1. Introduction

The rapid growth and continuous expansion of China’s OFDI has attracted much attention in recent years. In particular, since the establishment of the BRI (in 2013, Chinese President Xi Jinping proposed the initiative of jointly building the “Silk Road Economic Belt” and the “21st Century Maritime Silk Road”; the initiative is referred to as the “Belt and Road” Initiative, or BRI for short), Chinese OFDI has grown significantly in both scale and speed. China’s OFDI in countries along the “Belt and Road” has increased steadily. From 2013 to 2020, China’s accumulated OFDI in countries along the “Belt and Road” was worth USD 139.85 billion. In 2021, China’s non-financial direct investment in countries along the “Belt and Road” reached USD 20.3 billion, a year-on-year increase of 14.1%, accounting for 17.9% of the total amount in the same period. Since the BRI was put forward, China’s OFDI in countries along the route has continued to increase, and the growth rate of investment is also higher than that of other regions. As a result, China’s OFDI has also demonstrated some new characteristics, especially in terms of high-quality development and “double carbon” (“double carbon” refers to carbon peaking and carbon neutrality). In the context of this target, the investment structure, investment method and investment efficiency of OFDI have been optimized and adjusted, and the impact of OFDI has thereby also become the focus of academic attention.

Since the BRI was proposed, with the improvement of the institutional system and operational level, some problems and defects in the investment projects involved in the initial stages of the BRI have also been gradually solved. The “Belt and Road” cooperative has changed from simply pursuing a high quantity of investment projects, to focusing on their quality. The quality of the construction of various investment projects largely determines the quality of “Belt and Road” construction. Therefore, against the background of the “double carbon” goal, the investment efficiency of various investment projects, especially those concerning the ecological environment and other effects of sustainable development, has become a prominent concern in the process of building the “Belt and Road” toward high-quality development. This is an important guarantee required for China’s OFDI to achieve long-term returns and benefits against the background of the BRI.

In the context of high-quality development and the “double carbon” goal, and in the face of global warming and a complex international environment, whether China’s OFDI can produce positive environmental effects is of great strategic significance. Theoretical circles have carried out many studies on the environmental effects of OFDI, but there are inconsistent views. Some scholars believe that foreign direct investment will improve the ecological environment of the investment destination, while others believe that foreign direct investment will worsen the ecological environment. Some hold the opinion that the environmental effects of OFDI are not static, but dynamically adjusted. Others claim that the environmental effects of OFDI are characterized by an inverted “U” shape [

1]; it is believed that there is an “N”-type relationship between OFDI and environmental pollution [

2]. The reason for such a difference is that some researchers believe that this issue is closely related to the economic development, human capital, environmental regulation and financial development of the investment destination country [

3]. For example, in the initial period of the investment destination country’s economic development, OFDI will increase pollution, and in the transition period, it will reduce pollution [

4]. When the intensity of the environmental supervision in the destination country of investment is at a reasonable level, the negative effects of OFDI on environmental efficiency are weakened, and the quality of the OFDI will have a positive effect on the environmental efficiency [

5].

Regarding the inconsistencies in the above research conclusions, the existing research is conducted more from the perspective of the investment destination country, by taking into account the economic level of the investment destination country, the quality of the system in the environment, etc., and less from the angle of the home country, for example, considering the environmental responsibility of the home country [

6,

7]. The responsibility of the home country is more reflective of the specific advantages of the home country, which means that the role that the country can play in OFDI activities has been significantly enhanced, and it has become a basic feature of contemporary international investment. For multinational enterprises lacking the advantage of a monopoly, a country’s corresponding support, guidance and encouragement of OFDI activities, from the perspective of country strategy and interests, can have a positive impact on the OFDI performance of these enterprises [

8]. Through empirical analysis, some studies have concluded that China’s specific advantages play an important and key role in promoting foreign direct investment [

9]. With the globalization of the market, the role of the country-specific advantages (CSAs) of home countries has been steadily declining, and the impact of the CSAs of home countries is now relatively less important in driving value than their firm-specific advantages [

10]. This does not necessarily mean, however, that country-specific advantages do not affect the effectiveness of the OFDI of firms. As economic globalization and international market integration improve, enterprises, as major players in OFDI, in the context of the host country or the home country, cannot ignore the role of their own country [

11]. Although the existing literature on country-specific advantages is still immature, the importance of this aspect is growing, especially with regard to home countries. Future research should focus on how to make use of the CSAs of home countries and internalize these advantages to allow enterprises to excel in international competition. The country-specific advantages are a country’s relative advantages manifested in the uneven distribution or asynchronous development of various resources among different countries [

12]. Therefore, different countries have different country-specific advantages. In other words, country-specific advantages manifest differently in different countries.

