How Does the Pandemic Facilitate Mobile Payment? An Investigation on Users’ Perspective under the COVID-19 Pandemic

Abstract

1. Introduction

2. Theoretical Background

2.1. M-Payment and Its Utilization under the COVID-19 Pandemic

2.2. Mental Accounting Theory (MAT)

2.3. Unified Theory of Acceptance and Use of Technology (UTAUT)

3. Development of Hypotheses and Research Model

3.1. Revisiting the MAT

Perceived Benefits (PBs)

3.2. Revisiting UTAUT

3.2.1. Performance Expectancy (PE)

3.2.2. Effort Expectancy (EE)

3.2.3. Social Influence (SI)

3.2.4. Trust (TR)

3.2.5. Perceived Security (PS)

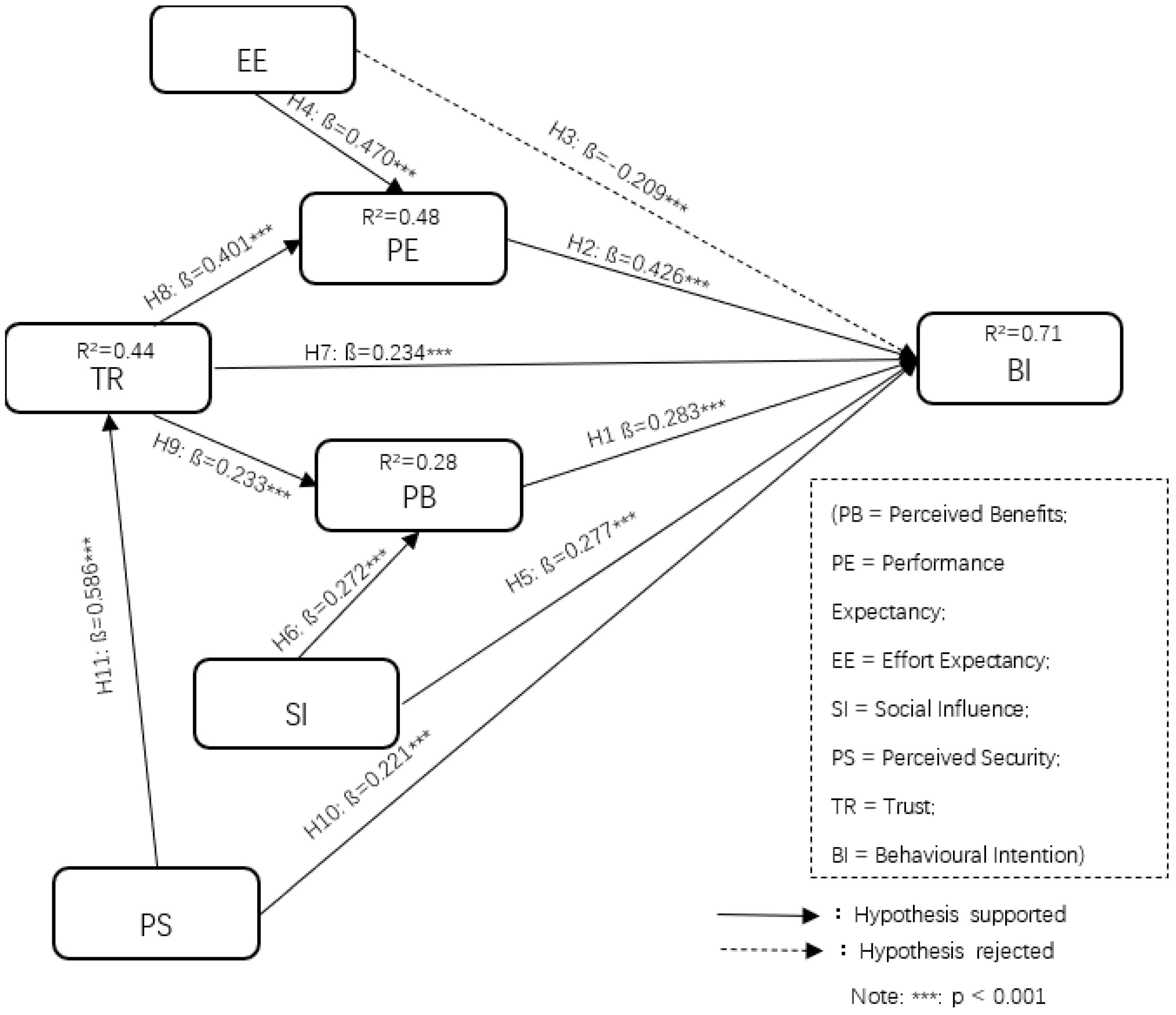

3.3. Research Model

4. Methodology

4.1. Measurement

4.2. Data Demographic Characteristics

5. Data Analysis

5.1. Measurement Model

5.2. Structural Model

6. Discussion

7. Theoretical and Practical Implications

7.1. Theoretical Implications

7.2. Practical Implications

8. Limitations and Future Research

9. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Constructs | Items | References |

