Can Major Public Health Emergencies Affect Changes in International Oil Prices?

Abstract

:1. Introduction

2. Deducing the Logical Relationship

3. Methods and Data

3.1. Methods

3.2. Data

4. Results

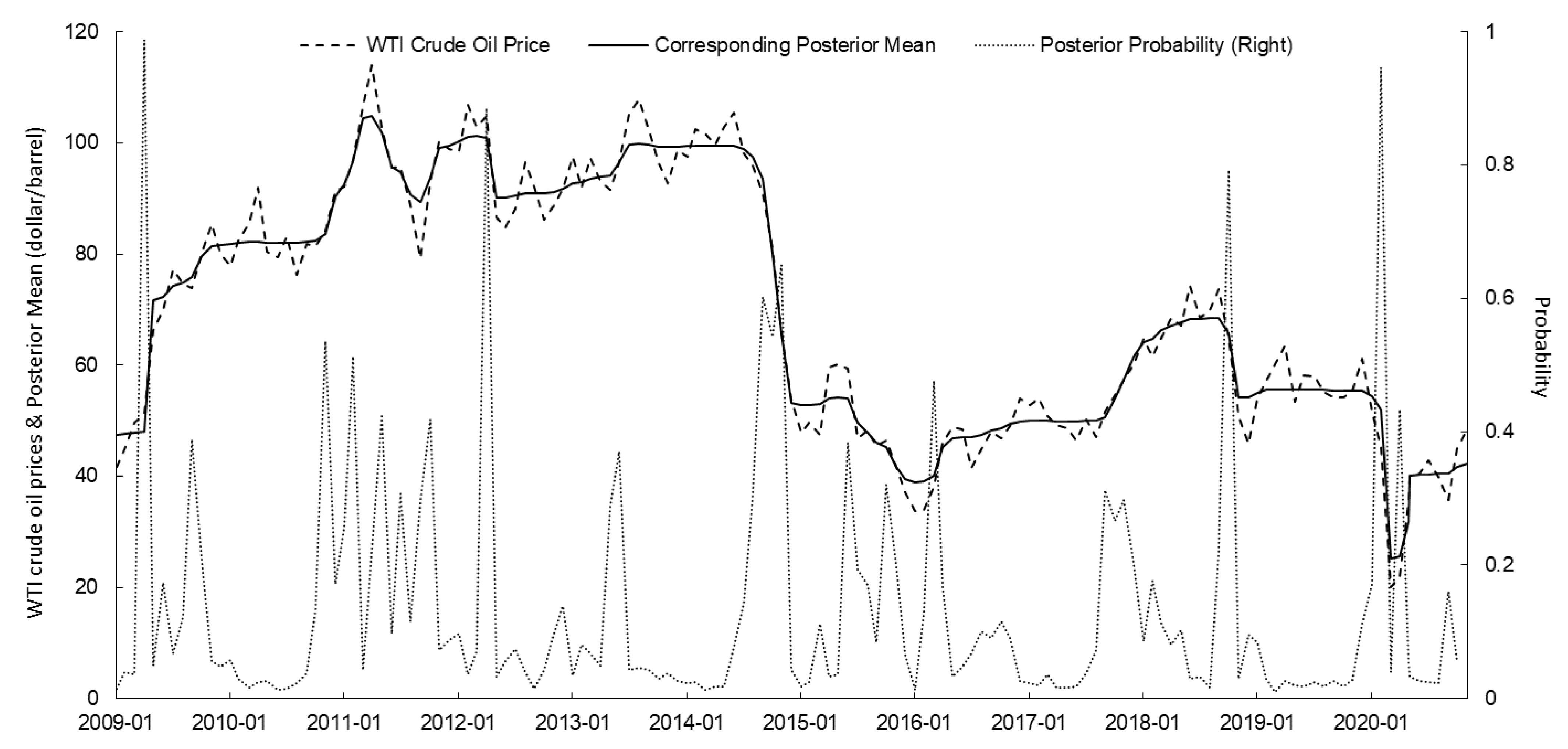

4.1. The Influenza A (H1N1) Pandemic and Oil Price Changes

4.2. The Wild Poliovirus Epidemic and Oil Price Changes

4.3. The Ebola Epidemic and Oil Price Changes

4.4. The Zika Epidemic and Oil Price Changes

4.5. The Ebola Epidemic in DRC and Oil Price Changes

4.6. The COVID-19 Pandemic and Oil Price Changes

5. Discussion

6. Conclusions and Insights

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| PHEIC | PHEIC Announcement Date | The Investigation Time of Abrupt Changes in Oil Prices | Posterior Probability of Abrupt Changes in Oil Prices | Posterior Probability of Abrupt Changes in the US Dollar Index | Posterior Probability of Abrupt Changes in Global Oil Production | Posterior Probability of Abrupt Changes in Oil Consumption of OECD Countries |

