Carbon Sink Cost and Influence Factors Analysis in a National Afforestation Project under Different Investment Modes

Abstract

:1. Introduction

2. Model Formulation

2.1. Modified Hartman Model for Woodland Net Present Value Calculation

2.2. Woodland Carbon Sink Cost under Different Investment Modes

3. Case Study

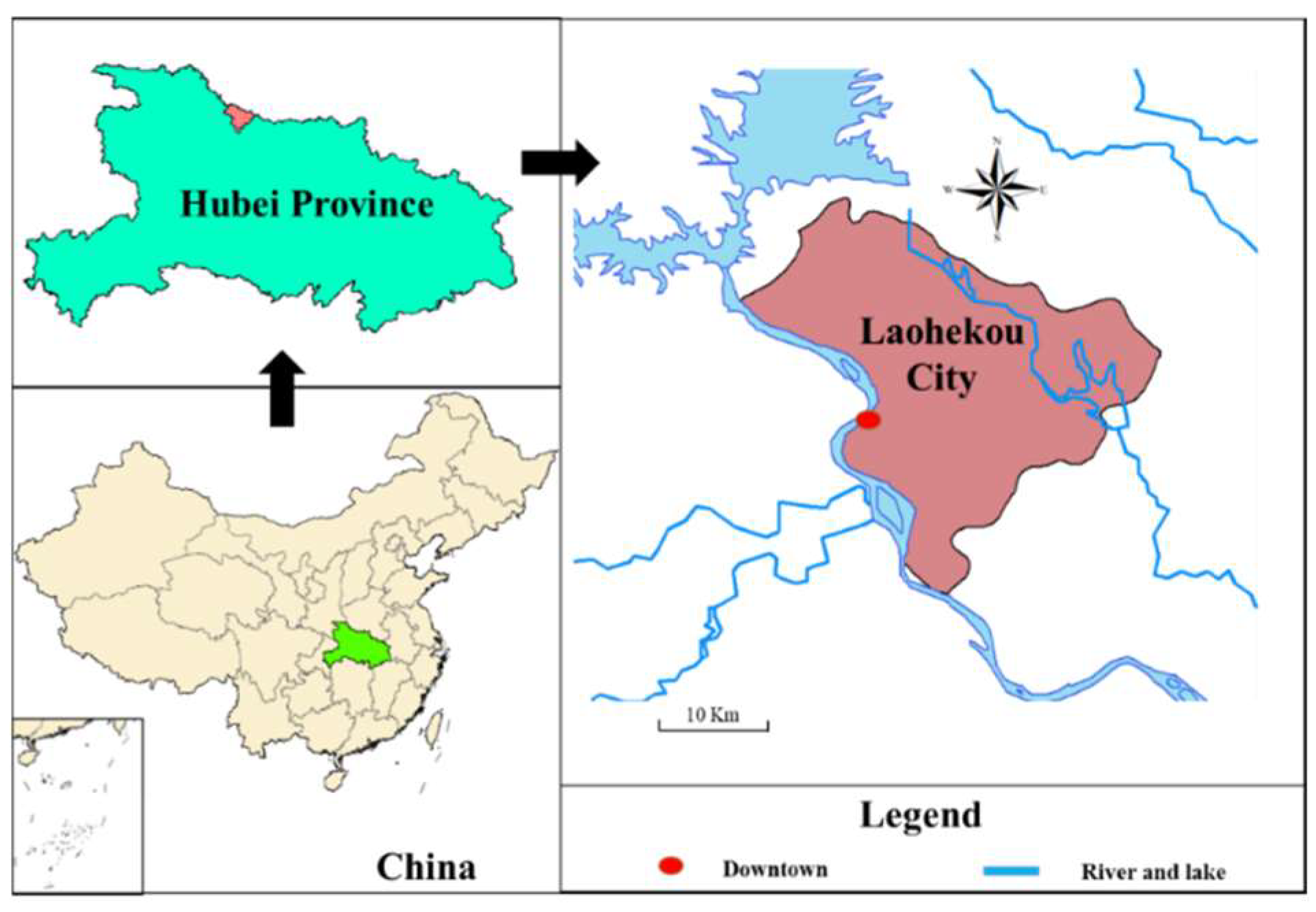

3.1. Overview of Study Area

3.2. Data Preparation

4. Results Analysis

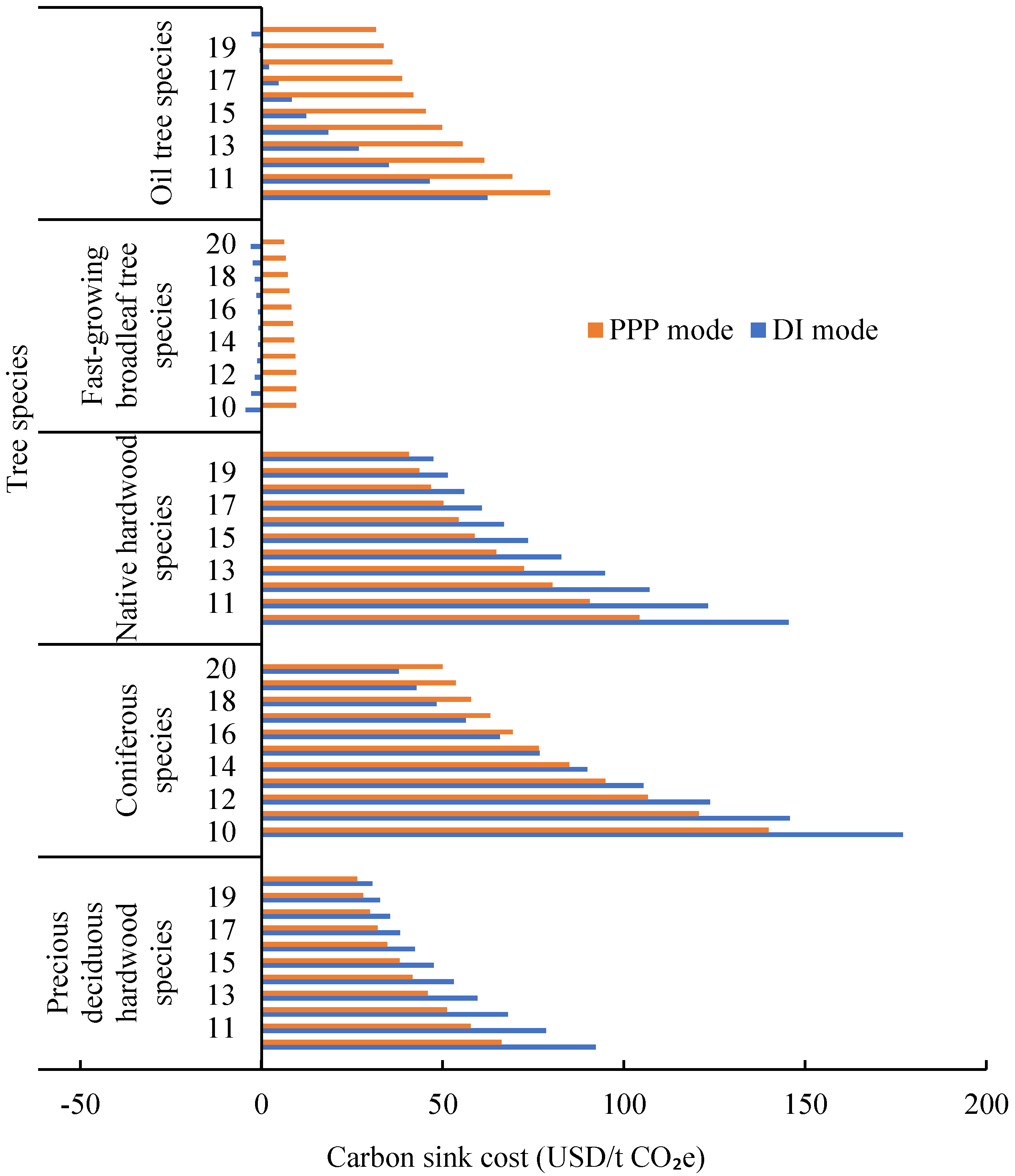

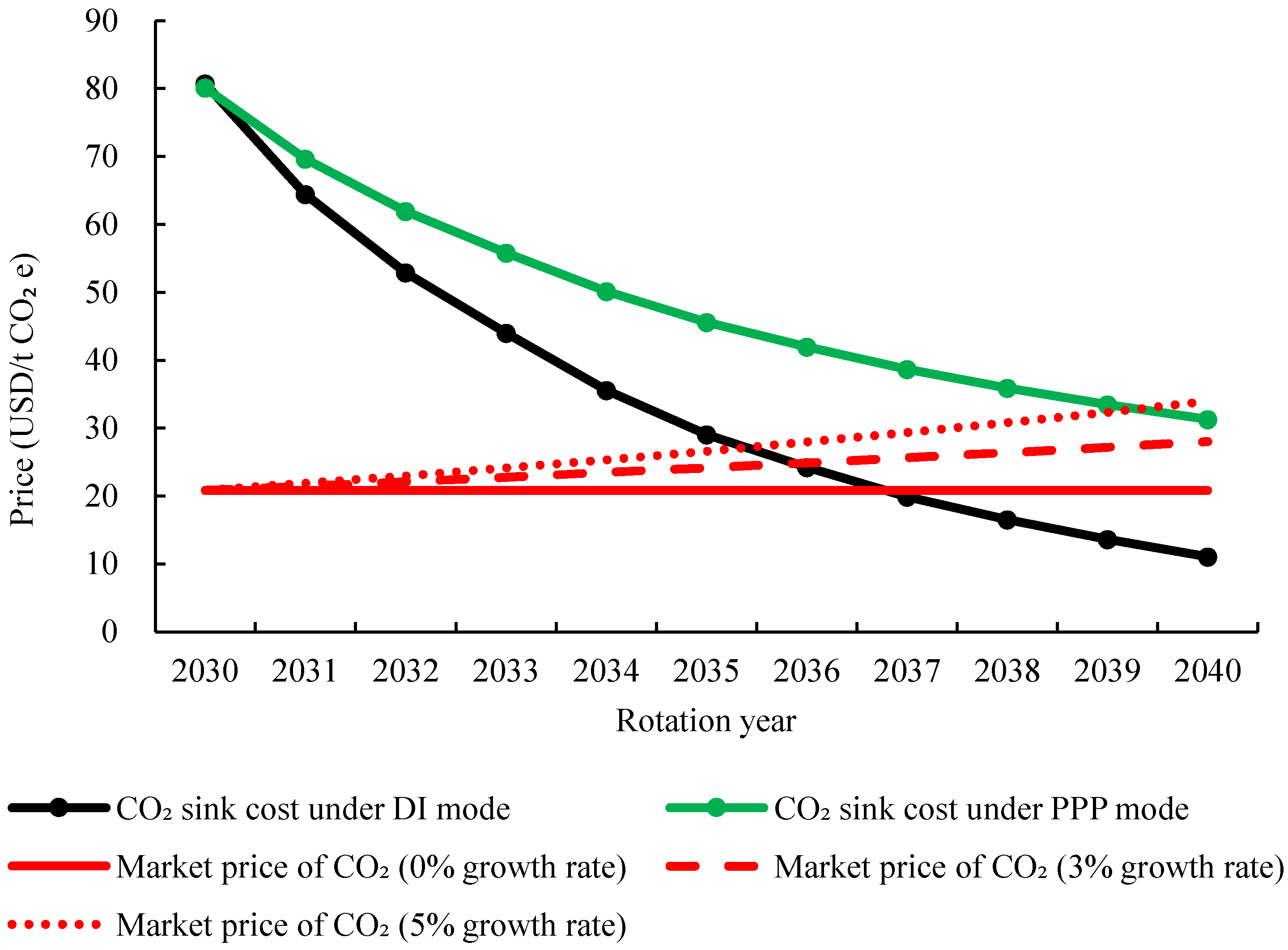