|---|---|---|

| Perceived benefit (PB) | PB1—I perceive convenience when using M-payment during the COVID-19 pandemic. PB2—I feel using M-payment as a contactless payment is safer than traditional payment during the COVID-19 pandemic. PB3—I feel using M-payment is a beneficial payment method among people when conducting a financial transaction during the COVID-19 pandemic. | [8,14,24] |

| Performance expectancy (PE) | PE1—I feel M-payment is a useful way of purchasing during the COVD-19 pandemic. PE2—Using M-payment makes the handling of payments easier during the COVD-19 pandemic. PE3—Using M-payment improves my payment efficiency during the COVD-19 pandemic. PE4—Using M-payment improves my payment more quickly during the COVD-19 pandemic. | [11] |

| Effort expectancy (EE) | EE1—Learning how to use M-payment is easy. EE2—It is easy to follow all the steps of M-payment. EE3—It is easy to become skilful at using M-payment. EE4—Interaction with M-payment is clear and comprehensible during the COVD-19 pandemic. | [11,19] |

| Social influence (SI) | SI1—People who are important to me (e.g., family members, close friends, and colleagues) recommend me using M-payments during the COVD-19 pandemic. SI2—People who are important to me view M-payments as beneficial during the COVD-19 pandemic. SI3—People who are important to me think it is a good idea to use M-payments during the COVD-19 pandemic. SI4—People who are important to me support me to use of M-payments during the COVD-19 pandemic. | [4,15] |

| Trust (TR) | TR1—I believe M-payment platforms are competent and effective in handling my contactless transactions during the COVD-19 pandemic. TR2—I believe M-payment platforms keep customers’ interests in mind during the COVD-19 pandemic. TR3—I believe M-payment platforms are trustworthy during the COVD-19 pandemic. TR4—I believe M-payment platforms are honest to users during COVD-19 pandemic. TR5—I believe that legal frameworks for M-payment provision sufficiently protect consumers. | [15,16] |

| Perceived security (PS) | PS1—I feel secure using my credit/debit card information through M-payments during COVD-19 pandemic. PS2—I feel M-payments are secure when transmitting sensitive information during COVD-19 pandemic. PS3—I feel secure providing personal information when using M-payments during COVD-19 pandemic. | [15] |

| Behavioural intention (BI) | BI1—Given the opportunity, I will use M-payments during COVD-19 pandemic. BI2—I am willing to continuously use M-payments in the near future during COVD-19 pandemic. BI3—I am open to using M-payment as my mainly payment method in different transaction processes. BI4—I intend to continuously use M-payments in the future. | [8,11] |

References

- Worldpay. Global Payments Reports. 2020. Available online: https://worldpay.globalpaymentsreport.com/ (accessed on 2 June 2020).

- Di Pietro, L.; Mugion, G.R.; Mattia, G.; Renzi, M.F.; Toni, M. The Integrated Model on Mobile Payment Acceptance (IMMPA): An empirical application to public transport. Transp. Res. Part C Emerg. Technol. 2015, 56, 463–479. [Google Scholar] [CrossRef]

- Liébana-Cabanillas, F.; Marinkovic, V.; De Luna, I.R.; Kalinic, Z. Predicting the determinants of mobile payment acceptance: A hybrid SEM-neural network approach. Technol. Forecast. Soc. Chang. 2018, 129, 117–130. [Google Scholar] [CrossRef]

- Cao, Q.; Niu, X. Integrating context-awareness and UTAUT to explain Alipay user adoption. Int. J. Ind. Ergon. 2019, 69, 9–13. [Google Scholar] [CrossRef]

- Dahlberg, T.; Guo, J.; Ondrus, J. A critical review of mobile payment research. Electron. Commer. Res. Appl. 2015, 14, 265–284. [Google Scholar] [CrossRef]

- World Health Organization. WHO Coronavirus Disease (COVID-19) Dashboard. 2020. Available online: https://covid19.who.int/ (accessed on 29 September 2020).

