1. Introduction

The amount of cash held plays an important role in most companies because it provides the ability to pay in cash and directly affects the performance of the company. The amount of cash held by the company is understood as cash and cash equivalents such as bank deposits and short-term securities which are able to be quickly converted into money (

Bates et al. 2009;

Ferreira and Vilela 2004). If the company holds a large amount of cash, the opportunity cost will arise. However, if a company holds too little cash, it may not be enough to cover the regular expenses. Therefore, the amount of cash held by the company must be sufficient to ensure regular operations solvency, contingency for emergencies, and also future projections (if needed).

Dittmar and Mahrt-Smith (

2007) stated that in 2003, the sum of all cash and cash equivalents represented more than 13% of the sum of all assets for large US firms.

Al-Najjar and Belghitar (

2011) found that cash represents, on average, 9% of the total assets for UK firms. In Vietnam context, the cash and cash equivalents account for more than 10% of total assets of firms. Thus, cash represents a sizeable asset for firms. Cash management may therefore be a key issue for corporate financial policies.

Regarding this topic, the first studies looked at antecedents of corporate cash holdings (

Ferreira and Vilela 2004;

Kim et al. 1998;

Opler et al. 1999;

Ozkan and Ozkan 2004). Most of these papers assume that cash holding is determined by the firm characteristics (i.e., leverage, growth opportunities, cash flow, investment in fixed assets, and size of the firm) and industry sector. In addition,

Sheikh and Khan (

2016) showed that cash holding is determined not only by the firm characteristics but also by the manager characteristics (i.e., age, gender, whether or not the manager is a chief executive officer, and whether or not the manager is a board director). Besides, corporate governance may also affect the value of a firm’s cash holdings. Evidence by

Dittmar and Mahrt-Smith (

2007) shows that investors value the excess cash holdings of well-governed firms at nearly double the value of the poorly governed firms.

Despite the increasing amount of literature on corporate cash holding, there are not many studies focusing on the relationship between cash holding and company performance. At the same time, corporate cash holdings have benefits and costs for the firm and, consequently, an optimum cash level may exist at which the performance of the firm is maximized. Evidence by

Cristina Martínez-Sola et al. (

2013) shows that in US industrial firms there exists an optimal cash holding ratio. This finding is also consistent with

Azmat (

2014), which found the existence of optimal cash level for a sample of listed Pakistani firms. Following this optimal level, firms will adjust their cash reserve to maximize firm value. On the other hand, most of the research work has been carried out in developed economies and very little is known about the cash holding of firms in developing economies.

According to

Horioka and Terada-Hagiwara (

2014), Asian firms are heavily constrained by borrowing limits and will hold more cash for future investments than firms in developed countries. Hence, our focus on an emerging country, Vietnam, allows us to offer a number of new insights beyond the existing studies of the relationship between cash holdings and firm’s performance. In Vietnam context, given the great opportunities and challenges now, companies need to focus on cash management, as lifeblood of the company. Therefore, the current question for listed companies on the Vietnam stock exchange market is how to manage cash in order to improve operational efficiency and contribute to increase of the company’s value. To solve this problem, listed companies on the Vietnam stock exchange market need to know how the cash holding ratio affects the firm’s performance.

In this study, the goal is to indicate to what extent the cash holding ratio will have a positive effect on increase of the company’s performance and to what extent the cash holding ratio will have a negative effect on reduction of company’s performance. Different from previous studies, this study applies the threshold regression model of

Hansen (

1999) to build the model to investigate the impact of cash holding ratio on the performance of the listed companies on the Vietnam stock exchange market. The results show empirically that an optimum level of cash holdings exists where firm’s performance is maximum, for a sample of 306 listed non-financial Vietnamese companies during 2008–2017. Deviations from the optimum level reduce firm value. It means that firms should balance the costs and benefits of cash holdings to find the optimal cash level to maximize firm’s performance and value. If a firm has a cash holding above or below the optimal level, its performance and value will decrease. The results of this study can help managers of listed companies on the Vietnam stock exchange market to adjust the cash holding ratio to improve operational efficiency and contribute to the increase of the company’s value.

To the best of author’s knowledge, until now, there has been no published research on the application of threshold regression model to study this relationship. Hence, by using the threshold regression model developed by

Hansen (

1999), this study further fills the gap in the literature on the behavior of firms, and focuses on evidence of cash policies and firm’s performance.

