Is Window-Dressing around Going Public Beneficial? Evidence from Poland

Abstract

1. Introduction

2. Brief Theoretical Background

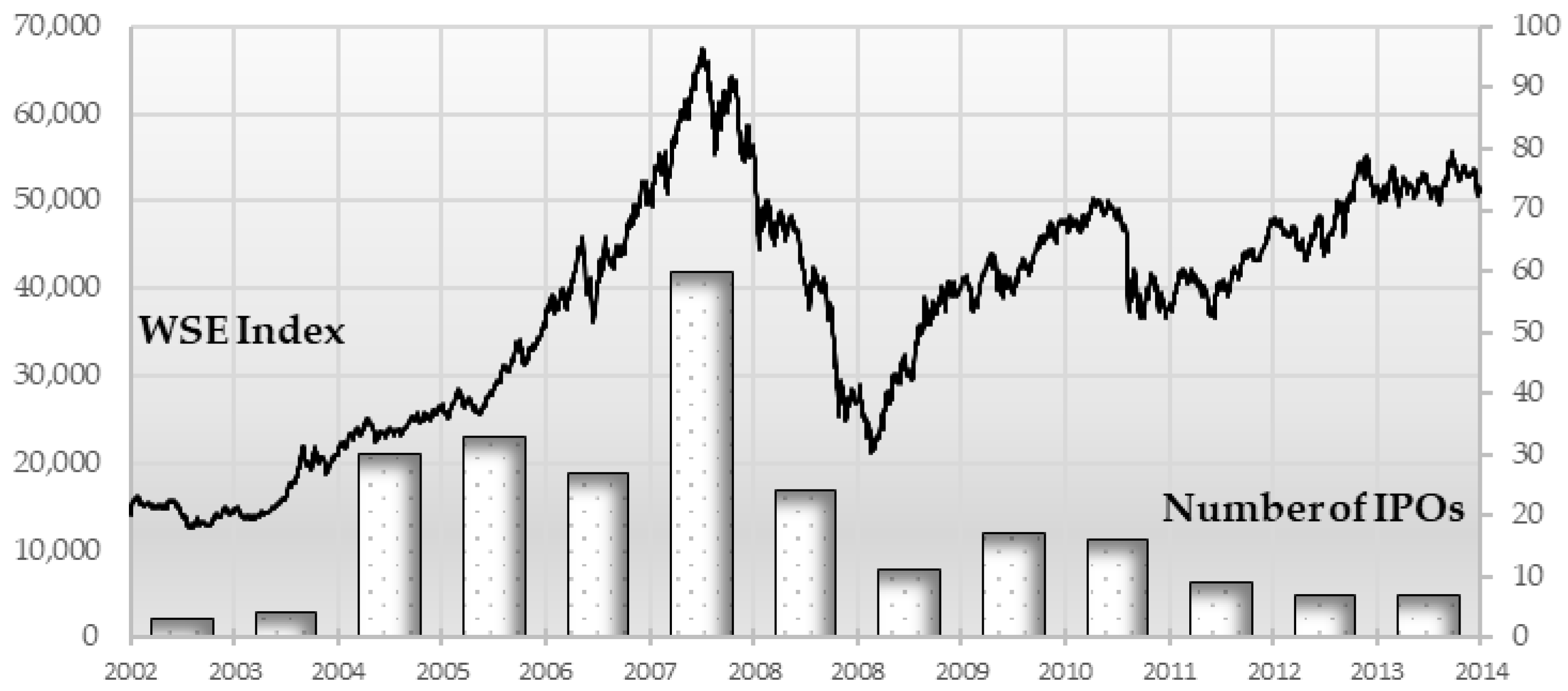

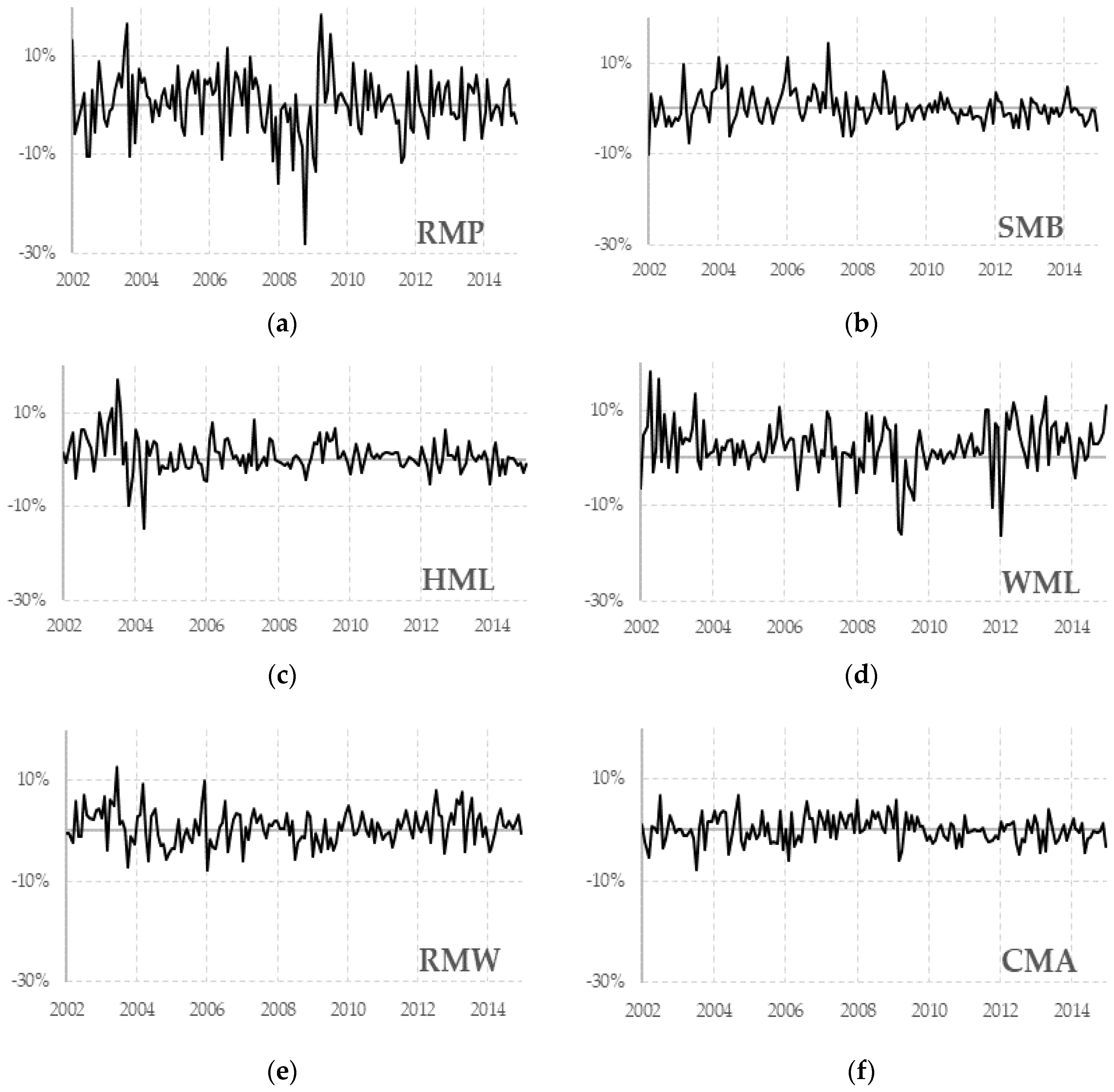

3. Sources of Data and Methodology

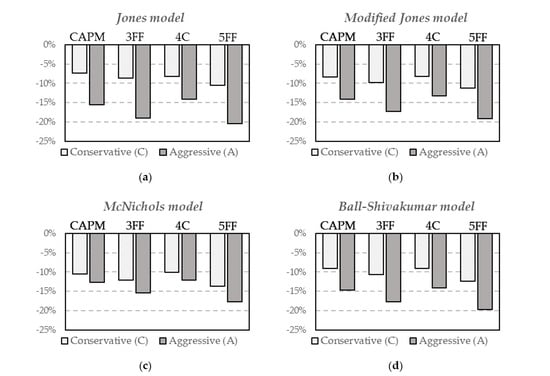

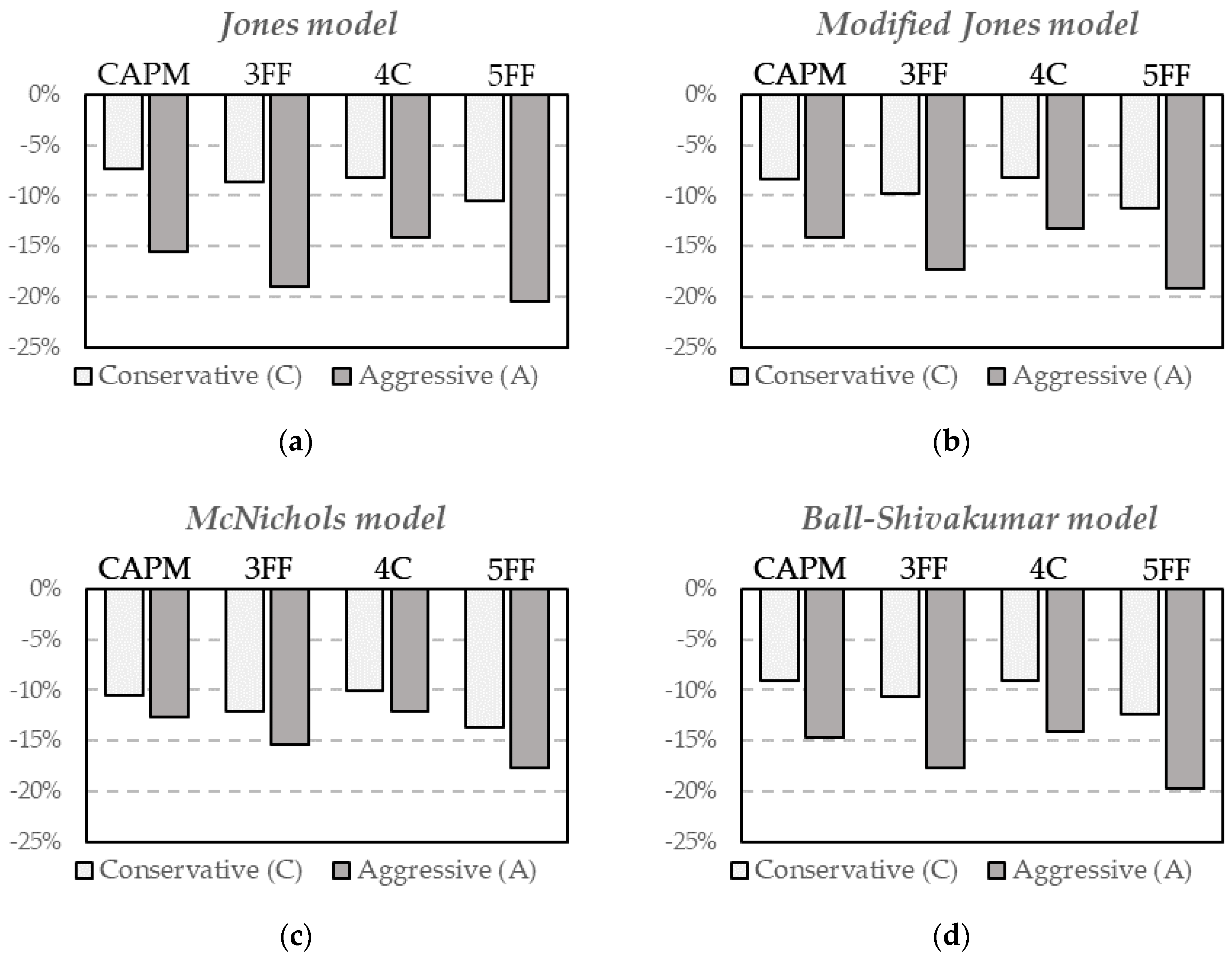

4. Descriptive Statistics and Risk Premiums

5. Earnings Manipulation and Calendar-Time Portfolio Returns: Empirical Results

6. Discussion of Empirical Results and Future Research

7. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Aharony, Joseph, Chan-Jane Lin, and Martin P. Loeb. 1993. Initial Public Offerings, Accounting Choices, and Earnings Management. Contemporary Accounting Research 10: 61–81. [Google Scholar] [CrossRef]

