How Can Agricultural Corporate Build Sustainable Competitive Advantage through Green Intellectual Capital? A New Environmental Management Approach to Green Agriculture

Abstract

:1. Introduction

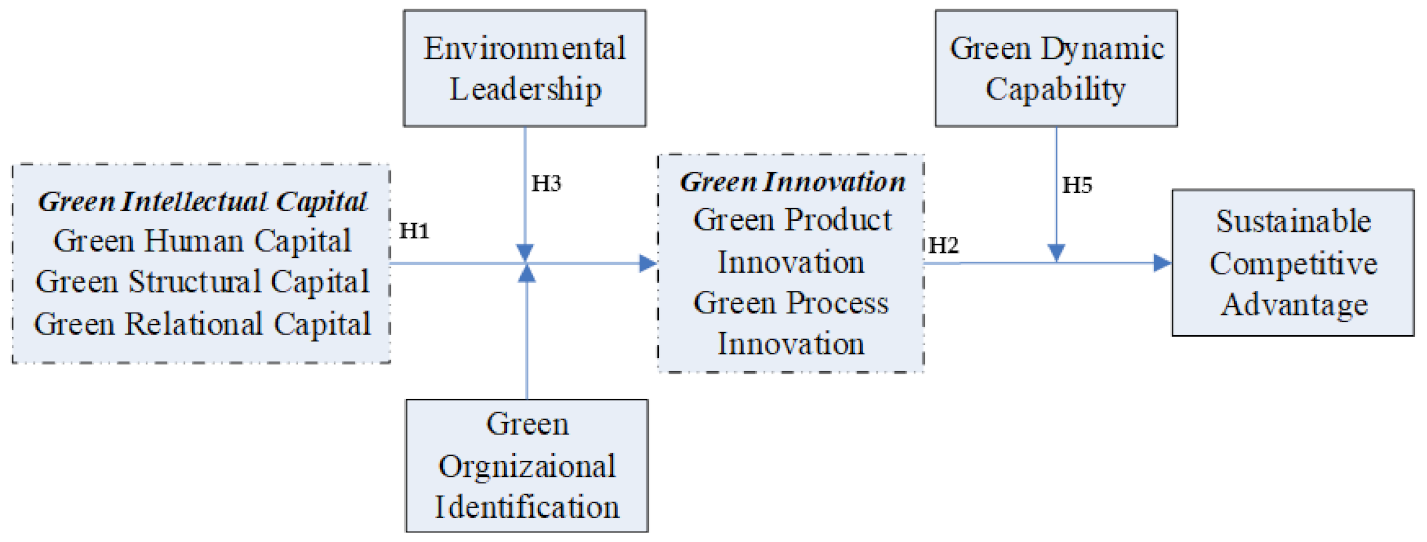

2. Literature Review and Theoretical Framework

2.1. Green Intellectual Capital and Agricultural Corporate Sustainable Competitive Advantage

2.2. The Mediation Effect of Green Innovation

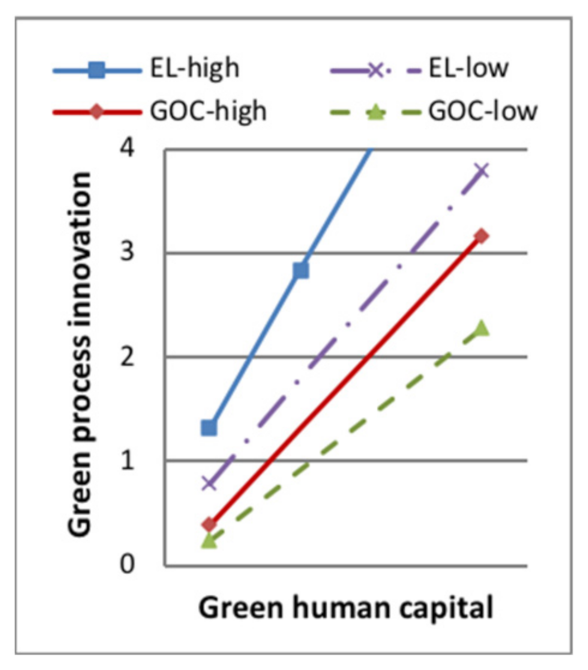

2.3. The Moderation Effect of Environmental Leadership

2.4. The Moderation Effect of Green Organizational Identification

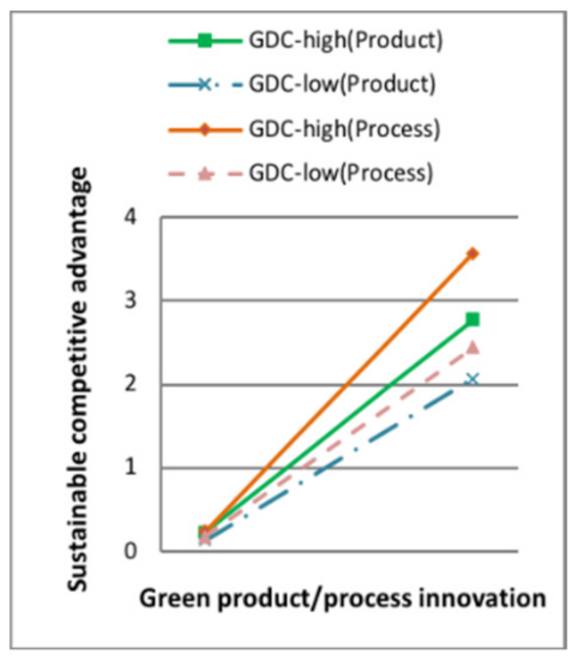

2.5. The Moderation Effect of Green Dynamic Ability