- WHO. WHO, Coronavirus Disease (COVID-19) Advice for the Public. 2020. Available online: https://www.who.int/emergencies/diseases/novel-coronavirus-2019/advice-for-public (accessed on 12 June 2020).

- Tang, B.; Bragazzi, N.L.; Li, Q.; Tang, S.; Xiao, Y.; Wu, J. An updated estimation of the risk of transmission of the novel coronavirus (2019-nCov). Infect. Dis. Model. 2020, 5, 248–255. [Google Scholar] [CrossRef]

- China Banking and Insurance News. Mobile Payment Transactions Rose 187 per cent Year on Year. 2020. Available online: http://xw.sinoins.com/2020-04/30/content_341521.htm (accessed on 6 May 2020).

- The 46th China Statistical Report on Internet Development. Available online: http://www.gov.cn/xinwen/2020-09/29/5548176/files/1c6b4a2ae06c4ffc8bccb49da353495e.pdf (accessed on 29 September 2020).

- Venkatesh, V.; Thong, J.Y.; Xu, X. Consumer acceptance and use of information technology: Extending the unified theory of acceptance and use of technology. MIS Q. 2012, 36, 157–178. [Google Scholar] [CrossRef]

- El-Haddadeh, R.; Weerakkody, V.; Osmani, M.; Thakker, D.; Kapoor, K.K. Examining citizens’ perceived value of internet of things technologies in facilitating public sector services engagement. Gov. Inf. Q. 2019, 36, 310–320. [Google Scholar] [CrossRef]

- Gupta, S.; Kim, H.-W. Value-driven Internet shopping: The mental accounting theory perspective. Psychol. Mark. 2009, 27, 13–35. [Google Scholar] [CrossRef]

- Park, J.; Ahn, J.; Thavisay, T.; Ren, T. Examining the role of anxiety and social influence in multi-benefits of mobile payment service. J. Retail. Consum. Serv. 2019, 47, 140–149. [Google Scholar] [CrossRef]

- Khalilzadeh, J.; Ozturk, A.B.; Bilgihan, A. Security-related factors in extended UTAUT model for NFC based mobile payment in the restaurant industry. Comput. Hum. Behav. 2017, 70, 460–474. [Google Scholar] [CrossRef]

- Shao, Z.; Zhang, L.; Li, X.; Guo, Y. Antecedents of Trust and Continuance Intention in Mobile Payment Plat-forms: The Moderating Effect of Gender. Electron. Commer. Res. Appl. 2018, 33, 100823. [Google Scholar] [CrossRef]

- Ramos de Luna, I.; Liébana-Cabanillas, F.; Sánchez-Fernández, J.; Muñoz-Leiva, F. Mobile payment is not all the same: The adoption of mobile payment systems depending on the technology applied. Technol. Forecast. Soc. Chang. 2018, 146, 931–944. [Google Scholar] [CrossRef]

- Shankar, A.; Datta, B. Factors Affecting Mobile Payment Adoption Intention: An Indian Perspective. Glob. Bus. Rev. 2018, 19, S72–S89. [Google Scholar] [CrossRef]

- Hsiao, M.-H. Mobile payment services as a facilitator of value co-creation: A conceptual framework. J. High Technol. Manag. Res. 2019, 30, 100353. [Google Scholar] [CrossRef]

- Zhou, T. An empirical examination of continuance intention of mobile payment services. Decis. Support Syst. 2013, 54, 1085–1091. [Google Scholar] [CrossRef]

- Thaler, R. Mental Accounting and Consumer Choice. Mark. Sci. 1985, 4, 199–214. [Google Scholar] [CrossRef]

- Alghamdi, A.; Elbeltagi, I.; Elsetouhi, A.; Haddoud, M.Y. Antecedents of continuance intention of using Internet banking in Saudi Arabia: A new integrated model. Strateg. Chang. 2018, 27, 231–243. [Google Scholar] [CrossRef]

- Prelec, D.; Loewenstein, G. The Red and the Black: Mental Accounting of Savings and Debt. Mark. Sci. 1998, 17, 4–28. [Google Scholar] [CrossRef]

- De Kerviler, G.; Demoulin, N.; Zidda, P. Adoption of in-store mobile payment: Are perceived risk and convenience the only drivers? J. Retail. Consum. Serv. 2016, 31, 334–344. [Google Scholar] [CrossRef]

