Study on the Influence Mechanism of Environmental Management System Certification on Enterprise Green Innovation

Abstract

1. Introduction

2. Literature Review and Research Hypothesis

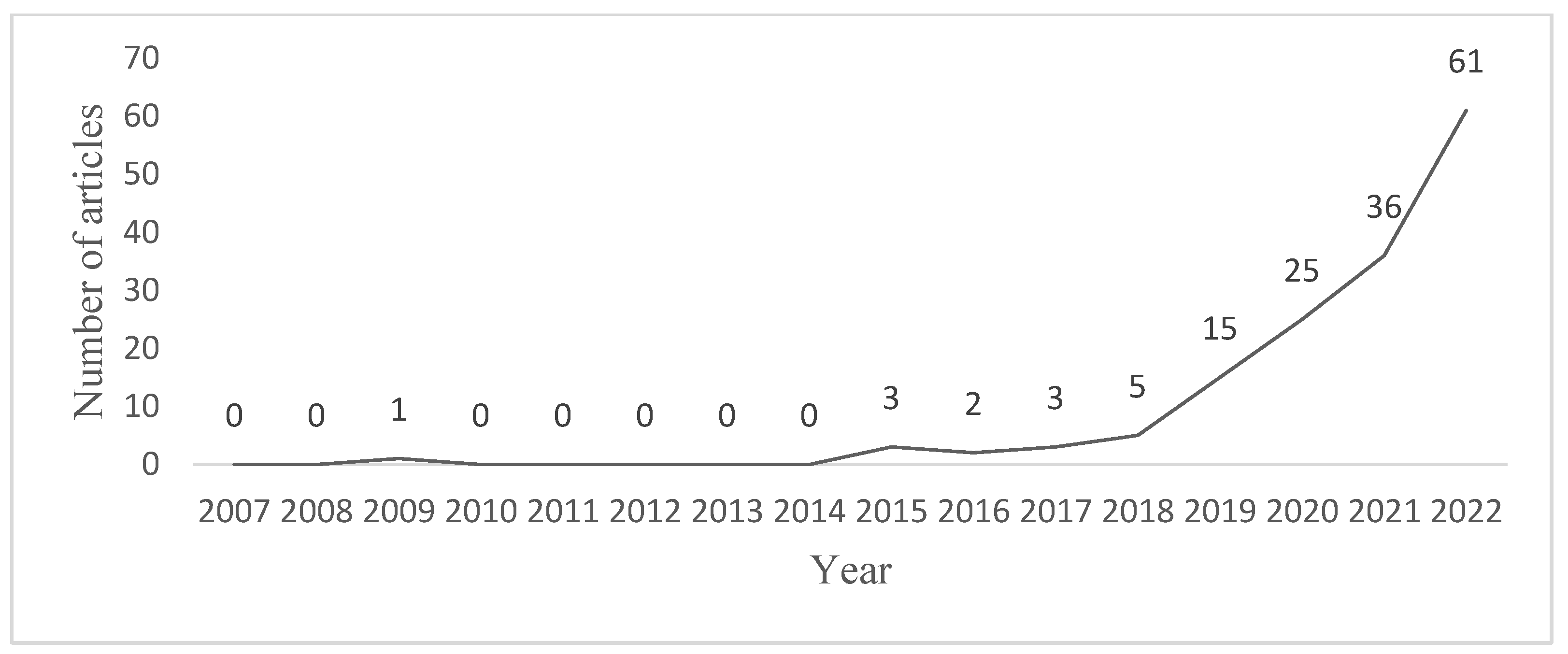

2.1. Literature Review

2.2. Research Hypothesis

2.2.1. The Relationship between EMSC and Corporate Green Innovation

2.2.2. The Differentiated Impact of EMSC on Corporate Green Innovation

2.2.3. The Moderating Role of Stakeholders

3. Materials and Methods

3.1. Sample Selection and Data Sources

3.2. Variables Definition

3.2.1. Explained Variable

3.2.2. Explanatory Variable

3.2.3. Moderating Variables

3.2.4. Control Variables

3.3. Model Specification

4. Results and Discussion

4.1. Descriptive Statistics

4.2. Impact of ESMC on Enterprises’ Green Innovation

4.3. Robustness Test

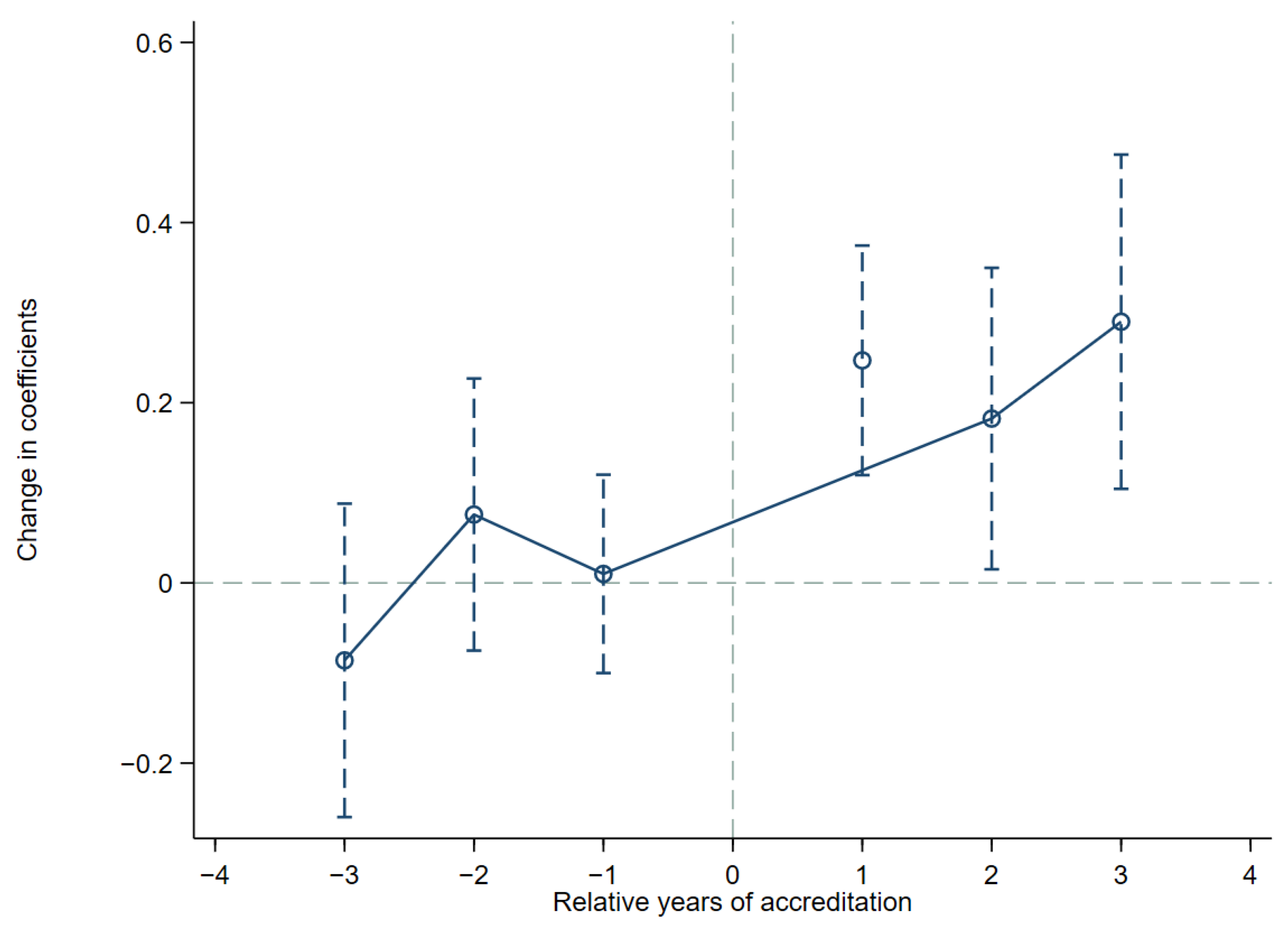

4.3.1. Common Trend Test

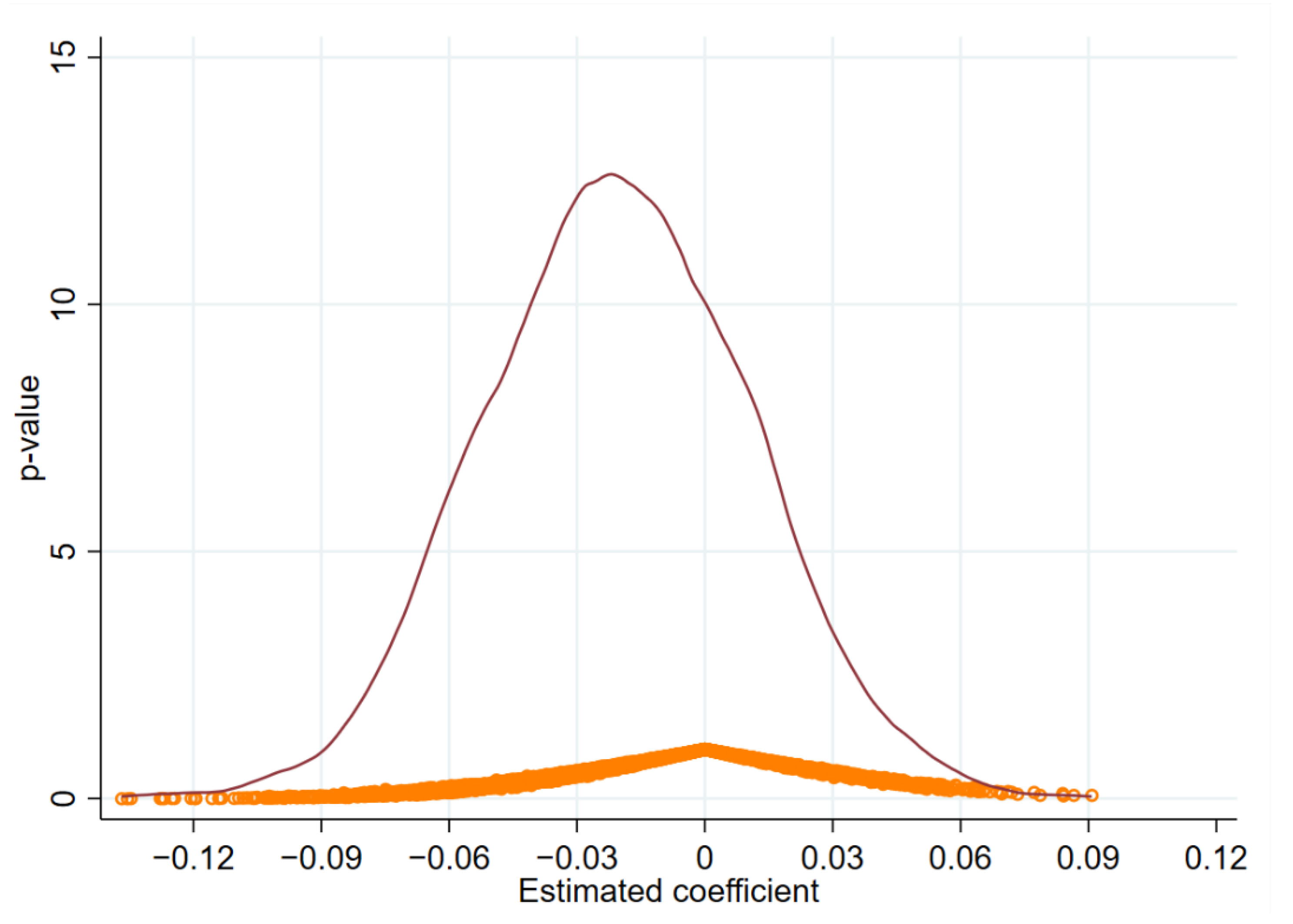

4.3.2. Placebo Test

4.3.3. Substitution of Explanatory Variables

4.3.4. Change Observation Window Period

4.3.5. Replacement Estimation Method

4.4. Heterogeneity Analysis

4.4.1. Enterprises’ Sizes

4.4.2. Enterprises’ Ownership

4.4.3. Enterprises’ Lifecycle

4.5. Mechanism Analysis

4.6. Discussion

5. Conclusions and Policy Implications

5.1. Conclusions