- Ahmad-Zaluki, Nurwati A., Kevin Campbell, and Alan Goodacre. 2011. Earnings management in Malaysian IPOs: The East Asian crisis, ownership control, and post-IPO performance. International Journal of Accounting 46: 111–37. [Google Scholar] [CrossRef]

- Alhadab, Mohammad, and Iain Clacher. 2018. The impact of audit quality on real and accrual earnings management around IPOs. British Accounting Review 50: 442–61. [Google Scholar] [CrossRef]

- Ang, James S., and Shaojun Zhang. 2015. Evaluating Long-Horizon Event Study Methodology. In Handbook of Financial Econometrics and Statistics. Edited by Cheng-Few Lee and John C. Lee. New York: Springer, pp. 383–411. [Google Scholar]

- Armstrong, Chris, George Foster, and Daniel J. Taylor. 2015. Abnormal accruals in newly public companies: Opportunistic misreporting or economic activity? Management Science 62: 1316–38. [Google Scholar] [CrossRef]

- Ball, Ray, and Lakshmanan Shivakumar. 2005. Earnings quality in UK private firms: Comparative loss recognition timeliness. Journal of Accounting and Economics 39: 83–128. [Google Scholar] [CrossRef]

- Ball, Ray, and Lakshmanan Shivakumar. 2006. The Role of Accruals in Asymmetrically Timely Gain and Loss Recognition. Journal of Accounting Research 44: 207–42. [Google Scholar] [CrossRef]

