Inflation Propensity of Collatz Orbits: A New Proof-of-Work for Blockchain Applications

Abstract

1. Introduction

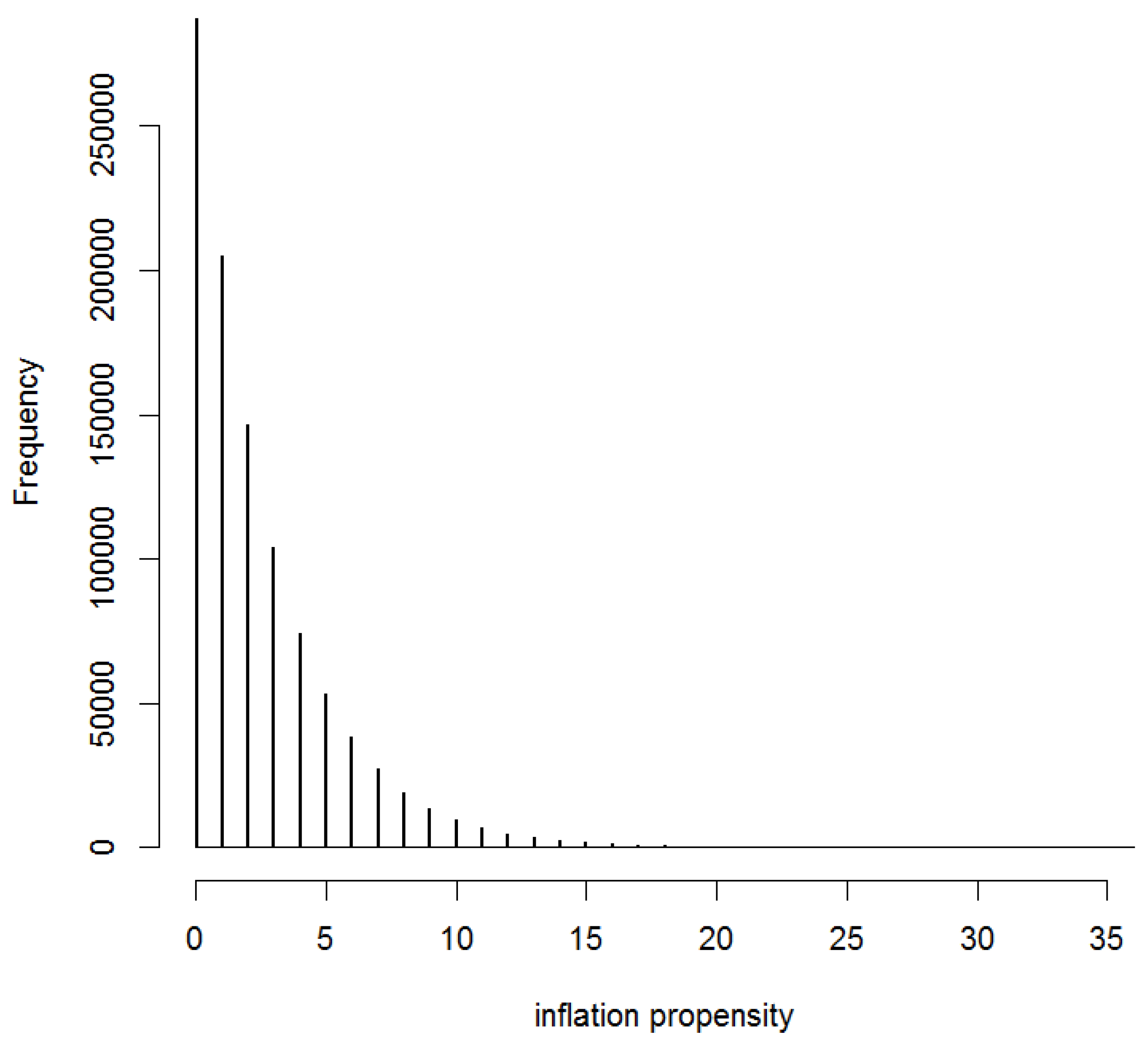

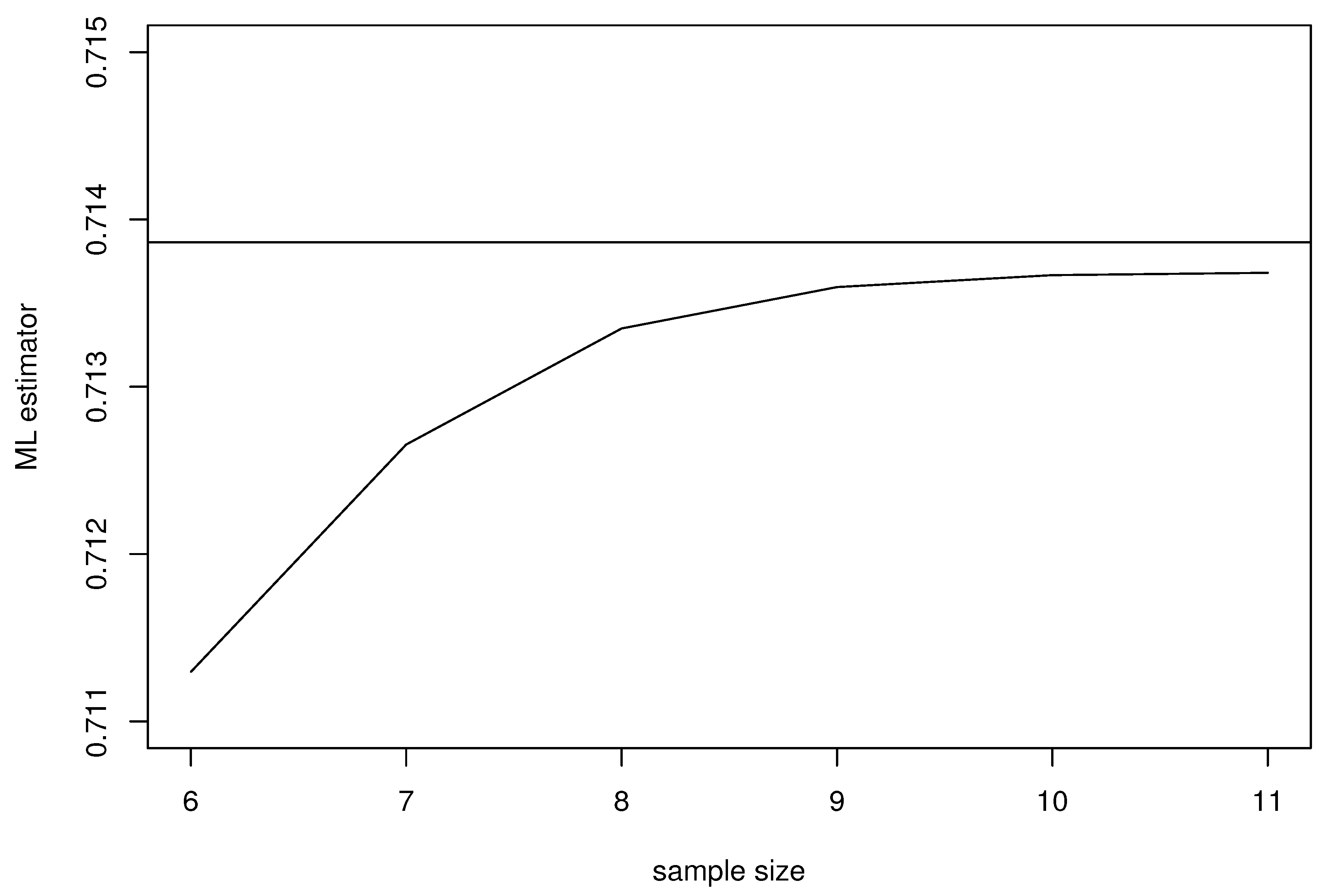

2. Inflation Propensity

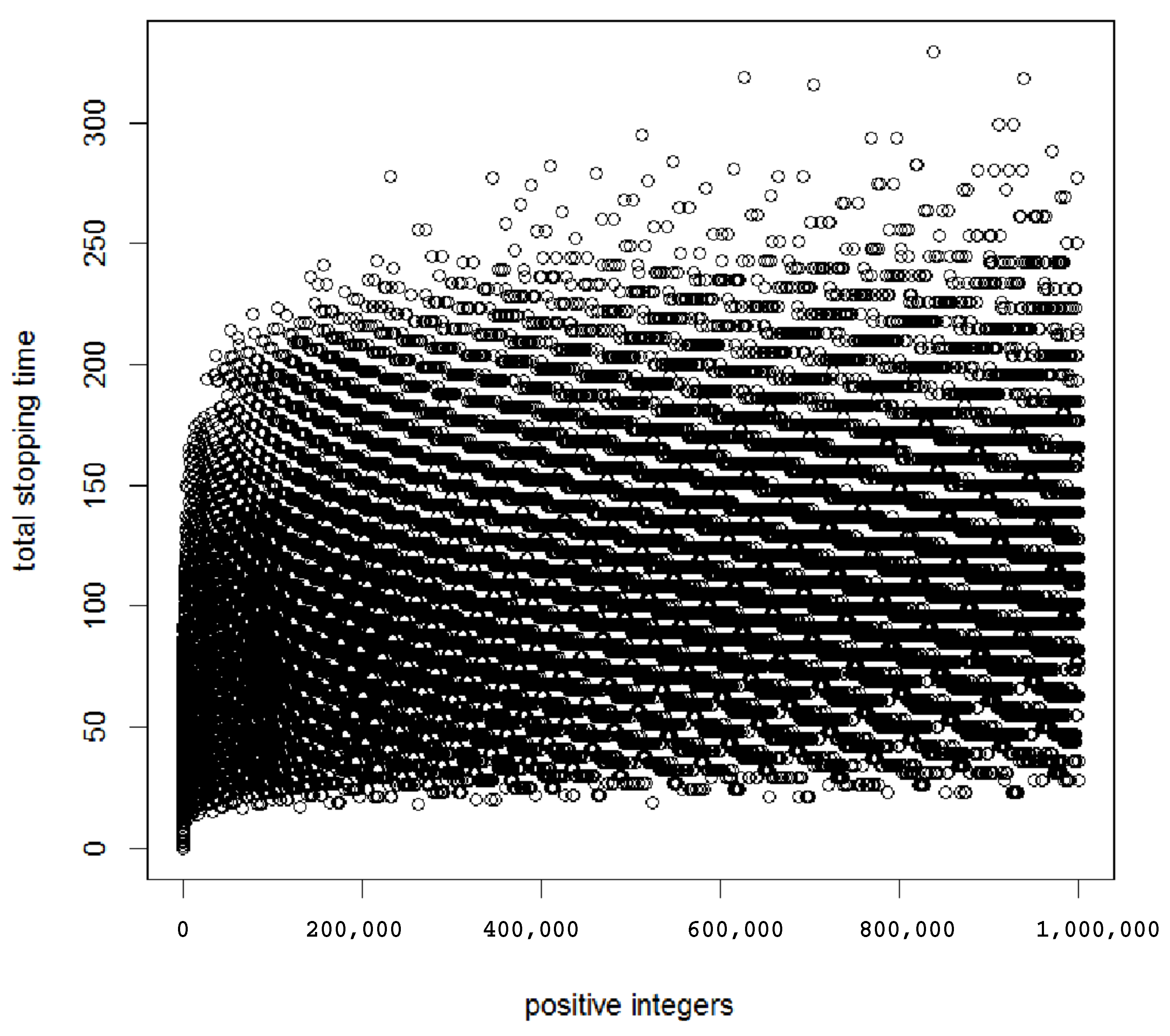

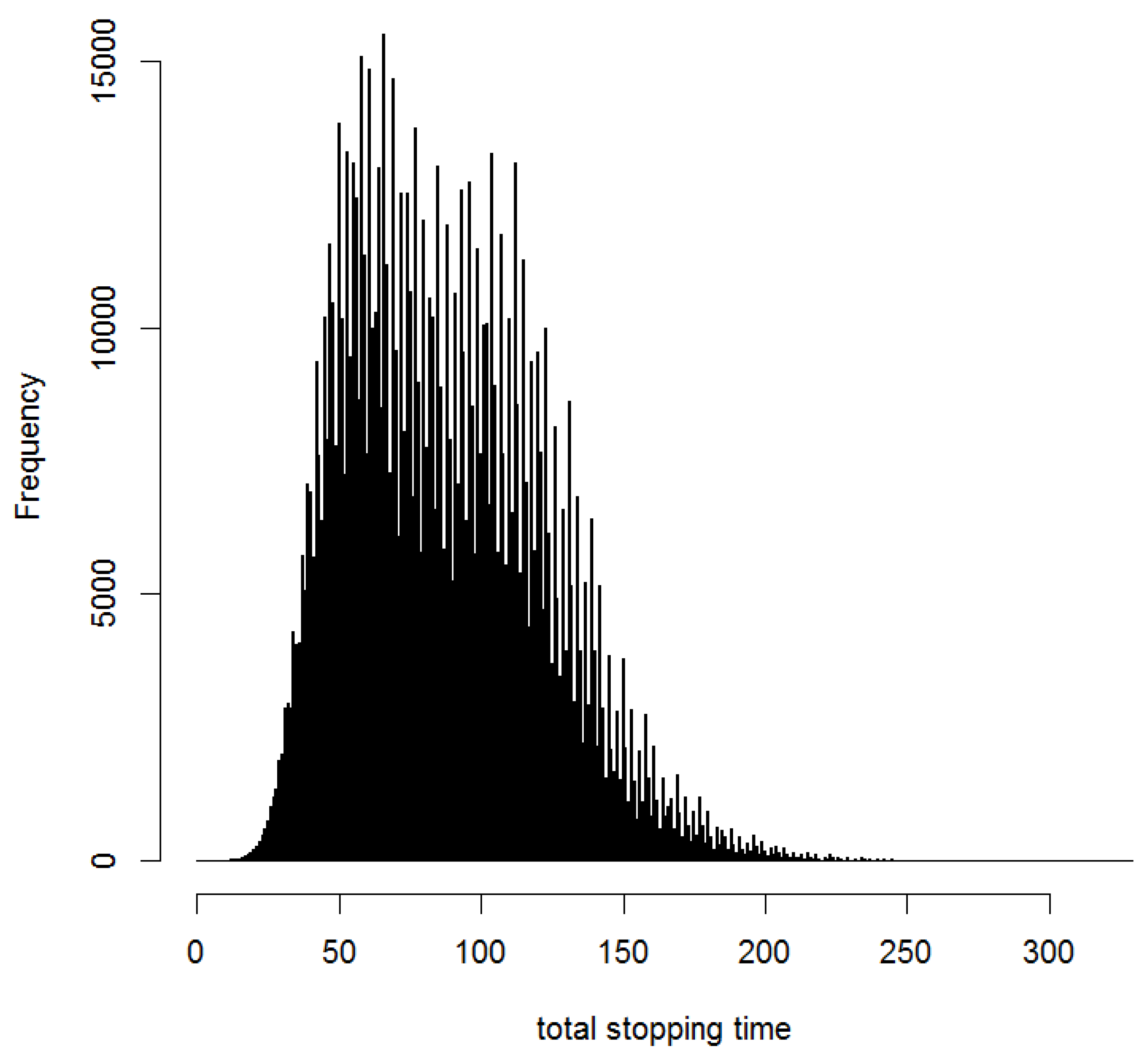

3. Empirical Results

4. Application

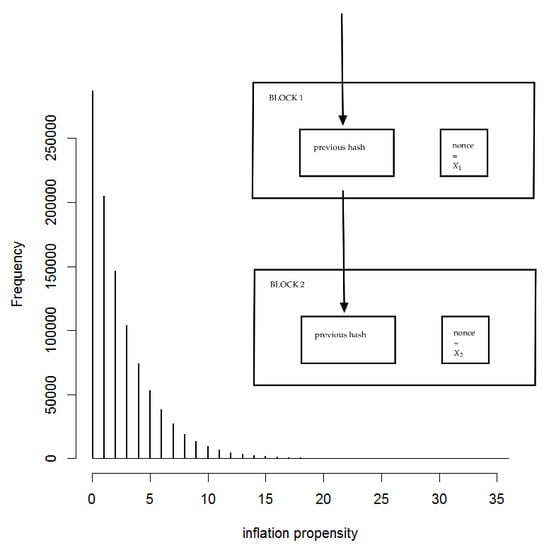

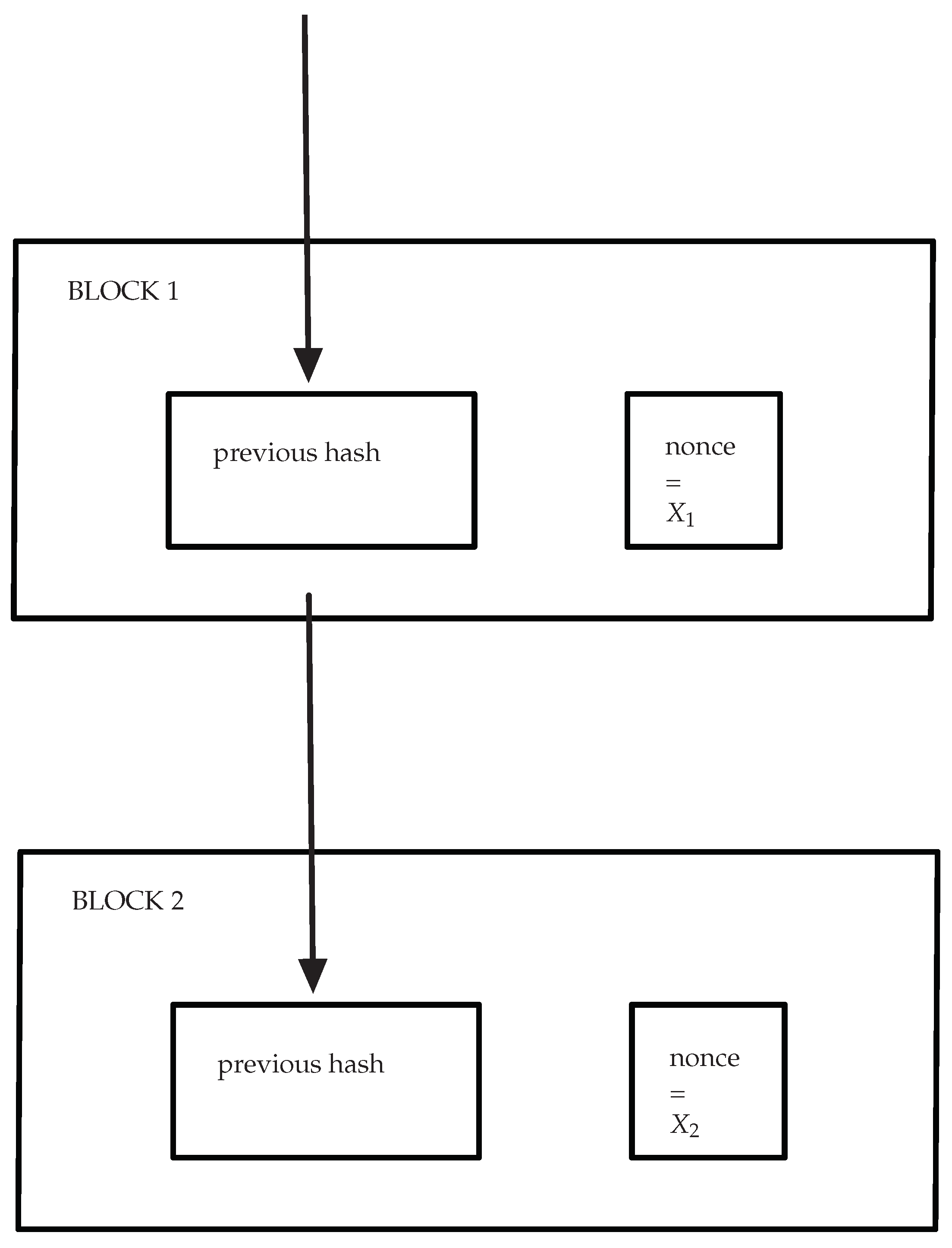

4.1. Collatz-Based Proof-of-Work

4.2. Example: Bitcoin Genesis Hash

4.3. Advantages of the Collatz-Based Proof-of-Work

5. Conclusions

Funding

Conflicts of Interest

Appendix A. Distribution of Inflation Propensity for the First 1 × 1011 Integers

| Observations | |

|---|---|

| 0 | 28,631,964,381 |

| 1 | 20,434,254,718 |

| 2 | 14,583,348,496 |

| 3 | 10,407,804,534 |

| 4 | 7,427,954,284 |

| 5 | 5,301,161,512 |

