Research on Digital Inclusive Finance Promoting the Integration of Rural Three-Industry

Abstract

1. Introduction

2. Review of Literature

3. Theoretical Mechanism and Model

3.1. Theoretical Mechanism

3.2. Theoretical Model

4. Research Design, Index Selection and Data Explanation

4.1. Metrological Model Design

4.2. Variable Description

- Explanatory variable: The efficiency of rural integration of tertiary industry. The DEA-Malmquist index method was used to measure rural tertiary industry integration efficiency in 31 provinces and cities in China from 2011 to 2018. Specific output and input indicators are selected as follows: (1) factor input: capital and labor are needed to promote the development of rural integration of the tertiary industry, and in the rural area it is often the government’s first input and other capital inflow. So, the expenditure of agriculture, forestry, and water affairs of 31 provinces and cities in China from 2011 to 2018 was taken as the input index of rural industry integration. This paper uses the number of rural non-agricultural employment to measure the input of the labor force. (2) output indicators: first, economic indicators select the total output value of agriculture, forestry, animal husbandry, and fishery services. Second, social indicators select rural per capita consumption expenditure. Third, the ecological indicators select the level of mechanised agriculture.

- Core explanatory variable: Whether to develop digital financial inclusion in the virtual variable Treat distinguishes the Experimental Group from the Control Group. If Treat = 1, it means the experimental province in the East; if Treat = 0, it means the comparative province in the Midwest. Time is a virtual variable of policy, and the G20 digital Pratt & Whitney senior principles of finance, published in 2016, formally introduced digital inclusive finance. Therefore, this paper selects 2016 as the policy shock event. The Time value of 2011–2015 is 0 and of 2016–2018 is 1. The interaction item Treat Time explains the variables for the important core.

- Financial ecological environment variables: The financial ecological environment of a region is closely related to the development of digital inclusive finance, and the development of the financial ecological environment will affect the effect of policy implementation. According to the existing research on the definition of financial ecological environment, the impact on the level of rural tertiary industry integration can be understood from the following three aspects: (1) government governance (Gs), measured by the ratio of fiscal expenditure to GDP; (2) financial development (Fin) is measured by the ratio of the financial loan balance of each province and city to the regional GDP; (3) economic base (Rgdp) is measured by per capita GDP.

- Control variables: (1) human capital level (Edu), which is measured by the number of students in ordinary colleges and universities in rural areas as a proportion of the total rural population; (2) information level (Info), which uses rural transportation and communication expenditures as a proportion of rural consumption expenditures measured by proportion.

- Intermediate variable: (1) technological innovation (Tech). Using patent licensing as a metric. (2) agricultural modernization (Arg). Use electricity consumption per square meter of agricultural land. (3) risk diversification (Insurance). Use the value of premium income as a metric.

4.3. Data Interpretation

- Data selection: The data time span selected in this paper is from 2011 to 2018, covering panel data of 31 provinces and cities in China because China’s digital inclusive finance has grown from birth to maturity since 2011. Since 2015 it has officially become the focus of government policies to promote the integration of the three industries in rural areas, so it is more reasonable to study the data during this period.

- Data source: Considering the problems such as the measurability and availability of data, the lag of data release, etc. The data are drawn from regional yearbooks and government websites, the 2011–2018 China Statistical Yearbook, and the report on developing China’s agricultural product processing industry. The descriptive statistics for each variable are shown in Table 1.

