Green Investment Changes in China: A Shift-Share Analysis

Abstract

1. Introduction

2. Literature Review

2.1. Green Investment

2.2. Shift-Share Analysis

3. Methodology and Data

3.1. Shift-Share Analysis and Its Homothetic Model Extension

3.2. Data Sources of Green Investment in China

4. Results and Discussion

4.1. Change of Green Investment in China

4.2. National Economic Growth Effect (NEG)

4.3. Homothetic Regional Green Investment Competition Effect (HRIC)

4.4. Regional Green Investment Allocation Effect (RIA)

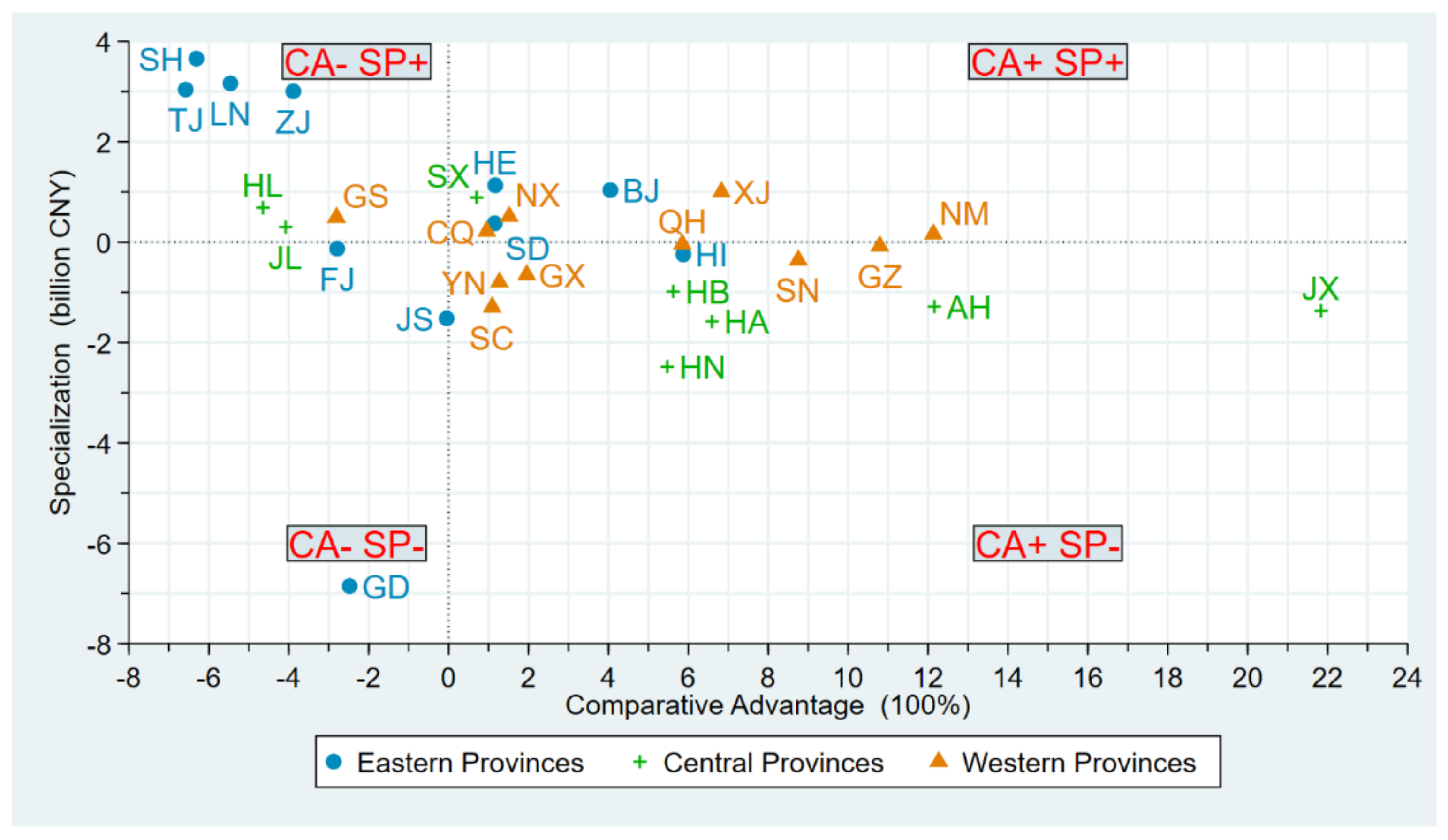

4.5. Specialization and Comparative Advantage

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Ouyang, J.; Zhang, K.; Wen, B.; Lu, Y. Top-Down and Bottom-Up Approaches to Environmental Governance in China: Evidence from the River Chief System (RCS). Int. J. Environ. Res. Public Health 2020, 17, 7058. [Google Scholar] [CrossRef]

- Mol, A.P.J.; Carter, N.T. China’s environmental governance in transition. Environ. Polit. 2006, 15, 149–170. [Google Scholar] [CrossRef]

- Xu, S.-C.; He, Z.-X.; Long, R.-Y.; Chen, H.; Han, H.-M.; Zhang, W.-W. Comparative analysis of the regional contributions to carbon emissions in China. J. Clean. Prod. 2016, 127, 406–417. [Google Scholar] [CrossRef]

- Eyraud, L.; Clements, B.; Wane, A. Green investment: Trends and determinants. Energy Policy 2013, 60, 852–865. [Google Scholar] [CrossRef]

- Xu, G.; Zhou, Y.; Ji, H. How Can Government Promote Technology Diffusion in Manufacturing Paradigm Shift? Evidence From China. IEEE Trans. Eng. Manag. 2020, 1–13. [Google Scholar] [CrossRef]