2.6. An Integrated Moderated-Mediation Effect Model

3. Materials and Methods

3.1. Data Collection and Sample

3.2. Variables and Measure

4. Empirical Results

4.1. Measurement Validation

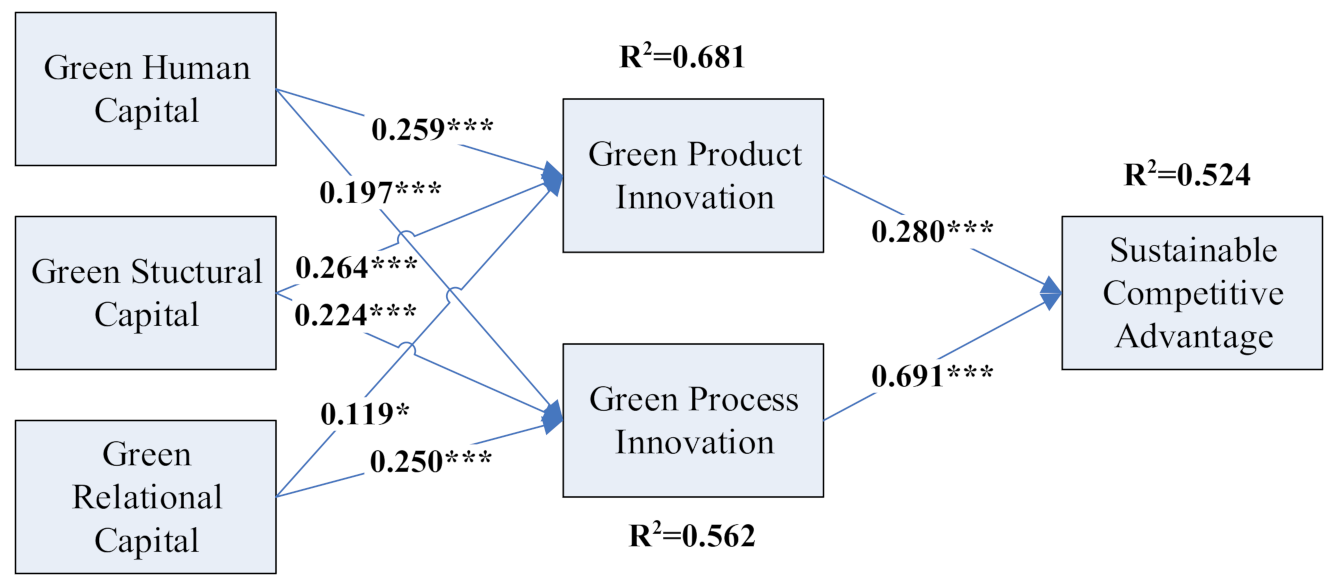

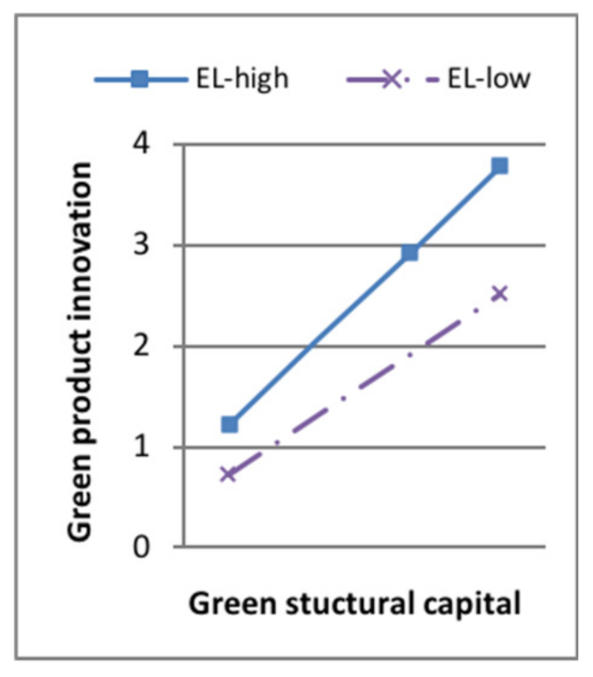

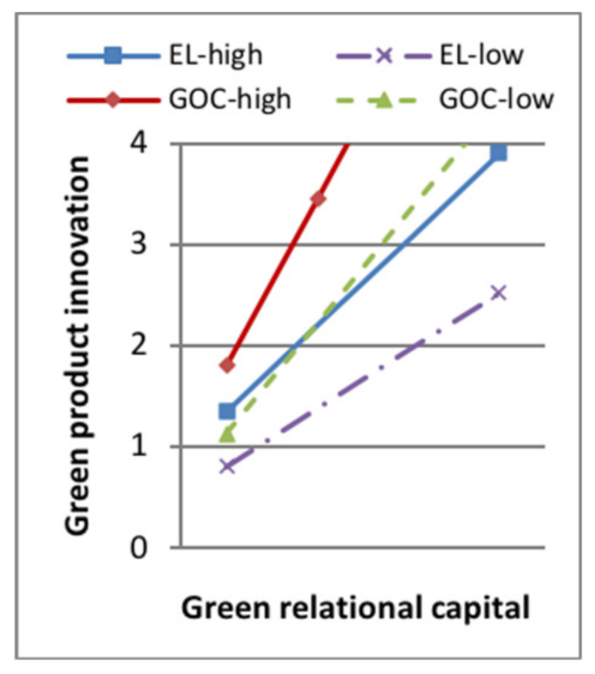

4.2. Hypothesis Testing

5. Discussion

5.1. The Mediation Effect for Managerial Implications

5.2. The Moderation Effect for Managerial Implications

6. Conclusions and Limitations

6.1. Conclusions

6.2. Limitations and Further Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Porter, M.E.; Claas, V.d.L. Green and competitive: Ending the stalemate. Harv. Bus. Rev. 1995, 33, 120. [Google Scholar]

