The Combined Effect of Environmental Policies on China’s Renewable Energy Development: A Multi-Perspective Study Based on Semiparametric Regression Model

Abstract

1. Introduction

2. Mechanism of Environmental Policies’ Effects on Renewable Energy Development

- (1)

- Green supervision and public regulations refer to the supervision of enterprises’ access to environmental policy preferences. This category is usually strict in monitoring standards. Enterprises that do not fit within the scope of the policy are excluded, guaranteeing that resources are precisely utilized in the environmentally friendly renewable energy sector, rather than in other sectors. This avoids the waste of resources and improves the quality and efficiency of renewable energy development. Therefore, we propose Hypothesis 1.

- (2)

- Green standardized regulations refer to a set of policy benefits provided by the government to environmentally friendly renewable energy enterprises, such as green finance, etc. These policies are of great significance for providing funding for the renewable energy industry to address its financing difficulties. Furthermore, they include some penalties for highly polluting industries, such as environmental taxes. These will enhance enterprises’ attention to renewable energy and guide capital into the renewable energy industry. Therefore, we propose Hypothesis 2.

- (3)

- Green accounting regulations integrate loss of resources and environmental damage into national economic statistics, and provide accurate green economic information for a country. This allows the country to gain real green economic growth not at the expense of the environment, in order to further develop plans for better promoting green development. Since green accounting regulations are only a post-accounting behavior adopted by the government, they have a limited effect on promoting renewable energy development. Therefore, we propose Hypothesis 3.

3. Data and models

3.1. Sample Selection

3.2. Variables

- (1)

- Renewable energy development . Man et al. (2013) found that this variable can be defined as the investments of renewable energy enterprises. Two definitions therefore emerge [32]. Firstly, external investment refers to the direct purchase of securities issued by external business entities, such as treasury bills, special treasury bonds, local bonds, and enterprise bonds, all of which have nothing to do with the renewable energy industry. Internal investment is the money used to add assets in renewable energy enterprises. Since the main business of renewable energy enterprises is related to new energy and renewable energy, internal investment is able to capture investment in renewable energy to the greatest extent. This paper therefore measures renewable energy development by the capital used for adding permanent assets, intangible assets, and other long-term assets in renewable energy enterprises, which is consistent with the research of Li and Yang (2015) [30].

- (2)

- Environmental policies . More scholars focus on a single policy and its environmental and economic effects. Therefore, there is a lack of attention on the comprehensive effects of a set of environmental policies. Drawing on the work of Yang et al. (2021), this research therefore provides a new indicator, the “green institutional environment”, for quantitative analysis using the functional data analysis method and the functional entropy weight method. This is because there is a set of complex indicators in green institutional environmental systems, and the importance of each indicator will vary over time due to complicated and dynamic economic effects.

- (3)

- Control variables. The resource endowment of an enterprise is measured by its asset:liability ratio. Time from the listing year to the sample period is used as a measure of enterprise age. Development potential is represented by the value of Tobin’s Q.

