The Effect of Air Pollution Control Auditing on Reducing Carbon Emissions: Evidence from China

Abstract

1. Introduction

2. Literature Review and Research Hypotheses

2.1. The Influencing Factors of Carbon Emission

2.2. Direct Impact of Air Pollution Control Auditing on Carbon Emissions

2.3. Indirect Impact of Air Pollution Control Auditing on Carbon Emissions

3. Materials and Methods

3.1. Data

3.2. Variables

3.2.1. Dependent Variable

3.2.2. Independent Variable

3.2.3. Mediating Variable

3.2.4. Control Variable

3.3. Modeling

3.3.1. Regression Analysis

3.3.2. Mediating Effect Analysis

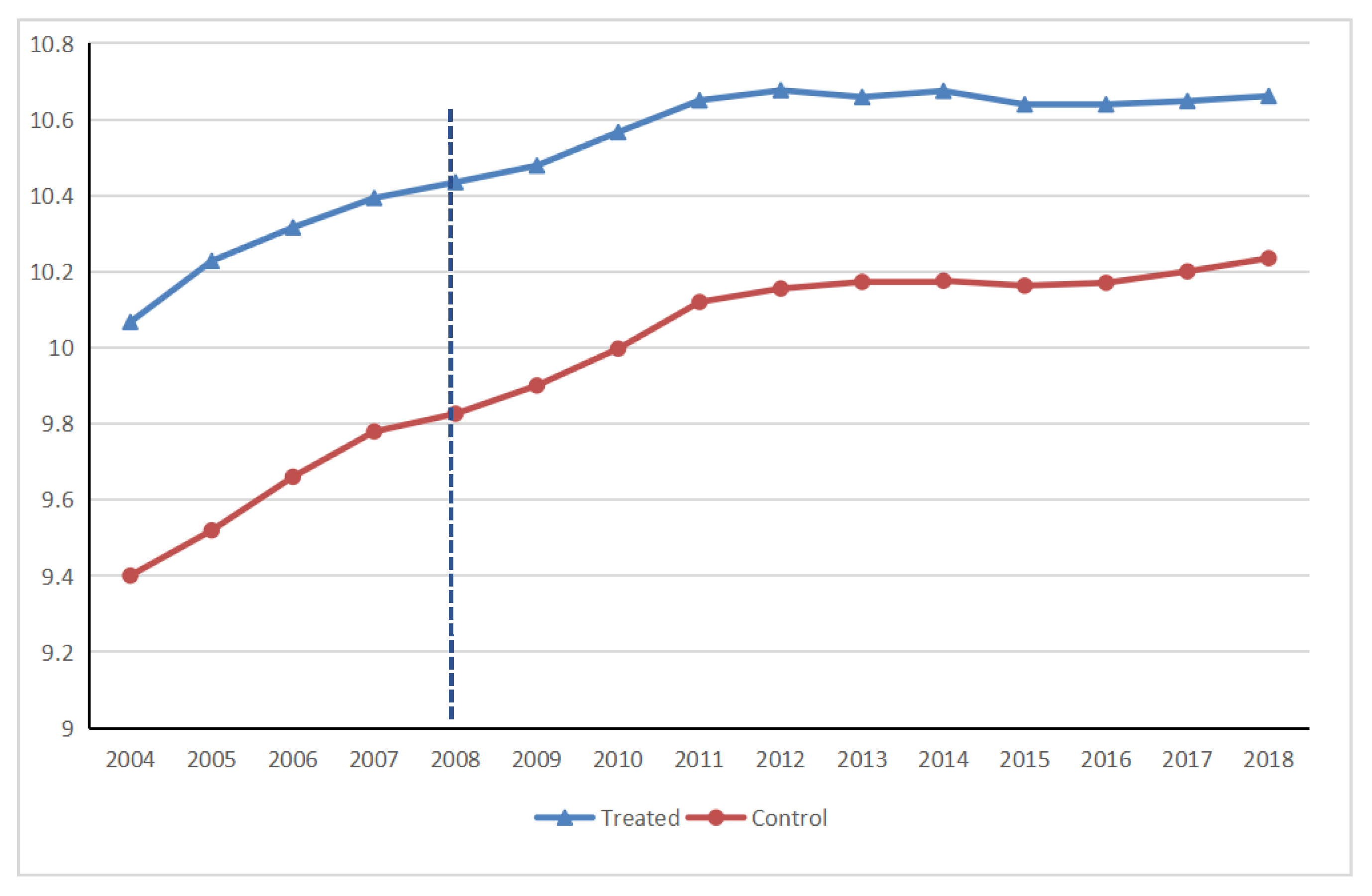

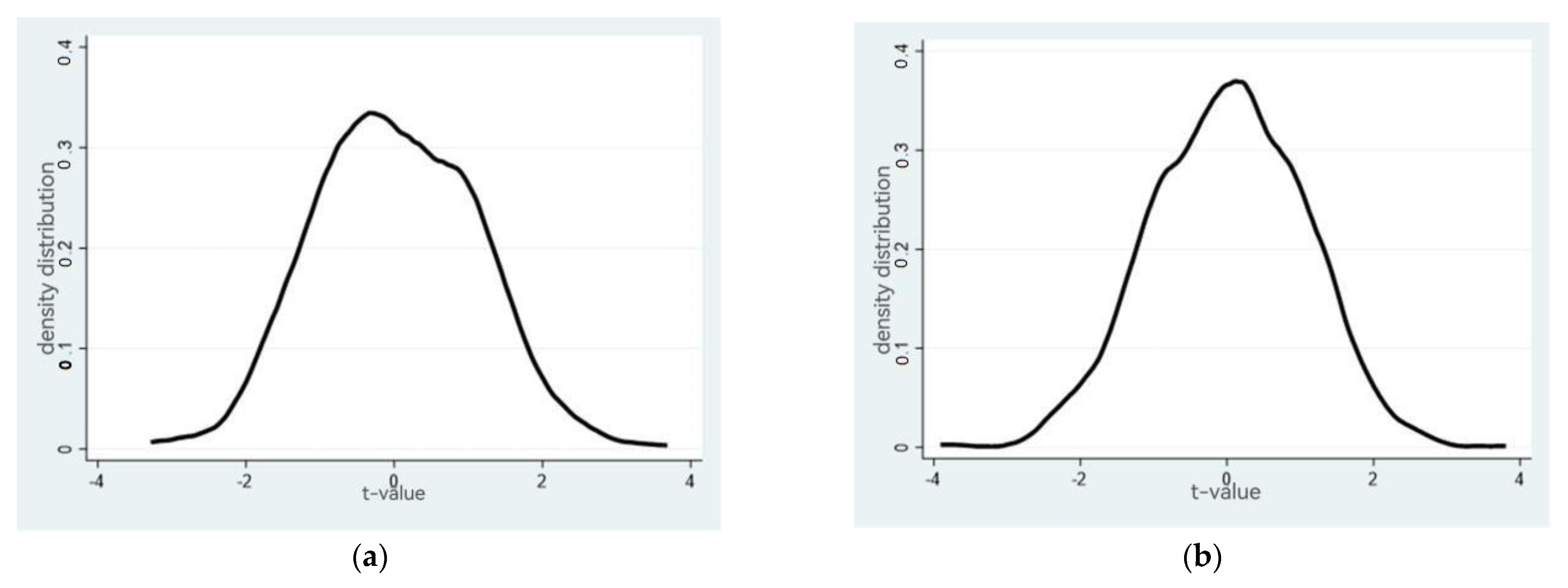

3.3.3. Robustness Test

4. Empirical Results and Analysis

4.1. Descriptive Statistics

4.2. Benchmark Regression Results

4.3. Mechanism of the Air Pollution Control Auditing

4.4. Robustness Test

5. Conclusions, Discussion, and Policy Implications

5.1. Conclusions

5.2. Discussion

5.3. Policy Implications

Author Contributions

Funding

Conflicts of Interest

References

- Miao, Z.; Chen, X.; Baležentis, T.; Sun, C. Atmospheric environmental productivity across the provinces of China: Joint decomposition of range adjusted measure and Luenberger productivity indicator. Energy Policy 2019, 132, 665–677. [Google Scholar] [CrossRef]

- Zeppetello, L.R.V.; Raftery, A.E.; Battisti, D.S. Probabilistic projections of increased heat stress driven by climate change. Commun. Earth Environ. 2022, 3, 1–7. [Google Scholar] [CrossRef]

- Zhang, K.; Wang, D.; Zhou, H. Regional endogenetic strategic interaction of environmental protection investment and emission. China Ind. Econ. 2016, 2, 68–82. [Google Scholar]