As China’s economy gradually shifts towards high-quality development, country-specific advantages will have some corresponding adjustments and changes. Then, the question is: in the context of the new era, how and to what extent will country-specific advantages affect OFDI activities and the effectiveness of OFDI?

Against the background of high-quality development and the “double carbon” goal, this study, taking the proposal and implementation of the BRI as an opportunity, attempts to explore the environmental impact of China’s OFDI on the investment destination country during the implementation of the BRI, from the angle of CSAs of home countries. Based on the idea of DID, this study establishes an empirical model, and assesses whether the BRI has a significant and promoting effect on the positive ecological and environmental effects of China’s OFDI. Comparing investment destination countries with different levels of economic development, the analysis shows that the BRI has a more positive role in promoting the environmental effect of China’s OFDI in developing countries.

With the high-quality development and the “double carbon” goal as the background, this paper discusses the environmental effects of China’s OFDI during the implementation of the BRI, which can not only enrich the theory of OFDI and sustainable development theories, but also provide corresponding countermeasures for optimizing OFDI structure, improving OFDI efficiency in countries along the “Belt and Road”, and providing corresponding suggestions for countries along the route to improve their ecological environment level, as well as for the development of China’s open economy, new regional economic cooperation and the improvement of the global governance structure. At the same time, this study explores the environmental impact of China’s OFDI on the host country during the implementation of the BRI. On the one hand, it can respond to the international community’s doubts that OFDI will transfer excess capacity and increase the environmental burden of the host country. On the other hand, it can further reflect the concept of high-quality development, and highlight the fact that China pays more attention to the impact of ecological environment and sustainable development in the process of OFDI. Therefore, this study has specific practical and theoretical significance. The main innovations of this study are as follows. At first, with the help of the theory of country-specific advantages, this paper starts from the angle of the home country and studies the impact of China’s OFDI on the environmental pollution of the investment destination during the implementation of the BRI. Second, with the help of the idea of DID, we conduct an empirical analysis and test of the policy effect brought by the implementation of the BRI, providing a realistic sample for assessing the country’s specific advantageous role in the processes of China’s OFDI. Third, with full-sample and sub-sample data to conduct empirical tests, it is concluded that compared with developed countries, against the background of the BRI, China’s OFDI can contribute to the environmental improvement of developing countries, which expands the existing research conclusions. The remaining parts of the paper are arranged as follows: the second section is about the literature review, theoretical analysis and research hypotheses; the third section contains the data and methodology; the fourth section concerns the empirical results; the last section outlines the conclusions and policy implications.

3. Data and Methodology

3.1. Mechanism Description

The endogenous growth theory and the exogenous growth theory emphasize the corresponding impacts of OFDI on the economic growth, technological progress, employment, income and other aspects of the host country. The endogenous growth theory proposed by Romer [

48,

49] is taken as representative, which expounds and analyzes the internal mechanism and the correlation between FDI and economic growth. FDI may play a role in economic growth through capital accumulation and knowledge spillovers [

25]. The exogenous growth theory [

50] assumes that economic growth and development is generated through external factors of production, such as capital accumulation and labor. Therefore, the introduction of technology via new FDI can increase the productivity of the labor and capital stock, which will further increase the return on investment. In general, exogenous growth theory holds that FDI enhances the host country’s capital stock, which then promotes rapid economic growth and development toward a new steady state. The impact of foreign capital introduction on economic growth and development is twofold: firstly, foreign capital introduction can affect economic growth through the introduction of new goods, capital accumulation and foreign technologies, according to exogenous growth theory [

25]. Secondly, the inflow of foreign capital can promote economic growth and development by increasing the host country’s knowledge reserves through knowledge transfer, according to endogenous growth theory [

51]. Therefore, theoretically speaking, for the host country, the purposes of economic growth can be achieved by introducing and absorbing FDI.

