Spatial Interaction Spillover Effects between Digital Financial Technology and Urban Ecological Efficiency in China: An Empirical Study Based on Spatial Simultaneous Equations

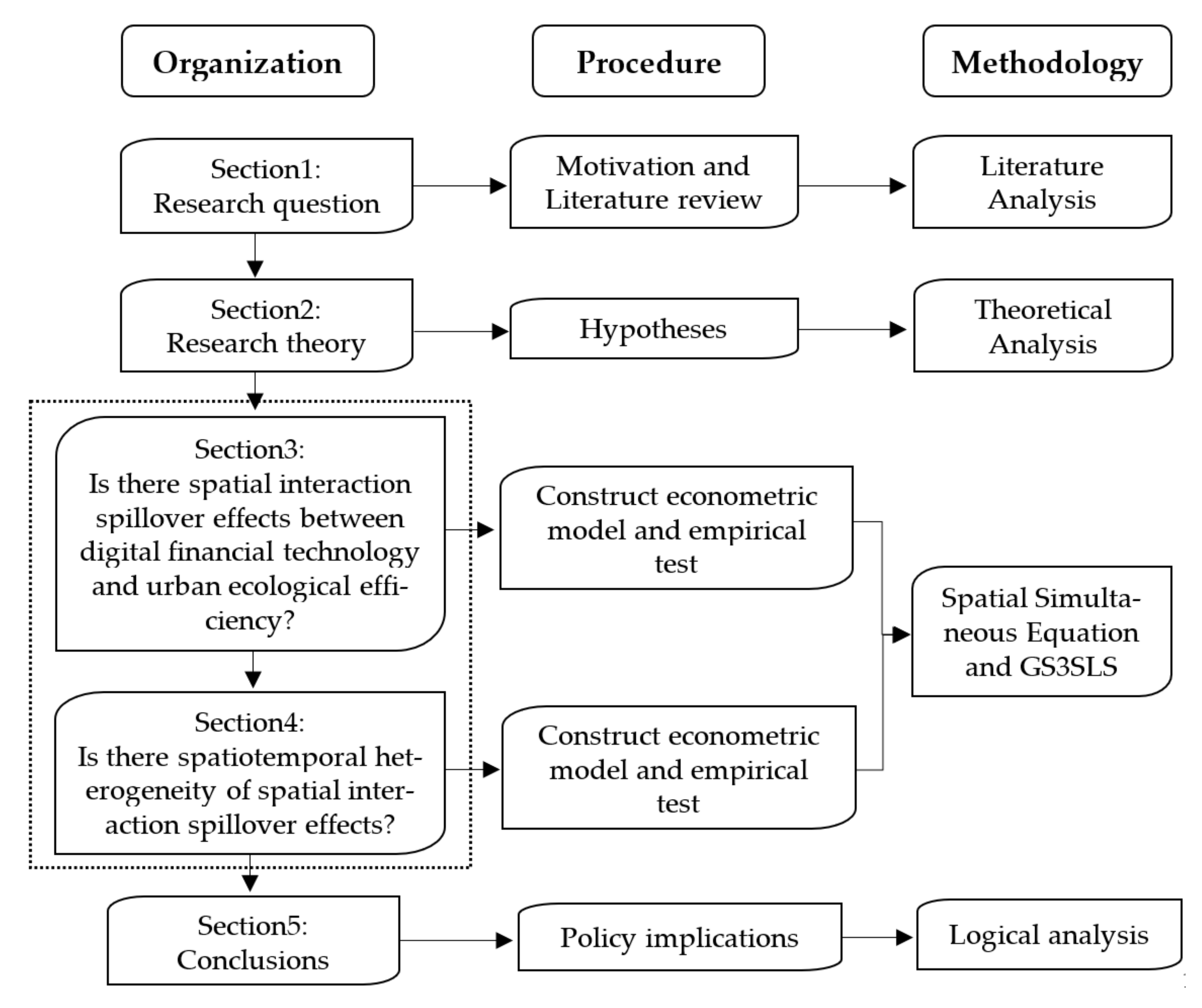

Abstract

:1. Introduction

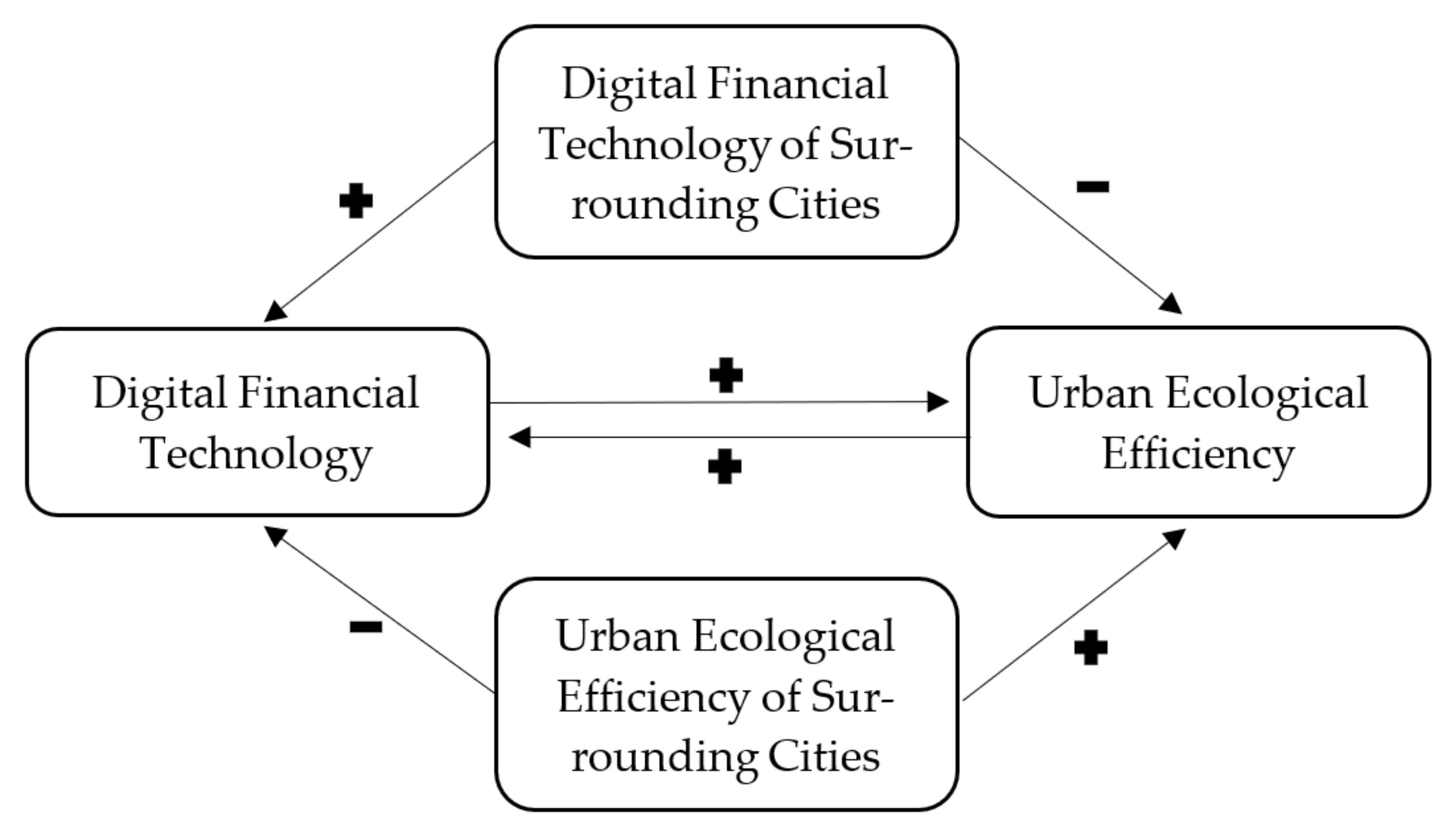

2. Theoretical Framework

3. Research Design and Pretreatment

3.1. Theoretical Analysis and Research Hypotheses

3.2. Methods

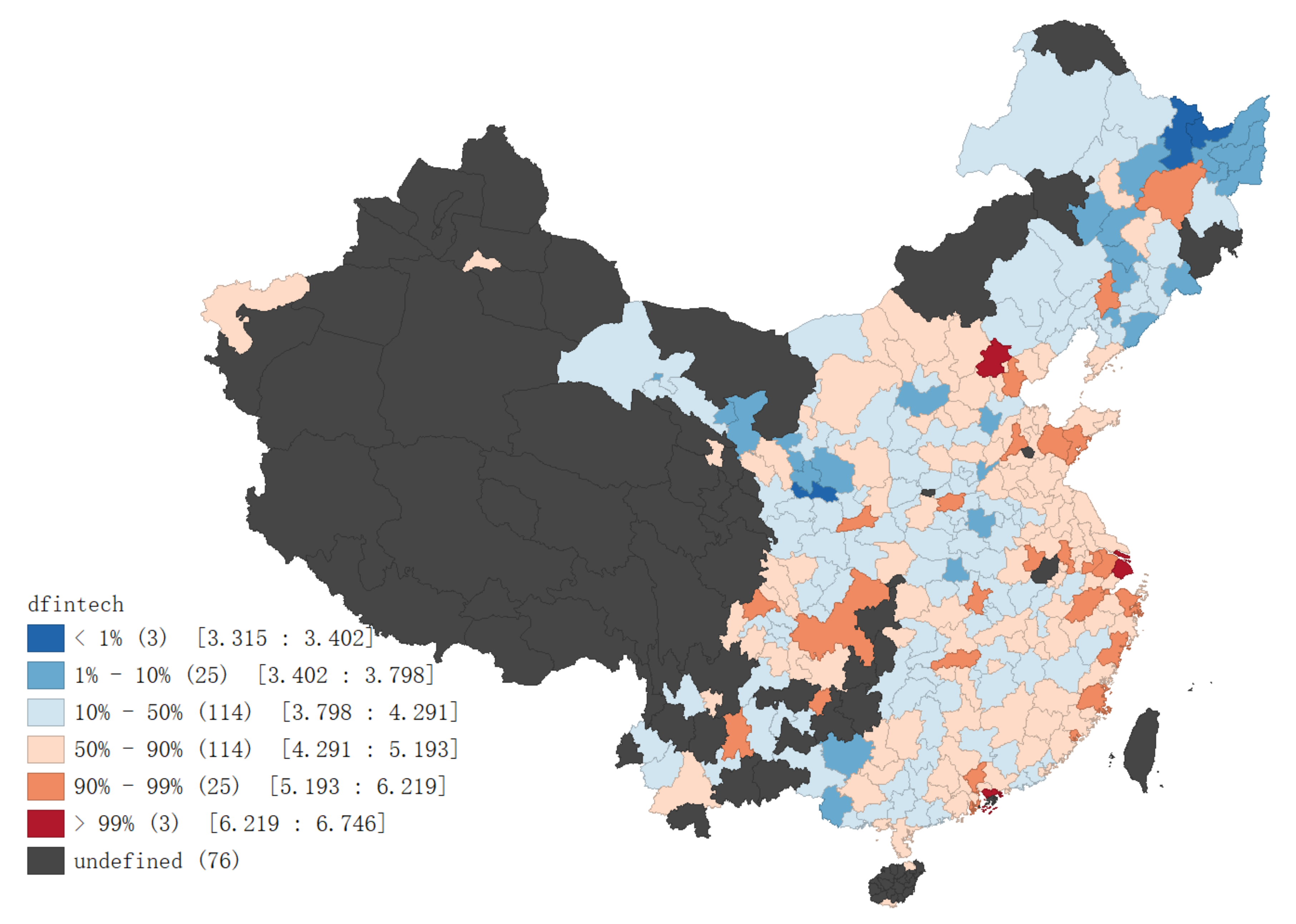

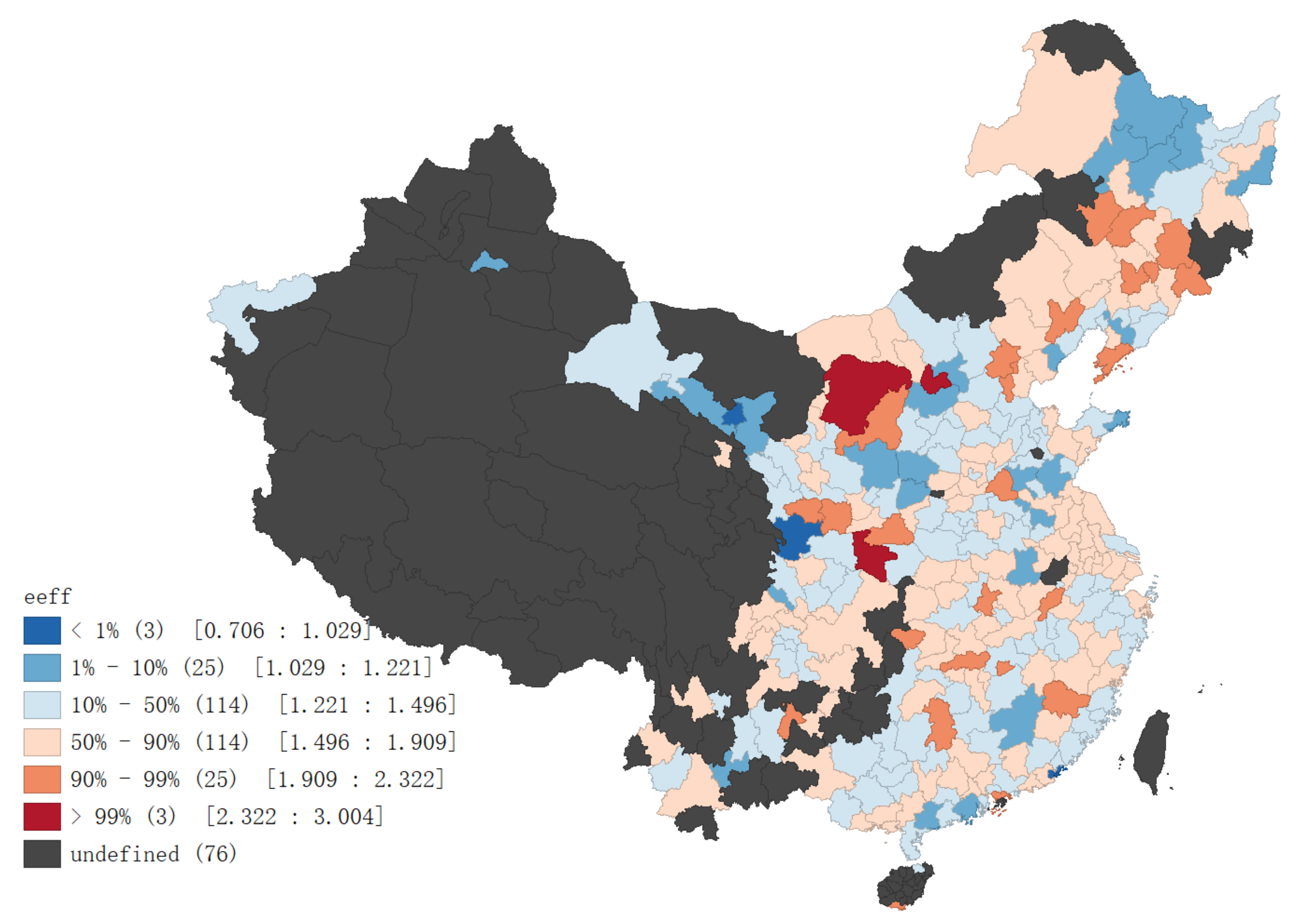

3.3. Variable Description and Data Sources

3.4. Pretreatment of Variables

3.4.1. Measurement of Digital Financial Technology

3.4.2. Measurement of Urban Ecological Efficiency

4. Econometric Examination of the Spatial Interaction Spillover Effects of Digital Financial Technology and Urban Ecological Efficiency

4.1. Results of Parameter Estimation

4.2. Analysis of Empirical Results

4.2.1. General Interaction Effects of Digital Financial Technology and Urban Ecological Efficiency

4.2.2. Spatial Spillover Effects of Digital Financial Technology and Urban Ecological Efficiency

4.2.3. Spatial Interaction Effects of Digital Financial Technology and Urban Ecological Efficiency

4.3. Robustness Test

4.3.1. Robustness Test of Distance Band

4.3.2. Robustness Test of Contiguity Spatial Weighting Matrix

4.3.3. Robustness Test of Adjusted Variables

5. Spatial–Temporal Heterogeneity of the Spatial Interaction Spillover Effects

5.1. Heterogeneity Analysis Based on the Regional Differences

5.1.1. Analysis of General Interaction Effects Based on the Regional Heterogeneity

5.1.2. Analysis of Spatial Spillover Effects Based on the Regional Heterogeneity

5.1.3. Analysis of Spatial Interaction Effects Based on the Regional Heterogeneity

5.2. Heterogeneity Analysis Based on the Period Differences

5.2.1. Analysis of General Interaction Effects Based on the Period Heterogeneity

