1. Introduction

Corporate governance is an old as well as challenging topic. It has gained attention due to worldwide high-profile scandals of the earlier 21st Century. These issues affect the market price of shares at a higher level, such as Enron, Volkswagen, Lehman Brothers, Kobe Steel, Equifax, etc. [

1]. It is reported that a better corporate governance mechanism plays a significant role in any organization. As a result, it improves sustainable performance, better allocation of resources, and creates a better relationship with shareholders compared to poor corporate governance mechanisms [

1,

2]. Corporate board members are the important mechanism of corporate governance in any firm; they hold the responsibilities for leading and controlling the firm and performing duties on behalf of its shareholders [

3]. Board gender diversity is a factor for corporate boards under the umbrella of corporate governance [

4,

5]. Gender diversity on corporate boards has gained attention from practitioners, researchers, investors, shareholders, and policymakers [

6]. With the passage of time, the presence of women on boards has had increasing consideration across the world and emerging economies [

7,

8,

9]. In this regard, researchers and practitioners claim that one of the best ways to improve and increase sustainable performance in every organization is through a higher representation of women on boards [

10,

11]. It has been identified that firms should reflect society and operate with a different homogenous group of members or board of directors [

12]. The burden for innovation in firms creates a negative impact on firms’ sustainable performance [

13,

14], however, a heterogeneous group of board members can provide a more diverse body of knowledge, creating significant innovation and decision-making capability [

15].

There has been a rise in awareness regarding the need for gender diversity on corporate boards, which has resulted in a number of countries passing legislation and instituting policies that encourage the nomination and involvement of women on corporate boards. The inclusion of a greater number of women on corporate boards is thought to promote not only social equity but also governance and company performance, which has given rise to a number of initiatives aimed at increasing the proportion of women in positions of power within corporations. The presence of female directors on board in a CEO position has become more crucial, especially in developing countries like Pakistan. Because of Pakistan’s perspective, females as CEOs play a significant role in enhancing sustainable performance [

16].

In the present literature, the proportion of female CEOs has created great interest, as the aspects of having female CEOs can impact firms’ sustainable performance [

17]. Most importantly, the decision-making and problem-solving power of the corporate board increase if the women on board perform duties as CEO [

8]. Chen and Elder [

18] claim that women on boards can curb managerial opportunism by monitoring their abilities. Researchers have shown female CEOs perform a significant role in firm innovation by reducing asymmetric information among shareholders and managers and reducing agency conflicts [

19]. Generally, women are working in middle-level management rather than higher board of directors or CEO positions. This situation exists not only in developed countries but also in developing emerging economies like Pakistan.

The proportion of female directors on board is neglected in Pakistani firms, particularly in top-level management positions such as CEO [

16]. The corporate culture and environment in Pakistan is dominated by men, which does not allow women to climb the ladder onto the corporate board [

8]. Consequently, there is a need to examine the association between women on boards and female directors as CEO on firms’ sustainable performance. By removing the glass ceiling for female directors as CEO or higher-level management in emerging economies, the result is that women can perform an excellent role in developing the economy through the sustainable performance of firms.

The literature on firms’ sustainability performance started at the end of the 20th century [

20,

21]. The concept of sustainability consists of three main dimensions within the business context, including the social, environmental, and economic factors [

22]. Sustainability is one of the significant issues for society and is about developing society by creating a proper balance between the economic, environmental, and social objectives [

23]. This study highlights the issue of firms’ sustainability performance with different proxies related to accounting base and market base measures.

The terminology of CEO duality in the financial literature is used if the CEO performs the dual role, i.e., simultaneously CEO and chairperson of the firm [

24,

25]. The previous research provided mixed results related to CEO duality for enhancing sustainable performance. The outcomes of the literature on CEO duality are inconclusive; many researchers offer evidence in favor of CEO duality, although this is sometimes insignificant, and most studies claim a negative impact on performance [

24,

26]. Supporting agency theory, researchers have argued for the negative effect of CEO duality on firm sustainability [

21]. Agency theory suggests the CEO does not work in the shareholder’s interest. Instead, they perform duties in their self-interest and benefit, which ultimately leads to agency conflicts with shareholders and executives, resulting in a negative impact on the performance of the firm.