- Shuai, C.; Shen, L.; Jiao, L.; Wu, Y.; Tan, Y. Identifying key impact factors on carbon emission: Evidences from panel and time-series data of 125 countries from 1990 to 2011. Appl. Energy 2017, 187, 310–325. [Google Scholar] [CrossRef]

- Watts, N.; Amann, M.; Arnell, N.; Ayeb-Karlsson, S.; Beagley, J.; Belesova, K.; Boykoff, M.; Byass, P.; Cai, W.; Campbell-Lendrum, D.; et al. The 2020 report of The Lancet Countdown on health and climate change: Responding to converging crises. Lancet 2020, 397, 129–170. [Google Scholar] [CrossRef]

- Peng, Z.; Lu, W.; Webster, C.J. Quantifying the embodied carbon saving potential of recycling construction and demolition waste in the Greater Bay Area, China: Status quo and future scenarios. Sci. Total Environ. 2021, 792, 148427. [Google Scholar] [CrossRef] [PubMed]

- Zhang, Y.; Wang, S.; Shao, W.; Hao, J. Feasible Distributed Energy Supply Options for Household Energy Use in China from a Carbon Neutral Perspective. Int. J. Environ. Res. Public Health 2021, 18, 12992. [Google Scholar] [CrossRef]

- Rehman, A.; Ma, H.; Ozturk, I.; Ahmad, M.; Rauf, A.; Irfan, M. Another outlook to sector-level energy consumption in Pakistan from dominant energy sources and correlation with economic growth. Environ. Sci. Pollut. Res. 2020, 28, 33735–33750. [Google Scholar] [CrossRef]

- Yu, S.; Zheng, S.; Li, X. The achievement of the carbon emissions peak in China: The role of energy consumption structure optimization. Energy Econ. 2018, 74, 693–707. [Google Scholar] [CrossRef]

- Xu, H.; Cao, S.; Xu, X. The development of highway infrastructure and CO2 emissions: The mediating role of agglomeration. J. Clean. Prod. 2022, 337, 130501. [Google Scholar] [CrossRef]

- Zhao, H.; Cao, X.; Ma, T. A spatial econometric empirical research on the impact of industrial agglomeration on haze pollution in China. Air Qual. Atmos. Health 2020, 13, 1305–1312. [Google Scholar] [CrossRef]

- Shi, T.; Si, S.; Chan, J.; Zhou, L. The Carbon Emission Reduction Effect of Technological Innovation on the Transportation Industry and Its Spatial Heterogeneity: Evidence from China. Atmosphere 2021, 12, 1169. [Google Scholar] [CrossRef]

- Wang, P.; Deng, X.; Zhou, H.; Yu, S. Estimates of the social cost of carbon: A review based on meta-analysis. J. Clean. Prod. 2018, 209, 1494–1507. [Google Scholar] [CrossRef]

- Ulucak, R.; Khan, S.U.D.; Baloch, M.A.; Li, N. Mitigation pathways toward sustainable development: Is there any trade-off between environmental regulation and carbon emissions reduction? Sustain. Dev. 2020, 28, 813–822. [Google Scholar]

- Yang, G.; Zha, D.; Wang, X.; Chen, Q. Exploring the nonlinear association between environmental regulation and carbon intensity in China: The mediating effect of green technology. Ecol. Indic. 2020, 114, 106309. [Google Scholar] [CrossRef]

- Ahmad, M.; Chandio, A.A.; Solangi, Y.A.; Shah, S.A.A.; Shahzad, F.; Rehman, A.; Jabeen, G. Dynamic interactive links among sustainable energy investment, air pollution, and sustainable development in regional China. Environ. Sci. Pollut. Res. 2020, 28, 1502–1518. [Google Scholar] [CrossRef]

- Palencia, J.C.G.; Furubayashi, T.; Nakata, T. Analysis of CO2 emissions reduction potential in secondary production and semi-fabrication of non-ferrous metals. Energy Policy 2013, 52, 328–341. [Google Scholar] [CrossRef]

- Wen, Y.; Liao, M. The Impact of Industrial Agglomeration on Carbon Emissions: Empirical Evidence from China. Int. J. Manag. Sustain. 2019, 8, 67–78. [Google Scholar] [CrossRef]

- Liu, J.-P.; Zhang, X.-B.; Song, X.-H. Regional carbon emission evolution mechanism and its prediction approach driven by carbon trading—A case study of Beijing. J. Clean. Prod. 2018, 172, 2793–2810. [Google Scholar] [CrossRef]