3.3. Descriptive Statistics

3.4. Models

4. Empirical Estimates

4.1. Estimation of Long-Term Relationships between Variables

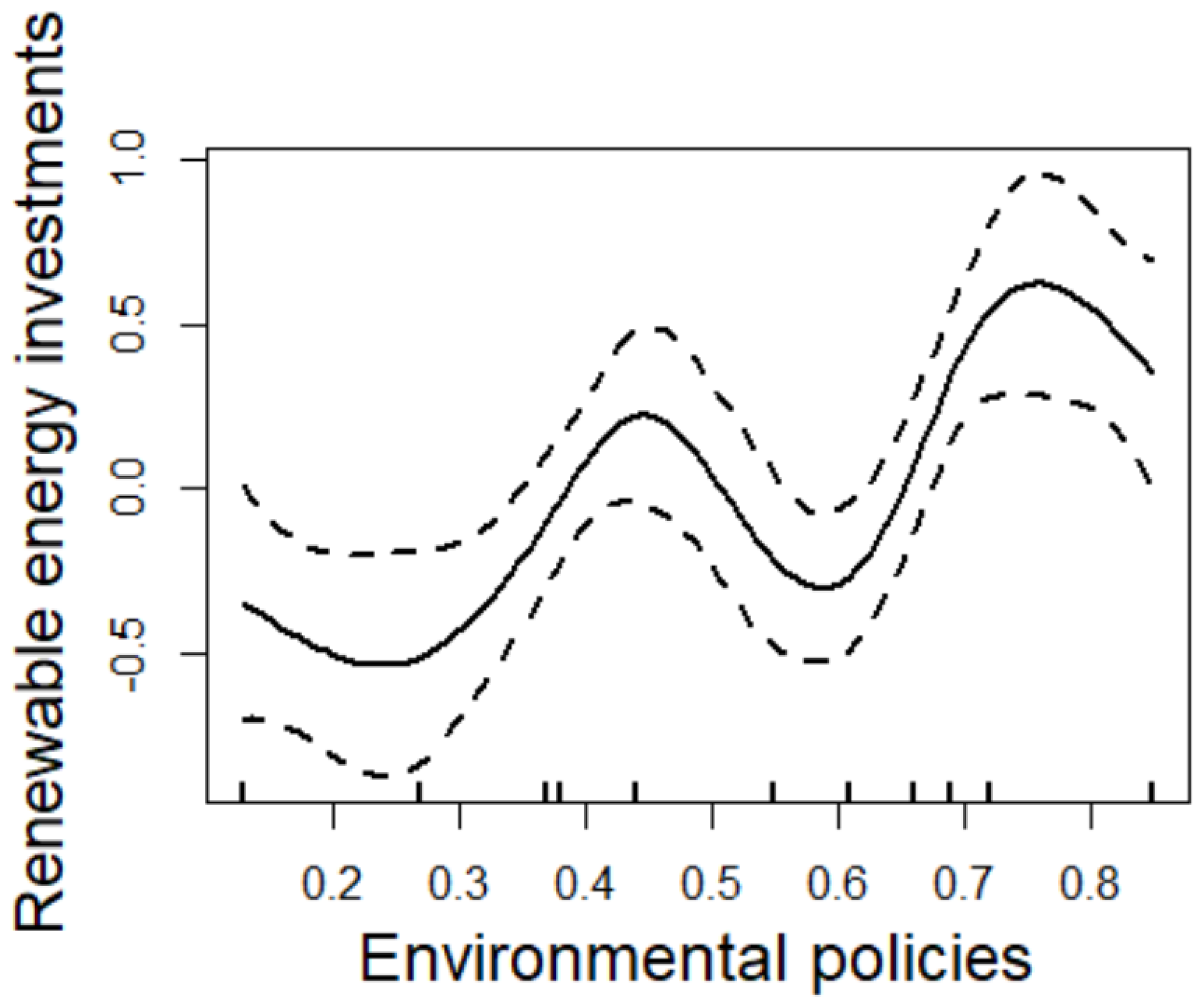

4.2. Estimates of the Nonlinear Impact of Environmental Policies on Renewable Energy Development

- (1)

- There is a “W-shaped” relationship between the environmental policy system and renewable energy development at the 10% significance level, which verifies the rationality of the nonparametric terms of the model and further confirms the superiority of the semiparametric regression model. This result is also consistent with Hypothesis 4.