4.1. Carbon Sink Cost with Different Rotation Periods

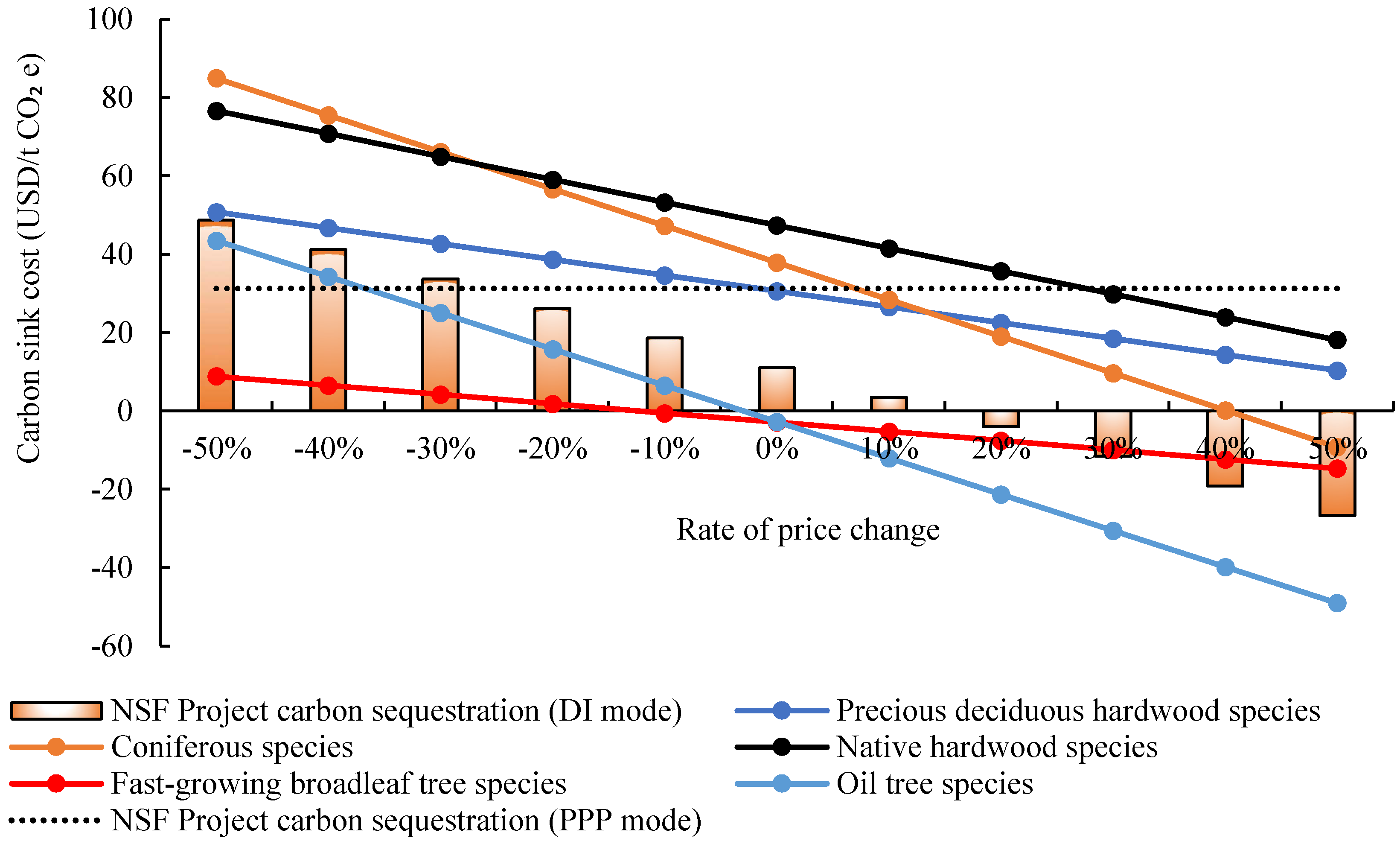

4.2. Sensitive Analysis of Wood Market Price

4.3. Sensitive Analysis of Wood Yield Rate

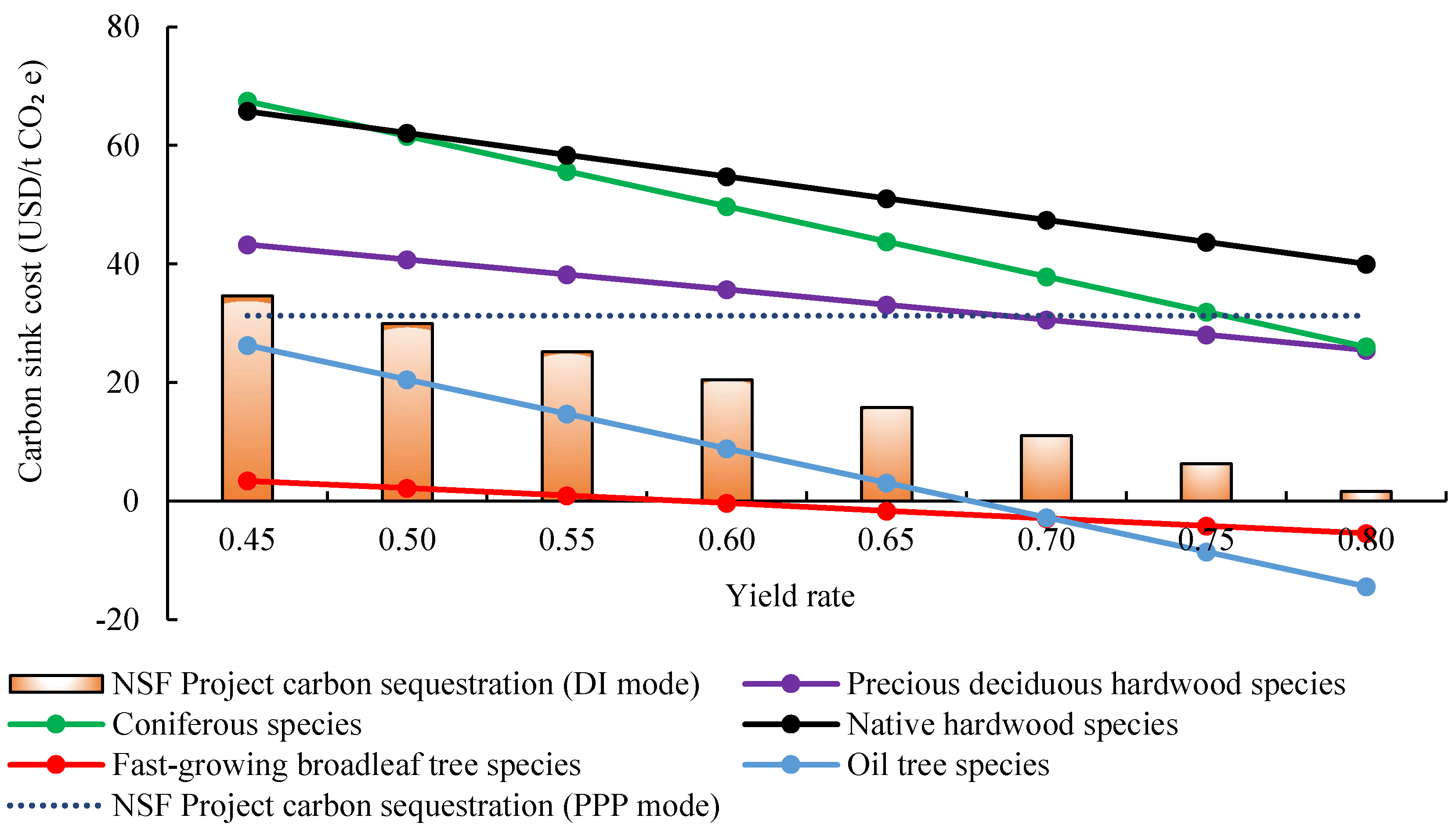

4.4. Sensitive Analysis of Discount Rate

5. Discussion

6. Conclusions

- (1)

- With the increasing of rotation period, wood market price, and yield rate of timber, the carbon sink cost of Laohekou NAP gradually decreases. The discount rate has the opposite dynamic trend with carbon sink