- Luo, Z.; Dubey, R.; Papadopoulos, T.; Hazen, B.; Roubaud, D. Explaining Environmental Sustainability in Supply Chains Using Graph Theory. Comput. Econ. 2017, 52, 1257–1275. [Google Scholar] [CrossRef]

- He, A.; Xue, Q.; Zhao, R.; Wang, D. Renewable energy technological innovation, market forces, and carbon emission efficiency. Sci. Total. Environ. 2021, 796, 148908. [Google Scholar] [CrossRef] [PubMed]

- Chen, J.; Gao, M.; Ma, K.; Song, M. Different effects of technological progress on China’s carbon emissions based on sustainable development. Bus. Strategy Environ. 2020, 29, 481–492. [Google Scholar] [CrossRef]

- Cheng, Z.; Li, L.; Liu, J. Industrial structure, technical progress and carbon intensity in China’s provinces. Renew, Sustain. Energy Rev. 2018, 81, 2935–2946. [Google Scholar] [CrossRef]

- Lin, B.; Chen, Y.; Zhang, G. Technological progress and rebound effect in China’s nonferrous metals industry: An empirical study. Energy Policy 2017, 109, 520–529. [Google Scholar] [CrossRef]

- Pao, H.-T.; Tsai, C.-M. CO2 emissions, energy consumption and economic growth in BRIC countries. Energy Policy 2010, 38, 7850–7860. [Google Scholar] [CrossRef]

- Pao, H.-T.; Tsai, C.-M. Multivariate Granger causality between CO2 emissions, energy consumption, FDI (foreign direct investment) and GDP (gross domestic product): Evidence from a panel of BRIC (Brazil, Russian Federation, India, and China) countries. Energy 2011, 36, 685–693. [Google Scholar] [CrossRef]

- Yin, K.; Liu, L.; Gu, H. Green Paradox or Forced Emission Reduction—The Dual Effects of Environmental Regulation on Carbon Emissions. Int. J. Environ. Res. Public Health 2022, 19, 11058. [Google Scholar] [CrossRef]

- Thollander, P.; Backlund, S.; Trianni, A.; Cagno, E. Beyond barriers–A case study on driving forces for improved energy efficiency in the foundry industries in Finland, France, Germany, Italy, Poland, Spain, and Sweden. Appl. Energy 2013, 111, 636–643. [Google Scholar] [CrossRef]

- Thollander, P.; Dotzauer, E. An energy efficiency program for Swedish industrial small- and medium-sized enterprises. J. Clean. Prod. 2010, 18, 1339–1346. [Google Scholar] [CrossRef]

- Boharb, A.; Allouhi, A.; Saidur, R.; Kousksou, T.; Jamil, A.; Mourad, Y.; Benbassou, A. Auditing and analysis of energy consumption of an industrial site in Morocco. Energy 2016, 101, 332–342. [Google Scholar] [CrossRef]

- Considine, T.J.; Sapci, O. The effectiveness of home energy audits: A case study of Jackson, Wyoming. Resour. Energy Econ. 2016, 44, 52–70. [Google Scholar] [CrossRef]

- Ogunjuyigbe, A.; Ayodele, T.; Ogunmuyiwa, S. Improving electrical energy utilization in some selected Nigerian food and beverage industries. Sustain. Energy Technol. Assess. 2015, 12, 38–45. [Google Scholar] [CrossRef]

- Fleiter, T.; Gruber, E.; Eichhammer, W.; Worrell, E. The German energy audit program for firms—A cost-effective way to improve energy efficiency? Energy Effic. 2012, 5, 447–469. [Google Scholar] [CrossRef]

- Paramonova, S.; Thollander, P. Ex-post impact and process evaluation of the Swedish energy audit policy programme for small and medium-sized enterprises. J. Clean. Prod. 2016, 135, 932–949. [Google Scholar] [CrossRef]

- Schleich, J.; Fleiter, T. Effectiveness of energy audits in small business organizations. Resour. Energy Econ. 2019, 56, 59–70. [Google Scholar] [CrossRef]

- Huang, R.; Chen, D. Does Environmental Information Disclosure Benefit Waste Discharge Reduction? Evidence from China. J. Bus. Ethics 2014, 129, 535–552. [Google Scholar] [CrossRef]