Alternatively, CEO duality can have a positive impact as per the stewardship theory. This theory assumes that the CEO performs duties as a good steward with a more robust and flexible corporate leadership structure, enhancing managerial efficiency, and positively impacting the firm’s sustainable performance [

27,

28]. In addition, the CEO would be expected to have greater knowledge of the firm and its industry than an external chair [

29], so they have a greater commitment to the firm, and thereby, provide greater insider representation to the firm [

30].

As an emerging country, Pakistan refurbished its corporate governance mechanism by issuing corporate codes for the first time in 2002, and these codes were revised by the securities and exchange commission of Pakistan in 2012. According to the dual role of the CEO, the first code advised the suppression of CEO and chairperson’s offices. In 2012, the latest codes stated that these two positions must be separated [

31]. Furthermore, the constitution of Pakistan provides equal rights for males and females. But in some Pakistani organizational cultural environments, men remain the dominant persons to perform duties on the board of directors rather than female participants, creating a cultural disparity between men and women when they reach higher ranks in any organization.

The conservative concept of gender diversity has been changing in Pakistan. The Government of Pakistan are planning a document vision in 2025 to recognize gender diversity in organizations, giving new opportunities for women to perform well in the economic, social, and corporate environment. A research survey conducted by CERB on gender diversity in Pakistan shows that the average board size is seven members in specific industries like banking and finance, cement, textile, and having an average of 1 to 4 women on the board of directors. The effects and interest increase consideration on the corporate board and provide opportunities to investigate whether female participation is related to firm sustainable performance. Therefore, there is a need to investigate the impact of female representation on boards and female CEOs on firms’ sustainable performance in the context of the emerging economy.

