1. Introduction

Environmental problems, such as climate change caused by global warming, are considered a persistent and extensive hazard that poses an enormous threat to human life and sustainable development [

1]. In most cases, however, environmental deterioration and ecological harm result from the production and manufacturing activities of enterprises [

2]. As environmental issues such as global warming and the oil crisis gain prominence, society’s environmental protection obligations for enterprises become increasingly stringent. Given this, enterprises have opted for green innovation as an effective method to achieve cleaner production and improved competitiveness [

3] because green innovation may drastically reduce the negative environmental impact of production and operations [

4].

In the era of the digital economy, digital technologies such as artificial intelligence, blockchain, cloud computing, big data, and the Internet of Things (IoT) are being applied broadly and intensively to the real economy, forcing enterprises to explore transformational pathways. The rapid expansion of the digital economy presents excellent opportunities for enterprises’ breakthrough innovation through the use of digital technologies, which would reshape enterprises’ production and operation models and play an increasingly crucial role in improving the efficiency of resource utilization [

5]. Existing research indicates that institutional pressure [

6], market demand [

7], innovation capacity [

8], and organizational factors [

9] are vital drivers of corporate green innovation. Despite this, there is a paucity of research addressing how digital transformation fosters green innovation [

10], particularly, there is lack of empirical evidence from the micro perspective of enterprises [

11]. Consequently, this paper studies the economic consequences of digital transformation from the standpoint of green innovation on the micro perspective of enterprises.

Despite China’s ascending economy in recent years, major environmental degradation has also been brought on by its extensive development model of high investment, high pollution, and high energy-consumption [

2]. It is a pressing issue for China to switch from an extensive development model to a green development model driven by total factor productivity [

12]. In order to attain “zero CO

2 emissions” by 2060, the Chinese government has committed to actively implementing the idea of green development, halting the growth of CO

2 emissions by 2030 and offsetting its own emissions by planting trees, conserving energy, and cutting emissions. Meanwhile, China has always emphasized and promoted the deep integration of information technology with the real economy, with the purpose of seizing opportunities of the new industrial revolution, building new digitally-driven industrial ecologies, and achieving high-quality economic development. In 2013, The Assessment Specification of Industrial Enterprises’ Informatization and Industrialization Integration (GBT23020-2013) was issued by China’s National Standardization Administration Committee, which emphasized strengthening the digitalization of the whole manufacturing process by 23 times and acted as the national criterion for promoting corporate digitalization. In 2014, the pilot project of the Integration of Informatization and Industrialization (IoII) was launched throughout China by the Ministry of Industry and Information Technology (MIIT). Those that met the criteria of the Specification were recognized as pilot enterprises. China’s pilot project of IoII presents a sound quasi-natural experimental setting for determining the economic consequences of corporate digital transformation. On the basis of this theoretical and practical background, by selecting pilot enterprises of IoII as the treatment group and those non-pilot enterprises as the control group, we apply the difference-in-differences (DID) model to explore the causal relationship between corporate digital transformation and green innovation, as well as how the macro external environment, meso industry attributes, and micro enterprise characteristics influence this relationship in order to further pursue the sustainable advantages of green innovation.

This paper makes three contributions. First, the existing research on digital transformation focuses mostly on corporate performance and capital market performance, but less on corporate environmental sustainability. We study the economic consequences of corporate digital transformation from the standpoint of green innovation, hence enriching research on digital transformation and its economic consequences. Then, we analyze and empirically test the impact of corporate digital transformation on environmental sustainability, thus extending research on the impact factors of corporate green innovation. Third, we examine the enhancement function of corporate digital transformation on environmental sustainability, providing empirical evidence through the implementation of the “IoII” policy, as well as a theoretical foundation and practical recommendation for advancing corporate digital transformation and promoting environmental sustainability.

The reminder of the paper is structured as follows:

Section 2 reviews the literature on corporate digitalization and green innovation;

Section 3 demonstrates the hypotheses of the paper;

Section 4 details the research design;

Section 5 presents and discusses the primary results and robustness tests;

Section 6 provides extended analysis; and

Section 7 concludes the paper.

3. Hypothesis Development

According to existing studies, green innovation requires integrating resource consumption and manufacturing processes, internal and external technical skills, and enhanced information sharing. AI, blockchain, cloud computing, big data, and the Internet of Things provide enterprises with new opportunities for green innovation. Through data mining, information sharing, and knowledge integration, corporate digital transformation may optimize green innovative resources and then enhance green technology innovation.

(1) Data mining. Corporate digital transformation has data mining functions to boost the system’s internal data vitality, and to help enterprises optimize their existing manufacturing process by enhancing energy efficiency and lowering pollutant emissions. From product design to terminal distribution, enterprises have acquired vast volumes of data. Before digital transformation, the efficiency of data processing is low, and enterprises cannot effectively mine the laws implicit in the data. Nevertheless, through the implementation of digital transformation, enterprises are equipped to process enormous, non-standardized, unstructured data with digital technologies, encode and output it as structured and standardized information, and increase information availability.