For the host country, firstly, in the process of achieving economic growth by attracting foreign capital, more resources and funds are invested in environmental protection and improving the quality of the country’s environment; secondly, attracting foreign direct investment can not only facilitate the export of more intermediate products to the investing countries, but also promote the absorption of advanced science and technology, production processes and management processes from the investing countries, so as to obtain the benefits brought by positive technology spillovers. Enterprises in the host country can adopt more environmentally friendly production standards to improve production processes, improve production efficiency and save production costs, thereby promoting the optimization of environmental quality [

52]. The natural environment of the host country will directly and indirectly reduce industrial environmental pollution through the spillover of ecological technology innovation [

4]. It is this positive technology spillover that enables the host country’s enterprises to better exert a local market effect, to promote the upgrading and optimization of the industrial structure, and thus promote the improvement of the investment destination country’s ecological environment. In addition, in the process of OFDI, multinational companies are not only encouraged and supported by the home country’s policy, but also come under the guidance of the home country’s policy and carry out OFDI activities according to its requirements. For example, the German government requires multinational companies that do OFDI to fulfill their corporate social responsibility and abide by specific principles that they have formulated, including high standards in terms of environmental impact [

52,

53]. With the implementation of the BRI and the expansion of China’s OFDI scale, the Chinese government has also paid more attention to promoting the green development model of green OFDI and cooperation [

54]. In 2021, the Ministry of Commerce and the Ministry of Ecology and Environment of China issued the Guidelines for Green Development of Foreign Investment and Cooperation. The guideline provides important guidance for Chinese enterprises to carry out OFDI activities and reflects the clear orientation of the Chinese government towards supporting enterprises to actively contribute to global green development. Against the background of high-quality development and the goal of “double carbon”, to integrate green concepts into the joint construction investment projects of the BRI is to take the new development concept as the guide, and to seek the development of a global ecological civilization [

55]. Therefore, in the implementation of the BRI, the OFDI, together with the specific advantages of the home country, has played a positive role (different from that in the traditional period) in promoting the integration of the specific advantages of enterprises and the specific advantages of the host country. The integration effect of these specific advantages can enable the accumulation of more resources and elements, thereby promoting the further improvement of the ecological environment of the host country.

3.2. Model

To consider the environmental impact of OFDI, Panayotou [

56] first proposed the “Environmental Kuznets Curve (EKC)”, based on the nonlinear idea of the Kuznets curve. The IPAT model (I = PAT) [

57] is used to test the impact of population growth on the environmental quality. However, with the development of OFDI, the limitations of existing models are further highlighted. Therefore, this paper draws on the model STIRPAT (Stochastic Effects of Population, Economic Development Level and Technology by Regression) established by other scholars [

39,

58,

59], as follows:

In Equation (1),

I represents the environmental index, and

P,

A and

T represent the factors that affect the environment, including population size, economic level and technological index. The variables

a,

b,

c and

d are the estimated parameters, and

e is the error term. In this paper, we refer to the practice of some scholars including OFDI as an additional variable, and thus construct an extended version of the STIRPAT model [

39]. After rearranging the natural logarithm of the model, some studies [

39] formulate a new model for the environmental effects of Chinese OFDI on the host country, as follows:

In Equation (2),

P stands for population size,

A stands for GDP level,

T stands for technological level, and

S stands for industrial structure. In the existing research, it is generally believed that a country’s population size, economic level, technological level and industrial structure are closely related to a country’s ecological environment quality [

39]. In different studies, these kinds of variables are represented by different proxy variables. In this study, we use the population of an investment destination country to represent the population size (Pop), the per capita GDP of a country to represent the economic level (GDPper), the proportion of a country’s communications and technology product exports to GDP to represent the technology level (Tech), and the proportion of the country’s industrial added value to GDP represents the industrial structure (Structure).