|---|---|---|---|---|---|---|

| The influenza A (H1N1) pandemic | 2009.4.25 | 2009.4 | 0.988 * | 0.962 * | 0.012 | 0.090 |

| 2009.5 | 0.050 | 0.036 | 0.174 | 0.048 | ||

| 2009.6 | 0.174 | 0.084 | 0.710 * | 0.064 | ||

| The wild poliovirus epidemic | 2014.5.5 | 2014.5 | 0.018 | 0.022 | 0.416 * | 0.038 |

| 2014.6 | 0.078 | 0.034 | 0.074 | 0.098 | ||

| 2014.7 | 0.144 | 0.052 | 0.098 | 0.040 | ||

| The Ebola epidemic | 2014.8.8 | 2014.8 | 0.304 * | 0.316 * | 0.554 * | 0.080 |

| 2014.9 | 0.602 * | 0.562 * | 0.354 * | 0.052 | ||

| 2014.10 | 0.542 * | 0.166 | 0.002 | 0.052 | ||

| The Zika epidemic | 2016.2.18 | 2016.2 | 0.128 | 0.160 | 0.006 | 0.016 |

| 2016.3 | 0.476 * | 0.018 | 0.022 | 0.016 | ||

| 2016.4 | 0.166 | 0.014 | 0.002 | 0.012 | ||

| The Ebola epidemic in DRC | 2019.7.17 | 2019.7 | 0.024 | 0.056 | 0.016 | 0.020 |

| 2019.8 | 0.018 | 0.022 | 0.010 | 0.022 | ||

| 2019.9 | 0.026 | 0.006 | 0.118 | 0.014 | ||

| COVID-19 | 2020.1.31 | 2020.1 | 0.172 | 0.030 | 0.092 | 0.034 |

| 2020.2 | 0.946 * | 0.986 * | 0.014 | 0.978 * | ||

| 2020.3 | 0.004 | 0.008 | 0.012 | 1.000 * |

References

- Baumeister, C.; Kilian, L. Forty Years of Oil Price Fluctuations: Why the Price of Oil May Still Surprise Us. J. Econ. Perspect. 2016, 30, 139–160. [Google Scholar] [CrossRef] [Green Version]

- Mork, K.A. Oil and the Macroeconomy When Prices Go Up and Down: An Extension of Hamilton’s Results. J. Polit. Econ. 1989, 97, 740–744. [Google Scholar] [CrossRef]

- Kilian, L. Not All Oil Price Shocks Are Alike: Disentangling Demand and Supply Shocks in the Crude Oil Market. Am. Econ. Rev. 2009, 99, 1053–1069. [Google Scholar] [CrossRef] [Green Version]

- Wang, Q.F.; Sun, X. Crude oil price: Demand, supply, economic activity, economic policy uncertainty and wars—From the perspective of structural equation modelling (SEM). Energy 2017, 133, 483–490. [Google Scholar] [CrossRef]

- Kollias, C.; Kyrtsou, C.; Papadamou, S. The effects of terrorism and war on the oil price-stock index relationship. Energy Econ. 2013, 40, 743–752. [Google Scholar] [CrossRef]

- Noguera-Santaella, J. Geopolitics and the oil price. Econ. Model. 2016, 52, 301–309. [Google Scholar] [CrossRef]

- Monge, M.; Gil-Alana, L.A.; de Gracia, F.P. Crude oil price behaviour before and after military conflicts and geopolitical events. Energy 2017, 120, 79–91. [Google Scholar] [CrossRef]

- Degiannakis, S.; Fills, G.; Panagiotakopoulou, S. Oil price shocks and uncertainty: How stable is their relationship over time? Econ. Model. 2018, 72, 42–53. [Google Scholar] [CrossRef] [Green Version]

- Han, X.; Chen, Y.; Wang, X. Impacts of China’s bioethanol policy on the global maize market: A partial equilibrium analysis to 2030. Food Secur. 2021, 1–17. [Google Scholar] [CrossRef]