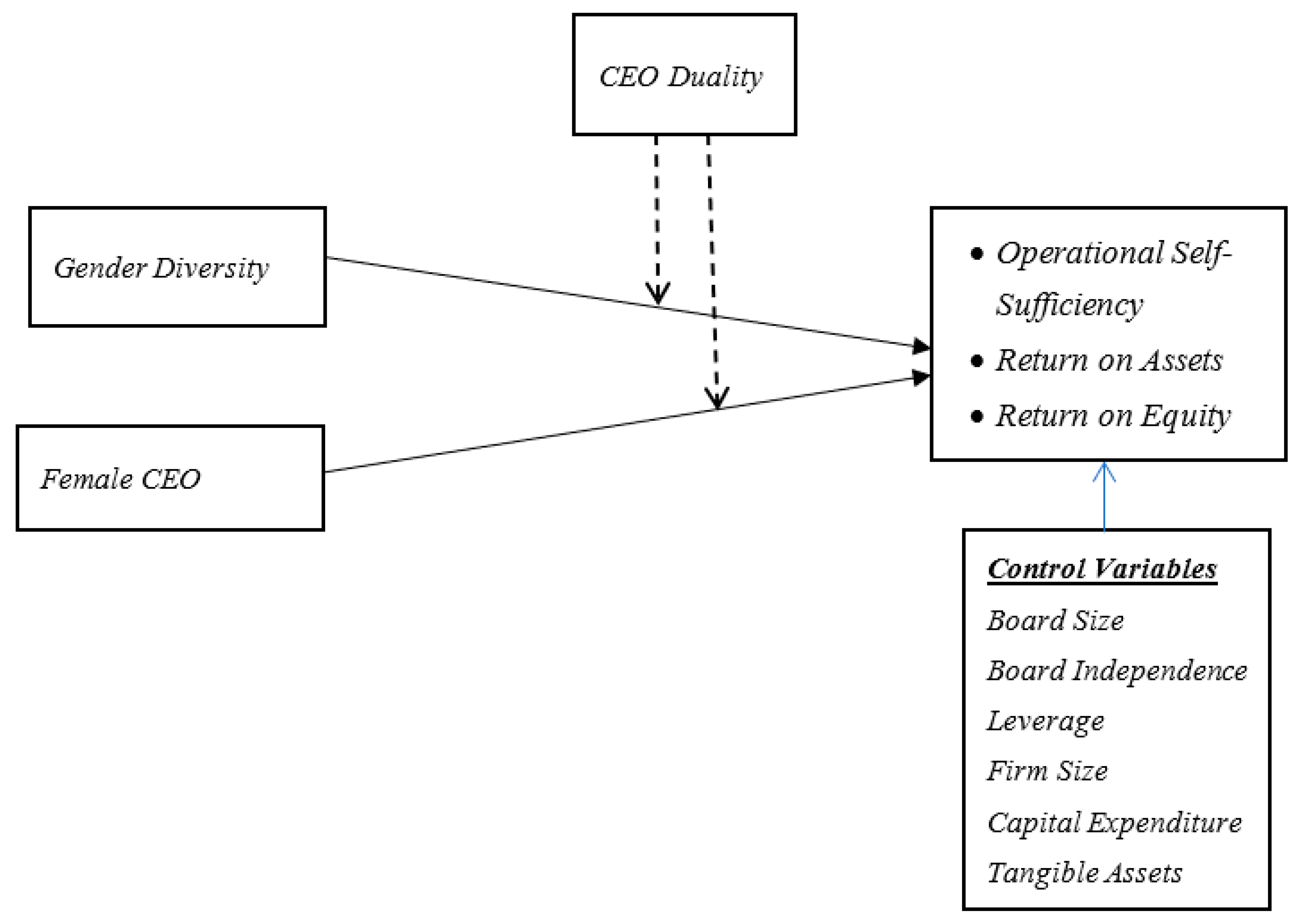

The objective of the study is to investigate the impact of female representation on boards and female CEOs on firms’ sustainable performance in the context of an emerging economy. We also introduce the CEO duality as a moderator variable between sustainable firm performance and board gender diversity. Researchers collected corporate governance-related variables and financial information of 200 non-financial firms listed on the PSX from 2005 to 2020 to analyze the stated association. To reduce the endogeneity and unobserved heterogeneity problem in corporate governance literature, the researcher uses GMM estimation techniques to examine the study model. To check the robustness of results, researchers used four alternative measures of firm sustainable performance, likewise accounting-based (ROA, ROE) and market-based measures (Tobin’s Q, MBR). Researchers use corporate board level control variables such as board size and board independence with firm sustainable performance. Additionally, the study also added several firm-level control variables such as financial leverage, firm size, capital expenditure, tangible assets, and firm age.

This study contributes to the existing literature in the following ways. To the best knowledge of researchers, we have introduced for the first time the moderating role of CEO duality in the relationship of board gender diversity and female CEO with firms’ sustainable performance. As CEO duality enhances the power of the CEO, there is an inherent conflict between a board of governance and the CEO-chair, thereby, the functions of the board of governance are compromised in disciplining the CEO. It, therefore, creates agency conflict and the agent cannot act in the interest of principle. This opposed relationship typically involves costs that are called agency costs which are payable by an organization. Researchers investigate how this agency cost is minimized by using CEO duality as a moderator variable in the association between gender diversity and firm sustainable performance. Besides this, we also contributed to the literature related to the influence of women on board and firm sustainable performance in the emerging economy, especially in Pakistan. Literature exists on gender diversity, while only a few studies show the importance of women as CEO for corporate governance mechanisms and their impact on sustainable performance [

32,

33]. Furthermore, we also examine the impact of board size and board independence on firms’ sustainable performance. This study provides empirical evidence that firms’ sustainable performance is increased when there are more women on the board.

The next section discusses the theoretical background and research methodology, which is followed by the results and discussion section.

6. Conclusions and Discussion

This study investigates whether female directors on board and female CEOs has an impact on firms’ sustainable performance with the moderating role of CEO duality in an emerging economy. To investigate this relationship, this study uses firms’ sustainable performance as a dependent variable while gender diversity and female CEO as independent variables. The data is collected from the PSX website, annual reports of firms, and State bank balance sheet analysis (BSA). The GMM technique has been used to access the relationship between independent, dependent, and moderating variables. Finding shows the positive and significant association of female directors on board and female CEOs with firm sustainable performance. Therefore, females working on top-level management increases firms’ sustainable performance [

51]. The results are consistent with past studies and suggest that gender diversity and female leaders have a significant impact on firms’ sustainable performance [

17,

21,

101]. The results of the study reveal that higher gender diversity on the corporate board panel enhances firms’ sustainable performance. Because they improve corporate governance mechanisms [

43], decrease asymmetric information, and improve effective communication systems with potential customers [

87]. From an agency theory perspective, the CEO duality itself has a negative and significant association with firms’ sustainable performance [

66,

67], and in alignment with the stewardship theory perspective, it does not moderate the relationship between female directors, female CEOs, and firms’ sustainable performance [