5.2. Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Luo, Y.; Salman, M.; Lu, Z. Heterogeneous impacts of environmental regulations and foreign direct investment on green innovation across different regions in China. Sci. Total Environ. 2021, 759, 143744. [Google Scholar] [CrossRef] [PubMed]

- Zhang, D.; Zheng, M.; Feng, G.F.; Chang, C.-P. Does an environmental policy bring to green innovation in renewable energy? Renew. Energy 2022, 195, 1113–1124. [Google Scholar] [CrossRef]

- Li, J.; Du, Y.X. Spatial effect of environmental regulation on green innovation efficiency: Evidence from prefectural-level cities in China. J. Clean. Prod. 2021, 286, 125032. [Google Scholar] [CrossRef]

- Pan, X.; Cheng, W.; Gao, Y.; Balezentis, T.; Shen, Z. Is environmental regulation effective in promoting the quantity and quality of green innovation? Environ. Sci. Pollut. Res. 2021, 28, 6232–6241. [Google Scholar] [CrossRef]

- Fang, Z.; Razzaq, A.; Mohsin, M.; Irfan, M. Spatial spillovers and threshold effects of internet development and entrepreneurship on green innovation efficiency in China. Technol. Soc. 2022, 68, 101844. [Google Scholar] [CrossRef]

- Zeng, W.; Li, L.; Huang, Y. Industrial collaborative agglomeration, marketization, and green innovation: Evidence from China’s provincial panel data. J. Clean. Prod. 2021, 279, 123598. [Google Scholar] [CrossRef]