| 6 | 3,783,166,989 |

| 7 | 2,699,976,430 |

| 8 | 1,927,052,441 |

| 9 | 1,375,229,862 |

| 10 | 981,424,318 |

| 11 | 700,353,911 |

| 12 | 499,868,474 |

| 13 | 356,795,944 |

| 14 | 254,706,290 |

| 15 | 181,761,315 |

| 16 | 129,757,032 |

| 17 | 92,628,127 |

| 18 | 66,127,176 |

| 19 | 47,199,172 |

| 20 | 33,676,458 |

| 21 | 24,024,158 |

| 22 | 17,138,021 |

| 23 | 12,231,945 |

| 24 | 8,727,118 |

| 25 | 6,225,787 |

| 26 | 4,432,544 |

| 27 | 3,162,432 |

| 28 | 2,251,004 |

| 29 | 1,599,248 |

| 30 | 1,139,341 |

| 31 | 814,975 |

| 32 | 583,455 |

| 33 | 416,994 |

| 34 | 298,683 |

| 35 | 212,914 |

| 36 | 150,443 |

| 37 | 106,613 |

| 38 | 76,749 |

| 39 | 55,452 |

| 40 | 39,947 |

| 41 | 28,495 |

| 42 | 20,259 |

| 43 | 14,253 |

| 44 | 10,396 |

| 45 | 7791 |

| 46 | 5431 |

| 47 | 3690 |

| 48 | 2640 |

| 49 | 1984 |