5.2.2. Analysis of Spatial Spillover Effects Based on the Period Heterogeneity

5.2.3. Analysis of Spatial Interaction Effects Based on the Period Heterogeneity

6. Conclusions and Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Huang, J.; Yang, X.; Cheng, G.; Wang, S. A comprehensive eco-efficiency model and dynamics of regional eco-efficiency in China. J. Clean. Prod. 2014, 67, 228–238. [Google Scholar] [CrossRef]

- Flaherty, M.; Gevorkyan, A.; Radpour, S.; Sr, W. Financing Climate Policies through Climate Bonds–A Three Stage Model and Empirics. Res. Int. Bus. Financ. 2016, 42, 468–479. [Google Scholar] [CrossRef]

- Stein, S.; Kaltofen, D.; Mervelskemper, L. Are Sustainable Investment Funds Worth the Effort? J. Sustain. Financ. Invest. 2014, 4, 127–146. [Google Scholar]

- Dyckhoff, H.; Allen, K. Measuring ecological efficiency with data envelopment analysis (DEA). Eur. J. Oper. Res. 2001, 132, 312–325. [Google Scholar] [CrossRef]

- Li, L.-B.; Hu, J.-L. Ecological total-factor energy efficiency of regions in China. Energy Policy 2012, 46, 216–224. [Google Scholar] [CrossRef]

- Sun, C. Digital Finance, Technology Innovation, and Marine Ecological Efficiency. J. Coast. Res. 2020, 108, 109–112. [Google Scholar] [CrossRef]

- Knight, E.; Wójcik, D. FinTech, economy and space: Introduction to the special issue. Environ. Plan. A Econ. Space 2020, 52, 1490–1497. [Google Scholar] [CrossRef]

- Xu, J.; Huang, D.; He, Z.; Zhu, Y. Research on the Structural Features and Influential Factors of the Spatial Network of China’s Regional Ecological Efficiency Spillover. Sustainability 2020, 12, 3137. [Google Scholar] [CrossRef] [Green Version]

- Climent, F.; Soriano, P. Green and Good? The Investment Performance of US Environmental Mutual Funds. J. Bus. Ethics 2011, 103, 275–287. [Google Scholar] [CrossRef] [Green Version]

- Pham, L. Is it risky to go green? A volatility analysis of the green bond market. J. Sustain. Financ. Invest. 2016, 6, 1–29. [Google Scholar] [CrossRef]