- Zhou, Y.; Zang, J.; Miao, Z.; Minshall, T. Upgrading Pathways of Intelligent Manufacturing in China: Transitioning across Technological Paradigms. Engineering 2019, 5, 691–701. [Google Scholar] [CrossRef]

- Kong, D.; Zhou, Y.; Liu, Y.; Xue, L. Using the data mining method to assess the innovation gap: A case of industrial robotics in a catching-up country. Technol. Forecast. Soc. Chang. 2017, 119, 80–97. [Google Scholar] [CrossRef]

- Shen, Y.; Su, Z.-W.; Malik, M.Y.; Umar, M.; Khan, Z.; Khan, M. Does green investment, financial development and natural resources rent limit carbon emissions? A provincial panel analysis of China. Sci. Total Environ. 2021, 755, 142538. [Google Scholar] [CrossRef] [PubMed]

- Umar, M.; Ji, X.; Kirikkaleli, D.; Xu, Q. COP21 Roadmap: Do innovation, financial development, and transportation infrastructure matter for environmental sustainability in China? J. Environ. Manag. 2020, 271, 111026. [Google Scholar] [CrossRef]

- Zhou, Y.; Zhou, R.; Chen, L.; Zhao, Y.; Zhang, Q. Environmental Policy Mixes and Green Industrial Development: An Empirical Study of the Chinese Textile Industry from 1998 to 2012. IEEE Trans. Eng. Manag. 2020, 1–13. [Google Scholar] [CrossRef]

- Shin, K. Environmental policy innovations in China: A critical analysis from a low-carbon city. Environ. Polit. 2018, 27, 830–851. [Google Scholar] [CrossRef]

- Liao, X.; Shi, X. Public appeal, environmental regulation and green investment: Evidence from China. Energy Policy 2018, 119, 554–562. [Google Scholar] [CrossRef]

- Zhou, Y.; Miao, Z.; Urban, F. China’s leadership in the hydropower sector: Identifying green windows of opportunity for technological catch-up. Ind. Corp. Chang. 2020, 29, 1319–1343. [Google Scholar] [CrossRef]

