The Impact of Menthol Cigarettes on Smoking Initiation among Non-Smoking Young Females in Japan

Abstract

:1. Introduction

2. Experimental Section

3. Results and Discussion

3.1. Internal Tobacco Industry Documents

3.1.1. Intent to Target Women with Menthol Brands

…attracting a higher proportion of young adult women, in markets where the incidence of young adult female smokers is growing as women become more emancipated. In Japan there are strong indications that the Salem franchise is attracting the same kind of smokers [26].

3.1.2. Introduction and Marketing of Menthol Brands

3.1.3. Impact of Menthol Brands on Trial and Use

3.2. Independent Survey Data

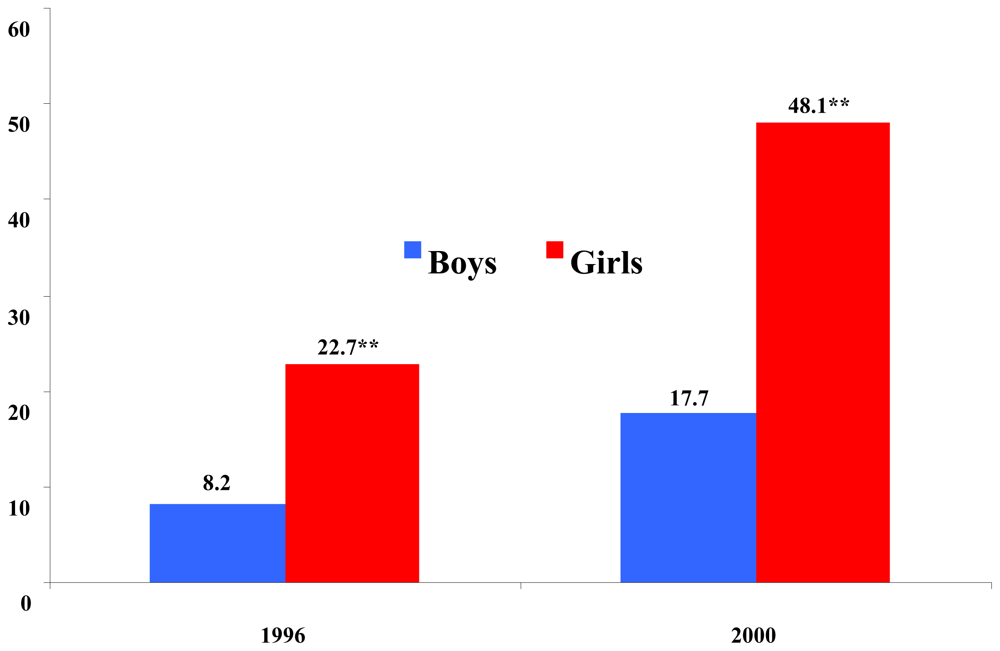

3.2.1. Adolescent Smoking Survey

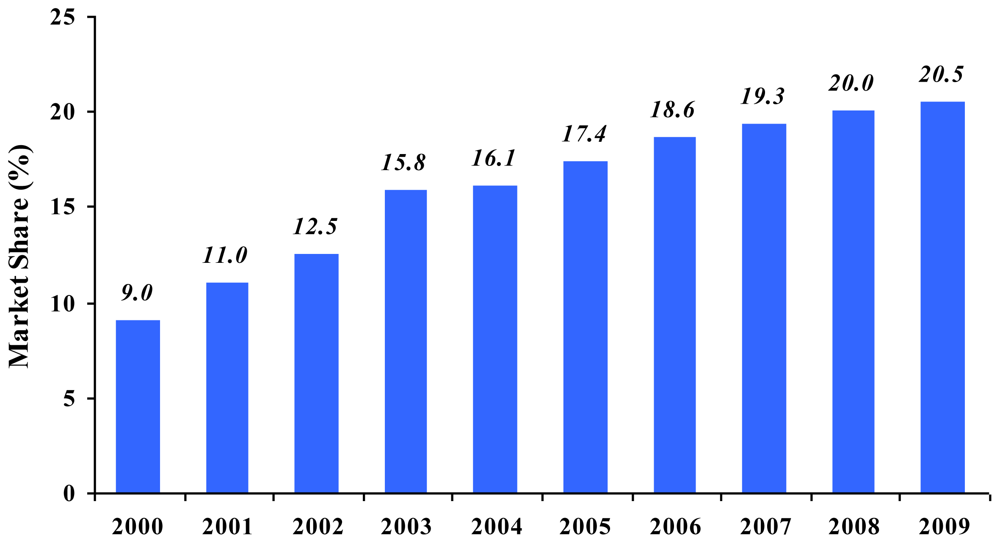

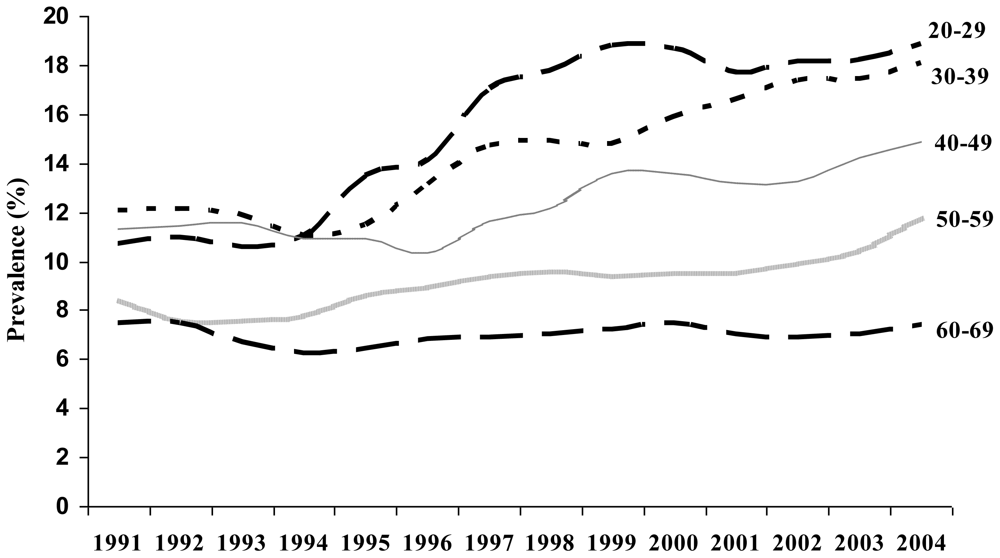

3.2.2. Japanese National Health and Nutrition Survey

3.3. Discussion

“… Japan is a prime example of us taking a proactive situation or a proactive involvement in the market place…..The decision that was taken early when that market opened up was to get in there and develop products designed for the Japanese market place…getting products into that market, and going through evaluation procedures to understand the sensory characteristics of the Japanese consumer, allowed us to understand that market place better. And again, that bottom line, that base, was understanding the sensory characteristics….” [58]

3.4. Study Strengths & Limitations

4. Conclusions

References and Notes

- Honjo, K; Kawachi, I. Effects of market liberalisation on smoking in Japan. Tob. Control 2000, 9, 193–200. [Google Scholar]

- Euromonitor International: Country Sector Briefing “Cigarettes”—Japan 2010; Euromonitor International: London, UK, 2010.

- Osaki, Y; Tanihata, T; Ohida, T; Minowa, M; Wada, K; Suzuki, K; Kaetsu, A; Okamoto, M; Kishimoto, T. Adolescent smoking behavior and cigarette brand preference in Japan. Tob. Control 2006, 15, 172–180. [Google Scholar]

- Silverman, J. A Market Philosophy for Japan; Brown & Williamson: Louisville, KY, USA, 1982. [Google Scholar]

- Euromonitor International: Country Sector Briefing “Cigarettes”—Japan 2005; Euromonitor International: London, UK, 2005.