- Antimiani, A.; Costantini, V.; Markandya, A.; Paglialunga, E.; Sforna, G. The Green Climate Fund as an effective compensatory mechanism in global climate negotiations. Environ. Sci. Policy 2017, 77, 49–68. [Google Scholar] [CrossRef]

- Cui, L.; Huang, Y. Exploring the Schemes for Green Climate Fund Financing: International Lessons. World Dev. 2018, 101, 173–187. [Google Scholar] [CrossRef]

- Huang, Z.; Liao, G.; Li, Z. Loaning scale and government subsidy for promoting green innovation. Technol. Forecast. Soc. Chang. 2019, 144, 148–156. [Google Scholar] [CrossRef]

- Hong, M.; Drakeford, B.; Zhang, K. The impact of mandatory CSR disclosure on green innovation: Evidence from China. Green Financ. 2020, 2, 302–322. [Google Scholar] [CrossRef]

- Zheng, Y.; Chen, S.; Wang, N. Does financial agglomeration enhance regional green economy development? Evidence from China. Green Financ. 2020, 2, 173–196. [Google Scholar] [CrossRef]

- Gao, Y.; Li, Z.; Wang, F.; Wang, F.; Tan, R.; Bi, J.; Jia, X. A game theory approach for corporate environmental risk mitigation. Resour. Conserv. Recycl. 2017, 130, 240–247. [Google Scholar] [CrossRef]

- Yang, Y.; Lan, Q.; Liu, P.; Ma, L. Insurance as a market mechanism in managing regional environmental and safety risks. Resour. Conserv. Recycl. 2017, 124, 62–66. [Google Scholar] [CrossRef]

- Galaz, V.; Gars, J.; Moberg, F.; Nykvist, B.; Repinski, C. Why Ecologists Should Care about Financial Markets. Trends Ecol. Evol. 2015, 30, 571–580. [Google Scholar] [CrossRef]

- Scholtens, B. Why Finance Should Care about Ecology. Trends Ecol. Evol. 2017, 32, 500–505. [Google Scholar] [CrossRef] [Green Version]

- Qamruzzaman, M.; Wei, J. Do financial inclusion, stock market development attract foreign capital flows in developing economy: A panel data investigation. Quant. Financ. Econ. 2019, 3, 88–108. [Google Scholar] [CrossRef]

