Intellectual Capital Performance and Profitability of Banks: Evidence from Pakistan

Abstract

1. Introduction

2. Review of the Pakistani Banking Industry

3. Literature Review and Hypothesis Development

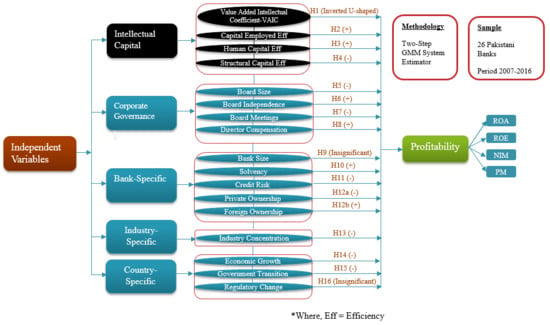

3.1. Intellectual Capital (IC)

3.2. Corporate Governance

3.3. Bank-Specific Variables

3.4. Industry and Country-Specific Variables

4. Methodology and Data

4.1. Sample and Data

4.2. Variable Selection

4.2.1. Profitability Indicators

4.2.2. Explanatory Variables

IC Indicators

Other Variables

4.3. Analysis Approach and Methodology

4.4. Econometric Specification

5. Results and Findings

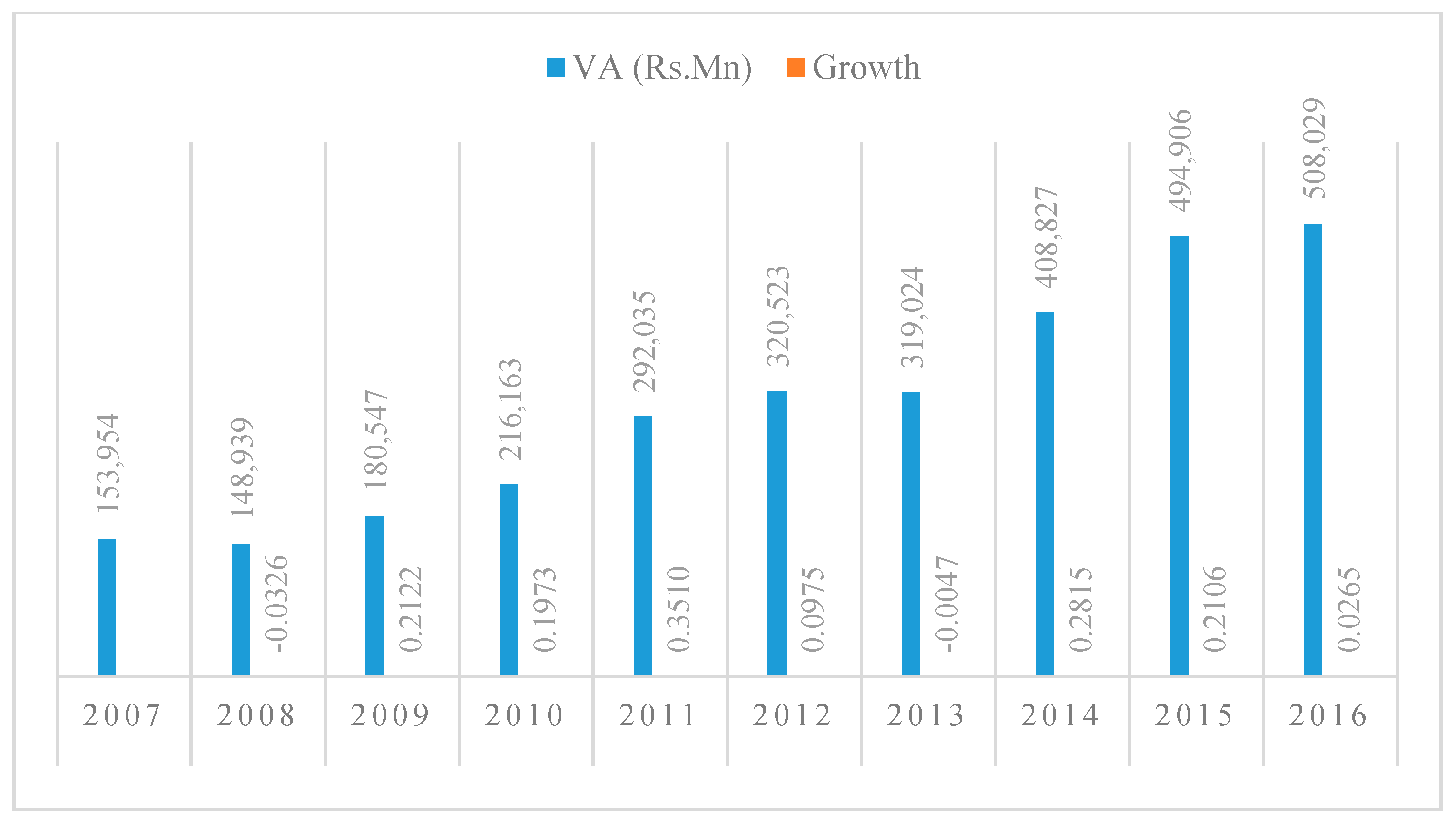

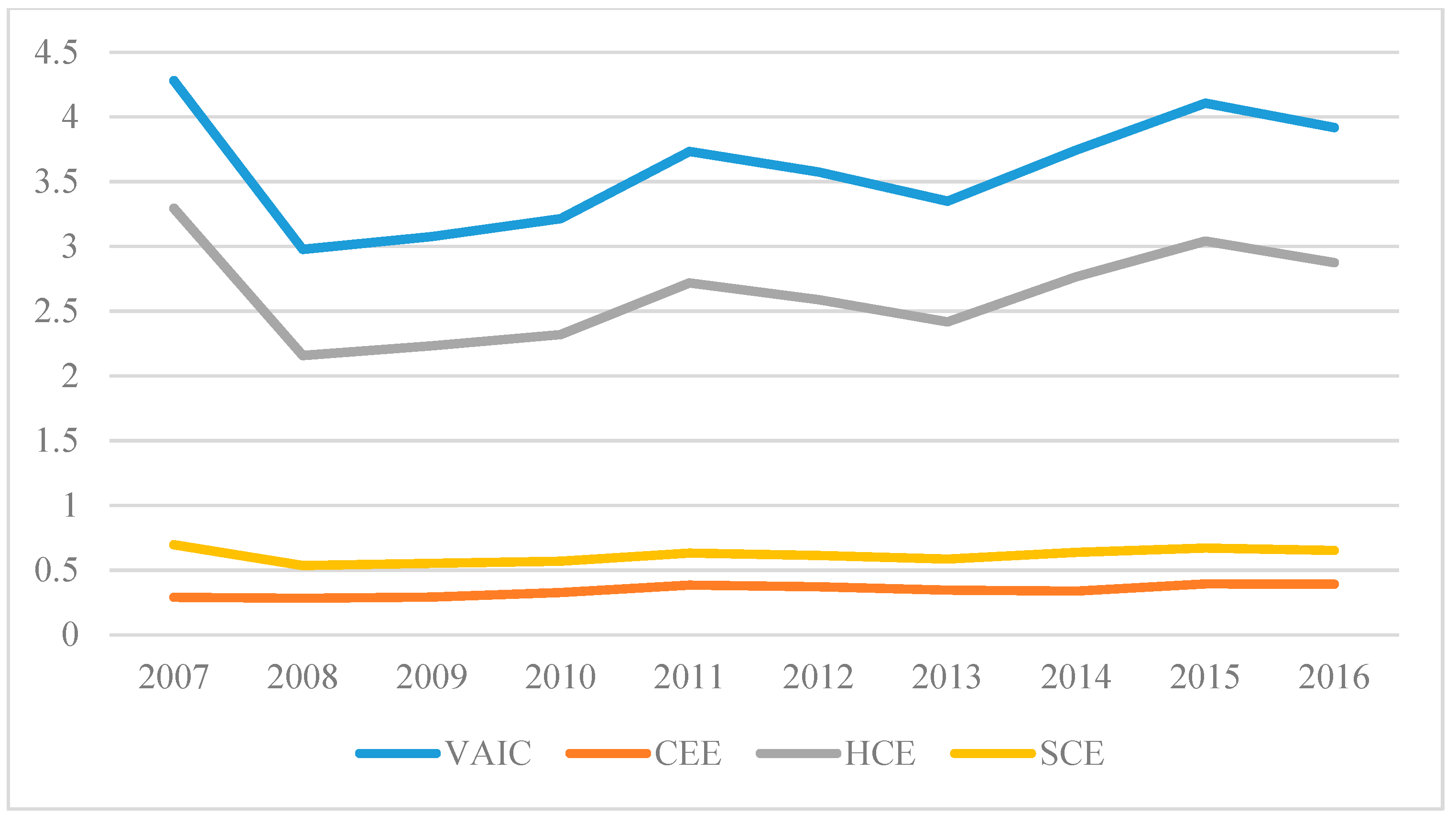

5.1. Descriptive Statistics

5.2. Main Findings

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Adams, Renée, and Hamid Mehran. 2003. Is corporate governance different for bank holding companies? Economic Policy Review 9: 123–42. [Google Scholar] [CrossRef]

- Adams, Renée B., and Hamid Mehran. 2012. Bank board structure and performance: Evidence for large bank holding companies. Journal of Financial Intermediation 21: 243–67. [Google Scholar] [CrossRef]

- Ahmad, Muhammad, and Naveed Ahmed. 2016. Testing the relationship between intellectual capital and a firm’s performance: An empirical investigation regarding financial industries of Pakistan. International Journal of Learning and Intellectual Capital 13: 250–72. [Google Scholar] [CrossRef]

- Akhtar, Shamshad. 2006. Pakistan banking Sector—The Need for Second Tier of Reforms. Available online: http://www.bis.org/review/r070117f.pdf (accessed on 7 August 2017).

- Al-Musali, Mahfoudh Abdul Karem, and Ku Nor Izah Ku Ismail. 2014. Intellectual capital and its effect on financial performance of banks: Evidence from Saudi Arabia. Procedia-Social and Behavioral Sciences 164: 201–7. [Google Scholar] [CrossRef]

- Al-Musali, Mahfoudh Abdulkarem, and Ku Nor Izah Ku Ismail. 2016. Cross-country comparison of intellectual capital performance and its impact on financial performance of commercial banks in GCC countries. International Journal of Islamic and Middle Eastern Finance and Management 9: 512–31. [Google Scholar] [CrossRef]

- Alhassan, Abdul Latif, and Nicholas Asare. 2016. Intellectual capital and bank productivity in emerging markets: Evidence from Ghana. Management Decision 54: 589–609. [Google Scholar] [CrossRef]

