1. Introduction

Friedman argues that firms should focus on maximizing profits for shareholders, who privately donate their wealth to the causes of their choice [

1]. Specifically, he points out that firm managers should refrain from unprofitable behavior regardless of their ownership structure, in accordance with “corporate social responsibility”, which may reduce returns to stockholders. If firms produce unfavorable outcomes to shareholders and the public, investors and the market would attempt to reverse these harmful choices.

With the currently heightened risk from climate change, carbon emission by firms has been brought under scrutiny and public criticism. Consequently, firm managers face greater pressure from several institutions, including the government, media, and NGOs, to both reduce and disclose their carbon emissions. For example, environmental organizations, including the Carbon Disclosure Project (CDP) and the Global Reporting Initiative (GRI), have publicly requested firms to increase transparency by disclosing environmental information, such as carbon emissions. Simultaneously, firm managers face growing shareholder pressure to self-evaluate and report the risks and opportunities their firms encounter regarding climate change.

A firm’s reputation for environmental responsibility brings potential benefits to the stakeholder community of the firm. These benefits include revenue growth, positive perception from various stakeholders, including employees, customers, and suppliers, and potential increases in the value of firms [

2]. Additionally, pressures from shareholders and various outside organizations serve as a momentum for firms’ internal management control systems to collect information on climate change. Thus, under these pressures, firms would act to disclose their information on carbon emissions while acknowledging that doing so could be disadvantageous to the market.

Several scholars have attempted to address how carbon emissions would drive a redistribution of firm values by pointing out a negative relationship between carbon emissions, their disclosures, and firm value [

3,

4,

5]. However, there have been only a few studies conducted in developing countries where a unique business environment and culture are predominant. In this study, we focus on the relationship between carbon emissions, their disclosures, and firm value for

chaebols, which are a special type of Korean conglomerate. We hand-collect Korean firms’ carbon emission data from the annual reports of the CDP, a global charity that runs the global carbon emission disclosure system. Our sample period runs from 2013 to 2017 due to the availability of environmental performance data. We use the E(SG) score published by the Korea Corporate Governance Services (KCGS)—an ESG-evaluating institution in Korea—to capture the effect of environmental performance on firms’ tendency to disclose carbon emissions voluntarily. We also employ various firm-specific variables to control for the effects of firm characteristics in the empirical models.

We chose the Korean financial market to examine the hypotheses for several reasons. The Korean market is ideal for estimating the effect of firm heterogeneity on the determination of ESG policies. Specifically, the Korean financial market has a unique set of family-owned business conglomerations—the

chaebols. These

chaebols have played a major role in the nation’s dramatic economic growth with the government’s support. However, over the last decade, critics’ demand for their reformation has grown because of their association with political scandals, which causes owner risk. In this social atmosphere, socially responsible management practices, including environmental protection, have become a major agenda in the demands for both

chaebol and non-

chaebol firms [

6,

7]. While

chaebols have come under wide criticism and have undergone structural changes, they have faced and continue to meet new “environmental” demands, which we verify and discuss in our analysis.

Unlike other advanced financial markets, it is reasonable to assume that this environmental demand will not yet be reflected in the value of Korean firms, particularly

chaebols. Rather, the firm value of

chaebols has been evaluated based on profitability, owing to the long support from the government in the last centuries. Since the 1997 Asian financial crisis,

chaebols have emerged as extremely profitable firms with less over-investment, despite fewer tax perks [

8]. Given the stable profitability of

chaebols since then, it is reasonable to assume that a substantial amount of carbon emissions could have been a “positive signal” to the market. Larger carbon emissions could imply lower operating costs and a higher rate of return. Therefore, a positive relationship may exist between carbon emissions and firm value, measured as the rate of annual return. As investors pay more attention to the profitability aspect of

chaebol affiliates, compared to non-

chaebol affiliates, this positive relationship is probably more significant for the former group of corporations.