cost. The PPP mode is more feasible than the DI mode only when the wood price is lower than 73.18% of the current price, the yield rate is lower than 0.485, and the discount rate is higher than 6.77%.

- (2)

- DI mode is a better option than PPP mode to reduce the carbon cost of Laohekou NAP in the current situation. Existing subsidy measures are not enough to motivate enterprises to choose the PPP mode. If the local government wants to attract business participation in PPP, existing subsidy measures are not enough. If the government wants to implement the PPP mode in Laohekou NAP, some cost reduction measures, such as extending the benefit period of enterprises and increasing subsidies, should be considered.

- (3)

- Tree species have different characteristics in growth rate, carbon sink capacity, market price, etc. When determining tree species for NAP construction, these factors should be synthetically considered to make the tradeoff between economic benefit and risk, which will support best management practice.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Lin, B.; Ge, J. Valued Forest carbon sinks: How much emissions abatement costs could be reduced in China. J. Clean. Prod. 2019, 224, 455–464. [Google Scholar] [CrossRef]

- Lin, B.; Sun, C. Evaluating carbon dioxide emissions in international trade of China. Energy Policy 2010, 38, 613–621. [Google Scholar] [CrossRef]

- Dong, L.; Miao, G.; Wen, W. China’s Carbon Neutrality Policy: Objectives, Impacts and Paths. East Asian Policy 2021, 13, 5–18. [Google Scholar] [CrossRef]