- Andres, Pablo de, and Eleuterio Vallelado. 2008. Corporate governance in banking: The role of the board of directors. Journal of Banking & Finance 32: 2570–80. [Google Scholar] [CrossRef]

- Andriessen, Daniel. 2004. IC valuation and measurement: Classifying the state of the art. Journal of Intellectual Capital 5: 230–42. [Google Scholar] [CrossRef]

- Ang, James, Beni Lauterbach, and Ben Z. Schreiber. 2002. Pay at the executive suite: How do US banks compensate their top management teams? Journal of Banking & Finance 26: 1143–63. [Google Scholar] [CrossRef]

- Arellano, Manuel, and Stephen Bond. 1991. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The Review of Economic Studies 58: 277–97. [Google Scholar] [CrossRef]

- Arellano, Manuel, and Olympia Bover. 1995. Another look at the instrumental variable estimation of error-components models. Journal of Econometrics 68: 29–51. [Google Scholar] [CrossRef]

- Athanasoglou, Panayiotis P., Sophocles N. Brissimisa, and Matthaios D. Delis. 2008. Bank-specific, industry-specific and macroeconomic determinants of bank profitability. Journal of international financial Markets, Institutions and Money 18: 121–36. [Google Scholar] [CrossRef]

- Baltagi, Badi H. 2001. Econometric Analysis of Panel Data, 2nd ed. Chichester: John Wiley & Sons. [Google Scholar]

- Baum, Christopher F., Mark E. Schaffer, and Steven Stillman. 2003. Instrumental variables and GMM: Estimation and testing. The Stata Journal 3: 1–31. [Google Scholar] [CrossRef]

- Becker, Brian E., Mark A. Huselid, and Dave Ulrich. 2001. The HR Scorecard: Linking People, Strategy and Performance. Watertown: Harvard Business Press Books. [Google Scholar]

- Becker, Gary S. 1964. Human Capital Theory. New York: Columbia. [Google Scholar]

- Berg, Herman Anthony Van den. 2002. Models of Intellectual Capital Valuation: A Comparative Evaluation. Paper presented at Conference: Knowledge Summit Doctoral Consortium 2002, Queen’s Centre for Knowledge-Based Enterprise, Queen’s University School of Business, Ontario. Available online: http://business.queensu.ca/knowledge/consortium2002/ModelsofICValuation.pdf (accessed on 19 October 2017).

- Berg, Ivar E. 1969. Jobs: The Great Training Robbery. New York: Praeger Publishers. [Google Scholar]

- Berger, Allen, and David Humphrey. 1994. Bank Scale Economies, Mergers, Concentration, and Efficiency: The U.S. Experience. Working Paper No. 94. Philadelphia, PA, USA: Financial Institution Centre, University of Pennsylvania. Available online: http://fic.wharton.upenn.edu/fic/papers/94/9425.pdf (accessed on 24 August 2017).