- Cheng, Y.-H.; Huang, T.-Y. High speed rail passengers’ mobile ticketing adoption. Transp. Res. Part C Emerg. Technol. 2013, 30, 143–160. [Google Scholar] [CrossRef]

- Venkatesh VMorris, M.G.; Davis, G.B.; Davis, F.D. User acceptance of information technology: Toward a unified view. MIS Q. 2003, 27, 425–478. [Google Scholar] [CrossRef]

- Marinković, V.; Đorđević, A.; Kalinić, Z. The moderating effects of gender on customer satisfaction and con-tinuance intention in mobile commerce: A UTAUT-based perspective. Technol. Anal. Strateg. Manag. 2020, 32, 306–318. [Google Scholar] [CrossRef]

- Oliveira, T.; Faria, M.; Thomas, M.A.; Popovič, A. Extending the understanding of mobile banking adoption: When UTAUT meets TTF and ITM. Int. J. Inf. Manag. 2014, 34, 689–703. [Google Scholar] [CrossRef]

- Forsythe, S.; Liu, C.; Shannon, D.; Gardner, L.C. Development of a scale to measure the perceived benefits and risks of online shopping. J. Interact. Mark. 2006, 20, 55–75. [Google Scholar] [CrossRef]

- Siyal, A.W.; Ding, D.; Umrani, W.A.; Siyal, S.; Bhand, S. Predicting Mobile Banking Acceptance and Loyalty in Chinese Bank Customers. SAGE Open 2019, 9. [Google Scholar] [CrossRef]

- Wilder-Smith, A.; Freedman, D.O. Isolation, quarantine, social distancing and community containment: Pivotal role for old-style public health measures in the novel coronavirus (2019-nCoV) outbreak. J. Travel Med. 2020, 27, 1–4. [Google Scholar] [CrossRef]

- Pham, T.T.T.; Ho, J.C. The effects of product-related, personal-related factors and attractiveness of alterna-tives on consumer adoption of NFC-based mobile payments. Technol. Soc. 2015, 43, 159–172. [Google Scholar] [CrossRef]

- Mun, Y.P.; Khalid, H.; Nadarajah, D. Millennials’ Perception on Mobile Payment Services in Malaysia. Procedia Comput. Sci. 2017, 124, 397–404. [Google Scholar] [CrossRef]

- Pal, D.; Vanijja, V.; Papasratorn, B. An Empirical Analysis towards the Adoption of NFC Mobile Payment System by the End User. Procedia Comput. Sci. 2015, 69, 13–25. [Google Scholar] [CrossRef]

- Alalwan, A.A.; Dwivedi, Y.K.; Rana, N.P. Factors influencing adoption of mobile banking by Jordanian bank customers: Extending UTAUT2 with trust. Int. J. Inf. Manag. 2017, 37, 99–110. [Google Scholar] [CrossRef]

- Slade, E.L.; Williams, M.D.; Dwivedi, Y.K.; Piercy, N. Exploring consumer adoption of proximity mobile payments. J. Strat. Mark. 2014, 23, 209–223. [Google Scholar] [CrossRef]

- Morosan, C.; DeFranco, A. It’s about time: Revisiting UTAUT2 to examine consumers’ intentions to use NFC mobile payments in hotels. Int. J. Hosp. Manag. 2016, 53, 17–29. [Google Scholar] [CrossRef]

- Gefen, D. E-commerce: The role of familiarity and trust. Omega 2000, 28, 725–737. [Google Scholar] [CrossRef]

- Zhu, D.H.; Lan, L.Y.; Chang, Y.P. Understanding the Intention to Continue Use of a Mobile Payment Pro-vider: An Examination of Alipay Wallet in China. Int. J. Bus. Inf. 2017, 12, 369–390. [Google Scholar]

- Shin, D.-H. Towards an understanding of the consumer acceptance of mobile wallet. Comput. Hum. Behav. 2009, 25, 1343–1354. [Google Scholar] [CrossRef]

- George, A.; Sunny, P. Determinants of Behavioral Intention to Use Mobile Wallets—A Conceptual Model. J. Manag. 2018, 5, 52–62. [Google Scholar]

- Hossain, M.S.; Zhou, X. Impact of m-payments on purchase intention and customer satisfaction: Perceived flow as mediator. Int. J. Sci. Bus. 2018, 2, 503–517. [Google Scholar]