Such value irrelevance or value-enhancing aspects may naturally predict a greater inclination of carbon disclosure among firms with good environmental performance in the Korean financial market. The evaluation of the environmental aspects of a corporation remains at the developmental stage in Korea. Numerous agencies, including the KCGS, have not placed significant weight on the amount of carbon emission in their evaluation [

9] but have assigned positive weights to disclosure activity. Consequently, firms that pay considerable attention to environmental performance have strong incentives to disclose carbon emission information voluntarily, to manage their reputations in the Korean market.

The major findings of our study are two-fold. First, we find a significantly positive relationship between carbon emissions and firm value among

chaebol affiliates. Non-

chaebol affiliates do not show a statistically significant relationship between these two variables. This result suggests that the carbon emissions of

chaebol-affiliated firms are not yet considered value-destructive but favored by the market and investors. This result is in line with the traditional view of corporate value determination [

1] but contrasts with most previous research findings [

3,

5]. Korean investors substantially focus on the cash flow generation aspect of

chaebol-affiliates, which might reflect their role in the financial market [

8].

Second, we find a positive relationship between environmental performance and the likelihood of carbon-emissions disclosure. The Korean media and agencies pay limited attention to the amount of carbon disclosure but value the disclosure activities. Consequently, there has been little hesitation to disclose carbon emission information among firms maintaining good reputations in terms of environmental performance. Such a positive association prevails for both chaebol and non-chaebol affiliates.

Combining these findings, we find a unique pattern of corporate behavior in terms of carbon emissions for the chaebol affiliate group. These firms have positive valuation effects from carbon emissions, potentially due to their influence on cash flow generation. As media and other agencies neglect the amount of emission, these firms do not hesitate to disclose their carbon emissions, regardless of their environmental reputation.

Our results provide supporting evidence for the traditional theory of corporations [

1]. Lowering carbon emissions increases the operating costs of firms and reduces their cash flow generation. Accordingly, a higher level of carbon emissions indicates a greater operating performance, and investors may value such large cash flow generation. This tendency is closely associated with the historical development of the Korean financial market [

8]. It adds new insights to the literature, highlighting the difference in ESG policy across advanced and developing financial markets [

3,

5].

This work is also closely associated with the literature that focuses on the effect of firm heterogeneity on CSR policy determination [

10,

11,

12]. The distinctive environments for

chaebol affiliates result in significantly different relationships between CSR activities and valuation or disclosure quality across

chaebol affiliates and non-

chaebol affiliates [

10,

11]. Investors in the Korean market value the cash flow generation aspect more highly among

chaebol-affiliated corporations compared to non-

chaebol ones; this leads to a positive valuation effect of carbon emissions, only within

chaebol affiliates.

The remainder of this paper is organized as follows.

Section 2 illustrates previous literature on carbon emissions and firm value, and

Section 3 introduces the hypothesis development. Further,

Section 4 explains the data and methodology, followed by an analysis of the results in

Section 5. Finally,

Section 6 concludes the research.

3. Hypothesis Development

We now develop an empirical hypothesis to be tested. First, contrary to previous findings, we predict a positive relationship between the value of carbon emissions and firm value in Korean firms, especially for

chaebol-affiliated firms. The analysis of Lee et al. [

8] suggests that the Korean investors apply different criteria for selecting the shares of chaebol and non-chaebol affiliates within their risky asset allocations. Chaebol affiliates are demanded to have stable and large cash flow generations because they need to operate internal financing market properly across affiliates. Such a well-functioning internal financing market is their key competitive advantage over non-chaebol affiliates. However, the Korean investors place greater weight on future growth opportunities rather than currently large profit generation abilities in their valuation of non-chaebol affiliates.

A higher carbon emission indicates a smaller investment in carbon reduction and lower operating costs, which increases profitability of a corporation. The Korean investors probably favor a large amount of carbon emission within chaebol affiliates because it may imply a higher profitability in the group of firms and their strong internal financing markets. Thus, a positive relationship can be formulated between the degree of carbon emission and a firm’s valuation within chaebol affiliates.