- Berger, Allen N. 1995. The Profit-Structure Relationship in Banking: Tests of Market-Power and Efficient Structure Hypotheses. Journal of Money, Credit and Banking 27: 404–31. [Google Scholar] [CrossRef]

- Blundell, Richard, and Stephen Bond. 1998. Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics 87: 115–43. [Google Scholar] [CrossRef]

- Bontis, Nick. 1996. There’s a price on your head: Managing intellectual capital strategically. Business Quarterly 60: 40–47. [Google Scholar]

- Bontis, Nick, William Chua Chong Keow, and Stanley Richardson. 2000. Intellectual capital and business performance in Malaysian industries. Journal of Intellectual Capital 1: 85–100. [Google Scholar] [CrossRef]

- Bourke, Philip. 1989. Concentration and other determinants of bank profitability in Europe, North America and Australia. Journal of Banking & Finance 13: 65–79. [Google Scholar] [CrossRef]

- Bouzgarrou, Houssam, Sameh Jouida, and Waël Louhichi. 2018. Bank profitability during and before the financial crisis: Domestic versus foreign banks. Research in International Business and Finance 44: 26–39. [Google Scholar] [CrossRef]

- Bozbura, F. Tunc. 2004. Measurement and application of intellectual capital in Turkey. The Learning Organization 11: 357–67. [Google Scholar] [CrossRef]

- Branco, Manuel Castelo, Catarina Delgado, Cristina Sousa, and Manuel Sa. 2011. Intellectual capital disclosure media in Portugal. Corporate Communications: An International Journal 16: 38–52. [Google Scholar] [CrossRef]

- Britto, Daniel Pitelli, Eliane Monetti, and Joao da Rocha Lima Jr. 2014. Intellectual capital in tangible intensive firms: The case of Brazilian real estate companies. Journal of Intellectual Capital 15: 333–48. [Google Scholar] [CrossRef]

- Cabrita, Maria do Rosário, and Jorge Landeiro Vaz. 2006. Intellectual capital and value creation: Evidence from the Portuguese banking industry. The Electronic Journal of Knowledge Management 4: 11–20. [Google Scholar]

- Cabrita, Maria do Rosário Meireles Ferreira, Maria de Lurdes Ribeiro da Silva, and Ana Maria Gome. 2017. Competitiveness and disclosure of intellectual capital: An empirical research in Portuguese banks. Journal of Intellectual Capital 18: 486–505. [Google Scholar] [CrossRef]

- Chan, Kin Hang. 2009. Impact of Intellectual Capital on Organisational Performance: An Empirical Study of Companies in the Hang Seng Index (Part 1). Learning Organization 16: 4–21. [Google Scholar] [CrossRef]

- Chang, Chen-Shan, Shang-Wu Yu, and Cheng-Huang Hung. 2015. Firm risk and performance: The role of corporate governance. Review of Managerial Science 9: 141–73. [Google Scholar] [CrossRef]

- Chen, Ming-Chin, Shu-Ju Cheng, and Yuhchang Hwang. 2005. An empirical investigation of the relationship between intellectual capital and firms’ market value and financial performance. Journal of Intellectual Capital 6: 159–76. [Google Scholar] [CrossRef]

- Chu, Samuel Kai Wah, Kin Hang Chan, and Wendy W.Y. Wu. 2011. Charting intellectual capital performance of the gateway to China. Journal of Intellectual Capital 12: 249–76. [Google Scholar] [CrossRef]

- Dietrich, Andreas, and Gabrielle Wanzenried. 2011. Determinants of bank profitability before and during the crisis: Evidence from Switzerland. Journal of International Financial Markets, Institutions & Money 21: 307–27. [Google Scholar]

- Dinç, I. Serdar. 2005. Politicians and banks: Political influences on government-owned banks in emerging markets. Journal of Financial Economics 77: 453–79. [Google Scholar] [CrossRef]

- Donaldson, Lex, and James H. Davis. 1991. Stewardship Theory or Agency Theory: CEO Governance and Shareholder Returns. Australian Journal of Management 16: 49–65. [Google Scholar] [CrossRef]

- Doucouliagos, Hristos, Janto Haman, and Saeed Askary. 2007. Directors’ Remuneration and Performance in Australian Banking. Corporate Governance: An International Review 15: 1363–83. [Google Scholar] [CrossRef]

- Edvinsson, Leif. 1997. Developing Intellectual Capital at Skandia. Long Range Planning 30: 366–73. [Google Scholar] [CrossRef]

- Elsas, Ralf, Andreas Hackethal, and Markus Holzhäuser. 2010. The anatomy of bank diversification. Journal of Banking & Finance 34: 1274–87. [Google Scholar] [CrossRef]

- Esman, Morekwa Nyamongo, and Temesgen Kebede. 2013. The effect of governance on performance of commercial banks in Kenya: A panel study. Corporate Governance: The International Journal of Business in Society 13: 236–48. [Google Scholar] [CrossRef]

- Fan, Joseph P. H., T. J. Wong, and Tianyu Zhang. 2007. Politically connected CEOs, corporate governance, and Post-IPO performance of China’s newly partially privatized firms. Journal of Financial Economics 84: 330–57. [Google Scholar] [CrossRef]

- Farag, Hisham, and Chris Mallin. 2017. Board diversity and financial fragility: Evidence from European banks. International Review of Financial Analysis 49: 98–112. [Google Scholar] [CrossRef]

- Farag, Hisham, Chris Mallin, and Kean Ow-Yong. 2017. Corporate governance in Islamic banks: New insights for dual board structure and agency relationships. Journal of International Financial Markets, Institutions and Money. [Google Scholar] [CrossRef]

- Firer, Steven, and S Mitchell Williams. 2003. Intellectual capital and traditional measures of corporate performance. Journal of Intellectual Capital 4: 348–60. [Google Scholar] [CrossRef]

- García-Herrero, Alicia, Sergio Gavilá, and Daniel Santabárbara. 2009. What explains the low profitability of Chinese banks? Journal of Banking & Finance 33: 2080–92. [Google Scholar] [CrossRef]

- García-Meca, Emma, Isabel-María García-Sánchez, and Jennifer Martínez-Ferrero. 2015. Board diversity and its effects on bank performance: An international analysis. Journal of Banking & Finance 53: 202–14. [Google Scholar] [CrossRef]

- Ghosh, Saibal. 2006. Do board characteristics affect corporate performance? Firm-level evidence for India. Applied Economics Letters 13: 435–43. [Google Scholar] [CrossRef]

- Ghosh, Santanu Kumar, and Amitava Mondal. 2009. Indian software and pharmaceutical sector ic and financial performance. Journal of Intellectual Capital 10: 369–88. [Google Scholar] [CrossRef]

- Goddard, John, Phil Molyneux, and John O. S. Wilson. 2004. Dynamics of Growth and Profitability in Banking. Journal of Money, Credit and Banking 36: 1069–90. [Google Scholar] [CrossRef]

- Goh, Pek Chen. 2005. Intellectual capital performance of commercial banks in Malaysia. Journal of Intellectual Capital 6: 385–96. [Google Scholar] [CrossRef]