- Vandevyvere, H.; Stremke, S. Urban Planning for a Renewable Energy Future: Methodological Challenges and Opportunities from a Design Perspective. Sustainability 2012, 4, 1309–1328. [Google Scholar] [CrossRef] [Green Version]

- Lebelo, K.; Malebo, N.; Mochane, M.; Masinde, M. Chemical Contamination Pathways and the Food Safety Implications along the Various Stages of Food Production: A Review. Int. J. Environ. Res. Public Health 2021, 18, 5795. [Google Scholar] [CrossRef]

- Struik, P.C.; Kuyper, T.W. Sustainable intensification in agriculture: The richer shade of green. A review. Agron. Sustain. Dev. 2017, 37, 39. [Google Scholar] [CrossRef]

- Sharma, S.; Vredenburg, H. Proactive corporate environmental strategy and the development of competitively valuable or-ganizational capabilities. Strateg. Manag. J. 1998, 19, 729–753. [Google Scholar] [CrossRef]

- Shrivastava, P. Environmental technologies and competitive advantage. Strat. Manag. J. 1995, 16, 183–200. [Google Scholar] [CrossRef]

- Cagno, E.; Trucco, P.; Tardini, L. Cleaner production and profitability: Analysis of 134 industrial pollution prevention (P2) project reports. J. Clean. Prod. 2005, 13, 593–605. [Google Scholar] [CrossRef]

- Hart, S.L. A Natural-Resource-Based View of the Firm. Acad. Manag. Rev. 1995, 20, 986–1014. [Google Scholar] [CrossRef] [Green Version]

- Chen, Y.-S. The Positive Effect of Green Intellectual Capital on Competitive Advantages of Firms. J. Bus. Ethics 2007, 77, 271–286. [Google Scholar] [CrossRef]

- Mengüç, B.; Ozanne, L.K. Challenges of the “green imperative”: A natural resource-based approach to the environmental orientation–business performance relationship. J. Bus. Res. 2005, 58, 430–438. [Google Scholar] [CrossRef]

- Berry, M.A.; Rondinelli, D.A. Proactive corporate environmental management: A new industrial revolution. Acad. Manag. Perspect. 1998, 12, 38–50. [Google Scholar] [CrossRef] [Green Version]

- Chen, Y.-S.; Lai, S.-B.; Wen, C.-T. The Influence of Green Innovation Performance on Corporate Advantage in Taiwan. J. Bus. Ethics 2006, 67, 331–339. [Google Scholar] [CrossRef]

- Reyes-Rodriguez, J.F.; Ulhøi, J.P.; Madsen, H. Corporate Environmental Sustainability in Danish SMEs: A Longitudinal Study of Motivators, Initiatives, and Strategic Effects. Corp. Soc. Responsib. Environ. Manag. 2014, 23, 193–212. [Google Scholar] [CrossRef]

- Russo, M.V.; Fouts, P.A. A Resource-Based Perspective On Corporate Environmental Performance And Profitability. Acad. Manag. J. 1997, 40, 534–559. [Google Scholar] [CrossRef] [Green Version]

- Harrison, S.; Sr, P.H.S. Profiting from intellectual capital. J. Intellect. Cap. 2000, 1, 33–46. [Google Scholar] [CrossRef]

- Stewart, T. Your Company’s Most Valuable Asset: Intellectual Capital. Fortune 1994, 130, 68–73. [Google Scholar]

- Chang, C.; Chen, Y. The determinants of green intellectual capital. Manag. Decis. 2012, 50, 74–94. [Google Scholar] [CrossRef]

- Chiou, T.-Y.; Chan, H.K.; Lettice, F.; Chung, S.H. The influence of greening the suppliers and green innovation on environmental performance and competitive advantage in Taiwan. Transp. Res. Part E Logist. Transp. Rev. 2011, 47, 822–836. [Google Scholar] [CrossRef]

- Guoyou, Q.; Saixing, Z.; Chiming, T.; Haitao, Y.; Hailiang, Z. Stakeholders’ Influences on Corporate Green Innovation Strategy: A Case Study of Manufacturing Firms in China. Corp. Soc. Responsib. Environ. Manag. 2011, 20, 1–14. [Google Scholar] [CrossRef]

- Rennings, K. Redefining innovation—eco-innovation research and the contribution from ecological economics. Ecol. Econ. 2000, 32, 319–332. [Google Scholar] [CrossRef]

- Subramaniam, M.; Youndt, M.A. The Influence of Intellectual Capital on the Types of Innovative Capabilities. Acad. Manag. J. 2005, 48, 450–463. [Google Scholar] [CrossRef] [Green Version]

- Purică, O.C.; Ispășoiu, C.E. Analyzing The Influence of Environmental Leadership on Pollution Abatement Costs. Young Econ. J. Rev. Tinerilor Econ. 2013, 10, 117–126. [Google Scholar]