- Cao, Y.; Li, X.; Yan, H.; Kuang, S. China’s efforts to peak carbon emissions: Targets and practice. Chin. J. Urban Environ. Stud. 2021, 9, 2150004. [Google Scholar] [CrossRef]

- Zhang, R.; He, J.; Zhao, Y.; Peng, Y.; Fu, L. Another important factor of rising sea level: Soil Erosion. CLEAN–Soil Air Water 2013, 41, 174–178. [Google Scholar] [CrossRef]

- Cao, X.; Li, X.; Breeze, T.D. Quantifying the carbon sink costs for Pinus elliottii afforestation project of China greenhouse gases voluntary emission reduction program: A case study in Jiangxi province. Forests 2020, 11, 928. [Google Scholar] [CrossRef]

- Erb, K.; Kastner, T.; Luyssaert, S.; Houghton, R.A.; Kuemmerle, T.; Olofsson, P.; Haberl, H. Bias in the attribution of forest carbon sinks. Nat. Clim. Chang. 2013, 3, 854–856. [Google Scholar] [CrossRef] [Green Version]

- Hyde, W.F. The experience of China’s forest reforms: What they mean for China and what they suggest for the world. For. Policy Econ. 2019, 98, 1–7. [Google Scholar] [CrossRef]

- S.F.A.G. National Reserve Forest Construction Plan (2018–2035); S.F.A.G.: Beijing, China, 2018. [Google Scholar]

- Cui, C.; Liu, Y.; Hope, A.; Wang, J. Review of studies on the public–private partnerships (PPP) for infrastructure projects. Int. J. Proj. Manag. 2018, 36, 773–794. [Google Scholar] [CrossRef]

- Richards, K.R.; Stokes, C. A Review of Forest Carbon Sink Cost Studies: A Dozen Years of Research. Clim. Chang. 2004, 63, 1–48. [Google Scholar] [CrossRef]

- Plantinga, A.J.; Mauldin, T. A method for estimating the cost of CO2 mitigation through afforestation. Clim. Chang. 2001, 49, 21–40. [Google Scholar] [CrossRef]

- Chen, P.; Chen, B.-Y.; Tsai, P.-H.; Chen, C.-C. Evaluating the impacts of a carbon tax on imported forest products—evidence from Taiwan. For. Policy Econ. 2015, 50, 45–52. [Google Scholar] [CrossRef]

- Coleman, A. Forest-based carbon sink, and the role of forward, futures, and carbon-lending markets: A comparative institutions approach. J. For. Econ. 2018, 33, 95–104. [Google Scholar]

- Xie, G.D.; Li, S.M.; Xiao, Y.; Yue, Q. Value of Carbon Sink: Concept and Evaluation. J. Nat. Resour. 2011, 26, 1–10. [Google Scholar]

- Huang, Z.S.; Chen, Q. Influencing factors analysis of forestry carbon sink cost-benefit based on afforestation cost methods. Resour. Sci. 2016, 38, 485–492. [Google Scholar]

- Ahn, S. How Feasible is Carbon Sink in Korea? A Study on the Costs of Sequestering Carbon in Forest. Environ. Resour. Econ. 2007, 41, 89–109. [Google Scholar] [CrossRef]

- Guo, J.; Gong, P.; Sveriges, L. The potential and cost of increasing forest carbon sink in Sweden. J. For. Econ. 2017, 29, 78–86. [Google Scholar]

- Benítez, P.C.; Obersteiner, M. Site identification for carbon sink in Latin America: A grid-based economic approach. For. Policy Econ. 2006, 8, 636–651. [Google Scholar] [CrossRef]

- Haight, R.G.; Bluffstone, R.; Kline, J.D.; Kline, J.D.; Coulston, J.W.; Wear, D.N.; Zook, K. Estimating the Present Value of Carbon Sink in U.S.A. Forests, 2015–2050, for Evaluating Federal Climate Change Mitigation Policies. Agric. Resour. Econ. Rev. 2020, 49, 150–177. [Google Scholar] [CrossRef] [Green Version]

- Zhang, D.; Pearse, P.H. Forest Economics; UBC Press: Vancouver, BC, Canada, 2011. [Google Scholar]

- AR-CM-001 -V01. Methodology of Carbon Sink Forestation Project [EB/OL]. (2013-10) [2015-08-26]. Available online: http://www.gsly.gov.cn/attachment/www/month-1501/20150105-105935-7874.pdf (accessed on 1 September 2019).