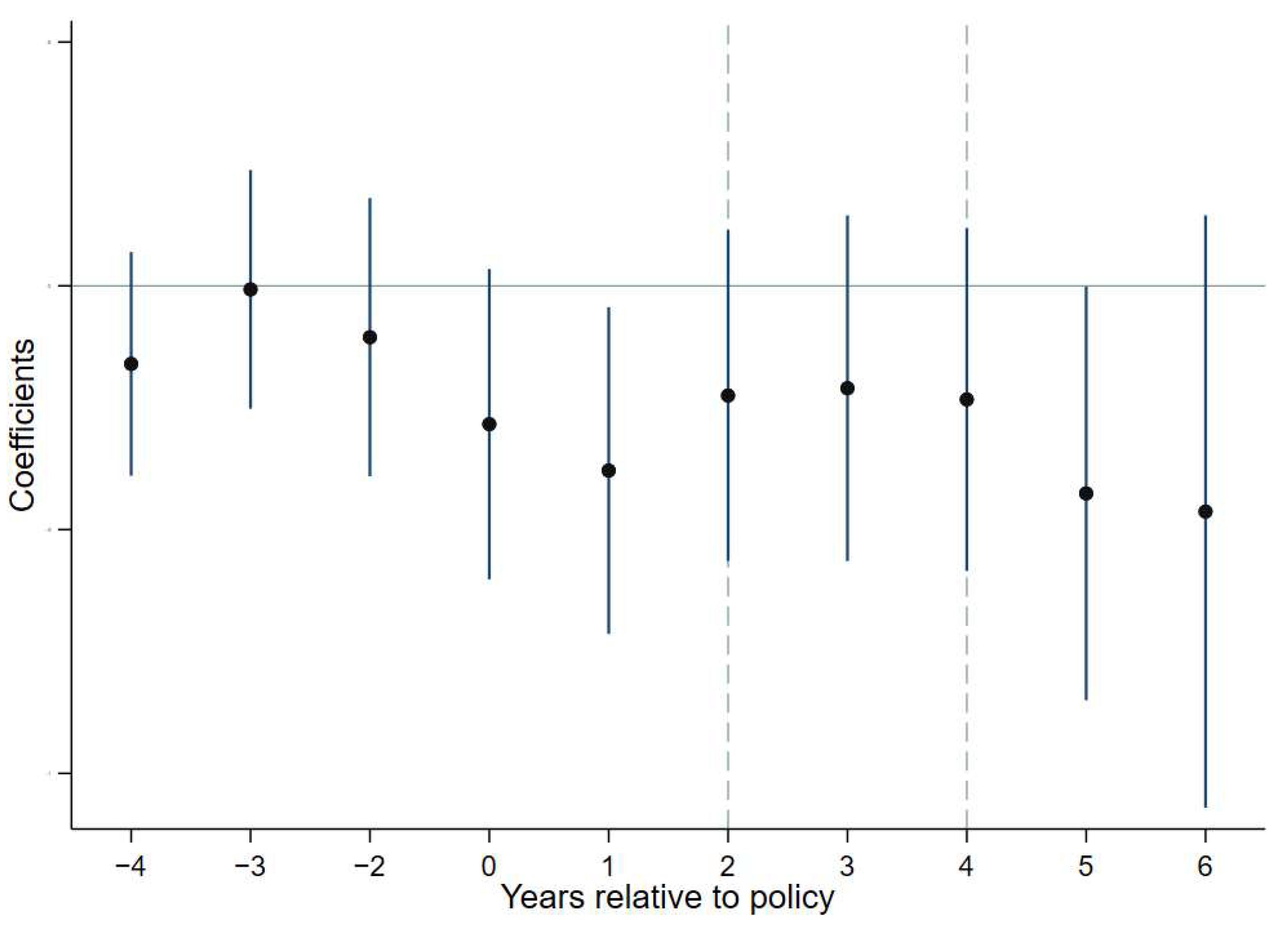

This paper continues to use the Difference-in-Differences to examine the environmental effects of China’s OFDI during the implementation of the BRI. Difference-in-Differences is a method proposed for counterfactual logic. In the process of its use, the observation objects need to be divided into the treatment group and the control group. The treatment group is the sample group affected by the policy, in which there is a policy change at a certain time point; the control group is the sample group not affected by the policy, in which, at the given time point, there is no policy change. This method mainly tests the effects of policy implementation by comparing the changes in the treatment group and the control group before and after the implementation of the policy. In empirical analysis, in order to avoid bias, it is necessary to find a suitable control group to be used as the counterfactual reference group of the treatment group and obtain the time effect before and after the policy implementation of the control group. Then, the changes in the control group before and after the implementation of the policy are subtracted from the changes of the treatment group before and after the implementation of the policy to obtain the real effect of the policy’s implementation, also known as the treatment effect.

This study examines the impact of the BRI on the environmental effects of OFDI. It is inaccurate to simply analyze the changes in the environmental effects of OFDI before and after the implementation of the BRI. Such a change contains two parts: one is the time effect without the implementation of the BRI, that is, the change in the time trend; the other is the direct policy effect of the BRI. The real policy effect is considered by excluding the time effect. To eliminate the time effect, the usual method is to choose a frame of reference [

9], that is, to select a sample affected by the implementation of the BRI and use this sample to obtain the OFDI’s environmental effects before and after the implementation of the BRI. Changes in OFDI environmental effects before and after the implementation of BRI can be obtained by subtracting the change of the sample which is not affected by the implementation of the BRI at the same time. This is the main idea of the DID model.