- Chen, Y.-S.; Chang, C.-H. The Determinants of Green Product Development Performance: Green Dynamic Capabilities, Green Transformational Leadership, and Green Creativity. J. Bus. Ethics 2012, 116, 107–119. [Google Scholar] [CrossRef]

- Wehrmeyer, W.; Parker, K.T. Identification, analysis and relevance of environmental corporate cultures. Bus. Strategy Environ. 1995, 4, 145–153. [Google Scholar] [CrossRef]

- Babiak, K.; Trendafilova, S. CSR and environmental responsibility: Motives and pressures to adopt green management practices. Corp. Soc. Responsib. Environ. Manag. 2011, 18, 11–24. [Google Scholar] [CrossRef]

- Ahmad, A. Business Intelligence for Sustainable Competitive Advantage. In Sustaining Competitive Advantage via Business Intelligence, Knowledge Management, and System Dynamics; Emerald Group Publishing Limited: Bingley, UK, 2015; Volume 22A, pp. 3–220. [Google Scholar]

- Jones, T.M.; Harrison, J.S.; Felps, W. How Applying Instrumental Stakeholder Theory Can Provide Sustainable Competitive Advantage. Acad. Manag. Rev. 2018, 43, 371–391. [Google Scholar] [CrossRef] [Green Version]

- Griffiths, G.H.; Finlay, P.N. IS-enabled sustainable competitive advantage in financial services, retailing and manufacturing. J. Strat. Inf. Syst. 2004, 13, 29–59. [Google Scholar] [CrossRef]

- Barney, J. Firm Resources and Sustained Competitive Advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Almada, L.; Borges, R. Sustainable Competitive Advantage Needs Green Human Resource Practices: A Framework for Environmental Management. Rev. Adm. Contemp. 2018, 22, 424–442. [Google Scholar] [CrossRef] [Green Version]

- Obeidat, S.M.; Al Bakri, A.A.; Elbanna, S. Leveraging “Green” Human Resource Practices to Enable Environmental and Organizational Performance: Evidence from the Qatari Oil and Gas Industry. J. Bus. Ethics 2018, 164, 371–388. [Google Scholar] [CrossRef]

- Lado, A.A.; Wilson, M.C. Human Resource Systems and Sustained Competitive Advantage: A Competency-Based Perspective. Acad. Manag. Rev. 1994, 19, 699–727. [Google Scholar] [CrossRef]

- Linnenluecke, M.K.; Griffiths, A. Corporate sustainability and organizational culture. J. World Bus. 2010, 45, 357–366. [Google Scholar] [CrossRef]

- Vilanova, M.; Lozano, J.M.; Arenas, D. Exploring the Nature of the Relationship between CSR and Competitiveness. J. Bus. Ethics 2008, 87, 57–69. [Google Scholar] [CrossRef]

- Berrone, P.; Fosfuri, A.; Gelabert, L.; Gomez-Mejia, L.R. Necessity as the mother of ‘green’ inventions: Institutional pressures and environmental innovations. Strateg. Manag. J. 2013, 34, 891–909. [Google Scholar] [CrossRef]

- Carrillo-Hermosilla, J.; del Río, P.; Könnölä, T. Diversity of eco-innovations: Reflections from selected case studies. J. Clean. Prod. 2010, 18, 1073–1083. [Google Scholar] [CrossRef]

- De Marchi, V. Environmental innovation and R&D cooperation: Empirical evidence from Spanish manufacturing firms. Res. Policy 2012, 41, 614–623. [Google Scholar] [CrossRef]

- Leenders, M.A.; Chandra, Y. Antecedents and consequences of green innovation in the wine industry: The role of channel structure. Technol. Anal. Strateg. Manag. 2013, 25, 203–218. [Google Scholar] [CrossRef]

- Rexhäuser, S.; Rammer, C. Environmental Innovations and Firm Profitability: Unmasking the Porter Hypothesis. Environ. Resour. Econ. 2013, 57, 145–167. [Google Scholar] [CrossRef]

- Papagiannakis, G.; Voudouris, I.; Lioukas, S. The Road to Sustainability: Exploring the Process of Corporate Environmental Strategy Over Time. Bus. Strategy Environ. 2013, 23, 254–271. [Google Scholar] [CrossRef]

- Lin, C.-Y.; Ho, Y.-H. An Empirical Study on Logistics Service Providers’ Intention to Adopt Green Innovations. J. Technol. Manag. Innov. 2008, 3, 17–26. [Google Scholar]

- Talke, K.; Salomo, S.; Mensel, N. A Competence-Based Model of Initiatives for Innovations. Creat. Innov. Manag. 2006, 15, 373–384. [Google Scholar] [CrossRef]

- Shu, C.; Zhao, M.; Liu, J.; Lindsay, W. Why firms go green and how green impacts financial and innovation performance differently: An awareness-motivation-capability perspective. Asia Pac. J. Manag. 2019, 37, 795–821. [Google Scholar] [CrossRef]

- Liao, Z.; Zhang, M. The influence of responsible leadership on environmental innovation and environmental performance: The moderating role of managerial discretion. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 2016–2027. [Google Scholar] [CrossRef]

- Yao, Q.; Zeng, S.; Sheng, S.; Gong, S. Green innovation and brand equity: Moderating effects of industrial institutions. Asia Pac. J. Manag. 2019, 38, 573–602. [Google Scholar] [CrossRef]

- Lao, K. Research on mechanism of consumer innovativeness influencing green consumption behavior. Nankai Bus. Rev. Int. 2014, 5, 211–224. [Google Scholar] [CrossRef]

