Main Factors Determining the Economic Production Sustained by Public Long-Term Care Spending in Spain

Abstract

1. Introduction

1.1. Background and Review of the Literature

1.2. Purpose of the Research

2. Materials and Methods

2.1. Modelling the Impact of Public LTC Spending on the Spanish Economy: DEIO Analysis

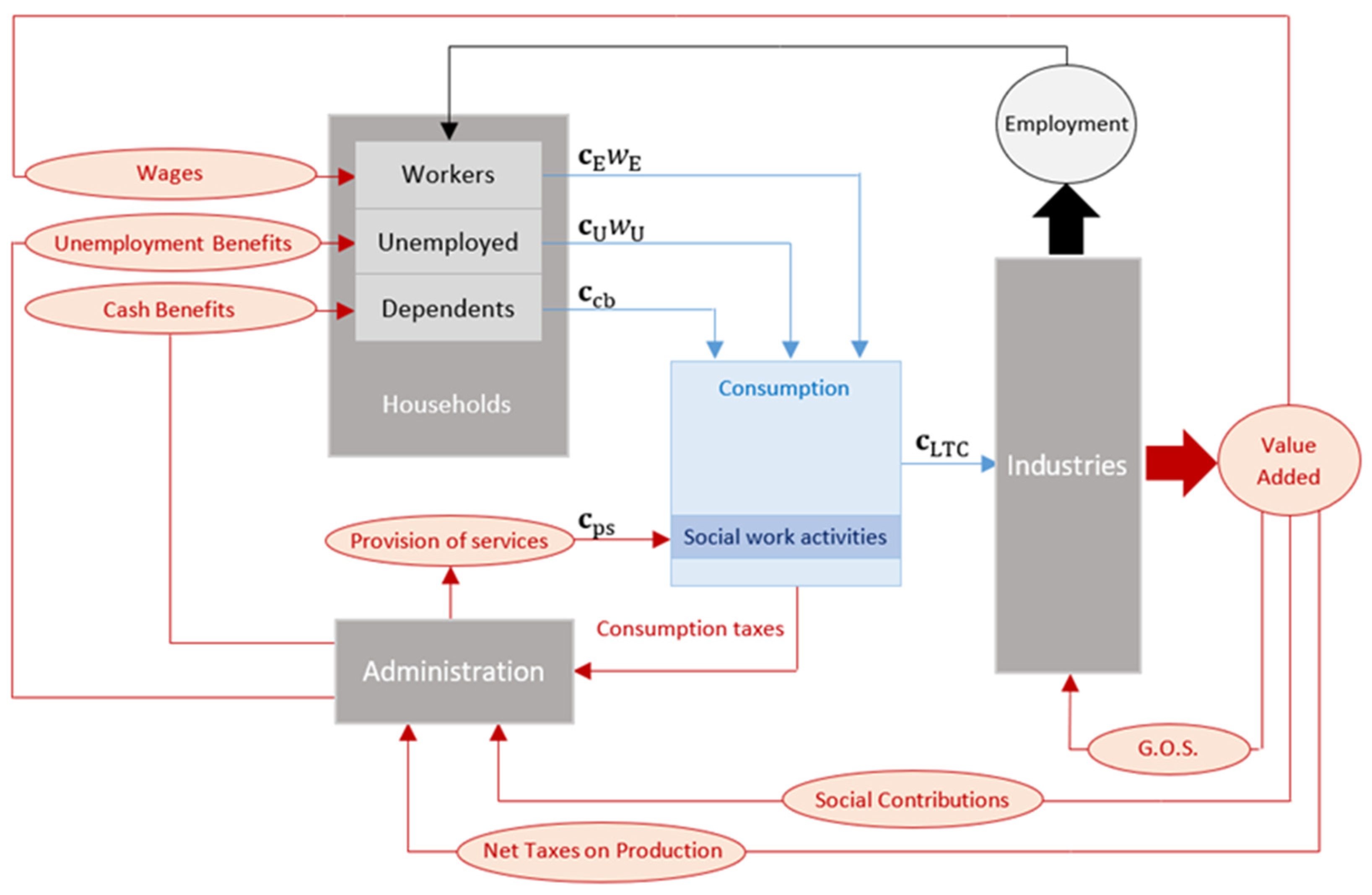

- Almost 66% of is directly allocated by the Administration for the provision of services , which generates a straightforward increase in consumption in the social work sector

- The remaining 33% of is granted via cash benefits , which means the Administration provides the eligible households with an amount of money as payment of informal care. While these sorts of transfers are provided to meet the dependency needs addressed by the LTC system, the ultimate effect is an increase in the total income of dependent households. Assuming that informal care is issued within the family circle [8], no third party payment is made for this service. Then, such a rise in income will effectively ease the budget constraint of households, allowing them to spend a more considerable amount of money not only on social work activities but also on the rest of goods and services.

