1. Introduction

Health is important for human beings, and it is also an important means to promote sustainable socio-economic development [

1]. In the context of social issues such as the COVID-19 pandemic and aging populations, governments are incorporating health improvements into sustainable development goals [

2]. China, with one-fifth of the world’s population, has the largest elderly population in the world [

3]. The increasing morbidity and an aging population place a considerable burden on health and social care systems [

4]. Thus, the Chinese government attaches great importance to population health, triggering the 14th Five-Year Plan for National Health in May 2022, which plans to build a better healthcare system and improve population health by 2025 [

5].

Health can be affected by the economic situation. The relationship between health and the economic situation can be analyzed from the macro regional perspective and the micro individual perspective [

6]. At the macro level, the rapid economic development of a region may lead to more government financial health expenditures, and may also lead to environmental pollution and ecological damage, thus affecting the health of individuals [

7]. At the micro level, the deterioration of a personal economic situation may mean an increase in work pressure, a decrease in social and economic status, and a decrease in health investment, thus affecting the health of individuals [

8,

9].

Household financial debt is an important indicator of the economic situation [

10]. Household financial debt refers to the borrowing funds of families, including all debts, bank loans, bills payable, etc. owed by all family members [

11]. In China, under the influence of traditional culture, Chinese people usually borrow money to buy houses [

9], so a large number of Chinese families have more or less family housing liabilities. At the same time, China’s highly accommodative monetary policy in recent years has contributed to the high leverage of Chinese households. In 2020, Chinese household financial debt reached 33.19 trillion yuan (about

$4.8 trillion), 13.5 times that of 2008 [

12]. High household financial debt may have a significant impact on the individuals’ social life [

13]. It affects household consumption [

14], the household education expenditure [

15], public expenditure [

16], employment [

17], income inequality [

18], etc. However, it is often overlooked in studies on the factors affecting the health of individuals.

Among the current research on the relationship between debt and health [

8,

19,

20,

21,

22], researchers have analyzed the correlation between debt and mental health, mainly using samples from developed countries. For example, Sweet et al. (2013) found that people with high financial debt were associated with more depressive symptoms in the United States [

8]. Keese (2011) used German data and found that household financial debt indicators were related to mental health and obesity [

19]. Lenton et al. (2008) conducted a study on UK individuals and found a correlation between household financial debt and mental health [

20]. Margareta (2018) found that household financial debt and payment difficulties were detrimental to people’s mental health in Sweden [

21]. Karen (2014) found that debt had a negative impact on depressive symptoms and mental health of middle-aged and elderly people in the United States [

22].

These studies from different countries have made many contributions to clarifying the impact of household financial debt on health, but they may have the following limitations: First, although existing studies have analyzed the impact of household financial debt on health, few have explored the intermediary mechanism and population heterogeneity. However, sorting out the intermediary mechanism of the impact of household financial debt on health and analyzing whether this correlation is different among different populations can help us understand the impacts more clearly. Second, existing research mainly carries out correlation analysis, but few studies consider the endogenous problems such as missing variables and reverse causality, and it is difficult to conclude causal inference. Third, existing research has mainly explored the effects of family debt on mental health, while neglecting the effects on physical health. However, physical health is different from mental health [

23]. Physical health is defined as the absence of disease in the organs, a high resistance to disease, and a high capacity for physical activity and work [

24]. In contrast, mental health is defined as the absence of mental illness [

25], and living in a state of well-being [

26]. Fourthly, most of the available studies have taken developed countries as their samples. However, there may be significant differences in the demand for loans, household income, and consumption levels in developing countries, so the findings of existing studies may not be applicable to developing countries such as China [

27,

28].