- Ball, Ray, and Lakshmanan Shivakumar. 2008. Earnings quality at initial public offerings. Journal of Accounting and Economics 45: 324–49. [Google Scholar] [CrossRef]

- Barber, Brad M., and John D. Lyon. 1997. Detecting long-run abnormal stock returns: The empirical power and specification of test statistics. Journal of Financial Economics 43: 341–72. [Google Scholar] [CrossRef]

- Beneish, Messod D. 1998. Discussion of “Are accruals during initial public offerings opportunistic?”. Review of Accounting Studies 3: 209–21. [Google Scholar] [CrossRef]

- Brown, Philip, Wendy Beekes, and Peter Verhoeven. 2011. Corporate governance, accounting and finance: A review. Accounting & Finance 51: 96–172. [Google Scholar] [CrossRef]

- Carhart, Mark M. 1997. On Persistence in Mutual Fund Performance. Journal of Finance 52: 57–82. [Google Scholar] [CrossRef]

- Chan, Konan, Louis K. Chan, Narasimhan Jegadeesh, and Josef Lakonishok. 2001. Earnings quality and stock returns. National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Chen, Ken Y., Kuen-Lin Lin, and Jian Zhou. 2005. Audit quality and earnings management for Taiwan IPO firms. Managerial Auditing Journal 20: 86–104. [Google Scholar] [CrossRef]

- Cohen, Daniel A., and Paul Zarowin. 2010. Accrual-based and real earnings management activities around seasoned equity offerings. Journal of Accounting and Economics 50: 2–19. [Google Scholar] [CrossRef]

- Dahlquist, Magnus, and Frank de Jong. 2008. Pseudo Market Timing: A Reappraisal. Journal of Financial and Quantitative Analysis 43: 547. [Google Scholar] [CrossRef]

- Darrough, Masako, and Srinivasan Rangan. 2005. Do Insiders Manipulate Earnings When They Sell Their Shares in an Initial Public Offering? Journal of Accounting Research 43: 1–33. [Google Scholar] [CrossRef]

- Dechow, Patricia M., and Ilia D. Dichev. 2002. The Quality of Accruals and Earnings: The Role of Accrual Estimation Errors. Accounting Review 77: 35–59. [Google Scholar] [CrossRef]

- Dechow, Patricia M., Richard G. Sloan, and Amy P. Sweeney. 1995. Detecting Earnings Management. Accounting Review 70: 193–225. Available online: http://www.jstor.org/stable/248303 (accessed on 16 May 2015).

- DeFond, Mark L., and James Jiambalvo. 1994. Debt covenant violation and manipulation of accruals. Journal of Accounting and Economics 17: 145–76. [Google Scholar] [CrossRef]

- DuCharme, Larry L., Paul H. Malatesta, and Stephan E. Sefcik. 2001. Earnings Management: IPO Valuation and Subsequent Performance. Journal of Accounting, Auditing & Finance 16: 369–96. [Google Scholar] [CrossRef]

- Fama, Eugene F. 1998. Market efficiency, long-term returns, and behavioral finance. Journal of Financial Economics 49: 283–306. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 1993. Common risk factors in the returns on stocks and bonds. Journal of Financial Economics 33: 3–56. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 2015. A five-factor asset pricing model. Journal of Financial Economics 116: 1–22. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 2016. Dissecting Anomalies with a Five-Factor Model. Review of Financial Studies 29: 69–103. [Google Scholar] [CrossRef]

- Friedlan, John M. 1994. Accounting Choices of Issuers of Initial Public Offerings. Contemporary Accounting Research 11: 1–31. [Google Scholar] [CrossRef]

- Gaver, Jennifer J., Kenneth M. Gaver, and Jeffrey R. Austin. 1995. Additional evidence on bonus plans and income management. Journal of Accounting and Economics 19: 3–28. [Google Scholar] [CrossRef]

- Graham, John R., Campbell R. Harvey, and Shiva Rajgopal. 2005. The economic implications of corporate financial reporting. Journal of Accounting and Economics 40: 3–73. [Google Scholar] [CrossRef]

- Gunny, Katherine A. 2010. The Relation Between Earnings Management Using Real Activities Manipulation and Future Performance: Evidence from Meeting Earnings Benchmarks. Contemporary Accounting Research 27: 855–88. [Google Scholar] [CrossRef]

- Healy, Paul M. 1985. The effect of bonus schemes on accounting decisions. Journal of Accounting and Economics 7: 85–107. [Google Scholar] [CrossRef]