5. Empirical Results and Robustness Test

5.1. Baseline Regression Result

5.2. Robustness Test

5.2.1. Hausman Test

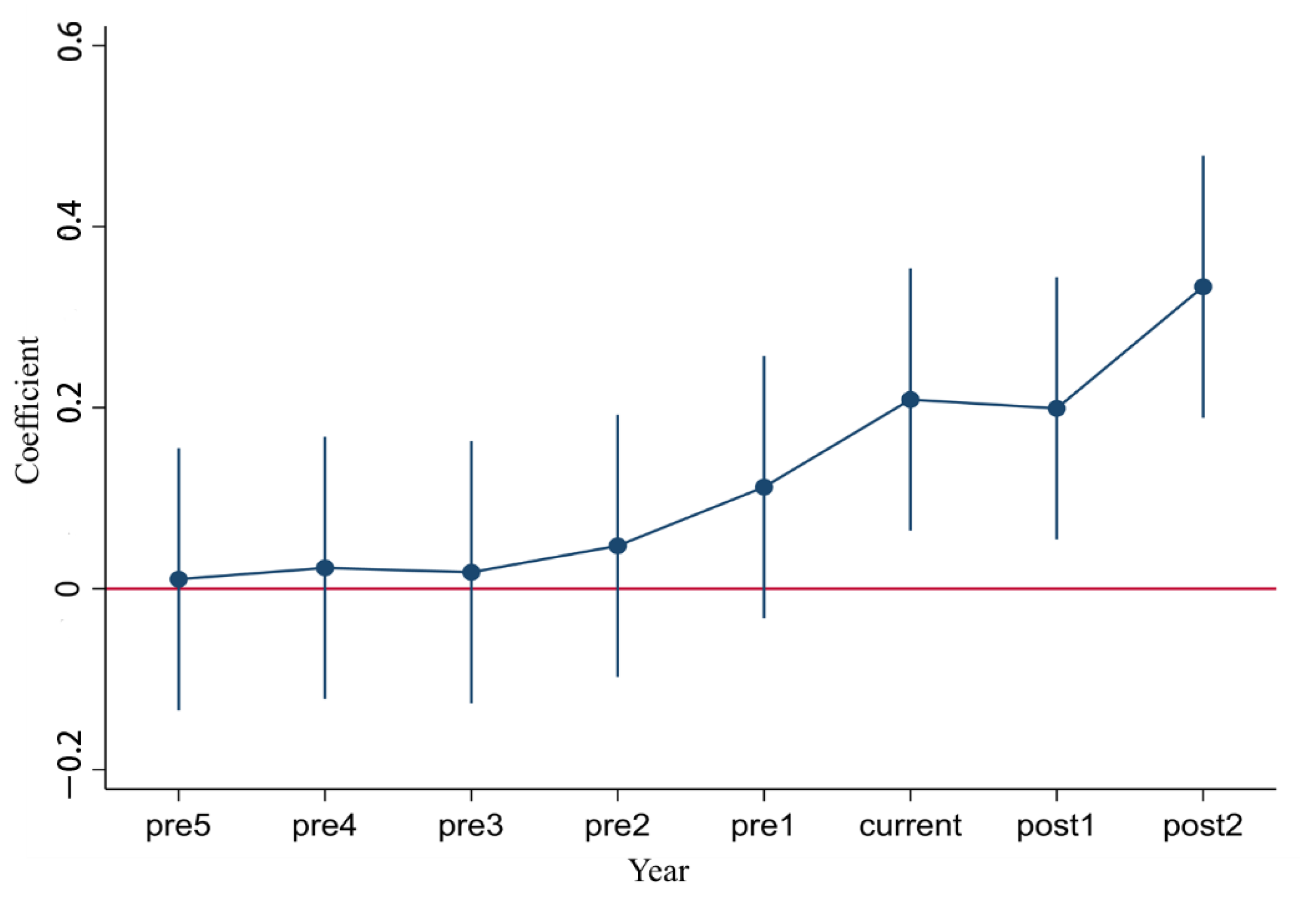

5.2.2. The Parallel Trend Test

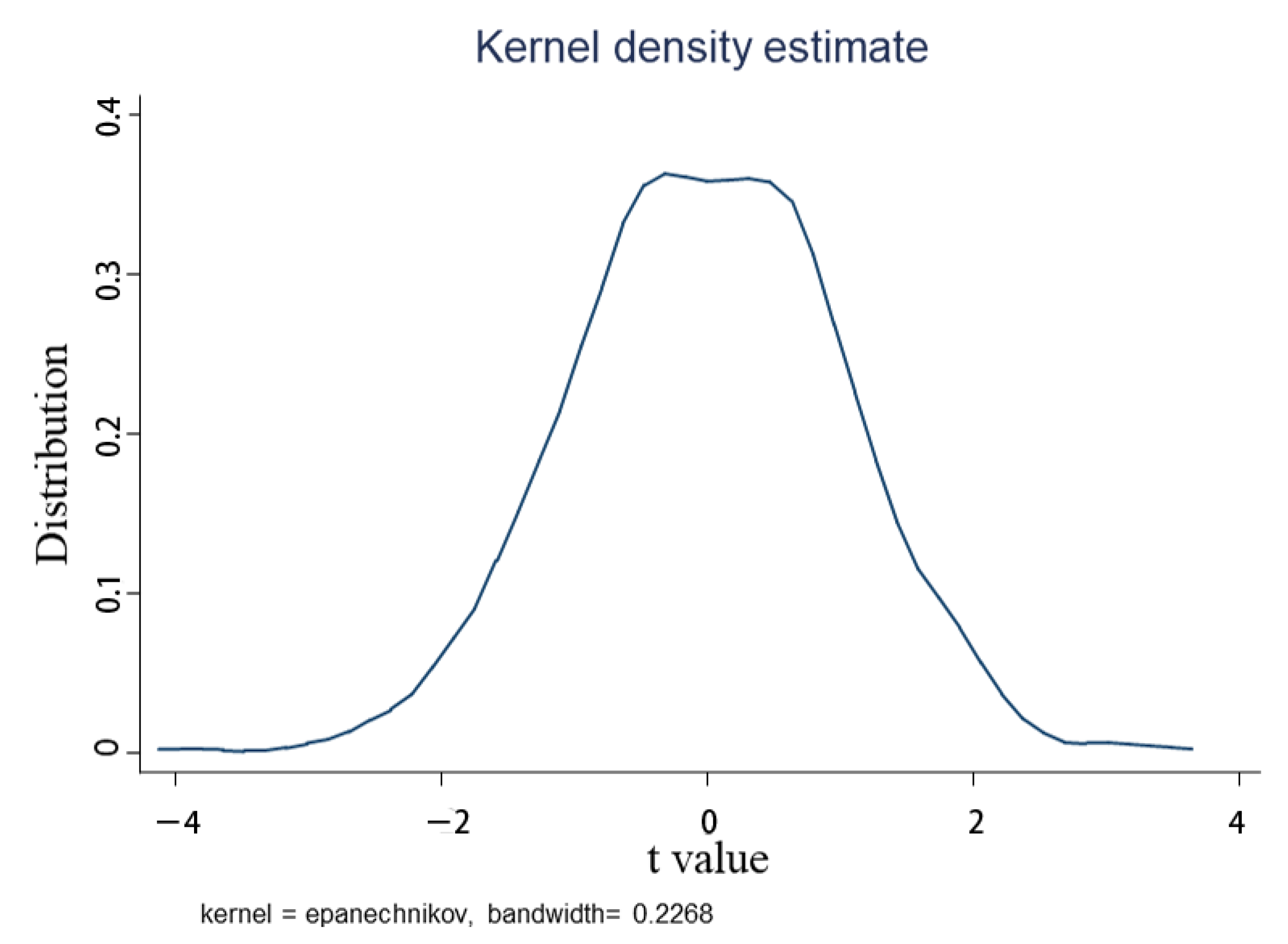

5.2.3. Placebo Test

5.2.4. Counterfactual testing

6. Further Discussion: Heterogeneity Analysis and Conduction Mechanism

6.1. Heterogeneity Analysis

6.2. Analysis of Conduction Mechanism

7. Conclusions and Recommendations

- First, optimize the financial ecological environment and realize the integration of rural tertiary industries.

- Second, rationally allocate financial resources and accurately support the integration of the tertiary industry.

- Third, improve the transmission mechanism to ensure the development of rural tertiary industries.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Opinions of the CPC Central Committee and the State Council on Comprehensively Promoting Rural Revitalization and Accelerating Agricultural and Rural Modernization. Available online: http://www.gov.cn/zhengce/2021-02/21/content_5588098.htm (accessed on 13 March 2021).

- CPC Central Committee and the State Council. Strategic Planning for Rural Revitalization (2018–2022). Available online: http://www.gov.cn/zhengce/2018-09/26/content_5325534.htm (accessed on 21 June 2021).

- Literature Research Office of the Central Committee of the Communist Party of China. Selection of Important Documents Since the Nineteenth National Congress of the Communist Party of China; Central Literature Research Office: Beijing, China, 2019. [Google Scholar]

- The Central People’s Government of the People’s Republic of China. Outline of the 14th Five-Year Plan (2021–2025) for National Economic and Social Development and the Long-Range Objectives through the Year 2035. Available online: http://www.gov.cn/xinwen/2021-03/13/content_5592681.htm (accessed on 11 March 2021).