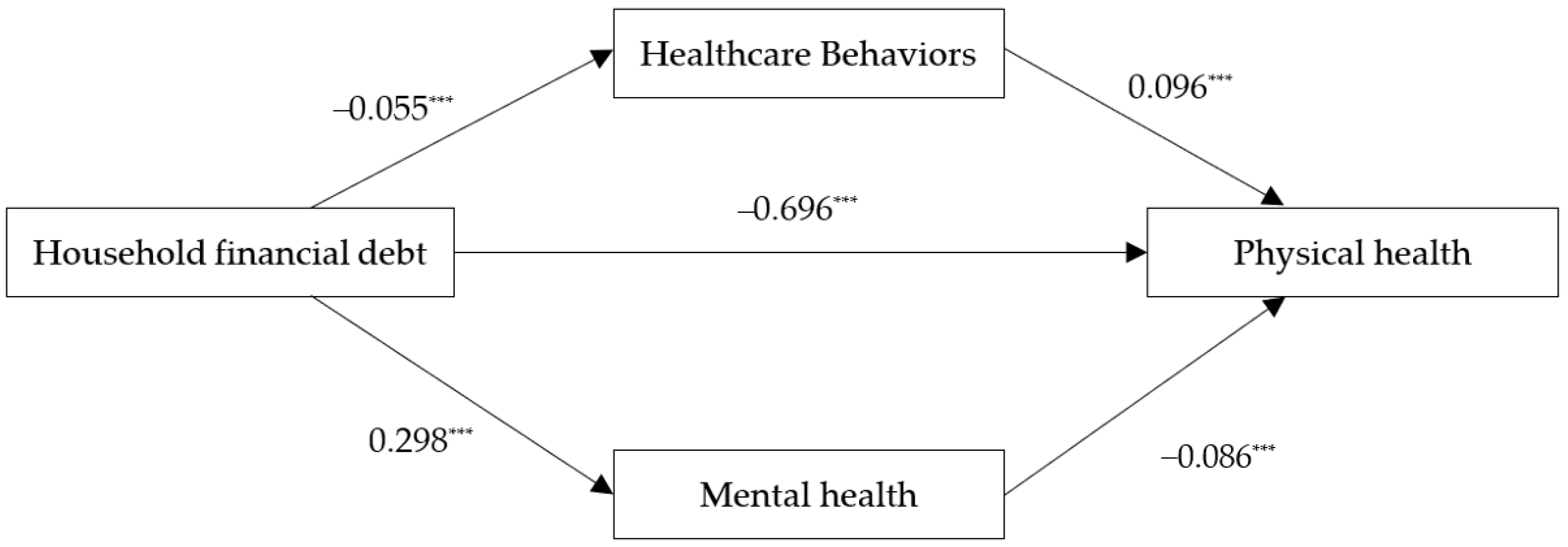

In this paper, we explore the impact mechanism of household financial debt on people’s physical health in China, the world’s largest developing country. Instrumental variables are used to address endogeneity. In addition, the mediating roles of healthcare behaviors and mental health were further analyzed, and heterogeneity was analyzed for people with different ages, marital statuses, and incomes. The findings of this paper are important for developing countries to clarify the relationship between household financial debt and population health, and then to formulate appropriate health intervention policies for different indebted households.

2. Theoretical Analysis and Hypothesis Development

Dahlgren and Whitehead put forward the theory of social determinants of health in 1991 [

29]. This theory reckons that in addition to factors that directly cause disease, people’s social status, as well as living and working environment, such as people’s income, wealth, economic status, living conditions, etc., are also factors affecting health. According to this theory, household financial debt, as a reflection of people’s wealth and economic status, should also be one of the social determinants of health. Therefore, this paper proposes research hypothesis 1.

H1. Household financial debt has a negative impact on physical health.

Additionally, in terms of the mediating mechanism of the effect of household financial debt on physical health, this paper argues that household financial debt affects individuals’ physical health in two main ways. (1) Healthcare behaviors: when people have household financial debt, they will spend less on consumption [

30], and therefore they will spend less on health care. This means that they may choose to seek health care at cheaper, lower-quality facilities, and then diseases may not be effectively treated, which can be detrimental to physical health. (2) Mental health: previous studies have shown that family debt has a negative impact on mental health [

8,

19,

20,

21,

22], while additional epidemiological studies have shown that mental health indicators, such as depression, stress, and poor sleep quality, are significantly associated with physical health indicators, such as obesity and hypertension [

23]. Therefore, this paper further proposes the following two research hypotheses.

H2. Healthcare behaviors mediate the effect of household financial debt on physical health.

H3. Mental health mediates the effect of household financial debt on physical health.