- Holthausen, Robert W., David F. Larcker, and Richard G. Sloan. 1995. Annual bonus schemes and the manipulation of earnings. Journal of Accounting and Economics 19: 29–74. [Google Scholar] [CrossRef]

- Hong, Bryan, Zhichuan Li, and Dylan Minor. 2016. Corporate Governance and Executive Compensation for Corporate Social Responsibility. Journal of Business Ethics 136: 199–213. [Google Scholar] [CrossRef]

- Jegadeesh, Narasimhan, and Jason Karceski. 2009. Long-run performance evaluation: Correlation and heteroskedasticity-consistent tests. Journal of Empirical Finance 16: 101–11. [Google Scholar] [CrossRef]

- Jones, Jennifer J. 1991. Earnings Management During Import Relief Investigations. Journal of Accounting Research 29: 193–228. [Google Scholar] [CrossRef]

- Kothari, Stephen P., Natalie Mizik, and Sugata Roychowdhury. 2016. Managing for the Moment: The Role of Earnings Management via Real Activities versus Accruals in SEO Valuation. Accounting Review 91: 559–86. [Google Scholar] [CrossRef]

- Krishnan, C. N. V., Vladimir I. Ivanov, Ronald W. Masulis, and Ajai K. Singh. 2011. Venture Capital Reputation, Post-IPO Performance, and Corporate Governance. Journal of Financial and Quantitative Analysis 46: 1295–333. [Google Scholar] [CrossRef]

- Li, Frank. 2016. Endogeneity in CEO power: A survey and experiment. Investment Analysts Journal 45: 149–62. [Google Scholar] [CrossRef]

- Liberty, Susan E., and Jerold L. Zimmerman. 1986. Labor union contract negotiations and accounting choices. Accounting Review 61: 692–712. [Google Scholar]

- Lintner, John. 1969. The Valuation of Risk Assets and the Selection of Risky Investments in Stock Portfolios and Capital Budgets: A Reply. The Review of Economics and Statistics 51: 222–24. [Google Scholar] [CrossRef]

- Lizińska, Joanna, and Leszek Czapiewski. 2018a. Earnings Management and the Long-Term Market Performance of Initial Public Offerings in Poland. In Finance and Sustainability: Proceedings from the Finance and Sustainability Conference, Wroclaw 2017. Edited by Agnieszka Bem, Karolina Daszyńska-Żygadło, Taťána Hajdíková and Péter Juhász. Springer Proceedings in Business and Economics. Cham: Springer International Publishing, vol. 62, pp. 121–34. [Google Scholar]

- Lizińska, Joanna, and Leszek Czapiewski. 2018b. Towards Economic Corporate Sustainability in Reporting: What Does Earnings Management around Equity Offerings Mean for Long-Term Performance? Sustainability 10: 4349. [Google Scholar] [CrossRef]

- Lyon, John D., Brad M. Barber, and Chih-Ling Tsai. 1999. Improved Methods for Tests of Long-Run Abnormal Stock Returns. Journal of Finance 54: 165–201. [Google Scholar] [CrossRef]

- McNichols, Maureen F. 2000. Research design issues in earnings management studies. Journal of Accounting and Public Policy 19: 313–45. [Google Scholar] [CrossRef]

- McNichols, Maureen F., and G. Peter Wilson. 1988. Evidence of Earnings Management from the Provision for Bad Debts. Journal of Accounting Research 26: 1. [Google Scholar] [CrossRef]

- Pastor-Llorca, María J., and Francisco Poveda-Fuentes. 2011. Earnings Management and the Long-Run Performance of Spanish Initial Public Offerings. In Initial Public Offerings (IPO): An International Perspective of IPOs. Edited by Greg N. Gregoriou. Quantitative Finance. Burlington: Elsevier Science, pp. 81–112. [Google Scholar]

- Perry, Susan E., and Thomas H. Williams. 1994. Earnings management preceding management buyout offers. Journal of Accounting and Economics 18: 157–79. [Google Scholar] [CrossRef]

- Pourciau, Susan. 1993. Earnings management and nonroutine executive changes. Journal of Accounting and Economics 16: 317–36. [Google Scholar] [CrossRef]

- Roberts, Michael R., and Toni M. Whited. 2005. Endogeneity in empirical corporate finance. Handbook of the Economics of Finance 2: 493–572. [Google Scholar] [CrossRef]

- Ronen, Joshua, and Varda Yaari. 2008. Earnings Management: Emerging Insights in Theory, Practice, and Research. Springer Series in Accounting Scholarship. New York: Springer. [Google Scholar]

- Roosenboom, Peter, Tjalling van der Goot, and Gerard Mertens. 2003. Earnings management and initial public offerings: Evidence from the Netherlands. International Journal of Accounting 38: 243–66. [Google Scholar] [CrossRef]