- Taskin, D.; Sariyer, G. Use of derivatives, financial stability and performance in Turkish banking sector. Quant. Financ. Econ. 2020, 4, 252–273. [Google Scholar] [CrossRef]

- Kopersak, A.A.; Kovaleva, E.V. Problems of assessment of the ecological-economic efficiency under the conditions of radiation pollution. Prirodoobustroistvo 2015, 3, 94–98. [Google Scholar]

- Turski, M. Eco-development aspect in modernization of industrial system. E3S Web Conf. 2018, 44, 00181. [Google Scholar] [CrossRef] [Green Version]

- Pan, M.; Lu, F.; Zhu, Y.; Li, H.; Yin, J.; Liao, Y.; Tong, C.; Zhang, F. 4E analysis and multiple objective optimizations of a cascade waste heat recovery system for waste-to-energy plant. Energy Convers. Manag. 2021, 230, 113765. [Google Scholar] [CrossRef]

- Feng, Z.; Yan, N. Putting a circular economy into practice in China. Sustain. Sci. 2007, 2, 95–101. [Google Scholar]

- Su, B.; Heshmati, A.; Geng, Y.; Yu, X. A review of the circular economy in China: Moving from rhetoric to implementation. J. Clean. Prod. 2013, 42, 215–227. [Google Scholar] [CrossRef]

- Figge, F.; Young, C.; Barkemeyer, R. Sufficiency or efficiency to achieve lower resource consumption and emissions? The role of the rebound effect. J. Clean. Prod. 2014, 69, 216–224. [Google Scholar] [CrossRef]

- Ghisellini, P.; Cialani, C.; Ulgiati, S. A review on circular economy: The expected transition to a balanced interplay of environmental and economic systems. J. Clean. Prod. 2016, 114, 11–32. [Google Scholar] [CrossRef]

- Li, Z.; Liao, G.; Albitar, K. Does corporate environmental responsibility engagement affect firm value? The mediating role of corporate innovation. Bus. Strategy Environ. 2020, 29, 1045–1055. [Google Scholar] [CrossRef]

- Li, T.; Li, X.; Liao, G. Business cycles and energy intensity. Evidence from emerging economies. Borsa Istanb. Rev. 2021. [Google Scholar] [CrossRef]

- Liao, G.; Hou, P.; Shen, X.; Albitar, K. The impact of economic policy uncertainty on stock returns: The role of corporate environmental responsibility engagement. Int. J. Financ. Econ. 2021, 26, 4386–4392. [Google Scholar] [CrossRef]

- Engelen, E. ‘Amsterdamned’? The uncertain ftiture of a financial centre. Environ. Plan. A-Econ. Space 2007, 39, 1306–1324. [Google Scholar] [CrossRef]

- Shen, Y.; Hueng, C.J.; Hu, W. Measurement and spillover effect of digital financial inclusion: A cross-country analysis. Appl. Econ. Lett. 2020, 1–6. [Google Scholar] [CrossRef]

- Salat, S. Shanghai in the New Economy of Global Flows Shaping Urban form and Connectedness in the Digital Age. J. Archit. Urban. 2017, 41, 145–161. [Google Scholar] [CrossRef] [Green Version]

- Rodima-Taylor, D.; Grimes, W.W. International remittance rails as infrastructures: Embeddedness, innovation and financial access in developing economies. Rev. Int. Political Econ. 2019, 26, 839–862. [Google Scholar] [CrossRef]

- Sun, Z.Q.; Sun, T. Financial Development, Industrial Structure Optimization, and Eco-Efficiency Promotion. Fresenius Environ. Bull. 2019, 28, 6231–6238. [Google Scholar]

- Chen, C.F.; Sun, Y.W.; Lan, Q.X.; Jiang, F. Impacts of industrial agglomeration on pollution and ecological efficiency-A spatial econometric analysis based on a big panel dataset of China’s 259 cities. J. Clean. Prod. 2020, 258, 120721. [Google Scholar] [CrossRef]

- Yue, L.; Xue, D.; Draz, M.U.; Ahmad, F.; Li, J.J.; Shahzad, F.; Ali, S. The Double-Edged Sword of Urbanization and Its Nexus with Eco-Efficiency in China. Int. J. Environ. Res. Public Health 2020, 17, 446. [Google Scholar] [CrossRef] [Green Version]

- Ren, W.Z.; Zhang, Z.L.; Wang, Y.J.; Xue, B.; Chen, X.P. Measuring Regional Eco-Efficiency in China (2003–2016): A “Full World” Perspective and Network Data Envelopment Analysis. Int. J. Environ. Res. Public Health 2020, 17, 3456. [Google Scholar] [CrossRef]

- Baumann, U.; Salvador, R.G.; Seitz, F. Global recessions and booms: What do Probit models tell us? Quant. Financ. Econ. 2019, 3, 187–200. [Google Scholar] [CrossRef]

- Li, F.; Yang, C.; Li, Z.; Failler, P. Does Geopolitics Have an Impact on Energy Trade? Empirical Research on Emerging Countries. Sustainability 2021, 13, 5199. [Google Scholar] [CrossRef]

- Wen, F.; Cao, J.; Liu, Z.; Wang, X. Dynamic volatility spillovers and investment strategies between the Chinese stock market and commodity markets. Int. Rev. Financ. Anal. 2021, 76, 101772. [Google Scholar] [CrossRef]

- Wen, F.; Li, C.; Sha, H.; Shao, L. How does economic policy uncertainty affect corporate risk-taking? Evidence from China. Financ. Res. Lett. 2021, 41, 101840. [Google Scholar] [CrossRef]

- Wen, F.; Zou, Q.; Wang, X. The contrarian strategy of institutional investors in Chinese stock market. Financ. Res. Lett. 2021, 41, 101845. [Google Scholar] [CrossRef]

- Liu, H.; Ma, L. Spatial Pattern and Effects of Urban Coordinated Development in China’s Urbanization. Sustainability 2020, 12, 2389. [Google Scholar] [CrossRef] [Green Version]

- Shi, T.; Yang, S.; Zhang, W.; Zhou, Q. Coupling coordination degree measurement and spatiotemporal heterogeneity between economic development and ecological environment—Empirical evidence from tropical and subtropical regions of China. J. Clean. Prod. 2020, 244, 118739. [Google Scholar] [CrossRef]

- Yao, Y.; Hu, D.; Yang, C.; Tan, Y. The impact and mechanism of fintech on green total factor productivity. Green Financ. 2021, 3, 198–221. [Google Scholar] [CrossRef]

- Li, T.; Huang, Z.; Drakeford, B. Statistical measurement of total factor productivity under resource and environmental constraints. Natl. Account. Rev. 2019, 1, 16–27. [Google Scholar] [CrossRef]

- Yang, C.Y.; Li, T.H.; Albitar, K. Does Energy Efficiency Affect Ambient PM2.5? The Moderating Role of Energy Investment. Front. Environ. Sci. 2021, 9, 707751. [Google Scholar] [CrossRef]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision making units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Tone, K. A slacks-based measure of super-efficiency in data envelopment analysis. Eur. J. Oper. Res. 2002, 143, 32–41. [Google Scholar] [CrossRef] [Green Version]

