Research on the Effect of Commercial Health Insurance Development on Economic Efficiency

Abstract

1. Introduction

2. Mechanism of Commercial Health Insurance to Improve Economic Efficiency

2.1. Give Full Play to the Market-Oriented Risk Protection Function

2.2. Promoting Targeted Risk Reduction Management

2.3. Promoting Capital Accumulation and Financing

3. China’s Commercial Health Insurance Development and Economic Efficiency Evaluation

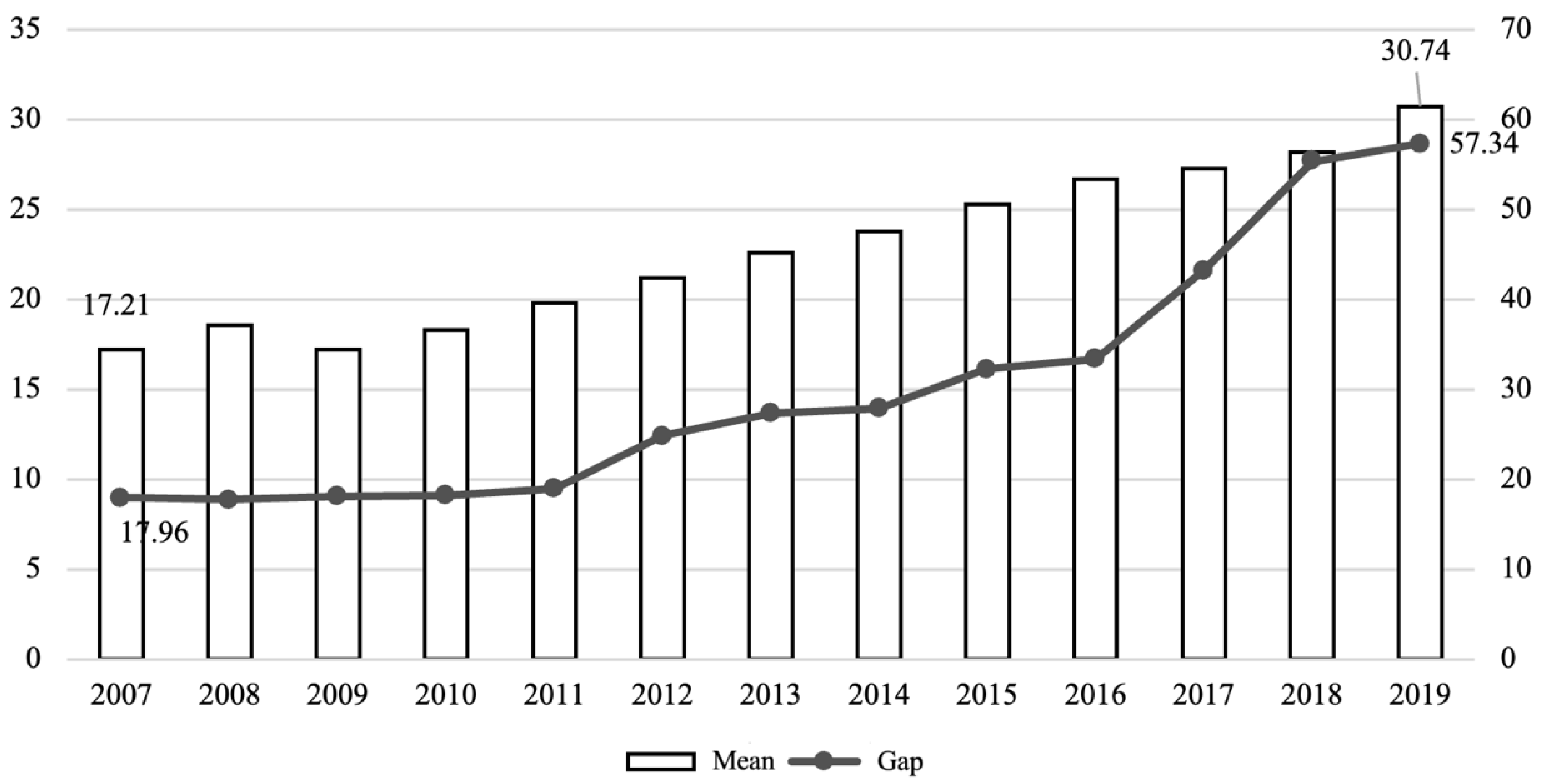

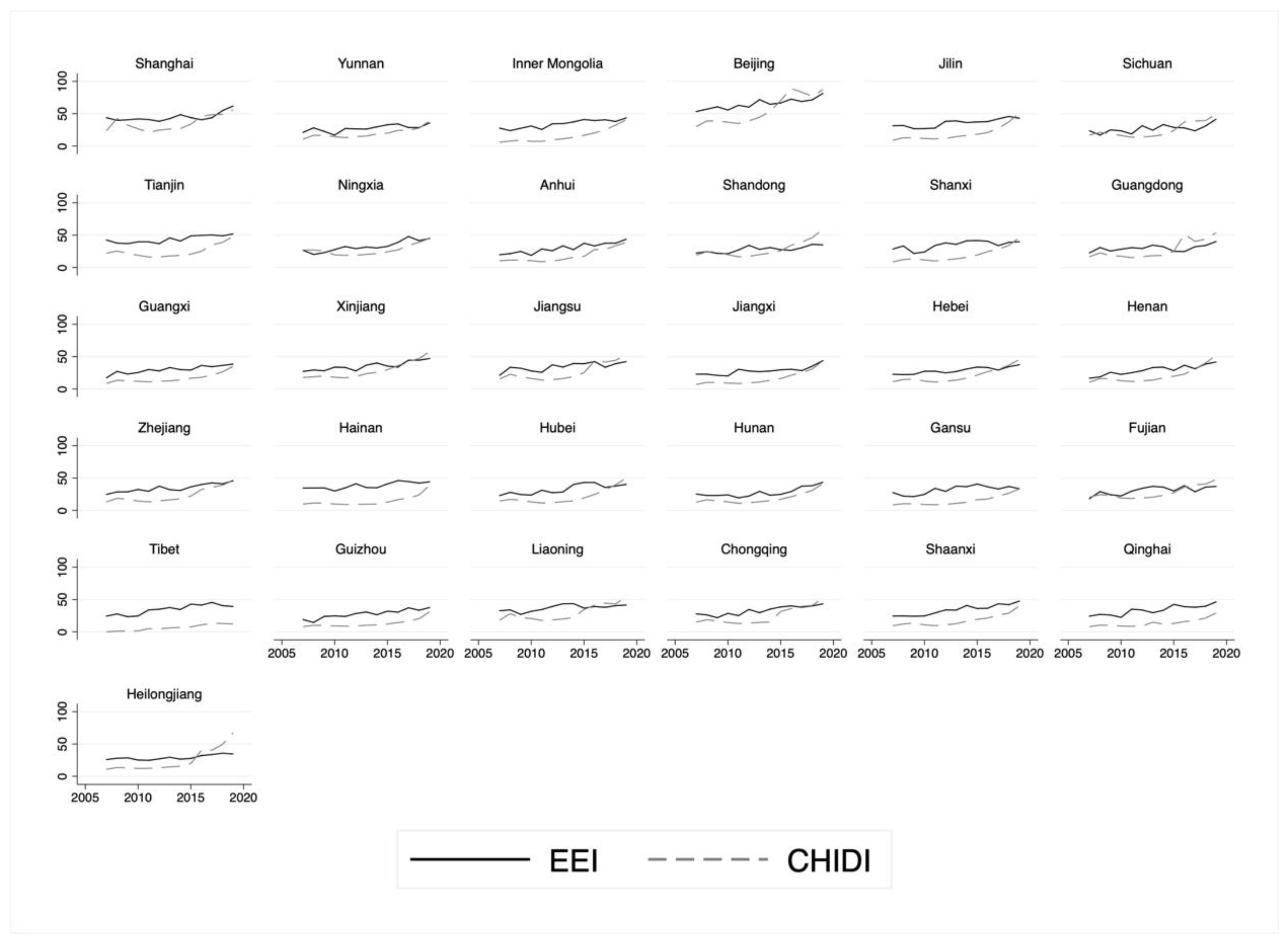

3.1. Measure the Development Level of Commercial Health Insurance

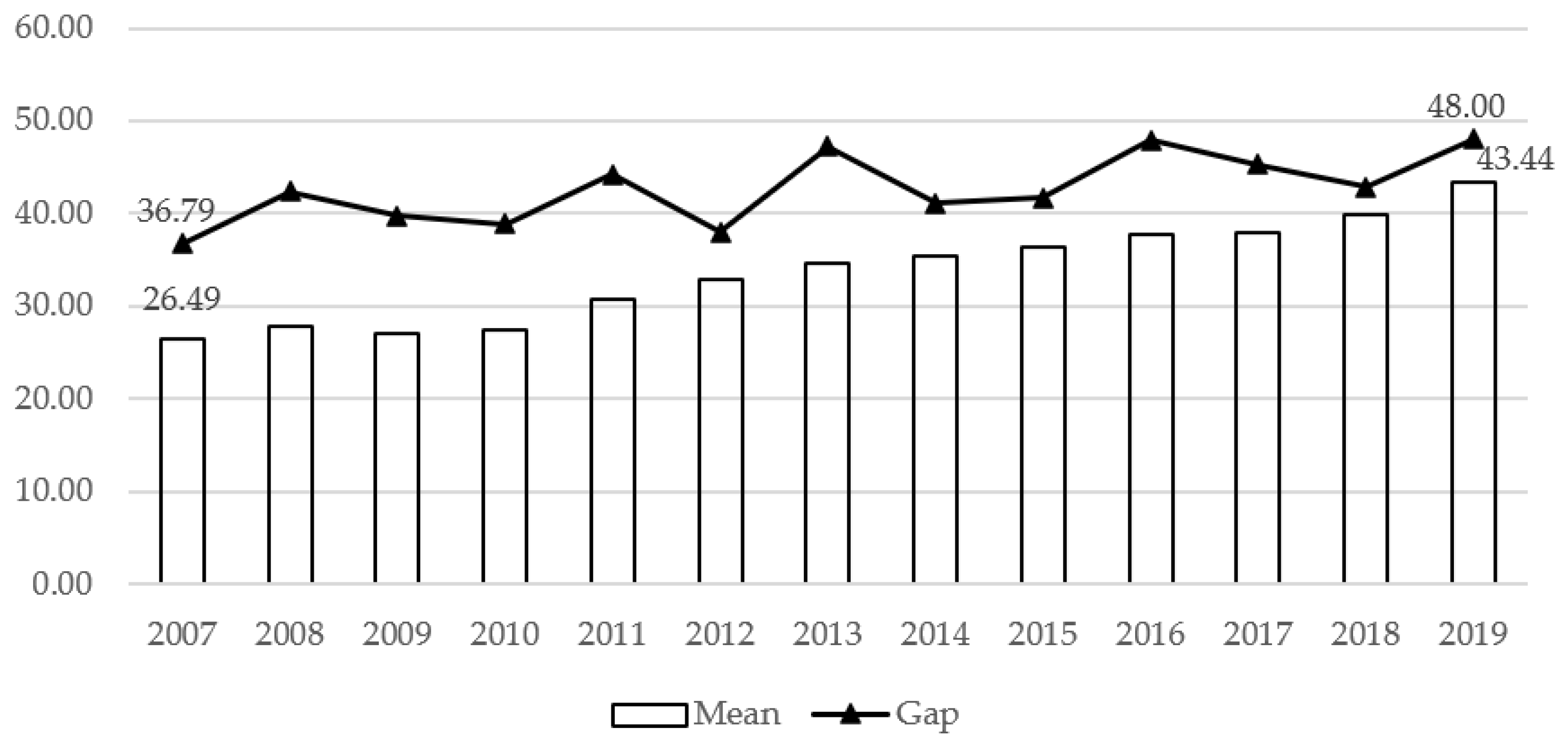

3.2. Quantitative Measurement of Commercial Health Insurance Promoting Economic Efficiency

4. Empirical Analysis

4.1. Research Design

4.1.1. Data Selection and Descriptive Statistics

4.1.2. Model Setting

4.2. Empirical Analysis

4.2.1. Baseline Regression

4.2.2. Robustness Tests

4.2.3. Endogeneity Test