- Roychowdhury, Sugata. 2006. Earnings management through real activities manipulation. Journal of Accounting and Economics 42: 335–70. [Google Scholar] [CrossRef]

- Schultz, Paul. 2003. Pseudo Market Timing and the Long-Run Underperformance of IPOs. Journal of Finance 58: 483–517. [Google Scholar] [CrossRef]

- Sharpe, William F. 1964. Capital asset prices: A theory of market equilibrium under conditions of risk. Journal of Finance 19: 425–42. [Google Scholar] [CrossRef]

- Sloan, Richard G. 1996. Do stock prices fully reflect information in accruals and cash flows about future earnings? Accounting Review 71: 289–315. [Google Scholar]

- Teoh, Siew Hong, Ivo Welch, and Tak J. Wong. 1998a. Earnings Management and the Long-Run Market Performance of Initial Public Offerings. Journal of Finance 53: 1935–74. [Google Scholar] [CrossRef]

- Teoh, Siew Hong, Ivo Welch, and Tak J. Wong. 1998b. Earnings management and the underperformance of seasoned equity offerings. Journal of Financial Economics 50: 63–99. [Google Scholar] [CrossRef]

- Teoh, Siew Hong, Tak J. Wong, and Gita R. Rao. 1998c. Are Accruals during Initial Public Offerings Opportunistic? Review of Accounting Studies 3: 175–208. [Google Scholar] [CrossRef]

- Teoh, Siew Hong, and Tak J. Wong. 1997. Analysts’ Credulity about Reported Earnings and Overoptimism in New Equity Issues. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Viswanathan, S., and Bin Wei. 2008. Endogenous Events and Long-Run Returns. Review of Financial Studies 21: 855–88. [Google Scholar] [CrossRef]

- Wongsunwai, Wan. 2013. The Effect of External Monitoring on Accrual-Based and Real Earnings Management: Evidence from Venture-Backed Initial Public Offerings. Contemporary Accounting Research 30: 296–324. [Google Scholar] [CrossRef]

- Wu, Ching-Chih, and Tung-Hsiao Yang. 2018. Insider Trading and Institutional Holdings in Seasoned Equity Offerings. Journal of Risk and Financial Management 11: 53. [Google Scholar] [CrossRef]

- Xie, Hong. 2001. The Mispricing of Abnormal Accruals. Accounting Review 76: 357–73. [Google Scholar] [CrossRef]

- Zang, Amy Y. 2012. Evidence on the Trade-Off between Real Activities Manipulation and Accrual-Based Earnings Management. Accounting Review 87: 675–703. [Google Scholar] [CrossRef]

| Company Characteristics | Mean | Median | |||

|---|---|---|---|---|---|

| IPO | WSE * | IPO | WSE * | ||

| Total assets (mln PLN) | Y-1 | 757 mln | 1.095 mln | 66 mln | 1.171 mln |

| Total assets (mln PLN) | Y0 | 906 mln | 1.226 mln | 113 mln | 1.223 mln |

| Revenues (mln PLN) | Y-1 | 544 mln | 985 mln | 95 mln | 995 mln |

| Revenues (mln PLN) | Y0 | 635 mln | 1.095 mln | 124 mln | 1.103 mln |

| Leverage | Y-1 | 56.1% | 55.9% | 58.1% | 51.6% |

| Leverage | Y0 | 39.3% | 53.3% | 39.4% | 51.6% |

| Return on assets | Y-1 | 13.0% | 3.7% | 8.3% | 4.8% |

| Return on assets | Y0 | 8.6% | 4.0% | 6.8% | 6.5% |

| Return on equity | Y-1 | 30.8% | 3.0% | 22.0% | 16.0% |

| Return on equity | Y0 | 15.2% | 9.2% | 11.8% | 15.7% |

| Operating return on assets | Y-1 | 16.6% | 6.7% | 11.2% | 8.1% |

| Operating return on assets | Y0 | 10.6% | 6.8% | 8.6% | 8.2% |

| Operating return on equity | Y-1 | 42.7% | 10.6% | 32.8% | 19.2% |

| Operating return on equity | Y0 | 19.0% | 16.4% | 14.9% | 19.2% |

| CAPM (C) | CAPM (A) | 3FF (C) | 3FF (A) | 4C (C) | 4C (A) | 5FF (C) | 5FF (A) | |

|---|---|---|---|---|---|---|---|---|

| Panel A: Calendar-Time Portfolio Regressions for the Conservative and Aggressive Portfolio | ||||||||

| Intercept | −0.006 | −0.013 *** | −0.007 * | −0.016 *** | −0.007 * | −0.012 *** | −0.009 ** | −0.017 *** |