| 50 | 1448 |

| 51 | 1041 |

| 52 | 745 |

| 53 | 595 |

| 54 | 467 |

| 55 | 347 |

| 56 | 234 |

| 57 | 170 |

| 58 | 127 |

| 59 | 72 |

| 60 | 41 |

| 61 | 21 |

| 62 | 20 |

| 63 | 17 |

| 64 | 17 |

| 65 | 9 |

| 66 | 2 |

| 67 | 0 |

| 68 | 1 |

| 69 | 0 |

Appendix B. Python Code for Genesis Block

import hashlib, struct, binascii, time, sys, optparse

from construct import *

def main(): options = get_args() input_script = create_input_script(options.timestamp) output_script = create_output_script(options.pubkey) tx = create_transaction(input_script, output_script,options) hash_merkle_root = hashlib.sha256(hashlib.sha256(tx).digest()).digest() print_block_info(options, hash_merkle_root) block_header = create_block_header(hash_merkle_root, options.time, options.bits, options.nonce) genesis_hash, nonce = generate_hash(block_header, options.nonce, options.bits) announce_found_genesis(genesis_hash, nonce) def get_args(): parser = optparse.OptionParser() parser.add_option("-t", "--time", dest="time", default=int(1231006505), type="int", help="the (unix) time

when the genesisblock is created")

parser.add_option("-z", "--timestamp", dest="timestamp", default= "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks",

type="string", help="the pszTimestamp found in the coinbase of the genesisblock") parser.add_option("-n", "--nonce", dest="nonce", default=0, type="int", help="the first value of the nonce that will be incremented when searching the genesis hash")

parser.add_option("-p", "--pubkey", dest="pubkey", default="04678afdb0fe5548271967f1a67130b7105cd6a828e03909 a67962e0ea1f61deb649f6bc3f4cef38c4f35504e51ec112de5c384df7ba0b8d578a4c702b6bf11d5f",

type="string", help="the pubkey found in the output script") parser.add_option("-v", "--value", dest="value", default=5000000000, type="int", help="the value in coins for the output, full value (exp. in bitcoin 5000000000 - To get other coins value: Block Value * 100000000)")

parser.add_option("-b", "--bits", dest="bits", type="int", help="the target in compact representation, associated to a difficulty of 1") (options, args) = parser.parse_args() if not options.bits:

options.bits = 40 return options

def create_input_script(psz_timestamp): psz_prefix = ""

if len(psz_timestamp) > 76: psz_prefix = ’4c’ script_prefix = ’04ffff001d0104’ + psz_prefix + chr(len(psz_timestamp)).encode(""’hex’) print (script_prefix + psz_timestamp.encode(’hex’))

return (script_prefix + psz_timestamp.encode(’hex’)).decode(’hex’) def create_output_script(pubkey): script_len = ’41’