- Grove, Hugh, Lorenzo Patelli, Lisa M Victoravich, and Pisun Tracy Xu. 2011. Corporate governance and performance in the wake of the financial crisis: Evidence from US commercial banks. Corporate Governance: An International Review 19: 418–36. [Google Scholar] [CrossRef]

- Hall, Brian J., and Jeffrey B. Liebman. 1998. Are CEOS Really Paid Like Bureaucrats? The Quarterly Journal of Economics 113: 653–91. [Google Scholar] [CrossRef]

- Hardy, Daniel C., and Emilia Bonaccorsi di Patti. 2001. Bank Reforms and Bank Efficiency in Pakistan. Working Paper. Washington, DC, USA: International Monetary Fund. [Google Scholar]

- Haris, Muhammad, HongXing Yao, Gulzara Tariq, and Ali Malik. 2019. An Evaluation of Performance of Public Sector Financial Institutions: Evidence from Pakistan. International Journal of Business Performance Management 20: 145–163. [Google Scholar] [CrossRef]

- Haris, Muhammad, HongXing Yao, Gulzara Tariq, Hafiz Mustansar Javaid, and Ali Malik. 2018. The Impact of Intellectual Capital and Employee Size on Bank Profitability: A Comparative Study of Islamic and Conventional Banks in Pakistan. Pacific Business Review International 11: 66–82. [Google Scholar]

- Hermalin, Benjamin E., and Michael S. Weisbach. 1998. Endogenously Chosen Boards of Directors and Their Monitoring of the CEO. The American Economic Review 88: 96–118. [Google Scholar]

- Iannotta, Giuliano, Giacomo Nocera, and Andrea Sironi. 2007. Ownership structure, risk and performance in the European banking industry. Journal of Banking & Finance 31: 2127–49. [Google Scholar] [CrossRef]

- Isaac, Ofoeda. 2017. Corporate governance and non-bank financial institutions profitability. International Journal of Law and Management 59: 854–75. [Google Scholar] [CrossRef]

- Jackowicz, Krzysztof, Oskar Kowalewski, and Łukasz Kozłowski. 2013. The influence of political factors on commercial banks in Central European countries. Journal of Financial Stability 9: 759–77. [Google Scholar] [CrossRef]

- Jensen, Michael C. 1993. The modern industrial revolution, exit, and the failure of internal control systems. The Journal of Finance 48: 831–80. [Google Scholar] [CrossRef]

- Jensen, Michael C., and William H. Meckling. 1976. Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics 3: 305–60. [Google Scholar] [CrossRef]

- John, Kose, and Yiming Qian. 2003. Incentive Features in CEO Compensation in the Banking Industry. Economic Policy Review 9: 109–21. [Google Scholar]

- Joshi, Mahesh, Daryll Cahill, and Jasvinder Sidhu. 2010. Intellectual capital performance in the banking sector: An assessment of Australian owned banks. Journal of Human Resource Costing & Accounting 14: 151–70. [Google Scholar] [CrossRef]

- Kamath, G. Barathi. 2007. The intellectual capital performance of the Indian banking sector. Journal of Intellectual Capital 8: 96–123. [Google Scholar] [CrossRef]

- Kennedy, Peter. 2008. A Guide to Econometrics. Malden: Blackwell. [Google Scholar]

- Khan, Ashfaque H., and Lubna Hasan. 1998. Financial Liberalization, Savings, and Economic Development in Pakistan. Economic Development and Cultural Change 46: 581–97. [Google Scholar] [CrossRef]

- Lee, John Y., Glenn Growe, Marinus DeBruine, and Inkyung Cha. 2015. Measuring the Impact of the 2007–2009 Financial Crisis on the Performance and Profitability of U.S. Regional Banks. Advances in Management Accounting. Bingley: Emerald Group Publishing Limited 25: 181–206. [Google Scholar]

- Hsu, Li-Chang, and Chao-Hung Wang. 2012. Clarifying the Effect of Intellectual Capital on Performance: The Mediating Role of Dynamic Capability. British Journal of Management 23: 179–205. [Google Scholar] [CrossRef]

- Liang, Qi, Pisun Xu, and Pornsit Jiraporn. 2013. Board characteristics and Chinese bank performance. Journal of Banking & Finance 37: 2953–68. [Google Scholar] [CrossRef]

- Lipton, Martin, and Jay W. Lorsch. 1992. A modest proposal for improved corporate governance. The Business Lawyer 48: 59–77. [Google Scholar]

- Masulis, Ronald W., Cong Wang, and Fei Xie. 2012. Globalizing the boardroom—The effects of foreign directors on corporate governance and firm performance. Journal of Accounting and Economics 53: 527–54. [Google Scholar] [CrossRef]

- Matolcsy, Zoltan, and Anna Wright. 2011. CEO compensation structure and firm performance. Accounting & Finance 51: 745–63. [Google Scholar] [CrossRef]

- Mavridis, Dimitrios G. 2004. Intellectual capital performance of the Japanese banking sector. Journal of Intellectual Capital 5: 92–115. [Google Scholar] [CrossRef]

- Mavridis, Dimitrios G., and Pantelis Kyrmizoglou. 2005. Intellectual capital performance drivers in the Greek banking sector. Management Research News 28: 43–62. [Google Scholar] [CrossRef]

- Meles, Antonio, Claudio Porzio, Gabriele Sampagnaro, and Vincenzo Verdolive. 2016. The imapct of intellectual capital efficiency on commercial banks performance: Evidence from the US. Journal of Multinational Financial Management 36: 64–74. [Google Scholar] [CrossRef]

- Micco, Alejandro, Ugo Panizza, and Monica Yañez. 2007. Bank ownership and performance. Does politics matter? Journal of Banking & Finance 31: 219–41. [Google Scholar] [CrossRef]

- Mollah, Sabur, and Mahbub Zaman. 2015. Shari’ah supervision, corporate governance and performance: Conventional vs. Islamic banks. Journal of Banking & Finance 58: 418–35. [Google Scholar] [CrossRef]

- Molyneux, Philip, and John Thornton. 1992. Determinants of European bank profitability: A note. Journal of Banking and Finance 16: 1173–78. [Google Scholar] [CrossRef]

- Mondal, Amitava, and Santanu Kumar Ghosh. 2012. Intellectual capital and financial performance of Indian banks. Journal of Intellectual Capital 13: 515–30. [Google Scholar] [CrossRef]

- Mostak Ahamed, M. 2017. Asset quality, non-interest income, and bank profitability: Evidence from Indian banks. Economic Modelling 63: 1–14. [Google Scholar] [CrossRef]

- Murphy, Kevin J. 1985. Corporate performance and managerial remuneration: An empirical analysis. Journal of Accounting and Economics 7: 11–42. [Google Scholar] [CrossRef]

- Naceur, Samy Ben. 2003. The determinants of the Tunisian banking industry profitability: Panel evidence. Paper presented at the Economic Research Forum (ERF) 10th Annual Conference, Marrakesh, Morocco, December 16–18; Available online: www.mafhoum.com/press6/174E11.pdf (accessed on 20 August 2017).