| (−1.566) | (−2.955) | (−1.971) | (−3.954) | (−1.691) | (−2.748) | (−2.439) | (−4.438) | |

| RMP | 0.803 *** | 0.925 *** | 0.774 *** | 0.856 *** | 0.773 *** | 0.821 *** | 0.719 *** | 0.782 *** |

| (13.063) | (13.407) | (13.200) | (13.347) | (12.769) | (12.727) | (12.440) | (12.704) | |

| SBM | 0.537 *** | 0.581 *** | 0.560 *** | 0.603 *** | 0.699 *** | 0.764 *** | ||

| (4.759) | (4.712) | (4.786) | (4.838) | (5.939) | (6.095) | |||

| HML | 0.190 | 0.589 *** | 0.147 | 0.470 *** | 0.357 ** | 0.779 *** | ||

| (1.300) | (3.689) | (0.987) | (2.959) | (2.340) | (4.795) | |||

| WML | −0.053 | −0.221 *** | ||||||

| (−0.730) | (−2.844) | |||||||

| RMW | 0.102 | 0.024 | ||||||

| (0.844) | (0.185) | |||||||

| CMA | −0.528 *** | −0.716 *** | ||||||

| (−3.458) | (−4.401) | |||||||

| p-value for F | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| adj. R2 | 0.588 | 0.600 | 0.650 | 0.678 | 0.648 | 0.693 | 0.684 | 0.725 |

| Panel B: Equivalent Regressions of the Difference between the Conservative and Aggressive Portfolio Returns | ||||||||

| α(A)–α(C) | −0.007 ** | −0.009 ** | −0.005 | −0.008 ** | ||||

| p-value | 0.036 | 0.012 | 0.109 | 0.018 | ||||

| CAPM (C) | CAPM (A) | 3FF (C) | 3FF (A) | 4C (C) | 4C (A) | 5FF (C) | 5FF (A) | |

|---|---|---|---|---|---|---|---|---|

| Panel A: Calendar-Time Portfolio Regressions for the Conservative and Aggressive Portfolio | ||||||||

| Intercept | −0.007 * | −0.012 *** | −0.008 ** | −0.014 *** | −0.007 * | −0.011 ** | −0.009 ** | −0.016 *** |

| (−1.784) | (−2.652) | (−2.215) | (−3.549) | (−1.712) | (−2.513) | (−2.616) | (−4.061) | |

| RMP | 0.799 *** | 0.942 *** | 0.770 *** | 0.876 *** | 0.760 *** | 0.849 *** | 0.711 *** | 0.806 *** |

| (13.071) | (13.573) | (13.171) | (13.504) | (12.694) | (12.846) | (12.403) | (12.828) | |

| SBM | 0.529 *** | 0.583 *** | 0.564 *** | 0.598 *** | 0.684 *** | 0.774 *** | ||

| (4.713) | (4.676) | (4.874) | (4.680) | (5.856) | (6.046) | |||

| HML | 0.202 | 0.547 *** | 0.144 | 0.440 *** | 0.362 ** | 0.745 *** | ||

| (1.387) | (3.383) | (0.976) | (2.709) | (2.393) | (4.489) | |||

| WML | −0.093 | −0.189 ** | ||||||

| (−1.291) | (−2.367) | |||||||

| RMW | 0.059 | 0.072 | ||||||

| (0.492) | (0.549) | |||||||

| CMA | −0.564 *** | −0.677 *** | ||||||

| (−3.718) | (−4.073) | |||||||

| p-value for F | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| adj. R2 | 0.588 | 0.606 | 0.649 | 0.678 | 0.653 | 0.686 | 0.686 | 0.720 |

| Panel B: Equivalent Regressions of the Difference between the Conservative and Aggressive Portfolio Returns | ||||||||

| α(A)–α(C) | −0.005 | −0.006 * | −0.004 | −0.007 * | ||||

| p-value | 0.109 | 0.053 | 0.160 | 0.053 | ||||

| CAPM (C) | CAPM (A) | 3FF (C) | 3FF (A) | 4C (C) | 4C (A) | 5FF (C) | 5FF (A) | |

|---|---|---|---|---|---|---|---|---|

| Panel A: Calendar-Time Portfolio Regressions for the Conservative and Aggressive Portfolio | ||||||||

| Intercept | −0.009 ** | −0.011 ** | −0.010 ** | −0.013 *** | −0.008 ** | −0.010 ** | −0.011 *** | −0.015 *** |

| (−2.147) | (−2.579) | (−2.602) | (−3.388) | (−2.010) | (−2.463) | (−3.065) | (−4.032) | |