- Braun, B.; Brzozowska, J. Natural conditions for the development of sustainable agriculture in the eastern part of the Łowicko-Błońska plain. Misc. Geogr. 2012, 16, 5–10. [Google Scholar] [CrossRef]

- Knutson, R.D.; Cropp, R.A. Managing the Supply Chain Through Cooperatives and Contract Integration. In U.S. Programs Affecting Food and Agricultural Marketing; Springer: New York, NY, USA, 2013; pp. 103–136. [Google Scholar]

- Verdouw, C.N.; Beulens, A.J.M.; Trienekens, J.H.; Wolfert, J. Process modelling in demand-driven supply chains: A reference model for the fruit industry. Comput. Electron. Agric. 2010, 73, 174–187. [Google Scholar] [CrossRef]

- Jang, W.; Klein, C.M. Supply chain models for small agricultural enterprises. Ann. Oper. Res. 2011, 190, 359–374. [Google Scholar] [CrossRef]

- Zhihong, S.; Dongmei, L. Patent-based Measurements on Technological Convergence and Competitor Identification: The Case of Semiconductor Industry. Eur. J. Bus. Manag. 2016, 8, 102–116. [Google Scholar]

- Abate, G.T.; Rashid, S.; Borzaga, C.; Getnet, K. Rural finance and agricultural technology adoption in Ethiopia: Does the institutional design of lending organizations matter? World Dev. 2016, 84, 235–253. [Google Scholar] [CrossRef]

- Biswas, A.K.; Hutin, Y.J.; Ramakrishnan, R.; Patra, B.; Gupte, M.D. Increased financial accessibility and targeted education messages could increase ownership and use of mosquito nets in Purulia District, West Bengal, India. Trans. R. Soc. Trop. Med. Hyg. 2010, 104, 423–428. [Google Scholar] [CrossRef] [PubMed]

- Wibella, N.; Fahmi, I.; Saptono, I.T. Factors Affecting Consumer Acceptance of Digital Financial Inclusion; An Anecdotal Evidence from Bogor City. Indep. J. Manag. Prod. 2018, 9, 1338–1353. [Google Scholar] [CrossRef]

- Grossman, J.; Tarzai, M. Serving Smallholder Farmers: Recent Developments in Digital Finance; Consultative Group to Assist the Poor: Washington, DC, USA, 2014; Volume 94, pp. 1–16. [Google Scholar]

- Dahiya, S.; Kumar, M. Linkage between financial inclusion and economic growth: An empirical study of the emerging Indian economy. Vision 2020, 24, 184–193. [Google Scholar] [CrossRef]

- Gabor, D.; Brooks, S. The digital revolution in financial inclusion: International development in the fintech era. New Polit. Econ. 2017, 22, 423–436. [Google Scholar] [CrossRef]

- Shiller, R.J. Reflections on finance and the good society. Am. Econ. Rev. 2013, 103, 402–405. [Google Scholar] [CrossRef]

- Schmied, J.; Ana, M. Financial inclusion and poverty: The case of Peru. Reg. Sect. Econ. Stud. 2016, 16, 29–40. [Google Scholar]

- Klapper, L.; El-Zoghbi, M.; Hess, J. Achieving the Sustainable Development Goals. The Role of Financial Inclusion. 2016. Available online: http://www.meridian.org/wp-content/uploads/2016/12/Achieving-the-Sustainable-Development-Goals-The-Role-of-Financial-Inclusion-April-2016_CGAP.pdf. (accessed on 18 January 2022).

- Zhang, L.; Wang, H.; Zhao, B. Research on the Impact of Digital Inclusive Finance Development on the Upgrading of Residents’ Consumption Structure. Sci. J. Econ. Manag. Res. 2022, 4, 165–183. [Google Scholar]

- Hongxi, C.; Juan, P. A Study on the Dynamic Relationship between Digital Financial Development, Social Consumption and Economic Growth. J. Econ. Public Financ. 2021, 7, 18–32. [Google Scholar] [CrossRef]

- Gennaioli, N.; Shleifer, A.; Vishny, R. Neglected risks, financial innovation, and financial fragility. J. Financ. Econ. 2012, 104, 452–468. [Google Scholar] [CrossRef]

- Sasidharan, S.; Lukose, P.J.J.; Komera, S. Financing constraints and investments in R&D: Evidence from Indian manufacturing firms. Q. Rev. Econ. Financ. 2015, 55, 28–39. [Google Scholar]

- Qian, Y.; Wang, H.H. Frontier Dynamic Research on China’s “Three Rural” Financial Development under the Background of Inclusive Finance: Based on Bibliometric Analysis. In E3S Web of Conferences; EDP Sciences: Les Ulis, France, 2021; p. 235. [Google Scholar]

- Bruhn, M.; Love, I. The real impact of improved access to finance: Evidence from Mexico. J. Financ. 2014, 69, 1347–1376. [Google Scholar] [CrossRef]