- Nawaz, Tasawar. 2017. Exploring the Nexus Between Human Capital, Corporate Governance and Performance: Evidence from Islamic Banks. Journal of Business Ethics, 1–21. [Google Scholar] [CrossRef]

- Nawaz, Tasawar, and Roszaini Haniffa. 2017. Determinants of financial performance of Islamic banks: An intellectual capital perspective. Journal of Islamic Accounting and Business Research 8: 130–42. [Google Scholar] [CrossRef]

- Netter, J., W. Wasserman, and M. H. Kutner. 1989. Applied Regression Models. Homewood: Richard D. Irwin. [Google Scholar]

- Nielsen, Christian, Per Nikolaj Bukh, Jan Mouritsen, Mette Rosenkrands Johansen, and Peter Gormsen. 2006. Intellectual capital statements on their way to the stock exchange: Analyzing new reporting systems. Journal of Intellectual Capital 7: 221–40. [Google Scholar] [CrossRef]

- Ozkan, Nasif, Sinan Cakan, and Murad Kayacan. 2016. Intellectual Capital and Financial Performance: A Study of the Turkish Banking Sector. Borsa Istanbul Review. [Google Scholar] [CrossRef]

- Pasiouras, Fotios, and Kyriaki Kosmidou. 2007. Factors influencing the profitability of domestic and foreign commercial banks in the European Union. Research in International Business and Finance 21: 222–37. [Google Scholar] [CrossRef]

- Pathan, Shams, Michael Skully, and J. Wickramanayake. 2007. Board Size, Independence and Performance: An Analysis of Thai Banks. Asia-Pacific Financial Markets 14: 211–27. [Google Scholar] [CrossRef]

- Patti, Emilia Bonaccorsi di, and Daniel C. Hardy. 2005. Financial sector liberalization, bank privatization, and efficiency: Evidence from Pakistan. Journal of Banking & Finance 29: 2381–406. [Google Scholar]

- Peng, Lee Siew, and Isa Mansor. 2015. Directors’ remuneration, governance and performance: The case of Malaysian banks. Managerial Finance 41: 26–44. [Google Scholar] [CrossRef]

- Pfeffer, Jeffrey, and Gerald R. Salancik. 1978. The External Control of Organizations: A Resource Dependence Perspective. New York: Harper and Row. [Google Scholar]

- Pulic, Ante. 1998. Measuring the Performance of Intellectual Potential in Knowledge Economy. Available online: http://www.measuring-ip.at/Opapers/Pulic/Vaictxt.vaictxt.html (accessed on 18 October 2017).

- Pulic. 2000. VAIC—An Accounting Tool for IC Management. International Journal of Technology Management 20: 702–14. [Google Scholar]

- Pulic. 2001. Value Creation Efficiency Analysis of Croatian Banks 1996–2000. Available online: www.vaic-on.net (accessed on 18 October 2017).

- Pulic. 2004. Intellectual capital—Does it create or destroy value? Measuring Business Excellence 8: 62–68. [Google Scholar] [CrossRef]

- Puntillo, Pina. 2009. Intellectual Capital and business performance. Evidence from Italian banking industry. Electronic Journal of Corporate Finance 4: 97–115. [Google Scholar]

- Roodman, D. 2009. How to do xtabond2: An introduction to difference and system GMM in Stata. Stata Journal 9: 86–136. [Google Scholar] [CrossRef]

- Saona, Paolo. 2016. Intra- and extra-bank determinants of Latin American Banks’ profitability. International Review of Economics & Finance 45: 197–214. [Google Scholar] [CrossRef]

- Schultz, Theodore W. 1961. Investment in human capital. The American Economic Review 51: 1–17. [Google Scholar]

- Shah, Syed Qasim, and Rizwan Jan. 2014. Analysis of Financial Performance of Private Banks in Pakistan. Procedia—Social and Behavioral Sciences 109: 1021–25. [Google Scholar] [CrossRef]

- Singh, Sukhdev, Jasvinder Sidhu, Mahesh Joshi, and Monika Kansal. 2016. Measuring intellectual capital performance of Indian banks: A public and private sector comparison. Managerial Finance 42: 635–55. [Google Scholar] [CrossRef]

- Smirlock, Michael. 1985. Evidence on the (Non) Relationship between Concentration and Profitability in Banking. Journal of Money, Credit and Banking 17: 69–83. [Google Scholar] [CrossRef]

- Staikouras, Panagiotis K., Christos K. Staikouras, and Maria-Eleni K. Agoraki. 2007. The effect of board size and composition on European bank performance. European Journal of Law and Economics 23: 1–27. [Google Scholar] [CrossRef]

- Sufian, Fadzlan. 2009. Determinants of Bank profitability in a Developing Economy: Empirical evidence from the China Banking Sector. Journal of Asia-Pacific Business 10: 201–307. [Google Scholar] [CrossRef]

- Sun, Poi Hun, Shamsher Mohamad, and M. Ariff. 2017. Determinants driving bank performance: A comparison of two types of banks in the OIC. Pacific-Basin Finance Journal 42: 193–203. [Google Scholar] [CrossRef]

- Sveiby, K. E. 1997. The New Organizational Wealth: Managing and Measuring Knowledge-Based Assets. San Francisco: Berrett-Koehler Publishers. [Google Scholar]

- Tan, Yong, and Christos Floros. 2012a. Bank profitability and inflation: The case of China. Journal of Economic Studies 39: 675–96. [Google Scholar] [CrossRef]

- Tan, Yong, and Christos Floros. 2012b. Bank profitability and GDP growth in China: A note. Journal of Chinese Economic and Business Studies 10: 267–73. [Google Scholar] [CrossRef]

- Tan, Yong, and Christos Floros. 2012c. Stock market volatility and bank performance in China. Studies in Economics and Finance 29: 211–28. [Google Scholar] [CrossRef]

- Tan, Yong. 2016. The impacts of risk and competition on bank profitability in China. Journal of International Financial Markets, Institutions and Money 40: 85–110. [Google Scholar] [CrossRef]

- Tan, Yong. 2017. The impacts of competition and shadow banking on profitability: Evidence from the Chinese banking industry. The North American Journal of Economics and Finance 42: 89–106. [Google Scholar] [CrossRef]

- Tan, Yong, and John Anchor. 2016. Stability and Profitability in the Chinese Banking Industry: Evidence from an autoregressive-distributed linear specification. Investment Management and Financial Innovations 13: 120–29. [Google Scholar] [CrossRef]

- Tan, Yong, Christos Floros, and John Anchor. 2017. The profitability of Chinese banks: Impacts of risk, competition and efficiency. Review of Accounting and Finance 16: 86–105. [Google Scholar] [CrossRef]

- Tanna, Sailesh, Fotios Pasiouras, and Matthias Nnadi. 2011. The effect of board size and composition on the efficiency of UK banks. International Journal of the Economics of Business 18: 441–62. [Google Scholar] [CrossRef]