- Wang, Q.J.; Wang, H.J.; Chang, C.P. Environmental performance, green finance and green innovation: What’s the long-run relationships among variables? Energy Econ. 2022, 110, 106004. [Google Scholar] [CrossRef]

- Shahzad, M.; Qu, Y.; Javed, S.A.; Zafar, A.U.; Rehman, S.U. Relation of environment sustainability to CSR and green innovation: A case of Pakistani manufacturing industry. J. Clean. Prod. 2020, 253, 119938. [Google Scholar] [CrossRef]

- Huang, Z.; Liao, G.; Li, Z. Loaning scale and government subsidy for promoting green innovation. Technol. Forecast. Soc. Chang. 2019, 144, 148–156. [Google Scholar] [CrossRef]

- Abbas, J.; Sağsan, M. Impact of knowledge management practices on green innovation and corporate sustainable development: A structural analysis. J. Clean. Prod. 2019, 229, 611–620. [Google Scholar] [CrossRef]

- Wang, H.; Qi, S.; Zhou, C.; Zhou, J.; Huang, X. Green credit policy, government behavior and green innovation quality of enterprises. J. Clean. Prod. 2022, 331, 129834. [Google Scholar] [CrossRef]

- Chen, Z.; Zhang, X.; Chen, F. Do carbon emission trading schemes stimulate green innovation in enterprises? Evid. China. Technol. Forecast. Soc. Chang. 2021, 168, 120744. [Google Scholar] [CrossRef]