- Sohngen, B.; Sedjo, R. Potential carbon flux from timber harvests and management in the context of a global timber market. Clim. Chang. 2000, 44, 151–172. [Google Scholar] [CrossRef]

- Ndjondo, M.; Gourlet-Fleury, S.; Manlay, R.J.; Obiang, N.L.E.; Ngomanda, A.; Romero, C.; Claeys, F.; Picard, N. Opportunity costs of carbon sink in a forest concession in central Africa. Carbon Balance Manag. 2014, 9, 4–13. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Hubei Provincial Forestry Department; Hubei Provincial Forestry Investigation and Planning Institute. The Second-Class Survey Results of Forest Resources in Hubei Province; Hubei Provincial Forestry Department: Wuhan, China, 2012. [Google Scholar]

- Xiangyang Bureau of Statistics. Xiangyang Statistical Yearbook; Xiangyang Bureau of Statistics: Xiangyang, China, 2021. [Google Scholar]

- Liu, Q. Chinese Vertical Timber Volume Table; China Forestry Publishing House: Beijing, China, 2017. [Google Scholar]

- Slater, H.; De Boer, D.; Qian, G.; Wang, S. China Carbon Price Survey Report; ICF: Beijing, China, 2021. [Google Scholar]

- Van Kooten, G.C.; Sohngen, B. Economics of forest ecosystem carbon sinks: A review. Int. Rev. Environ. Resour. Econ. 2007, 1, 237–269. [Google Scholar] [CrossRef]

- Zhong, W.; Xing, Z. Analysis on cost and benefit of carbon sequestration in each province of China: Based on afforestation and reforestation project. China Popul. Resour. Environ. 2012, 22, 33–41. [Google Scholar]

| Items | Unit | Precious Deciduous Hardwood Species | Coniferous Species | Native Hardwood Species | Fast-Growing Broadleaf Tree Species | Oil Tree Species |

|---|---|---|---|---|---|---|

| Planting area | ha | 200.00 | 333.33 | 286.67 | 333.33 | 1346.67 |

| Planting density | Plants/ha | 1167 | 1111 | 1000 | 625 | 1667 |

| Market price of wood | USD/m3 | 187.63 | 187.63 | 187.63 | 90.06 | 187.63 |

| Planting cost | USD/ha | 7769.00 | 12,123.43 | 10,009.99 | 6744.32 | 6706.59 |

| Raising cost | USD/ha | 3782.52 | 7204.80 | 5403.60 | 4728.15 | 5403.60 |

| Transport cost | USD/m3 | 22.52 | 22.52 | 22.52 | 22.52 | 22.52 |

| Wood density | kg/m3 | 0.60 | 0.28 | 0.44 | 0.44 | 0.24 |

| Biomass expansion factor | 1.67 | 1.51 | 1.59 | 1.83 | 1.93 | |

| The average carbon content | 0.50 | 0.50 | 0.48 | 0.47 | 0.47 | |

| Root biomass ratio | 0.26 | 0.32 | 0.29 | 0.25 | 0.27 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, X.; Hu, W.; Zhang, F.; Zhang, J.; Sheng, F.; Xu, X. Carbon Sink Cost and Influence Factors Analysis in a National Afforestation Project under Different Investment Modes. Int. J. Environ. Res. Public Health 2022, 19, 7738. https://doi.org/10.3390/ijerph19137738

Li X, Hu W, Zhang F, Zhang J, Sheng F, Xu X. Carbon Sink Cost and Influence Factors Analysis in a National Afforestation Project under Different Investment Modes. International Journal of Environmental Research and Public Health. 2022; 19(13):7738. https://doi.org/10.3390/ijerph19137738

Chicago/Turabian StyleLi, Xuexiang, Wanlin Hu, Fan Zhang, Jinxin Zhang, Feng Sheng, and Xiangyu Xu. 2022. "Carbon Sink Cost and Influence Factors Analysis in a National Afforestation Project under Different Investment Modes" International Journal of Environmental Research and Public Health 19, no. 13: 7738. https://doi.org/10.3390/ijerph19137738

APA StyleLi, X., Hu, W., Zhang, F., Zhang, J., Sheng, F., & Xu, X. (2022). Carbon Sink Cost and Influence Factors Analysis in a National Afforestation Project under Different Investment Modes. International Journal of Environmental Research and Public Health, 19(13), 7738. https://doi.org/10.3390/ijerph19137738