons: A note. International Review of Economics and Finance 17: 391–96. [Google Scholar] [CrossRef]

- Sarno, Lucio, and Giorgio Valente. 2000. The Cost of Carry Model and Regime Shifts in Stock Index Futures Markets: An Empirical Investigation. The Journal of Futures Markets 20: 603–24. [Google Scholar] [CrossRef]

- Sercu, Piet, and Xueping Wu. 2000. Cross and Delta Hedges: Regression versus Price-Based Hedge Ratios. Journal of Banking and Finance 24: 737–57. [Google Scholar] [CrossRef]

- Shaffer, David R., and Andrea DeMaskey. 2005. Currency Hedging Using the Mean-Gini Framework. Review of Quantitative Finance and Accounting 25: 125–37. [Google Scholar] [CrossRef]

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).