- is the identity matrix

- is the technical coefficient matrix entailing the consumption of commodity i by economic activity j

- is the monetary consumption by the employed, which results from applying the consumption propensities for the households where the reference person is employed on wages arisen from industrial production

- is the monetary consumption by the unemployed, which results from applying the consumption propensities for the households where the reference person is unemployed on unemployment benefit paid out by the Government

- is a diagonal matrix obtained from the vector of direct labor coefficients (being l employment and x total output by industry j).

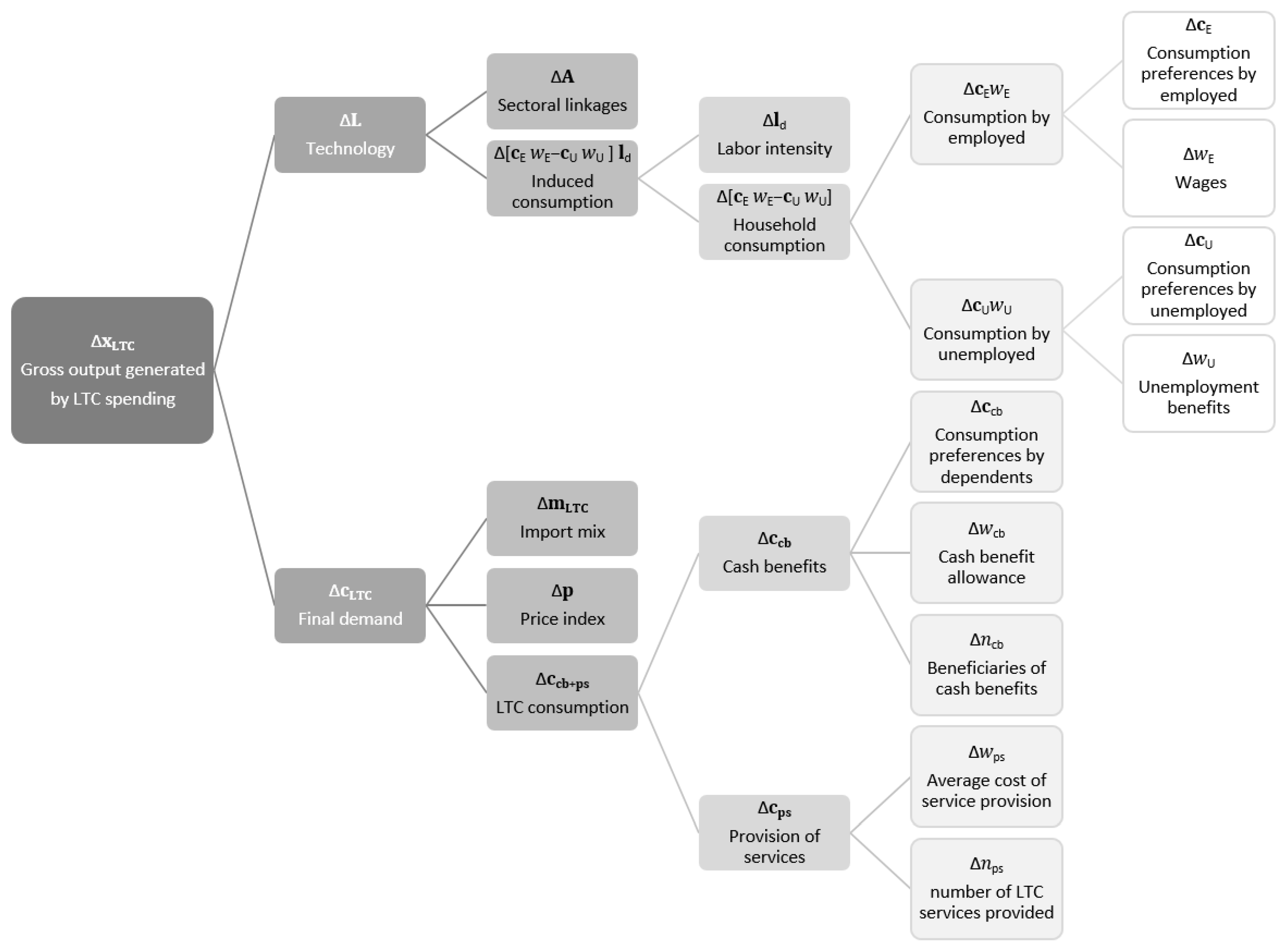

2.2. The Main Drivers of Change in the Output Sustained by Public LTC Spending: SDA Approach

2.3. Data Sources for the DEIO Model and SDA

3. Results

3.1. Empirical Results of the DEIO Model

3.2. SDA Results

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. The Dependency Extended Input-Output (DEIO)