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Huang, Y.; Shen, T.; Gu, W.R.; Li, Q. The Role of Health Management in Commercial Medical Insurance Cost Control. In Advanced Materials Research; Trans Tech Publications Ltd.: Stafa-Zurich, Switzerland, 2014; Volume 955, pp. 1078–1081. [Google Scholar]

- Ma, R.; Huang, L.; Zhao, D.; Xu, L. Commercial health insurance–a new power to push China healthcare reform forward? Value Health 2015, 18, A103. [Google Scholar] [CrossRef]

- Pinilla, J.; López-Valcárcel, B.G. Income and wealth as determinants of voluntary private health insurance: Empirical evidence in Spain, 2008–2014. BMC Public Health 2020, 20, 1262. [Google Scholar] [CrossRef] [PubMed]

- Sun, Q.X.; Zheng, W.; Suo, L.Y.; He, X.W. The Impact of Market Economy on the Development of Insurance Industry: Theoretical Analysis and Empirical Evidence. Financ. Res. 2010, 2, 158–172. (In Chinese) [Google Scholar]

- Feldstein, M. Social security and saving: New time series evidence. Natl. Tax J. 1996, 49, 151–164. [Google Scholar] [CrossRef]

- Yusof, S.A.; Rokis, R.A.; Jusoh, W.J.W. Financial fragility of urban households in Malaysia. J. Ekon. Malays. 2015, 49, 15–24. [Google Scholar] [CrossRef]