- Ansart, S.; Monvoisin, V. The new monetary and financial initiatives: Finance regaining its position as servant of the economy. Res. Int. Bus. Financ. 2017, 39, 750–760. [Google Scholar] [CrossRef]

- D’Orazio, P.; Valente, M. The role of finance in environmental innovation diffusion: An evolutionary modeling approach. J. Econ. Behav. Organ. 2019, 162, 417–439. [Google Scholar] [CrossRef]

- Sun, S.H.; Wang, A.; Yu, H. Analysis of financial development and industrial structure transformation. In E3S Web of Conferences; EDP Sciences: Les Ulis, France, 2021; Volume 235, p. 02080. [Google Scholar]

- Demertzis, M.; Merler, S.; Wolff, G.B. Capital Markets Union and the fintech opportunity. J. Financ. Regul. 2018, 4, 157–165. [Google Scholar] [CrossRef]

- Tang, H. Peer-to-peer lenders versus banks: Substitutes or complements? Rev. Financ. Stud. 2019, 32, 1900–1938. [Google Scholar] [CrossRef]

- Li, J.; Wu, Y.; Xiao, J.J. The impact of digital finance on household consumption: Evidence from China. Econ. Model. 2020, 86, 317–326. [Google Scholar] [CrossRef]

- Asongu, S. Law, finance, economic growth and welfare: Why does legal origin matter? Inst. Econ. 2015, 7, 30–55. [Google Scholar] [CrossRef][Green Version]

- Pocius, V.; Stungurienė, S.; Paškevičius, A. The factors of the attractiveness of the capital market of Lithuania. Procedia-Soc. Behav. Sci. 2014, 110, 1052–1062. [Google Scholar] [CrossRef]

- Chemmanur, T.J.; Chen, Z. Venture capitalists versus angels: The dynamics of private firm financing contracts. Rev. Corp. Financ. Stud. 2014, 3, 39–86. [Google Scholar] [CrossRef]

- Arizala, F.; Cavallo, E.; Galindo, A. Financial development and TFP growth: Cross-country and industry-level evidence. Appl. Financ. Econ. 2013, 23, 433–448. [Google Scholar] [CrossRef]

- Remig, M.C. Structured pluralism in ecological economics—A reply to Peter Söderbaum’s commentary. Ecol. Econ. 2017, 131, 533–537. [Google Scholar] [CrossRef]

- Ying, H. Research on Rural Financial Reform Innovation and Sustainable Development Countermeasures in Hebei Province of China. J. Hum. Resour. Sustain. Stud. 2018, 6, 53. [Google Scholar] [CrossRef][Green Version]

- Hondo, R.; Angel, S. Efficiency in Financial Regulation and Reform of Supervision Authorities: A Survey in the APEC Region; ITAM: Ciudad de México, Mexico, 2012; pp. 112–117. [Google Scholar]

- Chunhui, C.; Jiaman, L. Study on Accelerating the Construction of Digital Inclusive Financial Service System in Rural Area. Educ. Res. Front. 2020, 10, 32–54. [Google Scholar]

- Odedokun, M.O. Alternative econometric approaches for analysing the role of the financial sector in economic growth: Time-series evidence from LDCs. J. Dev. Econ. 1996, 50, 119–146. [Google Scholar] [CrossRef]

- Acemoglu, D.; Pischke, J.S. Why do firms train? Theory and evidence. Q. J. Econ. 1998, 113, 79–119. [Google Scholar] [CrossRef]

- Abadie, A.; Gardeazabal, J. The economic costs of conflict: A case study of the Basque Country. Am. Econ. Rev. 2003, 93, 113–132. [Google Scholar] [CrossRef]

| Variable | Number of Observations | Mean | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|---|

