What Determines Utility of International Currencies?

Abstract

1. Introduction

2. Related Literature

3. Utility of International Currency

3.1. Estimation Equation of Utility of International Currency

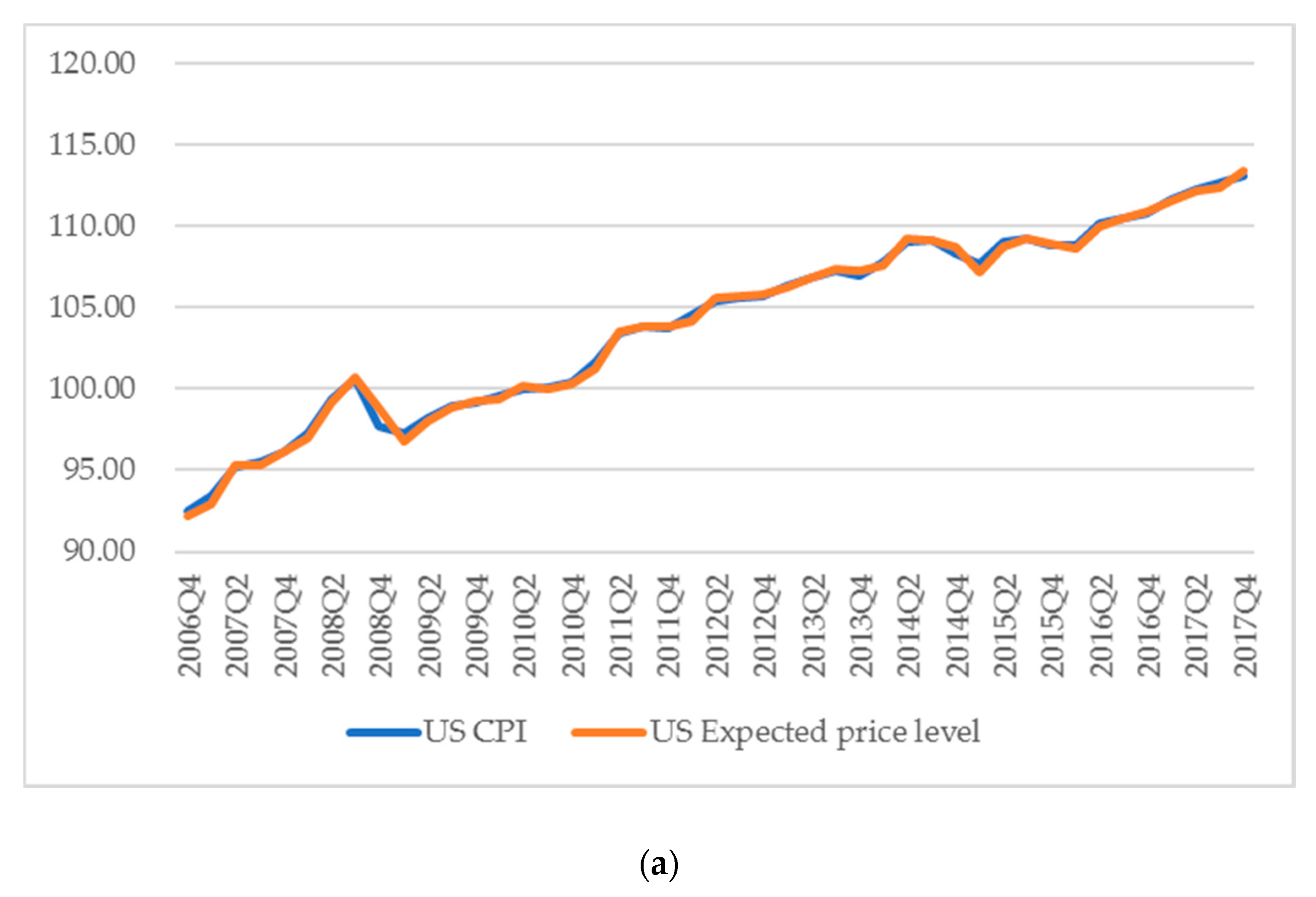

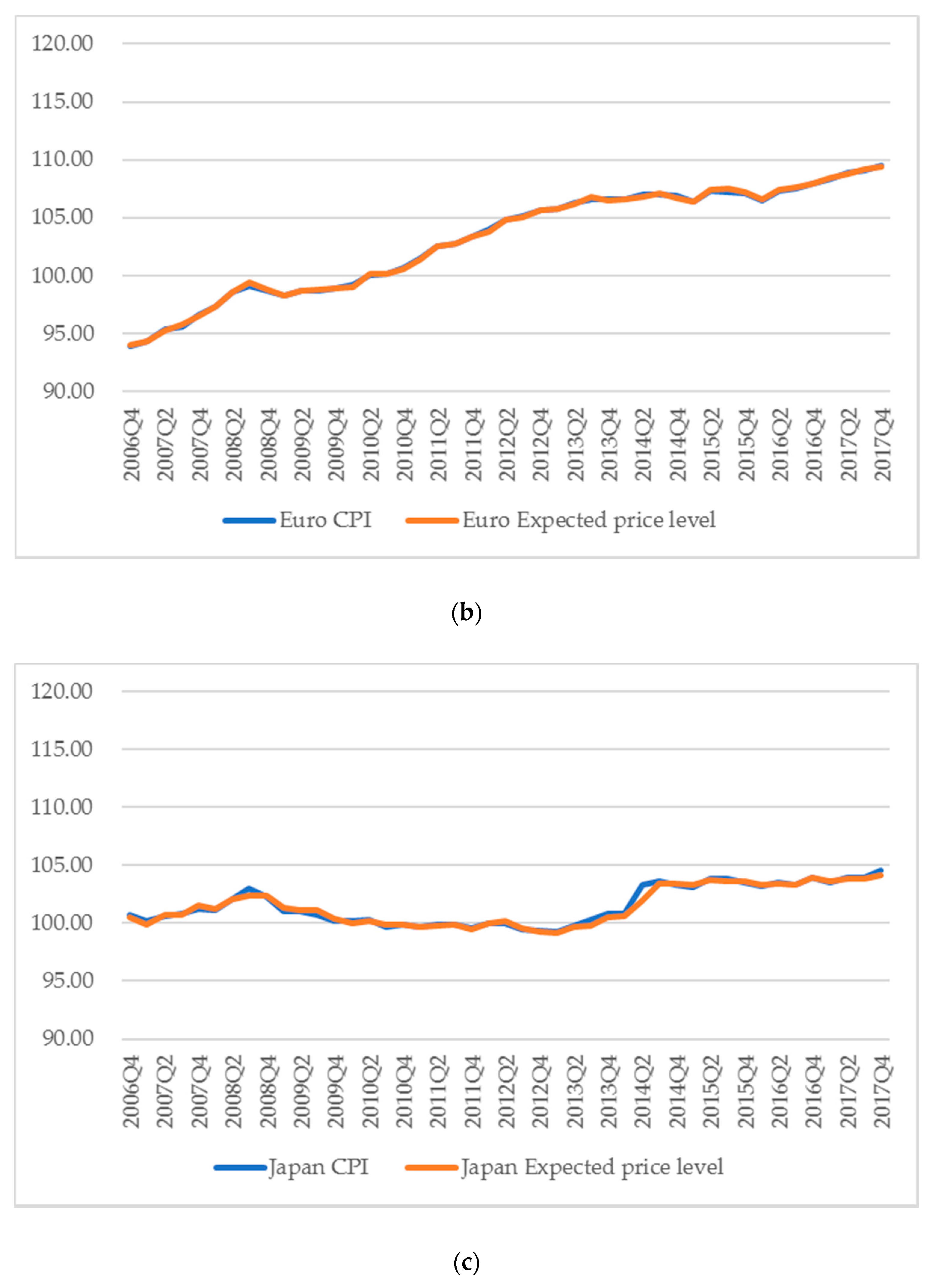

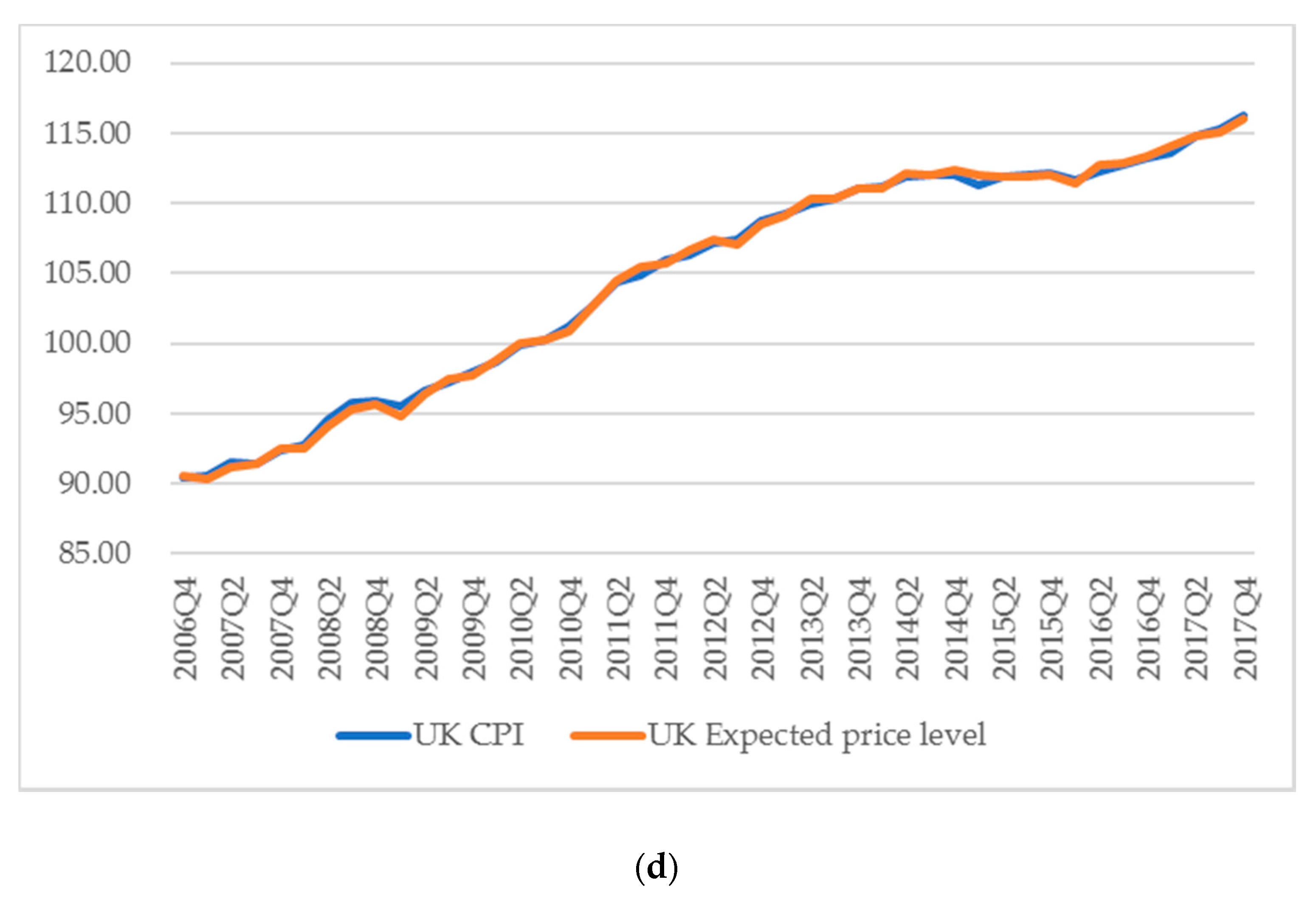

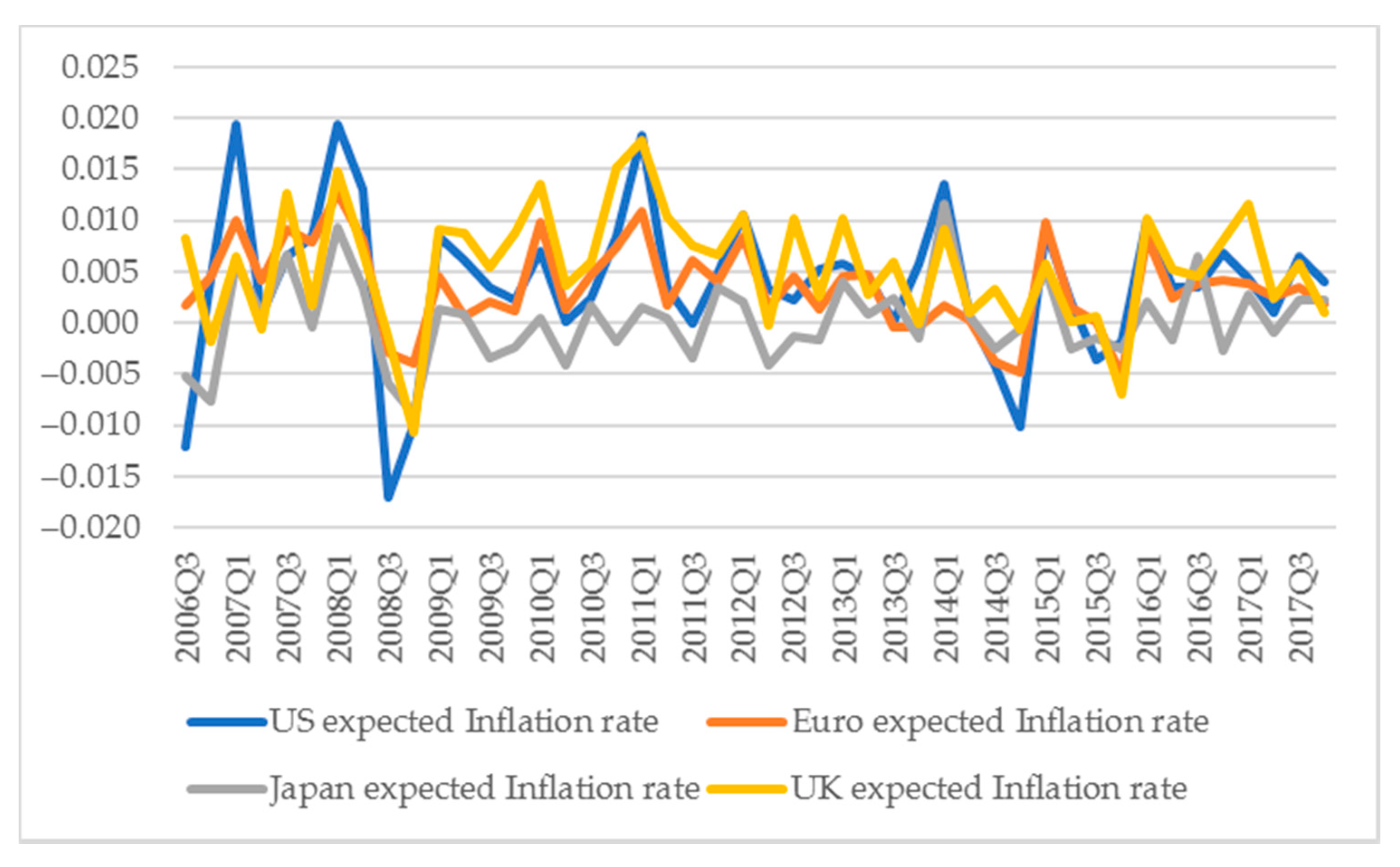

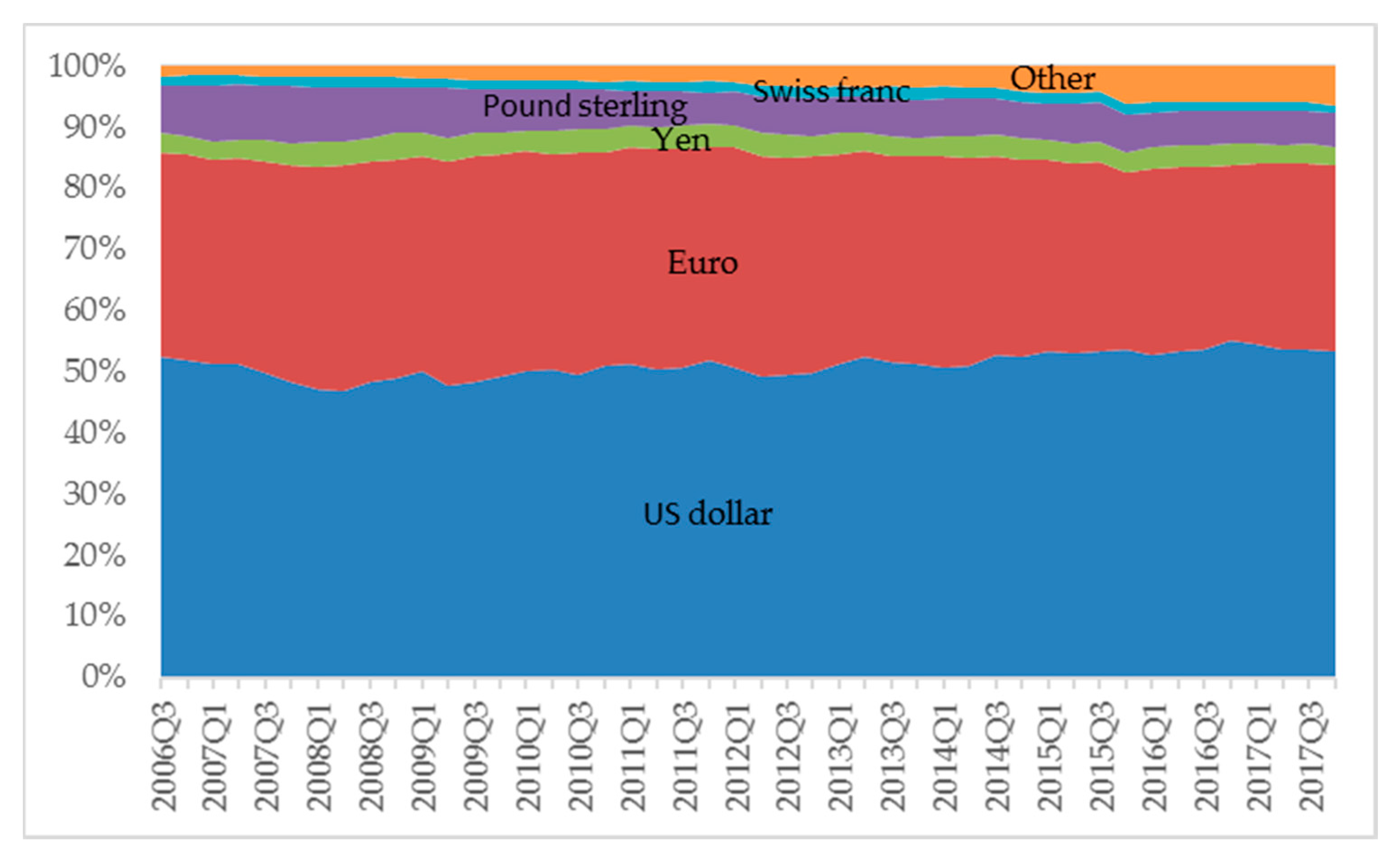

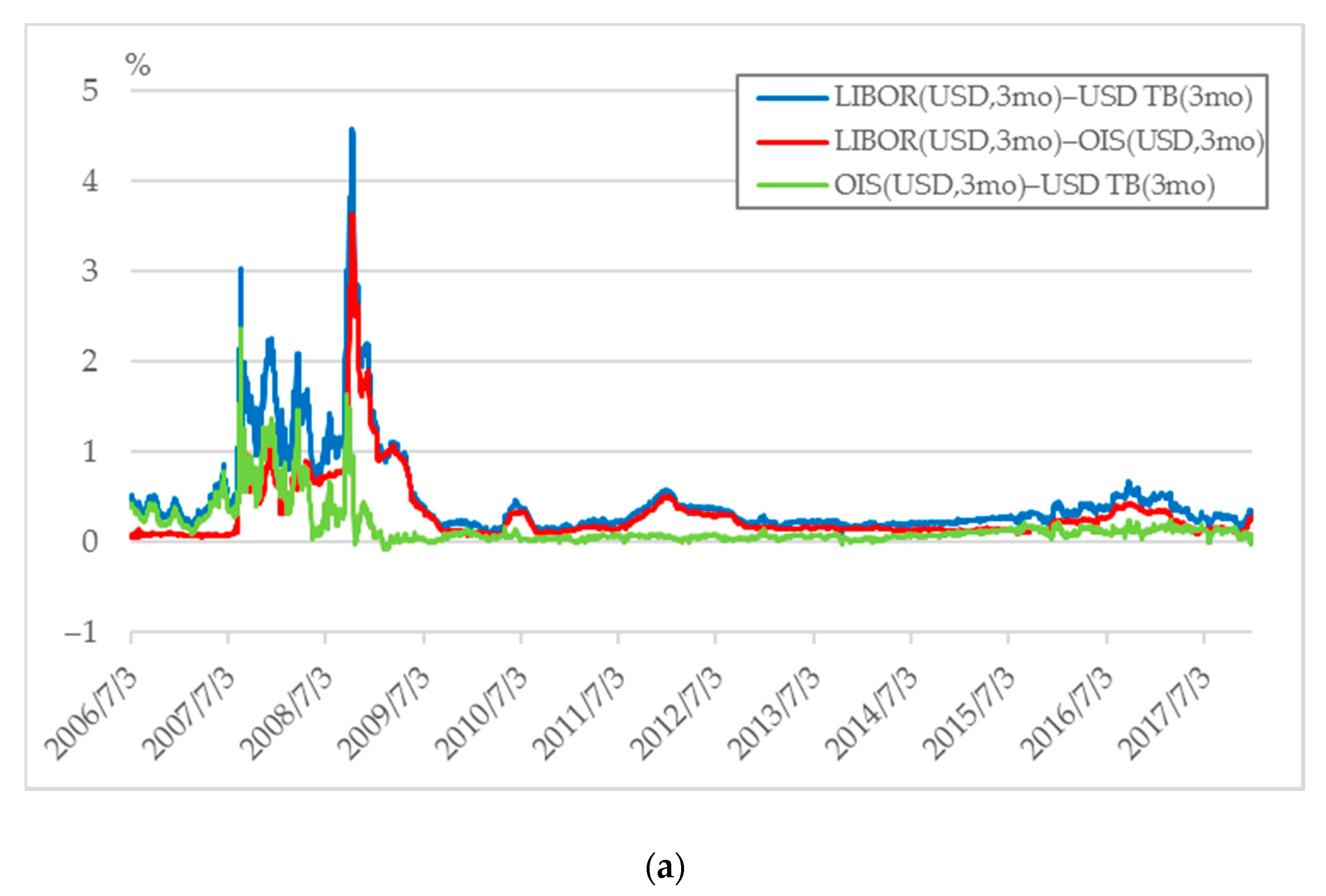

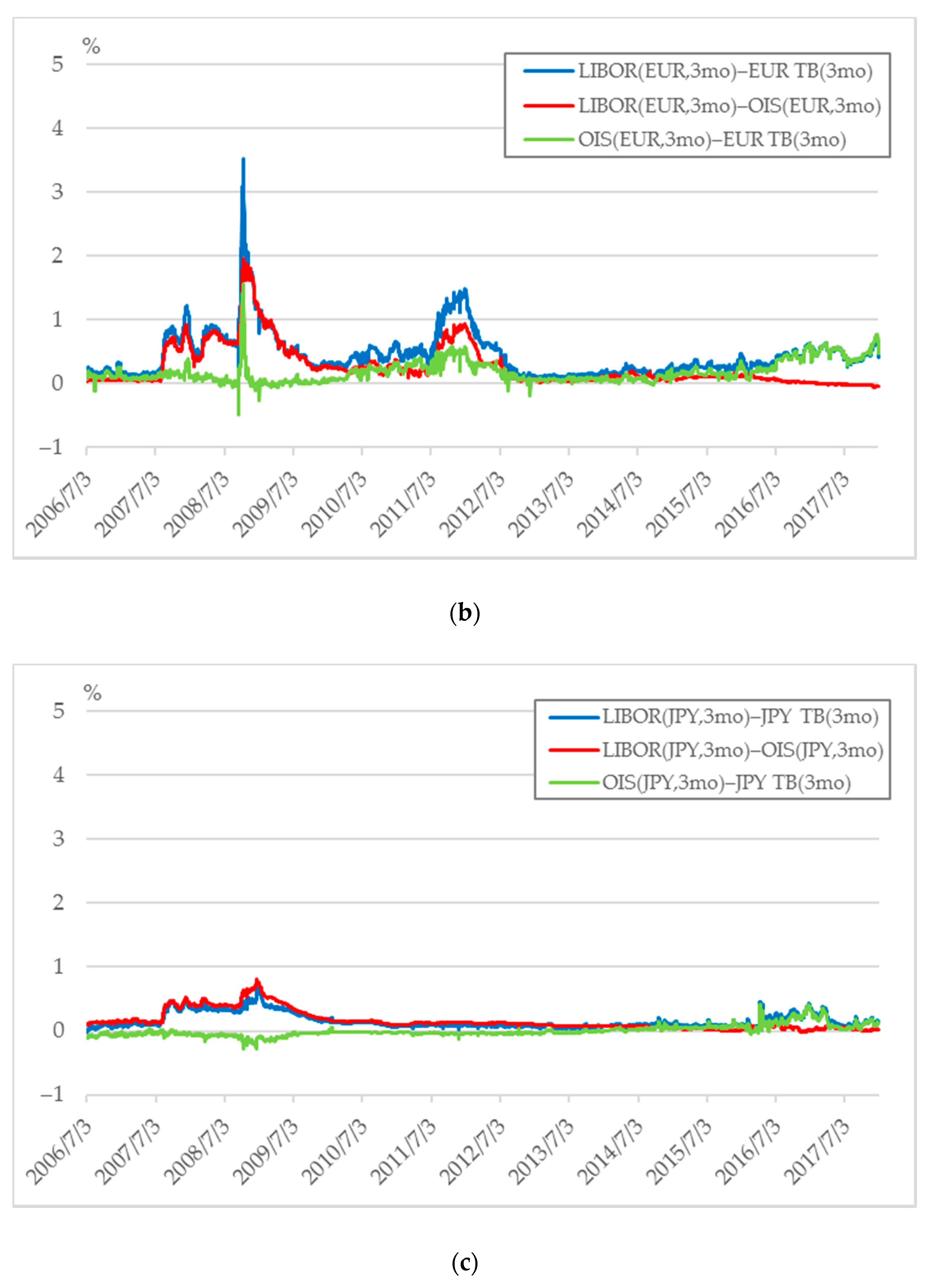

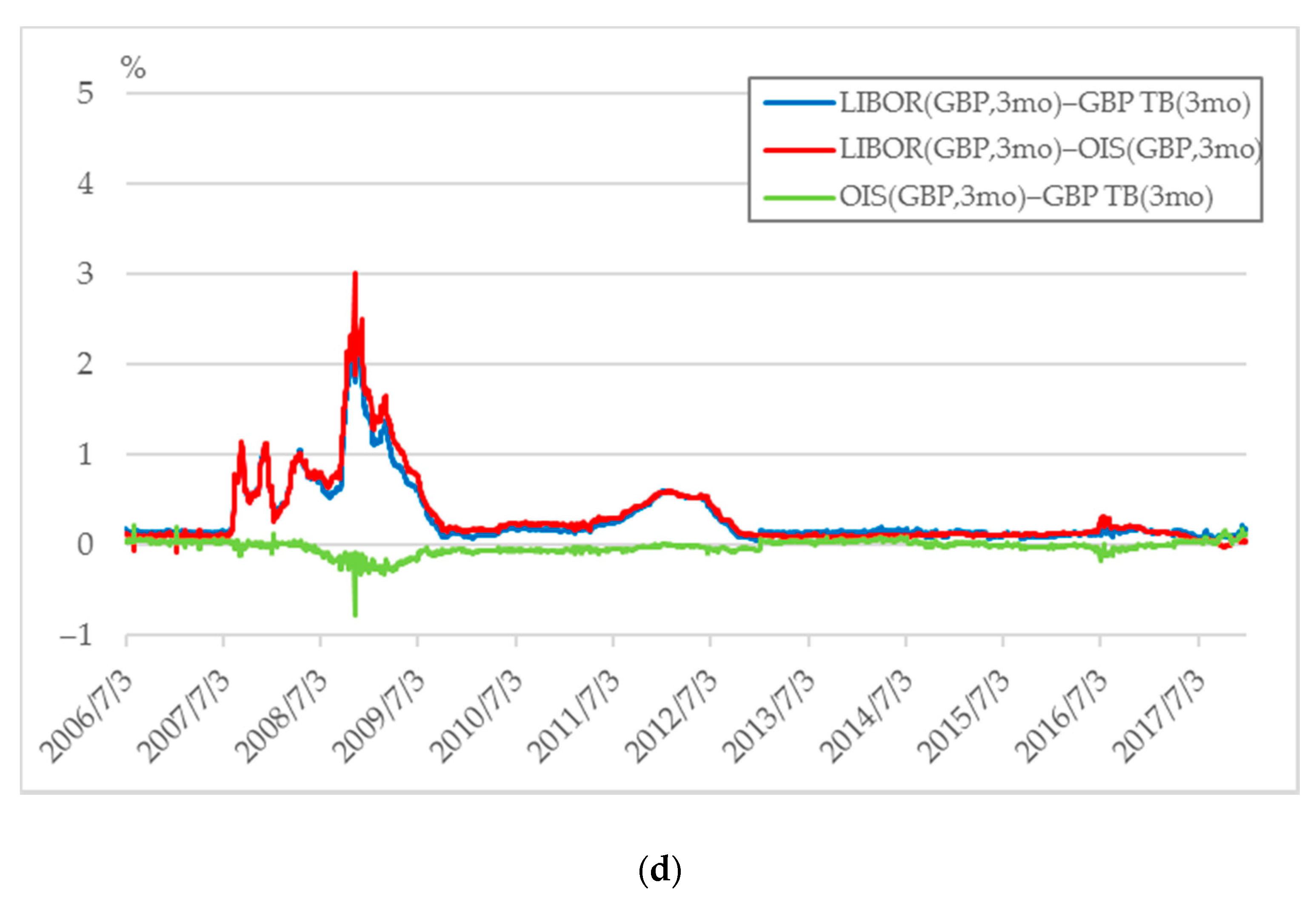

3.2. Data for Estimating Utility of International Currencies

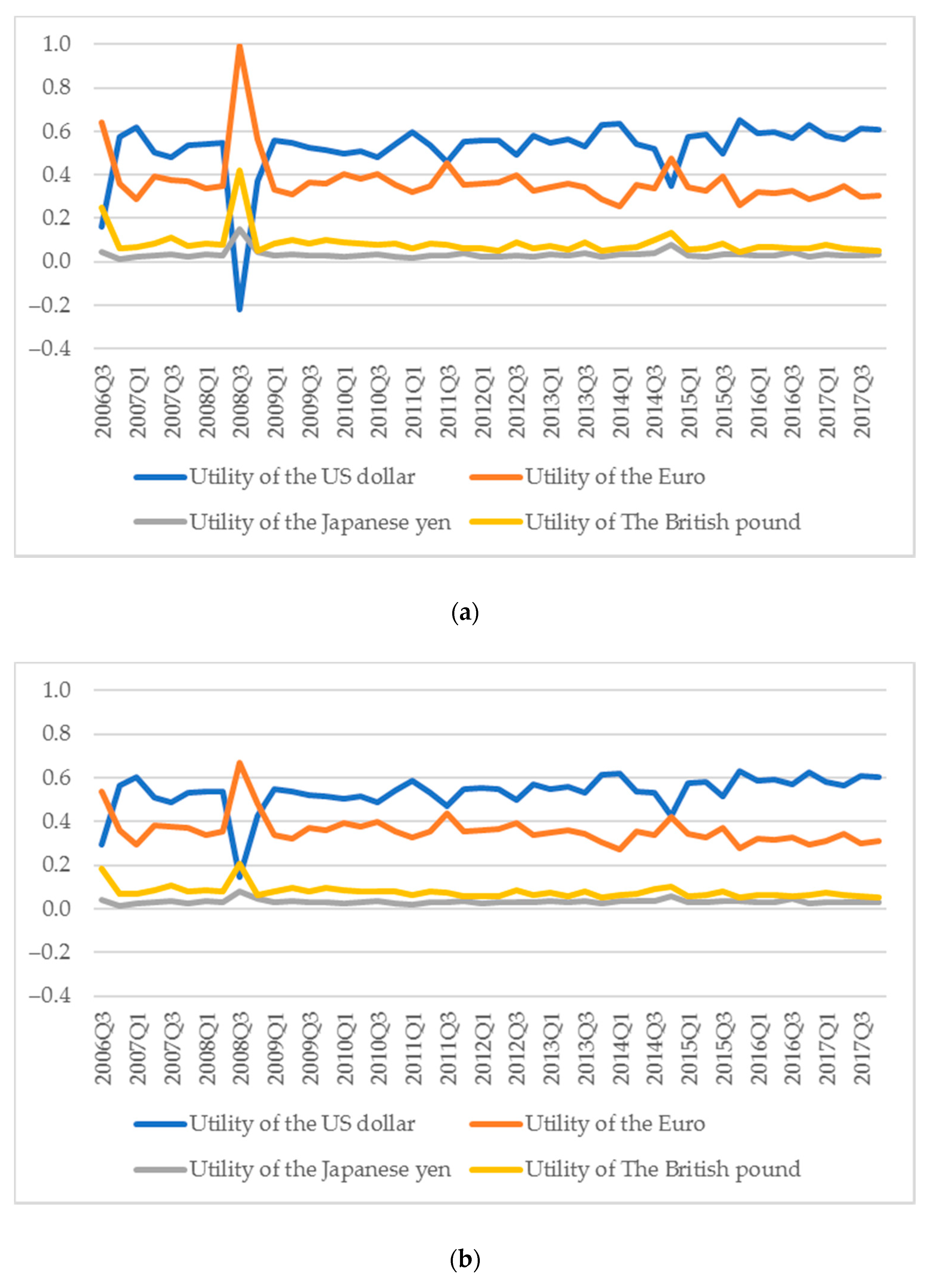

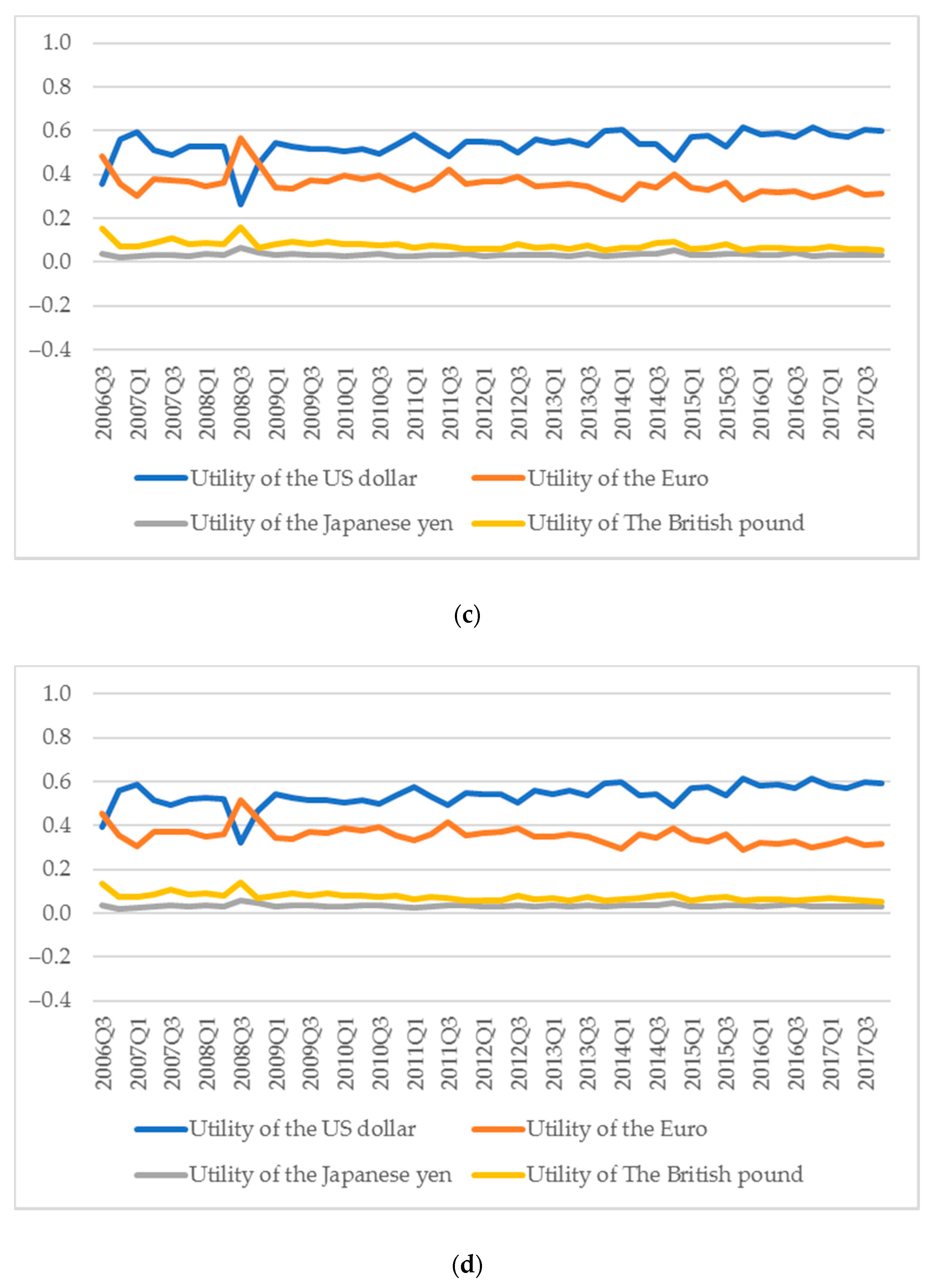

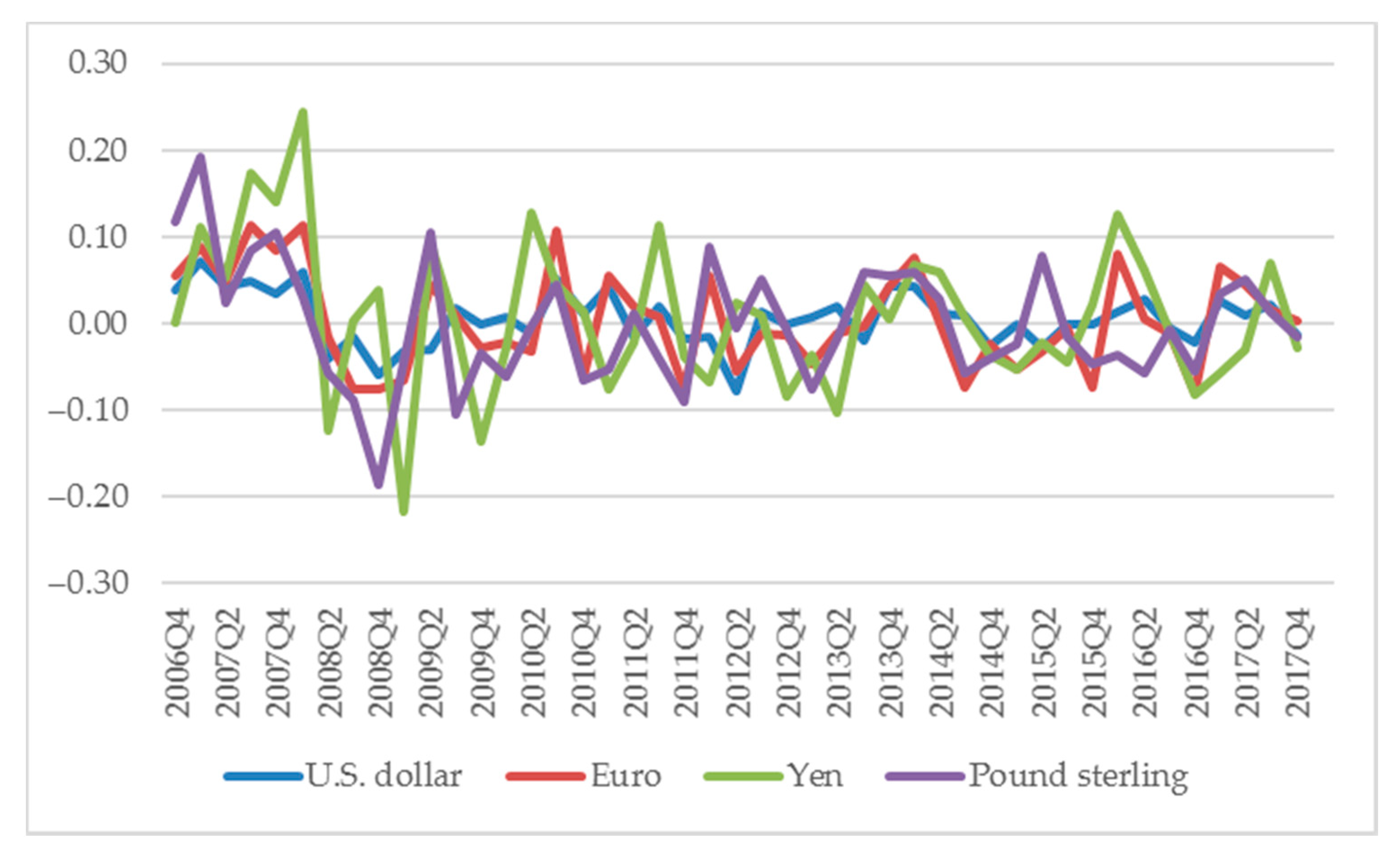

3.3. Movements of Utility of International Currencies

4. Empirical Model

4.1. Determinants of Utility of an International Currency

4.2. A Dynamic Panel Model

5. Sample Period and Data

5.1. Sample Period

5.2. Data for Determinants of Utility of International Currencies

6. Empirical Analysis on Determinants of Utility of International Currencies