- Poksinska, B.; Jörn dahlgaard, J.; Eklund, J.A. Implementing Iso 14000 in Sweden: Motives, Benefits and Comparisons with Iso. Int. J. Qual. Reliab. Manag. 2003, 20, 585–606. [Google Scholar] [CrossRef]

- Nishitani, K. An Empirical Analysis of the Effects on Firms’ Economic Performance of Implementing Environmental Man-agement Systems. Environ. Resour. Econ. 2011, 48, 569–586. [Google Scholar] [CrossRef]

- Chang, C.H. The influence of corporate environmental ethics on competitive advantage: The mediation role of green innova-tion. J. Bus. Ethics 2011, 104, 361–370. [Google Scholar] [CrossRef]

- Lai, A.; Yang, Z.; Cui, L. Can environmental regulations break down domestic market segmentation? Evidence from China. Environ. Sci. Pollut. Res. 2022, 29, 10157–10172. [Google Scholar] [CrossRef]

- Liao, Z.; Xu, C.; Cheng, H.; Dong, J. What drives environmental innovation? A content analysis of listed companies in China. J. Clean. Prod. 2018, 198, 1567–1573. [Google Scholar] [CrossRef]

- Wang, F.; Feng, L.; Li, J.; Wang, L. Environmental regulation, tenure length of officials, and green innovation of enterprises. Int. J. Environ. Res. Public Health 2020, 17, 2284. [Google Scholar] [CrossRef]

- Yi, M.; Wang, Y.; Yan, M.; Fu, L.; Zhang, Y. Government R&D subsidies, environmental regulations, and their effect on green innovation efficiency of manufacturing industry: Evidence from the Yangtze River economic belt of China. Int. J. Environ. Res. Public Health 2020, 17, 1330. [Google Scholar]

- Liu, Y.; Wang, A.; Wu, Y. Environmental regulation and green innovation: Evidence from China’s new environmental protection law. J. Clean. Prod. 2021, 297, 126698. [Google Scholar] [CrossRef]

- Yang, L.; Zhang, J.; Zhang, Y. Environmental regulations and corporate green innovation in China: The role of city leaders’ promotion pressure. Int. J. Environ. Res. Public Health 2021, 18, 7774. [Google Scholar] [CrossRef] [PubMed]

- Zhong, Z.; Peng, B. Can environmental regulation promote green innovation in heavily polluting enterprises? Empirical evidence from a quasi-natural experiment in China. Sustain. Prod. Consum. 2022, 30, 815–828. [Google Scholar] [CrossRef]

- Sun, W.; Yang, Q.; Ni, Q.; Kim, Y. The impact of environmental regulation on employment: An empirical study of China’s Two Control Zone policy. Environ. Sci. Pollut. Res. 2019, 26, 26472–26487. [Google Scholar] [CrossRef] [PubMed]

- Peng, H.; Shen, N.; Ying, H.; Wang, Q. Can environmental regulation directly promote green innovation behavior?—based on situation of industrial agglomeration. J. Clean. Prod. 2021, 314, 128044. [Google Scholar] [CrossRef]

- He, X.; Huang, S.Z.; Chau, K.Y.; Shen, H.W.; Zhu, Y.L. A study on the effect of environmental regulation on green innovation performance: A case of green manufacturing enterprises in Pearl River Delta in China. Ekoloji 2019, 28, 727–736. [Google Scholar]

- Tang, K.; Qiu, Y.; Zhou, D. Does command-and-control regulation promote green innovation performance? Evidence from China’s industrial enterprises. Sci. Total Environ. 2020, 712, 136362. [Google Scholar] [CrossRef]

- Wang, P.; Dong, C.; Chen, N.; Qi, M.; Yang, S.; Nnenna, A.B.; Li, W. Environmental Regulation, Government Subsidies, and Green Technology Innovation—A Provincial Panel Data Analysis from China. Int. J. Environ. Res. Public Health 2021, 18, 11991. [Google Scholar] [CrossRef]

- Jiang, Z.; Wang, Z.; Zeng, Y. Can voluntary environmental regulation promote corporate technological innovation? Bus. Strategy Environ. 2020, 29, 390–406. [Google Scholar] [CrossRef]

- Lanoie, P.; Laurent-Lucchetti, J.; Johnstone, N.; Ambec, S. Environmental Policy, Innovation and Performance: New Insights on the Porter Hypothesis. J. Econ. Manag. Strategy 2011, 20, 803–842. [Google Scholar] [CrossRef]

- Smirnova, O.; Strumsky, D.; Qualls, A.C. Do federal regulations beget innovation? Legislative policy and the role of executive orders. Energy Policy 2021, 158, 112570. [Google Scholar] [CrossRef]

- Wang, X.; Zhang, T.; Nathwani, J.; Yang, F.; Shao, Q. Environmental regulation, technology innovation, and low carbon development: Revisiting the EKC Hypothesis, Porter Hypothesis, and Jevons’ Paradox in China’s iron & steel industry. Technol. Forecast. Soc. Chang. 2022, 176, 121471. [Google Scholar]

- Huber, J. Pioneer countries and the global diffusion of environmental innovations: Theses from the viewpoint of ecological modernisation theory. Glob. Environ. Chang. 2008, 18, 360–367. [Google Scholar] [CrossRef]