- Chesney, M.; Reshetar, G.; Karaman, M. The impact of terrorism on financial markets: An empirical study. J. Bank. Financ. 2011, 35, 253–267. [Google Scholar] [CrossRef] [Green Version]

- Hartmann, P.; Straetmans, S.; de Vries, C.G. Asset Market Linkages in Crisis Periods. Rev. Econ. Stat. 2004, 86, 313–326. [Google Scholar] [CrossRef] [Green Version]

- White, H.; Kim, T.-H.; Manganelli, S. VAR for VaR: Measuring tail dependence using multivariate regression quantiles. J. Econom. 2015, 187, 169–188. [Google Scholar] [CrossRef] [Green Version]

- Decerf, B.; Ferreira, F.H.G.; Mahler, D.G.; Sterck, O. Lives and livelihoods: Estimates of the global mortality and poverty effects of the Covid-19 pandemic. World Dev. 2021, 146, 17. [Google Scholar] [CrossRef]

- Hobbs, J.E. Food supply chains during the COVID-19 pandemic. Can. J. Agric. Econ.-Rev. Can. Agroecon. 2020, 68, 171–176. [Google Scholar] [CrossRef] [Green Version]

- Di Gennaro, F.; Pizzol, D.; Marotta, C.; Antunes, M.; Racalbuto, V.; Veronese, N.; Smith, L. Coronavirus Diseases (COVID-19) Current Status and Future Perspectives: A Narrative Review. Int. J. Environ. Res. Public Health 2020, 17, 2690. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Alsharef, A.; Banerjee, S.; Uddin, S.M.J.; Albert, A.; Jaselskis, E. Early Impacts of the COVID-19 Pandemic on the United States Construction Industry. Int. J. Environ. Res. Public Health 2021, 18, 1559. [Google Scholar] [CrossRef]

- Sharif, A.; Aloui, C.; Yarovaya, L. COVID-19 pandemic, oil prices, stock market, geopolitical risk and policy uncertainty nexus in the US economy: Fresh evidence from the wavelet-based approach. Int. Rev. Financ. Anal. 2020, 70, 101496. [Google Scholar] [CrossRef]

- Young, E.J. An Overview of Human Brucellosis. Clin. Infect. Dis. 1995, 21, 283–289. [Google Scholar] [CrossRef]

- Gaynes, R. The discovery of penicillin—New insights after more than 75 years of clinical use. Emerg. Infect. Dis 2017, 23, 849–853. [Google Scholar] [CrossRef]

- Milner, D. Diagnostic Pathology: Infectious Diseases, 1st ed.; Amirsys: Salt Lake City, UT, USA, 2016. [Google Scholar]

- Rodríguez-Morales, A.J.; MacGregor, K.; Kanagarajah, S.; Patel, D.; Schlagenhauf, P. Going global—Travel and the 2019 novel coronavirus. Travel Med. Infect. Dis. 2020, 33, 101578. [Google Scholar] [CrossRef]

- World Health Organization. International Health Regulations (2005): Areas of Work for Implementation; World Health Organization: Geneva, Switzerland, 2007. [Google Scholar]

- Wilder-Smith, A.; Osman, S. Public health emergencies of international concern: A historic overview. J. Travel Med. 2020, 27, taaa227. [Google Scholar] [CrossRef]

- Christensen, D.; Dube, O.; Haushofer, J.; Siddiqi, B.; Voors, M. Building Resilient Health Systems: Experimental Evidence from Sierra Leone and The 2014 Ebola Outbreak. Q. J. Econ. 2020, 136, 1145–1198. [Google Scholar] [CrossRef]

- Chang, C.L.; McAleer, M.; Wang, Y.A. Herding behaviour in energy stock markets during the Global Financial Crisis, SARS, and ongoing COVID-19. Renew. Sustain. Energy Rev. 2020, 134, 110349. [Google Scholar] [CrossRef] [PubMed]

- Rizvi, S.K.A.; Itani, R. Oil market volatility: Comparison of COVID-19 crisis with the SARS outbreak of 2002 and the global financial crisis of 2008. Ekon. Istraz. 2021, Online. [Google Scholar] [CrossRef]

- Akhtaruzzaman, M.; Boubaker, S.; Chiah, M.; Zhong, A. COVID−19 and oil price risk exposure. Financ. Res. Lett. 2021, 42, 101882. [Google Scholar] [CrossRef]