An intelligent production system is equal to automating data collection, storage, analysis, production, monitoring, and management [

58]. Precision sensing technology and an intelligent system enables enterprises to monitor and analyze the production process, instantly complete the traceability and positioning of high-energy consumption links, combined with big data mining to continuously improve the follow-up production process, and provide a reliable basis for green innovation project decisions. Cloud computing also makes data mining economical for enterprises. Therefore, through the implementation of digital transformation, enterprises have more data mining space, better innovation decision-making ability, and deeper R & D project knowledge.

Enterprises can fully utilize this data to make the best production and sales decisions to optimize production and sale processes [

59], ensuring that their processing and manufacturing procedures follow environmental laws, and minimizing the negative effects on the environment.

(2) Information sharing. Corporate digital transformation can be capable of accelerating information exchange, promoting the sharing of information related to internal and external environment and resources, so as to motivate enterprises to engage in green technology innovation activities. Traditional enterprise information transfer and communication is inefficient, confined by time and space. However, digital technologies have eliminated barriers to achieving instant transmission of information and instant communication between individuals, hence significantly enhancing communication efficiency.

Internal and external information sharing are included in information sharing. Internal information sharing refers to the transfer and integration of data between organizational divisions [

60]. Digital technologies enhance links between employees, departments, and objects. Built by digital technologies such as cloud computing and the Internet of Things, data centers or data center clusters will efficiently collect and store enterprise data, share data via cloud platforms to break down “departmental walls”, eliminate “information silos” within the enterprise, and generate complementary innovations through the effective integration of internal resources [

61]. External information sharing stresses corporate contact and collaboration with external market participants. External information sharing is more effective as a result of digital transformation. Digital technologies enable enterprises to communicate more effectively with suppliers, customers, and governments, enabling them to possess external information in real time and facilitating internal and external communication and interaction. This will encourage information sharing to stimulate enterprises’ green innovation [

62].

Given this, digital transformation may increase the efficiency of information sharing within enterprises, as well as between internal and external partners, thereby fostering green innovation.

(3) Knowledge integration. Corporate digital transformation may promote the integration of R & D resources and knowledge to effectively accelerate enterprises to carry out green innovation activities. From the perspective of knowledge, green innovation is essentially a complex knowledge activity, involving the creation, integration, and diffusion of knowledge in different technological fields, such as corporate production and pollution reduction. It is challenging to obtain green innovation achievements with experience and knowledge from simply one technological discipline. To master green innovation’s mainstream technology, new ideas, and development trends, enterprises must combine information from several technical sectors, and manage and apply internal and external knowledge. Integration of knowledge is therefore an essential and effective method for manufacturing enterprises to execute green innovation.

Digital technologies help enterprises integrate knowledge. Agostino and Donati [

63] assumed that digital technologies may aid enterprises in enhancing exploratory search effects, gaining clear insight into their internal knowledge, and rapidly identifying and integrating external knowledge. Digital capture and intelligent analysis systems accelerate the integration of data resources, hence enhancing the effectiveness of green innovation decisions. Digital transformation links and aggregates data to provide innovation-relevant information [

11]. In addition, digital technologies will expand the area for innovation resource allocation, and encourage enterprises, universities, and research institutes to participate in cross-regional and cross-disciplinary collaborative innovation activities. According to Mubarak et al. [

64], digital technologies may stimulate open innovation in enterprises, enabling employees to engage in green innovation. Therefore, digital technologies are equipped to facilitate the integration and interchange of R & D resources, as well as the integration and reconfiguration of diverse knowledge elements across multiple technological disciplines, thereby boosting corporate green innovation.

In summary, through data mining, information sharing, and knowledge integration, corporate digital transformation may drive green innovation and improve environmental sustainability. The logic chain is shown in

Figure 1. Based on the above analysis, this paper proposes the following hypothesis.

Hypothesis 1. Corporate digitalization has a positive impact on green innovation.

7. Conclusions

This paper studies the economic consequences of corporate digital transformation via the lens of green innovation. Using a quasi-natural experimental scenario of the gradual deployment of “Integration of Informatization and Industrialization”, pilot firms are the treatment group and non-pilot firms are the control group. A DID model is used to evaluate the causal relationship and value enhancement mechanism between corporate digital transformation and green innovation, as well as how regional digital economy environment, industry competition, and firm size influence this relationship. The following conclusions are drawn.