- The first block on the left-hand side refers to an extended matrix of intermediate demand with the following components:

- ○

- the traditional Leontief matrix where the technical coefficient matrix represents the consumption of commodity i by economic activity j that is subtracted from the identity matrix I

- ○

- the (column) vector of monetary consumption by the employed, which results from applying the consumption propensities for the households where the reference person is employed on wages arisen from industrial production

- ○

- the (column) vector of monetary consumption by the unemployed, which results from applying the consumption propensities for the households where the reference person is unemployed on unemployment benefit paid out by the Government

- ○

- the (row) vector of direct labor coefficients representing the number of jobs required per unit of production by industry

- The second block on the left-hand side is the vector (column) of activity levels containing industrial gross output x, employed e and unemployed u.

- The block on the right-hand side is the vector (column) of inputs including final demand , external level of employment s = 0 and total labor force p. As previously said, denotes the consumption demand funded with LTC spending, while contains the remaining final demand excluding both the employed and unemployed consumption previously transferred to intermediate demand.

Appendix B. Structural Decomposition Analysis for Output

Appendix B.1. Decomposition of Changes in Technology (L)

| Decomposition of changes in technology (L) | changes in the local sectoral linkages | |

| changes in the consumption preferences of households where the reference person is employed | ||

| changes in annual wages | ||

| changes in the consumption preferences of households where the reference person is unemployed | ||

| changes in unemployment benefits | ||

| changes in the labor demand coefficients |

Appendix B.2. Decomposition of Changes in LTC Demand ()

| Decomposition of changes in LTC demand () | changes in the import shares of LTC consumption | |

| changes in LTC consumption due to inflation | ||

| changes in the distribution of cash-benefit consumption (product-mix effect on LTC consumption) | ||

| changes in cash-benefit allowances (level effect on demand via cash benefits) | ||

| changes in the number of cash-benefit receivers (level effect on demand via cash-benefit beneficiaries) | ||

| changes in the average cost of the LTC service provision (level effect on demand via provision of services) | ||

| changes in the number of LTC services provided (level effect on demand via service-provision beneficiaries) |

References

- Economic and Social Council of Spain. Memoria Sobre la Situación Socioeconómica y Laboral de España 2016; Consejo Económico y Social: Madrid, Spain, 2017. [Google Scholar]

- Estadísticas IMSERSO. Statistics Service of Attached General Department of Value, Quality and Evaluation of the System to Autonomy and Dependence Care; IMSERSO: Madrid, Spain, 2017. [Google Scholar]

- BOE. Promotion of Personal Autonomy and Assistance for Persons in a Situation of Dependency Act (Act 39/2006 of 14th December); Agencia Estatal Boletín Oficial del Estado: Madrid, Spain, 2006. [Google Scholar]

- Economic and Social Council of Spain. Memoria Sobre la Situación Socioeconómica y Laboral de España 2010; Consejo Económico y Social: Madrid, Spain, 2011. [Google Scholar]

- BOE. Resolución de 13 de julio de 2012, de la Secretaría de Estado de Servicios Sociales e Igualdad, por la que se publica el Acuerdo del Consejo Territorial del Sistema para la Autonomía y Atención a la Dependencia para la Mejora del Sistema para la Autonomía y Atención a la Dependencia; Agencia Estatal Boletín Oficial del Estado: Madrid, Spain, 2012. [Google Scholar]

- BOE. Real Decreto-ley 20/2012, de 13 de julio, de Medidas Para Garantizar la Estabilidad Presupuestaria y de Fomento de la Competitividad; Agencia Estatal Boletín Oficial del Estado: Madrid, Spain, 2012. [Google Scholar]

- Feldstein, M. Rethinking Social Insurance; National Bureau of Economic Research: Cambridge, MA, USA, 2005. [Google Scholar]

- del Pozo-Rubio, R.; Pardo-Garcia, I.; Escribano-Sotos, F. The co-payment of the dependence from the structural reform of 2012 in Spain. Gac. Sanit. 2017, 31, 23–29. [Google Scholar] [CrossRef]

- Montserrat, J.; Montejo, I. Análisis de las Medidas Introducidas en la Resolución de 13/7/2012; Actas de la Dependencia Fundación Caser; Fundación Caser para la Dependencia: Madrid, Spain, 2012; p. 6. [Google Scholar]