- Chang, C.-H. The Influence of Corporate Environmental Ethics on Competitive Advantage: The Mediation Role of Green Innovation. J. Bus. Ethics 2011, 104, 361–370. [Google Scholar] [CrossRef]

- Chan, R.Y.K.; Ma, K.H.Y. Environmental Orientation of Exporting SMEs from an Emerging Economy: Its Antecedents and Consequences. Manag. Int. Rev. 2016, 56, 597–632. [Google Scholar] [CrossRef]

- Huang, Y.-C.; Wong, Y.-J.; Yang, M.-L. Proactive environmental management and performance by a controlling family. Manag. Res. Rev. 2014, 37, 210–240. [Google Scholar] [CrossRef]

- Wee, Y.S.; Quazi, H.A. Development and validation of critical factors of environmental management. Ind. Manag. Data Syst. 2005, 105, 96–114. [Google Scholar] [CrossRef]

- DeChant, K.; Altman, B. Environmental leadership: From compliance to competitive advantage. Acad. Manag. Perspect. 1994, 8, 7–20. [Google Scholar] [CrossRef]

- Egri, C.P.; Herman, S. Leadership In The North American Environmental Sector: Values, Leadership Styles, And Contexts Of Environmental Leaders And Their Organizations. Acad. Manag. J. 2000, 43, 571–604. [Google Scholar] [CrossRef]

- Boiral, O.; Cayer, M.; Baron, C.M. The Action Logics of Environmental Leadership: A Developmental Perspective. J. Bus. Ethics 2009, 85, 479–499. [Google Scholar] [CrossRef]

- Kim, M.; Stepchenkova, S. Does environmental leadership affect market and eco performance? Evidence from Korean franchise firms. J. Bus. Ind. Mark. 2018, 33, 417–428. [Google Scholar] [CrossRef]

- Chen, Y. Green organizational identity: Sources and consequence. Manag. Decis. 2011, 49, 384–404. [Google Scholar] [CrossRef] [Green Version]

- Ramus, C.A.; Steger, U. The Roles of Supervisory Support Behaviors and Environmental Policy in Employee “Ecoinitiatives” at Leading-Edge European Companies. Acad. Manag. J. 2000, 43, 605–626. [Google Scholar] [CrossRef]

- Kodama, M. New knowledge creation through leadership-based strategic community—a case of new product development in IT and multimedia business fields. Technovation 2005, 25, 895–908. [Google Scholar] [CrossRef]

- Bonner, J.M.; Walker, O.C. Selecting Influential Business-to-Business Customers in New Product Development: Relational Embeddedness and Knowledge Heterogeneity Considerations. J. Prod. Innov. Manag. 2004, 21, 155–169. [Google Scholar] [CrossRef]

- Corley, K.G.; Harquail, C.V.; Pratt, M.G.; Glynn, M.A.; Fiol, C.M.; Hatch, M.J. Guiding Organizational Identity Through Aged Adolescence. J. Manag. Inq. 2006, 15, 85–99. [Google Scholar] [CrossRef]

- Albert, S.; Whetten, D. Organizational Identity. Res. Organ. Behav. 1985, 7, 89–118. [Google Scholar]

- Fernández, E.; Junquera, B.; Ordiz, M. Organizational culture and human resources in the environmental issue: A review of the literature. Int. J. Hum. Resour. Manag. 2003, 14, 634–656. [Google Scholar] [CrossRef]

- Song, W.; Yu, H. Green Innovation Strategy and Green Innovation: The Roles of Green Creativity and Green Organizational Identity. Corp. Soc. Responsib. Environ. Manag. 2017, 25, 135–150. [Google Scholar] [CrossRef]

- Chang, C.; Chen, Y. Green organizational identity and green innovation. Manag. Decis. 2013, 51, 1056–1070. [Google Scholar] [CrossRef]

- Soewarno, N.; Tjahjadi, B.; Fithrianti, F. Green innovation strategy and green innovation. Manag. Decis. 2019, 57, 3061–3078. [Google Scholar] [CrossRef]

- Sharma, S. Managerial Interpretations and Organizational Context as Predictors of Corporate Choice of Environmental Strategy. Acad. Manag. J. 2000, 43, 681–697. [Google Scholar] [CrossRef]

- McWilliams, A.; Siegel, D.S. Creating and Capturing Value: Strategic Corporate Social Responsibility, Resource-Based Theory, and Sustainable Competitive Advantage. J. Manag. 2010, 37, 1480–1495. [Google Scholar] [CrossRef]

- Helfat, C.E.; Peteraf, M.A. Understanding dynamic capabilities: Progress along a developmental path. Strateg. Organ. 2009, 7, 91–102. [Google Scholar] [CrossRef] [Green Version]

- Teece, D.J. Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef] [Green Version]

- Makkonen, H.; Pohjola, M.; Olkkonen, R.; Koponen, A. Dynamic capabilities and firm performance in a financial crisis. J. Bus. Res. 2014, 67, 2707–2719. [Google Scholar] [CrossRef]

- Wilden, R.; Gudergan, S.; Nielsen, B.B.; Lings, I. Dynamic Capabilities and Performance: Strategy, Structure and Environment. Long Range Plan. 2013, 46, 72–96. [Google Scholar] [CrossRef] [Green Version]

- Joshi, G.; Dhar, R.L. Green training in enhancing green creativity via green dynamic capabilities in the Indian handicraft sector: The moderating effect of resource commitment. J. Clean. Prod. 2020, 267, 121948. [Google Scholar] [CrossRef]