The paper includes five parts:

Section 1 introduces research issues;

Section 2 presents a theoretical overview and a research model;

Section 3 presents data collection and methods;

Section 4 presents the results of empirical research; the final section summarizes the findings and implications for cash management.

2. Literature Reviews and Hypothesis

Making a decision to hold an amount of cash in the company will affect efficiency or dynamics and corporate value. Each company has different reasons for holding cash; according to previous studies, there are major motives for the company to hold cash, that is:

Trading motive: Cash is the mean of exchange, so companies need cash to conduct daily transactions; however, the demands for cash of different companies are not the same (

Bates et al. 2009;

Opler et al. 1999). According to

Nguyen et al. (

2016), when firms have insufficient internal funds or liquid assets, they will raise funds from external capital markets, liquidate existing assets, limit dividend payouts, and reduce investment opportunities. However, all of these activities are costly.

Prevention motive: In addition to keeping cash for daily transactions, companies also need cash reserves for unexpected spending needs. According to

Ferreira and Vilela (

2004), the company holds cash to finance financial or investment activities when other resources are unavailable or very costly; however, each company has various demands for cash reserves in obtaining different objectives depending on situations.

Signal motive: Because of information asymmetry between managers and shareholders, managers will signal the prospects of the company to investors through their dividend payment policy. According to

Harford (

1999), the payment of dividends is more positive than the purchase of treasury shares by cash, because dividend payment generates a signal of a commitment to a higher dividend payment in the future; meanwhile, buying treasury securities is considered to be this year’s event only, and should not continue in the next year.

Represent motive: Managers can decide whether the company will withhold cash or pay dividends to shareholders. The free cash flow might increase discretion by managers, which goes against shareholders’ interest (

Jensen 1986). The study of

Harford (

1999) confirmed that companies with large amounts of cash tend to spend a lot of money to conduct numerous acquisitions. Furthermore, the study of

Blanchard et al. (

1994) provided evidence that firms do not pay dividends during a period of time but making zero acquisitions will spend their cash in many other investment activities.

The corporate cash holding determinants have been a subject of explanation in the framework of three theories, namely the trade-off model, pecking order theory, and free cash flow theory.

The free cash flow theory suggests that managers hold cash to serve their own interests, thus increasing the conflict between investors and company’s managers (

Harford 1999;

Jensen 1986). The theory of free cash flow also highlights the representative cost of holding cash. Companies with high growth opportunities have high agency costs, so they will tend to store more cash in order to be proactive in their capital. If there is a conflict between management and shareholders, management tends to store as much cash as possible to pursue their goals. Cash can be paid not only for making profits, but also for projects where investors are not ready to raise capital. Moreover, the board can also hold cash because of risk aversion.

The pecking order theory of

Myers and Majluf (

1984) suggests that managers can decide the order of capital financing to minimize the cost of information asymmetry and other financial costs. This theory implies that companies prefer internal financing. The directors adjust the dividend payout ratio to avoid the sale of ordinary shares, preventing a major change in the number of shares. If external funding is available,

Myers and Majluf (

1984) believed that the safest securities should be issued first. Specifically, debt is usually the first security to be issued and equity sold outside is the last solution. However,

Myers and Majluf (

1984) also argued that there will be no optimal level of cash holdings, but holding cash should serve as a buffer between retaining profits and investment needs.

The trade-off theory suggests that companies can finance by borrowing or retaining cash and they all have their advantages and costs. With the trade-off theory, also called transaction cost model of

Opler et al. (

1999), the company can determine a level of cash holdings by balancing the marginal cost of holding highly liquid assets and the profit margins of holding cash. Profit margins of cash holdings will reduce the likelihood of financial distress, allowing the company to make optimal investments and avoiding the costs incurred by external funding or liquidation of assets of company. Because the market is imperfect, it is difficult for companies to access the capital market or to bear the cost of external funding. The marginal cost of holding cash is the opportunity cost of holding cash when it offers less benefit than investing in an equal risk condition (

Ferreira and Vilela 2004;

Opler et al. 1999). When companies need cash to meet their expenses, they need external funding from the capital market or liquidate their assets. Since the capital markets are imperfect, transaction costs can be avoided by holding an optimal cash level.

Based on the benefits and costs of holding cash, there have been a few recent studies on the relationship between the amount of cash held and the performance or value of the company. The real impact of cash on firm’s performance or value is still being debated on the basis of empirical theory and evidence, creating many different perspectives.