- Ting, Irene Wei Kiong, and Hooi Hooi Lean. 2009. Intellectual capital performance of financial institutions in Malaysia. Journal of Intellectual Capital 10: 588–99. [Google Scholar] [CrossRef]

- Vafeas, Nikos. 1999. Board meeting frequency and firm performance. Journal of Financial Economics 53: 113–42. [Google Scholar] [CrossRef]

- Wang, Wen-Ying, and Chingfu Chang. 2005. Intellectual capital and performance in causal models: Evidence from the information technology industry in Taiwan. Journal of Intellectual Capital 6: 222–36. [Google Scholar] [CrossRef]

- Williamson, Oliver E. 1985. The Economic Institutions of Capitalism. New York: The Free Press. [Google Scholar]

- Windmeijer, Frank. 2005. A finite sample correction for the variance of linear efficient two-step GMM estimators. Journal of Econometrics 126: 25–51. [Google Scholar] [CrossRef]

- World Bank. 2003. Lifelong Learning in the Global Knowledge Economy: Challenges for Developing Countries. Washington, DC: World Bank. Available online: https://www.voced.edu.au/content/ngv:29323 (accessed on 18 October 2017).

- Xu, Jiang, and Binghan Wang. 2018. Intellectual Capital, Financial Performance and Companies’ Sustainable Growth: Evidence from the Korean Manufacturing Industry. Sustainability 10: 4651. [Google Scholar] [CrossRef]

- Yalama, Abdullah, and Metin Coskun. 2007. Intellectual capital performance of quoted banks on the Istanbul stock exchange market. Journal of Intellectual Capital 8: 256–71. [Google Scholar] [CrossRef]

- Yalama, Abdullah. 2013. The relationship between intellectual capital and banking performance in Turkey: Evidence from panel data. International Journal of Learning and Intellectual Capital 10: 71–87. [Google Scholar] [CrossRef]

- Yao, Hongxing, Muhammad Haris, and Gulzara Tariq. 2018. Profitability Determinants of Financial Institutions: Evidence from Banks in Pakistan. International Journal of Financial Studies 6: 53. [Google Scholar] [CrossRef]

- Yermack, David. 1996. Higher market valuation of companies with a small board of directors. Journal of Financial Economics 40: 185–211. [Google Scholar] [CrossRef]

- Yeung, Jim C. K. 2018. Nonlinear Effect of Board Size on Corporate Performance: Impact of the Cultural Backgrounds of Directors in Hong Kong. Asia-Pacific Journal of Financial Studies 47: 107–31. [Google Scholar] [CrossRef]

- Yulia, Titova. 2016. Are board characteristics relevant for banking efficiency? Evidence from the US. Corporate Governance: The International Journal of Business in Society 16: 655–79. [Google Scholar] [CrossRef]

| 1 | We use the squared value of VAIC (VAIC-SQ) to check the non-linear relationship between IC performance and profitability. The significant positive coefficients of VAIC and significant negative coefficients of VAIC-SQ affirm the inverted U-shape relationship between IC performance and profitability (see Table 5). |

| 2 | State Bank of Pakistan (SBP) is the central bank of country. All circulars can be accessed from http://www.sbp.org.pk/bpd/index.htm. |

| 3 | The Information is accessed from http://sbp.org.pk/publications/q_reviews/qpr.htm. |

| 4 | The value 1 has assigned to the year 2008–2009 (transition from Pakistan Muslim League-Qaid to Pakistan People Party) and has also been assigned to the period 2013–2014 (transition from Pakistan People Party to Pakistan Muslim League Noon) and 0 otherwise. |

| Year | VAIC | CEE | HCE | SCE | VA (Rs.MN) | VA-Growth |

|---|---|---|---|---|---|---|

| 2007 | 4.2805 | 0.2897 | 3.2943 | 0.6964 | 153,954 | - |

| 2008 | 2.9774 | 0.2833 | 2.1576 | 0.5365 | 148,939 | −0.0326 |

| 2009 | 3.0766 | 0.2917 | 2.2328 | 0.5521 | 180,547 | 0.2122 |

| 2010 | 3.2144 | 0.3273 | 2.3184 | 0.5687 | 216,163 | 0.1973 |

| 2011 | 3.7337 | 0.3842 | 2.7175 | 0.632 | 292,035 | 0.3510 |

| 2012 | 3.5744 | 0.3721 | 2.5886 | 0.6137 | 320,523 | 0.0975 |

| 2013 | 3.3498 | 0.3455 | 2.4179 | 0.5864 | 319,024 | −0.0047 |

| 2014 | 3.7437 | 0.3393 | 2.766 | 0.6385 | 408,827 | 0.2815 |

| 2015 | 4.1058 | 0.3941 | 3.0406 | 0.6711 | 494,906 | 0.2106 |

| 2016 | 3.9186 | 0.3926 | 2.874 | 0.652 | 508,029 | 0.0265 |

| 2007–2016 | 3.5975 | 0.3420 | 2.6408 | 0.6147 |

| Variables | Notation | Description | Expected Results |

|---|---|---|---|

| DEPENDENT | |||

| Return on Assets | ROA | Profit after tax to average assets | |

| Return on Equity | ROE | Profit after tax to average equity | |

| Net Interest Margin | NIM | Interest income-interest expense/average earning assets | |

| Earning assets defined as investment, advances, and lending to financial institutions | |||

| Profit Margin | PM | Profit before tax to average assets | |

| INDEPENDENT | |||

| Intellectual Capital | |||

| Value Added Intellectual Coefficient | VAIC | See Equation (1) | +/− |

| Capital Employed Efficiency | CEE | See Equation (3) | + |

| Human Capital Efficiency | HCE | See Equation (4) | + |

| Structural Capital Efficiency | SCE | See Equation (5) | +/− |

| Corporate Governance | |||

| Board Size | BODSIZE | Logarithm of total number of board members | +/− |

| Board Independence | BIND | Independent directors to total members in a board | + |

| Board Meetings | BMEETs | Logarithm of total board meetings held in a year | +/− |

| Director Compensation | DCOMP | Logarithm of total compensation paid to the board of directors | + |

| Bank-Specific | |||

| Bank Size | BSIZE | Logarithm of total assets | +/− |

| Solvency | SOLV | Total shareholder’s equity to total assets | + |

| Credit Risk | RISK | Total loan loss provisions to total advances | - |

| Bank Type | BTYPE | Equals to 1 if a bank is private owned and 0 otherwise | +/− |

| Foreign Ownership | FOWN | Equals to 1 if a bank represent any foreign ownership and 0 otherwise | +/− |

| Industry-Specific | |||

| Industry Concentration | IC5 | Ratio between the total assets of largest five banks and total assets of all domestic banks | - |

| Country-Specific | |||

| Economic Growth | GDPR | Annual percent change in the gross domestic product of the country | +/− |

| Regulatory Changes | REGC | Equal to 1 if any regulatory change (2013–2016) and 0 otherwise | + |