- Mensi, W.; Sensoy, A.; Vo, X.V.; Kang, S.H. Impact of COVID-19 outbreak on asymmetric multifractality of gold and oil prices. Resour. Policy 2020, 69, 101829. [Google Scholar] [CrossRef] [PubMed]

- Barry, D.; Hartigan, J.A. A Bayesian Analysis for Change Point Problems. J. Am. Stat. Assoc. 1993, 88, 309–319. [Google Scholar]

- Song, R.; Shu, M.; Zhu, W. The 2020 global stock market crash: Endogenous or exogenous? Phys. A 2022, 585, 126425. [Google Scholar] [CrossRef]

- Agboola, M.O.; Bekun, F.V.; Balsalobre-Lorente, D. Implications of Social Isolation in Combating COVID-19 Outbreak in Kingdom of Saudi Arabia: Its Consequences on the Carbon Emissions Reduction. Sustainability 2021, 13, 9476. [Google Scholar] [CrossRef]

- Malliaris, A.G.; Malliaris, M. What Microeconomic Fundamentals Drove Global Oil Prices during 1986–2020? J. Risk Financ. Manag. 2021, 14, 391. [Google Scholar] [CrossRef]

- Tudor, C.; Anghel, A. The Financialization of Crude Oil Markets and Its Impact on Market Efficiency: Evidence from the Predictive Ability and Performance of Technical Trading Strategies. Energies 2021, 14, 4485. [Google Scholar] [CrossRef]

- Khalfaoui, R.; Nammouri, H.; Labidi, O.; Ben Jabeur, S. Is the COVID-19 vaccine effective on the US financial market? Public Health 2021, 198, 177–179. [Google Scholar] [CrossRef]

- Wang, H.; Li, S. Asymmetric volatility spillovers between crude oil and China’s financial markets. Energy 2021, 233, 121168. [Google Scholar] [CrossRef]

- Joo, K.; Suh, J.H.; Lee, D.; Ahn, K. Impact of the global financial crisis on the crude oil market. Energy Strategy Rev. 2020, 30, 100516. [Google Scholar] [CrossRef]

- Bejger, S. Competition in a Wholesale Fuel Market—The Impact of the Structural Changes Caused by COVID-19. Energies 2021, 14, 4211. [Google Scholar] [CrossRef]

- Chen, Y. Evaluating the influence of energy prices on tight oil supply with implications on the impacts of COVID-19. Resour. Policy 2021, 73, 102129. [Google Scholar] [CrossRef]

- Ezeaku, H.C.; Asongu, S.A.; Nnanna, J. Volatility of international commodity prices in times of COVID-19: Effects of oil supply and global demand shocks. Extr. Ind. Soc. 2021, 8, 257–270. [Google Scholar] [CrossRef]

- Tian, M.; Li, W.; Wen, F. The dynamic impact of oil price shocks on the stock market and the USD/RMB exchange rate: Evidence from implied volatility indices. N. Am. Econ. Financ. 2021, 55, 101310. [Google Scholar] [CrossRef]

- Youssef, M.; Mokni, K. Modeling the relationship between oil and USD exchange rates: Evidence from a regime-switching-quantile regression approach. J. Multinatl. Financ. Manag. 2020, 55, 100625. [Google Scholar] [CrossRef]

- Bedoui, R.; Braeik, S.; Goutte, S.; Guesmi, K. On the study of conditional dependence structure between oil, gold and USD exchange rates. Int. Rev. Financ. Anal. 2018, 59, 134–146. [Google Scholar] [CrossRef]

- Horobet, A.; Vrinceanu, G.; Popescu, C.; Belascu, L. Oil Price and Stock Prices of EU Financial Companies: Evidence from Panel Data Modeling. Energies 2019, 12, 4072. [Google Scholar] [CrossRef] [Green Version]

- Fasanya, I.O.; Adekoya, O.B.; Adetokunbo, A.M. On the connection between oil and global foreign exchange markets: The role of economic policy uncertainty. Resour. Policy 2021, 72, 102110. [Google Scholar] [CrossRef]

- Fedoseeva, S. Under pressure: Dynamic pass-through of oil prices to the RUB/USD exchange rate. Int. Econ. 2018, 156, 117–126. [Google Scholar] [CrossRef]

- Alley, I. Oil price and USD-Naira exchange rate crash: Can economic diversification save the Naira? Energy Policy 2018, 118, 245–256. [Google Scholar] [CrossRef]

