1. Introduction

The deterioration of global environmental quality and extreme natural disasters have sounded the alarm for humans to protect the environment, and the development of a low-carbon economy with “low pollution, low energy consumption, and low emissions” has become a goal for countries around the world. At the United Nations General Assembly’s 75th General Debate in 2020, China proposed increasing its national contribution, implementing more aggressive policies and measures, and aiming for peak carbon emissions by 2030 and carbon neutrality by 2060. The proposed carbon peak and carbon neutral targets, on the one hand, respond to the global trend of sustainable economic development [

1,

2], fully demonstrate China’s role as a great power, and also prompt a renewed energy revolution and paradigm change and further economic development in China’s “countdown”; on the other hand, these targets also guide China’s response to climate change and green low-carbon development, and set specific emission reduction targets for governments and the public at all levels.

China’s rapid economic growth relies on huge energy consumption, which makes China one of the world’s largest carbon emitters and presents a serious threat to its sustainable economic development. From carbon peaking to carbon neutrality, China will take 30 years to complete the path that Western countries set off on 60 years ago. At present, the domestic and international political and economic environment has undergone obvious changes, a prominent manifestation of which is the frequent occurrence of uncertain events. Therefore, under the carbon neutrality target, China also faces the pressure of many crises, such as trade friction, the COVID-19 pandemic, and geopolitical risks, bringing many challenges and uncertainties to China’s macroeconomic policy practices [

3,

4,

5], which adversely affect national economic development [

6] and in turn the development of and policy planning for the energy, manufacturing, and transportation sectors. Altogether, these pressures are detrimental to the achievement of China’s carbon neutrality target. As economic and ecological systems become increasingly interconnected, it is of great practical and economic importance to analyze the impact of EPU on China’s carbon emissions to promote the achievement of China’s “double carbon goal” and contribute to sustainable economic development.

This study aims to investigate the effect of EPU on carbon emissions in China and its mechanism of action, with core work and marginal contributions in two main areas. First, this paper focuses on the effect of EPU shocks on carbon emissions as explored by relevant studies around the world. While clarifying the internal logic of EPU shocks on carbon emissions, it integrates the divergent findings of previous studies and the structural differences of China’s regional economy and empirically investigates the effect of EPU shocks on carbon emissions in China from a nonlinear perspective based on the panel smooth transition regression (PSTR) model, which is a useful supplement to the past studies. Second, to build an intuitive understanding of the reasons and mechanisms behind the effects of EPU shocks on carbon emissions in China, this paper further simulates and analyzes the nonlinear carbon emission effects of EPU under different economic or financial conditions in Chinese regions. The rest of this paper is structured as follows:

Section 2 reviews the relevant literature to identify the current state of research as well as recent breakthroughs;

Section 3 constructs the empirical model, followed by a description of the data used in the study and the results of the parameter estimation;

Section 4 presents the study’s findings;

Section 5 explains and discusses the findings; and

Section 6 concludes the paper.

2. Literature Review

Focusing on the core research question of this paper, we find that there are two mechanisms behind the impact of EPU on carbon emissions: first, EPU affects the rate of economic development and changes the intensity of energy consumption, which in turn affects carbon emissions; second, EPU directs governmental attention to the implementation of environmental protection policies, leading to changes in the intensity of environmental regulation and supervision, which ultimately affects carbon emissions.

Specifically, regarding the first mechanism of EPU shocks’ effects on carbon emissions in terms of the economic effects, Baker et al. [

7] found that output, investment, and employment all decrease when EPU rises in the US. Huang and Luk [

4] employed a structural vector autoregressive (SVAR) model to systematically examine China’s macroeconomic response to EPU shocks, concluding that rising EPU dampens real economic activities such as output and employment, which is consistent with findings in other economies. The environmental Kuznets curve (EKC) is a common tool for the study of economic growth-related carbon emission effects [

8,

9]. Scholars from different nations have empirically demonstrated that economic growth is a significant factor affecting carbon emissions using the EKC model [

10,

11]. As demonstrated in previous research, economic effects are indeed an important channel through which EPU shocks affect carbon emissions.