| Government Change | GOV | Equal to 1 if the government transition (2008–2009 & 2013–2014) and 0 otherwise | - |

| Bank Specific Variables | Intellectual Capital Variables | Corporate Governance Variables | Industry & Country-Specific Variables | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Coef. | PV | Coef. | PV | Coef. | PV | Coef. | PV | ||||

| ROA | 206.824 | 0.000 | VAIC | 210.637 | 0.000 | BODSIZE | 116.999 | 0.000 | IC5 | 134.501 | 0.000 |

| ROE | 134.098 | 0.000 | CEE | 135.912 | 0.000 | BIND | 109.683 | 0.000 | GDPR | 108.527 | 0.000 |

| NIM | 106.254 | 0.000 | HCE | 203.661 | 0.000 | BMEETs | 168.946 | 0.000 | REGC | 68.973 | 0.038 |

| PM | 146.766 | 0.000 | SCE | 122.471 | 0.000 | DCOMP | 229.166 | 0.000 | GOV | 95.426 | 0.000 |

| BSZIE | 148.318 | 0.000 | |||||||||

| CAP | 202.471 | 0.000 | |||||||||

| RISK | 109.375 | 0.000 | |||||||||

| BTYPE | 71.024 | 0.017 | |||||||||

| FOWN | 115.533 | 0.000 | |||||||||

| VAIC | CEE | HCE | SCE | BODSIZE | BIND | BMEETS | DCOMP | BSIZE | CAP | RISK | BTYPE | FOWN | IC5 | GDPR | REGC | GOV | VIF | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| VAIC | 1.000 | 1.33 | ||||||||||||||||

| CEE | 0.328 *** | 1.000 | 1.40 | |||||||||||||||

| HCE | 0.937 *** | 0.285 *** | 1.000 | 1.30 | ||||||||||||||

| SCE | 0.381 *** | −0.134 ** | 0.056 | 1.000 | 1.64 | |||||||||||||

| BODSIZE | 0.211 *** | −0.101 | 0.175 *** | 0.197 *** | 1.000 | 1.40 | ||||||||||||

| BIND | −0.043 | 0.076 | −0.059 | −0.004 | −0.189 *** | 1.000 | 1.42 | |||||||||||

| BMEETs | −0.136 ** | −0.226 *** | −0.134 ** | 0.039 | −0.157 ** | 0.303 *** | 1.000 | 1.50 | ||||||||||

| DCOMP | 0.241 *** | 0.140 ** | 0.191 *** | 0.155 ** | 0.245 *** | 0.145 ** | −0.019 | 1.000 | 2.26 | |||||||||

| BSZIE | 0.355 | 0.151 ** | 0.270 *** | 0.278 *** | 0.317 *** | 0.102 | 0.156 ** | 0.585 *** | 1.000 | 2.31 | ||||||||

| CAP | −0.010 | −0.141 ** | 0.019 | −0.022 | −0.091 | 0.208 *** | −0.029 | −0.273 *** | −0.346 *** | 1.000 | 1.38 | |||||||

| RISK | −0.288 *** | 0.142 ** | −0.145 ** | −0.506 *** | −0.341 *** | 0.025 | −0.018 | −0.197 *** | −0.343 *** | −0.022 | 1.000 | 1.40 | ||||||

| BTYPE | 0.157 ** | 0.088 | 0.111 * | 0.135 ** | 0.313 *** | −0.163 ** | −0.387 *** | 0.426 *** | 0.235 *** | −0.188 *** | −0.265 *** | 1.000 | 1.89 | |||||

| FOWN | −0.011 | −0.029 | −0.044 | 0.086 | 0.097 | −0.182 | −0.348 *** | 0.346 *** | −0.007 | 0.013 | −0.72 | 0.496 *** | 1000 | 1.66 | ||||

| IC5 | 0.016 | −0.152 ** | 0.043 | 0.008 | −0.003 | −0.164 ** | −0.058 | −0.226 *** | −0.197 *** | 0.102 | −0.055 | 0.030 | 1.000 | 2.12 | ||||

| GDPR | 0.112 * | 0.228 *** | 0.113 * | −0.048 | 0.021 | 0.217 *** | 0.005 | 0.212 *** | 0.167 *** | −0.041 | 0.088 | −0.044 | −0.140 ** | 1.000 | 4.32 | |||

| REGC | 0.020 | 0.204 *** | 0.018 | −0.062 | −0.009 | 0.267 *** | 0.010 | 0.278 *** | 0.231 *** | −0.104 * | 0.108 * | −0.051 | −0.084 | −0.525 *** | 0.740 *** | 1.000 | 6.41 | |

| GOV | −0.093 | −0.136 ** | −0.090 | 0.007 | −0.052 | 0.007 | −0.046 | −0.076 | −0.064 | 0.057 | −0.016 | −0.006 | 0.079 | −0.160 ** | 1.000 | 1.70 |

| Variable | Obs. | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| ROA | 251 | 0.005 | 0.019 | −0.092 | 0.044 |

| ROE | 251 | 0.048 | 0.248 | −2.030 | 0.334 |

| NIM | 251 | 0.043 | 0.019 | −0.020 | 0.100 |

| PM | 251 | 0.009 | 0.025 | −0.095 | 0.060 |

| VAIC | 247 | 3.015 | 4.271 | −12.045 | 53.444 |

| CEE | 247 | 0.291 | 0.529 | −3.999 | 4.578 |

| HCE | 247 | 2.293 | 3.769 | −9.155 | 52.050 |

| SCE | 247 | 0.433 | 1.493 | −11.162 | 5.287 |

| BODSIZE | 242 | 2.115 | 0.195 | 1.386 | 2.565 |

| BIND | 239 | 0.269 | 0.213 | 0 | 0.875 |

| BMEETs | 236 | 1.815 | 0.312 | 0.693 | 2.833 |

| DCOMP | 247 | 10.807 | 0.832 | 8.045 | 12.839 |

| BSZIE | 251 | 19.023 | 1.306 | 15.483 | 21.596 |

| CAP | 251 | 0.111 | 0.079 | 0.002 | 0.762 |

| RISK | 247 | 0.137 | 0.259 | 0 | 1.912 |

| BTYPE | 251 | 0.757 | 0.430 | 0 | 1 |

| FOWN | 251 | 0.434 | 0.497 | 0 | 1 |

| IC5 | 251 | 0.540 | 0.012 | 0.525 | 0.562 |

| GDPR | 251 | 3.709 | 1.335 | 1.607 | 5.741 |

| REGC | 251 | 0.414 | 0.494 | 0 | 1 |

| GOV | 251 | 0.398 | 0.494 | 0 | 1 |

| ROA | ROE | NIM | PM | |||||

|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 1 | 2 | 1 | 2 | 1 | 2 | |

| DEPt − 1 | 0.554 *** (0.198) | 0.607 *** (0.195) | 0.276 *** (0.057) | 0.252 *** (0.088) | 0.644 *** (0.130) | 0.449 ** (0.172) | 0.317 *** (0.088) | 0.317 (0.207) |