- Johnson, V.L.; Kiser, A.I.T.; Washington, R.; Torres, R. Limitations to the rapid adoption of M-payment services: Understanding the impact of privacy risk on M-Payment services. Comput. Hum. Behav. 2018, 79, 111–122. [Google Scholar] [CrossRef]

- Xin, H.; Techatassanasoontorn, A.A.; Tan, F.B. Exploring the Influence of Trust on Mobile Payment Adoption. In Proceedings of the 2013 Pacific Asia Conference on Information Systems, Jeju Island, Korea, 18–22 June 2013; Volume 13. Available online: http://aisel.aisnet.org/pacis2013/143 (accessed on 30 September 2020).

- Babakus, E.; Mangold, W.G. Adapting the SERVQUAL scale to hospital services: An empirical investigation. Health Serv. Res. 1992, 26, 767–786. [Google Scholar]

- Bouranta, N.; Chitiris, L.; Paravantis, J. The relationship between internal and external service quality. Int. J. Contemp. Hosp. Manag. 2009, 21, 275–293. [Google Scholar] [CrossRef]

- Jackson, D.L. Revisiting Sample Size and Number of Parameter Estimates: Some Support for the N:q Hypothesis. Struct. Equ. Model. A Multidiscip. J. 2003, 10, 128–141. [Google Scholar] [CrossRef]

- Ryans, A.B. Estimating consumer preferences for a new durable brand in an established product class. J. Mark. Res. 1974, 11, 434–443. [Google Scholar] [CrossRef]

- Zhao, Y.; Bacao, F. What factors determining customer continuingly using food delivery apps during 2019 novel coronavirus pandemic period? Int. J. Hosp. Manag. 2020, 91, 102683. [Google Scholar] [CrossRef] [PubMed]

- Ipsos. Q3 Third Party Mobile Payment User Research Report. 2020. Available online: https://www.ipsos.com/zh-cn/yipusuoipsoszhongbang-disanjidudisanfangyidongzhifuyonghuyanjiubaogao (accessed on 7 January 2021).

- Anderson, J.C.; Gerbing, D.W. Structural equation modeling in practice: A review and recommended two-step approach. Psychol. Bull 1988, 103, 411–423. [Google Scholar] [CrossRef]

- Nunnally, J.C.; Bernstein, I.H. The assessment of reliability. Psychom. Theory 1994, 3, 248–292. [Google Scholar]

- Hair, J.F.; Anderson, R.E.; Tatham, R.L.; Black, W.C. Multivariate Data Analysis; Pearson Education: New Delhi, India, 2012. [Google Scholar]

- Straub, D.W. Validating Instruments in MIS Research. MIS Q. 1989, 13, 147. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measure-ment error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Sharma, S.K.; Sharma, M. Examining the role of trust and quality dimensions in the actual usage of mobile banking services: An empirical investigation. Int. J. Inf. Manag. 2019, 44, 65–75. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; MacKenzie, S.B.; Lee, J.Y.; Podsakoff, N.P. Common method biases in behavioral research: A critical review of the literature and recommended remedies. J. Appl. Psychol. 2003, 88, 879–903. [Google Scholar] [CrossRef]

- Malhotra, N.K.; Kim, S.S.; Patil, A. Common Method Variance in IS Research: A Comparison of Alternative Approaches and a Reanalysis of Past Research. Manag. Sci. 2006, 52, 1865–1883. [Google Scholar] [CrossRef]

- Falk, R.F.; Miller, N.B. A Primer for Soft Modeling; The University of Akron Press: Akron, OH, USA, 1992. [Google Scholar]

- Chopdar, P.K.; Sivakumar, V.J. Understanding continuance usage of mobile shopping applications in India: The role of espoused cultural values and perceived risk. Behav. Inf. Technol. 2018, 38, 42–64. [Google Scholar] [CrossRef]

- Oliveira, T.; Thomas, M.; Baptista, G.; Campos, F. Mobile payment: Understanding the determinants of cus-tomer adoption and intention to recommend the technology. Comput. Hum. Behav. 2016, 61, 404–414. [Google Scholar] [CrossRef]

- Yuan, S.; Liu, Y.; Yao, R.; Liu, J. An investigation of users’ continuance intention towards mobile banking in China. Inf. Dev. 2016, 32, 20–34. [Google Scholar] [CrossRef]