- Dechezleprêtre, A.; Sato, M. The impacts of environmental regulations on competitiveness. Rev. Environ. Econ. Policy 2017, 11, 183–206. [Google Scholar] [CrossRef]

- Van Leeuwen, G.; Mohnen, P. Revisiting the Porter hypothesis: An empirical analysis of green innovation for the Netherlands. Econ. Innov. New Technol. 2017, 26, 63–77. [Google Scholar] [CrossRef]

- Amores-Salvadó, J.; Martin-de Castro, G.; Navas-López, J.E. The Importance of the Complementarity Between Environmental Management Systems and Environmental Innovation Capabilities: Afirm Level Approach to Environmental and Business Performance Benefits. Technol. Forecast. Soc. Chang. 2015, 96, 288–297. [Google Scholar] [CrossRef]

- Hsiao, T.Y.; Chuang, C.M.; Kuo, N.W.; Yu, S.M.-F. Establishing attributes of an environmental management system for green hotel evaluation. Int. J. Hosp. Manag. 2014, 36, 197–208. [Google Scholar] [CrossRef]

- Rennings, K.; Ziegler, A.; Ankele, K.; Hoffmann, E. The Influence of Different Characteristics of the Eu Environmental Management and Auditing Scheme on Technical Environmental Innovations and Economic Performance. Ecol. Econ. 2006, 57, 45–59. [Google Scholar] [CrossRef]

- Shu, C.; Zhou, K.; Xiao, Y.; Gao, S. How Green Management Influences Product Innovation in China: The Role of Institutional Ben-efits. J. Bus. Ethics 2016, 133, 471–485. [Google Scholar] [CrossRef]

- Zhang, Y.; Hu, H.; Zhu, G.; You, D. The impact of environmental regulation on enterprises’ green innovation under the constraint of external financing: Evidence from China’s industrial firms. Environ. Sci. Pollut. Res. 2022, 1–22. [Google Scholar] [CrossRef]

- Prag, A.; Röttgers, D.; Scherrer, I. State-owned enterprises and the low-carbon transition. OECD Environ. Work. Pap. 2018. No. 129. [Google Scholar] [CrossRef]

- Pfeffer, J. Size and Composition of Corporate Boards of Directors: The Organization and its Environment. Adm. Sci. Q. 1972, 17, 218–228. [Google Scholar] [CrossRef]

- Ma, Z.; Shu, G.; Wang, Q.; Wang, L. Sustainable Governance and Green Innovation: Aperspective from Gender Diversity in China’s Listed Companies. Sustainability 2022, 14, 6403. [Google Scholar] [CrossRef]

- Mayadunne, S.; Park, S. An economic model to evaluate information security investment of risk-taking small and medium enterprises. Int. J. Prod. Econ. 2016, 182, 519–530. [Google Scholar] [CrossRef]

- Kesidou, E.; Demirel, P. On the Drivers of Eco-innovations: Empirical Evidence from the UK. Res. Policy 2012, 41, 862–870. [Google Scholar] [CrossRef]

- Miller, D.; Friesen, P.H. Alongitudinal Study of the Corporate Life Cycle. Manag. Sci. 1984, 30, 1161–1183. [Google Scholar] [CrossRef]

- Shang, T.T.; Miao, X.M.; Lu, D.; Xin, X.-H. The evolutionary process of disruptive green innovation in China: Evidence from the electric bicycle sector. Technol. Anal. Strateg. Manag. 2020, 32, 910–922. [Google Scholar] [CrossRef]

- O’regan, N.; Ghobadian, A. Innovation in Smes: The Impact of Strategic Orientation and Environmental Perceptions. Int. J. Prod. Perform. Manag. 2005, 54, 81–97. [Google Scholar] [CrossRef]

- Maekelburger, B.; Schwens, C.; Kabst, R. Asset specificity and foreign market entry mode choice of small and medium-sized en-terprises: The moderating influence of knowledge safeguards and institutional safeguards. J. Int. Bus. Stud. 2012, 43, 458–476. [Google Scholar] [CrossRef]

- Bridoux, F.; Stoelhorst, J.W. Microfoundations for Stakeholder Theory: Managing Stakeholders with Heterogeneous Motives. Strateg. Manag. J. 2014, 35, 107–125. [Google Scholar] [CrossRef]

- Zhang, J.; Liang, G.; Feng, T.; Yuan, C.; Jiang, W. Green Innovation to Respond to Environmental Regulation: How External Knowledge Adoption and Green Absorptive Capacity Matter? Bus. Strategy Environ. 2020, 29, 39–53. [Google Scholar] [CrossRef]

- Song, H.; Yu, K.; Zhang, S. Green Procurement, Stakeholder Satisfaction and Operational Performance. Int. J. Logist. Manag. 2017, 28, 1054–1077. [Google Scholar] [CrossRef]

- Weng, H.H.; Chen, J.S.; Chen, P.C. Effects of green innovation on environmental and corporate performance: A stakeholder perspective. Sustainability 2015, 7, 4997–5026. [Google Scholar] [CrossRef]

- Popp, D. Induced innovation and energy prices. Am. Econ. Rev. 2002, 92, 160–180. [Google Scholar] [CrossRef]