| VAIC | 0.007 *** (0.002) | 0.051 *** (0.016) | 0.003 *** (0.001) | 0.007 *** (0.002) | ||||

| VAIC-SQ | −0.001 ** (0.000) | −0.005 *** (0.002) | −0.001 ** (0.000) | −0.001 *** (0.000) | ||||

| CEE | 0.008 (0.009) | 0.138 ** (0.064) | 0.006 *** (0.002) | 0.015 * (0.008) | ||||

| HCE | 0.006 ** (0.003) | 0.040 * (0.024) | 0.002 *** (0.001) | 0.004 ** (0.002) | ||||

| SCE | 0.006 (0.005) | 0.100 (0.061) | −0.002 ** (0.001) | −0.003 * (0.002) | ||||

| BODSIZE | −0.071 *** (0.024) | −0.053 ** (0.025) | −0.335 ** (0.157) | −0.489 * (0.262) | 0.001 (0.022) | −0.012 (0.015) | −0.044 * (0.024) | −0.040 * (0.023) |

| BIND | 0.006 (0.011) | 0.006 (0.014) | 0.180 ** (0.083) | 0.162 (0.164) | −0.007 (0.007) | −0.011 (0.007) | −0.008 (0.009) | 0.003 (0.011) |

| BMEETs | −0.021 ** (0.008) | −0.022 *** (0.007) | 0.022 (0.127) | −0.100 (0.135) | 0.001 (0.011) | 0.009 (0.010) | −0.017 ** (0.008) | 0.023 (0.014) |

| DCOMP | −0.005 (0.004) | −0.005 (0.003) | −0.118 (0.123) | −0.252 (0.198) | 0.002 (0.005) | 0.009 ** (0.004) | −0.005 (0.005) | −0.003 (0.012) |

| BSIZE | −0.005 (0.005) | −0.005 (0.004) | 0.049 (0.054) | 0.040 (0.074) | 0.002 (0.003) | −0.003 (0.003) | 0.001 (0.004) | 0.004 (0.006) |

| CAP | −0.029 (0.021) | 0.003 (0.023) | 0.320 (0.511) | 0.278 (0.536) | 0.051 *** (0.017) | 0.055 ** (0.025) | 0.024 ** (0.012) | 0.007 (0.021) |

| RISK | −0.068 ** (0.033) | −0.057 * (0.032) | −0.966 *** (0.151) | −1.360 *** (0.350) | −0.004 (0.032) | −0.058 *** (0.012) | −0.055 ** (0.022) | −0.068 *** (0.021) |

| TYPE | 0.004 (0.012) | −0.010 (0.009) | −0.049 (0.355) | 0.305 (0.179) | −0.010 (0.009) | −0.021* (0.012) | −0.021 ** (0.008) | −0.010 (0.019) |

| FOWN | −0.005 (0.012) | −0.001 (0.012) | 0.367 ** (0.134) | −0.045 (0.144) | −0.004 (0.013) | −0.008 (0.018) | −0.001 (0.008) | 0.008 (0.013) |

| IC5 | 0.125 (0.144) | 0.350 (0.200) | −3.476 ** (1.478) | −0.972 (1.418) | −0.432 *** (0.156) | 0.036 (0.140) | 0.198 (0.161) | −0.056 (0.107) |

| GDPR | 0.005 (0.005) | 0.001 (0.004) | 0.016 (0.024) | −0.029 (0.055) | −0.003 ** (0.001) | 0.000 (0.002) | −0.004 * (0.002) | −0.001 (0.002) |

| REGC | −0.013 (0.015) | −0.002 (0.008) | −0.088 (0.058) | 0.109 (0.111) | −0.001 (0.006) | −0.010 (0.009) | 0.012 (0.007) | −0.004 (0.010) |

| GOV. | −0.014 ** (0.007) | −0.020 *** (0.007) | −0.064 (0.039) | −0.158 *** (0.048) | 0.009 (0.006) | 0.001 (0.002) | −0.008 * (0.004) | −0.010 * (0.005) |

| Const. | 0.278 * (0.127) | 0.094 (0.104) | 2.778 ** (1.370) | 3.557 * (1.907) | 0.208 ** (0.079) | −0.004 (0.010) | 0.016 (0.069) | 0.044 (0.081) |

| Obs. | 210 | 210 | 210 | 210 | 211 | 213 | 211 | 213 |

| Banks | 26 | 26 | 26 | 26 | 26 | 26 | 26 | 26 |

| Instrument | 25 | 26 | 26 | 26 | 25 | 26 | 26 | 26 |

| F-statistics | 21.26 *** | 41.92 *** | 57.72 *** | 99.43 *** | 190.74 *** | 150.10 *** | 165.69 *** | 57.41 *** |

| AR-1 (p-value) | −1.43(0.153) | −1.35(0.178) | −0.67(0.502) | −1.22(0.222) | 0.02(0.985) | −2.11(0.035) | −1.74(0.082) | −1.51(0.131) |

| AR-2 (p-value) | −0.47(0.641) | −0.79(0.428) | −0.67(0.502) | −1.15(0.251) | 0.53(0.597) | −1.06(0.288) | 0.74(0.457) | −0.38(0.703) |

| Hansen-J (p-value) | 5.65(0.686) | 4.82(0.776) | 2.90(0.968) | 3.06 0.931) | 7.62(0.471) | 2.36(0.968) | 3.15(0.958) | 4.94(0.764) |

| C-statistics (p-value) | 1.81(0.614) | 1.50(0.682) | 0.75(0.860) | 0.55(0.909) | 3.57(0.311) | 1.76(0.623) | 0.31(0.959) | 1.88(0.597) |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Haris, M.; Yao, H.; Tariq, G.; Malik, A.; Javaid, H.M. Intellectual Capital Performance and Profitability of Banks: Evidence from Pakistan. J. Risk Financial Manag. 2019, 12, 56. https://doi.org/10.3390/jrfm12020056

Haris M, Yao H, Tariq G, Malik A, Javaid HM. Intellectual Capital Performance and Profitability of Banks: Evidence from Pakistan. Journal of Risk and Financial Management. 2019; 12(2):56. https://doi.org/10.3390/jrfm12020056

Chicago/Turabian StyleHaris, Muhammad, HongXing Yao, Gulzara Tariq, Ali Malik, and Hafiz Mustansar Javaid. 2019. "Intellectual Capital Performance and Profitability of Banks: Evidence from Pakistan" Journal of Risk and Financial Management 12, no. 2: 56. https://doi.org/10.3390/jrfm12020056

APA StyleHaris, M., Yao, H., Tariq, G., Malik, A., & Javaid, H. M. (2019). Intellectual Capital Performance and Profitability of Banks: Evidence from Pakistan. Journal of Risk and Financial Management, 12(2), 56. https://doi.org/10.3390/jrfm12020056