The second mechanism of EPU shocks’ effect on carbon emissions suggests that the intensity of environmental regulation may be relaxed when EPU rises and governments focus more on stabilizing economic development and overcoming the adverse effects of economic fluctuations [

12,

13]. However, lower regulating levels can lead to a tendency for companies to pay environmental fines and reduce investment in environmental R&D because of insufficient penalties. Instead, when uncertainty is low, the government generally increases the production costs of high-polluting enterprises through taxation and other means and promotes the green transformation of enterprises by providing financial support, at which point high-emission, high-polluting, and inefficient enterprises or industries generally decline [

14]. Clearly, the severity of environmental regulation and oversight may shift as a result of EPU shocks, which could ultimately impact carbon emissions.

Further, most previous frontier studies that empirically investigated the carbon emission effects of EPU from different perspectives assumed a linear effect between EPU and carbon emissions. For instance, Jiang et al. [

15] contended that increasing EPU considerably increases the carbon emissions of the United States through both direct and indirect effects on economic demand and policy moderation. Similarly, Wang et al. [

16] found that US carbon emissions show a positive relationship with EPU. Based on cross-country data, Wang et al. [

17] discovered that EPU increases carbon emissions, whereas economic development, globalization, and international trade significantly moderate the carbon emission effects of EPU. By contrast, there are results in the existing literature that contradict the above studies. For example, Chen et al. [

18] conducted an empirical study using a panel model with data from a sample of 15 countries and discovered that EPU has a negative carbon emission effect, which is greater in emerging market countries than in developed countries. Similarly, Liu and Zhang [

19] found that EPU in China has a negative impact on carbon emissions, but this relationship was not observed to be significant in the central or western regions.

Meanwhile, some studies shifted the relationship between EPU and carbon emissions from a linear to an asymmetric setting. For example, the EKC model framework was used by Odugbesan and Aghazadeh [

20] to examine the impact of EPU on carbon emissions in Japan. They found that there is a long-term cointegration relationship between EPU and carbon emissions and that EPU significantly contributes to the rise in carbon emissions. Anser et al. [

21] and Syed and Bouri [

22] empirically identified the asymmetric carbon emission effects of EPU based on an autoregressive distributed lag (ARDL) model analytical framework, and found that in the short run, EPU exacerbates carbon emissions, suggesting that high EPU leads to environmental degradation in the short run; conversely, in the long run, EPU reduces carbon emissions, which implies that high EPU improves environmental quality over time.

There are significant structural differences between regional economies in China, such as the policy intensity and economic and financial development conditions of each region [

23,

24], and these differences may affect the magnitude of the response of real economic activity to EPU shocks, which in turn affects carbon emissions via economic or policy effects; these factors are also directly related to the factors that affect the magnitude of the response of actual economic activity to uncertainty shocks, as highlighted by theoretical studies. Specifically, in terms of economic structure, regions with higher concentrations of the financial and real estate industries are likely to be impacted if uncertainty shocks have a significant influence on financial markets. Manufacturing is likely to be sensitive to changes in short-term interest rates, as Dai and Lin [

25] pointed out, and there is significant asymmetry and heterogeneity. If uncertainty shocks influence interest rates, their combined effect might be greater in areas with a more active manufacturing sector.

In terms of the condition of financial development, uncertainty affects the economy primarily through its impact on financial markets [

26,

27]; in this view, if financial market conditions are poor and financial frictions are prevalent, uncertainty shocks affect the real economy through their impact on the external financing premium, implying that their magnitude may be closely related to the intensity of financial frictions. In addition, differences in fiscal capacity across Chinese regions may lead to different responses to uncertainty shocks, implying that the degree of impact of uncertainty shocks may be influenced by the degree of support available to economic agents when their income or employment prospects decline. Furthermore, Carrière-Swallow and Céspedes [

28] pointed out that local fiscal policies may also affect the amplification and transmission effects of financial frictions on uncertainty shocks across regions. Tao et al. [

29] argue that financial development can directly influence carbon emissions.