- Fonseca, L.; Ramos, A.; Rosa, A.; Braga, A.; Sampaio, P. Stakeholders satisfaction and sustainable success. Stakehold. Satisf. Sus-Tainable Success 2016, 24, 144–157. [Google Scholar] [CrossRef]

- Ruf, B.M.; Muralidhar, K.; Brown, R.M.; Janney, J.J.; Paul, K. An Empirical Investigation of the Relationship Between Change in Corporate Social Performance and Financial Performance: Astakeholder Theory Perspective. J. Bus. Ethics 2001, 32, 143–156. [Google Scholar] [CrossRef]

- Crhová, Z.; Fišerová, Z.; Paseková, M. Corporate Insolvency Proceedings: A Case of Visegrad Four; Acta Universitatis Agriculturae et Silviculturae Mendelianae Brunensis: Brno, Czech Republic, 2016. [Google Scholar]

- Wu, J.; Xia, Q.; Li, Z. Green innovation and enterprise green total factor productivity at a micro level: A perspective of technical distance. J. Clean. Prod. 2022, 344, 131070. [Google Scholar] [CrossRef]

- Deshmukh, S.; Goel, A.M.; Howe, K.M. Do CEO beliefs affect corporate cash holdings? J. Corp. Financ. 2021, 67, 101886. [Google Scholar] [CrossRef]

- Sari, F.N.; Endri, E. Determinants of Return on Assets (ROA) On Conventional Banks Listed on Indonesian Stock Exchange (IDX) Period 2013–2017. IOSR J. Bus. Manag. (IOSR-JBM) 2019, 21, 52–62. [Google Scholar]

- Zhao, A.; Wang, J.; Sun, Z.; Guan, H. Environmental Taxes, Technology Innovation Quality and Firm Performance in China—A test of effects based on the Porter hypothesis. Econ. Anal. Policy 2022, 74, 309–325. [Google Scholar] [CrossRef]

- Chai, D.; Chiah, M.; Zhong, A. Decomposing value: Changes in size or changes in book-to-market? Pac. -Basin Financ. J. 2020, 64, 101467. [Google Scholar] [CrossRef]

- Santoro, G.; Bertoldi, B.; Giachino, C.; Candelo, E. Exploring the relationship between entrepreneurial resilience and success: The moderating role of stakeholders’ engagement. J. Bus. Res. 2020, 119, 142–150. [Google Scholar] [CrossRef]

- Beck, T.; Levine, R.; Levkov, A. Big Bad Banks? the Winners and Losers from Bank Deregulation in the United States. J. Financ. 2010, 65, 1637–1667. [Google Scholar] [CrossRef]

- Villa, J.R.; Howell, J.P.; Dorfman, P.W.; Daniel, D.L. Problems with detecting moderators in leadership research using moderated multiple regression. Leadersh. Q. 2003, 14, 3–23. [Google Scholar] [CrossRef]

- Gort, M.; Klepper, S. Time Paths in the Diffusion of Product Innovations. Econ. J. 1982, 92, 53–630. [Google Scholar] [CrossRef]

- Gupta, M.C. Environmental management and its impact on the operations function. Int. J. Oper. Prod. Manag. 1995, 15, 34–51. [Google Scholar] [CrossRef]

- Iraldo, F.; Testa, F.; Frey, M. Is an environmental management system able to influence environmental and competitive performance? The case of the eco-management and audit scheme (EMAS) in the European union. J. Clean. Prod. 2009, 17, 1444–1452. [Google Scholar] [CrossRef]

- González, P.; Sarkis, J.; Adenso-Díaz, B. Environmental management system certification and its influence on corporate practices: Evidence from the automotive industry. Int. J. Oper. Prod. Manag. 2008, 28, 1021–1041. [Google Scholar] [CrossRef]

- Ikram, M.; Zhou, P.; Shah, S.A.A.; Liu, G. Do environmental management systems help improve corporate sustainable development? Evidence from manufacturing companies in Pakistan. J. Clean. Prod. 2019, 226, 628–641. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Palmer, K. Environmental regulation and innovation: A panel data study. Rev. Econ. Stat. 1997, 79, 610–619. [Google Scholar] [CrossRef]

- Li, D.; Tang, F.; Jiang, J. Does environmental management system foster corporate green innovation? The moderating effect of environmental regulation. Technol. Anal. Strateg. Manag. 2019, 31, 1242–1256. [Google Scholar] [CrossRef]

| No. | Key Words | Frequency | Year |

|---|---|---|---|

| 1 | performance | 310 | 2008 |

| 2 | innovation | 282 | 2007 |

| 3 | impact | 275 | 2008 |

| 4 | green innovation | 230 | 2010 |

| 5 | management | 197 | 2008 |

| 6 | corporate social responsibility | 154 | 2008 |

| 7 | environmental regulation | 151 | 2009 |

| 8 | green | 148 | 2008 |

| 9 | eco innovation | 145 | 2014 |

| 10 | strategy | 118 | 2008 |

| 11 | financial performance | 116 | 2015 |

| 12 | firm performance | 112 | 2010 |

| 13 | policy | 108 | 2009 |

| 14 | research and development | 104 | 2008 |

| 15 | sustainability | 99 | 2014 |

| 16 | empirical evidence | 97 | 2016 |

| 17 | determinant | 91 | 2008 |

| 18 | firm | 90 | 2008 |

| 19 | product innovation | 86 | 2017 |

| 20 | environmental performance | 86 | 2011 |

| Variables | Symbol | Definition |

|---|---|---|

| Green Innovation | GIf | The number of green invention patents of enterprises plus one is taken as the natural logarithm [57] |