- Shaikh, I. On the relation between Pandemic Disease Outbreak News and Crude oil, Gold, Gold mining, Silver and Energy Markets. Resour. Policy 2021, 72, 102025. [Google Scholar] [CrossRef] [PubMed]

- Zhang, W.; Hamori, S. Crude oil market and stock markets during the COVID-19 pandemic: Evidence from the US, Japan, and Germany. Int. Rev. Financ. Anal. 2021, 74, 101702. [Google Scholar] [CrossRef]

- Jia, Z.; Wen, S.; Lin, B. The effects and reacts of COVID-19 pandemic and international oil price on energy, economy, and environment in China. Appl. Energy 2021, 302, 117612. [Google Scholar] [CrossRef]

- Loschi, R.H.; Cruz, F.R.B.; Iglesias, P.L.; Arellano-Valle, R.B. A Gibbs sampling scheme to the product partition model: An application to change-point problems. Comput. Oper. Res. 2003, 30, 463–482. [Google Scholar] [CrossRef]

- Quintana, F.A.; Iglesias, P.L. Bayesian Clustering and Product Partition Models. J. R. Stat. Soc. Ser. B-Stat. Methodol. 2003, 65, 557–574. [Google Scholar] [CrossRef]

- Loschi, R.H.; Cruz, F.R.B. Extension to the product partition model: Computing the probability of a change. Comput. Stat. Data Anal. 2005, 48, 255–268. [Google Scholar] [CrossRef]

- Ferreira, J.A.; Loschi, R.H.; Costa, M.A. Detecting changes in time series: A product partition model with across-cluster correlation. Signal Process. 2014, 96, 212–227. [Google Scholar] [CrossRef]

- Huang, X.; Huang, S. Identifying the comovement of price between China’s and international crude oil futures: A time-frequency perspective. Int. Rev. Financ. Anal. 2020, 72, 101562. [Google Scholar] [CrossRef]

- Makkonen, A.; Vallström, D.; Uddin, G.S.; Rahman, M.L.; Haddad, M.F.C. The effect of temperature anomaly and macroeconomic fundamentals on agricultural commodity futures returns. Energy Econ. 2021, 100, 105377. [Google Scholar] [CrossRef]

- Chai, J.; Zhu, Q.; Zhang, Z.Y.; Xiao, H.; Wang, S.Y. Identification and Analysis of the Breaking Point of Oil Price. China Popul. Resour. Environ. 2014, 24, 109–117. [Google Scholar]

- Wang, Q.; Zhang, T.; Zhu, H.; Wang, Y.; Liu, X.; Bai, G.; Dai, R.; Zhou, P.; Luo, L. Characteristics of and Public Health Emergency Responses to COVID-19 and H1N1 Outbreaks: A Case-Comparison Study. Int. J. Environ. Res. Public Health 2020, 17, 4409. [Google Scholar] [CrossRef]

- Schmidbauer, H.; Rösch, A. OPEC news announcements: Effects on oil price expectation and volatility. Energy Econ. 2012, 34, 1656–1663. [Google Scholar] [CrossRef]

- Su, C.-W.; Qin, M.; Tao, R.; Moldovan, N.-C.; Lobonţ, O.-R. Factors driving oil price—From the perspective of United States. Energy 2020, 197, 117219. [Google Scholar] [CrossRef]

- Wilder-Smith, A.; Leong, W.-Y.; Lopez, L.F.; Amaku, M.; Quam, M.; Khan, K.; Massad, E. Potential for international spread of wild poliovirus via travelers. BMC Med. 2015, 13, 133. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Baize, S.; Pannetier, D.; Oestereich, L.; Rieger, T.; Koivogui, L.; Magassouba, N.F.; Soropogui, B.; Sow, M.S.; Keïta, S.; De Clerck, H. Emergence of Zaire Ebola virus disease in Guinea. N. Engl. J. Med. 2014, 371, 1418–1425. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Petersen, L.R.; Jamieson, D.J.; Powers, A.M.; Honein, M.A. Zika Virus. N. Engl. J. Med. 2016, 374, 1552–1563. [Google Scholar] [CrossRef]

- Ilunga Kalenga, O.; Moeti, M.; Sparrow, A.; Nguyen, V.-K.; Lucey, D.; Ghebreyesus, T.A. The Ongoing Ebola Epidemic in the Democratic Republic of Congo, 2018–2019. N. Engl. J. Med. 2019, 381, 373–383. [Google Scholar] [CrossRef]

- Lurie, N.; Keusch, G.T.; Dzau, V.J. Urgent lessons from COVID 19: Why the world needs a standing, coordinated system and sustainable financing for global research and development. Lancet 2021, 397, 1229–1236. [Google Scholar] [CrossRef]

- Johns Hopkins University & Medicine. Coronavirus Resource Center. Available online: https://coronavirus.jhu.edu/ (accessed on 31 October 2021).