- del Pozo-Rubio, R.; Mínguez-Salido, R.; Pardo-García, I.; Escribano-Sotos, F. Catastrophic long-term care expenditure: Associated socio-demographic and economic factors. Eur. J. Health Econ. 2019, 20, 691–701. [Google Scholar] [CrossRef] [PubMed]

- Stiglitz, J. The global crisis, social protection and jobs. Int. Labour Rev. 2009, 148, 1–13. [Google Scholar] [CrossRef]

- Ghilarducci, T.; Saad-Lessler, J.; Fisher, E. The macroeconomic stabilisation effects of Social Security and 401 (k) plans. Camb. J. Econ. 2012, 36, 237–251. [Google Scholar] [CrossRef]

- Comas-Herrera, A.; Wittenberg, R.; Costa-Font, J.; Gori, C.; Di Maio, A.; Patxot, C.; Pickard, L.; Pozzi, A.; Rothgang, H. Future long-term care expenditure in Germany, Spain, Italy and the United Kingdom. Ageing Soc. 2006, 26, 285–302. [Google Scholar] [CrossRef]

- Costa-Font, J.; Courbage, C.; Zweifel, P. Policy dilemmas in financing long-term care in Europe. Glob. Policy 2017, 8, 38–45. [Google Scholar] [CrossRef]

- De Meijer, C.; Koopmanschap, M.; Uva, T.B.D.; van Doorslaer, E. Determinants of long-term care spending: Age, time to death or disability? J. Health Econ. 2011, 30, 425–438. [Google Scholar] [CrossRef] [PubMed]

- Economic Policy Committee. Budgetary Challenges Posed by Ageing Populations: The Impact on Public Spending on Pensions, Health and Long-Term Care for the Elderly and Possible Indicators of the Long-Term Sustainability of Public Finances; EPC/ECFIN/655/01-EN; European Commission: Brussels, Belgium, 2001. [Google Scholar]

- Jiménez-Martín, S.; Viola, A. Observatorio de Dependencia (Octubre 2017); FEDEA: Madrid, Spain, 2017. [Google Scholar]

- Díaz, B.D. La atención a la dependencia como motor de desarrollo económico. Rev. Int. De Sociol. 2014, 72, 139–171. [Google Scholar] [CrossRef]

- Rodríguez-Castedo, Á. Atención a las Personas en Situación de Dependencia en España; Libro Blanco; Ministerio de Trabajo y Asuntos Sociales: Madrid, Spain, 2004. [Google Scholar]

- Herce, J.A.; Labeaga, J.M.; Sosvilla, S.; Ortega, C. Sistema Nacional de Dependencia. Evaluación de sus efectos sobre el empleo. Rev. Minist. Trab. Asun. Soc. 2006, 60, 167–195. [Google Scholar]

- Jimenez-Martin, S.; Vilaplana, C.; Viola, A.A. Observatorio de la Dependencia (Febrero 2016); FEDEA: Madrid, Spain, 2016. [Google Scholar]

- Bermejo, F.; del Pozo-Rubio, R. The impact of Dependency Act benefits on employment. Gac. Sanit. 2019, 33, 341–347. [Google Scholar] [CrossRef]

- Moya-Martínez, P.; Bermejo, F.; del Pozo-Rubio, R. Hard times for long-term care systems? Spillover effects on the Spanish economy. Econ. Syst. Res. 2021, 33, 1–19. [Google Scholar] [CrossRef]

- Del Pozo-Rubio, R.; Bermejo-Patón, F.; Moya-Martínez, P. Impact of implementation of the Dependency Act on the Spanish economy: An analysis after the 2008 financial crisis. Int. J. Health Econ. Manag. 2021, 1–18. [Google Scholar] [CrossRef]

- Leontief, W. The Structure of the American Economy; Oxford University Press: New York, NY, USA, 1951. [Google Scholar]

- Alcántara, V.; Roca, J. Energy and CO2 emissions in Spain: Methodology of analysis and some results for 1980–1990. Energy Econ. 1995, 17, 221–230. [Google Scholar] [CrossRef]

- Arto, I.; Rueda-Cantuche, J.; Andreoni, V.; Mongelli, I.; Genty, A. The game of trading jobs for emissions. Energy Policy 2014, 66, 517–525. [Google Scholar] [CrossRef]

- Hsu, G.J.Y. Energy multipliers for economic analysis: An input-output approach. Energy Econ. 1989, 11, 33–38. [Google Scholar] [CrossRef]

- Kratena, K.; Schleicher, S. Impact of Carbon Dioxide Emissions Reduction on the Austrian Economy. Econ. Syst. Res. 1999, 11, 245–261. [Google Scholar] [CrossRef]