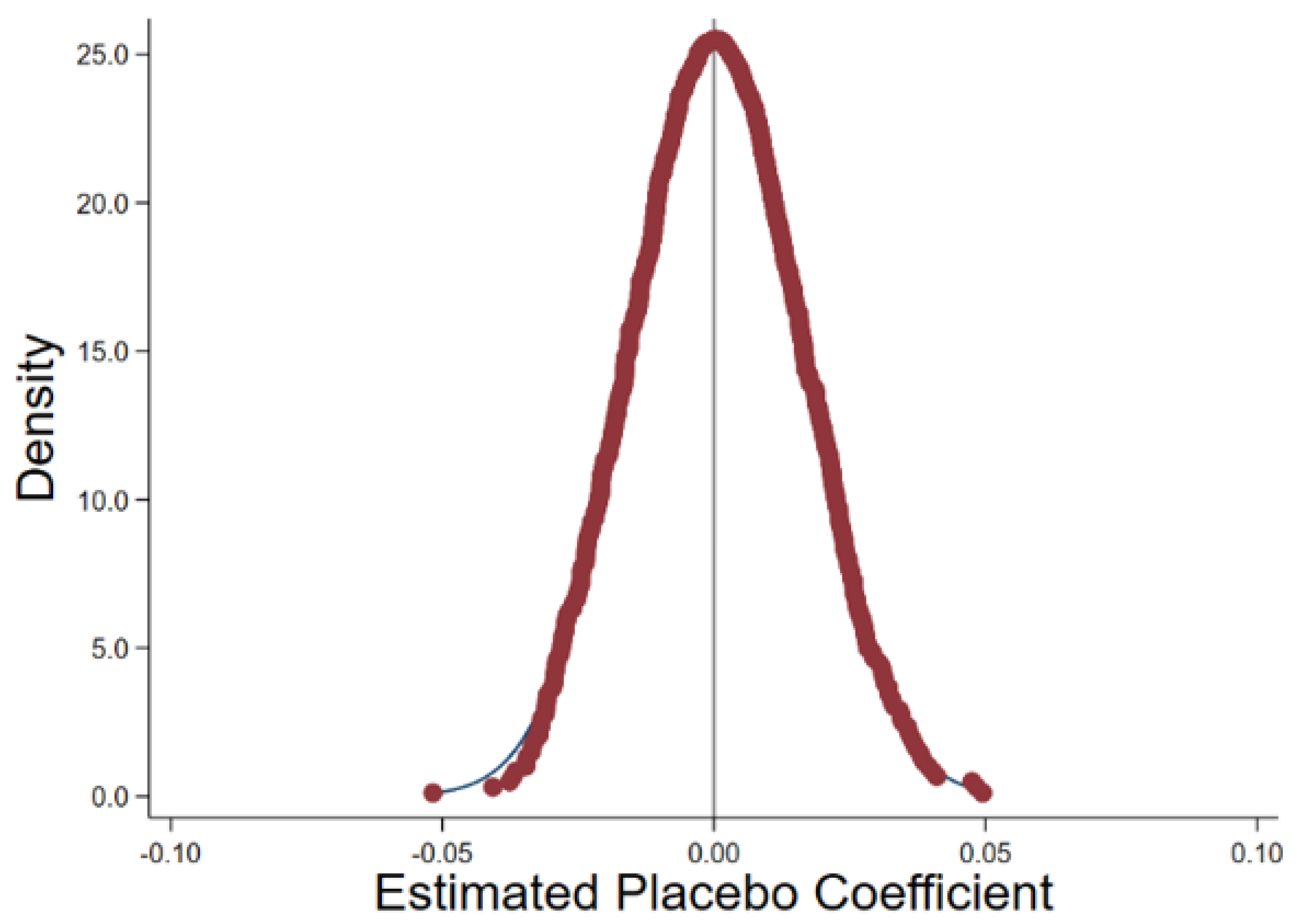

Green innovation output significantly increases after firms become pilots of the “Integration of Informatization and Industrialization” project, and the influence of corporate digital transformation on green innovation output is more substantial in regions with ailing digital economy, industries with lesser competition, and firms with larger size. It signifies that corporate digital transformation can boost green innovation output, but it is susceptible to the macro external environment, meso industry characteristics, and micro firm features. To evaluate the robustness of the empirical results, a parallel trend test, PSM-DID, Placebo tests, and delete observations which entered the pilot list in the current year are used, and the conclusion remains the same.

As the Integration of Informatization and Industrialization is an essential endeavor to promote corporate digital transformation and digital economy in China, its implementation effect has significant implications for China’s industrial transformation and upgrade, as well as the further development of digital industrialization and industrial digitization.

Nevertheless, this paper still has several limitations. First, due to the pilot policy, the sample firms in this study are confined to manufacturing industry, thus additional research is required to determine whether the findings are applicable to other industries. Then, the potential mechanisms by which corporate digital transformation affects green innovation need to be further explored. In addition, previous studies on the economic consequences of digital transformation still lack empirical evidence from the standpoint of micro enterprises, and future research can shed more light on this field.