OP_CHECKSIG = ’ac’

return (script_len + pubkey + OP_CHECKSIG).decode(’hex’) def create_transaction(input_script, output_script,options): transaction = Struct("transaction",

Bytes("version", 4),

Byte("num_inputs"),

StaticField("prev_output", 32),

UBInt32(’prev_out_idx’),

Byte(’input_script_len’),

Bytes(’input_script’, len(input_script)),

UBInt32(’sequence’),

Byte(’num_outputs’),

Bytes(’out_value’, 8),

Byte(’output_script_len’),

Bytes(’output_script’, 0x43),

UBInt32(’locktime’))

tx = transaction.parse(’\x00’*(127 + len(input_script)))

tx.version = struct.pack(’<I’, 1)

tx.num_inputs = 1 tx.prev_output = struct.pack(’<qqqq’, 0,0,0,0)

tx.prev_out_idx = 0xFFFFFFFF tx.input_script_len = len(input_script) tx.input_script = input_script tx.sequence = 0xFFFFFFFF tx.num_outputs = 1 tx.out_value = struct.pack(’<q’ ,options.value)

tx.output_script_len = 0x43 tx.output_script = output_script tx.locktime = 0 return transaction.build(tx)

def create_block_header(hash_merkle_root, time, bits, nonce): block_header = Struct(’<q’"block_header",

Bytes("version",4),

Bytes("hash_prev_block", 32),

Bytes("hash_merkle_root", 32),

Bytes("time", 4),

Bytes("bits", 4),

Bytes("nonce", 4))

genesisblock = block_header.parse(’\x00’*80)

genesisblock.version = struct.pack(’<I’, 1)

genesisblock.hash_prev_block = struct.pack(’<qqqq’, 0,0,0,0)

genesisblock.hash_merkle_root = hash_merkle_root genesisblock.time = struct.pack(’<I’, time)

genesisblock.bits = struct.pack(’<I’, bits)

genesisblock.nonce = struct.pack(’<I’, nonce)

return block_header.build(genesisblock)

#Collatz inflation propensity def inflation_propensity(x): xMax=x stepToMaximum=0 while x > 1:

if x % 2 == 0:

x = x / 2 else:

x = (3 * x + 1) / 2 if x > xMax:

xMax=x stepToMaximum+= 1 return stepToMaximum

def generate_hash(data_block, start_nonce, bits): print ’Searching for genesis hash..’

nonce = start_nonce last_updated = time.time() header_hash = generate_hashes_from_block(data_block) print(binascii.hexlify(header_hash)) orbitTrajectory=int(header_hash.encode(’hex_codec’), 16) print(orbitTrajectory) timeInit=time.time() while True:

xi=inflation_propensity(orbitTrajectory) last_updated = calculate_hashrate(nonce, last_updated, orbitTrajectory,timeInit) if xi==bits:

return (generate_hashes_from_block(data_block), nonce)

else:

nonce = nonce + 1 orbitTrajectory += 1 data_block = data_block[0:len(data_block) - 4] + struct.pack(’<I’, nonce) def generate_hashes_from_block(data_block): header_hash = hashlib.sha256(hashlib.sha256(data_block).digest()).digest()[::-1] return header_hash

def calculate_hashrate(nonce, last_updated, orbitTrajectory, timeinit): if nonce % 10000 == 0:

now = time.time() hashrate = round(10000/(now - last_updated)) sys.stdout.write("\r%s Xis/s, Orbit: %s, Total time: %s minutes "

%(str(hashrate), str(orbitTrajectory), str((now-timeinit)/60))) sys.stdout.flush() return now

else:

return last_updated

def print_block_info(options, hash_merkle_root): print "merkle hash: " + hash_merkle_root[::-1].encode(’hex_codec’) print "pszTimestamp: " + options.timestamp

print "pubkey: " + options.pubkey

print "time: " + str(options.time)

print "bits: " + str(hex(options.bits))

def announce_found_genesis(genesis_hash, nonce): print "genesis hash found!"

print "nonce: " + str(nonce)

print "genesis hash: " + genesis_hash.encode(’hex_codec’) main() |

References

- Back, Adam. 2002. Hashcash-A Denial of Service Counter-Measure. Available online: http://hashcash.org/papers/hashcash.pdf (accessed on 25 November 2018).