However, we expect that this positive relationship may not be significant for non-chaebol affiliates. As explained earlier, investors may not significantly value profit generation ability among non-chaebol affiliates. Although a higher level of carbon emission indicates lower operating cost, the investor may not have a high value for profit generation ability compared to chaebol affiliates. Furthermore, contrasting views on the relationship between carbon emissions and firm value [

3,

5,

19] highlight the negative valuation effect of large carbon emissions, especially in terms of future operating costs. Therefore, we expect a less apparent or negative relationship between the amount of carbon emission and firm value within non-chaebol affiliates.

H-1. A stronger positive relationship exists between carbon emission and firm value for chaebol-affiliated firms.

The assumption from the first hypothesis naturally leads to the following question: “If markets favor or neutrally value firms for their carbon emissions, would these firms disclose the information voluntarily?”

We argue that this decision might be more closely related to a firm’s overall management of its environmental policy. If a firm tries to maintain its overall reputation for environmental policy, it has strong incentives to disclose carbon emission information voluntarily in the Korean financial market. While investors may neglect the amount of carbon emission, the media and other rating agencies have paid significant attention to the action of voluntary disclosure [

23]. Thus, firms managing their environmental reputation do not hesitate to disclose carbon emissions information. In the face of the positive valuation effect of carbon emissions, disclosing it is optimal to maintain their reputation in these groups of firms.

H-2. Firms with high environmental performance would voluntarily disclose their carbon emission information.

4. Data Construction and Empirical Model

In research on carbon emissions, it is essential to use standardized and uniformly comparable information for analysis. As such, we hand-collected data on Korean firms’ carbon emissions from the CDP database.

For firm-specific data, we conducted a subsample analysis based on chaebol and non-chaebol affiliates. From the FnGuide, we downloaded all data for Korean listed firms between 2013 and 2017 and selected those affiliated with chaebols, as defined by the Korean Fair Trade Commission (KFTC), and assigned them to a chaebol group. The carbon emission data provided by the KCGS cover a portion of firms listed in the KOSPI market (the largest stock exchange in Korea) due to the availability of carbon emission data. The remaining firms were assigned to the non-chaebol group. We estimate the above two empirical models separately for chaebol and non-chaebol affiliates.

Table 2 provides a summary of Korean firms’ responses to the CDP questionnaires and carbon emissions for the years 2013 to 2017. Of the total sample, 222 firm-years (nearly 27%) disclosed their carbon emissions. However, among those disclosing carbon emissions,

chaebol-affiliated firms make up 88%, indicating that most

chaebol-affiliated firms were more willing than non-

chaebols to disclose their carbon emissions. Although the number of non-chaebols disclosing firms are smaller than that of chaebol-affiliated firms, the proportion of disclosing firms among the non-chaebol affiliates is still more than 8%, which may not cause substantial biases in empirical models with more than 300 samples.

As well, although individual firms in our study lie in different industries, we do not believe this difference would cause significant carbon emission intensities. In fact, Korean industries are largely dependent on manufacturing, which is evident in our study. For example, manufacture-related (Consumer discretionary/industry material/Raw material) industries account for 62% (523/841) of whole industry in our sample.

For H-1, the stock return variable is adjusted for the dividend payments, stock split and M&As. Here, our dependent variable is different from previous research, which used the market value of common equity [

3,

5]. We believe that our variable better approximates and reflects periodic changes in firm value and profitability during a specific period, at least by reflecting the amount of dividend payments properly.

We incorporate the model of Matsumura et al. [

3] to control for the effect of other firm-specific factors on firm value. In line with their model for carbon emissions and firm value, we employ the following variable as independent variable: CO

2_Sales (Carbon Emission/Sales). We also use the following firm and financial characteristic variables as control variables:

TA_Sales (Total Assets/Sales),

TL_Sales (Total Liabilities/Sales), and

NI_Sales (Net Income/Sales). Each variable’s denominator is the sales of each firm. Additionally, the value of CO

2_Sales was multiplied by 10,000 to match the numerical units of other variables. The definitions of the variables used in the empirical model for H-1 are summarized in

Table 3.