6.1. Expected Effect of Determinant on Utility of International Currencies

6.2. Empirical Results

7. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A. Derivation of Equation (1)

References

- Arellano, Manuel, and Stephen Bond. 1991. Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations. The Review of Economic Studies 58: 277–97. [Google Scholar] [CrossRef]

- Blanchard, Olivier J., and Stanley Fischer. 1989. Lectures on Macroeconomics. Cambridge: MIT Press. [Google Scholar]

- Calvo, Guillermo A. 1981. Devaluation: Levels versus Rates. Journal of International Economics 11: 165–72. [Google Scholar] [CrossRef]

- Calvo, Guillermo A. 1985. Currency Substitution and the Real Exchange Rate: The Utility Maximization Approach. Journal of International Money and Finance 4: 175–88. [Google Scholar] [CrossRef]

- Catão, Luis, and Marco Terrones. 2016. Financial De-Dollarization—A Global Perspective and the Peruvian Experience. IMF Working Paper WP/16/97. Washington, DC: International Monetary Fund. [Google Scholar] [CrossRef]

- Chinn, Menzie, and Jeffrey A. Frankel. 2007. Will the Euro Eventually Surpass the Dollar as Leading International Reserve Currency? In G7 Current Account Imbalances: Sustainability and Adjustment. Edited by Richard H. Clarida. Chicago: University of Chicago Press, pp. 283–338. [Google Scholar]

- Chinn, Menzie, and Jeffrey A. Frankel. 2008. Why the Euro Will Rival the Dollar. International Finance 11: 49–73. [Google Scholar] [CrossRef]

- Eichengreen, Barry, Livia Chiţu, and Arnaud Mehl. 2016a. Network Effects, Homogeneous Goods and International Currency Choice: New Evidence on Oil Markets from an Older Era. Canadian Journal of Economics/Revue Canadienne d’économique 49: 173–206. [Google Scholar] [CrossRef]

- Eichengreen, Barry, Livia Chiţu, and Arnaud Mehl. 2016b. Stability or Upheaval? The Currency Composition of International Reserves in the Long Run. IMF Economic Review 64: 354–80. [Google Scholar] [CrossRef]

- European Central Bank. 2015. The International Role of the Euro. Frankfurt: European Central Bank. [Google Scholar]

- Fama, Eugene F., and Michael R. Gibbons. 1984. A Comparison of Inflation Forecasts. Journal of Monetary Economics 13: 327–48. [Google Scholar] [CrossRef]

- Goldberg, Linda S., and Cédric Tille. 2008. Vehicle Currency Use in International Trade. Journal of International Economics 76: 177–92. [Google Scholar] [CrossRef]

- Honohan, Patrick. 2008. The Retreat of Deposit Dollarization. International Finance 11: 247–68. [Google Scholar] [CrossRef]

- Ito, Takatoshi, Satoshi Koibuchi, Kiyotaka Sato, and Junko Shimizu. 2013. Choice of Invoicing Currency: New Evidence from a Questionnaire Survey of Japanese Export Firms. Discussion Paper. Research Institute of Economy, Trade and Industry (RIETI) Discussion Paper Series, No. 13-E-034. Available online: https://econpapers.repec.org/paper/etidpaper/13034.htm (accessed on 7 January 2019).

- Kamps, Annette. 2006. The Euro as Invoicing Currency in International Trade (August 2006). ECB Working Paper No. 665. Available online: https://papers.ssrn.com/abstract=926402 (accessed on 7 January 2019).