- Bae, Minyoung, Ju-Sung Kang, and Yongjin Yeom. 2017. A Study on the One-to-Many Authentication Scheme for Cryptosystem Based on Quantum Key Distribution. Paper presented at IEEE Conference on Platform Technology and Service (PlatCon), Busan, Korea, February 13–15; pp. 1–4. [Google Scholar]

- Biryukov, Alex, and Dmitry Khovratovich. 2017. Equihash: Asymmetric proof-of-work based on the generalized birthday problem. Ledger 2: 1–30. [Google Scholar] [CrossRef]

- Conway, John H. 1972. Unpredictable iterations. Paper presented at 1972 Number Theory Conference, Boulder, CO, USA, August 14–18; pp. 49–52. [Google Scholar]

- Crandall, Richard E. 1978. On the 3x + 1 problem. Mathematics of Computation 32: 1281–92. [Google Scholar]

- Dwork, Cynthia, and Moni Naor. 1992. Pricing via processing or combatting junk mail. Paper presented at Annual International Cryptology Conference, Santa Barbara, CA, USA, August 16–20; Berlin and Heidelberg: Springer, pp. 139–47. [Google Scholar]

- e Silva, T. Oliveira. 2010. Empirical verification of the 3x+ 1 and related conjectures. In The Ultimate Challenge: The 3x+ 1 Problem. Edited by Jeffrey C. Lagarias. Providence: American Mathematical Society, pp. 189–207. ISBN 978-0821849408. [Google Scholar]

- Hartikka, Lauri. 2017. GenesisH0. Available online: https://github.com/lhartikk/GenesisH0 (accessed on 1 September 2018).

- Honda, Takumi, Yasuaki Ito, and Koji Nakano. 2017. GPU-accelerated Exhaustive Verification of the Collatz Conjecture. International Journal of Networking and Computing 7: 69–85. [Google Scholar] [CrossRef]

- King, Sunny. 2013. Primecoin: Cryptocurrency with Prime Number Proof-of-Work. Bitcoin Magazine, July 7. [Google Scholar]

- Kiktenko, Evgeniy O., Nikolay O. Pozhar, Maxim N. Anufriev, Anton S. Trushechkin, Ruslan R. Yunusov, Yuri V. Kurochkin, and Aleksey K. Fedorov. 2018. Quantum-secured blockchain. Quantum Science and Technology 3: 035004. [Google Scholar] [CrossRef]

- Kontorovich, Alex V., and Jeffrey C. Lagarias. 2010. Stochastic models for the 3x+ 1 and 5x+ 1 problems and related problems. In The Ultimate Challenge: The 3x+ 1 Problem. Edited by Jeffrey C. Lagarias. Providence: American Mathematical Society, pp. 131–88. ISBN 978-0821849408. [Google Scholar]

- Kurtz, Stuart A., and Janos Simon. 2007. The undecidability of the generalized Collatz problem. Paper presented at International Conference on Theory and Applications of Models of Computation, Shanghai, China, May 22–25; Berlin and Heidelberg: Springer, pp. 542–53. [Google Scholar]

- Lagarias, Jeffrey C. 1985. The 3x+ 1 problem and its generalizations. The American Mathematical Monthly 92: 3–23. [Google Scholar] [CrossRef]

- Lagarias, Jeffrey C., ed. 2010. The 3x+1 problem: An overview. In The Ultimate Challenge: The 3x+ 1 Problem. Providence: American Mathematical Society, pp. 3–30. ISBN 978-0821849408. [Google Scholar]

- Minsky, Marvin L. 1961. Recursive unsolvability of Post’s problem of “tag” and other topics in the theory of Turing machines. Annals of Mathematics 74: 437–55. [Google Scholar] [CrossRef]

- Nakamoto, Satoshi. 2008. Bitcoin: A Peer-to-Peer Electronic Cash System, Self-published.

- Nichols, Daniel. 2018. Analogues of the 3x + 1 Problem in Polynomial Rings of Characteristic 2. Experimental Mathematics 27: 100–10. [Google Scholar] [CrossRef]

- Percival, Colin. 2009. Stronger Key Derivation via Sequential Memory-Hard Functions, Self-published.

- Rubin, Jeremy. 2017. The Problem with ASICBOOST, Self-published.

- Terras, Riho. 1976. A stopping time problem on the positive integers. Acta Arithmetica 30: 241–52. [Google Scholar] [CrossRef]

- Tromp, John. 2015. Cuckoo cycle: A memory bound graph-theoretic proof-of-work. Paper presented at International Conference on Financial Cryptography and Data Security, San Juan, PR, USA, January 26–30; Berlin and Heidelberg: Springer, pp. 49–62. [Google Scholar]

- Urvoy, Tanguy. 2001. Regularity of congruential graphs. Paper presented at Mathematical Foundations of Computer Science 2000, MFCS 2000, Bratislava, Slovakia, August 28–September 1; Edited by Mogens Nielsen and Branislav Rovan. Lecture Notes in Computer Science. Berlin and Heidelberg: Springer, vol. 1893. [Google Scholar]