- Munksgaard, J.; Pedersen, K.A.; Wien, M. Impact of household consumption on CO2 emissions. Energy Econ. 2000, 22, 423–440. [Google Scholar] [CrossRef]

- Pié Dols, L. Multisectorial Models Applied to the Environment: An Analysis for Catalonia; Universitat Rovira i Virgili: Tarragona, Spain, 2010. [Google Scholar]

- Sánchez-Chóliz, J.; Duarte, R.; Mainar, A. Environmental impact of household activity in Spain. Ecol. Econ. 2007, 62, 308–318. [Google Scholar] [CrossRef]

- De Fuenmayor Fernández, A.; Pérez, R.G.; Morera, T.S. Impacto económico de las rentas mínimas: La Renta Valenciana de Inclusión. Investig. Reg. J. Reg. Res. 2019, 44, 97–110. [Google Scholar]

- Observatorio de la Realidad Social de Navarra, El impacto económico de la renta de inclusión social. Boletín Tend. 2016, 1, 1–6.

- Cobo Fernández, M.I.; Maldonado, Á.G.; del Río, C.R. Impacto Económico de la Renta Social Básica. Cantabria 2011–2015; Documentos Técnicos de ICANE, Doc. nº 4/2016; Instituto Cántabro de Estadística: Santander, Spain, 2016. [Google Scholar]

- Martínez, R.; Palma, A.; Flores Serrano, L.; Collinao, M.P. El impacto Económico de las Políticas Sociales; CEPAL: Santiago de Chile, Chile, 2013. [Google Scholar]

- Zubiri, I.; Martínez, J.; Vallejo, M. El impacto Económico del Gasto en Política Social de la Diputación Foral de Guipúzcoa; Universidad del País Vasco: País Vasco, Spain, 2010. [Google Scholar]

- Fletcher, J.E. Input-output analysis and tourism impact studies. Ann. Tour. Res. 1989, 16, 514–529. [Google Scholar] [CrossRef]

- Forsyth, P.; Dwyer, L.; Seetaram, N.; King, B. Measuring the Economic Impact of Migration-Induced Tourism. Tour. Anal. 2012, 17, 559–571. [Google Scholar] [CrossRef]

- Kronenberg, K.; Fuchs, M.; Lexhagen, M. A multi-period perspective on tourism’s economic contribution–a regional input-output analysis for Sweden. Tour. Rev. 2018, 73, 94–110. [Google Scholar] [CrossRef]

- Carrascal, A.; Fernández, M. Tourism and income distribution: Evidence from a developed regional economy. Tour. Manag. 2015, 48, 11–20. [Google Scholar] [CrossRef]

- Carrascal Incera, A.; Fernández, M.F.; López, X.P. Waste Generation from Inbound Tourism in Galicia. Rev. Galega Econ. 2013, 22. [Google Scholar] [CrossRef]

- Batey, P.; Madden, M. The employment impact of demographic change: A regional analysis. Pap. Reg. Sci. 1999, 78, 69–87. [Google Scholar] [CrossRef]

- Batey, P.W.; Madden, M.; Scholefield, G. Socio-economic impact assessment of large-scale projects using input–output analysis: A case study of an airport. Reg. Stud. 1993, 27, 179–191. [Google Scholar] [CrossRef]

- Batey, P.W.; Weeks, M.J. The Effects of Household Disaggregation in Extended Input-Output Models; Frontiers of Input-Output Analysis; Oxford University Press: New York, NY, USA, 1989; pp. 119–133. [Google Scholar]

- Batey, P.W.J.; Madden, M. The modelling of demographic-economic change within the context of regional decline: Analytical procedures and empirical results. Socio-Econ. Plan. Sci. 1983, 17, 315–328. [Google Scholar] [CrossRef]

- Batey, P.W.; Madden, M. Demographic-economic forecasting within an activity-commodity framework: Some theoretical considerations and empirical results. Environ. Plan. A 1981, 13, 1067–1083. [Google Scholar] [CrossRef]

- Chen, Q. The role of household consumption in the Chinese economy: Input-output analyzes. In SOM Research School; University of Groningen: Groningen, The Netherlands, 2015; p. 201. [Google Scholar]

- Duarte, R.; Mainar, A.; Sánchez-Chóliz, J. The role of consumption patterns, demand and technological factors on the recent evolution of CO2 emissions in a group of advanced economies. Ecol. Econ. 2013, 96, 1–13. [Google Scholar] [CrossRef]

- Duarte, R.; Mainar, A.; Sánchez-Chóliz, J. The impact of household consumption patterns on emissions in Spain. Energy Econ. 2010, 32, 176–185. [Google Scholar] [CrossRef]