- Kannan, Prakash. 2009. On the Welfare Benefits of an International Currency. European Economic Review 53: 588–606. [Google Scholar] [CrossRef]

- Krugman, Paul R. 1984. The International Role of the Dollar: Theory and Prospect. In Exchange Rate Theory and Practice. Chicago: University of Chicago Press, pp. 261–78. [Google Scholar]

- Matsuyama, Kiminori, Nobuhiro Kiyotaki, and Akihiko Matsui. 1993. Toward a Theory of International Currency. The Review of Economic Studies 60: 283–307. [Google Scholar] [CrossRef]

- Obstfeld, Maurice. 1981. Macroeconomic Policy, Exchange-Rate Dynamics, and Optimal Asset Accumulation. Journal of Political Economy 89: 1142–61. [Google Scholar] [CrossRef]

- Ogawa, Eiji, and Makoto Muto. 2017a. Inertia of the US Dollar as a Key Currency Through the Two Crises. Emerging Markets Finance and Trade 53: 2706–24. [Google Scholar] [CrossRef]

- Ogawa, Eiji, and Makoto Muto. 2017b. Declining Japanese Yen in the Changing International Monetary System. East Asian Economic Review 21: 317–42. [Google Scholar] [CrossRef]

- Ogawa, Eiji, and Yuri Nagataki Sasaki. 1998. Inertia in the Key Currency. Japan and The World Economy 10: 421–39. [Google Scholar] [CrossRef]

- Sidrauski, Miguel. 1967. Rational Choice and Patterns of Growth in a Monetary Economy. The American Economic Review 57: 534–44. [Google Scholar]

- Trejos, Alberto, and Randall Wright. 1996. Search—Theoretic Models of International Currency. Review 78. [Google Scholar] [CrossRef]

| 1 | See Appendix A for derivation of Equation (1). We suppose that γ might change over time because we have an important objective to investigate what factors influence utility of the currency γ during the analytical period though it seems to be stable as an exogenous. |

| 2 | An arithmetic average of real economic growth rates compared to the same quarter of previous year among the three countries and the region (the United States, the euro zone, Japan, and the United Kingdom) was about 1.1% from 2006Q3 to 2017Q4. However, if we exclude a period of 2008Q2 to 2010Q1 where the growth rate has greatly declined due to the global financial crisis, it was about 1.8%. Given the real economic growth rates, our setting the values as a real interest rate seem to be reasonable. The real economic growth rate data obtained from the OECD website. |

| 3 | We used a method of Fama and Gibbons (1984) to estimate expected inflation rates. However, a sample period is much shorter than that by using the ARIMA model due to data constraints if we use the method. In addition, we could not use it because expected inflation rate of TIPS and survey data was only long-term expectation data, and Japan’s TIPS data was a small sample. For those reasons, we choose to use the ARIMA model using CPI. |

| 4 | The FRB concluded new currency swap arrangements with the ECB and the Swiss National Bank on 12 December 2007. Afterwards, it increased amount of currency swap arrangements and concluded them with other central banks. |

| 5 | See Ogawa and Muto (2017a) for the detailed derivation. |

| 4 Countries | United States | Euro Area | Japan | United Kingdom | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Mean | SD | Mean | SD | Mean | SD | Mean | SD | Mean | SD | |

| ΔUtility of Currency (1.5%)t | −0.0001 | 0.1153 | 0.0010 | 0.1666 | −0.0015 | 0.1375 | 0.0004 | 0.0280 | −0.0001 | −0.0001 |

| ΔUtility of Currency (2.0%)t | 0.0000 | 0.0614 | 0.0010 | 0.0921 | −0.0013 | 0.0743 | 0.0003 | 0.0127 | −0.0002 | −0.0002 |

| ΔUtility of Currency (2.5%)t | 0.0000 | 0.0441 | 0.0010 | 0.0665 | −0.0012 | 0.0537 | 0.0003 | 0.0092 | −0.0003 | −0.0003 |

| ΔUtility of Currency (3.0%)t | 0.0000 | 0.0352 | 0.0010 | 0.0530 | −0.0011 | 0.0430 | 0.0002 | 0.0076 | −0.0003 | −0.0003 |

| ΔUtility of Currency (1.5%)t-1 | −0.0005 | 0.1221 | 0.0093 | 0.1778 | −0.0068 | 0.1437 | −0.0004 | 0.0285 | −0.0043 | −0.0043 |

| ΔUtility of Currency (2.0%)t-1 | −0.0003 | 0.0666 | 0.0063 | 0.1007 | −0.0044 | 0.0787 | −0.0002 | 0.0132 | −0.0028 | −0.0028 |

| ΔUtility of Currency (2.5%)t-1 | −0.0002 | 0.0481 | 0.0049 | 0.0730 | −0.0033 | 0.0569 | −0.0002 | 0.0097 | −0.0021 | −0.0021 |

| ΔUtility of Currency (3.0%)t-1 | −0.0001 | 0.0383 | 0.0041 | 0.0582 | −0.0027 | 0.0454 | −0.0001 | 0.0080 | −0.0018 | −0.0018 |

| ΔLiquidity Risk Premiumt | 0.0012 | 0.0754 | −0.0036 | 0.1111 | 0.0054 | 0.0873 | 0.0028 | 0.0429 | 0.0004 | 0.0003 |

| ΔMoney Stock Sharet | 0.0000 | 0.0087 | 0.0012 | 0.0040 | 0.0003 | 0.0108 | −0.0009 | 0.0122 | −0.0009 | −0.0007 |

| ΔRelative Nominal Economic Growtht | 0.0000 | 3.9457 | −0.0054 | 1.4781 | 0.0199 | 3.4264 | 0.0064 | 5.0524 | −0.0370 | −0.0208 |

| ΔRelative Real Economic Growtht | 0.0000 | 6.6128 | 0.0058 | 3.2296 | −0.0024 | 5.4797 | −0.0083 | 10.7073 | 0.0055 | 0.0049 |

| ΔGDP Sharet | 0.0000 | 0.0059 | 0.0012 | 0.0074 | −0.0004 | 0.0049 | −0.0007 | 0.0077 | −0.0002 | −0.0002 |

| ΔCapitalization Sharet | 0.0000 | 0.0042 | 0.0025 | 0.0044 | −0.0017 | 0.0046 | −0.0001 | 0.0039 | −0.0007 | −0.0007 |

| ΔTotal Trade Sharet | 0.0000 | 0.0068 | 0.0005 | 0.0072 | −0.0002 | 0.0102 | −0.0002 | 0.0050 | −0.0001 | −0.0001 |

| ΔTotal Export Sharet | 0.0000 | 0.0060 | 0.0007 | 0.0044 | −0.0002 | 0.0088 | −0.0004 | 0.0061 | −0.0002 | −0.0002 |

| ΔCapital Flow Sharet | 0.0000 | 0.0049 | 0.0010 | 0.0060 | 0.0006 | 0.0060 | 0.0004 | 0.0028 | −0.0020 | −0.0020 |

| ΔSD of Nominal Effective Exchange Ratet | 0.0082 | 0.9941 | 0.0107 | 0.6415 | 0.0016 | 0.6647 | 0.0046 | 1.3446 | 0.0089 | 0.0159 |

| ΔLN Nominal Effective Exchange Ratet | −0.0005 | 0.0340 | 0.0023 | 0.0281 | 0.0007 | 0.0227 | 0.0020 | 0.0494 | −0.0075 | −0.0071 |

| ΔLN Real Effective Exchange Ratet | −0.0023 | 0.0339 | 0.0015 | 0.0272 | −0.0017 | 0.0227 | −0.0029 | 0.0491 | −0.0065 | −0.0060 |

| number of observations | 172 | 43 | 43 | 43 | 43 | |||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | |

| ΔUtility of international currencyit-1 | 0.14 | 0.23 | 0.13 | 0.23 * | 0.16 | 0.26 * | 0.16 | 0.26 * | 0.15 | 0.24 * | 0.14 | 0.24 * | 0.21 ** | 0.20 ** | 0.20 ** | 0.21 ** | 0.21 ** | 0.06 |

| (0.30) | (0.10) | (0.28) | (0.09) | (0.25) | (0.07) | (0.22) | (0.05) | (0.28) | (0.08) | (0.27) | (0.07) | (0.01) | (0.05) | (0.04) | (0.02) | (0.02) | (0.43) | |

| ΔLiquidity risk premiumit | −0.21 *** | −0.24 *** | −0.21 *** | −0.23 *** | −0.22 *** | −0.25 *** | −0.22 *** | −0.24 *** | −0.22 *** | −0.25 *** | −0.22 *** | −0.24 *** | −0.19 *** | −0.21 *** | −0.21 *** | −0.22 *** | −0.21 *** | −0.23 *** |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| ΔMoney stock shareit | 3.50 * | 3.55 * | 3.57 * | 3.64 * | 3.36 | 3.49 | 3.44 | 3.58 | 3.50 | 3.62 | 3.60 | 3.72 * | 0.85 | |||||

| (0.07) | (0.06) | (0.07) | (0.06) | (0.15) | (0.13) | (0.14) | (0.12) | (0.11) | (0.10) | (0.10) | (0.09) | (0.19) | ||||||

| ΔRelative nominal economic growthit | −0.0007 | −0.0015 | −0.0008 | −0.0017 | −0.0009 | −0.0017 | −0.0020 | |||||||||||

| (0.63) | (0.35) | (0.59) | (0.33) | (0.58) | (0.33) | (0.32) | ||||||||||||

| ΔRelative real economic growthit | −0.0005 | −0.0006 | −0.0005 | −0.0006 | −0.0006 | −0.0006 | −0.0003 | |||||||||||

| (0.46) | (0.30) | (0.44) | (0.25) | (0.41) | (0.23) | (0.57) | ||||||||||||

| ΔGDP shareit | −2.97 | −3.71 | −2.97 | −3.66 | −3.69 | −4.47 | −3.62 | −4.38 * | −3.46 | −4.23 | −3.39 | −4.14 | −0.31 | |||||

| (0.32) | (0.17) | (0.31) | (0.15) | (0.24) | (0.11) | (0.23) | (0.10) | (0.26) | (0.12) | (0.26) | (0.11) | (0.67) | ||||||

| ΔCapitalization shareit | −0.02 | −0.29 | −0.04 | −0.28 | 0.13 | −0.15 | 0.07 | −0.18 | −0.03 | −0.30 | −0.10 | −0.35 | −0.03 | |||||

| (0.98) | (0.84) | (0.96) | (0.84) | (0.90) | (0.93) | (0.94) | (0.91) | (0.98) | (0.85) | (0.90) | (0.82) | (0.88) | ||||||

| ΔTotal trade shareit | −5.78 *** | −5.83 *** | −5.71 *** | −5.74 *** | −5.72 *** | −5.75 *** | −4.67 *** | |||||||||||

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | ||||||||||||

| ΔTotal export shareit | −3.45 * | −3.56 * | −3.41 * | −3.50 * | −3.48 * | −3.56 * | ||||||||||||

| (0.07) | (0.08) | (0.08) | (0.08) | (0.08) | (0.08) | |||||||||||||

| ΔCapital flow shareit | 2.36 *** | 2.36 ** | 2.34 *** | 2.30 ** | 2.85 *** | 2.93 *** | 2.78 *** | 2.83 ** | 2.83 *** | 2.91 ** | 2.76 *** | 2.81 ** | ||||||

| (0.00) | (0.02) | (0.00) | (0.03) | (0.00) | (0.01) | (0.00) | (0.02) | (0.00) | (0.02) | (0.00) | (0.04) | |||||||

| ΔSD of Nominal effective exchange rateit | −0.01 | −0.01 ** | −0.01 | −0.01 ** | −0.02 | −0.02 | −0.02 | −0.02 | −0.02 | −0.01 | ||||||||

| (0.16) | (0.04) | (0.16) | (0.04) | (0.25) | (0.24) | (0.25) | (0.26) | (0.23) | (0.36) | |||||||||

| ΔLN Nominal effective exchange rateit | 0.15 | 0.13 | 0.14 | 0.13 | ||||||||||||||

| (0.65) | (0.72) | (0.65) | (0.71) | |||||||||||||||

| ΔLN Real effective exchange rateit | 0.05 | 0.04 | 0.05 | 0.04 | ||||||||||||||

| (0.87) | (0.92) | (0.89) | (0.91) | |||||||||||||||

| Sargan test | 0.95 | 0.97 | 0.95 | 0.97 | 0.99 | 0.99 | 0.99 | 0.99 | 0.98 | 0.99 | 0.98 | 0.99 | 0.97 | 0.98 | 0.98 | 0.97 | 0.98 | 0.87 |

| AR(1) serial correlation test | 0.08 * | 0.10 * | 0.08 * | 0.10 * | 0.08 * | 0.10 | 0.08 * | 0.10 | 0.08 * | 0.10 * | 0.08 * | 0.10 * | 0.09 * | 0.10 * | 0.10 * | 0.10 * | 0.10 | 0.08 * |