Based on the abovementioned studies, it is clear that there is obvious divergence in past studies on the carbon emission effects of EPU, possibly resulting in very different research conclusions. This may be because the mechanism of EPU’s effects on carbon emissions is highly complex, and different factors, such as economic structure and economic and financial development status, may lead to significant changes in the mechanism of action of EPU on carbon emissions; thus, EPU shocks may have state-dependent nonlinear effects on carbon emissions. Therefore, previous studies based on linear VAR models or standard panel data models ignore the state-dependent effects of EPU, with the standard panel data models in particular mostly assuming cross-sectional homogeneity of slope parameters, and although heterogeneity can be controlled by adding additional regression variables, it is still difficult to explicitly characterize the cross-sectional dependence of the identification results. Furthermore, the majority of research to date has examined the national-level effects of EPU on carbon emissions without systematically examining the impact mechanisms, particularly the transmission mechanisms between shocks within a nation. It is obviously challenging to utilize the findings from research at the national level to inform the future development requirements of specific regions due to the existence of regional disparities among countries.

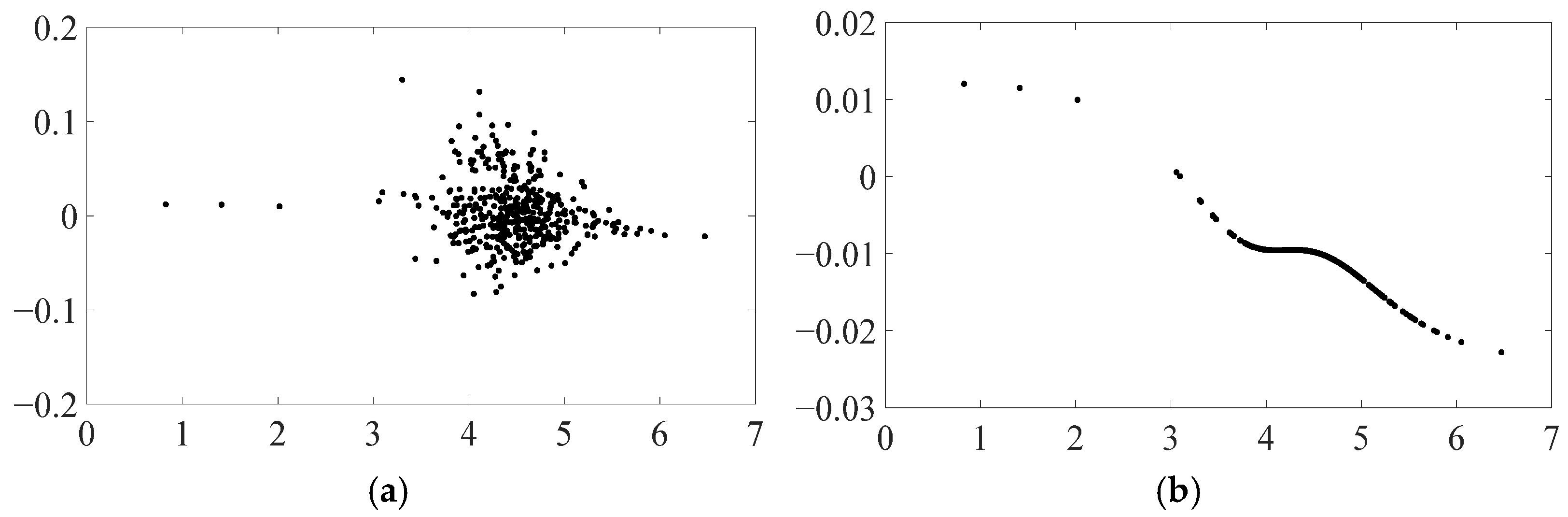

Thus, this paper selects the PSTR model proposed by Gonzalez et al. [

30] to systematically examine the nonlinear and heterogeneous effects of provincial EPU shocks on carbon emissions in China. The PSTR model can be viewed as an improvement over the PTR model [