- Tone, K. A slacks-based measure of efficiency in data envelopment analysis. Eur. J. Oper. Res. 2001, 130, 498–509. [Google Scholar] [CrossRef] [Green Version]

- Malmquist, S. Index numbers and indifference surfaces. Trab. Estad. 1953, 4, 209. [Google Scholar] [CrossRef]

- Caves, D.W.; Christensen, L.R.; Diewert, W.E. The Economic Theory of Index Numbers and the Measurement of Input, Output, and Productivity. Econometrica 1982, 50, 1393. [Google Scholar] [CrossRef]

- Oh, D.-H. A global Malmquist-Luenberger productivity index. J. Product. Anal. 2010, 34, 183. [Google Scholar] [CrossRef]

- Long, R.; Gan, X.; Chen, H.; Wang, J.; Li, Q. Spatial econometric analysis of foreign direct investment and carbon productivity in China: Two-tier moderating roles of industrialization development. Resour. Conserv. Recycl. 2020, 155, 104677. [Google Scholar] [CrossRef]

- Gan, T.; Yang, H.; Liang, W. How do urban haze pollution and economic development affect each other? Empirical evidence from 287 Chinese cities during 2000–2016. Sustain. Cities Soc. 2021, 65, 102642. [Google Scholar] [CrossRef]

- Zhang, S.; Wang, Y.; Liu, Z.; Hao, Y. The spatial dynamic relationship between haze pollution and economic growth: New evidence from 285 prefecture-level cities in China. J. Environ. Plan. Manag. 2021, 64, 1985–2020. [Google Scholar] [CrossRef]

| Variable | Abbr. | Source |

|---|---|---|

| Digital Financial Technology | d-fintech | Web Crawler Search |

| Urban Ecological Efficiency | e-eff | Data Envelopment Analysis |

| Economic Development Level | pgdp | China City Statistical Yearbook |

| Regional Urbanization Level | urb | China City Statistical Yearbook |

| Upgrading of Industrial Structure | ind | China City Statistical Yearbook |

| Openness | ope | China City Statistical Yearbook |

| Degree of Marketization | mar | China City Statistical Yearbook |

| Population density | den | China City Statistical Yearbook |

| Transportation Development Level | tra | China City Statistical Yearbook |

| Development Level of Posts | pos | China City Statistical Yearbook |

| Unit | Items | Summary | Eastern Region | Central Region | Western Region | 2008–2012 | 2013–2018 | |

|---|---|---|---|---|---|---|---|---|

| N | - | - | 3124 | 1232 | 1221 | 671 | 1420 | 1704 |

| d-fintech | - | Mean | 4.401 | 4.636 | 4.227 | 4.286 | 3.974 | 4.757 |

| Std | 0.833 | 0.915 | 0.703 | 0.793 | 0.587 | 0.841 | ||

| e-eff | - | Mean | 1.528 | 1.516 | 1.553 | 1.504 | 1.256 | 1.754 |

| Std | 0.516 | 0.464 | 0.535 | 0.57 | 0.314 | 0.542 | ||

| pgdp | ln(RMB/person) | Mean | 10.498 | 10.725 | 10.428 | 10.211 | 10.223 | 10.728 |

| Std | 0.644 | 0.611 | 0.576 | 0.676 | 0.634 | 0.556 | ||

| urb | ratio | Mean | 0.357 | 0.388 | 0.321 | 0.364 | 0.341 | 0.369 |

| Std | 0.238 | 0.261 | 0.215 | 0.223 | 0.237 | 0.237 | ||

| ind | ratio | Mean | 0.872 | 0.893 | 0.86 | 0.854 | 0.862 | 0.879 |

| Std | 0.081 | 0.068 | 0.088 | 0.081 | 0.084 | 0.077 | ||

| ope | ratio | Mean | 0.027 | 0.027 | 0.038 | 0.008 | 0.036 | 0.02 |

| Std | 0.096 | 0.059 | 0.138 | 0.04 | 0.138 | 0.03 | ||

| mar | ratio | Mean | 0.128 | 0.167 | 0.111 | 0.088 | 0.1 | 0.151 |

| Std | 0.136 | 0.188 | 0.082 | 0.067 | 0.112 | 0.15 | ||

| den | ln(person/km2) | Mean | 5.725 | 6.109 | 5.597 | 5.256 | 5.706 | 5.742 |

| Std | 0.917 | 0.672 | 0.951 | 0.959 | 0.909 | 0.923 | ||

| tra | ln(RMB/person) | Mean | 2.771 | 2.799 | 2.678 | 2.891 | 2.944 | 2.628 |

| Std | 0.784 | 0.863 | 0.692 | 0.77 | 0.765 | 0.771 | ||

| pos | ln(RMB/person) | Mean | 4.235 | 4.424 | 4.155 | 4.034 | 3.935 | 4.485 |

| Std | 0.796 | 0.868 | 0.731 | 0.693 | 0.69 | 0.793 |

| First-Grade Indicators | Second-Grade Indicators | Third-Grade Indicators |

|---|---|---|

| Input indicator | Capital | Investment in fixed assets |

| Labor | Employees | |

| Construction | Built up area | |

| Energy | Energy consumption | |

| Output indicator | Desirable output | GDP |

| Undesirable output | Waste water | |

| Waste gas | ||

| Smoke and dust |

| Dependent Variable: d-fintech | Dependent Variable: e-eff | |||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| e-eff | 0.720 *** (27.85) | 0.352 *** (16.23) | 0.247 *** (12.54) | - | - | - |

| d-fintech | - | - | - | 0.277 *** (27.85) | 0.221 *** (16.23) | 0.213 *** (12.54) |

| pgdp | - | 0.453 *** (16.14) | 0.921 *** (27.81) | - | 0.276 *** (12.20) | 0.511 *** (15.33) |

| urb | - | −0.001 (−0.02) | 0.825 *** (7.79) | - | −0.295 *** (−7.09) | 0.511 *** (−2.98) |

| ind | - | 0.136 (0.71) | −1.456 *** (−4.10) | - | −0.749 *** (−4.94) | 0.371 (1.12) |

| ope | - | −0.205 ** (−2.02) | −0.059 (−0.84) | - | 0.174 ** (2.17) | 0.181 *** (2.76) |

| mar | - | 1.155 *** (12.03) | 1.607 *** (14.52) | - | −0.241 *** (−3.11) | −0.271 ** (−2.55) |

| den | - | 0.202 *** (17.50) | 0.252 *** (4.18) | - | −0.066 *** (−6.95) | −0.177 *** (−3.16) |

| tra | - | −0.108 *** (−7.81) | −0.141 *** (−10.12) | - | −0.067 *** (−6.09) | −0.074 *** (−5.64) |

| pos | - | 0.146 *** (9.23) | 0.119 *** (6.79) | - | 0.061 *** (4.79) | 0.145 *** (8.93) |

| Cons | 3.302 | −2.631 | −6.430 | 0.311 | −1.254 | −4.355 |

| FE | No | No | Yes | No | No | Yes |

| N | 3124 | 3124 | 3124 | 3124 | 3124 | 3124 |

| R2 | 0.1990 | 0.5718 | 0.7044 | 0.1990 | 0.2996 | 0.5391 |

| F | 775.79 | 462.08 | 749.64 | 775.79 | 148.01 | 367.98 |

| Items | Geographical Distance | Economic–Geographical Distance | ||

|---|---|---|---|---|

| Dependent Variable: e-eff (1) | Dependent Variable: d-fintech (2) | Dependent Variable: e-eff (3) | Dependent Variable: d-fintech (4) | |

