1. Introduction

With rapid economic development in the past decades, the excessive use of nonrenewable resources has damaged the atmosphere and exacerbated many environmental problems [

1]. To save energy and reduce carbon emissions, the United Nations has created sustainable development goals (SDGs), and many countries have declared their commitment to environmentally friendly and sustainable activities [

2]. The pressure of resource shortages and environmental pollution makes it difficult to maintain the growth mode of the traditional manufacturing sectors. As the demand for environmentally friendly technologies has gradually increased, major polluters such as manufacturing firms have become the focus of public attention. Firms in developing countries have become urgently required to change their business models to achieve green and sustainable development. Sustainable development has been discovered to be fundamentally dependent on upgrading and innovations [

2,

3]. Consequently, green innovation has become a significant component of firms’ promotion of green transformation [

4,

5]. Green innovation refers to the measures taken by firms to bring technological practices to bear on environmental pollution and actively reduce environmental problems caused by their production and operation activities [

6,

7]. However, green innovation has unique dual externalities (i.e., knowledge spillover and environmental protection externalities), combined with the inherent characteristics of traditional innovation activities, such as high risks and a long and unpredictable investment return cycle [

8,

9], which means that it is treated as a balance between environmental sustainability and economic interests that determines the difficulty of implementation. According to the Porter hypothesis, stringent environmental regulations can induce efficiency and facilitate innovations that can improve competitive advantages. Therefore, green innovation has become a significant strategic concern for top management teams (TMTs) in practice and has attracted research attention in recent years [

5,

10]. Particularly, researchers have studied how TMT characteristics affect firms’ green innovation performance. We seek to extend this stream of literature in the context of China.

Over the past decade, another significant change in economic development has been the expansion of a wide range of digital technologies and digital infrastructures, which have reshaped all aspects of business and organizations [

11,

12]. In addition, the development of the digital economy (i.e., digital platforms, digital technologies, and digital infrastructure) has been crucial for sustainable growth in modern society [

13,

14,

15]. These phenomena have attracted the attention of researchers and practitioners [

14,

16,

17,

18]. However, how firms’ digital transformation efforts and regions’ digital economy development affect green innovation and how they are involved in the strategic processes of TMTs have not yet been investigated in previous studies.