31], with an unsmoothed variance of regression coefficients across different regimes, as well as an extension of the STAR model [

32] from time series to panel data. Hence, the PSTR model has a clear advantage in examining the mechanism of nonlinear effects of provincial EPU shocks on carbon emissions in China because it can convincingly depict the nonlinear correlations among variables on the one hand and effectively capture the heterogeneous characteristics of panel data by smoothing the transformation of threshold variables across different regimes on the other. In addition, because of the structural differences in China’s regional economies, this paper includes indicators of economic development level, industrial structure, financial development status, local fiscal scale, and environmental regulation in the explanatory variables to account for economic, financial, and policy factors and enhance the precision of model identification. In summary, as a useful supplement to past studies, this paper examines the mechanism of the nonlinear effects of EPU shocks on carbon emissions using the PSTR model based on provincial panel data in China to provide useful empirical evidence and policy insights, aiming to accelerate China’s achievement of the “double carbon goal”.

5. Discussion

Since the reform and opening up, China’s energy consumption and carbon dioxide emissions have increased along with the country’s rapid economic growth, and ecological pollution and environmental management are currently faced with a number of major issues. As the domestic and international economic environment and the COVID-19 pandemic continue to change, China’s economic development is facing significant pressure and uncertainty [

3,

4,

5]. In weighing and adjusting various economic objectives, the problem of EPU inevitably becomes prominent. In this context, it is crucial to examine the effect of EPU on carbon emissions and its underlying mechanism, and the solution to this problem may contribute to the realization of China’s “double carbon objective”.

Furthermore, to clarify the current state of research on the topic of this paper and to optimize the research proposal, in the process of combing through studies related to this paper, we found that there is a clear disagreement among academics about the carbon emission effects of EPU, which may even present very different research conclusions. For this reason, we argue that economic and financial factors such as economic structure and economic and financial development status may lead to significant changes in the mechanism of the effect of EPU on carbon emissions, and the effect of EPU shocks on carbon emissions is likely to have nonlinear characteristics. Considering the structural differences of China’s regional economies, we finally used the PSTR model to investigate the effect of EPU on carbon emissions and its mechanism of action.

