Research on Voluntary Carbon Information Disclosure Mechanism of Enterprises from the Perspective of Stakeholders—A Case Study on the Automobile Manufacturing Industry

Abstract

1. Introduction

2. Data and Methods

2.1. Research Hypothesis

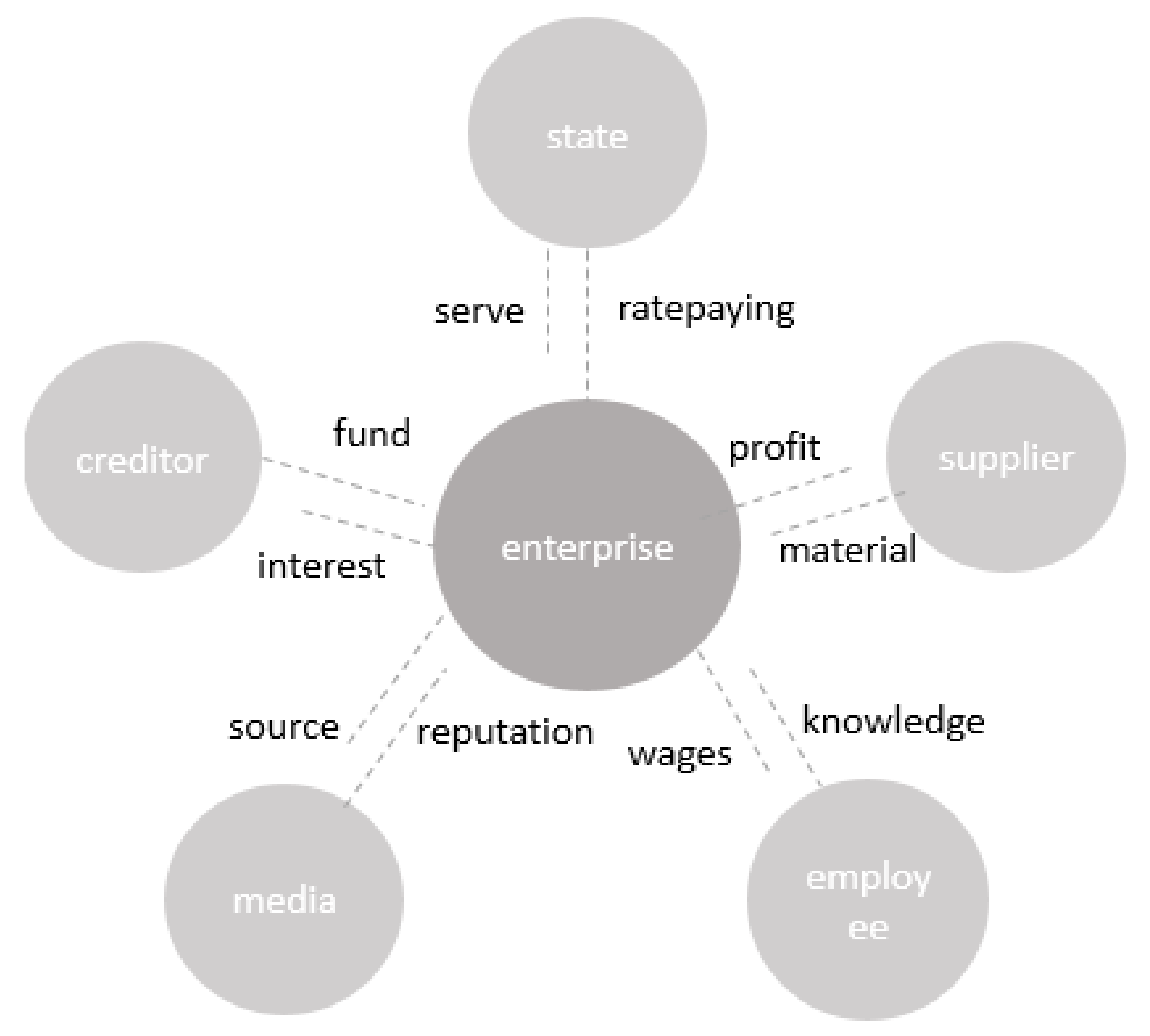

2.1.1. State

2.1.2. Creditor

2.1.3. Media

2.1.4. Employee

2.1.5. Supplier

2.2. Sample Selection and Data Sources

2.3. Selection of Variables

2.3.1. Explanatory Variables

2.3.2. Control Variables

2.4. Model Construction

3. Results and Analysis

3.1. Descriptive Statistics

3.2. Correlation Analysis

3.3. Regression Analysis

3.4. Robustness Tests

4. Discussion and Conclusions

4.1. Conclusions

4.2. Recommendation

4.3. Research Limitations and Future Prospects

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- MEE. China’s Policies and Actions for Addressing Climate Change (2019) [EB/OL]. Available online: https://english.mee.gov.cn/Resources/Reports/ (accessed on 16 September 2022).

- Lu, Y.; Wang, Y.; Zhang, Y. Study on the current situation of statistics, verification and reporting system for national GHG emission. Environ. Impact Assess. Rev. 2017, 39, 72–75. [Google Scholar]

- Weinhofer, G.; Busch, T. Corporate strategies for managing climate risks. Bus. Strategy Environ. 2013, 22, 121–144. [Google Scholar] [CrossRef]

- Hu, X.; Yang, Z.; Sun, J.; Zhang, Y. Carbon tax or cap-and-trade: Which is more viable for Chinese remanufacturing industry? J. Clean Prod. 2020, 243, 118606. [Google Scholar] [CrossRef]

- Liu, Z.; Cheng, Q. Research on influencing factors of carbon information disclosure quality in China’s power industry. Environ. Sci. Pollut. Res. 2022, 1–18. [Google Scholar]