- Dietzenbacher, E.; de Groot, O.J.; Los, B. Consumption growth accounting. Rev. Income Wealth 2007, 53, 422–439. [Google Scholar] [CrossRef]

- Kagawa, S. Inter-industry analysis, consumption structure, and the household waste production structure. Econ. Syst. Res. 2005, 17, 409–423. [Google Scholar] [CrossRef]

- Kim, Y.J.; Kim, C.Y.; Shin, Y.J. The effects of ubiquitous healthcare service on the South Korean Economy: Using input–output analysis. Inf. Syst. Front. 2017, 19, 1149–1160. [Google Scholar] [CrossRef]

- Yamada, G.; Imanaka, Y. Input–output analysis on the economic impact of medical care in Japan. Environ. Health Prev. Med. 2015, 20, 379. [Google Scholar] [CrossRef]

- Scazzieri, R. Structural dynamics and evolutionary change. Struct. Chang. Econ. Dyn. 2018, 46, 52–58. [Google Scholar] [CrossRef]

- Wang, H.; Ang, B.W.; Su, B. Multiplicative structural decomposition analysis of energy and emission intensities: Some methodological issues. Energy 2017, 123, 47–63. [Google Scholar] [CrossRef]

- Vu, K.M. Structural change and economic growth: Empirical evidence and policy insights from Asian economies. Struct. Chang. Econ. Dyn. 2017, 41, 64–77. [Google Scholar] [CrossRef]

- Carrascal Incera, A. Drivers of change in the European youth employment: A comparative structural decomposition analysis. Econ. Syst. Res. 2017, 29, 463–485. [Google Scholar] [CrossRef]

- Shigetomi, Y.; Nansai, K.; Kagawa, S.; Tohno, S. Changes in the Carbon Footprint of Japanese Households in an Aging Society. Environ. Sci. Technol. 2014, 48, 6069–6080. [Google Scholar] [CrossRef]

- Cazcarro, I.; Duarte, R.; Sánchez-Chóliz, J. Economic growth and the evolution of water consumption in Spain: A structural decomposition analysis. Ecol. Econ. 2013, 96, 51–61. [Google Scholar] [CrossRef]

- Su, B.; Ang, B.W. Structural decomposition analysis applied to energy and emissions: Some methodological developments. Energy Econ. 2012, 34, 177–188. [Google Scholar] [CrossRef]

- Yoon, S.G.; Hewings, G.J. Impacts of Demographic Changes in the Chicago Region; Discussion Papers; Regional Economics Applications Laboratory (REAL): Urbana, IL, USA, 2006. [Google Scholar]

- Percoco, M.; Hewings, G.J.D.; Senn, L. Structural change decomposition through a global sensitivity analysis of input–output models. Econ. Syst. Res. 2006, 18, 115–131. [Google Scholar] [CrossRef]

- Hoekstra, R.; van den Bergh, J.J.M. Structural Decomposition Analysis of Physical Flows in the Economy. Environ. Resour. Econ. 2002, 23, 357–378. [Google Scholar] [CrossRef]

- Dietzenbacher, E.; Los, B. Structural decomposition techniques: Sense and sensitivity. Econ. Syst. Res. 1998, 10, 307–324. [Google Scholar] [CrossRef]

- Rose, A.; Chen, C.Y. Sources of change in energy use in the U.S. economy, 1972–1982: A structural decomposition analysis. Resour. Energy 1991, 13, 1–21. [Google Scholar] [CrossRef]

- Comisión Análisis Dependencia. Informe de la Comisión Para el Análisis de la Situación Actual del Sistema de la Dependencia, de su Sostenibilidad y de los Actuales Mecanismos de Financiación, Para Evaluar su Adecuación a las Necesidades Asociadas a la Dependencia; IMSERSO: Madrid, Spain, 2017. [Google Scholar]

- Timmer, M.; Erumban, A.A.; Gouma, R.; Los, B.; Temurshoev, U.; de Vries, G.J.; Arto, I.; Genty, V.A.A.; Neuwahl, F.; Rueda-Cantuche, J.M.; et al. The World Input-Output Database (WIOD): Contents, Sources and Methods. WIOD Background Document. 2012. Available online: www.wiod.org (accessed on 15 June 2021).

- Timmer, M.P.; Dietzenbacher, E.; Los, B.; Stehrer, R.; De Vries, G.J. An illustrated user guide to the world input–output database: The case of global automotive production. Rev. Int. Econ. 2015, 23, 575–605. [Google Scholar] [CrossRef]

- INE. Encuesta de Presupuestos Familiares. Several Years. Available online: https://www.ine.es/dyngs/INEbase/es/operacion.htm?c=Estadistica_C&cid=1254736176806&menu=resultados&idp=1254735976608#!tabs-1254736194790 (accessed on 15 June 2021).