| AR(2) serial correlation test | 0.47 | 0.20 | 0.58 | 0.22 | 0.97 | 0.23 | 0.88 | 0.27 | 0.86 | 0.23 | 0.95 | 0.26 | 0.18 | 0.19 | 0.19 | 0.18 | 0.18 | 0.13 |

| 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 | 31 | 32 | 33 | 34 | 35 | 36 | |

| ΔUtility of international currencyit-1 | 0.15 ** | 0.22 ** | 0.21 ** | 0.23 ** | 0.23 ** | 0.23 ** | 0.23 ** | 0.07 | 0.16 * | 0.25 *** | 0.20 ** | 0.22 ** | 0.22 ** | 0.23 ** | 0.23 ** | 0.07 | 0.16 * | 0.25 ** |

| (0.05) | (0.01) | (0.04) | (0.02) | (0.02) | (0.02) | (0.04) | (0.50) | (0.09) | (0.01) | (0.04) | (0.03) | (0.03) | (0.02) | (0.04) | (0.51) | (0.10) | (0.01) | |

| ΔLiquidity risk premiumit | −0.25 *** | −0.21 *** | −0.20 *** | −0.21 *** | −0.20 *** | −0.21 *** | −0.20 *** | −0.22 *** | −0.24 *** | −0.21 *** | −0.20 *** | −0.21 *** | −0.21 *** | −0.21 *** | −0.20 *** | −0.22 *** | −0.24 *** | −0.22 *** |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| ΔMoney stock shareit | 0.61 | 0.90 | ||||||||||||||||

| (0.47) | (0.23) | |||||||||||||||||

| ΔRelative nominal economic growthit | −0.0019 | −0.0020 | ||||||||||||||||

| (0.35) | (0.34) | |||||||||||||||||

| ΔRelative real economic growthit | −0.0002 | −0.0002 | ||||||||||||||||

| (0.56) | (0.55) | |||||||||||||||||

| ΔGDP shareit | −1.83 *** | −1.68 ** | ||||||||||||||||

| (0.00) | (0.01) | |||||||||||||||||

| ΔCapitalization shareit | −0.31 | −0.23 | ||||||||||||||||

| (0.57) | (0.71) | |||||||||||||||||

| ΔTotal trade shareit | −5.57 *** | −5.52 *** | ||||||||||||||||

| (0.00) | (0.00) | |||||||||||||||||

| ΔTotal export shareit | −2.70 | −3.56 * | −3.55 * | |||||||||||||||

| (0.11) | (0.07) | (0.06) | ||||||||||||||||

| ΔCapital flow shareit | 1.00 | 1.05 | 1.21 * | |||||||||||||||

| (0.26) | (0.15) | (0.06) | ||||||||||||||||

| ΔSD of Nominal effective exchange rateit | −0.01 | −0.02 | ||||||||||||||||

| (0.26) | (0.16) | |||||||||||||||||

| ΔLN Nominal effective exchange rateit | 0.01 | 0.14 | 0.17 | 0.45 | 0.17 | 0.43 | 0.33 | 0.11 | ||||||||||

| (0.97) | (0.58) | (0.50) | (0.10) | (0.51) | (0.18) | (0.29) | (0.67) | |||||||||||

| ΔLN Real effective exchange rateit | −0.09 | 0.09 | 0.12 | 0.39 | 0.12 | 0.40 | 0.30 | 0.04 | ||||||||||

| (0.78) | (0.72) | (0.62) | (0.15) | (0.64) | (0.19) | (0.32) | (0.86) | |||||||||||

| Sargan test | 0.94 | 0.98 | 0.98 | 1.00 | 1.00 | 1.00 | 1.00 | 0.98 | 0.99 | 1.00 | 0.97 | 1.00 | 1.00 | 1.00 | 1.00 | 0.98 | 0.99 | 1.00 |

| AR(1) serial correlation test | 0.09 * | 0.09 * | 0.09 * | 0.10 * | 0.10 * | 0.10 | 0.10 * | 0.08 * | 0.09 * | 0.09 * | 0.09 * | 0.10 * | 0.10 * | 0.10 | 0.10 | 0.08 * | 0.09 * | 0.09 * |

| AR(2) serial correlation test | 0.16 | 0.20 | 0.21 | 0.26 | 0.25 | 0.32 | 0.24 | 0.51 | 0.16 | 0.27 | 0.21 | 0.26 | 0.25 | 0.32 | 0.24 | 0.47 | 0.16 | 0.26 |

| 37 | 38 | 39 | 40 | 41 | 42 | 43 | 44 | 45 | 46 | 47 | 48 | 49 | 50 | 51 | 52 | 53 | 54 | |

| ΔUtility of international currencyit-1 | 0.20 | 0.30 | 0.19 | 0.30 | 0.25 | 0.37 | 0.25 | 0.37 | 0.20 | 0.31 | 0.19 | 0.30 | 0.31 *** | 0.29 ** | 0.28 ** | 0.31 ** | 0.32 ** | 0.12 |

| (0.38) | (0.22) | (0.35) | (0.20) | (0.32) | (0.18) | (0.28) | (0.14) | (0.35) | (0.18) | (0.31) | (0.14) | (0.01) | (0.03) | (0.02) | (0.01) | (0.01) | (0.20) | |

| ΔLiquidity risk premiumit | −0.08 *** | −0.10 *** | −0.08 *** | −0.10 *** | −0.10 *** | −0.11 *** | −0.10 *** | −0.11 *** | −0.10 *** | −0.11 *** | −0.09 *** | −0.11 *** | −0.07 *** | −0.08 *** | −0.08 *** | −0.08 *** | −0.08 *** | −0.09 *** |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| ΔMoney stock shareit | 1.54 | 1.59 | 1.57 | 1.64 | 1.40 | 1.54 | 1.44 | 1.59 | 1.41 | 1.54 | 1.45 | 1.59 | 0.58 ** | |||||

| (0.17) | (0.16) | (0.16) | (0.13) | (0.36) | (0.32) | (0.34) | (0.29) | (0.30) | (0.27) | (0.28) | (0.23) | (0.05) | ||||||

| ΔRelative nominal economic growthit | −0.0007 | −0.0012 | −0.0008 | −0.0014 | −0.0008 | −0.0013 | −0.0014 | |||||||||||

| (0.46) | (0.27) | (0.48) | (0.28) | (0.47) | (0.27) | (0.24) | ||||||||||||

| ΔRelative real economic growthit | −0.0002 | −0.0003 | −0.0002 | −0.0003 | −0.0002 | −0.0003 | −0.0001 | |||||||||||

| (0.56) | (0.40) | (0.54) | (0.34) | (0.51) | (0.30) | (0.71) | ||||||||||||

| ΔGDP shareit | −0.90 | −1.36 | −0.86 | −1.29 | −1.51 | −2.00 | −1.46 | −1.94 | −1.19 | −1.66 | −1.14 | −1.59 | 0.20 | |||||

| (0.60) | (0.38) | (0.59) | (0.35) | (0.42) | (0.25) | (0.40) | (0.21) | (0.46) | (0.25) | (0.44) | (0.22) | (0.43) | ||||||

| ΔCapitalization shareit | 0.09 | −0.08 | 0.10 | −0.05 | 0.27 | 0.09 | 0.25 | 0.09 | 0.12 | −0.05 | 0.09 | −0.06 | 0.32 | |||||

| (0.85) | (0.93) | (0.83) | (0.95) | (0.67) | (0.93) | (0.68) | (0.93) | (0.80) | (0.96) | (0.83) | (0.94) | (0.19) | ||||||

| ΔTotal trade shareit | −3.45 *** | −3.51 *** | −3.37 *** | −3.42 *** | −3.46 *** | −3.51 *** | −2.61 *** | |||||||||||

| (0.00) | (0.00) | (0.01) | (0.00) | (0.01) | (0.00) | (0.00) | ||||||||||||

| ΔTotal export shareit | −2.12 * | −2.23 * | −1.97 * | −2.06 * | −2.13 * | −2.22 * | ||||||||||||

| (0.06) | (0.05) | (0.07) | (0.05) | (0.06) | (0.05) | |||||||||||||

| ΔCapital flow shareit | 1.32 *** | 1.35 *** | 1.28 *** | 1.28 *** | 1.63 *** | 1.71 *** | 1.57 *** | 1.62 *** | 1.51 *** | 1.59 *** | 1.46 *** | 1.50 *** | ||||||

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.01) | |||||||

| ΔSD of Nominal effective exchange rateit | 0.00 | −0.01 ** | −0.01 | −0.01 ** | −0.01 | −0.01 | −0.01 | −0.01 | −0.01 | −0.01 | ||||||||

| (0.18) | (0.03) | (0.18) | (0.03) | (0.24) | (0.26) | (0.26) | (0.25) | (0.21) | (0.40) | |||||||||

| ΔLN Nominal effective exchange rateit | 0.14 | 0.12 | 0.15 | 0.13 | ||||||||||||||

| (0.49) | (0.60) | (0.47) | (0.57) | |||||||||||||||

| ΔLN Real effective exchange rateit | 0.08 | 0.05 | 0.08 | 0.06 | ||||||||||||||

| (0.71) | (0.82) | (0.69) | (0.79) | |||||||||||||||

| Sargan test | 0.80 | 0.88 | 0.80 | 0.89 | 0.94 | 0.97 | 0.95 | 0.98 | 0.84 | 0.92 | 0.84 | 0.92 | 0.91 | 0.89 | 0.89 | 0.91 | 0.92 | 0.51 |

| AR(1) serial correlation test | 0.09 * | 0.13 | 0.09 * | 0.13 | 0.11 | 0.15 | 0.11 | 0.15 | 0.10 * | 0.13 | 0.09 * | 0.13 | 0.10 | 0.12 | 0.12 | 0.11 | 0.12 | 0.11 |

| AR(2) serial correlation test | 0.55 | 0.26 | 0.62 | 0.27 | 0.99 | 0.23 | 0.91 | 0.23 | 0.70 | 0.22 | 0.77 | 0.22 | 0.22 | 0.21 | 0.20 | 0.21 | 0.21 | 0.16 |

| 55 | 56 | 57 | 58 | 59 | 60 | 61 | 62 | 63 | 64 | 65 | 66 | 67 | 68 | 69 | 70 | 71 | 72 | |

| ΔUtility of international currencyit-1 | 0.22 ** | 0.34 ** | 0.31 ** | 0.36 *** | 0.36 *** | 0.37 *** | 0.38 ** | 0.16 | 0.27 * | 0.40 *** | 0.29 ** | 0.35 *** | 0.35 *** | 0.36 *** | 0.37 ** | 0.16 | 0.26 * | 0.40 ** |

| (0.03) | (0.01) | (0.01) | (0.00) | (0.00) | (0.00) | (0.01) | (0.24) | (0.05) | (0.01) | (0.01) | (0.00) | (0.00) | (0.00) | (0.02) | (0.25) | (0.06) | (0.01) | |

| ΔLiquidity risk premiumit | −0.09 *** | −0.09 *** | −0.08 *** | −0.09 *** | −0.09 *** | −0.08 *** | −0.09 *** | −0.09 *** | −0.10 *** | −0.10 *** | −0.08 *** | −0.09 *** | −0.09 *** | −0.09 *** | −0.09 *** | −0.09 *** | −0.10 *** | −0.10 *** |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | |

| ΔMoney stock shareit | 0.29 | 0.44 | ||||||||||||||||

| (0.61) | (0.43) | |||||||||||||||||

| ΔRelative nominal economic growthit | −0.0014 | −0.0014 | ||||||||||||||||

| (0.28) | (0.27) | |||||||||||||||||

| ΔRelative real economic growthit | −0.0001 | −0.0001 | ||||||||||||||||

| (0.75) | (0.76) | |||||||||||||||||

| ΔGDP shareit | −0.62 *** | −0.49 ** | ||||||||||||||||

| (0.00) | (0.02) | |||||||||||||||||

| ΔCapitalization shareit | 0.15 | 0.21 | ||||||||||||||||

| (0.81) | (0.75) | |||||||||||||||||

| ΔTotal trade shareit | −3.29 *** | −3.25 *** | ||||||||||||||||

| (0.00) | (0.00) | |||||||||||||||||

| ΔTotal export shareit | −1.45 * | −2.01 * | −2.02 ** | |||||||||||||||

| (0.07) | (0.05) | (0.05) | ||||||||||||||||

| ΔCapital flow shareit | 0.89 *** | 0.86 *** | 0.97 *** | |||||||||||||||

| (0.00) | (0.00) | (0.00) | ||||||||||||||||

| ΔSD of Nominal effective exchange rateit | −0.01 | −0.01 * | ||||||||||||||||

| (0.29) | (0.09) | |||||||||||||||||

| ΔLN Nominal effective exchange rateit | 0.07 | 0.12 | 0.14 | 0.25 | 0.14 | 0.30 * | 0.24 | 0.09 | ||||||||||

| (0.76) | (0.36) | (0.28) | (0.17) | (0.36) | (0.10) | (0.16) | (0.52) | |||||||||||

| ΔLN Real effective exchange rateit | 0.00 | 0.09 | 0.11 | 0.20 | 0.10 | 0.29 | 0.22 | 0.05 | ||||||||||

| (0.99) | (0.47) | (0.36) | (0.25) | (0.48) | (0.11) | (0.17) | (0.72) | |||||||||||

| Sargan test | 0.79 | 0.94 | 0.95 | 0.99 | 0.99 | 0.99 | 0.99 | 0.93 | 0.98 | 0.99 | 0.91 | 0.98 | 0.99 | 0.99 | 0.99 | 0.92 | 0.97 | 0.99 |

| AR(1) serial correlation test | 0.12 | 0.11 | 0.11 | 0.11 | 0.11 | 0.12 | 0.11 | 0.10 * | 0.11 | 0.10 | 0.11 | 0.11 | 0.12 | 0.12 | 0.12 | 0.10 | 0.12 | 0.11 |

| AR(2) serial correlation test | 0.18 | 0.22 | 0.21 | 0.25 | 0.24 | 0.26 | 0.24 | 0.72 | 0.17 | 0.25 | 0.21 | 0.25 | 0.23 | 0.25 | 0.24 | 0.66 | 0.17 | 0.25 |

| 73 | 74 | 75 | 76 | 77 | 78 | 79 | 80 | 81 | 82 | 83 | 84 | 85 | 86 | 87 | 88 | 89 | 90 | |

| ΔUtility of international currencyit-1 | 0.12 | 0.23 | 0.12 | 0.22 | 0.20 | 0.32 | 0.21 | 0.33 | 0.11 | 0.22 | 0.11 | 0.22 | 0.32 *** | 0.31 ** | 0.30 ** | 0.33 ** | 0.34 *** | 0.16 ** |

| (0.55) | (0.37) | (0.52) | (0.33) | (0.48) | (0.34) | (0.42) | (0.29) | (0.50) | (0.29) | (0.43) | (0.23) | (0.00) | (0.03) | (0.03) | (0.01) | (0.01) | (0.05) | |

| ΔLiquidity risk premiumit | −0.04 * | −0.05 * | −0.04 * | −0.05 * | −0.05 ** | −0.07 ** | −0.05 ** | −0.06 ** | −0.05 * | −0.06 * | −0.05 * | −0.06 * | −0.03 * | −0.04 ** | −0.04 ** | −0.04 ** | −0.04 ** | −0.04 *** |

| (0.08) | (0.09) | (0.10) | (0.09) | (0.03) | (0.04) | (0.03) | (0.04) | (0.06) | (0.06) | (0.07) | (0.06) | (0.06) | (0.01) | (0.02) | (0.02) | (0.01) | (0.00) | |

| ΔMoney stock shareit | 0.79 | 0.82 | 0.82 | 0.86 | 0.69 | 0.80 | 0.73 | 0.85 | 0.64 | 0.75 | 0.67 | 0.79 | 0.42 ** | |||||

| (0.29) | (0.26) | (0.26) | (0.22) | (0.53) | (0.47) | (0.50) | (0.43) | (0.46) | (0.40) | (0.42) | (0.35) | (0.04) | ||||||

| ΔRelative nominal economic growthit | −0.0005 | −0.0009 | −0.0006 | −0.0010 | −0.0005 | −0.0009 | −0.0011 | |||||||||||

| (0.45) | (0.25) | (0.50) | (0.30) | (0.46) | (0.24) | (0.22) | ||||||||||||

| ΔRelative real economic growthit | −0.0001 | −0.0001 | −0.0001 | −0.0001 | −0.0001 | −0.0001 | −0.0001 | |||||||||||

| (0.76) | (0.62) | (0.69) | (0.45) | (0.71) | (0.49) | (0.76) | ||||||||||||

| ΔGDP shareit | −0.09 | −0.39 | −0.07 | −0.36 | −0.60 | −0.93 | −0.60 | −0.92 | −0.27 | −0.59 | −0.25 | −0.56 | 0.25 | |||||

| (0.94) | (0.68) | (0.94) | (0.66) | (0.65) | (0.44) | (0.62) | (0.40) | (0.76) | (0.46) | (0.76) | (0.42) | (0.14) | ||||||

| ΔCapitalization shareit | 0.00 | −0.14 | 0.01 | −0.12 | 0.16 | 0.01 | 0.17 | 0.02 | 0.04 | −0.11 | 0.03 | −0.11 | 0.27 ** | |||||

| (0.99) | (0.75) | (0.94) | (0.79) | (0.62) | (0.99) | (0.62) | (0.97) | (0.82) | (0.81) | (0.85) | (0.80) | (0.02) | ||||||

| ΔTotal trade shareit | −2.72 *** | −2.76 *** | −2.63 ** | −2.65 *** | −2.77 *** | −2.79 *** | −1.82 *** | |||||||||||

| (0.00) | (0.00) | (0.01) | (0.01) | (0.00) | (0.00) | (0.00) | ||||||||||||

| ΔTotal export shareit | −1.83 * | −1.89 ** | −1.64 * | −1.69 * | −1.84 ** | −1.89 ** | ||||||||||||

| (0.05) | (0.05) | (0.07) | (0.06) | (0.05) | (0.04) | |||||||||||||

| ΔCapital flow shareit | 0.80 *** | 0.81 ** | 0.78 *** | 0.76 * | 1.02 *** | 1.07 *** | 0.99 *** | 1.02 *** | 0.89 ** | 0.94 ** | 0.87 ** | 0.89 | ||||||

| (0.00) | (0.02) | (0.01) | (0.06) | (0.00) | (0.00) | (0.00) | (0.00) | (0.02) | (0.04) | (0.05) | (0.10) | |||||||

| ΔSD of Nominal effective exchange rateit | 0.00 | 0.00 | 0.00 | 0.00 | −0.01 | −0.01 | −0.01 | −0.01 | −0.01 | 0.00 | ||||||||

| (0.35) | (0.16) | (0.34) | (0.15) | (0.24) | (0.26) | (0.26) | (0.23) | (0.20) | (0.38) | |||||||||

| ΔLN Nominal effective exchange rateit | 0.12 | 0.09 | 0.12 | 0.10 | ||||||||||||||

| (0.39) | (0.52) | (0.36) | (0.48) | |||||||||||||||

| ΔLN Real effective exchange rateit | 0.07 | 0.04 | 0.07 | 0.05 | ||||||||||||||

| (0.57) | (0.74) | (0.54) | (0.70) | |||||||||||||||

| Sargan test | 0.54 | 0.71 | 0.57 | 0.74 | 0.81 | 0.90 | 0.84 | 0.93 | 0.54 | 0.74 | 0.56 | 0.77 | 0.89 | 0.85 | 0.86 | 0.90 | 0.90 | 0.42 |

| AR(1) serial correlation test | 0.09 * | 0.15 | 0.09 * | 0.14 | 0.14 | 0.20 | 0.13 | 0.19 | 0.10 * | 0.14 | 0.10 * | 0.13 | 0.10 * | 0.12 | 0.13 | 0.11 | 0.12 | 0.13 |

| AR(2) serial correlation test | 0.35 | 0.25 | 0.38 | 0.26 | 0.63 | 0.23 | 0.73 | 0.23 | 0.32 | 0.20 | 0.34 | 0.19 | 0.24 | 0.22 | 0.22 | 0.23 | 0.23 | 0.18 |

| 91 | 92 | 93 | 94 | 95 | 96 | 97 | 98 | 99 | 100 | 101 | 102 | 103 | 104 | 105 | 106 | 107 | 108 | |

| ΔUtility of international currencyit-1 | 0.24 ** | 0.36 ** | 0.34 ** | 0.42 *** | 0.42 *** | 0.43 *** | 0.44 ** | 0.21 | 0.31 * | 0.45 ** | 0.31 *** | 0.41 *** | 0.41 *** | 0.42 *** | 0.44 ** | 0.21 | 0.31 * | 0.45 ** |

| (0.02) | (0.02) | (0.01) | (0.00) | (0.00) | (0.00) | (0.02) | (0.18) | (0.08) | (0.03) | (0.01) | (0.01) | (0.00) | (0.00) | (0.02) | (0.20) | (0.09) | (0.04) | |

| ΔLiquidity risk premiumit | −0.05 *** | −0.04 ** | −0.04 ** | −0.05 *** | −0.05 *** | −0.05 *** | −0.05 *** | −0.05 *** | −0.06 *** | −0.06 *** | −0.04 ** | −0.05 *** | −0.05 *** | −0.05 *** | −0.05 *** | −0.05 *** | −0.06 *** | −0.06 *** |

| (0.00) | (0.05) | (0.03) | (0.00) | (0.00) | (0.01) | (0.00) | (0.00) | (0.01) | (0.00) | (0.04) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.01) | (0.00) | |

| ΔMoney stock shareit | 0.17 | 0.27 | ||||||||||||||||

| (0.69) | (0.52) | |||||||||||||||||

| ΔRelative nominal economic growthit | −0.0011 | −0.0011 | ||||||||||||||||

| (0.27) | (0.26) | |||||||||||||||||

| ΔRelative real economic growthit | −0.0001 | 0.0000 | ||||||||||||||||

| (0.81) | (0.82) | |||||||||||||||||

| ΔGDP shareit | −0.31 * | −0.20 | ||||||||||||||||

| (0.09) | (0.40) | |||||||||||||||||

| ΔCapitalization shareit | 0.17 | 0.22 | ||||||||||||||||

| (0.74) | (0.70) | |||||||||||||||||

| ΔTotal trade shareit | −2.39 *** | −2.37 *** | ||||||||||||||||

| (0.00) | (0.00) | |||||||||||||||||

| ΔTotal export shareit | −1.03 * | −1.44 * | −1.46 ** | |||||||||||||||

| (0.08) | (0.06) | (0.05) | ||||||||||||||||

| ΔCapital flow shareit | 0.66 *** | 0.65 ** | 0.73 *** | |||||||||||||||

| (0.00) | (0.01) | (0.01) | ||||||||||||||||

| ΔSD of Nominal effective exchange rateit | 0.00 | 0.00 * | ||||||||||||||||

| (0.29) | (0.07) | |||||||||||||||||

| ΔLN Nominal effective exchange rateit | 0.07 | 0.10 | 0.12 | 0.17 | 0.11 | 0.24 * | 0.18 | 0.07 | ||||||||||

| (0.69) | (0.30) | (0.22) | (0.21) | (0.33) | (0.08) | (0.12) | (0.48) | |||||||||||

| ΔLN Real effective exchange rateit | 0.02 | 0.08 | 0.10 | 0.13 | 0.08 | 0.23 * | 0.17 | 0.04 | ||||||||||

| (0.90) | (0.40) | (0.30) | (0.34) | (0.45) | (0.09) | (0.14) | (0.70) | |||||||||||