- Brunetti, M.; Giarda, E.; Torricelli, C. Is financial fragility a matter of illiquidity? An appraisal for Italian households. Rev. Income Wealth 2016, 62, 628–649. [Google Scholar] [CrossRef]

- Wu, C.J.; Zhu, Y.Y.; Ding, Y. The strategic position and incentive policy of commercial health insurance in the construction of a healthy China. China Med. Insur. 2017, 3, 69–72. (In Chinese) [Google Scholar]

- Janzen, S.A.; Carter, M.R.; Ikegami, M. Can insurance alter poverty dynamics and reduce the cost of social protection in developing countries? J. Risk Insur. 2021, 88, 293–324. [Google Scholar] [CrossRef]

- Zhang, D.H.; Yin, Z.C.; Sui, Y.B. Can Financial Inclusion Improve the Quality of Poverty Reduction?——An Analysis Based on Multidimensional Poverty. South. Econ. 2020, 39, 56–75. (In Chinese) [Google Scholar]

- Sherman, B.W.; Stiehl, E. Health management in commercially insured populations: It is time to include social determinants of health. J. Occup. Environ. Med. 2018, 60, 688–692. [Google Scholar] [CrossRef]

- Baum, A.; Song, Z.; Landon, B.E.; Phillips, R.S.; Bitton, A.; Basu, S. Health care spending slowed after Rhode Island applied affordability standards to commercial insurers. Health Aff. 2019, 38, 237–245. [Google Scholar] [CrossRef] [PubMed]

- Sun, D. Promoting the health industry with commercial health insurance at the provincial level. Chin. Reform. 2018, 6, 64–76. (In Chinese) [Google Scholar]

- Jia, Y.F.; Yu, B.R. The role of commercial health insurance in the payment of medical expenses and international experience. Health Econ. Res. 2020, 37, 8–12. (In Chinese) [Google Scholar]

- Wang, Y.L. Commercial insurance participates in the development of the “combination of medical care and elderly care”pension model—Taking the creative products of comprehensive security of health insurance in Jiangsu Province as an example. Soc. Sci. 2019, 9, 69–75. (In Chinese) [Google Scholar]

- Zou, H.; Adams, M.B.; Buckle, M.J. Corporate risks and property insurance: Evidence from the People’s Republic of China. J. Risk Insur. 2003, 70, 289–314. [Google Scholar] [CrossRef]