- Wood, Gavin. 2014. Ethereum: A secure decentralised generalised transaction ledger. Ethereum Project Yellow Paper 151: 1–32. [Google Scholar]

| 1. | also called “trajectory” or “forward orbit”. |

| Name | ∼Fully Diluted (Y2050) Marketcap/15 October 2018 | Underlying Algorithm |

|---|---|---|

| Bitcoin (BTC) | $134,308,812,450 | SHA-256 |

| Ethereum (ETH) | $29,787,293,584 | SHA-3 |

| Bitcoin Cash (BCH) | $9,225,442,784 | SHA-256 |

| Litecoin (LTC) | $4,430,985,913 | Scrypt |

| Dash (DASH) | $2,956,683,098 | X11 |

| Monero (XMR) | $2,300,499,210 | CryptoNight |

| ZCash (ZEC) | $2,262,517,311 | Equihash |

| Ethereum Classic (ETC) | $2,161,731,159 | SHA-3 |

| Dogecoin (DOGE) | $1,402,169,807 | Scrypt |

| Siacoin (SC) | $564,862,312 | Blake-2b |

| Bitcoin Gold (BTG) | $526,927,423 | Equihash |

| Digibyte (DGB) | $483,402,492 | SHA-256 and others |

| ReddCoin (RDD) | $447,635,857 | Scrypt |

| Bitcoin Diamond (BCD) | $343,664,370 | X13 |

| ZenCash (ZEN) | $275,245,426 | SHA-3 |

| Verge (XVG) | $229,929,732 | Scrypt |

| Zcoin (XZC) | $194,506,940 | Equihash |

| Monacoin (MONA) | $124,690,762 | Scrypt |

| Syscoin (SYS) | $81,207,881 | Scrypt |

| Zclassic (ZCL) | $67,149,925 | Equihash |

| Vertcoin (VTC) | $53,917,212 | Lyra2REv2 |

| Bitcoin Private (BTCP) | $51,124,537 | Equihash |

| LBRY Credits (LBC) | $41,220,511 | LBRY |

| Einsteinium (EMC2) | $25,808,910 | Scrypt |

| GameCredits (GAME) | $13,734,781 | Scrypt |

| Sample 1 | Sample 1 | Sample 1 | Sample 1 | ||

|---|---|---|---|---|---|

| 0.7133482 | 0.7135956 | 0.713667 | 0.713681 | ||

| Percentile | p-Value | p-Value | p-Value | p-Value | |

| 0 | 29 | 0.01 | 0.15 | 0.70 | 0.64 |

| 1 | 49 | 0.04 | 0.19 | 0.70 | 0.14 |

| 2 | 64 | 0.09 | 0.00 | 0.23 | 0.25 |

| 3 | 74 | 0.15 | 0.00 | 0.36 | 0.39 |

| 4 | 82 | 0.08 | 0.00 | 0.11 | 0.35 |

| 5 | 87 | 0.05 | 0.00 | 0.01 | 0.37 |

| 6 | 91 | 0.07 | 0.00 | 0.00 | 0.13 |

| 7 | 93 | 0.11 | 0.00 | 0.00 | 0.03 |

| 8 | 95 | 0.00 | 0.00 | 0.00 | 0.04 |

| 9 | 97 | 0.00 | 0.00 | 0.00 | 0.03 |

| 10 | 98 | 0.00 | 0.00 | 0.00 | 0.00 |

| block header hash | 37d25f7f472fde7bb5b84f4bb319097c580383911b45eff10e68afa06073d6c0 |

| corresponding integer | 25248903652996148805237565338196318809513309980842754974279018460154571249344 |

| merkle hash | 4a5e1e4baab89f3a32518a88c31bc87f618f76673e2cc77ab2127b7afdeda33b |

| pszTimestamp | The Times 3 January 2009 Chancellor on brink of second bailout for banks |

| pubkey | 04678afdb0fe5548271967f1a67130b7105cd6a828e03909a67962e0ea1f61deb649f6bc3f4cef38c4f |

| 35504e51ec112de5c384df7ba0b8d578a4c702b6bf11d5f | |

| time | 1231006505 |

| inflation propensity target | 40 (0 × 28) |

| nounce | 3420991 |

| genesis hash | 9ed4d59e375c60e568524ac7fdfcce2c36dd8d449a20b0be8c9f6f9dbd2f8709 |

| computational time | 28 min |

© 2018 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bocart, F. Inflation Propensity of Collatz Orbits: A New Proof-of-Work for Blockchain Applications. J. Risk Financial Manag. 2018, 11, 83. https://doi.org/10.3390/jrfm11040083

Bocart F. Inflation Propensity of Collatz Orbits: A New Proof-of-Work for Blockchain Applications. Journal of Risk and Financial Management. 2018; 11(4):83. https://doi.org/10.3390/jrfm11040083

Chicago/Turabian StyleBocart, Fabian. 2018. "Inflation Propensity of Collatz Orbits: A New Proof-of-Work for Blockchain Applications" Journal of Risk and Financial Management 11, no. 4: 83. https://doi.org/10.3390/jrfm11040083

APA StyleBocart, F. (2018). Inflation Propensity of Collatz Orbits: A New Proof-of-Work for Blockchain Applications. Journal of Risk and Financial Management, 11(4), 83. https://doi.org/10.3390/jrfm11040083