- Rongbing, H. Environmental Auditing: An Informationized Regulatory Tool of Carbon Emission Reduction. Energy Procedia 2011, 5, 6–14. [Google Scholar] [CrossRef]

- Zeng, C.; Li, J. Government audit of environment and improvement of environmental performance. Aud. Res. 2018, 4, 44–52. [Google Scholar]

- Annunziata, E.; Rizzi, F.; Frey, M. Enhancing energy efficiency in public buildings: The role of local energy audit programmes. Energy Policy 2014, 69, 364–373. [Google Scholar] [CrossRef]

- Cao, H.; Zhang, L.; Qi, Y.; Yang, Z.; Li, X. Government auditing and environmental governance: Evidence from China’s auditing system reform. Environ. Impact Assess. Rev. 2022, 93, 106705. [Google Scholar] [CrossRef]

- Wu, Y.; Xu, B. When will China’s carbon emissions peak? Evidence from judgment criteria and emissions reduction paths. Energy Rep. 2022, 8, 8722–8735. [Google Scholar] [CrossRef]

- Sun, X.; Zhu, B.; Zhang, S.; Zeng, H.; Li, K.; Wang, B.; Dong, Z.; Zhou, C. New indices system for quantifying the nexus between economic-social development, natural resources consumption, and environmental pollution in China during 1978–2018. Sci. Total. Environ. 2021, 804, 150180. [Google Scholar] [CrossRef] [PubMed]

- Huang, J.; Leng, M.; Liang, L.; Liu, J. Promoting electric automobiles: Supply chain analysis under a government’s subsidy incentive scheme. IIE Trans. 2013, 45, 826–844. [Google Scholar] [CrossRef]

- Ma, X.; Shahbaz, M.; Song, M. Off-office audit of natural resource assets and water pollution: A quasi-natural experiment in China. J. Enterp. Inf. Manag. 2021. ahead-of-print. [Google Scholar] [CrossRef]

- Anderson, S.T.; Newell, R. Information programs for technology adoption: The case of energy-efficiency audits. Resour. Energy Econ. 2004, 26, 27–50. [Google Scholar] [CrossRef]

- Andersson, E.; Arfwidsson, O.; Bergstrand, V.; Thollander, P. A study of the comparability of energy audit program evaluations. J. Clean. Prod. 2017, 142, 2133–2139. [Google Scholar] [CrossRef]

- Cao, K.; He, P.; Liu, Z. Production and pricing decisions in a dual-channel supply chain under remanufacturing subsidy policy and carbon tax policy. J. Oper. Res. Soc. 2019, 71, 1199–1215. [Google Scholar] [CrossRef]

- Petrakis, E.; Poyago-Theotoky, J. R&D subsidies versus R&D cooperation in a duopoly with spillovers and pollution. Aust. Econ. Pap. 2002, 41, 37–52. [Google Scholar]

- Wang, W.; Sun, X.; Zhang, M. Does the central environmental inspection effectively improve air pollution?-An empirical study of 290 prefecture-level cities in China. J. Environ. Manag. 2021, 286, 112274. [Google Scholar] [CrossRef]

- Zhao, Z. Local Government Auditing in the People’s Republic of China. In Auditing Practices in Local Governments: An International Comparison; Emerald Publishing Limited: Bingley, UK, 2022; pp. 47–56. [Google Scholar]

- Du, S.; Xu, X.; Yu, K. Does corporate social responsibility affect auditor-client contracting? Evidence from auditor selection and audit fees. Adv. Account. 2020, 51, 100499. [Google Scholar] [CrossRef]

- Wen, Z.; Ye, B. Analyses of Mediating Effects: The Development of Methods and Models. Adv. Psychol. Sci. 2014, 22, 731–745. [Google Scholar] [CrossRef]

- Fan, Y.; Bai, B.; Qiao, Q.; Kang, P.; Zhang, Y.; Guo, J. Study on eco-efficiency of industrial parks in China based on data envelopment analysis. J. Environ. Manag. 2017, 192, 107–115. [Google Scholar] [CrossRef] [PubMed]

- Sharma, S.S. Determinants of carbon dioxide emissions: Empirical evidence from 69 countries. Appl. Energy 2011, 88, 376–382. [Google Scholar] [CrossRef]

- Grubb, M.; Sha, F.; Spencer, T.; Hughes, N.; Zhang, Z.; Agnolucci, P. A review of Chinese CO2 emission projections to 2030: The role of economic structure and policy. Clim. Policy 2015, 15, S7–S39. [Google Scholar] [CrossRef]