- ONS. Office for National Statistics—Supply and Use Tables. Several Years. Available online: https://www.ons.gov.uk/economy/nationalaccounts/supplyandusetables (accessed on 15 June 2021).

- INE. Contabilidad Nacional anual de España, Base 2010. Several Years. Available online: https://www.ine.es/dyngs/INEbase/es/operacion.htm?c=Estadistica_C&cid=1254736177056&menu=resultados&idp=1254735576581 (accessed on 15 June 2021).

- Perez, S.A.; Matsaganis, M. The political economy of austerity in Southern Europe. New Political Econ. 2018, 23, 192–207. [Google Scholar] [CrossRef]

- Rodríguez-López, J.; Solís-García, M. Accounting for Spanish business cycles. Macroecon. Dyn. 2016, 20, 685–714. [Google Scholar] [CrossRef]

- Martí, F.; Pérez, J.J. Spanish public finances through the financial crisis. Fisc. Stud. 2015, 36, 527–554. [Google Scholar] [CrossRef]

- Economic and Social Council of Spain. Memoria Sobre la Situación Socioeconómica y Laboral de España 2011; Consejo Económico y Social: Madrid, Spain, 2012. [Google Scholar]

- Economic and Social Council of Spain. Memoria Sobre la Situación Socioeconómica y Laboral de España 2012; Consejo Económico y Social: Madrid, Spain, 2013. [Google Scholar]

- Peña-Longobardo, L.M.; Oliva-Moreno, J.; García-Armesto, S.; Hernández-Quevedo, C. The Spanish long-term care system in transition: Ten years since the 2006 Dependency Act. Health Policy 2016, 120, 1177–1182. [Google Scholar] [CrossRef]

- Economic and Social Council of Spain. Memoria Sobre la Situación Socioeconómica y Laboral de España 2018; Consejo Económico y Social: Madrid, Spain, 2019. [Google Scholar]

- López Casanovas, G.; del Pozo-Rubio, R. La Protección Social de los Problemas de Dependencia en España; Documentos de trabajo; Fundación CASER-CRES: Madrid, Spain, 2010; p. 1. [Google Scholar]

- Del Pozo, R.; Sotos, F.E. Coste agregado e individual esperado de la Ley de Dependencia en España a partir de los modelos de simulación de Monte Carlo y Multi-Estado de Discapacidad. Hacienda Pública Española 2013, 204, 85–110. [Google Scholar]

- Jimenez-Martin, S.; Viola, A. Observatorio de la Dependencia. In Estudios Sobre la Economía Española; FEDEA: Madrid, Spain, 2017. [Google Scholar]

- Del Pozo-Rubio, R.; Jiménez-Rubio, D. Catastrophic risk associated with out-of-pocket payments for long term care in Spain. Health Policy 2019, 123, 582–589. [Google Scholar] [CrossRef]

- Batey, P.W. What Can Demographic–Economic Modeling Tell Us about the Consequences of Regional Decline? Int. Reg. Sci. Rev. 2016, 41, 256–281. [Google Scholar] [CrossRef]

- Skolka, J. Input-output structural decomposition analysis for Austria. J. Policy Modeling 1989, 11, 45–66. [Google Scholar] [CrossRef]

- Miller, R.E.; Blair, P.D. Input-Output Analysis: Foundations and Extensions; Cambridge University Press: Cambridge, UK, 2009. [Google Scholar]

- Rose, A.; Casler, S. Input–output structural decomposition analysis: A critical appraisal. Econ. Syst. Res. 1996, 8, 33–62. [Google Scholar] [CrossRef]

- Arto, I.; Dietzenbacher, E. Drivers of the growth in global greenhouse gas emissions. Environ. Sci. Technol. 2014, 48, 5388–5394. [Google Scholar] [CrossRef]