| Size | Sca | Natural logarithm of total assets [12] |

| Ownership | Own | 1 for state-owned enterprises, 0 otherwise |

| Age | Age | Years on market/Total years |

| Cash hold | Cas | (Monetary funds + financial assets held for trading)/total assets [58] |

| Cash Flow Level | Flo | Net cash flow from operating activities/total assets [58] |

| Return on Assets | Pro | Net profit/Average total assets [59] |

| Business Growth | Inc | Operating income growth rate: (current period operating income–previous period operating income)/previous period operating income [58] |

| Profit growth rate | Ear | (Total profit for the current year − Total profit for the same period of the previous year)/(Total profit for the same period of the previous year) |

| Capital Intensity | Cap | ln(Total fixed assets/number of employees + 1) [60] |

| Market Power | Mar | ln(Operating income/operating cost) [59] |

| Board Size | Bor | Number of board members/number of independent directors |

| Executive Compensation | Com | Top three executives’ salaries are taken as logarithms |

| Book-to-market ratio | BM | Book value/Market value [61] |

| Supplier Satisfaction | L1 | Accounts Payable Turnover Ratio [62] |

| Customer Satisfaction | L2 | Inventory turnover rate [62] |

| Shareholder Satisfaction | L3 | Earnings per share [62] |

| Creditor satisfaction | L4 | Gearing ratio [62] |

| Variable | N | Mean | Median | SD | Min | Max |

|---|---|---|---|---|---|---|

| GIf | 3945 | 1.902 | 0.000 | 5.098 | 0.000 | 35.000 |

| EMS | 3945 | 0.152 | 0.000 | 0.359 | 0.000 | 1.000 |

| Sca | 3945 | 3.754 | 3.557 | 1.339 | 1.179 | 7.791 |

| Own | 3945 | 0.520 | 1.000 | 0.500 | 0.000 | 1.000 |

| Age | 3945 | 11.52 | 12.00 | 6.819 | 0.000 | 27.000 |

| Cas | 3945 | 0.159 | 0.123 | 0.124 | 0.010 | 0.608 |

| Flo | 3945 | 0.051 | 0.050 | 0.068 | 0.167 | 0.239 |

| Pro | 3945 | 0.038 | 0.034 | 0.063 | 0.216 | 0.213 |

| Inc | 3945 | 0.203 | 0.108 | 0.562 | 0.520 | 4.140 |

| Ear | 3945 | −0.03 | 0.108 | 4.311 | 25.510 | 18.950 |

| Cap | 3945 | 1.835 | 1.680 | 0.884 | 0.269 | 4.758 |

| Mar | 3945 | 0.932 | 0.838 | 0.272 | 0.673 | 2.047 |

| Bor | 3945 | 8.859 | 9.000 | 1.792 | 5.000 | 15.000 |

| Com | 3945 | 2.655 | 2.639 | 0.679 | 0.942 | 4.510 |

| BM | 3945 | 0.628 | 0.636 | 0.256 | 0.099 | 1.142 |

| L1 | 3945 | 0.198 | 0.049 | 1.997 | 0.000 | 91.360 |

| L2 | 3945 | 0.136 | 0.069 | 0.355 | 0.000 | 13.510 |

| L3 | 3945 | 0.345 | 0.250 | 0.636 | 5.019 | 8.599 |

| L4 | 3945 | 0.446 | 0.441 | 0.299 | 0.007 | 10.080 |

| L5 | 3945 | 0.007 | 0.004 | 0.017 | 0.002 | 0.489 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| lnGIf | lnGIf | lnGIf | lnGIf | |