- (2)

- The control variables discussed above show that the resource endowment of enterprises is an inverse indicator; it significantly inhibits investment in renewable energy. This is because an enterprise’s resource endowment is limited, and the enterprise needs to increase production size and market share through debt management. Most well-developed enterprises have the ability to use debt from creditors to implement high-efficiency production. Therefore, the debt ratio of an enterprise represents its vitality. Enterprises with high debt ratios (i.e., insufficient resource endowments) tend to be more competitive and more reliant on high-risk, high-yield investments, such as renewable energy development. This indicates that China’s renewable energy enterprises should appropriately increase their debt ratios in exchange for greater profit margins and stronger business vitality. Second, the coefficient of enterprise age on renewable energy development fails the significance test. This is because the renewable energy industry, as an emerging industry, is still in its infancy. Enterprise leaders pay more to operations than investments. Therefore, enterprise age does not generate a significant effect on renewable energy development. Third, development potential inhibits the level of renewable energy development at the 1% significance level. This could be because renewable energy enterprises with higher development potential spend more money on technology promotion instead of investment, resulting in a lower level of renewable energy development.

4.3. Estimates of the Impact of Environmental Policies on Renewable Energy Development at Different Stages

- (1)

- Green supervision and public regulations can enhance investments in the renewable energy industry, with an estimated coefficient of 10.8173. The nonlinear relationship between green accounting regulations and investments in the renewable energy industry fails the significance test. This shows that green supervision and public regulations can play an important role in enhancing investment in the renewable energy industry, but green accounting regulations cannot, which is consistent with Hypothesis 1 and 3.

- (2)

- A nonlinear effect of green standardized regulations on investment in the renewable energy industry can be found, with a curve shape similar to the “W-shape”. It indicates that the nonlinear effect of environmental policies on renewable energy development is reflected mainly in green standardized regulations, which is inconsistent with Hypothesis 2. Due to serious pollution and irreversible resource depletion, China attaches great importance to the governance of environmental problems. Green standardized regulations include rules to regulate and restrain the economic activities of various actors, which are therefore expected to be the main component of environmental policies. The number of policies in green standardized regulations are much more than the number in the other two kinds of environmental policies. Different policies may lead to different effects on renewable energy development. Some policies in green standardized regulations were issued earlier and have been implemented for longer, resulting in the significant promotion of renewable energy development. However, some policies produce limited promotion effects. This results in an unstable relationship between green standardized regulations and renewable energy development.

5. Estimation from the Classification Perspective

5.1. Group Estimation Based on Industry-Type Classification

- (1)

- Environmental policy will promote investments in solar energy with a coefficient of 1.0697, at the 10% significance level. This is because China has rich solar energy resources and huge development potential. In addition, the development of China’s solar energy industry is occurring relatively late. It is thus highly dependent on policies and is highly valued by the government. Specifically, the feed-in tariff on photovoltaic power issued in 2011 can help to improve China’s solar power market. The 13th Five-Year Plan for Solar Energy Development in 2016 can help diversify solar power generation methods and build a clean and efficient energy system. These all reflect the government’s strong support for the development of the solar energy industry, which has achieved a desirable effect.

- (2)

- Environmental policy will inhibit investments in biomass energy with a coefficient of −1.2101, at the 10% significance level. This indicates that China’s environmental policy is still unable to effectively promote biomass, and may even generate a negative impact, though the importance of biomass energy in the energy supply of China is increasing. This may be because, on the one hand, there are still some problems in the development of biomass energy itself, such as an inconsistent understanding of biomass energy, less development experience, and inadequate technical expertise. On the other hand, China’s policy system has not yet been perfected regarding the biomass energy industry, which is manifested in scattered policies. In addition, policies are mostly aimed at other industries instead of the biomass energy industry, which sends a signal to the public, resulting in the inflow of social capital into other industries instead of the biomass energy industry.

- (3)

- The coefficients of environmental policies on investments in wind energy, hydro energy, and geothermal energy fail the significance test. This is due to limited developmental conditions. Due to natural conditions such as geographical location and climate change, the development of China’s hydropower industry has stagnated. As far as the wind energy industry is concerned, the utilization of wind energy in China is still stagnant, and even faces the emergence of wind curtailment problems in many regions. In terms of the geothermal energy industry, due to its requirements for large capital investment and strong technical expertise, its development is not likely, but its potential is still very large.