- Chen, Y.-S.; Lin, Y.-H.; Lin, C.-Y.; Chang, C.-W. Enhancing Green Absorptive Capacity, Green Dynamic Capacities and Green Service Innovation to Improve Firm Performance: An Analysis of Structural Equation Modeling (SEM). Sustainability 2015, 7, 15674–15692. [Google Scholar] [CrossRef] [Green Version]

- Eisenhardt, K.M.; Martin, J.A. Dynamic Capabilities: What Are They? SMS Blackwell Handb. Organ. Capab. 2017. [Google Scholar] [CrossRef]

- Wang, C.L.; Ahmed, P.K. Dynamic capabilities: A review and research agenda. Int. J. Manag. Rev. 2007, 9, 31–51. [Google Scholar] [CrossRef]

- Cohen, W.M.; Levinthal, D. Absorptive Capacity: A New Perspective on Learning and Innovation. Adm. Sci. Q. 1990, 35, 128. [Google Scholar] [CrossRef]

- Zahra, S.A.; George, G. Absorptive Capacity: A Review, Reconceptualization, and Extension. Acad. Manag. Rev. 2002, 27, 185–203. [Google Scholar] [CrossRef] [Green Version]

- Nonaka, I. A Dynamic Theory of Organizational Knowledge Creation. Organ. Sci. 1994, 5, 14–37. [Google Scholar] [CrossRef]

- Lin, Y.-H.; Chen, Y.-S. Determinants of green competitive advantage: The roles of green knowledge sharing, green dynamic capabilities, and green service innovation. Qual. Quant. 2016, 51, 1663–1685. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Edwards, J.R.; Lambert, L.S. Methods for integrating moderation and mediation: A general analytical framework using moderated path analysis. Psychol. Methods 2007, 12, 1–22. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Pers. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef] [PubMed]

- Wong, S.K. The influence of green product competitiveness on the success of green product innovation. Eur. J. Innov. Manag. 2012, 15, 468–490. [Google Scholar] [CrossRef]

- Ceballos, J.D.; Aragón-Correa, J.A.; Ortiz-De-Mandojana, N.; Rueda-Manzanares, A. The Effect of Internal Barriers on the Connection between Stakeholder Integration and Proactive Environmental Strategies. J. Bus. Ethics 2011, 107, 281–293. [Google Scholar] [CrossRef]

- Nunnally, J.C. Psychometric Theory; Mc Graw-Hill: New York, NY, USA, 1978. [Google Scholar]

- Kline, R.B. Principles and Practice of Structural Equation Modeling, 3rd ed.; Guilford Press: New York, NY, USA, 2011. [Google Scholar]

- Fornell, C.; Larcker, D.F. Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Lehman, A.; O’Rourke, N.; Hatcher, L.; Stepanski, E. JMP for Basic Univariate and Multivariate Statistics: Methods for Researchers and Social Scientists; SAS Press: Cary, NC, USA, 2013. [Google Scholar]

- Podsakoff, P.M.; MacKenzie, S.B.; Lee, J.Y.; Podsakoff, N.P. Common method biases in behavioral research: A critical review of the literature and recommended remedies. J. Appl. Psychol. 2003, 88, 879–903. [Google Scholar] [CrossRef] [PubMed]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E.; Tatham, R.L. Multivariate Data Analysis; Technometrics: Milwaukee, WI, USA, 1998; Volume 15. [Google Scholar]

- Bolin, J.H.; Hayes, A.F. Introduction to Mediation, Moderation, and Conditional Process Analysis: A Regression-Based Approach. J. Educ. Meas. 2013, 51, 335–337. [Google Scholar] [CrossRef]

- Miller, R.; Wurzburg, G. Investing in human capital. OECD Obs. 1995, 193, 16–19. [Google Scholar]

- Gordon, J.C.; Berry, J.K. Environmental Leadership Equals Essential Leadership: Redefining Who Leads and How; Yale University Press: New Haven, CT, USA, 2006. [Google Scholar]

- Borck, J.C.; Coglianese, C.; Nash, J. Environmental Leadership Programs: Toward an Empirical Assessment of Their Perfor-mance. Ecol. Law Q. 2008, 35, 771–834. [Google Scholar]

- Lasrado, F.; Zakaria, N. Go green! Exploring the organizational factors that influence self-initiated green behavior in the United Arab Emirates. Asia Pac. J. Manag. 2019, 37, 823–850. [Google Scholar] [CrossRef]

- Yusliza, M.-Y.; Norazmi, N.A.; Jabbour, C.J.C.; Fernando, Y.; Fawehinmi, O.; Seles, B.M.R.P. Top management commitment, corporate social responsibility and green human resource management. Benchmark. Int. J. 2019, 26, 2051–2078. [Google Scholar] [CrossRef]