- Carpenter, CM; Wayne, GF; Connolly, GN. The role of sensory perception in the development and targeting of tobacco products. Addiction 2007, 102, 136–137. [Google Scholar]

- Wayne, GF; Connolly, GN. Application, function, and effects of menthol in cigarettes: A survey of the tobacco industry documents. Nicotine Tob. Res 2004, 6, S43–S54. [Google Scholar]

- Lindemann, J; Tsakiropoulou, E; Scheithauer, MO; Konstantinidis, I; Wiesmiller, KM. Impact of menthol inhalation on nasal mucosal temperature and nasal patency. Am. J. Rhinol 2008, 22, 402–405. [Google Scholar]

- Eccles, R. Menthol: Effects on nasal sensation of airflow and the drive to breathe. Curr. Allergy Asthma Rep 2003, 3, 210–214. [Google Scholar]

- Muilenburg, JL; Legge, JS. African American adolescents and menthol cigarettes: Smoking behavior among secondary school students. J. Adolesc. Health 2008, 43, 570–575. [Google Scholar]

- Kreslake, JM; Wayne, GF; Connolly, GN. The menthol smoker: Tobacco industry research on consumer sensory perception of menthol cigarettes and its role in smoking behavior. Nicotine Tob. Res 2008, 10, 705–715. [Google Scholar]

- Kreslake, JM; Wayne, GF; Alpert, HA; Koh, HK; Connolly, GN. Tobacco industry control of menthol in cigarettes and targeting of adolescents and young adults. Am. J. Public Health 2008, 98, 1685–1692. [Google Scholar]

- Wackowski, O; Delnevo, CD. Menthol cigarettes and indicators of tobacco dependence among adolescents. Addict. Behav 2007, 32, 1964–1969. [Google Scholar]

- Hersey, JC; Ng, SW; Nonnemaker, JM; Mowery, P; Thomas, KY; Vilsaint, MC; Allen, JA; Haviland, ML. Are menthol cigarettes a starter product for youth? Nicotine Tob. Res 2006, 8, 403–413. [Google Scholar]

- Euromonitor International: Country Sector Briefing “Cigarettes”—Russia 2010; Euromonitor International: London, UK, 2010.

- Euromonitor International: Country Sector Briefing “Cigarettes”—Poland 2010; Euromonitor International: London, UK, 2010.

- Japan 1985 Marketing Workshop; Philip Morris: Pittsburgh, PA, USA, 1985.

- British-American Tobacco: America-Pacific Region—Regional Plan 1997–1999; British American Tobacco: London, UK, 1996.

- Philip Morris: Pittsburgh, PA, USA, 1992. Available online: http://legacy.library.ucsf.edu/tid/bjp96e00 (accessed on 22 December 2010).

- ASI Market Research Japan; PM, Philip Morris, ASI Market Research Japan. In Qualitative Research on Menthol/Nonmenthol Smokers; Philip Morris: Pittsburgh, PA, USA, 1991.

- Philip Morris: Pittsburgh, PA, USA, 1986. Available online: http://legacy.library.ucsf.edu/tid/dtw32e00 (accessed on 22 December 2010).

- New TI Projects Summary; RJ Reynolds: Winston-Salem, NC, USA, 1994.

- Brand Switching Study 1989; Philip Morris: Pittsburgh, PA, USA, 1989.

- Brock, TH. Japan; RJ Reynolds: Winston-Salem, NC, USA, 1978. Available online: http://legacy.library.ucsf.edu/tid/ywg85d00 (accessed on 22 December 2010).

- Cantrell, D. Kool Super Lights KS/100 Japan Product Improvement Status/957/958; Brown & Williamson: Louisville, KY, USA, 1984. [Google Scholar]

- Pan Asia Menthol Project; Philip Morris: Pittsburgh, PA, USA, 1990.

- The Cowboy Freshens Up—A Global Review of Marlboro Menthol; British American Tobacco: London, UK, 1996.

- Green, C. International Marketing Research Request Revised 940201. In Japan: Kool Milds Quantitative TOT. 1994–04; Brown & Williamson: Louisville, KY, USA, 1994. [Google Scholar]

- Japan Marketing Strategy; RJ Reynolds: Winston-Salem, NC, USA, 1996.