- Baptista, G.; Oliveira, T. Understanding mobile banking: The unified theory of acceptance and use of technol-ogy combined with cultural moderators. Comput. Hum. Behav. 2015, 50, 418–430. [Google Scholar] [CrossRef]

- Hassan, H.E.; Wood, V.R. Does country culture influence consumers’ perceptions toward mobile banking? A comparison between Egypt and the United States. Telemat. Inform. 2020, 46, 101312. [Google Scholar] [CrossRef]

| Studies | Theoretical Frameworks | Factors |

|---|---|---|

| [15] | UTAUT | Risk Security Trust Performance Expectancy (Hedonic and Utilitarian) Social Influence Effort Expectancy Self-Efficacy Facilitating Conditions |

| [18] | TAM | Perceived ease of use Perceived usefulness Trust Self-efficacy Subjective norms Personal innovativeness |

| [14] | Mental accounting theory | Technology anxiety Social influences. Multidimensional benefits (Convenient; Economic; Information security; Enjoyment; Experiential; Social) Attitudes towards using. |

| [17] | TAM | Perceived ease of use Perceived usefulness Subjective norms Attitude Perceived security |

| [19] | Expectancy-value theory, Task–technology fit | Characteristics Capability Task–technology fit Utilization Benefits |

| Measures | Items | N | % |

|---|---|---|---|

| Gender | Male | 338 | 45.74% |

| Female | 401 | 54.26% | |

| Age | <21 | 170 | 23.00% |

| 21–30 | 398 | 53.86% | |

| 31–40 | 80 | 10.83% | |

| 41–50 | 29 | 3.92% | |

| >50 | 62 | 8.39% | |

| Education | High school and lower | 66 | 8.93% |

| Bachler or collage | 456 | 61.71% | |

| Master | 194 | 26.25% | |

| PhD and above | 18 | 2.44% | |

| Other | 5 | 0.68% | |

| Occupation | Student | 175 | 23.68% |

| Employee | 318 | 43.03% | |

| Public Servant | 47 | 6.36% | |

| Retiree | 47 | 6.36% | |

| Unemployed | 6 | 0.81% | |

| Freelancer | 65 | 8.80% | |

| Other | 81 | 10.96% | |

| Experience | At least 1 time per 1day | 415 | 56.16% |

| At least 1 time per 1 week | 278 | 37.62% | |

| At least 1 time per 2 weeks | 37 | 5.01% | |

| At least 1 time per 1 month | 7 | 0.95% | |

| Never use during the COVID-19 pandemic | 2 | 0.27% |

| Factors | Items | Loadings | Cronbach’s Alpha |

|---|---|---|---|

| Performance Expectancy (PE) | PE1 | 0.810 | 0.888 |

| PE2 | 0.850 | ||

| PE3 | 0.792 | ||

| PE4 | 0.812 | ||

| Effort Expectancy (EE) | EE1 | 0.813 | 0.897 |

| EE2 | 0.854 | ||

| EE3 | 0.806 | ||

| EE4 | 0.843 | ||

| Social Influence (SI) | SI1 | 0.805 | 0.894 |

| SI2 | 0.829 | ||

| SI3 | 0.805 | ||

| SI4 | 0.854 | ||

| Perceived benefits (PBs) | PB1 | 0.719 | 0.807 |

| PB2 | 0.828 | ||

| PB3 | 0.751 | ||

| Perceived Security (PS) | PS1 | 0.773 | 0.848 |

| PS2 | 0.850 | ||

| PS3 | 0.800 | ||

| Trust (TR) | TR1 | 0.771 | 0.878 |

| TR2 | 0.714 | ||

| TR3 | 0.794 | ||

| TR4 | 0.801 | ||

| TR5 | 0.769 | ||

| Behavioral Intention (BI) | BI1 | 0.829 | 0.877 |

| BI2 | 0.799 | ||

| BI3 | 0.777 | ||

| BI4 | 0.797 |

| CR | AVE | MSV | TR | PE | EE | SI | PB | PS | BI | |

|---|---|---|---|---|---|---|---|---|---|---|

| TR | 0.879 | 0.594 | 0.487 | 0.770 | ||||||

| PE | 0.859 | 0.670 | 0.442 | 0.532 | 0.818 | |||||

| EE | 0.898 | 0.688 | 0.165 | 0.280 | 0.582 | 0.829 | ||||

| SI | 0.894 | 0.678 | 0.496 | 0.594 | 0.630 | 0.406 | 0.823 | |||

| PB | 0.811 | 0.589 | 0.361 | 0.463 | 0.459 | 0.256 | 0.506 | 0.767 | ||

| PS | 0.850 | 0.653 | 0.387 | 0.619 | 0.379 | 0.184 | 0.497 | 0.388 | 0.808 | |