- Grauel, J.; Gotthardt, D. The relevance of national contexts for carbon disclosure decisions of stock-listed companies: A multilevel analysis. J. Clean Prod. 2016, 133, 1204–1217. [Google Scholar] [CrossRef]

- Wu, D.; Memon, H. Public Pressure, Environmental Policy Uncertainty, and Enterprises’ Environmental Information Disclosure. Sustainability 2022, 14, 6948. [Google Scholar] [CrossRef]

- Kalu, J.; Buang, A.; Aliagha, G. Determinants of voluntary carbon disclosure in the corporate real estate sector of Malaysia. J. Environ. Manag. 2016, 182, 519–524. [Google Scholar] [CrossRef]

- Damert, M.; Paul, A.; Baumgartner, R. Exploring the determinants and long-term performance outcomes of corporate carbon strategies. J. Clean Prod. 2017, 160, 123–138. [Google Scholar] [CrossRef]

- Akbaş, H.; Canikli, S. Determinants of voluntary greenhouse gas emission disclosure: An empirical investigation on turkish firms. Sustainability 2018, 11, 107. [Google Scholar] [CrossRef]

- Luo, L.; Lan, Y.; Tang, Q. Corporate incentives to disclose carbon information: Evidence from the CDP global 500 report. J. Int. Financ. Manag. Account. 2012, 23, 93–120. [Google Scholar] [CrossRef]

- He, P.; Shen, H.; Zhang, Y.; Ren, J. External pressure, corporate governance, and voluntary carbon disclosure: Evidence from China. Sustainability 2019, 11, 2901. [Google Scholar] [CrossRef]

- Li, X.; Shi, Y. Green development, carbon information disclosure quality and financial performance. Econ. Manag. 2016, 38, 119–132. [Google Scholar]

- Bui, B.; Houqe, M.; Zaman, M. Climate governance effects on carbon disclosure and performance. Br. Account. Rev. 2020, 52, 100880. [Google Scholar] [CrossRef]

- Bazhair, A.; Khatib, S.; Amosh, H. Taking Stock of Carbon Disclosure Research While Looking to the Future: A Systematic Literature Review. Sustainability 2022, 14, 13475. [Google Scholar] [CrossRef]