| Sargan test | 0.75 | 0.90 | 0.95 | 0.99 | 0.99 | 0.99 | 0.99 | 0.93 | 0.98 | 0.99 | 0.89 | 0.98 | 0.99 | 0.99 | 0.99 | 0.92 | 0.98 | 0.98 |

| AR(1) serial correlation test | 0.13 | 0.11 | 0.11 | 0.11 | 0.11 | 0.12 | 0.11 | 0.11 | 0.13 | 0.11 | 0.10 | 0.11 | 0.12 | 0.12 | 0.12 | 0.11 | 0.13 | 0.12 |

| AR(2) serial correlation test | 0.19 | 0.23 | 0.22 | 0.25 | 0.24 | 0.24 | 0.25 | 0.75 | 0.19 | 0.25 | 0.21 | 0.25 | 0.24 | 0.24 | 0.24 | 0.68 | 0.19 | 0.25 |

| 109 | 110 | 111 | 112 | 113 | 114 | 115 | 116 | 117 | 118 | 119 | 120 | 121 | 122 | 123 | 124 | 125 | 126 | |

| ΔUtility of international currencyit-1 | −0.03 | 0.06 * | −0.02 | 0.06 ** | 0.03 | 0.14 | 0.05 | 0.16 | −0.06 | 0.05 | −0.05 | 0.06 | 0.29 *** | 0.27 ** | 0.27 ** | 0.30 *** | 0.30 *** | 0.17 *** |

| (0.69) | (0.06) | (0.79) | (0.04) | (0.55) | (0.24) | (0.42) | (0.20) | (0.57) | (0.26) | (0.63) | (0.17) | (0.00) | (0.01) | (0.01) | (0.01) | (0.00) | (0.00) | |

| ΔLiquidity risk premiumit | −0.02 | −0.03 | −0.02 | −0.03 | −0.03 | −0.04 | −0.03 | −0.04 | −0.03 | −0.04 | −0.03 | −0.04 | −0.02 | −0.02 | −0.02 | −0.02 | −0.02 | −0.03 |

| (0.42) | (0.33) | (0.42) | (0.33) | (0.29) | (0.25) | (0.28) | (0.24) | (0.38) | (0.29) | (0.37) | (0.28) | (0.41) | (0.28) | (0.33) | (0.32) | (0.31) | (0.14) | |

| ΔMoney stock shareit | 0.36 | 0.37 | 0.38 | 0.40 | 0.24 | 0.33 | 0.28 | 0.38 | 0.20 | 0.28 | 0.22 | 0.32 | 0.31 | |||||

| (0.28) | (0.28) | (0.25) | (0.23) | (0.67) | (0.57) | (0.63) | (0.51) | (0.58) | (0.49) | (0.53) | (0.43) | (0.16) | ||||||

| ΔRelative nominal economic growthit | −0.0003 | −0.0006 | −0.0003 | −0.0007 | −0.0002 | −0.0006 | −0.0009 | |||||||||||

| (0.32) | (0.14) | (0.44) | (0.21) | (0.31) | (0.12) | (0.20) | ||||||||||||

| ΔRelative real economic growthit | 0.0000 | 0.0000 | 0.0000 | −0.0001 | 0.0000 | 0.0000 | −0.0001 | |||||||||||

| (0.99) | (0.90) | (1.00) | (0.80) | (0.94) | (0.88) | (0.79) | ||||||||||||

| ΔGDP shareit | 0.39 | 0.18 | 0.39 | 0.18 | 0.03 | −0.19 | 0.00 | −0.22 | 0.27 | 0.05 | 0.27 | 0.04 | 0.23 | |||||

| (0.28) | (0.33) | (0.25) | (0.25) | (0.94) | (0.64) | (0.99) | (0.59) | (0.24) | (0.88) | (0.24) | (0.90) | (0.20) | ||||||

| ΔCapitalization shareit | −0.06 | −0.20 | −0.05 | −0.17 | 0.06 | −0.09 | 0.07 | −0.07 | −0.02 | −0.17 | −0.02 | −0.16 | 0.17 | |||||

| (0.83) | (0.18) | (0.86) | (0.25) | (0.77) | (0.72) | (0.72) | (0.79) | (0.94) | (0.26) | (0.93) | (0.30) | (0.10) | ||||||

| ΔTotal trade shareit | −2.45 *** | −2.46 *** | −2.40 *** | −2.39 *** | −2.52 *** | −2.52 *** | −1.41 *** | |||||||||||

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | ||||||||||||

| ΔTotal export shareit | −1.78 ** | −1.81 ** | −1.65 ** | −1.65 ** | −1.80 ** | −1.82 ** | ||||||||||||

| (0.02) | (0.02) | (0.01) | (0.02) | (0.01) | (0.02) | |||||||||||||

| ΔCapital flow shareit | 0.53 | 0.52 | 0.52 | 0.49 | 0.65 | 0.67 | 0.64 | 0.65 | 0.57 | 0.60 | 0.56 | 0.57 | ||||||

| (0.28) | (0.38) | (0.30) | (0.42) | (0.19) | (0.23) | (0.20) | (0.26) | (0.39) | (0.41) | (0.41) | (0.45) | |||||||

| ΔSD of Nominal effective exchange rateit | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||

| (0.53) | (0.42) | (0.52) | (0.40) | (0.30) | (0.30) | (0.30) | (0.29) | (0.27) | (0.37) | |||||||||

| ΔLN Nominal effective exchange rateit | 0.10 | 0.07 | 0.11 | 0.08 | ||||||||||||||

| (0.23) | (0.38) | (0.22) | (0.35) | |||||||||||||||

| ΔLN Real effective exchange rateit | 0.07 | 0.04 | 0.07 | 0.05 | ||||||||||||||

| (0.32) | (0.55) | (0.31) | (0.50) | |||||||||||||||

| Sargan test | 0.29 | 0.51 | 0.32 | 0.56 | 0.48 | 0.68 | 0.55 | 0.76 | 0.25 | 0.49 | 0.29 | 0.55 | 0.86 | 0.81 | 0.83 | 0.88 | 0.87 | 0.41 |

| AR(1) serial correlation test | 0.14 | 0.13 | 0.13 | 0.13 | 0.15 | 0.18 | 0.15 | 0.18 | 0.23 | 0.17 | 0.22 | 0.17 | 0.09 * | 0.12 | 0.12 | 0.10 * | 0.11 | 0.14 |

| AR(2) serial correlation test | 0.08 * | 0.15 | 0.08 * | 0.15 | 0.19 | 0.13 | 0.21 | 0.13 | 0.18 | 0.12 | 0.19 | 0.11 | 0.23 | 0.22 | 0.22 | 0.23 | 0.22 | 0.17 |

| 127 | 128 | 129 | 130 | 131 | 132 | 133 | 134 | 135 | 136 | 137 | 138 | 139 | 140 | 141 | 142 | 143 | 144 | |

| ΔUtility of international currencyit-1 | 0.22 *** | 0.30 *** | 0.31 *** | 0.42 *** | 0.42 *** | 0.43 *** | 0.43 ** | 0.23 | 0.31 * | 0.42 ** | 0.27 *** | 0.41 *** | 0.42 *** | 0.42 *** | 0.43 ** | 0.23 | 0.30 | 0.41 ** |

| (0.00) | (0.00) | (0.00) | (0.01) | (0.01) | (0.00) | (0.02) | (0.11) | (0.10) | (0.03) | (0.00) | (0.01) | (0.01) | (0.00) | (0.03) | (0.13) | (0.10) | (0.04) | |

| ΔLiquidity risk premiumit | −0.03 | −0.02 | −0.03 | −0.03 * | −0.03 * | −0.03 * | −0.03 ** | −0.04 ** | −0.04 * | −0.04 * | −0.02 | −0.03 * | −0.03 * | −0.03 * | −0.03 ** | −0.04 * | −0.04 * | −0.03 * |

| (0.13) | (0.36) | (0.24) | (0.06) | (0.07) | (0.08) | (0.04) | (0.05) | (0.08) | (0.07) | (0.32) | (0.05) | (0.06) | (0.06) | (0.04) | (0.05) | (0.09) | (0.06) | |

| ΔMoney stock shareit | 0.09 | 0.15 | ||||||||||||||||

| (0.75) | (0.55) | |||||||||||||||||

| ΔRelative nominal economic growthit | −0.0009 | −0.0009 | ||||||||||||||||

| (0.27) | (0.26) | |||||||||||||||||

| ΔRelative real economic growthit | 0.0000 | 0.0000 | ||||||||||||||||

| (0.83) | (0.84) | |||||||||||||||||

| ΔGDP shareit | −0.18 | −0.08 | ||||||||||||||||

| (0.20) | (0.64) | |||||||||||||||||

| ΔCapitalization shareit | 0.11 | 0.14 | ||||||||||||||||

| (0.76) | (0.72) | |||||||||||||||||

| ΔTotal trade shareit | −1.91 *** | −1.90 *** | ||||||||||||||||

| (0.00) | (0.00) | |||||||||||||||||

| ΔTotal export shareit | −0.84 | −1.17 * | −1.20 ** | |||||||||||||||

| (0.13) | (0.06) | (0.05) | ||||||||||||||||

| ΔCapital flow shareit | 0.47 | 0.45 *** | 0.51 *** | |||||||||||||||

| (0.20) | (0.00) | (0.00) | ||||||||||||||||

| ΔSD of Nominal effective exchange rateit | 0.00 | 0.00 | ||||||||||||||||

| (0.32) | (0.16) | |||||||||||||||||

| ΔLN Nominal effective exchange rateit | 0.06 | 0.08 | 0.10 | 0.13 | 0.09 | 0.20 * | 0.15 | 0.06 | ||||||||||

| (0.63) | (0.31) | (0.22) | (0.24) | (0.32) | (0.08) | (0.11) | (0.45) | |||||||||||

| ΔLN Real effective exchange rateit | 0.03 | 0.07 | 0.08 | 0.09 | 0.07 | 0.19 * | 0.14 | 0.03 | ||||||||||

| (0.81) | (0.41) | (0.30) | (0.40) | (0.44) | (0.10) | (0.13) | (0.67) | |||||||||||

| Sargan test | 0.73 | 0.82 | 0.93 | 0.99 | 0.99 | 0.99 | 0.99 | 0.94 | 0.98 | 0.97 | 0.86 | 0.98 | 0.99 | 0.99 | 0.99 | 0.93 | 0.97 | 0.96 |

| AR(1) serial correlation test | 0.13 | 0.10 | 0.11 | 0.11 | 0.11 | 0.12 | 0.11 | 0.11 | 0.14 | 0.10 | 0.10 | 0.11 | 0.11 | 0.11 | 0.11 | 0.12 | 0.15 | 0.11 |

| AR(2) serial correlation test | 0.19 | 0.22 | 0.21 | 0.25 | 0.25 | 0.24 | 0.25 | 0.68 | 0.20 | 0.25 | 0.21 | 0.25 | 0.24 | 0.24 | 0.25 | 0.60 | 0.19 | 0.24 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ogawa, E.; Muto, M. What Determines Utility of International Currencies? J. Risk Financial Manag. 2019, 12, 10. https://doi.org/10.3390/jrfm12010010

Ogawa E, Muto M. What Determines Utility of International Currencies? Journal of Risk and Financial Management. 2019; 12(1):10. https://doi.org/10.3390/jrfm12010010

Chicago/Turabian StyleOgawa, Eiji, and Makoto Muto. 2019. "What Determines Utility of International Currencies?" Journal of Risk and Financial Management 12, no. 1: 10. https://doi.org/10.3390/jrfm12010010

APA StyleOgawa, E., & Muto, M. (2019). What Determines Utility of International Currencies? Journal of Risk and Financial Management, 12(1), 10. https://doi.org/10.3390/jrfm12010010