The first view is that a high ratio of cash reserves will reduce the performance or value of the company. Supporting this point of view,

Harford (

1999) examined the relation between a firm’s acquisition policy and its cash holding. It was shown by the results that firms with a large amount of cash are more likely to make acquisitions that will decrease operational efficiency and firm value. The results of this empirical study are explained based on the theory of free cash flow. It means that managers of firms with a large amount of cash desire to increase the scope of their authority. In another study,

Harford et al. (

2008) concluded that firms with poor governance will spend more cash than other similar firms since the entrenched managers will prefer to overinvest rather than reserving cash for firms. Therefore, firms with a high level of cash holdings will have a lower firm performance or value.

The second opinion supports the existence of a positive relationship between business value and the amount of cash held.

Saddour (

2006) studied the relationship between firm’s value and the amount of cash held on the French stock exchange market in the period of 1998–2002. The results indicate that high cash reserves will increase operational efficiency or company’s value. Similarly,

Bates et al. (

2009) also found evidence that firms hold more cash when firms’ cash flow becomes riskier. This evidence strongly supports the precautionary motivations of cash holdings and implies a positive relationship between firm value and cash holdings.

The third view believes in a nonlinear relationship between cash holding and firm’s performance or value. Supporting this perspective,

Martínez-Sola et al. (

2013) used US industry’s data from 2001 to 2007, and found a nonlinear relationship between cash holding ratio and company’s value. They explained that the concave relationship between cash holdings and firm value exists because firms balance the costs and benefits of cash holdings to identify the optimal level of cash. Following this optimal level, firms will adjust their cash reserve to maximize the firm value. This result was also discovered earlier by

Azmat (

2014), who found the existence of optimal cash level for a sample of listed Pakistan firms from 2003 to 2008. In Vietnam,

Nguyen et al. (

2016) investigated the nonlinear relationship between firm value and corporate cash holdings in a sample of non-financial Vietnamese firms from 2008 to 2013. Authors focused on both static and dynamic regressions to test for a nonlinear relationship. Their results reveal an “inverse U-shape” relationship between firm value and cash holdings, which is in line with the trade-off theory.

According to the trade-off theory, in the context of Vietnam firms, author still expect there is a nonlinear relationship between cash holdings and company’s performance. Agreeing with thes studies above, for this relationship, we set the hypothesis as following:

Hypothesis 1 (H1): There is a nonlinear relationship between cash holdings and company’s performance in Vietnamese listed non-financial companies.