- Hardiyansah, M.; Agustini, A.; Purnamawati, I. The Effect of Carbon Emission Disclosure on Firm Value: Environmental Performance and Industrial Type. J. Asian Financ. Econ. Bus. 2021, 8, 123–133. [Google Scholar]

- Alsaifi, K.; Elnahass, M.; Salama, A. Market Responses to Firms’ Voluntary Carbon Disclosure: Empirical Evidence from the United Kingdom. J. Clean Prod. 2020, 262, 121377. [Google Scholar] [CrossRef]

- Blanco, C.; Caro, F.; Corbett, C.J. An inside perspective on carbon disclosure. Bus. Horiz. 2017, 60, 635–646. [Google Scholar] [CrossRef]

- Lu, W.; Zhu, N.; Zhang, J. The Impact of Carbon Disclosure on Financial Performance under Low Carbon Constraints. Energies 2021, 14, 4126. [Google Scholar] [CrossRef]

- Li, L.; Liu, Q.; Wang, J.; Hong, X. Carbon information disclosure, marketization, and cost of equity financing. Int. J. Environ. Res. Public Health 2019, 16, 150. [Google Scholar] [CrossRef]

- Liesen, A.; Hoepner, A.; Patten, D.M.; Figge, F. Does stakeholder pressure influence corporate GHG emissions reporting? Empirical evidence from Europe. Account. Audit. Account. J. 2015, 28, 1047–1074. [Google Scholar] [CrossRef]

- Clarkson, P.; Li, Y.; Richardson, G.; Vasvari, F. Revisiting the relation between environmental performance and environmental disclosure: An empirical analysis. Account. Organ. Soc. 2008, 33, 303–327. [Google Scholar] [CrossRef]

- Li, D.; Huang, M.; Ren, S.; Chen, X.; Ning, L. Environmental legitimacy, green innovation, and corporate carbon disclosure: Evidence from CDP China 100. J. Bus. Ethics 2018, 150, 1089–1104. [Google Scholar] [CrossRef]

- Cotter, J.; Najah, M. Institutional investor influence on global climate change disclosure practices. Aust. J. Manag. 2012, 37, 169–187. [Google Scholar] [CrossRef]

- Velte, P.; Stawinoga, M.; Lueg, R. Carbon performance and disclosure: A systematic review of governance-related determinants and financial consequences. J. Clean Prod. 2020, 254, 120063. [Google Scholar] [CrossRef]

- Liu, Z.; Zhang, C. Quality evaluation of carbon information disclosure of public companies in China’s electric power sector based on ANP-Cloud model. Environ. Impact Assess. Rev. 2022, 96, 106818. [Google Scholar] [CrossRef]

- Tauringana, V.; Chithambo, L. The effect of DEFRA guidance on greenhouse gas disclosure. Br. Account. Rev. 2015, 47, 425–444. [Google Scholar] [CrossRef]

- Liu, X.; Anbumozhi, V. Determinant factors of corporate environmental information disclosure: An empirical study of Chinese listed companies. J. Clean Prod. 2009, 17, 593–600. [Google Scholar] [CrossRef]

- Jensen, M.; Meckling, W. Theory of the firm: Managerial behavior, agency costs, and ownership Structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Brockman, P.; Unlu, E. Dividend policy, creditor rights, and the agency costs of debt. J. Financ. Econ. 2009, 92, 276–299. [Google Scholar] [CrossRef]

- Brown, N.; Deegan, C. The public disclosure of environmental performance information—A dual test of media agenda setting theory and legitimacy theory. Account. Bus. Res. 1998, 29, 21–41. [Google Scholar] [CrossRef]

- Alrazi, B.; De Villiers, C.; Van Staden, C. The environmental disclosures of the electricity generation industry: A global perspective. Account. Bus. Res. 2016, 46, 665–701. [Google Scholar] [CrossRef]

- Shen, H.; Zheng, S.; Adams, J.; Jaggi, B. The effect stakeholders have on voluntary carbon disclosure within Chinese business organizations. Carbon Manag. 2020, 11, 455–472. [Google Scholar] [CrossRef]