| RMP | 0.897 *** | 0.827 *** | 0.865 *** | 0.771 *** | 0.853 *** | 0.749 *** | 0.795 *** | 0.710 *** |

| (13.995) | (12.905) | (14.025) | (12.749) | (13.478) | (12.139) | (13.342) | (12.103) | |

| SBM | 0.533 *** | 0.529 *** | 0.562 *** | 0.549 *** | 0.704 *** | 0.729 *** | ||

| (4.498) | (4.551) | (4.598) | (4.605) | (5.792) | (6.098) | |||

| HML | 0.229 | 0.463 *** | 0.163 | 0.374 ** | 0.422 *** | 0.663 *** | ||

| (1.488) | (3.075) | (1.049) | (2.466) | (2.681) | (4.283) | |||

| WML | −0.106 | −0.156 ** | ||||||

| (−1.396) | (−2.105) | |||||||

| RMW | 0.057 | 0.141 | ||||||

| (0.459) | (1.155) | |||||||

| CMA | −0.678 *** | −0.572 *** | ||||||

| (−4.304) | (−3.691) | |||||||

| p-value for F | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| adj. R2 | 0.621 | 0.582 | 0.673 | 0.652 | 0.675 | 0.659 | 0.716 | 0.696 |

| Panel B: Equivalent Regressions of the Difference between the Conservative and Aggressive Portfolio Returns | ||||||||

| α(A)–α(C) | −0.002 | −0.003 | −0.002 | −0.003 | ||||

| p-value | 0.304 | 0.212 | 0.332 | 0.176 | ||||

| CAPM (C) | CAPM (A) | 3FF (C) | 3FF (A) | 4C (C) | 4C (A) | 5FF (C) | 5FF (A) | |

|---|---|---|---|---|---|---|---|---|

| Panel A: Calendar-time portfolio regressions for the conservative and aggressive portfolio | ||||||||

| Intercept | −0.008 * | −0.012 *** | −0.009 ** | −0.015 *** | −0.008 * | −0.012 *** | −0.010 *** | −0.016 *** |

| (−1.810) | (−2.953) | (−2.222) | (−3.965) | (−1.737) | (−2.908) | (−2.632) | (−4.526) | |

| RMP | 0.851 *** | 0.884 *** | 0.818 *** | 0.822 *** | 0.809 *** | 0.797 *** | 0.750 *** | 0.762 *** |

| (12.922) | (13.584) | (12.790) | (13.790) | (12.296) | (13.148) | (12.020) | (13.140) | |

| SBM | 0.515 *** | 0.611 *** | 0.543 *** | 0.629 *** | 0.683 *** | 0.794 *** | ||

| (4.186) | (5.334) | (4.276) | (5.375) | (5.371) | (6.718) | |||

| HML | 0.237 | 0.511 *** | 0.179 | 0.409 *** | 0.428 ** | 0.683 *** | ||

| (1.488) | (3.441) | (1.106) | (2.742) | (2.594) | (4.460) | |||

| WML | −0.092 | −0.177 ** | ||||||

| (−1.163) | (−2.421) | |||||||

| RMW | 0.060 | 0.095 | ||||||

| (0.462) | (0.787) | |||||||

| CMA | −0.659 *** | −0.565 *** | ||||||

| (−3.995) | (−3.683) | |||||||

| p-value for F | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| adj. R2 | 0.582 | 0.607 | 0.632 | 0.692 | 0.634 | 0.700 | 0.675 | 0.729 |

| Panel B: Equivalent regressions of the difference between the conservative and aggressive portfolio returns | ||||||||

| α(A)–α(C) | −0.005 | −0.006 * | −0.004 | −0.006 * | ||||

| p-value | 0.120 | 0.071 | 0.173 | 0.071 | ||||

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lizińska, J.; Czapiewski, L. Is Window-Dressing around Going Public Beneficial? Evidence from Poland. J. Risk Financial Manag. 2019, 12, 18. https://doi.org/10.3390/jrfm12010018

Lizińska J, Czapiewski L. Is Window-Dressing around Going Public Beneficial? Evidence from Poland. Journal of Risk and Financial Management. 2019; 12(1):18. https://doi.org/10.3390/jrfm12010018

Chicago/Turabian StyleLizińska, Joanna, and Leszek Czapiewski. 2019. "Is Window-Dressing around Going Public Beneficial? Evidence from Poland" Journal of Risk and Financial Management 12, no. 1: 18. https://doi.org/10.3390/jrfm12010018

APA StyleLizińska, J., & Czapiewski, L. (2019). Is Window-Dressing around Going Public Beneficial? Evidence from Poland. Journal of Risk and Financial Management, 12(1), 18. https://doi.org/10.3390/jrfm12010018