- McJeon, H.; Edmonds, J.; Bauer, N.; Clarke, L.; Fisher, B.; Flannery, B.P.; Hilaire, J.; Krey, V.; Marangoni, G.; Mi, R.; et al. Limited impact on decadal-scale climate change from increased use of natural gas. Nature 2014, 514, 482–485. [Google Scholar] [CrossRef] [PubMed]

- Lan, J.; Kakinaka, M.; Huang, X. Foreign Direct Investment, Human Capital and Environmental Pollution in China. Environ. Resour. Econ. 2011, 51, 255–275. [Google Scholar] [CrossRef]

- Pei, Y.; Zhu, Y.; Liu, S.; Wang, X.; Cao, J. Environmental regulation and carbon emission: The mediation effect of technical efficiency. J. Clean. Prod. 2019, 236, 117599. [Google Scholar] [CrossRef]

- MacKinnon, D.P.; Lockwood, C.M.; Williams, J. Confidence Limits for the Indirect Effect: Distribution of the Product and Resampling Methods. Multivar. Behav. Res. 2004, 39, 99–128. [Google Scholar] [CrossRef] [PubMed]

- Hayes, A.F. Mediation, moderation, and conditional process analysis. In Introduction to Mediation, Moderation, and Conditional Process Analysis: A Regression-Based Approach; Guilford Publications: New York, NY, USA, 2013; Volume 1, p. 20. [Google Scholar]

- Jalil, Z.A.; Naji, H.I.; Mahmood, M.S. Developing Sustainable Alternatives from Destroyed Buildings Waste for Reconstruction Projects. Civ. Eng. J. 2020, 6, 60–68. [Google Scholar] [CrossRef]

- Ouyang, Z.; Sang, J.; Li, P.; Peng, J. Organizational justice and job insecurity as mediators of the effect of emotional intelligence on job satisfaction: A study from China. Pers. Individ. Differ. 2015, 76, 147–152. [Google Scholar] [CrossRef]

- Liu, Y.; Ye, D.; Liu, S.; Lan, H. The effect of China’s leading officials’ accountability audit of natural resources policy on provincial agricultural carbon intensities: The mediating role of technological progress. Environ. Sci. Pollut. Res. 2022. [Google Scholar] [CrossRef]

- Shiqiao, Z.; Ping, Y. Position of Auditing Office, Auditing Compromise and Efficiency of Auditing Decisions. Aud. Res. 2010, 6, 53–58. [Google Scholar]

- Wang, Q.; Chen, Y. Energy saving and emission reduction revolutionizing China’s environmental protection. Renew. Sustain. Energy Rev. 2010, 14, 535–539. [Google Scholar] [CrossRef]

- Wang, S.; Tang, Y.; Du, Z.; Song, M. Export trade, embodied carbon emissions, and environmental pollution: An empirical analysis of China’s high-and new-technology industries. J. Environ. Manag. 2020, 276, 111371. [Google Scholar] [CrossRef] [PubMed]

- Suchang, Y.; Haiyan, L.; Sijie, Z. Spatial Spillover Effect and Influencing Factors of Environmental Auditing. J. Environ. Econ. 2018, 3, 94–112+138. [Google Scholar] [CrossRef]

- Du, Q.; Deng, Y.; Zhou, J.; Wu, J.; Pang, Q. Spatial spillover effect of carbon emission efficiency in the construction industry of China. Environ. Sci. Pollut. Res. 2021, 29, 2466–2479. [Google Scholar] [CrossRef]

- Zhou, K.; Yang, J.; Yang, T.; Ding, T. Spatial and temporal evolution characteristics and spillover effects of China’s regional carbon emissions. J. Environ. Manag. 2023, 325, 116423. [Google Scholar] [CrossRef]

| Energy Type | Conversion Coefficient of Standard Coal | Calorific Value of Standard Coal (kJ/kg) | Carbon Content per Unit Calorific Value (t-C/TJ) | Carbon Oxidation Rate | Carbon Emission Coefficient |

