6.1. Conclusions

This paper discusses the mechanism by which population mobility affects urban economic resilience based on Baidu migration big data. The results indicate the following:

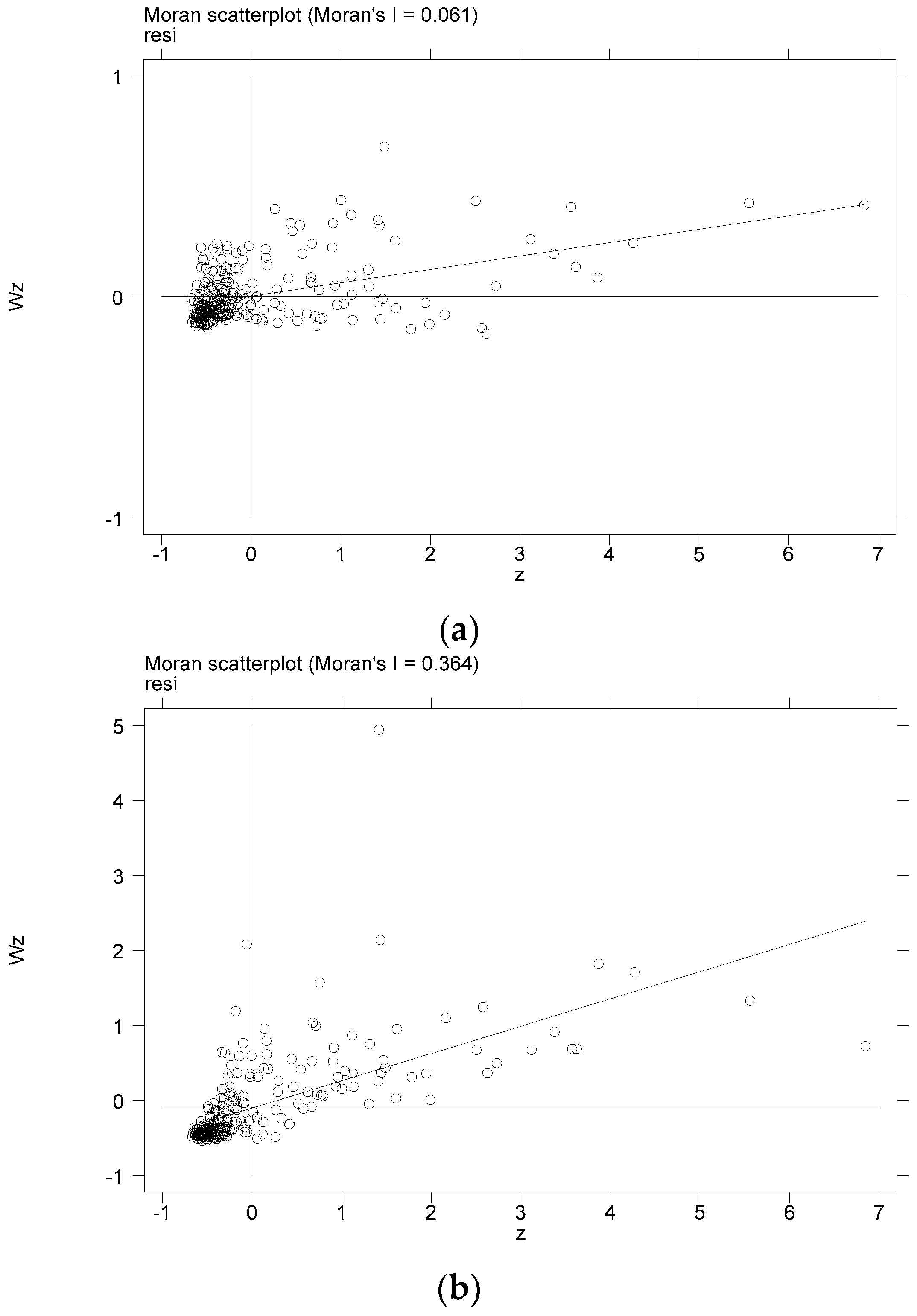

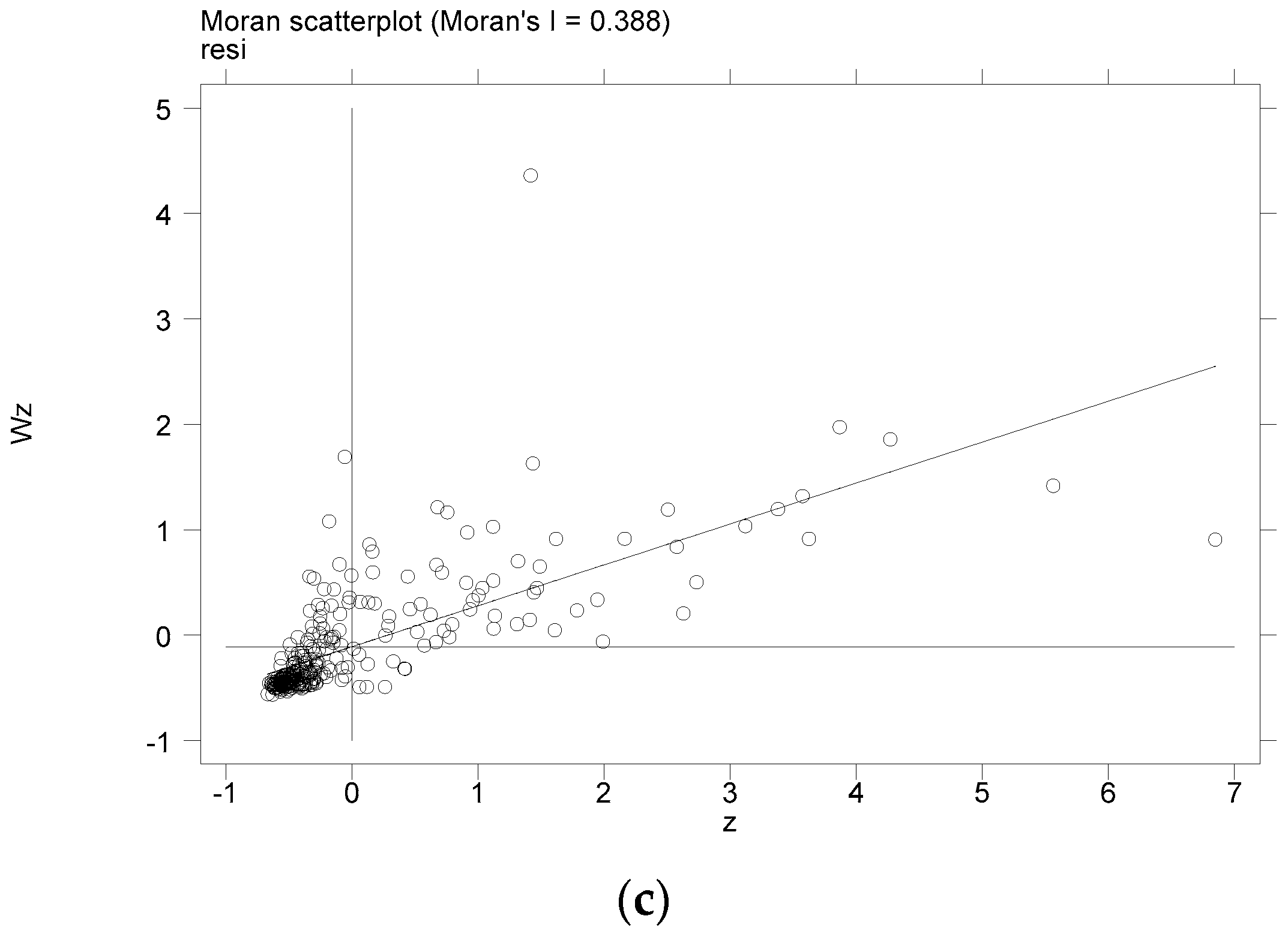

(1) Urban economic resilience is spatially correlated in W1, W2 and W3, and there are high-high aggregations and low-low aggregations in space, and the correlation order is W3 > W2 > W1.

(2) The economic resilience levels of inflow areas are significantly influenced positively by the population net inflow. By introducing the similarity between dialects and Mandarin and the terrain up and down degree, a more accurate result is found, that is, the urban economic resilience index increases by 0.36–0.56% when the population mobility index increases by one unit.