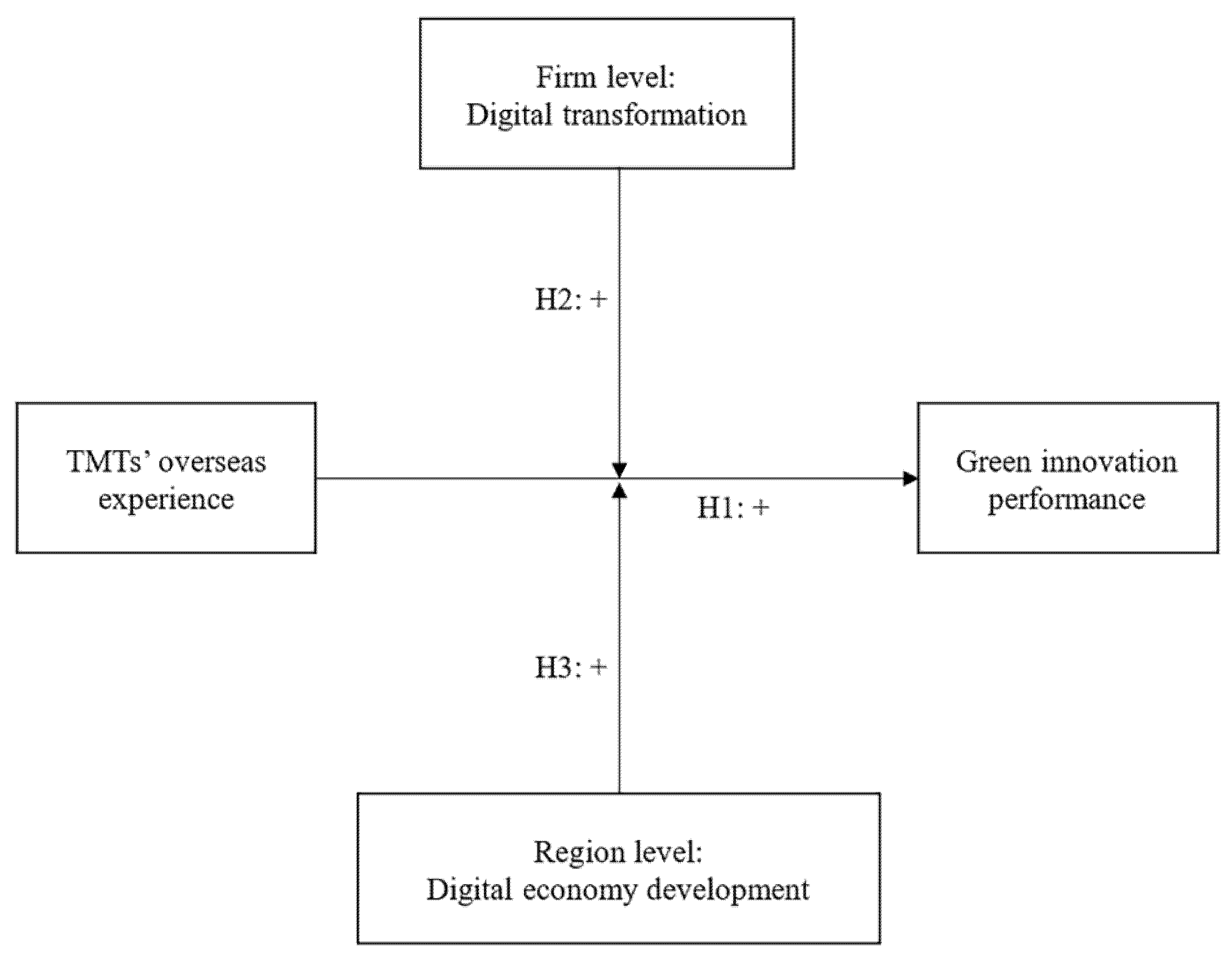

This study aims to answer the following questions: What are the effects of TMTs’ overseas experience on firms’ green innovation performance? How do firms’ digital transformation and regions’ digital economy development moderate the relationship between TMTs’ overseas experience and green innovation in the digital era? This study employs a panel dataset of Chinese A-share listed firms from 2011 to 2018 to conduct the empirical analysis. It is found that TMT’s overseas experience exerts positive impacts on green innovation and that the positive relationship between TMT’s overseas experience and green innovation can be positively moderated by digital transformation and digital economy development. In addition to micro-level data on firm characteristics, we further incorporate macro-level data on regional digital economy development into this study. The combination of both micro- and macro-level data in the empirical analysis allows us to scrutinize the moderating effects of firms’ digital transformation and regional digital economy development, which have not been simultaneously and systematically investigated in previous studies. Our findings provide a theoretical basis and practical implications for firms to adjust the structure and strategic choices of TMTs effectively to drive green innovation development.

The contributions of this study to the existing literature are threefold. First, we extend the literature on the antecedents and determinants of firms’ green innovation performance. In particular, we contribute to the determinants of green innovation at the firm level, that is, the specific characteristics of TMT and the context of the digital era. Second, this study adds to the previous literature on TMTs and their strategic outcomes. In particular, we contribute to the research stream on upper echelons theory by providing empirical evidence for the relationship between the TMT’s overseas experience and firms’ green innovation performance. Finally, we highlight the importance of digital transformation and digital economy development in the process of TMT decision-making, which has not been systematically studied in previous studies. Although some of the recent studies have explored the relationship between the characteristics of TMT and firm performance in the digital age [

19,

20], this study differs from their work in two major aspects. On the one hand, by utilizing a panel dataset of Chinese listed firms, we focus on firms’ sustainable development from the perspective of green innovation. On the other hand, we specifically examine the moderating effects of firms’ digital transformation and regional digital economy development, which contribute to existing studies by shedding both micro- and macro-level empirical light on this topic.