The idea of DID is generally represented by a linear regression model containing the experimental group dummy variable and the time dummy variable:

In the above regression model, Gi represents the grouping dummy variable (Gi = 1, if i belongs to the experimental group; Gi = 0 if i belongs to the control group); Dt represents the experimental period dummy variable (Dt = 1, if t = 2; Dt = 0, if t = 1), and the coefficient of the multiplication term GiDt is the real measure of the policy implementation effect of the experimental group.

Taking the proposal of the BRI as its focus, this paper considers how the CSAs of the home country can promote the environmental effects of OFDI. Therefore, the BRI, which represents the CSAs of the home country, is taken as the main variable and incorporated into the empirical model to examine whether the BRI can significantly promote China’s OFDI to bring about an improvement in the environmental effects of the host countries. While discussing the environmental effects of China’s OFDI on each investment destination country, this study uses the per capita carbon dioxide emissions proxy variable of each host country (based on the DID model and existing research results [

60]) and combines Equations (2) and (3) to construct the following empirical model:

Here, represents the pollution emissions, indicating the ecological environment level of each host country, using the per capita carbon dioxide emissions of each host country as a proxy variable; represents the level of China’s OFDI in each investment destination country, and its value is equal to the stock of China’s OFDI in country i in period t, taking the logarithm in the empirical analysis; is the grouping dummy variable (1 for countries along the “Belt and Road”, otherwise 0); is the time dummy variable (with a value of 1 after the BRI is proposed, otherwise 0). In the empirical analysis, for years after 2013, the value is 1; and for the year of 2013 and before, the value is 0. This paper incorporates the dummy variable , which determines whether the investment destination country is a country along the route, into the model, mainly to compare and analyze the countries along the route and those that are not and use this to exclude the influence of other policy factors during this period. The most important part of the model is the interaction term , which examines whether the value of the regression coefficient of the interaction term is negative, and whether it passes the significance test. If the coefficient is significantly negative, it means that the BRI can significantly improve the environmental effects of OFDI on the investment destination country. In addition, in the model, stands for the control variable, including the population size (Pop), economic development level (GDPper), technological level (Tech), industrial structure (Structure) and the scale of FDI that actually flows into each host country (IFDI).

Equation (4) is specially designed for China’s country-specific advantages and has good applicability in empirical analyses to explain the policy effects of the implementation of the BRI. This is the advantage of this model. However, whether the model can draw consistent conclusions in other application scenarios still needs to be tested in practice.

3.3. Data Source and Description

Taking China’s proposal of the BRI in 2013 as the time node, this paper focuses on whether the implementation of the BRI can promote improvements in the environmental quality of China’s OFDI and compares the changes in the environmental effects of China’s OFDI before and after 2013. The sample data of China’s OFDI from 2003 to 2020 was collected, along with the population, economic level, industrial structure and technological level of each host country, and the scale of FDI that actually flows into each host country. After filtering out and deleting missing values, this paper finally retains data on China’s OFDI in 162 countries, and the relevant information of these 162 host countries. According to the “Statistical Bulletin of China’s OFDI”, the statistics of 63 countries and regions along the “Belt and Road” have been collected. Among these 162 countries, 53 are countries along the “Belt and Road” (the 53 countries are Afghanistan, Albania, United Arab Emirates, Azerbaijan, Bangladesh, Bulgaria, Bahrain, Bosnia and Herzegovina, Belarus, Brunei, Czech Republic, Estonia, Georgia, Croatia, Hungary, India, Iran, Israel, Jordan, Kazakhstan, Kyrgyzstan, Cambodia, Kuwait, Lao PDR, Lebanon, Sri Lanka, Lithuania, Latvia, Moldova, North Macedonia, Myanmar, Mongolia, Malaysia, Nepal, Oman, Pakistan, Philippines, Poland, Qatar, Romania, Russian Federation, Saudi Arabia, Singapore, Serbia, Slovakia, Slovenia, Syria, Thailand, Turkey, Ukraine, Uzbekistan, Vietnam and Yemen). For specific data sources, see

Table 1.