- Tindall, JE. Menthol Segment Possibilities; Philip Morris: Pittsburgh, PA, USA, 1991. [Google Scholar]

- Michael Normile Marketing, General Consumer Survey of the Japanese Cigarette Market; Philip Morris: Pittsburgh, PA, USA, 1988.

- Norsearch International, Proposal for a Strategic Market Positioning Study for Philip Morris Brands in the Japanese Cigarette Market; Philip Morris: Pittsburgh, PA, USA, 1984.

- Japan Group Market Overview. British American Tobacco: London, UK, 1996. Available online: http://legacy.library.ucsf.edu/tid/gau50a99 (accessed on 22 December 2010).

- Virginia Slims Special Lights Japan; Philip Morris: Pittsburgh, PA, USA, 1995.

- Harris, D. Philip Morris Asia Three Year Plan 1994–1996; Philip Morris: Pittsburgh, PA, USA, 1993. [Google Scholar]

- Takahashi M. Marlboro Menthol in Japan; Brown & Williamson: Louisville, KY, USA, 1996.

- Lambert, A; Sargent, JD; Glantz, SA; Ling, PM. How Philip Morris unlocked the Japanese cigarette market: Lessons for global tobacco control. Tob. Control 2004, 13, 379–387. [Google Scholar]

- Tobacco International [Trade Journal]; August 1996; [Glen, Japan’s Race for #1.?].

- Note regarding menthol segment; British American Tobacco: London, UK. Date unknown. Available online: http://legacy.library.ucsf.edu/tid/crh73a99 (accessed on 22 December 2010).

- Report on Marlboro Menthol; British American Tobacco: London, UK, 1995.

- An Overview of Salem Cigarettes in Markets in Asia; British American Tobacco: London, UK, 1993.

- Five Year Plan, 1996–2000; Philip Morris: Pittsburgh, PA, USA, 1996.

- Davidoff Strategic Brand Review with a Focus on the Premium Segment Growth; British American Tobacco: London, UK, 2000.

- Simamane, N. Business Review; British American Tobacco: London, UK, 1997. [Google Scholar]

- Webb, WH. New Product Introduction: Marlboro Menthol Full Flavor (Box); Philip Morris: Pittsburgh, PA, USA, 1995. [Google Scholar]

- Caufield, RT. Salem Unisex Repositioning; RJ Reynolds: Winston-Salem, NC, USA, 1996. [Google Scholar]

- Global Business Review; British American Tobacco: London, UK, 1998.

- Japan Marlboro; Philip Morris: Pittsburgh, PA, USA, 1996.

- Hirao, Y. Virginia Slims Short Cut; Philip Morris: Pittsburgh, PA, USA, 1998. [Google Scholar]

- Morgan Stanley Presentation, London, UK, 21 November 2000; Philip Morris: Pittsburgh, PA, USA, 2000.

- Philip Morris: Pittsburgh, PA, USA, 1999. Available online: http://legacy.library.ucsf.edu/tid/rsp35c00 (accessed on 22 December 2010).

- Japan Technical Review 1998–1999; British American Tobacco: London, UK, 2000.

- Tonge, J. Japan: Market Monitor IV 1989-55—Final Report; Brown & Williamson: Louisville, KY, USA, 1990. [Google Scholar]

- Fact Sheet Japan (Local and Imports); Philip Morris: Pittsburgh, PA, USA, 1985.

- Strategy Workshop Goals; Philip Morris: Pittsburgh, PA, USA, 1994.

- Brand Switching Study, 1992a, Japan; Philip Morris: Pittsburgh, PA, USA, 1992.

- Philip Morris International, Worldwide Marlboro Monitor—Historical Trends 1989–1995; Philip Morris: Pittsburgh, PA, USA, 1996.