5. Conclusions and Recommendations

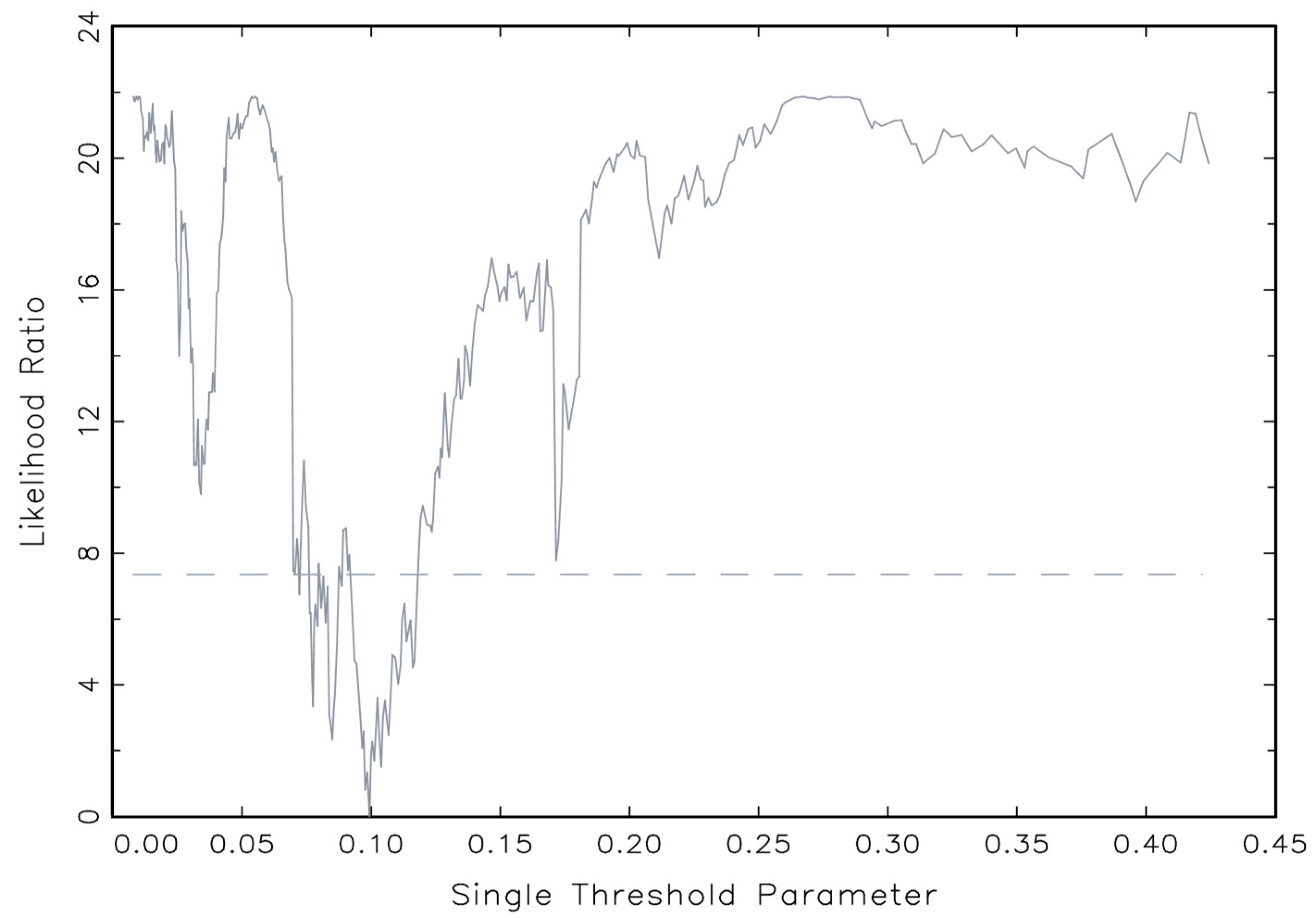

The decision on the cash holding ratio could have a significant impact on firm’s performance and value. This study used the threshold regression model of

Hansen (

1999) to examine the threshold effect of cash holding ratio on the performance of 306 listed non-financial companies in the Vietnam stock exchange market during the period of 2008–2017. ROA was used to represent company performance, and the ratio of money and cash equivalents on total assets (CASH) was used to represent the company’s cash holding ratio.

Experimental results showed that the single-threshold effect exists between the ratio of cash holding and company’s performance. In addition, the coefficient is positive when the cash holding ratio is less than 9.93%, which means a proportion of cash holding within this threshold could contribute to improvement of company’s efficiency. The coefficient is positive but tends to decrease when the ratio of cash holdings is higher than 9.93%, implying that an increase in cash holdings ratio beyond this threshold will further reduce the company’s performance. Therefore, this result might conclude that the relationship between cash holding ratio and firm’s performance is a nonlinear relationship. These results are consistent with the trade-off theory, in that the optimal cash holding ratio is determined by a trade-off between marginal cost and profit margin of cash holdings (

Opler et al. 1999). At the same time, this result is also consistent with some previous empirical research (

Azmat 2014;

Martínez-Sola et al. 2013;

Nguyen et al. 2016). Among the control variables, firm size and leverage have a significant negative effect on company’s performance whereas market-to-book value ratio of stocks has a significant positive effect on company’s performance.

From the research results above, this study suggested a few recommendations for non-financial companies listed on the Vietnam stock exchange market in deciding the cash holding ratio as follows: Firstly, companies should not hold cash more than 9.93% of total assets. To ensure and improve the company’s performance, the optimal range of cash holding ratio should be below 9.93%. Secondly, for companies that currently have a cash holding ratio higher than 9.93%, it is necessary to reduce the cash holding ratio to approach the optimal ratio as discussed above. In order to accomplish this task, it is necessary to identify the factors that affect the motive of holding cash, thereby having specific policies to adjust the cash holding ratio more suitable for each specific group of companies. From this idea, we will conduct research on the factors that affect the cash holding motive for each group of companies at each specific cash holding rate threshold. Hopefully, our next research results will provide practical suggestions in determining the optimal percentage of cash holdings to improve firm’s performance and value.

This study has used panel threshold regression by

Hansen (

1999), that is, for non-dynamic panels, studies can be conducted by using extended threshold panels (for dynamic panels and considering the issue of endogeneity) and for more rigorous results. This would be a worthwhile subject for future research.