| Characteristics | n | Percentage | |

|---|---|---|---|

| Enterprise type | State-owned | 85 | 24.93% |

| Non state-owned | 256 | 75.07% | |

| Enterprise scale (The number of employees) | Lower than 100 | 40 | 11.73% |

| 101–500 | 101 | 29.62% | |

| 501–1000 | 139 | 40.76% | |

| 1001 or higher | 61 | 17.89% | |

| Region | Northeast China region | 142 | 41.64% |

| Yangtze river delta region | 133 | 39.00% | |

| Pearl river delta region | 66 | 19.36% | |

| Industry | Food processing | 52 | 15.25% |

| Food manufacturing | 54 | 15.84% | |

| Beverage manufacturing | 42 | 12.32% | |

| Tobacco processing | 24 | 7.04% | |

| Textile manufacturing | 47 | 13.78% | |

| Wood processing | 31 | 9.09% | |

| Furniture manufacturing | 49 | 14.37% | |

| Rubber products | 25 | 7.33% | |

| Paper making and paper products | 17 | 4.99% |

| Variable | KMO | MFL | AVE | CR | Cronbach’s α |

|---|---|---|---|---|---|

| Ghc | 0.803 | 0.717 | 0.642 | 0.9 | 0.862 |

| Gsc | 0.909 | 0.678 | 0.595 | 0.921 | 0.901 |

| Grc | 0.784 | 0.720 | 0.582 | 0.874 | 0.818 |

| Gpi1 | 0.824 | 0.820 | 0.692 | 0.9 | 0.852 |

| Gpi2 | 0.831 | 0.830 | 0.729 | 0.915 | 0.875 |

| Sca | 0.823 | 0.623 | 0.508 | 0.907 | 0.884 |

| Goi | 0.904 | 0.787 | 0.654 | 0.919 | 0.897 |

| El | 0.862 | 0.725 | 0.568 | 0.902 | 0.873 |

| Gdc | 0.934 | 0.734 | 0.616 | 0.928 | 0.907 |

| Mean | S.D. | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 Type | 0.300 | 0.459 | |||||||||||

| 2 Scale | 1.060 | 0.988 | 0.251 ** | ||||||||||

| 3 Ghc | 4.049 | 1.094 | 0.308 ** | 0.129 ** | 0.801 | ||||||||

| 4 Gsc | 3.739 | 1.025 | 0.224 ** | 0.082 | 0.210 ** | 0.771 | |||||||

| 5 Grc | 3.890 | 0.986 | 0.303 ** | 0.186 * | 0.252 ** | 0.176 ** | 0.763 | ||||||

| 6 Gpi1 | 3.994 | 1.095 | 0.279 ** | 0.097 * | 0.246 ** | 0.198 ** | 0.184 ** | 0.832 | |||||

| 7 Gpi2 | 3.990 | 1.083 | 0.293 ** | 0.112 ** | 0.235 ** | 0.167 ** | 0.201 ** | 0.461 ** | 0.854 | ||||

| 8 Sca | 4.004 | 0.849 | 0.557 ** | 0.357 ** | 0.383 ** | 0.285 ** | 0.375 ** | 0.338 ** | 0.334 ** | 0.712 | |||

| 9 Goi | 4.384 | 1.014 | 0.292 ** | 0.137 ** | 0.172 ** | 0.206 ** | 0.242 ** | 0.220 ** | 0.169 ** | 0.295 ** | 0.809 | ||

| 10 El | 4.204 | 1.061 | 0.172 ** | 0.013 | 0.067 | 0.066 | 0.058 | 0.174 ** | 0.140 ** | 0.095 * | 0.192 ** | 0.754 | |

| 11 Gdc | 4.109 | 1.028 | 0.164 ** | −0.011 | 0.096* | 0.136 ** | 0.056 | 0.159 ** | 0.180 ** | 0.097 * | 0.176 ** | 0.283 ** | 0.785 |

| Ave | 0.642 | 0.595 | 0.582 | 0.692 | 0.729 | 0.448 | 0.654 | 0.568 | 0.616 | ||||

| Cr | 0.900 | 0.921 | 0.874 | 0.900 | 0.915 | 0.907 | 0.919 | 0.902 | 0.928 |

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | Model 9 | |

|---|---|---|---|---|---|---|---|---|---|

| Type | 0.513 *** | 0.559 *** | 0.522 *** | 0.464 *** | 0.471 *** | 0.495 *** | 0.501 *** | 0.456 *** | 0.472 *** |

| Scale | 0.174 *** | 0.179 *** | 0.153 *** | 0.178 *** | 0.175 *** | 0.183 *** | 0.180 *** | 0.159 *** | 0.156 *** |

| Ghc | 0.300 *** | 0.249 *** | 0.266 *** | ||||||

| Gsc | 0.218 *** | 0.174 *** | 0.193 *** | ||||||

| Grc | 0.290 *** | 0.259 *** | 0.262 *** | ||||||

| GPi1 | 0.195 *** | 0.223 *** | 0.224 *** | ||||||

| GPi2 | 0.148 *** | 0.179 *** | 0.164 *** | ||||||

| Adj-R2 | 0.545 | 0.511 | 0.539 | 0.576 | 0.562 | 0.552 | 0.537 | 0.582 | 0.561 |

| R2 Change | 0.031 | 0.017 | 0.041 | 0.026 | 0.043 | 0.022 | |||

| F Value | 136.921 *** | 119.357 *** | 133.769 *** | 116.347 *** | 110.165 *** | 105.721 *** | 99.505 *** | 119.362 *** | 109.637 *** |

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | |

|---|---|---|---|---|---|---|

| Type | 0.168 ** | 0.231 *** | 0.227 *** | 0.210 *** | 0.272 *** | 0.246 *** |

| Scale | −0.051 | −0.011 | −0.027 | −0.037 | 0.002 | −0.019 |

| Ghc | 0.268 *** | 0.233 *** | ||||

| Gsc | 0.214 *** | 0.165 ** | ||||

| Grc | 0.161 ** | 0.192 *** | ||||

| El | 0.290 *** | 0.231 *** | 0.257 *** | 0.250 *** | 0.200 *** | 0.220 *** |

| Ghc* El | 0.254 *** | 0.245 *** | ||||

| Gsc* El | 0.122 * | 0.145 ** | ||||

| Grc* El | 0.131 * | 0.134 * | ||||

| Adj-R2 | 0.254 | 0.191 | 0.173 | 0.240 | 0.183 | 0.185 |

| R2 Change | ||||||

| F Value | 24.208 *** | 17.043 *** | 15.259 *** | 22.444 *** | 16.225 *** | 16.467 *** |