Moreover, the impact of household financial debt on physical health may be heterogeneous across populations. First, concerning different age groups in China, the middle-aged population is the main workforce of the family and bears most of the responsibility for repaying household financial debts, whereas young people and older people are in the cared-for group and often do not have to bear the responsibility for repaying debts [

31]. Therefore, the impact of household financial debt on the physical health of middle-aged people may be greater than that of young and old people. Secondly, influenced by traditional culture, Chinese people have the habit of using family debt to buy a house when they get married [

9]. Therefore, married people tend to have more pressure to repay household financial debt, and the impact of household financial debt on the physical health of married people may be greater. Finally, income is an important source of funds for debt repayment [

32]. People at low-income levels may face greater pressure to repay debt, and the impact of household financial debt on physical health may be greater for people at low-income levels. Therefore, this paper proposes the following three research hypotheses.

H4. Household financial debt has a greater impact on physical health in middle-aged adults compared to young and old adults.

H5. Household financial debt has a greater impact on physical health among married people compared to unmarried people.

H6. Household financial debt has a greater impact on the physical health of people with lower income levels compared to those with higher income levels.

5. Discussion

Using the longitudinal data of CFPS during 2010–2018, we empirically analyzed the impact of household financial debt on individuals’ physical health, as well as explored the mediating mechanisms and the heterogeneity of different groups. The results are articulated as follows.

First, household financial debt has a significant negative effect on individuals’ physical health. That is, those in households with debt have worse physical health status. The finding holds after replacing the explanatory variables and adding an instrumental variable, which is consistent with results from developed countries, such as the United States, Germany, and the United Kingdom [

8,

19].

Second, household financial debt can have a negative impact on individuals’ health by affecting their healthcare behaviors and mental health. People with debt cannot afford high medical expenses and may choose cheap clinics with less satisfactory medical treatment. Therefore, diseases may not be effectively treated, which will affect physical health. This conclusion is consistent with previous research on debt and consumer spending [

30]. In addition, household financial debt makes individuals bear the pressure of repayment and brings them mental health problems, such as depression. Depression and psychological burdens are often considered to be related to physical health diseases, such as hypertension and obesity. This conclusion is consistent with the research on the impact of debt on mental health [

46], and the relationship between mental health and physical health [

23].

Thirdly, the effects of household financial debt on physical health are heterogeneous across populations. First, the effects are more significant in the middle-aged population between the ages of 30 and 75. This may be due to the fact that middle-aged people are the main breadwinners of the family and bear the majority of household financial debts, which in turn causes severe physical discomfort and contributes to the progressive deterioration of physical health. This is in line with the findings of existing studies on the relationship between household financial debt and health [

22,

47]. Second, the effects are more significant for those who are married compared to those who are unmarried. This may be due to the fact that marriage pulls consumption and demand, which in turn increases the likelihood of borrowing and changes the level of household financial debt. Thus, those who are married tend to have more household financial debt and incur higher levels of psychological stress during debt repayment, which in turn causes more severe deterioration in physical health. This is consistent with the findings of existing research on debt and life satisfaction [

48]. Finally, for the income level, the regression results are most significant for those with a low net household income and gradually weaken with the increase of the income level. This may be due to the fact that low-income households are faced with increasing consumption levels and constantly optimizing the quality of services and have to resort to borrowing to maintain their daily needs, which leads to a vicious cycle of deteriorating physical and mental health, resulting in the long-term suffering of both health and debt [

20,

49].

There are certain research limitations in this paper. First, the measurement of physical health is self-rated, which may incur self-report bias. Second, since chronically ill might also refer to chronic mental diseases and mentally ill people can also be hospitalized, these two indicators may not measure physical health accurately. However, the bias may be minimal, because few individuals in China consider chronic mental diseases as having chronic diseases, and even fewer are hospitalized for the reason of mental illness [

50]. Third, more exact explanatory variables measure can be developed to reflect other perspectives of debts, such as debt structure and attitudes toward debt.

Meanwhile, the strengths of this paper are mainly reflected in the following aspects. First, while previous studies have paid less attention to theoretical mechanisms and subgroup analysis [

8,

20], this paper further expands to examine the mediating mechanisms, as well as population heterogeneity, and further enriches the theoretical mechanisms of action between household financial debt and individuals’ physical health. Second, existing studies have focused on the impact of family debt on mental health [

8,

47,

51], while neglecting the impact on physical health, and this study focuses on this research gap. Third, while most previous studies have only conducted correlation studies, this paper addresses possible endogeneity issues using an instrumental variable and conducts causal inference. Fourth, most previous studies have taken developed countries as samples [

8,

19,

20], while this paper takes China, the world’s largest developing country, as a sample, so as to provide relevant policy recommendations for other developing countries.