- Alizade, S. The role of insurance in the world economy and its effect to macroeconomic indicators. Eura. Uni. Sci. 2016, 33, 76–79. [Google Scholar]

- Wanyan, R.Y.; Suo, L.Y. Research on the Impact of Insurtech on the Insurance Industry. Insur. Res. 2019, 10, 35–46. (In Chinese) [Google Scholar]

- Chen, Q.; Zhang, Q.; Liu, J. Research on the social security role of China’s commercial health insurance under the background of aging. Technol. Ind. 2019, 9, 150–155. (In Chinese) [Google Scholar]

- Zhang, J.K.; Hou, Y.Z.; Liu, P.L.; He, J.W.; Zhuo, X. Goal requirements and strategic path for high-quality development. Manag. World 2019, 35, 1–7. (In Chinese) [Google Scholar]

- Suo, L.Y.; Wanyan, R.Y.; Chen, T. Research on the current situation and causes of regional development imbalance of commercial health insurance in China. Ins. Res. 2015, 1, 42–53. (In Chinese) [Google Scholar]

- Yang, B.; Jiang, R.Y. Research on Regional Development Differences and Influencing Factors of Commercial Health Insurance—Analysis from the Perspective of Demand. J. Southeast Univ. Philos. Soc. Sci. Ed. 2018, 3, 60–68. (In Chinese) [Google Scholar]

- Wei, M.; Li, S.H. Measurement Research on the High-quality Development Level of China’s Economy in the New Era. Quant. Econ. Tech. Econ. Res. 2018, 11, 3–20. (In Chinese) [Google Scholar]

- Fang, D.C.; Ma, W.B. The measurement and spatial-temporal characteristics of China’s inter-provincial high-quality development. Reg. Econ. Rev. 2019, 2, 61–70. (In Chinese) [Google Scholar]

- Shi, B.; Zhang, B.Y. Measurement and analysis of high-quality economic development of cities above the prefecture level across the country. Soc. Sci. Res. 2019, 3, 19–27. (In Chinese) [Google Scholar]

- Li, M.X.; Ren, X.Y. Measurement, Evaluation and Path Design of China’s Provincial Economic Growth Quality. Stat. Inf. Forum 2020, 35, 61–73. (In Chinese) [Google Scholar]

- Yang, Y.; Zhang, P. The logic, measurement and governance of China’s high-quality economic development. Econ. Res. 2021, 1, 26–42. (In Chinese) [Google Scholar]

- Liu, Y.X.; Tian, C.S.; Cheng, L.Y. Measurement and comparison of high-quality development of the world economy. Economy 2020, 5, 69–78. (In Chinese) [Google Scholar]

- Li, H.; Dong, Y.L. Does the equalization of basic public services narrow the regional gap in the quality of economic growth? Quant. Econ. Tech. Econ. Res. 2020, 37, 48–70. (In Chinese) [Google Scholar]

- Schnabl, G. Exchange rate volatility and growth in small open economies at the EMU periphery. Econ. Syst. 2008, 32, 70–91. [Google Scholar] [CrossRef]

- Yuan, G.C.; Pan, M. Analysis of the Impact of Household Sector Leverage Changes on Economic Growth. Financ. Trade Econ. 2021, 42, 86–102. (In Chinese) [Google Scholar]

- Teng, L.; Ma, D.G. Can digital finance promote high-quality development? Stat. Res. 2020, 37, 80–92. (In Chinese) [Google Scholar]

- Luo, Y.; He, Q.; Xue, C. The impact of regional law enforcement level on China’s regional financial development. Econ. Res. 2016, 51, 118–131. (In Chinese) [Google Scholar]

- Chong TT, L.; Lu, L.; Ongena, S. Does banking competition alleviate or worsen credit constraints faced by small-and medium-sized enterprises? Evidence from China. J. Bank. Financ. 2013, 37, 3412–3424. [Google Scholar] [CrossRef]