| EMS | 0.211 *** | 0.209 *** | 0.172 *** | 0.169 *** |

| (0.054) | (0.053) | (0.055) | (0.055) | |

| _cons | 0.493 *** | 0.469 *** | 0.465 *** | 0.613 *** |

| (0.029) | (0.035) | (0.026) | (0.220) | |

| Time fixed effects | NO | YES | YES | YES |

| Enterprise fixed effect | NO | NO | YES | YES |

| Control variables | NO | NO | NO | YES |

| N | 3960 | 3960 | 3960 | 3945 |

| R2 | 0.008 | 0.012 | 0.013 | 0.018 |

| (1) | (2) | |

|---|---|---|

| GIfA | GIfA | |

| EMS | 0.126 *** | 0.130 *** |

| (0.047) | (0.047) | |

| _cons | 0.736 *** | 0.747 *** |

| (0.031) | (0.209) | |

| Time fixed effects | YES | YES |

| enterprises fixed effect | YES | YES |

| Control variables | NO | YES |

| N | 3584 | 3572 |

| R2 | 0.01 | 0.018 |

| (3) | (4) | |

|---|---|---|

| GIf | GIf | |

| EMS | 0.098 ** | 0.097 ** |

| (0.047) | (0.047) | |

| Time fixed effects | YES | YES |

| enterprises fixed effect | YES | YES |

| Control variables | NO | YES |

| _cons | 0.494 *** | 0.710 *** |

| −0.024 | −0.21 | |

| N | 2688 | 2684 |

| R2 | 0.007 | 0.013 |

| (1) | (2) | |

|---|---|---|

| Tobit | MLE | |

| EMS | 0.200 *** | 0.200 *** |

| (0.058) | (0.055) | |

| _cons | 0.613 *** | 0.613 *** |

| (0.154) | (0.140) | |

| Time fixed effects | YES | YES |

| Control variables | YES | YES |

| N | 3945 | 3945 |

| Enterprises’ Size | Classification Criteria | Assignment |

|---|---|---|

| Large enterprises | Engaged in ≥ 1000 people or business income ≥ 40,000 million yuan | 1 |

| Medium enterprises | 300 people ≤ employees < 1000 and 20 million yuan ≤ operating income < 40,000 million yuan | 0 |

| Small enterprises | 20 people ≤ employees < 300 people and 3 million yuan ≤ operating income < 20 million yuan | 0 |

| Micro enterprises | Employees < 20 and business revenue < 3 million | 0 |

| (1) | (2) | |

|---|---|---|

| Large Enterprises | MSMEs | |

| EMS | 0.170 *** | 0.150 * |

| (−0.059) | (−0.088) | |

| _cons | 0.649 ** | 0.988 * |

| −0.269 | −0.573 | |

| Time fixed effect | YES | YES |

| Enterprise fixed effects | YES | YES |

| Control variables | YES | YES |

| N | 3628 | 317 |

| R2 | 0.019 | 0.052 |

| (1) | (2) | |

|---|---|---|

| State-Owned Enterprises | Non-State-Owned Enterprises | |

| EMS | 0.166 ** | 0.145 ** |

| (−0.083) | (−0.071) | |

| _cons | 0.257 | 0.945 *** |

| (−0.299) | (−0.242) | |

| Time fixed effect | YES | YES |

| Enterprise fixed effects | YES | YES |

| Control variables | YES | YES |

| N | 2050 | 1895 |

| R2 | 0.029 | 0.031 |

| (1) | (2) | (3) | |

|---|---|---|---|

| Growth Stage | Maturity Stage | Decline Stage | |

| EMS | 0.183 ** | 0.081 | 0.237 |

| (−0.073) | (−0.092) | (−0.185) | |

| _cons | 0.412 | 0.523 | 0.957 *** |

| (−0.271) | (−0.527) | (−0.299) | |

| Time fixed effect | YES | YES | YES |

| Enterprise fixed effect | YES | YES | YES |

| Control variables | YES | YES | YES |

| N | 1809 | 1507 | 629 |

| R2 | 0.024 | 0.031 | 0.048 |

| Self-Focused | Reciprocal | |||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| EMS | 0.310 *** | 0.318 *** | 0.315 *** | 0.316 *** |

| (−0.036) | (−0.036) | (−0.036) | (−0.036) | |

| L1 | −0.258 *** | |||

| (−0.054) | ||||

| L1 * EMS | −0.052 | |||

| (−0.21) | ||||

| L2 | −0.054 | |||

| (−0.072) | ||||

| L2 * EMS | 0.317 ** | |||

| (−0.207) | ||||

| L3 | −0.038 | |||

| (−0.039) | ||||

| L3 * EMS | 0.152 ** | |||

| (−0.069) | ||||

| L4 | −0.243 *** | |||

| (−0.08) | ||||

| L4 * EMS | 0.362 ** | |||

| (−0.162) | ||||

| _cons | 0.362 *** | 0.385 *** | 0.382 *** | 0.497 *** |

| (−0.101) | (−0.102) | (−0.102) | (−0.107) | |

| Time fixed effects | YES | YES | YES | YES |

| Enterprise fixed effects | YES | YES | YES | YES |

| Control variables | YES | YES | YES | YES |

| N | 3945 | 3945 | 3945 | 3945 |

| R2 | 0.135 | 0.13 | 0.13 | 0.132 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Su, W.; Lei, G.; Guo, S.; Dan, H. Study on the Influence Mechanism of Environmental Management System Certification on Enterprise Green Innovation. Int. J. Environ. Res. Public Health 2022, 19, 12379. https://doi.org/10.3390/ijerph191912379

Su W, Lei G, Guo S, Dan H. Study on the Influence Mechanism of Environmental Management System Certification on Enterprise Green Innovation. International Journal of Environmental Research and Public Health. 2022; 19(19):12379. https://doi.org/10.3390/ijerph191912379

Chicago/Turabian StyleSu, Weizhou, Gaowen Lei, Sidai Guo, and Hongche Dan. 2022. "Study on the Influence Mechanism of Environmental Management System Certification on Enterprise Green Innovation" International Journal of Environmental Research and Public Health 19, no. 19: 12379. https://doi.org/10.3390/ijerph191912379

APA StyleSu, W., Lei, G., Guo, S., & Dan, H. (2022). Study on the Influence Mechanism of Environmental Management System Certification on Enterprise Green Innovation. International Journal of Environmental Research and Public Health, 19(19), 12379. https://doi.org/10.3390/ijerph191912379