As for H-2, we employ binary for the dependent variable,

DISC_CO

2, and assign 1 if firms disclose carbon emission information and 0 if not. Next, we introduce independent and control variables to test our hypotheses. We use the environmental score,

ENV, among the ESG scores from the KCGS as independent variable. Here,

ENV measures how firms in Korea diligently carries out their environmental responsibility in a particular period. Using the score, we verify whether firms with high environmental scores have a high tendency to disclose their carbon emissions voluntarily. The use of this variable has several implications. Economic theory predicts that firms that are more environmentally proactive through various initiatives have incentives to voluntarily disclose environmental information, including carbon emissions, to reveal their environmental type, which investors and external stakeholders do not directly observe [

3]. Therefore, our study attempts to test whether this trend becomes more apparent in the case of

chaebol-affiliated firms.

Moreover, we use a control variable,

IND_DISC, defined as the proportion of firms disclosing carbon emissions in affiliated industries to capture both industry pressure and individual optimal disclosure decisions. We also include a variable,

LogTA, measured using the log of the firm’s total assets. Previous research has reported that firm size is positively correlated with the chance that it will respond [

17,

24]. We also control for firm growth by including the Return-on-Asset ratio (

ROA) of the firm to observe profitability, in line with previous findings [

3,

20].

Consistent with higher-leverage firms providing higher-quality disclosures, we include firm leverage,

Leverage. As the CDP is a network of large institutional investors, firms with high institutional holdings may tend to disclose their carbon emissions, owing to the investors’ call for more transparent disclosures about socially responsible activities [

25]. Finally, we use advertising expenses divided by total assets,

AdvExp, as a control variable. Regarding the empirical models for H-1 and H-2, the individual data that composed each firm variable, such as

TA_Sales and

TL_Sales, were collected from the FnGuide, a data-providing company. We also separated

chaebol and non-

chaebol affiliates using the category item published in FnGuide. Finally, carbon emission data for each firm were hand-collected from annual CDP reports, and E(environmental) scores were obtained from the KCGS.

Our empirical model for H-1 can be described as follows. First, in Equation (1), we test the relationship between carbon emissions and firm value, controlling for other firm-specific variables. Here, the firm-specific variables encompass total assets divided by sales

(TA_Sales), total liabilities divided by sales

(TL_Sales), and net income divided by sales

(NI_Sales). We adopt the ordinary least squares (OLS) method to estimate our empirical models in line with Matsumura et al. [

3]. The OLS method is widely used in literature because of its robustness. It relies on a limited set of assumptions to obtain consistent estimators. As a firm’s financial variables for a fiscal year are substantially affected by firm-specific events, such as mergers and acquisitions, managerial turnovers, and the outcome of R&D projects, the OLS method is known to be one of the best methods to test empirical hypotheses with financial variables (Equation (1)).

The empirical model for H-2 employs a logit model to examine firms’ carbon emission disclosure choices.

DISC_CO

2, the dependent variable, is an indicator variable coded as 1 if a firm discloses its carbon emission data to the CDP and allows public disclosure, and 0 otherwise (Equation (2)).

Subsequently, we conduct a subsample analysis based on the categories of chaebol and non-chaebol affiliates to capture the different effects of chaebol-affiliated firms.

Table 4 presents the summary statistics of the carbon emission data, along with descriptive statistics for the corporate financial information variables. The table includes the mean, standard deviation, minimum, first quartile, median, third quartile, and minimum and maximum values.