5.2. Group Estimation Based on Business Scale Classification

6. Conclusions and Discussions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Bhattacharya, M.; Paramati, S.R.; Ozturk, I.; Bhattacharya, S. The Effect of Renewable Energy Consumption on Economic Growth: Evidence from top 38 countries. Appl. Energy 2016, 162, 733–741. [Google Scholar] [CrossRef]

- Bilgili, F.; Koçak, E.; Bulut, Ü. The Dynamic Impact of Renewable Energy Consumption on CO2 Emissions: A Revisited Environmental Kuznets Curve Approach. Renew. Sustain. Energy Rev. 2016, 54, 838–845. [Google Scholar] [CrossRef]

- Arbex, M.; Perobelli, F.S. Solow meets Leontief: Economic growth and energy consumption. Energy Econ. 2010, 32, 43–53. [Google Scholar] [CrossRef]

- Salim, R.A.; Hassan, K.; Shafiei, S. Renewable and non-renewable energy consumption and economic activities: Further evidence from OECD countries. Energy Econ. 2014, 44, 350–360. [Google Scholar] [CrossRef]

- Inglesi-Lotz, R. The impact of renewable energy consumption to economic growth: A panel data application. Energy Econ. 2016, 53, 58–63. [Google Scholar] [CrossRef]

- Qi, S.Z.; Li, Y. Threshold effects of renewable energy consumption on economic growth under energy transformation. China Popul. Resour. Environ. 2018, 28, 19–27. [Google Scholar] [CrossRef]

- Shen, J.; Pan, J.Q. Fiscal Policy Analysis of Renewable Energy Development. Contemp. Econ. Res. 2009, 3, 63–66. [Google Scholar]

- Yang, C.H.; Tseng, Y.H.; Chen, C.P. Environmental regulations, induced R & D, and productivity: Evidence from Taiwan’s manufacturing industries. Resour. Energy Econ. 2012, 34, 514–532. [Google Scholar]

- Bi, Q.; Gu, L.M.; Zhang, J.J. Traditional culture, environmental system and corporate environmental information disclosure. Account. Res. 2015, 3, 12–19. [Google Scholar]

- Li, X.J.; He, N. Research on the influence of environmental tax on enterprise green technology innovation under regional competition. China Popul. Resour. Environ. 2018, 28, 73–81. [Google Scholar]

- Abid, N.; Ikram, M.; Wu, J.; Ferasso, M. Towards environmental sustainability: Exploring the nexus among ISO 14001, governance indicators and green economy in Pakistan. Sustain. Prod. Consum. 2021, 27, 653–666. [Google Scholar] [CrossRef]

- Nie, P.Y.; Chen, Y.H.; Yang, Y.C.; Wang, X.H. Subsidies in carbon finance for promoting renewable energy development. J. Clean. Prod. 2016, 139, 677–684. [Google Scholar] [CrossRef]

- Terkla, D. The efficiency value of effluent tax revenues. J. Environ. Econ. Manag. 1984, 11, 107–123. [Google Scholar] [CrossRef]

- Carrasco, J.M.; Franquelo, L.G.; Bialasiewicz, J.T.; Galvan, E.; Guisado, R.C.P.; Prats, M.A.M.; Leon, J.I.; Moreno-Alfonso, N. Power-Electronic Systems for the Grid Integration of Renewable Energy Sources: A Survey. IEEE Trans. Ind. Electron. 2006, 53, 1002–1016. [Google Scholar] [CrossRef]

- Abadie, L.M. Valuation of Long-Term Investments in Energy Assets under Uncertainty. Energies 2009, 2, 738–768. [Google Scholar] [CrossRef]

- Dent, C.M. China’s renewable energy development: Policy, industry and business perspectives. Asia Pac. Bus. Rev. 2015, 21, 26–43. [Google Scholar] [CrossRef]

