Financial Reasons for Working beyond the Statutory Retirement Age: Risk Factors and Associations with Health in Late Life

Abstract

1. Introduction

2. Materials and Methods

2.1. Study Design and Data

2.2. Measures

2.2.1. Outcomes

2.2.2. Covariates

2.3. Statistical Analyses

3. Results

3.1. Participants’ Characteristics

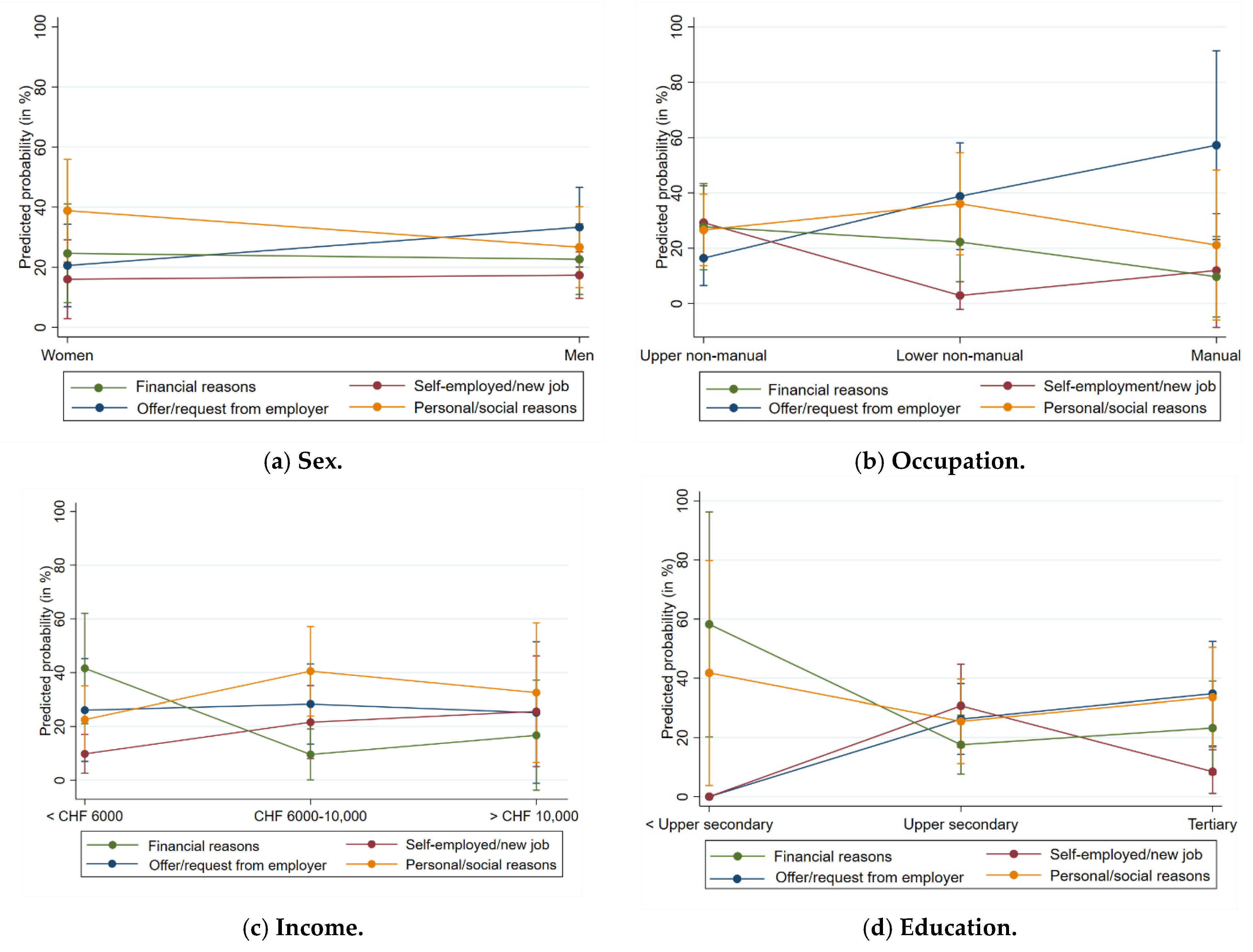

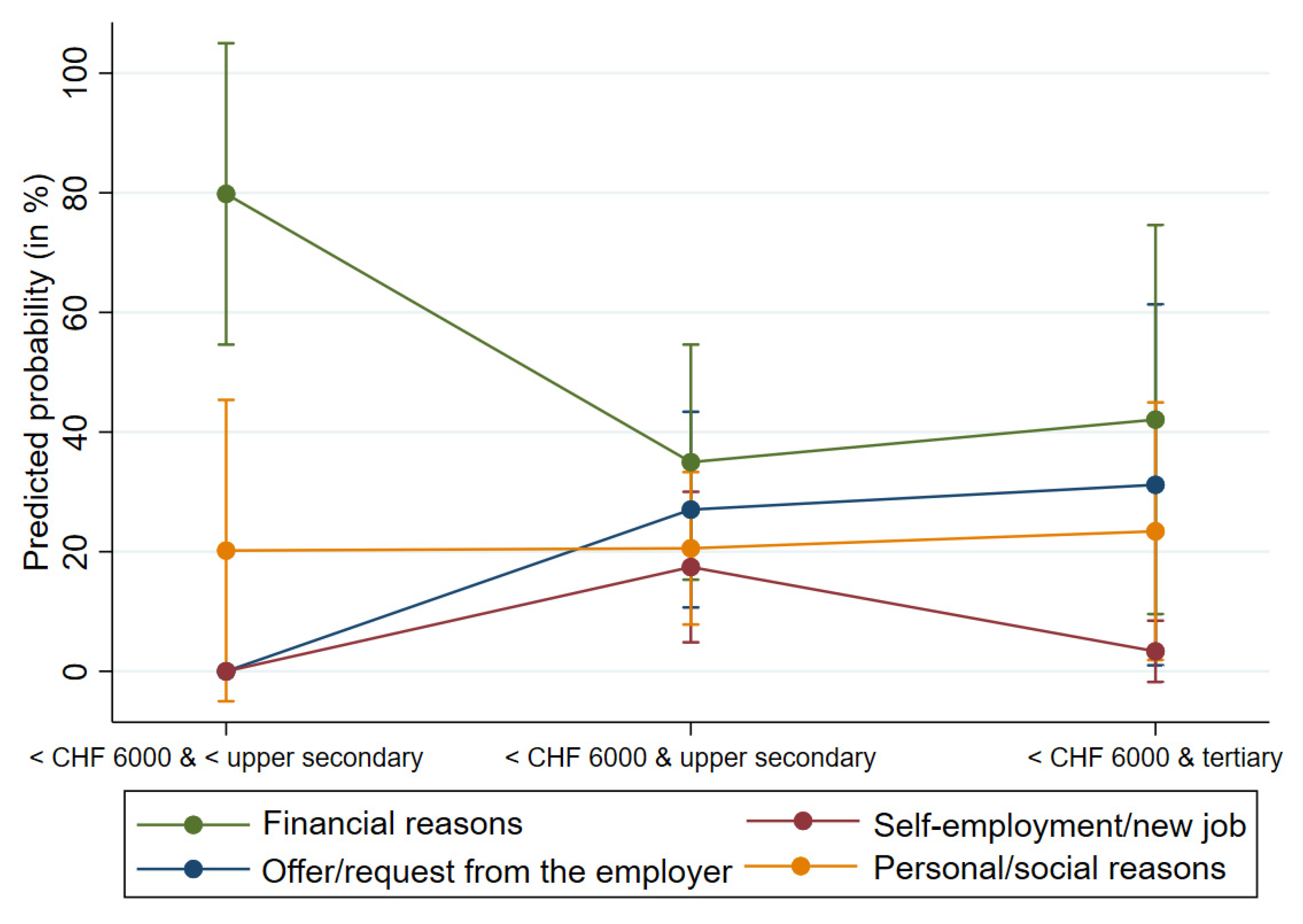

3.2. Reasons for Working beyond the SRA

3.3. Factors Associated with Working beyond the SRA

3.4. Factors Associated with Self-Rated Health

4. Discussion

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Hofäcker, D.; Hess, M.; König, S. Delaying Retirement: Progress and Challenges of Active Aging in Europe, the United States and Japan; Palgrave, M., Ed.; Palgrave Macmillan: London, UK, 2016; ISBN 9781137566966. [Google Scholar]