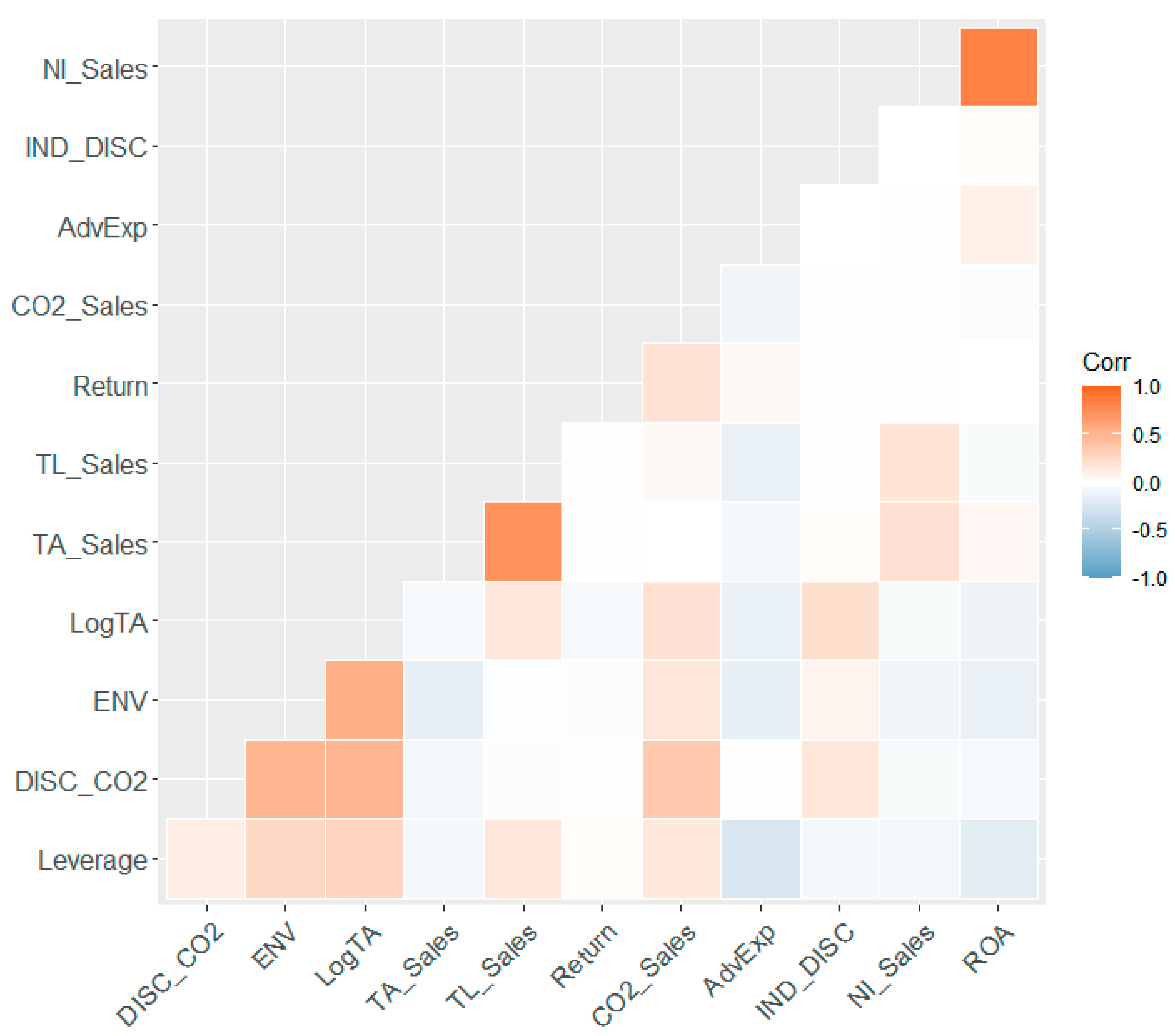

Table 5 presents the correlation coefficients of the variables in the analysis. The table shows that

Return, the measure of firm value for H-1, is highly correlated with the carbon emissions of firms, as represented by CO

2_Sales. Additionally, the correlation coefficients for

LogTA,

ENV, and CO

2_Sales with

DISC_CO

2 were 0.36, 0.49, and 0.36, respectively. This indicates that a firm with size and environmental performance has a positive association with a firm’s tendency to disclose carbon emissions. However, the absolute value of the correlation coefficient was still smaller than 0.7; thus, it is not likely to cause multicollinearity problems in the estimations. The absolute values of all the other correlation coefficients were also smaller than 0.7. The correlation is presented graphically in

Figure 1.