- Porter, M.E.; Linde, C.V.D. Toward a New Conception of the Environment-Competitiveness Relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Bi, Q.; Yu, L.C. Environmental Taxes, Media Surveillance and Corporate Green Investments. Financ. Account. Mon. 2016, 20, 66–70. [Google Scholar]

- Carfora, A.; Pansini, R.V.; Romano, A.A.; Scandurra, G. Renewable energy development and green public policies complementarities: The case of developed and developing countries. Renew. Energy 2018, 115, 741–749. [Google Scholar] [CrossRef]

- Zhao, Y.Q.; Xiong, N.J. Review on Economic Incentive Policies for Renewable Energy in China. Res. Econ. Manag. 2010, 4, 5–11. [Google Scholar]

- Zhang, C.; Lu, Y.; Guo, L.; Yu, T.S. The intensity of environmental regulation and the progress of production technology. Econ. Res. J. 2011, 46, 113–124. [Google Scholar]

- Sun, W.Y.; Yang, Q. Environmental regulation and optimal decision-making of enterprises: A study based on the mixed oligopoly model. Commer. Res. 2017, 59, 145–152. [Google Scholar]

- Liu, G.; Yang, Z.; Zhang, F.; Zhang, N. Environmental tax reform and environmental investment: A quasi-natural experiment based on China’s Environmental Protection Tax Law. Energy Econ. 2022, 109, 106000. [Google Scholar] [CrossRef]

- Cao, J.; Ho, M.S.; Ma, R.; Teng, F. When carbon emission trading meets a regulated industry: Evidence from the electricity sector of China. J. Public Econ. 2021, 200, 104470. [Google Scholar] [CrossRef]

- Li, Z.; Wang, J. Spatial spillover effect of carbon emission trading on carbon emission reduction: Empirical data from pilot regions in China. Energy 2022, 251, 123906. [Google Scholar] [CrossRef]

- Zhang, C.; Zhou, D.; Wang, Q.; Ding, H.; Zhao, S. Will fiscal decentralization stimulate renewable energy development? Evidence from China. Energy Policy 2022, 164, 112893. [Google Scholar] [CrossRef]

- Wang, B.; Song, C.X. Resource Endowment, Resource Demand and Industrial Investor Introduction of Start-Up Enterprises-Evidence from GEM Listed Companies. Account. Res. 2015, 12, 59–66. [Google Scholar]

- Palangkaraya, A.; Stierwald, A.; Yong, J. Is Firm Productivity Related to Size and Age? The Case of Large Australian Firms. J. Ind. Compet. Trade 2009, 9, 167–195. [Google Scholar] [CrossRef]

- Zhou, W.X. Overinvestment or Underinvestment-Evidence from A-Share Listed Companies. China Ind. Econ. 2010, 9, 151–160. [Google Scholar]

- Li, F.Y.; Yang, M.Z. Will Economic Policy Uncertainty Constrain Corporate Investment?-An Empirical Study Based on China’s Economic Policy Uncertainty Index. J. Financ. Res. 2015, 4, 115–129. [Google Scholar]

- Wang, Q.; Kwan, M.P.; Fan, J.; Zhou, K.; Wang, Y.F. A study on the spatial distribution of the renewable energy industries in China and their driving factors. Renew. Energy 2019, 139, 161–175. [Google Scholar] [CrossRef]

- Man, X.Y.; Zhu, X.J.; Chen, J. A Study on the Statistical Index System of Energy Investment. Stat. Res. 2013, 30, 25–29. [Google Scholar]

- Yang, X.; He, L.; Tian, S.; Wang, D. Construction of China’s Green Institutional Environmental Index: Using Functional Data Analysis method. Soc. Indic. Res. 2021, 154, 559–582. [Google Scholar] [CrossRef]