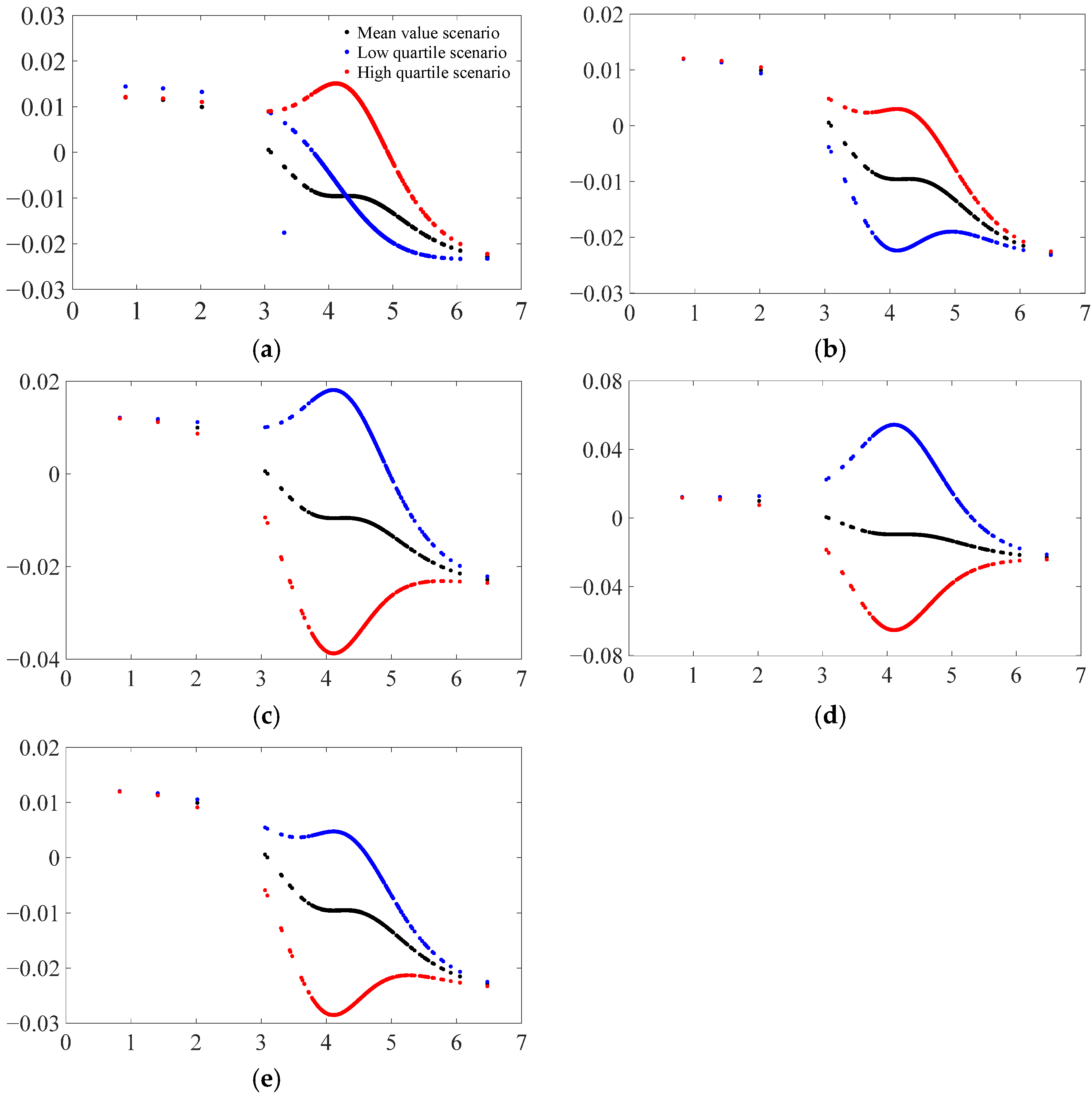

It was found that the magnitude and direction of the impact of EPU shocks on carbon emissions in China are not constant, but show a positive and then negative pattern of change as EPU increases; moreover, the increase in the level of EPU, in addition to leading to a significant change in the mechanism underlying its own impact on carbon emissions, also triggers a nonlinear migration of the effect of other variables on carbon emissions, which to some extent also explains the existence of a large amount of heterogeneity among Chinese provinces. In provinces with higher levels of economic and financial development, the positive carbon emission effects of EPU are more pronounced; conversely, provinces with lower levels of economic and financial development are more negatively affected by EPU. In contrast, the nonlinear carbon emission effects of EPU are greater in provinces with irrational industrial structures, smaller fiscal expenditures, and poorer environmental regulations.

We argue that the reason behind the above empirical phenomenon is strongly related to the transmission channels through which EPU shocks affect carbon emissions, as described in past relevant studies, and thus the nonlinear effects caused by EPU shocks on carbon emissions at the provincial level in China are mainly due to the differences in their economic and policy effects. Specifically, in terms of economic effects, EPU not only affects policy effectiveness but can also have a nonlinear effect on economic growth [

36,

37,

38]; based on this, when the EPU is low or declining, the provincial economy grows rapidly due to, for example, increased policy effectiveness [

39], which has a pulling effect on carbon emissions; conversely, an increase in EPU ultimately has a dampening effect on carbon emissions by inhibiting economic growth dynamics and thus reducing energy consumption. In terms of policy effects, the emission reduction effect of environmental regulation is more effective when EPU is low, but when EPU is high, local governments focus more on stabilizing economic development and overcoming the adverse effects of economic fluctuations, the intensity of environmental regulation may be relaxed, and the emission reduction effect of environmental regulation is weakened or even ineffective. By combining these two effects, it is easy to understand the nonlinear effect of EPU shocks on carbon emissions; the final response dynamics of carbon emissions may depend on the actual magnitude of the relationship between the two effects at different periods and different levels of policy uncertainty. The analysis in

Section 4.2 and

Section 4.3 of this paper provides an intuitive understanding of the causes and mechanisms of action.