The remainder of the study is organized as follows.

Section 2 provides the literature review and develops three hypotheses.

Section 3 presents the data and methodology used.

Section 4 presents the empirical results and robustness checks.

Section 5 discusses the findings and provides theoretical and practical implications. Finally,

Section 6 concludes the study.

5. Discussion

Nowadays, many countries have declared their commitment to sustainable practices in response to the United Nations’ SDGs. Meanwhile, the digital economy has fundamental impacts on business activities and performance. Especially in developing countries, such as China, Brazil and South Africa, firms are increasingly embedded in complex contexts that drive their strategic behavior and performance outcomes to be more environmentally friendly and sustainable [

26,

27]. As one of the key decision-makers in the firms, TMT plays a particularly important role in strategy formulation and the strategic direction process. TMTs’ overseas experience, as one type of unique resource, constitutes the cognitive basis of the team and thus influences firms’ strategic decision-making. Therefore, how TMT’s overseas experience affects firms’ green innovation in the digital era has become an important and interesting research direction.

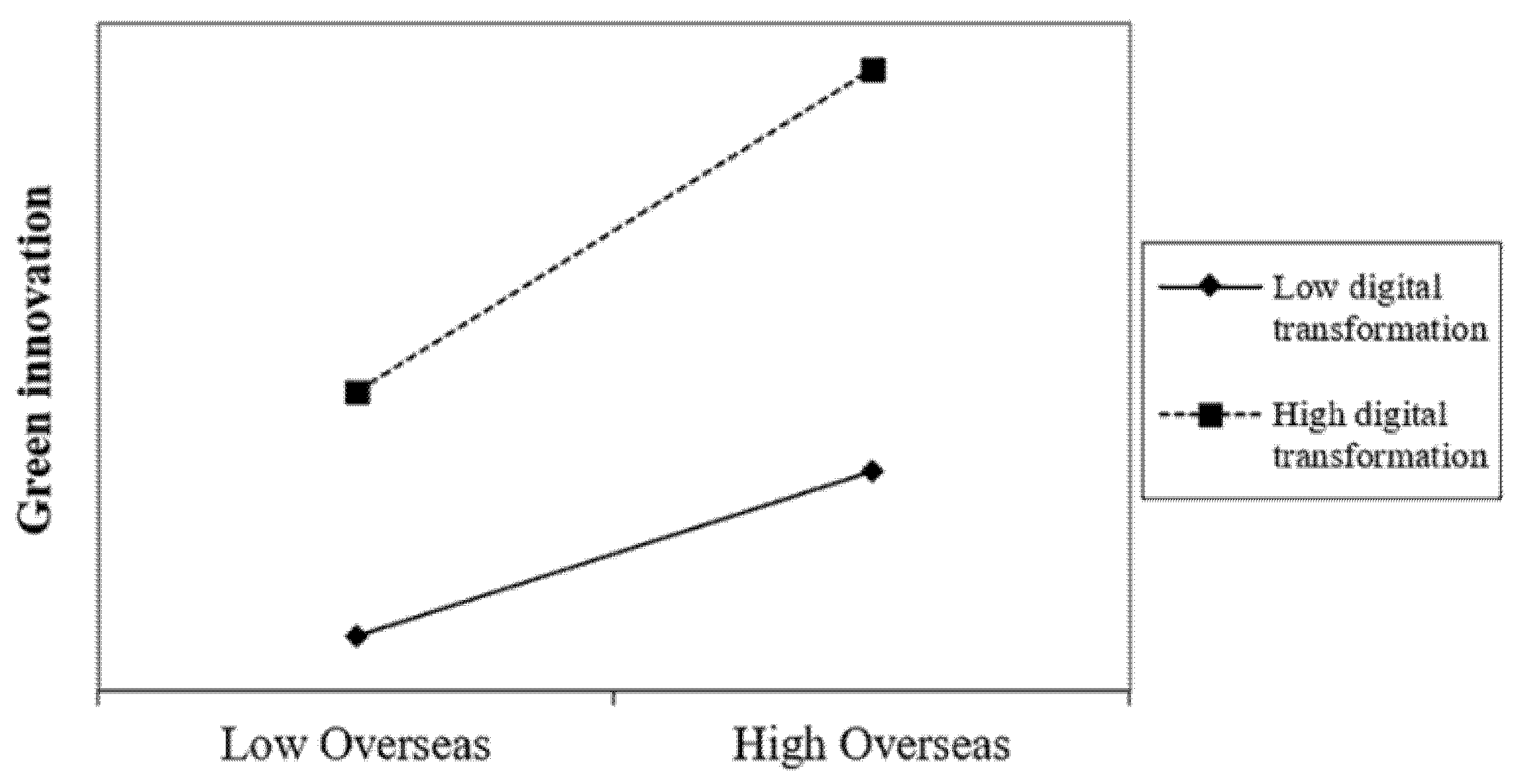

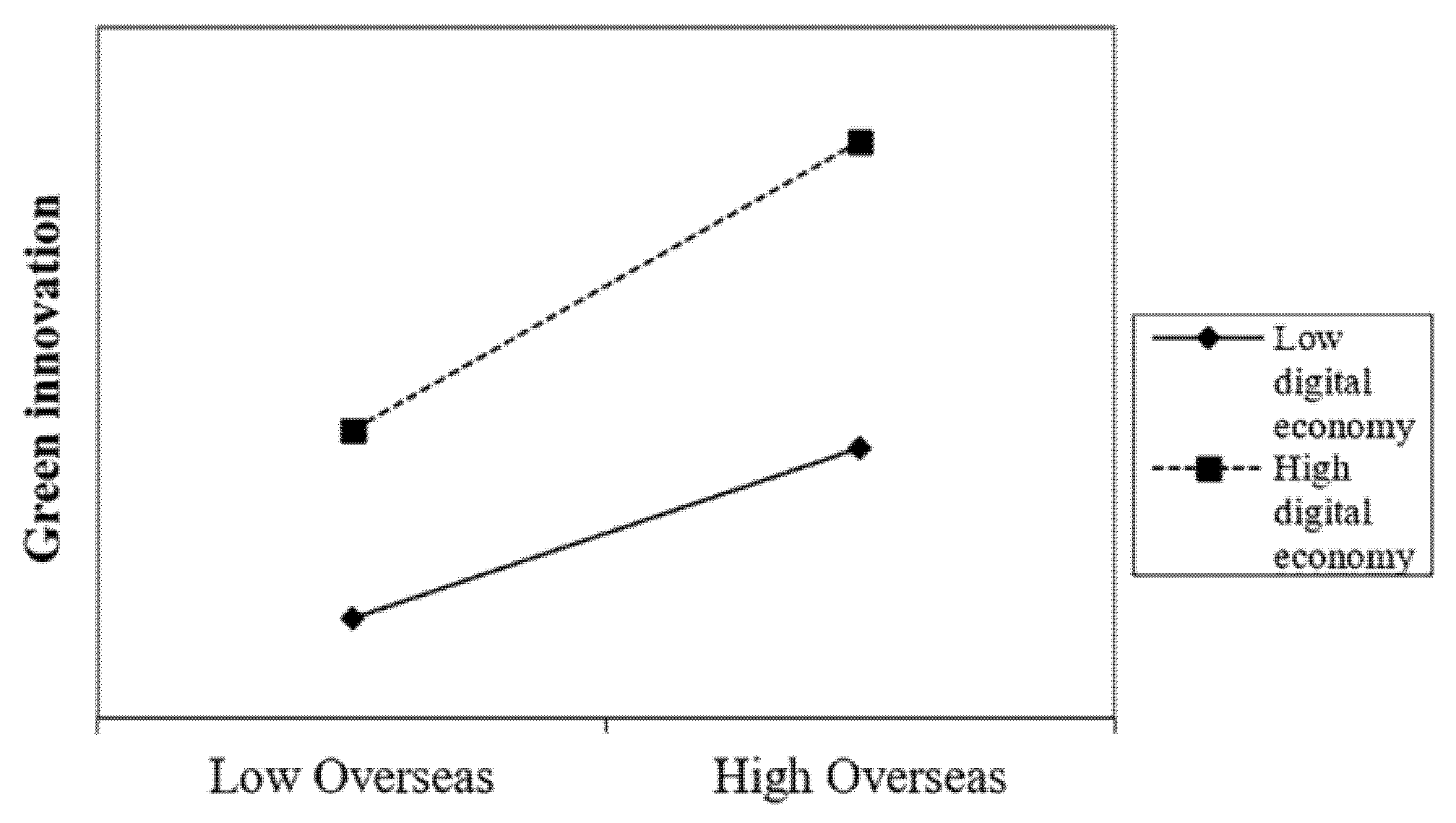

By combining upper echelons theory with innovation research, this study sheds light on the theoretical relationship between TMT overseas experience, digital economy, and green innovation. To obtain an empirically grounded understanding of this important topic, this study uses a panel dataset