- Wu, X.P.; Gao, M.; Zeng, L.T. Retest of the relationship between air pollution and economic growth based on semiparametric spatial model. Stat. Res. 2018, 35, 82–93. [Google Scholar]

- Zheng, W.J.; Ye, A.Z. Urban-rural income gap, industrial structure upgrading and economic growth-based on semi-parametric spatial panel VAR model. Economist 2015, 10, 61–67. [Google Scholar]

| Variable | Symbol Indicator Description | Unit |

|---|---|---|

| Renewable energy development | The capital used for adding permanent assets, intangible assets, and other long-term assets in renewable energy enterprises | RMB |

| Environmental policies | Green institutional environmental index | None |

| Enterprise’s resource endowment | Asset–liability ratio of renewable energy enterprises | None |

| Enterprise age | A period from the listing year to the sample interval | Year |

| Development potential | Renewable energy enterprises’ Tobin’s Q | None |

| Variable | Average Value | Median Value | Minimum Value | Maximum Value | Standard Deviation | Skewness | Kurtosis |

|---|---|---|---|---|---|---|---|

| Renewable energy development | 951,900,000 | 232,300,000 | −352,200,000 | 27,960,000,000 | 2,449,148,000 | 6.7107 | 54.8628 |

| Environmental policy indicators | 0.5169 | 0.5540 | 0.1305 | 0.8547 | 0.2171 | −0.1993 | −1.2458 |

| Enterprise’s resource endowment | 0.5571 | 0.5712 | 0.0386 | 1.2008 | 0.1788 | −0.3268 | 0.0490 |

| Enterprise age | 13.47 | 14.00 | 0.00 | 28.00 | 5.4130 | −0.0199 | −0.4987 |

| Development potential | 1.7340 | 1.4590 | 0.7978 | 10.1589 | 0.9337 | 3.1969 | 16.2706 |

| Methods | INV | ENV | RE | AGE | TQ |

|---|---|---|---|---|---|

| Levin, Lin, and Chu t * | −18.0261 *** | −32.5115 *** | −12.6475 *** | −53.7304 *** | −28.8035 *** |

| (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | |

| Im, Pesaran, and Shin W-stat | −2.23335 ** | −14.6464 *** | −1.69587 ** | −143.718 *** | −6.35045 *** |

| (0.0128) | (0.0000) | (0.0450) | (0.0000) | (0.0000) | |

| ADF—Fisher Chi-square | 259.720 *** | 500.201 *** | 237.827 *** | 1694.70 *** | 404.563 *** |

| (0.0001) | (0.0000) | (0.0046) | (0.0000) | (0.0000) | |

| PP—Fisher Chi-square | 354.644 *** | 1389.70 *** | 269.286 *** | 1694.70 *** | 535.011 *** |

| (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) |

| Methods | Renewable Energy Development and Environmental Policies | Renewable Energy Development, Environmental Policies, and Control Variables |

|---|---|---|

| Panel PP | −8.0826 *** | −3.1275 *** |

| (0.0000) | (0.0009) | |

| Panel ADF | −11.7690 *** | −2.9774 *** |

| (0.0000) | (0.0015) | |

| Group PP | −8.8801 *** | −10.2553 *** |

| (0.0000) | (0.0000) | |

| Group ADF | −12.3452 *** | −5.2328 *** |

| (0.0000) | (0.0000) |

| Variables | Coefficient | Standard Error | T Statistic | p-Value |

|---|---|---|---|---|

| 1.08 *** | 0.32 | 3.35 | 0.00 | |

| −0.02 | 0.12 | −0.20 | 0.84 | |

| −0.71 *** | 0.07 | −10.91 | 0.00 | |

| / * | 0.42 | −1.74 | 0.08 |

| Variables | Semiparametric Regression Model | Variables | Fixed-Effect Model | |

|---|---|---|---|---|

| Green Standardized Regulations | Green Accounting Regulations | Green Supervision and Public Regulations | ||