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | |

|---|---|---|---|---|---|---|---|---|

| Type | 0.165 ** | 0.228 ** | 0.173 ** | 0.265 *** | 0.264 *** | 0.204 *** | 0.518 *** | 0.522 *** |

| Scale | −0.065 | −0.036 | −0.055 | −0.020 | −0.028 | −0.204 | 0.181 | 0.186 |

| Ghc | 0.330 *** | 0.265 *** | ||||||

| Gsc | 0.177 ** | 0.162 ** | ||||||

| Grc | 0.170 ** | 0.212 *** | ||||||

| Goi | 0.280 *** | 0.213 *** | 0.335 *** | 0.072 * | 0.200 *** | 0.262 *** | ||

| Ghc* Goi | 0.255 *** | 0.123 * | ||||||

| Gsc* Goi | 0.077 | 0.197 *** | ||||||

| Grc* Goi | 0.275 *** | 0.267 *** | ||||||

| Gpi1 | 0.263 *** | |||||||

| Gpi2 | 0.222 *** | |||||||

| Gdc | 0.045 | 0.057 * | ||||||

| Gpi1*Gdc | 0.114 * | |||||||

| Gpi2*Gdc | 0.173 *** | |||||||

| Adj-R2 | 0.249 | 0.174 | 0.209 | 0.177 | 0.187 | 0.211 | 0.534 | 0.528 |

| R2 Change | ||||||||

| F Value | 23.577 *** | 15.367 *** | 19.002 *** | 15.636 *** | 16.684 | 19.178 *** | 78.952 *** | 77.096 *** |

| Mediator | El | Goi | Gdc | Effect | BootSE | BootLLCI | BootULCI |

|---|---|---|---|---|---|---|---|

| Gpi1 | 3.143 | 3.370 | 3.081 | 0.008 | 0.021 | −0.075 | 0.012 |

| 3.143 | 3.370 | 5.136 | 0.011 | 0.016 | −0.052 | 0.011 | |

| 3.143 | 5.397 | 3.081 | 0.048 | 0.029 | 0.008 | 0.131 | |

| 3.143 | 5.397 | 5.136 | 0.067 | 0.020 | 0.008 | 0.090 | |

| 5.266 | 3.370 | 3.081 | 0.079 | 0.035 | 0.023 | 0.165 | |

| 5.266 | 3.370 | 5.136 | 0.059 | 0.026 | 0.019 | 0.121 | |

| 5.266 | 5.397 | 3.081 | 0.146 | 0.059 | 0.036 | 0.271 | |

| 5.266 | 5.397 | 5.136 | 0.110 | 0.039 | 0.040 | 0.194 | |

| Gpi2 | 3.143 | 3.370 | 3.081 | 0.002 | 0.008 | −0.019 | 0.016 |

| 3.143 | 3.370 | 5.136 | 0.004 | 0.019 | −0.046 | 0.030 | |

| 3.143 | 5.397 | 3.081 | 0.007 | 0.012 | −0.019 | 0.036 | |

| 3.143 | 5.397 | 5.136 | 0.154 | 0.025 | −0.032 | 0.068 | |

| 5.266 | 3.370 | 4.109 | 0.052 | 0.030 | 0.002 | 0.119 | |

| 5.266 | 3.370 | 5.136 | 0.099 | 0.036 | 0.040 | 0.184 | |

| 5.266 | 5.397 | 4.109 | 0.062 | 0.033 | 0.002 | 0.134 | |

| 5.266 | 5.397 | 5.136 | 0.119 | 0.038 | 0.055 | 0.207 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pan, C.; Jiang, Y.; Wang, M.; Xu, S.; Xu, M.; Dong, Y. How Can Agricultural Corporate Build Sustainable Competitive Advantage through Green Intellectual Capital? A New Environmental Management Approach to Green Agriculture. Int. J. Environ. Res. Public Health 2021, 18, 7900. https://doi.org/10.3390/ijerph18157900

Pan C, Jiang Y, Wang M, Xu S, Xu M, Dong Y. How Can Agricultural Corporate Build Sustainable Competitive Advantage through Green Intellectual Capital? A New Environmental Management Approach to Green Agriculture. International Journal of Environmental Research and Public Health. 2021; 18(15):7900. https://doi.org/10.3390/ijerph18157900

Chicago/Turabian StylePan, Chulin, Yufeng Jiang, Mingliang Wang, Shuang Xu, Ming Xu, and Yixin Dong. 2021. "How Can Agricultural Corporate Build Sustainable Competitive Advantage through Green Intellectual Capital? A New Environmental Management Approach to Green Agriculture" International Journal of Environmental Research and Public Health 18, no. 15: 7900. https://doi.org/10.3390/ijerph18157900

APA StylePan, C., Jiang, Y., Wang, M., Xu, S., Xu, M., & Dong, Y. (2021). How Can Agricultural Corporate Build Sustainable Competitive Advantage through Green Intellectual Capital? A New Environmental Management Approach to Green Agriculture. International Journal of Environmental Research and Public Health, 18(15), 7900. https://doi.org/10.3390/ijerph18157900