(3) Through the decomposition of spatial spillover effects, it can be concluded that in the case of economic adjacency and geo-economic adjacency, there is a spatial interaction relationship of “building a good partnership with its neighbors” in the effect mechanism of population migration on urban economic resilience.

(4) Innovation input has a favorable moderating influence on urban economic resilience and population mobility. With the increase in innovation input, the promotion effect of population mobility on urban economic resilience will be enhanced. According to the spatial spillover effect, in W1 and W2, the innovation input effect has a negative externality.

(5) Fixed asset investment has a favorable moderating influence on urban economic resilience and population mobility. With the increase in fixed asset investment, the promotion effect of population mobility on urban economic resilience will be enhanced. According to the spatial spillover effect, the fixed asset investment effect has a significant positive externality in the case of W2 and W3.

6.2. Suggestions

First, we make use of spatial correlation to play the driving role of economic resources between cities. According to the research, we find that urban economic resilience is spatially correlated, and the spatial autocorrelation test shows that there are phenomena of high-high and low-low concentrations of urban economic resilience. That is, the interactions between different cities have some positive feedback or some low-level negative effects. This research argues that to construct strong urban economic resilience, on the one hand, we need to fully utilize the typical leadership role of pilot demonstration, strengthen the mobility of the value of economic resources between cities, generate spatial effects such as cooperation, learning, imitation and competition through externalities, capital and personnel flows, and information technology sharing, and encourage individual cities to take the lead in setting an example and make breakthroughs with the help of cities with high levels of economic resilience to promote the economic resilience of surrounding cities. On the other hand, it is necessary to be vigilant in resisting the negative impact of urban economic resilience on neighboring municipalities. Interactions between cities are not always positive and are sometimes negative. For example, cities with low levels of economic resilience are also less able to respond to risks and challenges, which not only hinders their own economic development but also hampers the economic development power of surrounding cities. In short, the spatial distribution of urban economic resilience is characterized by imbalanced and inadequate levels. To prevent this imbalanced and inadequate effect from evolving into a serious spatial Matthew effect, the driving effect of high levels of urban economic resilience on the economic resources of surrounding cities should be given special consideration.

Second, population mobility should be reasonably promoted between cities. According to the research, we find that the economic resilience of inflow areas is significantly positively influenced by the net inflow of the population. Although population mobility may bring problems such as rising housing prices [

45] and urban diseases [

46] to urban economic development, at present, the continuous inflow of population has always been proven to be an indispensable driving force for creating a better economic environment [

47]. The premium power should be constantly enhanced. First, first-tier cities and central cities are the main areas of population inflow. At the present stage, population control cannot be used to solve the urban economic development problem. In contrast, it is necessary to maintain a relatively open population migration policy, transform the conditions for settling down and relax the restrictions on settling down. Additionally, an inclusive system should be developed to provide a friendly social environment for migrants who are unwilling or unable to settle down. Second, for cities with small population inflows and large population outflows, the population concentration of these cities is low, and industrial development is often limited by labor shortages. This part of the region should not only remove restrictions on settlement but also, more importantly, actively develop a series of incentive policies, provide employment opportunities, improve the quality of employment, improve public facilities and services, and improve the living environment and quality of life, which will increase the attractiveness of these cities to the population, achieve balanced population mobility, guarantee regional economic vitality, and enhance urban economic resilience. Finally, population flow should be properly controlled in light of the current situation of COVID-19 prevention and control. The common measures used to prevent the spread of COVID-19 are lockdown and quarantine, which, while helping to stop the further spread of COVID-19, will inevitably aggravate the impact of the epidemic on economic development [

48,

49]. However, if we allow excessive population movement, it will put enormous pressure on the epidemic prevention and control work, and also hinder the improvement of economic resilience. Therefore, the government needs to adopt corresponding policies and supporting measures according to the specific situation and the city’s current resource endowment and economic foundation to jointly promote the population flow management during the epidemic, which can not only ensure the public health of the masses, but also generally not hinder the urban economic development.