of Chinese listed firms from 2011 to 2018, and finds significant and robust evidence to support the hypotheses. We have two important findings. First, TMT’s overseas experience positively affects firms’ green innovation performance in that the challenging and complex task of green innovation requires higher risk tolerance, confidence, and moral courage from decision makers, which are the at-tributes of TMT members with overseas experience. Second, firm- level digital transformation and region- level digital economy development positively moderate the relationship between TMT overseas experience and firms’ green innovation performance in that digital economy may reduce costs and improve efficiency.

5.1. Theoretical Implications

Synthesizing upper echelon theories and the emergent research on the digital economy, our study provides a theoretical framework and empirical evidence that TMTs’ overseas experience promotes firms’ green innovation performance and that this positive relationship is more pronounced for firms with higher digital transformation and for firms located in regions with better digital economy development. Thus, the contributions of this study are threefold.

Firstly, this study contributes to the existing literature on the antecedents and determinants of green innovation at the organizational level. Emergent research has focused on the determinants of green innovation/eco-innovation/environmental innovation from the perspectives of human capital [

21], relationship system [

36], export intensity [

37], and dynamic capabilities [

25]. We extend the literature on green innovation from the firm management perspective by investigating the interaction between TMT characteristics and digital economy development in the context of the digital age.

Secondly, this study advances the upper echelons literature on the impact of TMTs’ overseas experience on firms’ strategies and performance. Upper echelons theory is a theoretical framework that states that organizations’ strategic choices and performance are predicted by their TMT characteristics and a methodology that relies on TMT member demography as a measurement proxy for individual and group cognition and behavior [

46,

55]. Based on upper echelons theory, some previous studies have found the positive impacts of TMTs’ or CEOs’ international experience or diversity on firms’ strategic choices [

43,

48], internationalization [

54,

56], innovation performance [

47,

57], and social responsibility [

58]. However, few studies have focused on TMTs’ international experience impacts on green performance, and most of the literature has not studied the role of digital economy development in the TMT’s decision-making process.

Finally, this study sheds light on the literature in a new field of research, digital economy and corporate strategy. Despite the growing awareness of the topic in practice, digital economy topics have rarely been touched upon in the previous literature on TMT. Previous studies have called for research to focus on the digital economy [

11] and its impacts on innovation [

12] and sustainable development [

20]. To respond to this need, we contribute to determining the contingency effects of how firm digital transformation and regional digital economy shape the positive effect of TMTs’ overseas experience on green innovation.