5. Empirical Results

Table 6 reports the estimation results of the firm value model for the entire sample of Korean firms, including both

chaebol and non-

chaebol affiliates. To test the effect of carbon emission on firm value, we apply the empirical model in H-1 to the estimation. Specifically, the first column covers all firms, and the second and third columns cover

chaebols and non-

chaebols, respectively. The estimated coefficients and corresponding t-values (in parenthesis) are also reported.

The first column of

Table 6 shows a positive relationship between carbon emissions and firm value for

chaebol-affiliated firms, as specified in the second column. The estimated coefficient was 0.42, which was statistically significant at the 95% level. This significantly positive coefficient indicates the effect of carbon emissions on firm value, which supports H-1 and builds on corporate culture theory. The R

2 was 0.06, which is low in the absolute term but is considerably consistent with the extant studies. For instance, Matsumura et al. [

3] conducted a similar analysis, and their R

2 values ranged from 0.2 to 0.3.

Our results indicate that markets consider firms’ carbon emissions in

chaebol-affiliated firms as a positive signal of profitability and value it rather highly. As indicated in the second column, carbon emissions had significantly positive effects on the firm value of

chaebol-affiliated firms after controlling for other firm-specific variables. This finding is in line with the traditional view of corporate theory [

1]. This theory argues for the cost-generating perspective of environmentally-friendly policy and its negative implications on the value of a firm.

Interestingly, this robust result contrasts with the results for non-

chaebol firms with an estimated effect of −0.04, which is not statistically significant. This result is consistent with the findings of Lee et al. [

8]. They argue that the Korean investors mainly consider profitability of chaebol affiliates in their decisions of investments, particularly from the experience of the East Asian Crisis of 1997. Chaebol is a special type of conglomerate operating large internal financing markets across its affiliates. A greater profitability implies the chaebol’s stable and strong internal financing market, which reduces the default probability of all of its affiliates substantially. However, non-chaebol affiliates have limited demand of operating internal financing with currently large cash flow generations. Thus, investors tend value more for the growth options of these firms rather than (current) profitability. In sum, their argument suggests that the valuation mechanism across chaebol and non-chaebol affiliates are different in the Korean financial market

Remarkably, our results contrast with Choi et al. [

5], which pointed out a negative relationship between carbon emissions and firm value. This may be due to the fact that we use

Return as a dependent variable which forecasts the performance of a business, serving as better proxy for profitability. On the other hand, the dependent variable for Choi et al. [

5] is market value for all firms, which may exhibit short term instability, plausibly showing negative trend in particular period.

Table 7 reports the estimation results for the carbon disclosure model (H-2). In accordance with H-1, the data encompass the sample of Korean firms, including

chaebol and non-

chaebol affiliates. To test the tendency of carbon emission disclosure for firms, we apply a logit model to the estimation. Here, the indicator (dependent) variable is

DISC_CO

2, which is coded 1 if the firm voluntarily discloses carbon emission, and 0 otherwise. The estimated coefficients and corresponding p-values (in parenthesis) are also reported.

Interestingly, the relationship between a firm’s environmental performance (

ENV), as measured in the ESG score, and their tendency to disclose carbon emission was statistically significant at 0.02 across all groups of firms. This finding confirms H-2. As shown in

Table 6, excessive carbon emission turns out to be favorable or neutral to the investor. In the face of investors’ perceptions, firms that manage the reputation of environmental policy do not hesitate to disclose information related to carbon emissions, which reinforces their reputation.

Contrary to all firms and non-

chaebol firms,

LogTA and

AdvExp for the

chaebol-affiliated firms were statistically significant at 0.55 and 14.10, respectively. This result suggests that firms’ high environmental performance has a positive relationship with their disclosure of carbon emissions, regardless of the form of the firms. The indifference in the coefficient between

chaebol-affiliated firms and non-

chaebols might be due to a higher standard with regard to environmental performance. This outweighs the difference in the forms of the firms, which leads to strong transparency in “unfavorable” information on carbon emissions. In particular, this result is in line with the finding of Verrecchia et al. [

26] in that firms that are less environmentally damaging are more likely to disclose environmental information voluntarily.