| BI | 0.877 | 0.641 | 0.496 | 0.698 | 0.665 | 0.271 | 0.704 | 0.601 | 0.622 | 0.801 |

| X2/DF | CFI | GFI | AGFI | NFI | TLI | RMSEA | |

|---|---|---|---|---|---|---|---|

| Recommended Value | <3 | >0.9 | >0.9 | >0.9 | >0.9 | >0.9 | <0.08 |

| Measurement Model | 1.832 | 0.979 | 0.948 | 0.935 | 0.959 | 0.979 | 0.034 |

| Structural Model | 2.369 | 0.965 | 0.933 | 0.918 | 0.942 | 0.961 | 0.043 |

| Hypotheses | Relations | Estimate | T and p | Decisions |

|---|---|---|---|---|

| Hypothesis 1: Perceived benefits have a positive effect on the behavioral intention to adopt M-payments during the COVID-19 pandemic. | PB → BI | 0.283 | 5.591 *** | Supported |

| Hypothesis 2: Performance expectancy has a positive effect on the behavioral intention to adopt M-payments during the COVID-19 pandemic. | PE → BI | 0.426 | 8.059 *** | Supported |

| Hypothesis 3: Effort expectancy has a positive effect on the behavioral intention to adopt M-payments during the COVID-19 pandemic. | EE → BI | −0.209 | −4.712 *** | Rejected |

| Hypothesis 4: Effort expectancy has a positive effect on the performance expectancy to adopt M-payments during the COVID-19 pandemic. | EE → PE | 0.470 | 13.35 *** | Supported |

| Hypothesis 5: Social influence has a positive effect on the behavioral intention to adopt M-payments during the COVID-19 pandemic. | SI → BI | 0.277 | 6.416 *** | Supported |

| Hypothesis 6: Social influence has a positive effect on the perceived benefits to adopt M-payments during the COVID-19 pandemic. | SI → PB | 0.272 | 8.057 *** | Supported |

| Hypothesis 7: Trust has a positive effect on the behavioral intention to adopt M-payments during the COVID-19 pandemic. | TR → BI | 0.234 | 4.254 *** | Supported |

| Hypothesis 8: Trust has a positive effect on performance expectancy to adopt M-payments during the COVID-19 pandemic. | TR → PE | 0.401 | 11.242 *** | Supported |

| Hypothesis 9: Trust has a positive effect on perceived benefits to adopt M-payments during the COVID-19 pandemic. | TR → PB | 0.233 | 6.306 *** | Supported |

| Hypothesis 10: Perceived security has a positive effect on the behavioral intention to adopt M-payments during the COVID-19 pandemic. | PS → BI | 0.221 | 4.493 *** | Supported |

| Hypothesis 11: Perceived security has a positive effect on trust to adopt M-payments during the COVID-19 pandemic. | PS → TR | 0.586 | 14.664 *** | Supported |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhao, Y.; Bacao, F. How Does the Pandemic Facilitate Mobile Payment? An Investigation on Users’ Perspective under the COVID-19 Pandemic. Int. J. Environ. Res. Public Health 2021, 18, 1016. https://doi.org/10.3390/ijerph18031016

Zhao Y, Bacao F. How Does the Pandemic Facilitate Mobile Payment? An Investigation on Users’ Perspective under the COVID-19 Pandemic. International Journal of Environmental Research and Public Health. 2021; 18(3):1016. https://doi.org/10.3390/ijerph18031016

Chicago/Turabian StyleZhao, Yuyang, and Fernando Bacao. 2021. "How Does the Pandemic Facilitate Mobile Payment? An Investigation on Users’ Perspective under the COVID-19 Pandemic" International Journal of Environmental Research and Public Health 18, no. 3: 1016. https://doi.org/10.3390/ijerph18031016

APA StyleZhao, Y., & Bacao, F. (2021). How Does the Pandemic Facilitate Mobile Payment? An Investigation on Users’ Perspective under the COVID-19 Pandemic. International Journal of Environmental Research and Public Health, 18(3), 1016. https://doi.org/10.3390/ijerph18031016