|---|---|---|---|---|---|

| Raw coal | 0.7143 | 29,307 | 26.37 | 0.94 | 1.9027 |

| Coke | 0.9714 | 29,307 | 29.50 | 0.93 | 2.8638 |

| Crude oil | 1.4286 | 29,307 | 20.10 | 0.98 | 3.0240 |

| Gasoline | 1.4714 | 29,307 | 18.90 | 0.98 | 2.9286 |

| Kerosene | 1.4714 | 29,307 | 19.60 | 0.98 | 3.0371 |

| Diesel oil | 1.4571 | 29,307 | 20.20 | 0.98 | 3.0996 |

| Power | 0.1229 | 29,307 | 26.37 | 0.94 | 0.3274 |

| Fuel oil | 1.4286 | 29,307 | 21.10 | 0.98 | 3.1744 |

| Natural gas | 1.3300 | 29,307 | 15.30 | 0.99 | 2.1648 |

| Liquefied petroleum gas | 1.7143 | 29,307 | 17.2 | 0.98 | 3.1052 |

| Variable | Index Selection | Symbol | Definition |

|---|---|---|---|

| Dependent variables | Carbon emission | Ln_Carbon | Logarithm of carbon emission |

| Carbon emission intensity | Intensity | Carbon emission/GDP | |

| Independent variables | Air pollution control auditing | AA | Whether the air pollution control auditing is implemented by the National Audit Office or local audit institutions |

| Top-down audit | Cen.AA | Whether the air pollution control auditing is implemented by the National Audit Office | |

| Bottom-up audit | Loc.AA | Whether the air pollution control auditing is implemented by the local audit institutions | |

| Mediating variables | Industrial added value | IVA | Logarithm of industrial value-added |

| Industrial waste gas treatment capacity | faci | Logarithm of industrial waste gas treatment capacity | |

| Industrial pollution control waste gas project | pro | Number of waste gas projects for industrial pollution control | |

| Operating cost of industrial waste gas treatment facilities | cost | Logarithm of operation cost of industrial waste treatment facilities | |

| Control variables | Economic development level | pgdp | GDP/population |

| Industrial structure | Ind | The added value of the second industry/GDP | |

| Energy-resource structure | Energy | Coal consumption/energy consumption | |

| Technical level | Tech | GDP/energy consumption | |

| Urbanization level | Urban | Urban population/total population | |

| Environmental regulation | Regulation | Investment in industrial pollution source control/GDP |

| Variable | Sample | Mean | Med | Std. Dev. | Min | Max |

|---|---|---|---|---|---|---|

| ln_Carbon | 450 | 10.20 | 10.20 | 0.805 | 7.129 | 11.91 |

| Intensity | 450 | 3.286 | 2.592 | 2.418 | 0.250 | 14.77 |

| AA | 450 | 0.333 | 0 | 0.472 | 0 | 1 |

| Cen.AA | 450 | 0.218 | 0 | 0.413 | 0 | 1 |

| Loc.AA | 450 | 0.162 | 0 | 0.369 | 0 | 1 |

| pgdp | 450 | 3.670 | 3.221 | 2.460 | 0.424 | 15.10 |

| Urban | 450 | 0.532 | 0.516 | 0.143 | 0.263 | 0.896 |

| Ind | 450 | 0.435 | 0.447 | 0.0812 | 0.165 | 0.620 |

| Energy | 450 | 0.951 | 0.890 | 0.389 | 0.0380 | 2.423 |

| Tech | 450 | 1.195 | 1.031 | 0.685 | 0.224 | 4.554 |

| Regulation | 450 | 0.00182 | 0.001 | 0.00165 | 6.4 × 10−5 | 0.0110 |

| IVA | 450 | 8.333 | 8.477 | 1.100 | 4.785 | 10.54 |

| faci | 450 | 10.40 | 10.36 | 1.230 | 6.937 | 14.87 |

| pro | 450 | 125.1 | 83 | 108.3 | 1 | 651 |

| cost | 450 | 12.39 | 12.52 | 1.152 | 8.006 | 14.96 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Variable | Ln_Carbon | Intensity | Ln_Carbon | Intensity | Ln_Carbon | Intensity |

| AA | −0.021 ** | 0.021 | ||||

| (−2.18) | (0.20) | |||||

| Cen.AA | 0.006 | 0.107 | ||||

| (0.58) | (0.92) | |||||

| Loc.AA | −0.029 ** | −0.040 | ||||

| (−2.57) | (−0.61) | |||||

| Control variables | YES | YES | YES | YES | YES | YES |

| Region | YES | YES | YES | YES | YES | YES |

| Year | YES | YES | YES | YES | YES | YES |

| R2 | 0.881 | 0.742 | 0.881 | 0.743 | 0.882 | 0.742 |

| Sample size | 450 | 450 | 450 | 450 | 450 | 450 |

| Dependent Variables | Independent Variables | Mediating Variables | Effect Category | Effect Size | 95% Error Corrected Confidence Interval | ||