- Hofäcker, D.; Radl, J. Retirement Transitions in Times of Institutional Change: Theoretical Concept. In Delaying Retirement: Progress and Challenges of Active Aging in Europe, the United States and Japan; Palgrave Macmillan: London, UK, 2016; pp. 1–22. [Google Scholar]

- Hofäcker, D.; Naumann, E. Arbeiten Nach 65 in Deutschland: Eine Zunehmende Soziale Ungleichheit? Z. Gerontol. Geriatr. 2015, 48, 473–479. [Google Scholar] [CrossRef]

- OECD. Pensions at a Glance 2019; OECD Publishing: Paris, France, 2019. [Google Scholar]

- OECD. Statistics Statistics. Available online: http://stats.oecd.org/ (accessed on 2 August 2022).

- Dorn, D.; Sousa-Poza, A. Why Is the Employment Rate of Older Swiss so High? An Analysis of the Social Security System. Geneva Pap. Risk Insur. Issues Pract. 2003, 28, 652–672. [Google Scholar] [CrossRef]

- Bütler, M. The Impact of Longevity Risk on the Optimal Contribution Rate and Asset Allocation for Defined Contribution Pension Plans. Geneva Pap. Risk Insur. Issues Pract. 2009, 34, 561–577. [Google Scholar] [CrossRef][Green Version]

- Hanel, B.; Riphahn, R.T. The Timing of Retirement—New Evidence from Swiss Female Workers. Labour Econ. 2012, 19, 718–728. [Google Scholar] [CrossRef]

- Oesch, D.; Baumann, I. Smooth Transition or Permanent Exit? Evidence on Job Prospects of Displaced Industrial Workers. Socio-Econ. Rev. 2015, 13, 101–123. [Google Scholar] [CrossRef]

- Baumann, I. The Plight of Older Workers. Labor Market Experience after Plant Closure in the Swiss Manufacturing Sector; Springer: Cham, Switzerland, 2016; ISBN 9783319397528. [Google Scholar]

- Ebbinghaus, B.; Hofäcker, D. Reversing Early Retirement in Advanced Welfare Economies: Overcoming Push and Pull Factors. Comp. Popul. Stud. 2013, 38, 807–840. [Google Scholar] [CrossRef]

- Andersen, L.L.; Jensen, P.H.; Sundstrup, E. Barriers and Opportunities for Prolonging Working Life across Different Occupational Groups: The SeniorWorkingLife Study. Eur. J. Public Health 2020, 30, 241–246. [Google Scholar] [CrossRef]

- Andersen, L.L.; Thorsen, S.V.; Larsen, M.; Sundstrup, E.; Boot, C.R.; Rugulies, R. Work Factors Facilitating Working beyond State Pension Age: Prospective Cohort Study with Register Follow-Up. Scand. J. Work. Environ. Health 2021, 47, 15–21. [Google Scholar] [CrossRef] [PubMed]

- Madero-Cabib, I. The Life Course Determinants of Vulnerability in Late Careers. Longit. Life Course Stud. 2015, 6, 88–106. [Google Scholar] [CrossRef]

- Baumann, I.; Madero-Cabib, I. Retirement Trajectories in Countries with Flexible Retirement Policies but Different Welfare Regimes. J. Aging Soc. Policy 2021, 33, 138–160. [Google Scholar] [CrossRef]

- Axelrad, H. Early Retirement and Late Retirement: Comparative Analysis of 20 European Countries. Int. J. Sociol. 2018, 48, 231–250. [Google Scholar] [CrossRef]

- Hochfellner, D.; Burkert, C. Employment in Retirement: Continuation of a Working Career or Essential Additional Income? Z. Gerontol. Geriatr. 2013, 46, 242–250. [Google Scholar] [CrossRef]

- Beehr, T.A.; Bennett, M.M. Working after Retirement: Features of Bridge Employment and Research Directions. Work. Aging Retire. 2015, 1, 112–128. [Google Scholar] [CrossRef]