- Lin, X.; Polenske, K.R. Input–output anatomy of China’s energy use changes in the 1980s. Econ. Syst. Res. 1995, 7, 67–84. [Google Scholar] [CrossRef]

| LTC Spending (Million Euros) | Provision of Services | Cash Benefits | |||||

|---|---|---|---|---|---|---|---|

| nps1 | %nps2 | wps3 (euros) | ncb4 | %ncb5 | wcb6 (Euros) | ||

| 2009 | 6124.03 | 285,185 | 49.87% | 15,901.20 | 286,723 | 50.13% | 5124.00 |

| 2012 | 6895.00 | 317,063 | 39.16% | 13,700.27 | 492,622 | 60.84% | 5178.72 |

| 2015 | 7449.00 | 380,592 | 45.95% | 13,357.99 | 447,679 | 54.05% | 5282.93 |

| Social Work Activities Sector | Total (All Sectors) | |||

|---|---|---|---|---|

| Million Euros | Percentual Change | Million Euros | Percentual Change | |

| Consumption 1 : | ||||

| Base year (2009) | 4319.1 | 5465.82 | ||

| Δ2009−2012 | −55.3 | −1.28 | 922.88 | 16.88 |

| Δ2012−2015 | 704.7 | 16.53 | 513.68 | 8.04 |

| Output 2 : | ||||

| Base year (2009) | 4394.9 | 13,573.6 | ||

| Δ2009−2012 | −46.6 | −1.06 | 4131.86 | 30.44 |

| Δ2012−2015 | 720.1 | 16.56 | 2521.91 | 14.24 |

| 2009–2012 | 2012–2015 | |||

|---|---|---|---|---|

| Million € of 2012 | (%) | Million € of 2012 | (%) | |

| A. TECHNOLOGY factors | 1670.63 | 12.31 | 1125.46 | 8.29 |

| 1. Inter-industry linkages | 357.40 | 2.63 | −39.16 | −0.29 |

| 2. Induced consumption | 1420.60 | 10.47 | 1107.52 | 8.16 |

| 2.1. Induced consumption by employed | 83.43 | 0.61 | 73.92 | 0.54 |

| 2.1.1. Consumption coefficients of employed households | 114.31 | 0.84 | −14.28 | −0.11 |

| 2.1.2. Wages | −30.87 | −0.23 | 88.19 | 0.65 |

| 2.2. Induced consumption by unemployed | 1337.17 | 9.85 | 1033.60 | 7.61 |

| 2.2.1. Consumption coefficients of unemployed households | −23.36 | −0.17 | 36.84 | 0.27 |

| 2.2.2. Unemployment benefits | 1360.53 | 10.02 | 996.77 | 7.34 |

| 2.3. Labor intensity | −107.38 | −0.79 | 57.09 | 0.42 |

| B. LTC DEMAND factors | 2461.23 | 18.13 | 1396.45 | 10.29 |

| 1. Share of imports in LTC consumption | −89.14 | −0.66 | −32.14 | −0.24 |

| 2. Price index | 670.16 | 4.94 | 13.03 | 0.10 |

| 3. LTC domestic consumption at constant prices of 2012 | 1880.21 | 13.85 | 1415.56 | 10.43 |

| 3.1. Consumption derived from cash benefits | 2534.46 | 18.67 | −469.10 | −3.46 |

| 3.1.1. Distribution of consumption funded with cash benefits | 76.21 | 0.56 | −68.17 | −0.50 |

| 3.1.2. Average of monetary value allocated for cash benefits | 203.03 | 1.50 | 52.54 | 0.39 |

| 3.1.3. Beneficiaries of cash benefits | 2255.22 | 16.61 | −453.47 | −3.34 |

| 3.2. Consumption derived from provision of services | −654.25 | −4.82 | 1884.66 | 13.88 |

| 3.2.1. Average of monetary value allocated for provision of services | −1855.68 | −13.67 | −576.63 | −4.25 |

| 3.2.2. Beneficiaries of provision of services | 1201.44 | 8.85 | 2461.29 | 18.13 |

| Total output | 4131.86 | 30.44 | 2521.91 | 18.58 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bermejo, F.; del Pozo, R.; Moya, P. Main Factors Determining the Economic Production Sustained by Public Long-Term Care Spending in Spain. Int. J. Environ. Res. Public Health 2021, 18, 9199. https://doi.org/10.3390/ijerph18179199

Bermejo F, del Pozo R, Moya P. Main Factors Determining the Economic Production Sustained by Public Long-Term Care Spending in Spain. International Journal of Environmental Research and Public Health. 2021; 18(17):9199. https://doi.org/10.3390/ijerph18179199

Chicago/Turabian StyleBermejo, Fernando, Raúl del Pozo, and Pablo Moya. 2021. "Main Factors Determining the Economic Production Sustained by Public Long-Term Care Spending in Spain" International Journal of Environmental Research and Public Health 18, no. 17: 9199. https://doi.org/10.3390/ijerph18179199

APA StyleBermejo, F., del Pozo, R., & Moya, P. (2021). Main Factors Determining the Economic Production Sustained by Public Long-Term Care Spending in Spain. International Journal of Environmental Research and Public Health, 18(17), 9199. https://doi.org/10.3390/ijerph18179199