- AbdelMaksoud, K.M.; Hathout, H.M.R.; Albagoury, S.H. The socio-economic impact of COVID-19 on the petroleum sector in Egypt: A descriptive analysis. Int. J. Soc. Econ. 2021. ahead-of-print. [Google Scholar] [CrossRef]

- Ma, R.R.; Xiong, T.; Bao, Y.K. The Russia-Saudi Arabia oil price war during the COVID-19 pandemic. Energy Econ. 2021, 102, 105517. [Google Scholar] [CrossRef]

| Scheme | Outbreak Time | Epidemic Name |

|---|---|---|

| 1 | 2009.3 | Influenza A (H1N1) pandemic |

| 2 | 2014.5 | Wild poliovirus epidemic |

| 3 | 2014.8 | Ebola epidemic |

| 4 | 2016.2 | Zika epidemic |

| 5 | 2019.7 | Ebola epidemic in DRC |

| 6 | 2020.1 | COVID-19 |

| PHEIC | PHEIC Announcement Date | The Investigation Time of Abrupt Changes in Oil Prices | Posterior Probability of Abrupt Changes in Oil Prices | Posterior Probability of Abrupt Changes in the US Dollar Index | Posterior Probability of Abrupt Changes in Global Oil Production | Posterior Probability of Abrupt Changes in Oil Consumption of OECD Countries |

|---|---|---|---|---|---|---|

| The influenza A (H1N1) pandemic | 2009.4.25 | 2009.4 | 0.988 * | 0.962 * | 0.012 | 0.090 |

| 2009.5 | 0.050 | 0.036 | 0.174 | 0.048 | ||

| The wild poliovirus epidemic | 2014.5.5 | 2014.5 | 0.018 | 0.022 | 0.416 * | 0.038 |

| 2014.6 | 0.078 | 0.034 | 0.074 | 0.098 | ||

| The Ebola epidemic | 2014.8.8 | 2014.8 | 0.304 * | 0.316 * | 0.554 * | 0.080 |

| 2014.9 | 0.602 * | 0.562 * | 0.354 * | 0.052 | ||

| The Zika epidemic | 2016.2.18 | 2016.2 | 0.128 | 0.160 | 0.006 | 0.016 |

| 2016.3 | 0.476 * | 0.018 | 0.022 | 0.016 | ||

| The Ebola epidemic in DRC | 2019.7.17 | 2019.7 | 0.024 | 0.056 | 0.016 | 0.020 |

| 2019.8 | 0.018 | 0.022 | 0.010 | 0.022 | ||

| COVID-19 | 2020.1.31 | 2020.1 | 0.172 | 0.030 | 0.092 | 0.034 |

| 2020.2 | 0.946 * | 0.986 * | 0.014 | 0.978 * |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cheng, A.; Chen, T.; Jiang, G.; Han, X. Can Major Public Health Emergencies Affect Changes in International Oil Prices? Int. J. Environ. Res. Public Health 2021, 18, 12955. https://doi.org/10.3390/ijerph182412955

Cheng A, Chen T, Jiang G, Han X. Can Major Public Health Emergencies Affect Changes in International Oil Prices? International Journal of Environmental Research and Public Health. 2021; 18(24):12955. https://doi.org/10.3390/ijerph182412955

Chicago/Turabian StyleCheng, An, Tonghui Chen, Guogang Jiang, and Xinru Han. 2021. "Can Major Public Health Emergencies Affect Changes in International Oil Prices?" International Journal of Environmental Research and Public Health 18, no. 24: 12955. https://doi.org/10.3390/ijerph182412955

APA StyleCheng, A., Chen, T., Jiang, G., & Han, X. (2021). Can Major Public Health Emergencies Affect Changes in International Oil Prices? International Journal of Environmental Research and Public Health, 18(24), 12955. https://doi.org/10.3390/ijerph182412955