- Madero-Cabib, I.; Kaeser, L. How Voluntary Is the Active Ageing Life? A Life-Course Study on the Determinants of Extending Careers. Eur. J. Ageing 2016, 13, 25–37. [Google Scholar] [CrossRef]

- De Wind, A.; van der Pas, S.; Blatter, B.M.; van der Beek, A.J. A Life Course Perspective on Working beyond Retirement—Results from a Longitudinal Study in the Netherlands. BMC Public Health 2016, 16, 1–12. [Google Scholar] [CrossRef] [PubMed]

- Henkens, K.; van Dalen, H.P.; van Solinge, H. The Rhetoric and Reality of Phased Retirement Policies. Public Policy Aging Rep. 2021, 31, 78–82. [Google Scholar] [CrossRef]

- Scharn, M.; Sewdas, R.; Boot, C.R.L.; Huisman, M.; Lindeboom, M.; van der Beek, A.J. Domains and Determinants of Retirement Timing: A Systematic Review of Longitudinal Studies. BMC Public Health 2018, 18, 1–14. [Google Scholar] [CrossRef]

- Austen, S.; Ong, R. The Employment Transitions of Mid-Life Women: Health and Care Effects. Ageing Soc. 2010, 30, 207–227. [Google Scholar] [CrossRef]

- Heggebø, K. Unemployment in Scandinavia during an Economic Crisis: Cross-National Differences in Health Selection. Soc. Sci. Med. 2015, 130, 115–124. [Google Scholar] [CrossRef]

- Dingemans, E.; Henkens, K. Involuntary Retirement, Bridge Employment, and Satisfaction with Life: A Longitudinal Investigation. J. Organ. Behav. 2014, 35, 575–591. [Google Scholar] [CrossRef]

- Pilipiec, P.; Groot, W.; Pavlova, M. The Causal Influence of Increasing the Statutory Retirement Age on Job Satisfaction among Older Workers in the Netherlands. Appl. Econ. 2021, 53, 1498–1527. [Google Scholar] [CrossRef]

- De Grip, A.; Lindeboom, M.; Montizaan, R. Shattered Dreams: The Effects of Changing the Pension System Late in the Game. Econ. J. 2012, 122, 1–25. [Google Scholar] [CrossRef]

- Eibich, P. Understanding the Effect of Retirement on Health: Mechanisms and Heterogeneity. J. Health Econ. 2015, 43, 1–12. [Google Scholar] [CrossRef]

- Carrino, L.; Glaser, K.; Avendano, M. Later Retirement, Job Strain, and Health: Evidence from the New State Pension Age in the United Kingdom. Health Econ. 2020, 29, 891–912. [Google Scholar] [CrossRef]

- Belles, C.; Jiménez, S.; Ye, H. The Effect of Removing Early Retirement on Mortality; Fedea Working Paper; Fedea: Madrid, Spain, 2022. [Google Scholar]

- Lindwall, M.; Berg, A.I.; Bjälkebring, P.; Buratti, S.; Hansson, I.; Hassing, L.; Henning, G.; Kivi, M.; König, S.; Thorvaldsson, V.; et al. Psychological Health in the Retirement Transition: Rationale and First Findings in the HEalth, Ageing and Retirement Transitions in Sweden (HEARTS) Study. Front. Psychol. 2017, 8, 1634. [Google Scholar] [CrossRef]

- Meng, A.; Sundstrup, E.; Andersen, L.L. Factors Contributing to Retirement Decisions in Denmark: Comparing Employees Who Expect to Retire before, at, and after the State Pension Age. Int. J. Environ. Res. Public Health 2020, 17, 3338. [Google Scholar] [CrossRef]

- Ludwig, C.; Cavalli, S.; Oris, M. “Vivre/Leben/Vivere”: An Interdisciplinary Survey Addressing Progress and Inequalities of Aging over the Past 30 Years in Switzerland. Arch. Gerontol. Geriatr. 2014, 59, 240–248. [Google Scholar] [CrossRef]

- Fisher, G.G.; Chaffee, D.S.; Sonnega, A. Retirement Timing: A Review and Recommendations for Future Research. Work. Aging Retire. 2016, 2, 230–261. [Google Scholar] [CrossRef]