Obviously, the findings of this paper differ from the empirical findings of Jiang et al. [

15], Wang et al. [

17], Chen et al. [

18], and Liu and Zhang [

19], because we examined the dynamic impact of provincial EPU on carbon emissions in China from a nonlinear perspective, taking into account the complexity and structural differences of the Chinese provincial economic system. The findings are more consistent with Chinese economic reality, which is the paper’s main marginal contribution. Of course, this paper also has obvious limitations. The analysis of the nonlinear carbon emission effects of EPU lacks a theoretical model to regulate the interpretation, which will be the focus of further research. This paper can also provide a direct empirical basis for the study of related theoretical mechanisms. In addition, in the context of rapid global economic transformation, the impact of EPU has penetrated various fields of production and life, and this study can provide some empirical support and policy inspiration for the correct understanding of environmental risks brought by EPU and the optimization of macroeconomic multi-objective regulation practices.

6. Conclusions

Based on the in-depth consideration of issues in China’s economic and environmental development, this paper adopts the PSTR model to systematically investigate the nonlinear impact effects of provincial EPU shocks on carbon emissions and their mechanism of action. The findings demonstrate that the magnitude and direction of the impact of EPU shock on China’s carbon emissions are not constant and exhibit a nonlinear pattern of firstly positive and then adverse changes with an increase in EPU; in addition, an increase in the level of EPU not only causes a significant change in the mechanism underlying its own impact on carbon emissions, but also causes a nonlinear migration of the effects of local economic and financial development, industrial structure, government expenditure, and environmental regulation on carbon emissions; further studies reveal that these cross-sectional factors are important causes and mechanisms of action for the nonlinear carbon emission effects of EPU at the provincial level in China. In conclusion, our study not only confirms the existence of a nonlinear link between EPU and carbon emissions at the provincial level in China, but also sheds some light on the mechanisms and causes underlying their empirical occurrence. These findings provide, on the one hand, direct empirical evidence that improves the understanding of the carbon emissions problem in the context of high EPU, and on the other, an important empirical basis for theoretical exploration of the transmission mechanism of shocks to carbon emissions from EPU. According to the research conclusions, the policy implications of this paper are as follows:

First, although the rise in EPU can curb carbon emissions, it does not achieve green and sustainable economic development at the expense of economic development vitality, which is not in line with the requirements of “high-quality development” of the economy. Therefore, the government should emphasize authoritative interpretation when policy programs are adjusted or major emergencies occur, prevent misjudgment and overreaction, enhance risk management and expectation management capabilities in complex situations, improve the stability of the interaction structure among economic individuals, control economic policy uncertainty within a moderate space from the root, and create an effective policy environment for green and sustainable economic development.

Second, although the decline in EPU creates a good environment for economic development, rapid economic growth at the expense of environmental quality is not in line with the requirements of “high-quality development”. Therefore, the government should actively encourage enterprises to research and develop green technology, promote the further development of their energy structure, and promote “environmentally friendly” economic development with the use of clean energy and the advancement of green technology. In addition, the government should not relax its environmental regulations and improve and perfect the market information disclosure system to encourage enterprises to fulfill their social responsibility.

Third, the difference in regional economic structure has a significant adjustment effect on the carbon emission effect of EPU shock. Therefore, the government should also actively improve the market economic system, optimize the structure of the economic system, afford full play to the market’s ability to self-correct and engage in spontaneous regulation, and reduce the market’s over-reliance on economic policies.