- Jiang, L.T. Research on the Developmental Relationship between Basic Medical Insurance and Commercial Health Insurance in China—Analysis Based on Spatial Durbin Model. Financ. Dev. Res. 2019, 2, 68–75. (In Chinese) [Google Scholar]

| Dimension | Indicators | Description | Data Resources |

|---|---|---|---|

| Efficiency | Health insurance depth | Ratio of commercial health insurance premiums to local GDP | CBIRC |

| Health insurance density | Regional per capita commercial health insurance premiums | CBIRC | |

| Fairness | Density of special business insurance premium income | Ratio of special business insurance premium income to regional population | CBIRC |

| Sustainability | Proportion of commercial health insurance compensation | Ratio of the total compensation amount of commercial health insurance to the total medical expenses | CBIRC& China Health Statistical Yearbook |

| Proportion of commercial health insurance liability reserve | Ratio of long-term health insurance liability reserves to total assets | CBIRC |

| Mean | Med. | S.D. | Min | Max | Obs | |

|---|---|---|---|---|---|---|

| EEI | 33.696 | 33.286 | 9.5324 | 14.507 | 81.435 | 403 |

| CHIDI | 22.452 | 18.128 | 13.972 | 0.0387 | 88.852 | 403 |

| Aging level | 9.8375 | 9.6356 | 2.2051 | 4.8630 | 16.265 | 403 |

| Local fiscal expenditure | 3830.5 | 3312.2 | 2675.4 | 241.85 | 17298 | 403 |

| Urbanization | 54.285 | 5.3205 | 1.4096 | 21.453 | 89.607 | 403 |

| The added value of the tertiary industry | 9328.4 | 6227.6 | 9415.7 | 196.60 | 60268 | 403 |

| Mileage of first-class highway | 0.2632 | 0.1400 | 0.3043 | 0.0000 | 1.5300 | 403 |

| Road mileage | 13.959 | 14.320 | 7.5431 | 1.1200 | 33.710 | 403 |

| Local industrial structure | 47.086 | 46.219 | 9.2534 | 29.792 | 83.688 | 403 |

| Infrastructure | 2.1536 | 1.2520 | 2.0508 | 0.0000 | 9.5685 | 403 |

| GDP per capita | 43512 | 37580 | 25772 | 7778 | 161776 | 403 |

| Average local total foreign investment (million yuan) | 65.545 | 56.825 | 38.832 | 10.181 | 287.30 | 403 |

| Gini coefficient | 0.4274 | 0.4258 | 0.0449 | 0.3502 | 0.5097 | 403 |

| Number of students enrolled in primary schools | 323.00 | 261.40 | 242.23 | 29.200 | 1092.9 | 403 |

| Unemployment rate | 3.3838 | 3.5000 | 0.6511 | 1.2000 | 4.6000 | 403 |

| Per capita medical insurance expenditure | 1268.4 | 1089.4 | 741.40 | 292.42 | 5340.0 | 403 |

| Long-term health insurance liability reserve ratio to total assets | 5.0995 | 4.7172 | 1.9883 | 0.0000 | 10.793 | 403 |

| Commercial health insurance premium income to total medical expenditure | 19.519 | 14.884 | 14.444 | 0.0583 | 81.216 | 403 |

| The ratio of the premium income of the eight major businesses to the resident population | 13.875 | 7.0490 | 19.290 | 0.0000 | 124.99 | 403 |

| Commercial Health Insurance Density | 170.98 | 83.876 | 224.04 | 0.3460 | 1861.7 | 403 |

| Commercial Health Insurance Depth | 0.3124 | 0.2196 | 0.2389 | 0.0000 | 1.5135 | 403 |

| Fundamentals | Social Efficiency | Industry Transformation | EEI | |

|---|---|---|---|---|

| CHIDI | 0.135 *** (3.882) | 0.151 * (1.691) | 0.303 *** (7.433) | 0.106 *** (2.826) |

| Aging level | 0.023 (1.480) | −0.005 (−0.134) | −0.028 (−1.151) | −0.003 (−0.192) |

| Urbanization level | 0.189 *** (8.499) | 0.004 (−0.070) | 0.118 *** (4.530) | 0.101 *** (4.221) |