- Sewdas, R.; De Wind, A.; Van Der Zwaan, L.G.L.; Van Der Borg, W.E.; Steenbeek, R.; Van Der Beek, A.J.; Boot, C.R.L. Why Older Workers Work beyond the Retirement Age: A Qualitative Study. BMC Public Health 2017, 17, 1–9. [Google Scholar] [CrossRef]

- Schmidthuber, L.; Fechter, C.; Schröder, H.; Hess, M. Active Ageing Policies and Delaying Retirement: Comparing Work-Retirement Transitions in Austria and Germany. J. Int. Comp. Soc. Policy 2020, 37, 176–193. [Google Scholar] [CrossRef]

- Madero-Cabib, I.; Gauthier, J.-A.; Le Goff, J.-M. The Influence of Interlocked Employment—Family Trajectories on Retirement Timing. Work. Aging Retire. 2016, 2, 38–53. [Google Scholar] [CrossRef]

- Coppola, M.; Wilke, C.B. At What Age Do You Expect to Retire? Retirement Expectations and Increases in the Statutory Retirement Age. Fisc. Stud. 2014, 35, 165–188. [Google Scholar] [CrossRef]

- Cooper, J. Cognitive Dissonance: Where We’ve Been and Where We’re Going. Int. Rev. Soc. Psychol. 2019, 32, 1–11. [Google Scholar] [CrossRef]

- Hofäcker, D.; Schröder, H.; Li, Y.; Flynn, M. Trends and Determinants of Work-Retirement Transitions under Changing Institutional Conditions: Germany, England and Japan Compared. J. Soc. Policy 2016, 45, 39–64. [Google Scholar] [CrossRef]

- OECD. Preventing Ageing Unequally; OECD Publishing: Paris, France, 2017; ISBN 9789264279087. [Google Scholar]

- Baumann, I.; Cabib, I.; Eyjólfsdóttir, H.S.; Agahi, N. Part-Time Work and Health in Late Careers: Evidence from a Longitudinal and Cross-National Study. SSM-Popul. Health 2022, 18, 1–12. [Google Scholar] [CrossRef]

- Steiger-Sackmann, S. Anspruch Auf Änderung Des Arbeitspensums. Sui Generis 2018, 71, 237–254. [Google Scholar] [CrossRef]

| Total (100%, N = 1241) | Retirement after the SRA (6.6%, n = 82) | |||

|---|---|---|---|---|

| Variables | % | N | % | N |

| Sex | ||||

| Women | 42.8 | 531 | 37.8 | 31 |

| Men | 57.2 | 710 | 62.2 | 51 |

| Education level | ||||

| <Secondary education | 14.1 | 175 | 7.3 | 6 |

| Secondary education | 58.3 | 723 | 53.7 | 44 |

| Tertiary education | 27.6 | 343 | 39.0 | 32 |

| Occupational groups | ||||

| Higher non-manual | 32.8 | 407 | 50.0 | 41 |

| Lower non-manual | 48.2 | 598 | 36.6 | 30 |

| Manual | 19.0 | 236 | 13.4 | 11 |

| Household income | ||||

| <6000 CHF | 43.2 | 536 | 42.7 | 35 |

| 6000–10,000 CHF | 47.6 | 591 | 43.9 | 36 |

| >10,000 CHF | 9.2 | 114 | 13.4 | 11 |

| Self-rated health | ||||

| Poor | 1.0 | 12 | 1.2 | 1 |

| Rather poor | 5.6 | 69 | 6.1 | 5 |

| Satisfactory | 31.5 | 389 | 23.2 | 19 |

| Good | 48.5 | 598 | 56.1 | 46 |

| Very good | 13.5 | 166 | 13.8 | 11 |

| Age in years, mean (SD) | 72.5 (4.4) | 73.3 (3.8) | ||

| Ref = Retirement at the SRA | Retirement before the SRA | Retirement after the SRA | ||