- Heretick, R. Product Needs; Philip Morris: Pittsburgh, PA, USA, 1990. [Google Scholar]

| Theme | Source | Quotes |

|---|---|---|

| Perception of menthol brands | BW, 1994 | “The menthol segment in Japan has long been identified with ‘lightness,’ being dominated by Virginia Slim Lights Menthol, Salem Lights, Salem Slim Lights, and Sometime Lights.” [28] |

| PM, 1991 | “The desire for a “lighter” cigarette was an important underlying motive for switching to menthol cigarettes.” [20] | |

| PM, 1991 | [From focus group testing ]: “More like candy than ordinary cigarettes/Ordinary cigarettes and menthol cigarettes are completely different.” [20] | |

| PM, 1991 | “Female menthol smokers were generally more satisfied with menthol cigarettes than male menthol smokers, as current menthol cigarettes fulfilled a greater range of needs for females (particularly psychological needs, such as fashionableness, expression of femininity).” [20] | |

| Menthol attracts newer smokers | RJR, 1996 | “Movement to low tar and menthol is partially “trendy/modern” and partially personal concern. Also females/young adults coming to market now often start with low tar or menthol brands.” [29] |

| PM, 1991 | “I strongly suspect that, as was true in the US, especially for Kool and partially for Salem, where the menthol share is growing, it is not doing so by attracting smokers with established tastes, but by attracting new smokers…. new smokers may be young beginning smokers, newly “liberated” females of any age, or people of any age just beginning to acquire the economic status required to smoke manufactured cigarettes.” [30] | |

| PM, 1988 | “…these younger smokers also show considerable interest in menthol cigarettes”. [31] | |

| PM, 1985 | “The menthol market could develop quite rapidly as there is considerable interest in cigarettes with a cool refreshing flavor. Its main source of business is likely to be new younger smokers of both sexes.”[32] | |

| Intent to grow the menthol segment and reach young women | BAT, 1996 | “Given the growing importance of females and the long-term growth history of menthol slims, it seems advisable to try to participate in this slims segment.” [33] |

| PM, 1995 | “The growing young adult female segment in Japan has been identified as a market opportunity for further growth.” [34] | |

| PM, 1993 | “Menthol products, though still small in volume terms, represent one of the strongest growth categories in Asia, particularly outside traditionally menthol markets like the Philippines.” [35] | |

| PM, 1991 | “Menthol should have potential in any market in which the percentage of female smokers is growing.” [30] | |

| Salem Pianissimo (100’s slim) | VSLM (100’s slim) | Marlboro Lts. M (KS) | |

|---|---|---|---|

| “Major” and “Widely” Acceptable | |||

| Basic Value | “low smoke/low odor” and “1mg tar” cigarette for women | “basic” women’s cigarette | “KS” and “higher tar” cigarette which even women can smoke |

| Image value | Feminine; Natural/Soft women | Feminine; Independent women | Not feminine; Women with strong personality |

| Parameter | Salem Pianissimo (100’s slim) | VSLM (100’s slim) | Marlboro Lights Menthol (KS) |

|---|---|---|---|

| Nicotine/Puff (mg) (ISO) | 0.01 | 0.05 | 0.08 |

| Tar/Puff (mg) (ISO) | 0.15 | 0.63 | 1.13 |

| Menthol (Rod %) | 1.28 | 0.82 | 0.57 |

© 2011 by the authors; licensee Molecular Diversity Preservation International, Basel, Switzerland. This article is an open-access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/3.0/).

Share and Cite

Connolly, G.N.; Behm, I.; Osaki, Y.; Wayne, G.F. The Impact of Menthol Cigarettes on Smoking Initiation among Non-Smoking Young Females in Japan. Int. J. Environ. Res. Public Health 2011, 8, 1-14. https://doi.org/10.3390/ijerph8010001

Connolly GN, Behm I, Osaki Y, Wayne GF. The Impact of Menthol Cigarettes on Smoking Initiation among Non-Smoking Young Females in Japan. International Journal of Environmental Research and Public Health. 2011; 8(1):1-14. https://doi.org/10.3390/ijerph8010001

Chicago/Turabian StyleConnolly, Gregory N., Ilan Behm, Yoneatsu Osaki, and Geoffrey F. Wayne. 2011. "The Impact of Menthol Cigarettes on Smoking Initiation among Non-Smoking Young Females in Japan" International Journal of Environmental Research and Public Health 8, no. 1: 1-14. https://doi.org/10.3390/ijerph8010001