5.2. Practical Implications

This study generates various policy implications for governments and managerial implications for firms that intend to promote sustainable growth and green transformation.

Firstly, our findings provide implications for governments, particularly in developing countries. Many countries have endeavored to fulfill the SDGs and should encourage more responsible innovation [

2]. In developing countries, green innovation is of vital for firms to gain competitive advantages and be able to compete with developed countries [

26]. This study reveals the importance of human capital in green innovation and extends research on green innovation in terms of the overseas experience of TMTs, which is helpful for firms when deciding on TMT strategies and investing in innovation. In this new stage of economic development, attracting excellent talent with overseas experience to drive green innovation is undoubtedly an important path toward achieving high-quality and environmentally friendly development. Additionally, governments should attach importance to digital economy development and further strengthen the development of digital infrastructure, which is particularly important for promoting firms to carry out energy savings, emission reduction, and environmentally friendly industrial upgrading.

Secondly, our findings suggest that the structure of the TMT is a key driver of green innovation performance. Since green innovation has been proven to be significant for firms’ development and performance [

22,

24], firms should consider its strategic aspects. Firms should be aware that heterogeneous TMTs may have richer perspectives and diversified resources and information to help make high-quality strategic decisions [

51,

80]. In addition, firms should be aware of the importance of green innovation in their organizations’ sustainable development.

Finally, this study highlights the value of digital economy for firms’ sustainable goals and sustainable development. It has been widely acknowledged that digital economy can aid in accelerating organizational performance [

64,

81] and sustainable development [

14], but its role in the decision-making process of knowledge exchange and knowledge spillovers should not be neglected. Thus, firms should be able to recognize the importance of digital economy development in promoting green innovation and ensure that digital economy development plays a greater role in firms’ innovation and sustainable development. As firms are conducting green innovation in response to government policy, policy-makers should take preemptive action to encourage firms’ managers to pursue eco-innovation and green transformation in the digital era. To the extent that green innovation activities are advantageous for both firms and the whole society, this study implies that governments can promote firms’ green transformation and sustainable growth by providing financial incentives and environmental subsidies to achieve a win–win outcome.

5.3. Limitations and Future Research Directions

Although this study makes several contributions to the literature, there are some potential limitations that should be addressed in future research. Firstly, even though we conducted a thorough analysis using the latest measure of the digital economy (i.e., firms’ digital transformation by dictionary-based text analysis from annual report and regions’ digital economy development by PCA from statistical yearbooks), these measures can only reflect some specific aspects of digital economy development. Future research can extend our research with detailed studies of other specific components of digital transformation (e.g., digital marketing or digital servitization) or digital economy development (e.g., digital government or digital finance). Secondly, due to the limitation in data access, our research sample comprises Chinese listed firms, which are mostly large and profitable firms. Practice and previous studies show that there are potential differences between large firms and small- and medium-sized enterprises (SMEs) in terms of management practices and strategic decisions [

82]. Future research can compare the different strategic outcomes between listed firms and SMEs in terms of TMT and green innovation using more in-depth survey data. Thirdly, our research has identified the TMT’s overseas background as a significant characteristic that shapes firms’ green innovation. Limited by data access, the key measure of TMT’s overseas background is based on the general calculation on the quantity of TMT background based on the text analysis from the annual report. If future research conducts survey analysis and obtain more detailed data, it would be interesting to examine more diverse aspects of TMT members regarding overseas background (e.g., local connections and inter-organization connections) to compare with local TMT members. Moreover, it would be interesting to investigate the original countries of the TMTs’ overseas experience because the context in which that overseas experience is absorbed may matter in the green innovation decision-making process. Last but not least, as it has been documented in the literature that green innovation requires more external sources of knowledge and information compared to other innovations [

83], exploring the differential impacts of internal and external sources of knowledge on green innovation deserves further investigation. Examining the organizational absorptive capacity of external knowledge (e.g., partnerships, cooperation, and open innovation) is worthy of further study.