| 1.07 *** (3.33) | 1.11 *** (3.44) | 2.0992 *** (5.32) | ||

| −0.02 (−0.16) | −0.01 (−0.10) | 0.4114 ** (2.39) | ||

| −0.72 *** (−10.90) | −0.69 *** (−10.73) | −0.1907 *** (−3.39) | ||

| / * (−1.86) | / (0.21) | 10.8173 * (1.80) | ||

| Hypothesis | Whether the Hypothesis Is Confirmed or Not | Results |

|---|---|---|

Hypothesis 1. Green supervision and public regulations can promote renewable energy development. | Yes | Green supervision and public regulations can enhance investments in the renewable energy industry, with an estimated coefficient of 10.8173. |

Hypothesis 2. Green standardized regulations can promote renewable energy development. | No | There is a “W-shaped” relationship between green standardized regulations and renewable energy development. |

Hypothesis 3. Green accounting regulations will produce a limited effect on renewable energy development. | Yes | Green accounting regulations cannot play an important role in enhancing investment in the renewable energy industry. |

Hypothesis 4. Total environmental policies will produce a complex effect on renewable energy development. | Yes | A complex effect of the environmental policy system on investment in the renewable energy industry can be obtained, whose curve shape is similar to “W-shaped”. |

| Variables | Model (6) | ||||

|---|---|---|---|---|---|

| Solar Energy | Hydro Energy | Biomass Energy | Wind Energy | Geothermal Energy | |

| 1.1295 * (1.78) | 2.7127 ** (2.13) | 3.7117 *** (4.82) | −0.9459 (−1.46) | 2.8103 ** (2.18) | |

| 0.1202 (0.34) | 0.4062 (0.91) | 0.7671 * (1.96) | 1.1738 *** (3.61) | 0.2021 (0.29) | |

| −0.1933 ** (−2.23) | 0.3220 (0.81) | 0.0111 (0.11) | −0.2892 *** (−2.60) | −0.0636 (−0.30) | |

| 1.0697 * (1.93) | 0.3925 (0.48) | −1.2101 * (−1.64) | −0.4804 (−0.84) | 0.5263 (0.50) | |

| Variables | Model (6) | |

|---|---|---|

| Large-Sized Enterprises | Medium-, Small-, and Micro-Sized Enterprises | |

| −0.0540 (−0.14) | 0.9702 (1.30) | |

| 0.5732 *** (2.68) | 0.0027 (0.0078) | |

| −0.2413 *** (−4.34) | −0.1190 (−1.13) | |

| 0.2208 (0.63) | 1.8276 *** (2.58) | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yang, X.; Zhong, S. The Combined Effect of Environmental Policies on China’s Renewable Energy Development: A Multi-Perspective Study Based on Semiparametric Regression Model. Int. J. Environ. Res. Public Health 2023, 20, 184. https://doi.org/10.3390/ijerph20010184

Yang X, Zhong S. The Combined Effect of Environmental Policies on China’s Renewable Energy Development: A Multi-Perspective Study Based on Semiparametric Regression Model. International Journal of Environmental Research and Public Health. 2023; 20(1):184. https://doi.org/10.3390/ijerph20010184

Chicago/Turabian StyleYang, Xiaolei, and Shuiying Zhong. 2023. "The Combined Effect of Environmental Policies on China’s Renewable Energy Development: A Multi-Perspective Study Based on Semiparametric Regression Model" International Journal of Environmental Research and Public Health 20, no. 1: 184. https://doi.org/10.3390/ijerph20010184

APA StyleYang, X., & Zhong, S. (2023). The Combined Effect of Environmental Policies on China’s Renewable Energy Development: A Multi-Perspective Study Based on Semiparametric Regression Model. International Journal of Environmental Research and Public Health, 20(1), 184. https://doi.org/10.3390/ijerph20010184