Now, we conduct an additional analysis for H-2 to capture specific effects on carbon emission disclosure. The purpose of this analysis is to reduce or eliminate the endogeneity problem because ENV variables in H-2 could be endogenous to firms’ tendency to disclose carbon emissions voluntarily. The issue of endogeneity can be addressed by conducting the following analysis for the subset of the ENV variable, which, in turn, proves that the results of H-2 are not due to endogeneity.

For the analysis, we used subsets of the E(SG) score instead of the total environmental score; they are divided into environmental strategy (Envstrag), environmental organization (Envorg), environmental management (Envmang), environmental performance (Envperf), and stakeholder action (stakeholder). By definition, the disclosure of carbon emissions is most closely associated with the environmental management variable.

Following the previous analysis, the data encompass a sample of Korean firms, including both

chaebol and non-

chaebol affiliates. Owing to the availability of data, we analyzed used data across three years (2013–2015). The new equation for H-2 is as follows Equation (3):

The detailed regression results are summarized in

Table 8. Most importantly, a higher score on the environmental management variable, (

Envmang), which measures how well a firm organizes decision-making units and plans to invest in relation to eco-friendly management, did not lead to a larger tendency for carbon disclosure. In other words,

Table 8 argues that the results in

Table 7 are not driven by an endogenous relationship between a higher ESG score and voluntary disclosure. If the endogenous relationship directly matters in the empirical examination, a higher score on environmental management (

Envmang) should result in a greater tendency to disclose carbon emissions.

The table also shows the statistical robustness of the stakeholder score in the decision of voluntary disclosure for both chaebol-affiliated firms and non-chaebols. A higher score on the stakeholder indicates that a firm tends to place significant policy weights to maintain reputations from their stakeholders. Their actual policies related to strategy and implementation or their organizational structures are directly captured by other categories of environmental scores. Korean firms striving to earn the trust of stakeholders in terms of their environmental policies tend to disclose information related to carbon emissions.

This emphasis on the stakeholder score is generally in line with the development of our empirical hypothesis. Reputations from stakeholders are critical to the decision to open carbon emission information to the public. With the expectation of no negative valuation effect from the amount of carbon emission, a firm has considerably strong incentives to disclose information on carbon emissions if the firm tries to maintain its reputation for environmental policies.

Further, notably, the tendency of

chaebol-affiliated firms to carbon disclosure was largely dependent on the size of the firms, as evidenced by the robustness in firm size,

LogTA, which was statistically significant at 0.60. This finding is in line with

Table 7 and potentially reflects the increasing level of media attention and evaluation of environmental policy for a larger firm. Under such media pressure, these large firms may “involuntarily” disclose their level of carbon emissions.

6. Discussions

The empirical analysis above for the Korean firms supports the two main empirical hypotheses of this work in general: (1) a significant positive relationship between carbon emissions and firm value for chaebols and (2) a significant positive relationship between environmental performance and disclosure of carbon emissions at all firm levels. Notably, the result in H-1 was statistically significant only for chaebol-affiliated firms, while the result for H-2 was statistically significantly positive across all groups of firms.

In particular, the two findings suggest that while chaebol-affiliated firms are more responsive to the industrial and governmental request of climate risk, they enjoy substantial value premium as their ‘unfavorable’ act of carbon emission is yet regarded as strong sign for profitability by market and investors. Simultaneously, chaebol-affiliated firms’ act of voluntarily disclosing carbon emission may be due to the significant controlling power of a specific family and its large size, as these firms are under stricter monitoring from the government and receive intensive media attentions for a variety of corporate policies.

In contrast, note that the positive valuation effect of carbon emissions is not widely observed in advanced financial markets [

3,

19]. The amount of carbon emission generally has a negative effect on the value of firms in these markets, where investors have a deeper understanding of environmental issues. These investors may consider the potential damage to the company brand image from such a large emission or a potentially large operating cost involved in reducing carbon emissions in the near future. However, Korea is a developing market, especially in terms of environmental policy. Thus, such damages to brand image or future costs may not yet be valued as significantly high by investors in reducing carbon emissions under strengthening regulations. This tendency is more apparent for

chaebol affiliates, where investors have paid extensive attention to accounting profitability.