| Y | 248 | 0.219 | 0.251 | 0.005 | 1 |

| Key | 248 | 0.133 | 0.34 | 0 | 1 |

| Edu | 248 | 0.17 | 0.06 | 0.07 | 0.34 |

| Gs | 248 | 0.249 | 0.187 | 0.097 | 1.291 |

| Fin | 248 | 3.193 | 1.202 | 1.518 | 8.131 |

| Rgdp | 248 | 3.633 | 2.039 | 0.692 | 10.523 |

| Info | 248 | 0.107 | 0.019 | 0.067 | 0.179 |

| Tech | 248 | 9.783 | 1.627 | 4.796 | 13.078 |

| Arg | 248 | 7.207 | 0.93 | 3.168 | 8.752 |

| Insurance | 248 | 5.094 | 1.105 | 1.206 | 7.247 |

| Variables | (1) | (2) |

|---|---|---|

| M1 | M2 | |

| Key | 0.1867768 *** | 0.2472517 *** |

| (0.0330637) | (0.0422542) | |

| Edu | 0.1000542 *** | |

| (0.0269285) | ||

| Gs | 0.0827181 | |

| (0.0466475) | ||

| Fin | −0.059176 *** | |

| (0.0117108) | ||

| Rgdp | 0.0282231 *** | |

| (0.0046531) | ||

| Info | 0.1680336 | |

| (0.4590347) | ||

| constant | 0.1862145 *** | 0.2358232 *** |

| (0.0135973) | (0.0660355) | |

| N | 248 | 248 |

| R2 | 0.2564 | 0.2818 |

| City fixed | YES | YES |

| Year fixed | YES | YES |

| Chi-Square Value | p-Value | |

|---|---|---|

| M1 | 177.140 | 0.000 |

| M2 | 288.164 | 0.000 |

| (1) | (2) | (1) | (2) | (1) | (2) | |

|---|---|---|---|---|---|---|

| M1 | M2 | M1 | M2 | M1 | M2 | |

| key_advanve1 | 0.001677 | 0.003023 | ||||

| (0.00800) | (0.00595) | |||||

| key_advanve2 | 0.000569 | −0.00182 | ||||

| (0.00649) | (0.00563) | |||||

| key_advanve3 | −0.00171 | −0.0043 | ||||

| (0.00552) | (0.00534) | |||||

| control | NO | YES | NO | YES | NO | YES |

| N | 248 | 248 | 248 | 248 | 248 | 248 |

| R2 | 0.0009 | 0.0143 | 0.009 | 0.121 | 0.0038 | 0.0122 |

| City fixed | YES | YES | YES | YES | YES | YES |

| Year fixed | YES | YES | YES | YES | YES | YES |

| q10 | q20 | q30 | q40 | q50 | q60 | q70 | q80 | q90 | |

|---|---|---|---|---|---|---|---|---|---|

| Key | 0.19 *** | 0.223 *** | 0.236 *** | 0.27 *** | 0.34 *** | 0.45 *** | 0.549 *** | 0.766 *** | 0.616 *** |

| (0.009) | (0.024) | (0.03) | (0.028) | (0.033) | (0.037) | (0.055) | (0.0819) | (0.15) | |

| N | 248 | 248 | 248 | 248 | 248 | 248 | 248 | 248 | 248 |

| (1) | (2) | (3) | |

|---|---|---|---|

| M1 | M2 | M3 | |

| Key | 0.5355956 *** | 0.8121402 *** | 0.5481415 *** |

| (0.1679885) | (0.183524) | (0.1224661) | |

| Key * Tech | 0.0662445 *** | ||

| (0.013545) | |||

| Key * Arg | 0.1303135 *** | ||

| (0.0214283) | |||

| Key * Insurance | 0.1224768 *** | ||

| (0.0167246) | |||

| control | YES | YES | YES |

| N | 248 | 248 | 248 |

| City fixed | YES | YES | YES |

| Year fixed | YES | YES | YES |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ge, H.; Li, B.; Tang, D.; Xu, H.; Boamah, V. Research on Digital Inclusive Finance Promoting the Integration of Rural Three-Industry. Int. J. Environ. Res. Public Health 2022, 19, 3363. https://doi.org/10.3390/ijerph19063363

Ge H, Li B, Tang D, Xu H, Boamah V. Research on Digital Inclusive Finance Promoting the Integration of Rural Three-Industry. International Journal of Environmental Research and Public Health. 2022; 19(6):3363. https://doi.org/10.3390/ijerph19063363

Chicago/Turabian StyleGe, Heping, Bowen Li, Decai Tang, Hao Xu, and Valentina Boamah. 2022. "Research on Digital Inclusive Finance Promoting the Integration of Rural Three-Industry" International Journal of Environmental Research and Public Health 19, no. 6: 3363. https://doi.org/10.3390/ijerph19063363

APA StyleGe, H., Li, B., Tang, D., Xu, H., & Boamah, V. (2022). Research on Digital Inclusive Finance Promoting the Integration of Rural Three-Industry. International Journal of Environmental Research and Public Health, 19(6), 3363. https://doi.org/10.3390/ijerph19063363