| W×d-fintech | −0.605 *** (−9.02) | 1.206 *** (8.51) | −0.131 *** (−3.84) | 0.112 ** (2.37) |

| W×e-eff | 1.263 *** (13.41) | −2.444 *** (−9.00) | 0.691 *** (12.21) | −0.131 (−1.00) |

| d-fintech | 0.489 *** (17.03) | - | 0.345 *** (6.65) | - |

| e-eff | - | 1.936 *** (13.82) | - | 0.814 *** (6.32) |

| pgdp | 0.055 ** (2.54) | −0.091 * (−1.94) | 0.054 ** (2.24) | 0.158 *** (4.10) |

| urb | −0.281 *** (−7.12) | 0.553 *** (6.99) | −0.216 *** (−6.22) | 0.214 *** (3.82) |

| ind | −0.405 ** (−2.85) | 0.809 *** (3.04) | −0.204 (−1.64) | 0.766 *** (4.05) |

| ope | 0.237 *** (3.25) | −0.458 *** (−3.21) | 0.215 *** (3.37) | −0.199 * (−1.92) |

| mar | −0.500 *** (−6.73) | 1.010 *** (7.64) | −0.351 *** (−4.37) | 1.060 *** (11.22) |

| den | −0.093 *** (−9.78) | 0.190 *** (11.06) | −0.087 *** (−7.01) | 0.200 *** (16.48) |

| tra | 0.031 *** (2.98) | −0.060 *** (−3.02) | 0.011 (1.15) | −0.033 ** (−2.30) |

| pos | −0.036 *** (−3.08) | 0.077 *** (3.51) | −0.007 (−0.63) | 0.077 *** (4.81) |

| N | 3124 | 3124 | 3124 | 3124 |

| R2 | 0.9493 | 0.9568 | 0.9702 | 0.9811 |

| F | 6122.85 (p = 0.000) | 8106.93 (p = 0.000) | 9820.02 (p = 0.000) | 16,467.77 (p = 0.000) |

| Items | W: 0–20 | W: 0–40 | ||

|---|---|---|---|---|

| Dependent Variable: e-eff (1) | Dependent Variable: d-fintech (2) | Dependent Variable: e-eff (3) | Dependent Variable: d-fintech (4) | |

| W×d-fintech | −0.508 *** (−7.23) | 0.819 *** (6.50) | −0.599 *** (−9.05) | 1.345 *** (8.90) |

| W×e-eff | 1.080 *** (11.48) | −1.597 *** (−6.21) | 1.303 *** (13.57) | −2.898 *** (−10.09) |

| d-fintech | 0.534 *** (13.58) | - | 0.443 *** (19.07) | - |

| e-eff | - | 1.608 *** (9.62) | - | 2.221 *** (15.71) |

| pgdp | 0.025 (1.12) | −0.001 (−0.03) | 0.069 *** (3.16) | −0.149 *** (−2.85) |

| urb | −0.262 *** (−6.64) | 0.430 *** (6.32) | −0.272 *** (−6.93) | 0.608 *** (6.75) |

| ind | −0.327 ** (−2.28) | 0.624 *** (2.68) | −0.370 *** (−2.63) | 0.830 *** (2.74) |

| ope | 0.244 *** (3.36) | −0.382 *** (−3.05) | 0.240 *** (3.28) | −0.533 *** (−3.25) |

| mar | −0.545 *** (−7.00) | 1.011 *** (8.87) | −0.457 *** (−6.27) | 1.026 *** (6.74) |

| den | −0.105 *** (−10.25) | 0.198 *** (12.41) | −0.085 *** (−9.12) | 0.191 *** (9.97) |

| tra | 0.025 ** (2.46) | −0.042 ** (−2.43) | 0.030 *** (−9.12) | −0.067 *** (−2.92) |

| pos | −0.042 *** (−3.48) | 0.084 *** (4.43) | −0.032 *** (−2.73) | 0.073 *** (2.89) |

| N | 3124 | 3124 | 3124 | 3124 |

| R2 | 0.9261 | 0.9320 | 0.9523 | 0.9651 |

| F | 4443.21 (p = 0.000) | 5544.52 (p = 0.000) | 6204.77 (p = 0.000) | 9154.76 (p = 0.000) |

| Items | W: 0–20 (Contiguity) | W: 0–30 (Contiguity) | W: 0–40 (Contiguity) | |||

|---|---|---|---|---|---|---|

| Dependent Variable: e-eff (1) | Dependent Variable: d-fintech (2) | Dependent Variable: e-eff (3) | Dependent Variable: d-fintech (4) | Dependent Variable: e-eff (5) | Dependent Variable: d-fintech (6) | |

| W×d-fintech | −0.121 ** (−2.15) | 0.963 *** (9.56) | −0.614 *** (−7.93) | 0.869 *** (6.65) | −0.566 *** (−7.31) | 1.286 *** (7.33) |

| W×e-eff | 0.832 *** (8.70) | −0.135 (−0.67) | 1.085 *** (10.54) | −1.360 *** (−6.23) | 1.277 *** (11.12) | −2.897 *** (−9.51) |

| d-fintech | 0.112 * (1.71) | - | 0.679 *** (12.97) | - | 0.441 *** (19.54) | - |

| e-eff | - | 0.336 * (0.67) | - | 1.258 *** (13.66) | - | 2.263 *** (18.80) |

| pgdp | 0.164 *** (6.97) | 0.286 *** (7.83) | −0.011 (−0.45) | 0.052 (1.56) | 0.054 ** (2.34) | −0.123 ** (−2.27) |

| urb | −0.147 *** (−3.90) | 0.061 (1.10) | −0.237 *** (−5.65) | 0.312 *** (5.52) | −0.218 *** (−5.32) | 0.494 *** (5.26) |

| ind | 0.369 ** (2.37) | 1.297 *** (7.08) | −0.671 *** (−4.00) | 0.312 *** (4.93) | −0.403 *** (−2.62) | 0.915 *** (2.70) |

| ope | 0.298 *** (4.16) | 0.198 * (1.87) | 0.221 *** (2.78) | −0.266 ** (4.93) | 0.227 *** (2.90) | −0.514 *** (−2.87) |

| mar | 0.024 (0.27) | 0.996 *** (11.08) | −0.823 *** (−8.85) | 1.192 *** (12.06) | −0.588 *** (−7.54) | 1.333 *** (7.99) |

| den | −0.012 (−0.94) | 0.159 *** (12.94) | −0.155 *** (−11.88) | 0.222 *** (18.23) | −0.112 *** (−11.44) | 0.253 *** (12.46) |

| tra | 0.008 (0.78) | −0.027 ** (−1.98) | 0.029 ** (2.57) | −0.042 *** (−2.80) | 0.029 *** (2.64) | −0.067 *** (−2.66) |

| pos | 0.034 *** (0.78) | 0.113 *** (7.40) | −0.045 *** (−3.37) | 0.073 *** (4.44) | −0.027 ** (−2.17) | 0.062 ** (2.24) |