Unlike the issue of evaluating the effect of carbon emissions, media and other agencies highly value the action of voluntary disclosure itself. As far as the amount of carbon emissions is not value destructive, a firm has strong incentives to open the information of its carbon emissions to the public if it wants to maintain its reputation on environmental policies. As ESG evaluation has burgeoned since the early 2010s in the Korean financial market, environmental performance, especially in terms of reputation among stakeholders, has a positive relationship with the tendency to disclose carbon emissions.

These findings highlight two important aspects of CSR policies. First, our findings emphasize the significance of firm characteristics in shaping the implications of CSR policies. Consistent with the results of Yoon and Lee [

10,

11,

12], our findings show that the unique characteristics of

chaebols significantly affect corporate policies and even investor perceptions. The

chaebol-affiliated group has significantly different historical backgrounds and investor relationships throughout the rapid growth of the Korean economy. Our analysis shows that such consideration of heterogeneity is important to the literature on ESG analysis.

Second, our findings suggest that fast-growing ESG-related policies could be appreciated differently across developing and advanced countries. The Korean market has grown rapidly and extensively and is now sometimes considered an advanced financial market. However, the development of market perception and media understanding is relatively slow in terms of carbon emissions and other environmental issues. Our analysis indicates that Korean investors may underestimate the future costs of large carbon emissions. They may not properly predict the implications of snowballing regulations on carbon emissions, unlike the investors in advanced markets. From now onward, such large carbon emissions have to be reduced significantly by regulations, which incur substantial losses in operating profits.

Therefore, notably, the aforementioned two-fold positive relationship of firm value and carbon disclosure for chaebol-affiliated firms could be due to a limited period of observation. Investors in the future may take more environmental concerns into “sustainable” profitability for chaebols. In this case, we expect that the positive relationship between carbon emissions and firm value for chaebol-affiliated firms could turn around in the near future.

7. Conclusions

This study develops two empirical hypotheses using a sample of Korean corporations. We hypothesize (1) a positive relationship between carbon emissions and firm value for chaebol affiliates and (2) a positive relationship between environmental performance and carbon disclosure in both firm groups.

Our empirical analysis confirms these two empirical hypotheses using hand-collected carbon emission data and firm-specific financial statement information. Specifically, for H-1, we found a significantly positive relationship between carbon emissions and firm value exclusively for chaebol affiliates. For H-2, the measure of environmental performance is positively related to the likelihood of voluntary carbon emission disclosure for all subgroups in our examination.

The main contributions of our study are summarized as follows. We find new empirical evidence supporting the traditional view of corporate theory, which highlights the cost-generating aspect of any environmental policy [

1]. This finding is closely related to Korea’s unique financial market environment. Korean investors highly value the profit generation aspect of

chaebol affiliates from historical experience after the East Asian Crisis of 1997 [

8]. Furthermore, large carbon emissions could signal a lower cost incurred by environmentally unfriendly policies, which increases the firm’s value. This nature of

chaebols aligns with a branch of literature that emphasizes the importance of firm heterogeneity in the analysis of the overall ESG policy [

10,

11].

Furthermore, our analysis suggests distinctive environments related to E(SG) policies across advanced and developing markets [

3,

5,

19,

20,

21]. Although the Korean market is considered to be one of the rapidly growing and well-established financial markets, almost an advanced one, the environmental policy is still considerably new for investors. Accordingly, the amount of carbon emission has not been strictly regulated, and its economic implications are largely unexamined in the Korean financial market. Our unique finding on the positive relationship between carbon emissions and firm value suggests the importance of the market development stage in the analysis of E(SG) policies.

Notably, our results could be a temporary one that occurred during the 2010s when the understanding of environmental policy was just initiated. Sustainable development and climate change now lie at the center of the debate in the Korean market as well. As the regulations on carbon emission policy become stricter, investors are expected to penalize the amount of carbon emission substantially in their valuation. The investigation of dynamic changes in the valuation is left for future research.