- Chen, X.; Liu, X. Supplier (Customer) Concentration and Enterprise Information Disclosure Violations. Nankai Bus. Rev. Int. 2021, 24, 213–226. [Google Scholar]

- Chen, H.; Wang, H.; Jin, X. Study on content definition, measure methods and status of carbon information disclosure in Chinese enterprises. China J. Account. Res. 2013, 12, 18–24. [Google Scholar]

- Li, H.; Fu, S.; Wang, R. Construction of carbon information disclosure evaluation system. Stat. Decis. 2015, 13, 40–42. [Google Scholar]

- Yu, H.; Kuo, L.; Ma, B. The drivers of carbon disclosure: Evidence from China’s sustainability plans. Carbon Manag. 2020, 11, 399–414. [Google Scholar] [CrossRef]

- Prado-Lorenzo, J.; Rodriguez-Dominguez, L.; Gallego-Alvarez, I.; García-Sánchez, I.M. Factors influencing the disclosure of greenhouse gas emissions in companies world-wide. Manag. Decis. 2009, 47, 1133–1157. [Google Scholar] [CrossRef]

- Lu, Y.; Abeysekera, I. Stakeholders’ power, corporate characteristics, and social and environmental disclosure: Evidence from China. J. Clean Prod. 2014, 64, 426–436. [Google Scholar] [CrossRef]

- Albuquerque, A.; Papadakis, G.; Wysocki, P. The Impact of Risk on CEO Equity Incentives: Evidence from Customer Concentration. 2014. Available online: https://ssrn.com/abstract=1944015 (accessed on 1 August 2022).

- Pan, W.; Gulzar, M.; Hassan, W. Synthetic evaluation of China’s regional low-carbon economy challenges by Driver-Pressure-State-Impact-Response model. Int. J. Environ. Res. Public Health 2020, 17, 5463. [Google Scholar] [CrossRef]

| Variable | Explanation | References |

|---|---|---|

| CSR | Whether to publish a CSR report | |

| Risk | Whether to disclose fines related to environmental pollution Whether to disclose litigation related to environmental pollution | CDP 1 |

| Strategy | Whether to set abatement plans, targets Whether there are management systems and institutions related to emission reduction Whether environmental training, awareness, and actions are conducted | CDSB 2 |

| Governance | Whether to disclose the emission reduction of the “three wastes” Whether to disclose the treatment, recycling, and utilization of waste Whether to disclose the operation and renovation of environmental protection facilities Whether to disclose environmental capital investment, research, and innovation | PWC 3 |

| Accounting | Whether to disclose greenhouse gas emissions Whether to disclose wastewater discharge Whether to disclose other solid emissions of pollutants | CDP 1 |

| Performance and subsidies | Whether economic benefits from emission reductions are disclosed Whether there are honors related to environmental protection Whether there are environmental bonuses or subsidies | GRI 4 |

| Validation/Authentication | Whether it has passed IS014001 environmental management system certification Whether it has been inspected by an independent third-party organization | PWC 3 |

| Type | Codes | Description |

|---|---|---|

| Explained variables | CDI | Each secondary indicator is given the same weighting when scoring, with a range of 0–34 points |

| Explanatory variables | State | Percentage of state-owned shares |

| Creditor | Gearing ratio | |

| Media | Natural logarithm of (1 + number of media reports) | |

| Staff | Natural logarithm of the number of employees | |

| SR | Top five suppliers’ purchases/total annual purchases | |

| control variables | Industry | Priority emission units are assigned a value of 1, otherwise 0 |