| N | 3124 | 3124 | 3124 | 3124 | 3124 | 3124 |

| R2 | 0.9677 | 0.9876 | 0.9525 | 0.9730 | 0.9590 | 0.9718 |

| F | 8098.71 (p = 0.000) | 22,216.75 (p = 0.000) | 7261.85 (p = 0.000) | 14,091.28 (p = 0.000) | 6569.67 (p = 0.000) | 10,025.23 (p = 0.000) |

| Items | Super-SBM-GML (2003–2018) | Global-Super-SBM | ||

|---|---|---|---|---|

| Dependent Variable: e-eff (1) | Dependent Variable: d-fintech (2) | Dependent Variable: e-eff (3) | Dependent Variable: d-fintech (4) | |

| W×d-fintech | −2.362 *** (−6.84) | 0.887 *** (6.53) | −0.300 *** (−8.30) | 1.405 *** (7.75) |

| W×e-eff | 1.138 *** (4.60) | −0.416 *** (−3.23) | 2.187 *** (2.187) | −6.721 *** (−4.89) |

| d-fintech | 2.686 *** (11.52) | - | 0.106 *** (5.62) | - |

| e-eff | - | 0.271 *** (9.45) | - | 2.242 *** (5.40) |

| pgdp | 0.092 (0.78) | 0.022 (0.46) | 0.095 *** (11.91) | −0.005 (−0.08) |

| urb | 0.291 (0.15) | 0.012 (0.18) | −0.151 *** (−13.62) | 0.462 *** (6.24) |

| ind | −0.874 (−0.96) | 0.672 *** (2.93) | −0.364 *** (−8.31) | 1.403 *** (6.28) |

| ope | 2.403 *** (5.34) | −0.652 *** (−4.78) | 0.111 *** (0.111) | −0.193 * (−1.84) |

| mar | −3.701 *** (−7.75) | 1.248 *** (10.88) | 0.041 (1.54) | 0.626 *** (5.84) |

| den | −0.660 *** (−10.31) | 0.213 *** (12.52) | 0.001 (0.21) | 0.125 *** (8.96) |

| tra | 0.020 (0.35) | −0.032 * (−1.92) | −0.001 (−0.33) | −0.017 (−1.22) |

| pos | −0.293 *** (−4.30) | 0.124 *** (6.92) | −0.008 ** (−2.16) | 0.103 *** (6.98) |

| N | 3124 | 3124 | 3124 | 3124 |

| R2 | 0.8609 | 0.8244 | 0.6462 | 0.9000 |

| F | 1951.85 (p = 0.000) | 2536.74 (p = 0.000) | 608.59 (p = 0.000) | 2795.96 (p = 0.000) |

| Items | Eastern Region | Central Region | Western Region | |||

|---|---|---|---|---|---|---|

| Dependent Variable: e-eff (1) | Dependent Variable: d-fintech (2) | Dependent Variable: e-eff (3) | Dependent Variable: d-fintech (4) | Dependent Variable: e-eff (5) | Dependent Variable: d-fintech (6) | |

| W×d-fintech | −0.299 *** (−5.20) | 0.876 *** (6.47) | −0.822 *** (−8.17) | 1.034 *** (12.31) | −0.634 *** (−6.75) | 0.968 *** (8.38) |

| W×e-eff | 1.059 *** (12.09) | −1.776 *** (−4.49) | 1.191 *** (11.95) | −1.134 *** (−7.42) | 1.196 *** (11.29) | −1.821 *** (−7.45) |

| d-fintech | 0.279 *** (8.06) | - | 0.728 *** (8.97) | - | 0.653 *** (9.26) | - |

| e-eff | - | 1.599 *** (5.54) | - | 0.915 *** (9.47) | - | 1.518 *** (9.08) |

| pgdp | 0.011 (0.35) | 0.143 ** (2.32) | 0.101 ** (2.52) | −0.008 (−0.17) | −0.017 (−0.32) | 0.028 (0.35) |

| urb | −0.136 *** (−2.83) | 0.430 *** (4.61) | −0.277 *** (−4.25) | 0.288 *** (3.69) | −0.049 (−0.39) | 0.055 (0.30) |

| ind | −0.673 *** (−3.01) | 1.374 *** (3.08) | −0.438 ** (−2.30) | 0.757 *** (3.86) | 0.122 (0.32) | −0.170 (−0.30) |

| ope | −0.015 (−0.10) | 0.284 (1.07) | 0.230 *** (2.83) | −0.167 * (−1.70) | −0.141 (−0.31) | 0.225 (0.34) |

| mar | −0.130 * (−1.84) | 0.546 *** (4.36) | −0.652 *** (−3.30) | 0.886 *** (4.14) | −3.719 *** (−9.77) | 5.696 *** (8.94) |

| den | −0.066 *** (−3.82) | 0.206 *** (6.68) | −0.120 *** (−7.48) | 0.143 *** (9.36) | −0.109 *** (−5.17) | 0.167 *** (7.03) |

| tra | 0.001 (0.12) | −0.043 * (−1.67) | 0.053 *** (2.98) | −0.045 ** (−2.12) | 0.006 (0.25) | −0.008 (−0.25) |

| pos | 0.026 * (1.88) | 0.057 * (1.84) | −0.055 *** (−3.08) | 0.060 *** (2.93) | 0.022 (0.60) | −0.030 (−0.54) |

| N | 1232 | 1232 | 1221 | 1221 | 671 | 671 |

| R2 | 0.9886 | 0.9800 | 0.9643 | 0.9949 | 0.9885 | 0.9959 |

| F | 10,078.46 (p = 0.000) | 7889.74 (p = 0.000) | 4306.01 (p = 0.000) | 29,348.68 (p = 0.000) | 6003.32 (p = 0.000) | 18,775.58 (p = 0.000) |

| Items | Eastern Region | Central Region | Western Region | |||

|---|---|---|---|---|---|---|

| Dependent Variable: e-eff (1) | Dependent Variable: d-fintech (2) | Dependent Variable: e-eff (3) | Dependent Variable: d-fintech (4) | Dependent Variable: e-eff (5) | Dependent Variable: d-fintech (6) | |

| W×d-fintech | −3.384 (−1.48) | 3.360 (0.81) | −23.996 *** (−7.74) | 14.637 ** (2.33) | −6.770 *** (−3.06) | 7.527 ** (2.28) |

| W×e-eff | 11.573 * (1.87) | −12.526 (−1.09) | 64.775 *** (8.98) | −37.579 ** (−2.39) | 18.941 *** (3.44) | −20.599 ** (−2.44) |

| d-fintech | 0.609 *** (18.63) | - | 0.708 *** (18.54) | - | 0.723 *** (12.40) | - |

| e-eff | - | 1.581 *** (17.71) | - | 1.102 *** (13.23) | - | 1.290 *** (11.61) |

| pgdp | −0.119 *** (−2.93) | 0.214 *** (3.56) | −0.068 * (−1.80) | 0.147 ** (2.56) | −0.062 (−0.92) | 0.099 (1.12) |

| urb | −0.122 ** (−2.04) | 0.191 * (1.96) | −0.102 * (−1.77) | 0.075 (0.91) | 0.056 (0.41) | −0.116 (−0.65) |

| ind | −0.904 *** (−3.05) | 1.428 *** (2.95) | −0.069 (−0.46) | 0.450 * (1.84) | 0.299 (0.68) | −0.368 (−0.63) |