|---|---|---|---|---|

| Variables | Coeff. | SE a | Coeff. | SE a |

| Gender (ref = women) | ||||

| Men | 0.496 *** | (0.140) | 0.189 | (0.259) |

| Education level (ref = < secondary education) | ||||

| Secondary education | 0.028 | (0.191) | 0.580 | (0.455) |

| Tertiary education | −0.325 | (0.231) | 0.700 | (0.503) |

| Occupational groups (ref = higher non-manual) | ||||

| Lower non-manual | 0.115 | (0.159) | −0.578 ** | (0.280) |

| Manual | −0.271 | (0.199) | −0.765 * | (0.396) |

| Income (ref = < 6000 CHF) | ||||

| 6000–10,000 CHF | 0.822 *** | (0.138) | 0.061 | (0.272) |

| >10,000 CHF | 0.805 *** | (0.240) | 0.303 | (0.416) |

| Age | −0.138 | (0.208) | −0.036 | (0.364) |

| Age2 | −0.0004 | (0.0003) | 0.0001 | (0.0005) |

| Constant | 1.572 | (1.179) | −2.795 | (2.072) |

| N | 1241 | |||

| Pseudo R-square | 0.057 | |||

| Reasons | % | N |

|---|---|---|

| Financial reasons (total) | 23.0 | 19 |

| Financially necessary | 10.0 | 8 |

| Supplement pension | 13.0 | 11 |

| Offer/request from employer (total) | 28.0 | 23 |

| Being needed in the workplace | 26.0 | 21 |

| Skills are valued in the workplace | 2.0 | 2 |

| Self-employed/new job (total) | 17.0 | 14 |

| Self-employment | 13.0 | 11 |

| Started new position | 4.0 | 3 |

| Personal/social reasons (total) | 30.0 | 26 |

| Good health | 2.0 | 2 |

| Partner still working | 1.0 | 1 |

| Importance of social contacts | 1.0 | 1 |

| Likes the work | 24.0 | 20 |

| Employment is good for you | 1.0 | 1 |

| Has found a new challenge | 1.0 | 1 |

| Self-Rated Health | ||

|---|---|---|

| Coef. | SE a | |

| Reason for working beyond the SRA (ref = financial) | ||

| Offer/request from employer | −0.099 | (0.283) |

| Self-employment/new job | 0.118 | (0.297) |

| Personal/social | 0.110 | (0.236) |

| Gender (ref = women) | ||

| Men | 0.055 | (0.189) |

| Education level (ref = < secondary education) | ||

| Secondary education | 0.919 ** | (0.330) |

| Tertiary education | 1.295 ** | (0.385) |

| Occupation groups (ref = higher non-manual) | ||

| Lower non-manual | 0.222 | (0.216) |

| Manual | −0.110 | (0.334) |

| Income (ref = < 6000 CHF) | ||

| 6000–10,000 CHF | −0.817 ** | (0.239) |

| >10,000 CHF | −0.237 | (0.221) |

| Age | −0.443 | (0.311) |

| Age2 | 0.000 | (0.000) |

| Constant | 3.209 * | (1.567) |

| N | 82 | |

| R2 | 0.333 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Burkhalter, D.; Wagner, A.; Feer, S.; Wieber, F.; Ihle, A.; Baumann, I. Financial Reasons for Working beyond the Statutory Retirement Age: Risk Factors and Associations with Health in Late Life. Int. J. Environ. Res. Public Health 2022, 19, 10505. https://doi.org/10.3390/ijerph191710505

Burkhalter D, Wagner A, Feer S, Wieber F, Ihle A, Baumann I. Financial Reasons for Working beyond the Statutory Retirement Age: Risk Factors and Associations with Health in Late Life. International Journal of Environmental Research and Public Health. 2022; 19(17):10505. https://doi.org/10.3390/ijerph191710505

Chicago/Turabian StyleBurkhalter, Denise, Aylin Wagner, Sonja Feer, Frank Wieber, Andreas Ihle, and Isabel Baumann. 2022. "Financial Reasons for Working beyond the Statutory Retirement Age: Risk Factors and Associations with Health in Late Life" International Journal of Environmental Research and Public Health 19, no. 17: 10505. https://doi.org/10.3390/ijerph191710505

APA StyleBurkhalter, D., Wagner, A., Feer, S., Wieber, F., Ihle, A., & Baumann, I. (2022). Financial Reasons for Working beyond the Statutory Retirement Age: Risk Factors and Associations with Health in Late Life. International Journal of Environmental Research and Public Health, 19(17), 10505. https://doi.org/10.3390/ijerph191710505