| Size | Natural logarithm of total assets at the end of the year | |

| RA | Total return on assets |

| Year | Variable | Obs | Mean | Sd. | Min | Max |

|---|---|---|---|---|---|---|

| 2017 | CDI | 118 | 3.1102 | 4.2342 | 0 | 17 |

| 2018 | CDI | 118 | 4.8220 | 4.6347 | 0 | 24 |

| 2019 | CDI | 118 | 5.3898 | 5.1454 | 0 | 27 |

| 2020 | CDI | 118 | 5.6017 | 4.9061 | 0 | 24 |

| 2021 | CDI | 118 | 7.6780 | 5.6627 | 0 | 27 |

| Total | CDI | 590 | 5.3203 | 5.1491 | 0 | 27 |

| CDI | State | Creditor | Media | Staff | SR | Industry | Size | RA | |

|---|---|---|---|---|---|---|---|---|---|

| CDI | 1 | ||||||||

| State | 0.333 *** | 1 | |||||||

| Creditor | 0.329 *** | 0.309 *** | 1 | ||||||

| Media | 0.483 *** | 0.309 *** | 0.390 *** | 1 | |||||

| Staff | 0.634 *** | 0.368 *** | 0.491 *** | 0.598 *** | 1 | ||||

| SR | −0.114 *** | −0.136 *** | −0.212 *** | −0.189 *** | −0.344 *** | 1 | |||

| Industry | 0.641 *** | 0.252 *** | 0.411 *** | 0.326 *** | 0.413 *** | −0.024 | 1 | ||

| Size | 0.660 *** | 0.442 *** | 0.534 *** | 0.649 *** | 0.920 *** | −0.277 *** | 0.446 *** | 1 | |

| RA | −0.337 *** | −0.341 *** | −0.527 *** | −0.272 *** | −0.386 *** | −0.041 | −0.468 *** | −0.469 *** | 1 |

| Variable | VIF | 1/VIF |

|---|---|---|

| Size | 8.54 | 0.117076 |

| Staff | 7.11 | 0.140604 |

| Media | 1.76 | 0.569473 |

| Creditor | 1.69 | 0.590786 |

| RA | 1.69 | 0.591324 |

| Industry | 1.45 | 0.690247 |

| State | 1.30 | 0.770244 |

| Supplier | 1.19 | 0.840036 |

| Mean VIF | 3.09 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

|---|---|---|---|---|---|---|---|

| VARIABLES | CDI | CDI | CDI | CDI | CDI | CDI | CDI |

| State | 0.333 *** | 0.103 *** | 0.051 * | ||||

| (8.57) | (3.03) | (1.74) | |||||

| Creditor | 0.329 *** | −0.006 | −0.123 *** | ||||

| (8.44) | (−0.17) | (−3.66) | |||||

| Media | 0.483 *** | 0.145 *** | 0.068 ** | ||||

| (13.36) | (3.69) | (1.98) | |||||

| Staff | 0.634 *** | 0.553 *** | 0.184 *** | ||||

| (19.90) | (12.76) | (2.67) | |||||

| Supplier | −0.114 *** | 0.116 *** | 0.042 | ||||

| (−2.78) | (3.52) | (1.48) | |||||

| Industry | 0.945 *** | ||||||

| (15.20) | |||||||

| Size | 0.327 *** | ||||||

| (4.34) | |||||||

| RA | 0.077 ** | ||||||

| (2.30) | |||||||

| Constant | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | −0.444 *** |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (−11.39) | |

| Observations | 590 | 590 | 590 | 590 | 590 | 590 | 590 |

| R-squared | 0.111 | 0.108 | 0.233 | 0.402 | 0.013 | 0.440 | 0.613 |

| r2_a | 0.109 | 0.106 | 0.232 | 0.401 | 0.0113 | 0.435 | 0.608 |

| F | 73.37 | 71.16 | 178.6 | 395.9 | 7.723 | 91.62 | 115.3 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