| ope | −0.185 (−1.00) | 0.300 (1.00) | 0.297 *** (4.64) | −0.321 *** (−3.34) | −0.262 (−0.55) | 0.378 (0.60) |

| mar | −0.405 *** (−4.46) | 0.674 *** (5.03) | −0.557 *** (−3.02) | 0.714 *** (3.01) | −3.975 *** (−8.67) | 5.430 *** (9.60) |

| den | −0.169 *** (−7.75) | 0.277 *** (8.21) | −0.159 *** (−9.45) | 0.206 *** (10.98) | −0.126 *** (−5.17) | 0.176 *** (6.39) |

| tra | −0.001 (−0.04) | −0.003 (−0.10) | 0.028 * (1.79) | −0.033 (−1.38) | −0.020 (−0.75) | 0.026 (0.70) |

| pos | −0.003 (−0.17) | 0.013 (0.43) | −0.037 ** (−2.34) | 0.053 ** (2.36) | 0.043 (0.97) | −0.042 (−0.69) |

| N | 1232 | 1232 | 1221 | 1221 | 671 | 671 |

| R2 | 0.9296 | 0.9768 | 0.9704 | 0.9809 | 0.9179 | 0.9780 |

| F | 1742.55 (p = 0.000) | 5441.93 (p = 0.000) | 4446.35 (p = 0.000) | 6269.19 (p = 0.000) | 835.27 (p = 0.000) | 3306.43 (p = 0.000) |

| Items | Geographical Distance | Economic–Geographical Distance | ||

|---|---|---|---|---|

| Dependent Variable: e-eff (1) | Dependent Variable: d-fintech (2) | Dependent Variable: e-eff (3) | Dependent Variable: d-fintech (4) | |

| W×d-fintech | −0.376 *** (−6.53) | 0.980 *** (14.81) | −0.118 ** (−2.20) | 0.141 (1.57) |

| W×e-eff | 1.030 *** (14.65) | −1.753 *** (−4.88) | 0.260 ** (2.17) | 0.132 (0.57) |

| d-fintech | 0.370 *** (7.37) | - | 0.480 *** (8.86) | - |

| e-eff | - | 1.641 *** (4.80) | - | 1.532 *** (8.82) |

| pgdp | 0.019 (0.86) | 0.021 (0.48) | 0.016 (0.64) | 0.023 (0.49) |

| urb | −0.011 (−0.28) | 0.011 (0.17) | 0.012 (0.29) | −0.058 (−0.86) |

| ind | −0.192 (−1.29) | 0.782 *** (3.10) | −0.370 ** (−2.42) | 0.847 *** (3.30) |

| ope | 0.201 *** (3.96) | −0.328 *** (−2.90) | 0.168 *** (3.30) | −0.271 *** (−2.75) |

| mar | −0.101 (−1.16) | 0.349 ** (2.37) | −0.150 * (−1.65) | 0.397 *** (2.58) |

| den | −0.055 *** (−6.19) | 0.126 *** (8.46) | −0.076 *** (−7.03) | 0.147 *** (9.17) |

| tra | −0.006 (−0.48) | 0.022 (1.11) | −0.010 (−0.82) | 0.018 (0.85) |

| pos | −0.048 *** (−3.52) | 0.103 *** (4.17) | −0.065 *** (−4.44) | 0.125 *** (5.00) |

| N | 1420 | 1420 | 1420 | 1420 |

| R2 | 0.9865 | 0.9940 | 0.9587 | 0.9757 |

| F | 11,161.40 (p = 0.000) | 31,383.46 (p = 0.000) | 3931.48 (p = 0.000) | 7109.45 (p = 0.000) |

| Items | Geographical Distance | Economic–Geographical Distance | ||

|---|---|---|---|---|

| Dependent Variable: e-eff (1) | Dependent Variable: d-fintech (2) | Dependent Variable: e-eff (3) | Dependent Variable: d-fintech (4) | |

| W×d-fintech | −0.657 *** (−5.78) | 0.987 *** (5.94) | −0.108 ** (−2.52) | 0.032 (0.56) |

| W×e-eff | 1.251 *** (9.20) | −1.361 *** (−4.70) | 0.607 *** (8.50) | −0.039 (−0.26) |

| d-fintech | 0.536 *** (8.55) | - | 0.522 *** (8.35) | - |

| e-eff | - | 1.125 *** (7.52) | - | 0.884 *** (6.16) |

| pgdp | 0.099 *** (2.57) | 0.009 (0.15) | 0.070 * (1.85) | 0.105 * (1.78) |

| urb | −0.520 *** (−7.88) | 0.719 *** (7.44) | −0.431 *** (−7.38) | 0.505 *** (5.61) |

| ind | −0.517 ** (−2.21) | 0.982 *** (3.38) | −0.541 *** (−2.60) | 1.112 *** (3.87) |

| ope | 0.484 (1.31) | −0.401 (−0.81) | 0.767 ** (2.19) | −0.629 (−1.28) |

| mar | −0.601 *** (−5.16) | 1.009 *** (7.52) | −0.663 *** (−5.85) | 1.202 *** (9.24) |

| den | −0.124 *** (−6.60) | 0.218 *** (11.34) | −0.153 *** (−7.75) | 0.257 *** (14.01) |

| tra | 0.041 ** (2.55) | −0.052 ** (−2.42) | 0.043 *** (2.81) | −0.059 *** (−2.82) |

| pos | −0.042 ** (−2.26) | 0.101 *** (4.59) | −0.039 ** (−2.11) | 0.109 *** (4.80) |

| N | 1704 | 1704 | 1704 | 1704 |

| R2 | 0.9424 | 0.9694 | 0.9625 | 0.9814 |

| F | 3052.99 (p = 0.000) | 6857.65 (p = 0.000) | 4760.23 (p = 0.000) | 9732.83 (p = 0.000) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Su, Y.; Li, Z.; Yang, C. Spatial Interaction Spillover Effects between Digital Financial Technology and Urban Ecological Efficiency in China: An Empirical Study Based on Spatial Simultaneous Equations. Int. J. Environ. Res. Public Health 2021, 18, 8535. https://doi.org/10.3390/ijerph18168535

Su Y, Li Z, Yang C. Spatial Interaction Spillover Effects between Digital Financial Technology and Urban Ecological Efficiency in China: An Empirical Study Based on Spatial Simultaneous Equations. International Journal of Environmental Research and Public Health. 2021; 18(16):8535. https://doi.org/10.3390/ijerph18168535

Chicago/Turabian StyleSu, Yaya, Zhenghui Li, and Cunyi Yang. 2021. "Spatial Interaction Spillover Effects between Digital Financial Technology and Urban Ecological Efficiency in China: An Empirical Study Based on Spatial Simultaneous Equations" International Journal of Environmental Research and Public Health 18, no. 16: 8535. https://doi.org/10.3390/ijerph18168535

APA StyleSu, Y., Li, Z., & Yang, C. (2021). Spatial Interaction Spillover Effects between Digital Financial Technology and Urban Ecological Efficiency in China: An Empirical Study Based on Spatial Simultaneous Equations. International Journal of Environmental Research and Public Health, 18(16), 8535. https://doi.org/10.3390/ijerph18168535