| Local fiscal expenditure | −0.358 *** (−15.73) | 0.075 (1.299) | −0.030 (−1.143) | −0.104 *** (−4.270) |

| Infrastructure | 0.004 (0.020) | 0.928 *** (2.042) | 0.176 ** (0.856) | 0.369 * (1.931) |

| Local industrial structure | 0.208 *** (5.756) | 0.577 * (1.694) | 0.679 *** (16.07) | 0.489 *** (12.56) |

| Place FE | Y | Y | Y | Y |

| Year FE | Y | Y | Y | Y |

| Adjusted R2 | 0.749 | 0.282 | 0.812 | 0.736 |

| Obs | 403 | 403 | 403 | 403 |

| F-value | 64.00 | 9.32 | 92.62 | 59.98 |

| p-value | 0.000 | 0.000 | 0.000 | 0.000 |

| EEI | |||

|---|---|---|---|

| CHI Depth | 0.134 * (3.220) | ||

| CHI Density | 0.099 *** (4.610) | ||

| CHIDI | 0.128 *** (2.885) | ||

| Controls | Y | Y | Y |

| Place FE | Y | Y | Y |

| Year FE | Y | Y | Y |

| Adjusted R2 | 0.738 | 0.704 | 0.618 |

| Obs | 403 | 403 | 351 |

| F-value | 60.47 | 137.3 | 30.74 |

| p-value | 0.000 | 0.000 | 0.000 |

| Eastern Region | Middle Region | Western Region | |

|---|---|---|---|

| CHIDI | 0.455 *** (11.15) | 0.164 * (1.681) | 0.070 (1.215) |

| Controls | Y | Y | Y |

| Place FE | Y | Y | Y |

| Year FE | Y | Y | Y |

| Adjusted R2 | 0.846 | 0.684 | 0.701 |

| Obs | 169 | 78 | 156 |

| F-value | 124.3 | 82.93 | 20.10 |

| p-value | 0.000 | 0.000 | 0.000 |

| First Stage | Second Stage | ||

|---|---|---|---|

| 2SLS | LIML | ||

| Variables | CHIDI | EEI | |

| IV_AVG_CHIDI | 0.684 *** (11.33) | ||

| CHIDI | 0.164 *** (3.246) | 0.164 *** (3.246) | |

| Controls | Y | Y | Y |

| Place FE | Y | Y | Y |

| Year FE | Y | Y | Y |

| Obs | 403 | 403 | 403 |

| EEI | ||

|---|---|---|

| l. EEI(1) | 0.394 *** (4.711) | 0.394 *** (5.530) |

| l. EEI(2) | 0.133 (1.570) | 0.149 * (1.682) |

| CHIDI | 0.072 ** (2.452) | 0.088 ** (2.450) |

| Controls | Y | Y |

| AR(2) | 0.282 (0.778) | 0.166 (0.868) |

| Hansen | 18.68 (0.720) | 24.31 (0.690) |

| Place FE | Y | Y |

| Year FE | Y | Y |

| Obs | 341 | 341 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhao, T.; Wanyan, R.; Suo, L. Research on the Effect of Commercial Health Insurance Development on Economic Efficiency. Int. J. Environ. Res. Public Health 2023, 20, 5178. https://doi.org/10.3390/ijerph20065178

Zhao T, Wanyan R, Suo L. Research on the Effect of Commercial Health Insurance Development on Economic Efficiency. International Journal of Environmental Research and Public Health. 2023; 20(6):5178. https://doi.org/10.3390/ijerph20065178

Chicago/Turabian StyleZhao, Tongpu, Ruiyun Wanyan, and Lingyan Suo. 2023. "Research on the Effect of Commercial Health Insurance Development on Economic Efficiency" International Journal of Environmental Research and Public Health 20, no. 6: 5178. https://doi.org/10.3390/ijerph20065178

APA StyleZhao, T., Wanyan, R., & Suo, L. (2023). Research on the Effect of Commercial Health Insurance Development on Economic Efficiency. International Journal of Environmental Research and Public Health, 20(6), 5178. https://doi.org/10.3390/ijerph20065178