|---|---|---|---|---|---|---|---|

| Standard Error | Lower Bound | Upper Bound | |||||

| Ln_Carbon | AA | IVA | Indirect effect | −0.0099 | 0.0040 | −0.0168 | −0.0025 |

| Direct effect | −0.0113 | 0.0111 | −0.0319 | 0.0194 | |||

| faci | Indirect effect | −0.0003 | 0.0011 | −0.0011 | 0.0005 | ||

| Direct effect | −0.0210 | 0.0129 | −0.0450 | 0.0030 | |||

| pro | Indirect effect | −0.0009 | 0.0011 | −0.0041 | 0.0007 | ||

| Direct effect | −0.0203 | 0.0123 | −0.0460 | 0.0056 | |||

| cost | Indirect effect | 0.0017 | 0.0037 | −0.0052 | 0.0116 | ||

| Direct effect | −0.0229 | 0.0122 | −0.0442 | 0.0086 | |||

| Loc.AA | IVA | Indirect effect | −0.0081 | 0.0039 | −0.0146 | −0.0027 | |

| Direct effect | −0.0208 | 0.0109 | −0.0466 | −0.0040 | |||

| faci | Indirect effect | 0.0001 | 0.0010 | −0.0004 | 0.0031 | ||

| Direct effect | −0.0290 | 0.0123 | −0.0486 | −0.0001 | |||

| pro | Indirect effect | −0.0007 | 0.0009 | −0.0045 | 0.0002 | ||

| Direct effect | −0.0281 | 0.0125 | −0.0525 | −0.0037 | |||

| cost | Indirect effect | 0.0005 | 0.0043 | −0.0069 | 0.0114 | ||

| Direct effect | −0.0294 | 0.0115 | −0.0410 | 0.0140 | |||

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Variables | Ln_Carbon | Intensity | Ln_Carbon | Intensity | Ln_Carbon | Intensity |

| AA | −0.021 ** | 0.021 | −0.022 ** | 0.001 | ||

| (−2.18) | (0.20) | (−2.25) | (0.01) | |||

| AAF | −0.008 ** | −0.006 | ||||

| (−2.10) | (−0.17) | |||||

| Control variables | YES | YES | YES | YES | YES | YES |

| Region | YES | YES | YES | YES | YES | YES |

| Year | YES | YES | YES | YES | YES | YES |

| R2 | 0.881 | 0.742 | 0.882 | 0.742 | 0.877 | 0.743 |

| Sample size | 450 | 450 | 450 | 450 | 450 | 450 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhao, C.; Zhu, J.; Xu, Z.; Wang, Y.; Liu, B.; Yuan, L.; Wang, X.; Xiong, J.; Zhao, Y. The Effect of Air Pollution Control Auditing on Reducing Carbon Emissions: Evidence from China. Int. J. Environ. Res. Public Health 2022, 19, 17019. https://doi.org/10.3390/ijerph192417019

Zhao C, Zhu J, Xu Z, Wang Y, Liu B, Yuan L, Wang X, Xiong J, Zhao Y. The Effect of Air Pollution Control Auditing on Reducing Carbon Emissions: Evidence from China. International Journal of Environmental Research and Public Health. 2022; 19(24):17019. https://doi.org/10.3390/ijerph192417019

Chicago/Turabian StyleZhao, Chen, Jiaxuan Zhu, Zhiyao Xu, Yixuan Wang, Bin Liu, Lu Yuan, Xiaowen Wang, Jiali Xiong, and Yiming Zhao. 2022. "The Effect of Air Pollution Control Auditing on Reducing Carbon Emissions: Evidence from China" International Journal of Environmental Research and Public Health 19, no. 24: 17019. https://doi.org/10.3390/ijerph192417019

APA StyleZhao, C., Zhu, J., Xu, Z., Wang, Y., Liu, B., Yuan, L., Wang, X., Xiong, J., & Zhao, Y. (2022). The Effect of Air Pollution Control Auditing on Reducing Carbon Emissions: Evidence from China. International Journal of Environmental Research and Public Health, 19(24), 17019. https://doi.org/10.3390/ijerph192417019