25,

57]. Furthermore, our results show that board independence has a positive impact on sustainable performance, which is consistent with the study of [

102]. One possible reason of this positive impact is the fact that more independent directors on boards leads to improving the corporate governance mechanism in a company which ultimately enhances the sustainable firms’ performance. This study contributes to financial literature and shows that high representations of gender diversity on corporate boards reduce agency conflicts and enhance monitoring power in corporate governance mechanisms. Firms’ performance is a key element for all the stakeholders [

97,

103,

104]. This study also highlights the issue of female CEOs and suggests that females in the top-level management, such as CEOs, are the most important attribute that can enhance the sustainable performance of the firm. Furthermore, the stewardship behavior of CEO are also in favor of corporate governance and firms’ sustainable performance. It allows the CEO to run firms with clear leadership. The findings suggest that corporations should consider increasing the number of women on their boards of directors if their participation can improve company performance. Additionally, greater diversity may boost productivity, creativity, and innovation. Governments and market regulators should establish gender quotas for women on boards, similar to what European countries have done. Gender diversity should be increased, with mandatory regulations being a key component. Furthermore, it is important to note that these results are equally important and relevant for emerging and developed economies because, in European countries already quota system has been established. Therefore, in consistent with European countries, other developed and emerging countries government and market regulators should establish gender quotas for women on boards.

7. Practical Insights and Future Recommendations

Gender diversity on corporate boards is becoming increasingly important, leading to the development of numerous legislation and policies aimed at encouraging female board nomination and participation around the world. Initiatives to increase the number of female directors on corporate boards are based on the belief that adding more talents, ideas, conversations, and views to corporate boards’ decision-making will improve not just social justice, but also governance and company performance.

Our findings offer various managerial takeaways and policy recommendations. The consequences of women’s presence on corporate boards have sparked fresh interest during the last decade. Women are generally underrepresented in the boardroom. Female boardroom presence, however, may promote access to a larger pool of human resources, which has substantial ramifications for firms’ competition and performance. This raises the important topic of whether women directors boost corporate performance, which has yielded conflicting results in previous empirical studies. The addition of more females to boards of directors improves Pakistani firms’ long-term financial success, according to this study. Indeed, the economic justification for gender-balanced boards is as much about enhancing company performance as it is about supporting women’s equality. As a result, boosting female representation in boardrooms will contribute to long-term sustainable transformation in the workplace, responsible governance, and global competitiveness. The results of this study serve as the guidelines for investors, shareholders, and all stakeholders of a firm when selecting a board of governance. Particularly, to mitigate the gender diversity in the firm, the board members should consider the balance between female and male board members to obtain sustainable firms’ performance through diversified accumulated human capital. The board of directors recommended adding specific criteria for evaluating gender compensation for new corporate board members. This practical improvement of having gender diversity may act as a catalyst for other stakeholders like employees, customers, and even society.

Finally, the study demonstrates some future recommendations with the known limitations of the study. The study is restricted concerning corporate governance variables; likewise, the study uses the internal level of corporate governance factors, not external level like political influence, market competition, media exposures, etc. New research may consider other factors such as audits, directors’ meetings, and remuneration. This study consists of secondary data analysis. New researchers improve our findings by conducting interviews, case studies, and questionnaires to investigate the association of gender diversity with firms’ sustainable performance. Furthermore, this study only used the data of the listed companies in Pakistan, while future research can replicate this study in other emerging countries and even in the developed world. In addition, future research should use cross-country samples to analyze and compare the appointment of female representation on boards under the voluntary approach with nations that establish quotas for female presence on boards.

We looked at gender diversity on the board in this research, but there are other sorts of board diversity (e.g., race and age) that can have an impact on sustainable company performance, and whose role can be mitigated by CEO duality, so they are worth looking into. Furthermore, we primarily focus on financial performance indicators; nevertheless, non-financial performance measures (e.g., social performance) are becoming increasingly significant and are thus worth investigating. Even while there is a growing body of literature demonstrating that female directors can influence various board decisions, the impact of CEO duality on such relationships is not well understood and is another area for future research. Finally, this study looks at the impact of board gender diversity on company performance in Pakistan; nevertheless, while looking at board gender diversity and its impact on firms’ performance, institutional and cultural systems are critical. To further understand the role of CEO duality in the impact of board gender diversity on the firm, cross-country research is essential.