Third, cities should increase investment in innovation. The results show that innovation input can enhance the promoting effect of population mobility on urban economic resilience, which is an important moderating variable. In addition, the innovation input effect may be competitive between cities that are geographically close or have similar levels of urban economic development. Therefore, local governments need to do the following three things. (1) They should adopt an innovation-driven strategy and increase investment in innovation, especially for the training of innovative talent. The essence of innovation is that it is talent-driven, and local governments should focus on key areas, cultivate talent with special characteristics, serve urban development, and convert human capital into talent capital. We will adopt an innovation-driven strategy and improve the talent security mechanism. We will increase social security for migrant workers in cities, expand the coverage of basic services, and provide opportunities for the floating population and their family members. We need to avoid the competition between cities that leads to the flow of well-trained talent to geographic or economic proximity not only to attract people, but also to retain people. (2) The efficiency of innovation resource utilization should be improved, the innovation environment should be continuously optimized, human resources should be reasonably allocated, and human capital should be consolidated. Local governments should focus on the matching and coordination degree of innovation and human capital in different stages of urban areas and adjust and optimize innovation resources and talent policies dynamically in real time so that the accumulation of human resources and innovation development levels of cities at the current stage can develop in a coordinated coupling. The loss of economic factors due to the misallocation of innovation resources and the idleness of human capital should be avoided. (3) Focus on the practical application of innovation. Especially in the context of COVID-19, innovation is the key to solving the conflict between population mobility, public health and economic development. For example, big data analysis technology has played an important role in close contact tracing and epidemic prediction [

50]. Under the normal movement of people, it has reduced the risk of epidemic transmission, ensured the public health and safety of the people, and enhanced the resilience of the urban economy.

Fourth, they should focus on the scientific regulation of fixed asset investment. The findings show that enhancing effective investment in fixed assets significantly enhances the contribution of population mobility to urban economic resilience, and furthermore, the fixed asset investment effect has significant positive externalities between cities with economic proximity and geo-economic proximity. Therefore, the reconciliation effect of fixed assets should be utilized with maximum effectiveness. Specific paths include (1) improving the efficiency of fixed asset investment. The Fourteenth Five-Year Plan clearly stated the goal to “adhere to the development of economic focus on the real economy”, which cannot be separated from investment. However, it should be noted that investment here refers to effective investment, not to reduce the economic efficiency of repeated investment. Because of the government’s limited resources, it is necessary to continuously optimize the regional allocation structure of investment and build an investment mechanism with multiple channels to maximize the efficiency of fixed asset investment. (2) A more reasonable growth rate of fixed asset investment should be maintained. There are still structural factors supporting fixed asset investment in China; that is, the human advantage has not been fully utilized in the central and western areas, where there are many idle labor resources. In view of this situation, boosting fixed asset investment is still an efficient approach to stimulate economic growth and assist the central and western regions in their ascent. (3) Give full play to the driving force of government investment. The government should scientifically regulate fixed asset investment, drive industrial development and optimize industrial structure through effective investment in fixed assets so that the labor force flowing into the city can be fully utilized to achieve the maximum promotion effect of population mobility on urban economic resilience and make full use of the positive externality of wielding the effect of fixed asset investment to drive the improvement of the economic resilience of cities in surrounding areas.

But it should be noted that the higher mobility of the population will also bring some disadvantages to urban development. For example, in some eastern regions with high population density, high mobility and aggregation degree, the urban land carrying space tends to be saturated, and high population inflow will bring great pressure on the infrastructure and public services that are already in short supply, which is not conducive to the improvement of urban economic resilience. On the contrary, labor is already scarce in some areas of the central and western regions, in addition to northeast China, and the massive population outflow has aggravated the labor shortage, which further slows the economic development which is already lacking in power, and is not conducive to enhancing the resilience of the urban economy. In addition, population flow may further complicate government management. Due to its complex composition, large number and frequent change frequency, the floating population will increase the management difficulties and costs of the government. In terms of social effect, the surge of urban population flow will bring great challenges to community security and social security, meanwhile accompanied by a large number of “left-behind children”, “empty-nesters”, as well as urban ecological resource consumption and environmental pollution [

51]. In terms of public health, China’s population flow is large and complicated, and most of these people have weak health awareness. Large-scale migration will increase the chance of disease transmission and pose a serious threat to public health, especially in the context of the ongoing COVID-19 pandemic. Based on this, we should carefully weigh the advantages and disadvantages brought by the mobility of the urban population and work out the most suitable strategic planning for the current development of the city.