|---|---|---|---|---|---|---|---|

| VARIABLES | CDI | CDI | CDI | CDI | CDI | CDI | CDI |

| State | 0.331 *** | 0.097 *** | 0.054 * | ||||

| (8.57) | (2.89) | (1.90) | |||||

| Creditor | 0.329 *** | −0.007 | −0.122 *** | ||||

| (8.54) | (−0.19) | (−3.65) | |||||

| Media | 0.490 *** | 0.134 *** | 0.067 * | ||||

| (13.48) | (3.32) | (1.94) | |||||

| Staff | 0.642 *** | 0.564 *** | 0.200 *** | ||||

| (20.19) | (12.79) | (2.94) | |||||

| Supplier | −0.113 *** | 0.112 *** | 0.049 * | ||||

| (−2.78) | (3.43) | (1.77) | |||||

| Industry | 0.944 *** | ||||||

| (15.48) | |||||||

| Size | 0.317 *** | ||||||

| (4.26) | |||||||

| RA | 0.085 ** | ||||||

| (2.39) | |||||||

| Constant | −0.003 | −0.004 | −0.007 | −0.006 | −0.004 | −0.006 | −0.446 *** |

| (−0.08) | (−0.09) | (−0.19) | (−0.21) | (−0.10) | (−0.21) | (−11.70) | |

| Observations | 590 | 590 | 590 | 590 | 590 | 590 | 590 |

| R-squared | 0.111 | 0.110 | 0.236 | 0.409 | 0.013 | 0.442 | 0.620 |

| r2_a | 0.110 | 0.109 | 0.235 | 0.408 | 0.0113 | 0.437 | 0.615 |

| F | 73.46 | 72.86 | 181.6 | 407.6 | 7.709 | 92.38 | 118.7 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

|---|---|---|---|---|---|---|---|

| VARIABLES | CDI | CDI | CDI | CDI | CDI | CDI | CDI |

| State | 0.333 *** | 0.103 *** | 0.059 * | ||||

| (8.57) | (3.03) | (1.95) | |||||

| Creditor | 0.329 *** | −0.006 | −0.147 *** | ||||

| (8.44) | (−0.17) | (−4.27) | |||||

| Media | 0.483 *** | 0.145 *** | 0.103 *** | ||||

| (13.36) | (3.69) | (3.03) | |||||

| Staff | 0.634 *** | 0.553 *** | 0.348 *** | ||||

| (19.90) | (12.76) | (4.58) | |||||

| Supplier | −0.114 *** | 0.116 *** | 0.046 | ||||

| (−2.78) | (3.52) | (1.62) | |||||

| Industry | 0.914 *** | ||||||

| (14.88) | |||||||

| Size | 0.111 | ||||||

| (1.34) | |||||||

| ROE | −0.028 | ||||||

| (−0.99) | |||||||

| Constant | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | −0.429 *** |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (−11.02) | |

| Observations | 590 | 590 | 590 | 590 | 590 | 590 | 590 |

| R-squared | 0.111 | 0.108 | 0.233 | 0.402 | 0.013 | 0.440 | 0.601 |

| r2_a | 0.109 | 0.106 | 0.232 | 0.401 | 0.0113 | 0.435 | 0.596 |

| F | 73.37 | 71.16 | 178.6 | 395.9 | 7.723 | 91.62 | 109.4 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Guo, C.; Pan, W. Research on Voluntary Carbon Information Disclosure Mechanism of Enterprises from the Perspective of Stakeholders—A Case Study on the Automobile Manufacturing Industry. Int. J. Environ. Res. Public Health 2022, 19, 17053. https://doi.org/10.3390/ijerph192417053

Guo C, Pan W. Research on Voluntary Carbon Information Disclosure Mechanism of Enterprises from the Perspective of Stakeholders—A Case Study on the Automobile Manufacturing Industry. International Journal of Environmental Research and Public Health. 2022; 19(24):17053. https://doi.org/10.3390/ijerph192417053

Chicago/Turabian StyleGuo, Chensi, and Wenyan Pan. 2022. "Research on Voluntary Carbon Information Disclosure Mechanism of Enterprises from the Perspective of Stakeholders—A Case Study on the Automobile Manufacturing Industry" International Journal of Environmental Research and Public Health 19, no. 24: 17053. https://doi.org/10.3390/ijerph192417053

APA StyleGuo, C., & Pan, W. (2022). Research on Voluntary Carbon Information Disclosure Mechanism of Enterprises from the Perspective of Stakeholders—A Case Study on the Automobile Manufacturing Industry. International Journal of Environmental Research and Public Health, 19(24), 17053. https://doi.org/10.3390/ijerph192417053