- Zhou, Y.; Li, X.; Lema, R.; Urban, F. Comparing the knowledge bases of wind turbine firms in Asia and Europe: Patent trajectories, networks, and globalisation. Sci. Public Policy 2016, 43, 476–491. [Google Scholar] [CrossRef]

- Kostka, G.; Zhang, C. Tightening the grip: Environmental governance under Xi Jinping—Introduction. Environ. Polit. 2018, 27, 769–781. [Google Scholar] [CrossRef]

- Li, L.B.; Wu, W.B.; Zhang, M.Y.; Lin, L. Linkage Analysis between Finance and Environmental Protection Sectors in China: An Approach to Evaluating Green Finance. Int. J. Environ. Res. Public Health 2021, 18, 2634. [Google Scholar] [CrossRef]

- Barbieri, N.; Marzucchi, A.; Rizzo, U. Knowledge sources and impacts on subsequent inventions: Do green technologies differ from non-green ones? Res. Policy 2020, 49, 103901. [Google Scholar] [CrossRef]

- Du, H.S.; Zhan, B.; Xu, J.; Yang, X. The influencing mechanism of multi-factors on green investments: A hybrid analysis. J. Clean. Prod. 2019, 239, 117977. [Google Scholar] [CrossRef]

- Murovec, N.; Erker, R.S.; Prodan, I. Determinants of environmental investments: Testing the structural model. J. Clean. Prod. 2012, 37, 265–277. [Google Scholar] [CrossRef]

- Leete, S.; Xu, J.; Wheeler, D. Investment barriers and incentives for marine renewable energy in the UK: An analysis of investor preferences. Energy Policy 2013, 60, 866–875. [Google Scholar] [CrossRef]

- Perruchas, F.; Consoli, D.; Barbieri, N. Specialisation, diversification and the ladder of green technology development. Res. Policy 2020, 49, 12. [Google Scholar] [CrossRef]

- Zhu, X.; Du, J.; Boamah, K.B.; Long, X. Dynamic analysis of green investment decision of manufacturer. Environ. Sci. Pollut. Res. 2020, 27, 16998–17012. [Google Scholar] [CrossRef]

- Xu, Q.; Lei, Y.; Ge, J.; Ma, X. Did investment become green in China? Evidence from a sectoral panel analysis from 2003 to 2012. J. Clean. Prod. 2017, 156, 500–506. [Google Scholar] [CrossRef]

- Dunn, E.S. A statistical and analytical technique for regional analysis. J. Am. Stat. Assoc. 1960, 55, 359. [Google Scholar] [CrossRef]

- Arcelus, F.J. An Extension of Shift-Share Analysis. Growth Chang. 1984, 15, 3–8. [Google Scholar] [CrossRef]

- Herzog, H.W.; Olsen, R.J. Shift-Share Analysis Revisited: The Allocation Effect and the Stability of Regional Structure. J. Reg. Sci. 1977, 17, 441–454. [Google Scholar] [CrossRef]

- Esteban-Marquillas, J.M. I. A reinterpretation of shift-share analysis. Reg. Urban Econ. 1972, 2, 249–255. [Google Scholar] [CrossRef]

- Sihag, B.S.; McDonough, C.C. Shift-Share Analysis: The International Dimension. Growth Chang. 1989, 20, 80–88. [Google Scholar] [CrossRef]

- Artige, L.; van Neuss, L. A New Shift-Share Method. Growth Chang. 2014, 45, 667–683. [Google Scholar] [CrossRef]

- Kemble Stokes, H. Shift share once again. Reg. Urban Econ. 1974, 4, 57–60. [Google Scholar] [CrossRef]

- Loveridge, S.; Selting, A.C. A review and comparison of shift-share identities. Int. Reg. Sci. Rev. 1998, 21, 37–58. [Google Scholar] [CrossRef]

- Zhu, B.; Zhai, S.; He, J. Is the Development of China’s Financial Inclusion Sustainable? Evidence from a Perspective of Balance. Sustainability 2018, 10, 1200. [Google Scholar] [CrossRef]