- (1)

Dependent variable. The per capita carbon dioxide emission of each host country is used as a proxy variable for the explained variable.

- (2)

Explanatory variables. The most important core independent variable is the impact of the BRI on the ecological effects of China’s OFDI on each host country, and the specific variable is an interaction item, including China’s OFDI, the implementation of the BRI and countries along the “Belt and Road”. In the process of the concrete empirical analysis, the stock of OFDI is used as a proxy variable for OFDI.

- (3)

Control variables. The level of ecological environment is constrained by many factors, such as the level of economic, the population size, the industrial structure, and the technological level. Considering the environmental effects of FDI inflows into each country from others, this paper also controls for the scale of FDI that actually flows into each country. The control variables in this empirical model include the per capita GDP of each country, the total population of each host country, the proportion of each country’s industrial added value in terms of GDP, the proportion of communication and technology exports in GDP and the scale of FDI that actually flows into each host country.

In

Table 2, the descriptive statistics of the main variables can be obtained. The treatment group reported the per capita carbon dioxide emissions of the host countries along the “Belt and Road”, the stock of FDI absorbed from China, the size of the population, the per capita GDP, the proportion of communications and technology exports in GDP, the proportion of industrial added value in GDP and the scale of FDI that actually flows into each host country. The control group reported the per capita carbon dioxide emissions of host countries not along the “Belt and Road”, the stock of FDI absorbed from China, the population size, the per capita GDP, the proportion of communications and technology exports in GDP, the proportion of industrial added value in GDP and the scale of FDI that actually flows into each host country.

5. Conclusions and Policy Implications

This study analyzes the environmental effects of China’s OFDI against the background of the “Belt and Road”, from the angle of the CSAs of the home country. With the help of the DID concept, this paper focuses on the impact of the implementation of the BRI on the environmental effects of China’s OFDI in various countries. The basic conclusions are as follows: First, the implementation of the BRI can effectively promote the improvement of the environmental effects of China’s OFDI in the investment destination. That is, after the implementation of the BRI, China’s OFDI can significantly improve the environmental quality of the investment destination. Second, the positive environmental impact of China’s OFDI in developing countries is more significantly affected by the BRI than in developed countries. Third, for developing Asian countries, the BRI has played a more significant and positive role in promoting the environmental effects of China’s OFDI.

After the implementation of the BRI, the specific advantages derived by the home country in the process of China’s OFDI are further enhanced. Firstly, by integrating these specific advantages, China can further optimize the integration and allocation of resources and elements in the process of OFDI, promote the upgrading of the investment destination country’s domestic industry, and bring about an improvement in environmental quality. Secondly, with the implementation of the BRI, China’s OFDI has encouraged host countries to improve quality of their ecological environment, while achieving economic development. To improve the quality of the ecological environment, a relatively large number of projects with high environmental protection standards have been introduced, which reduces the discharging of pollutants and makes the ecological environment less prone to deterioration. Therefore, to a large extent, the influence of China’s OFDI on the environmental quality of the investment destination country is proven. This finding is consistent with the conclusion of [

52] that with the implementation of the BRI, China’s OFDI in countries along the route has produced positive environmental effects. This paper further examines the different impacts of BRI implementation on different host countries. Compared with developed countries, the BRI has a more significant positive impact on the environmental improvement effect of China’s OFDI in developing countries. This differs from the conclusions derived in existing studies [

61,

62] that OFDI reduces CO

2 emissions only in high-income countries and regions, and not in middle- and low-income countries and regions. This finding, on the one hand, responds to the international community’s doubts about the implementation of the BRI, and on the other hand, further highlights the positive impact of the implementation of the BRI.

This study has important policy implications for improving the quality and efficiency of China’s OFDI in the context of BRI. On the one hand, it is necessary to increase OFDI in countries along the route, improve the environmental quality of host countries and meet the goal of sustainable development. On the other hand, countries along the route can actively participate in the process of BRI implementation, attract more FDI from China and promote the improvement of their own environment. Therefore, this study shows that the BRI can effectively improve the positive effects of China’s OFDI on the environmental quality of the investment destination, which provides a further reference for adjusting and optimizing the scale and structure of OFDI during the implementation of the BRI. It also provides a reference that will help countries along the route attract FDI from China. The host countries, especially those along the route, can actively participate in the BRI to absorb more FDI from China and improve their own environmental quality.