- Pérez-González, M.d.C.; Valiente-Palma, L. Cooperative Societies and Sustainability: A Spatial Analysis of Andalusia as a Tool for Implementing Territorial Development Policies, Strategies and Initiatives. Sustainability 2021, 13, 0609. [Google Scholar] [CrossRef]

- Lv, D.; Gao, H.; Zhang, Y. Rural Economic Development Based on Shift-Share Analysis in a Developing Country: A Case Study in Heilongjiang Province, China. Sustainability 2021, 13, 1969. [Google Scholar] [CrossRef]

- Antczak, E.; Lewandowska-Gwarda, K. How Fast Is Europe Getting Old? Analysis of Dynamics Applying the Spatial Shift–Share Approach. Sustainability 2019, 11, 5661. [Google Scholar] [CrossRef]

- Zheng, Y.; Xiao, J.; Cheng, J. Industrial Structure Adjustment and Regional Green Development from the Perspective of Mineral Resource Security. Int. J. Environ. Res. Public Health 2020, 17, 6978. [Google Scholar] [CrossRef] [PubMed]

- Liu, Y.; Dong, F. How Industrial Transfer Processes Impact on Haze Pollution in China: An Analysis from the Perspective of Spatial Effects. Int. J. Environ. Res. Public Health 2019, 16, 0423. [Google Scholar] [CrossRef] [PubMed]

- Blanco, M.; Ferasso, M.; Bares, L. Evaluation of the Effects on Regional Production and Employment in Spain of the Renewable Energy Plan 2011–2020. Sustainability 2021, 13. [Google Scholar] [CrossRef]

- Gilli, M.; Marin, G.; Mazzanti, M.; Nicolli, F. Sustainable development and industrial development: Manufacturing environmental performance, technology and consumption/production perspectives. J. Environ. Econ. Policy 2016, 6, 183–203. [Google Scholar] [CrossRef]

- Otsuka, A. Regional energy demand in Japan: Dynamic shift-share analysis. Energy Sustain. Soc. 2016, 6. [Google Scholar] [CrossRef]

- Grossi, L.; Mussini, M. A spatial shift-share decomposition of electricity consumption changes across Italian regions. Energy Policy 2018, 113, 278–293. [Google Scholar] [CrossRef]

- Vaona, A. The sclerosis of regional electricity intensities in Italy: An aggregate and sectoral analysis. Appl. Energy 2013, 104, 880–889. [Google Scholar] [CrossRef][Green Version]

- Bao, C.; Liu, R. Electricity Consumption Changes across China’s Provinces Using a Spatial Shift-Share Decomposition Model. Sustainability 2019, 11, 2494. [Google Scholar] [CrossRef]

- Lin, G.; Jiang, D.; Fu, J.; Wang, D.; Li, X. A spatial shift-share decomposition of energy consumption changes in China. Energy Policy 2019, 135. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sheng, R.; Zhou, R.; Zhang, Y.; Wang, Z. Green Investment Changes in China: A Shift-Share Analysis. Int. J. Environ. Res. Public Health 2021, 18, 6658. https://doi.org/10.3390/ijerph18126658

Sheng R, Zhou R, Zhang Y, Wang Z. Green Investment Changes in China: A Shift-Share Analysis. International Journal of Environmental Research and Public Health. 2021; 18(12):6658. https://doi.org/10.3390/ijerph18126658

Chicago/Turabian StyleSheng, Ruxu, Rong Zhou, Ying Zhang, and Zidi Wang. 2021. "Green Investment Changes in China: A Shift-Share Analysis" International Journal of Environmental Research and Public Health 18, no. 12: 6658. https://doi.org/10.3390/ijerph18126658

APA StyleSheng, R., Zhou, R., Zhang, Y., & Wang, Z. (2021). Green Investment Changes in China: A Shift-Share Analysis. International Journal of Environmental Research and Public Health, 18(12), 6658. https://doi.org/10.3390/ijerph18126658