Financial Performance of Public Hospitals: A Cross-Sectional Study among Polish Providers

Abstract

1. Introduction

2. Materials and Methods

2.1. Study Design and Participants

2.2. Data Sources and Variables

- generation/existence of gross profit (profit before tax); yes—there is gross profit, no—there is no gross profit, the hospital generated gross loss

- generation/existence of arrears (overdue liabilities); yes—there are overdue liabilities, no—there are no overdue liabilities

- gross profit margin (profit or loss before tax per total revenues);

- debt ratio (total liabilities per total assets);

- the share of arrears (overdue liabilities) in total liabilities.

2.3. Statistical Analyses

3. Results

3.1. Participants’ Descriptive Statistics

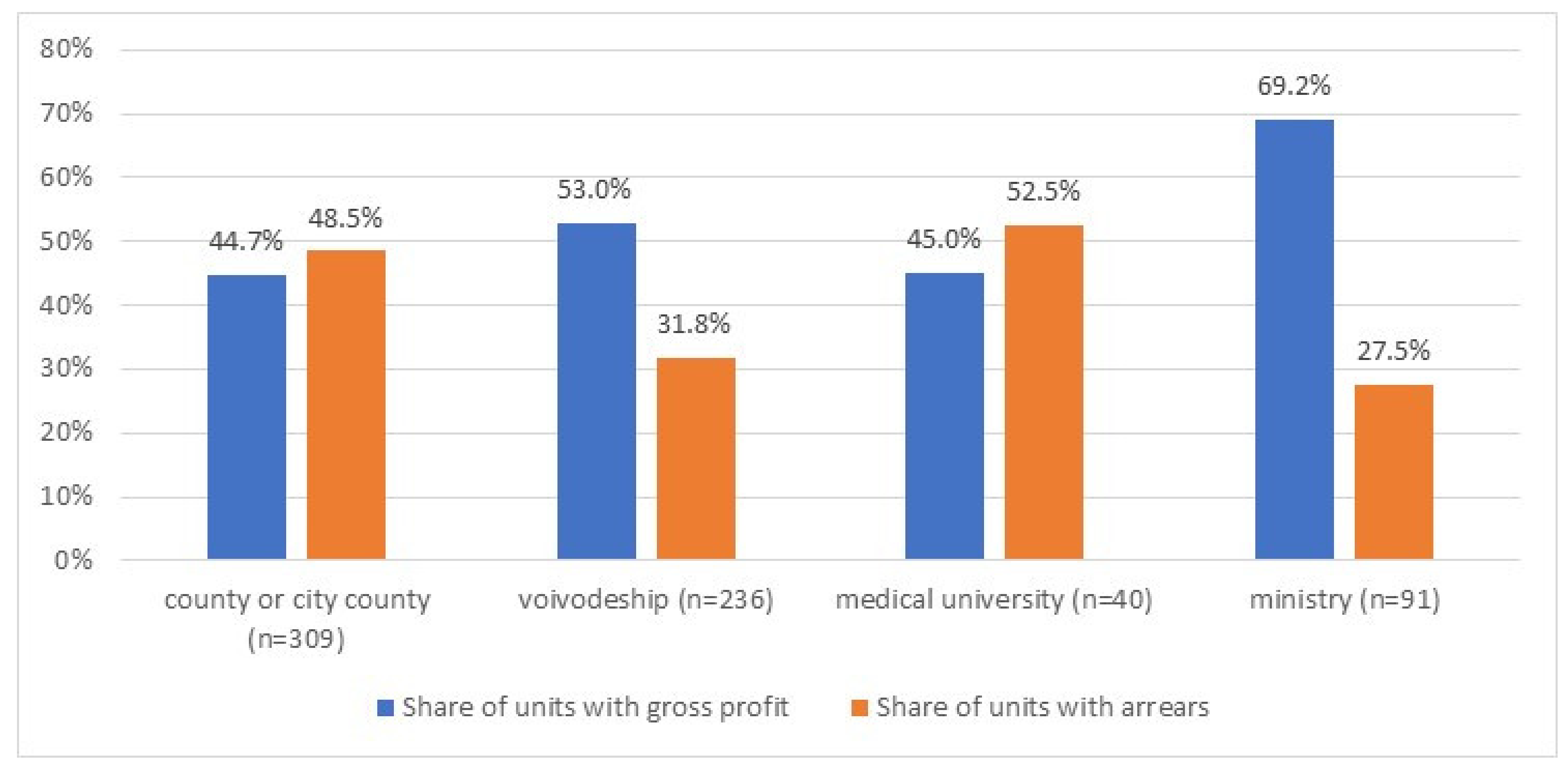

3.2. Financial Performance per Hospital Owners

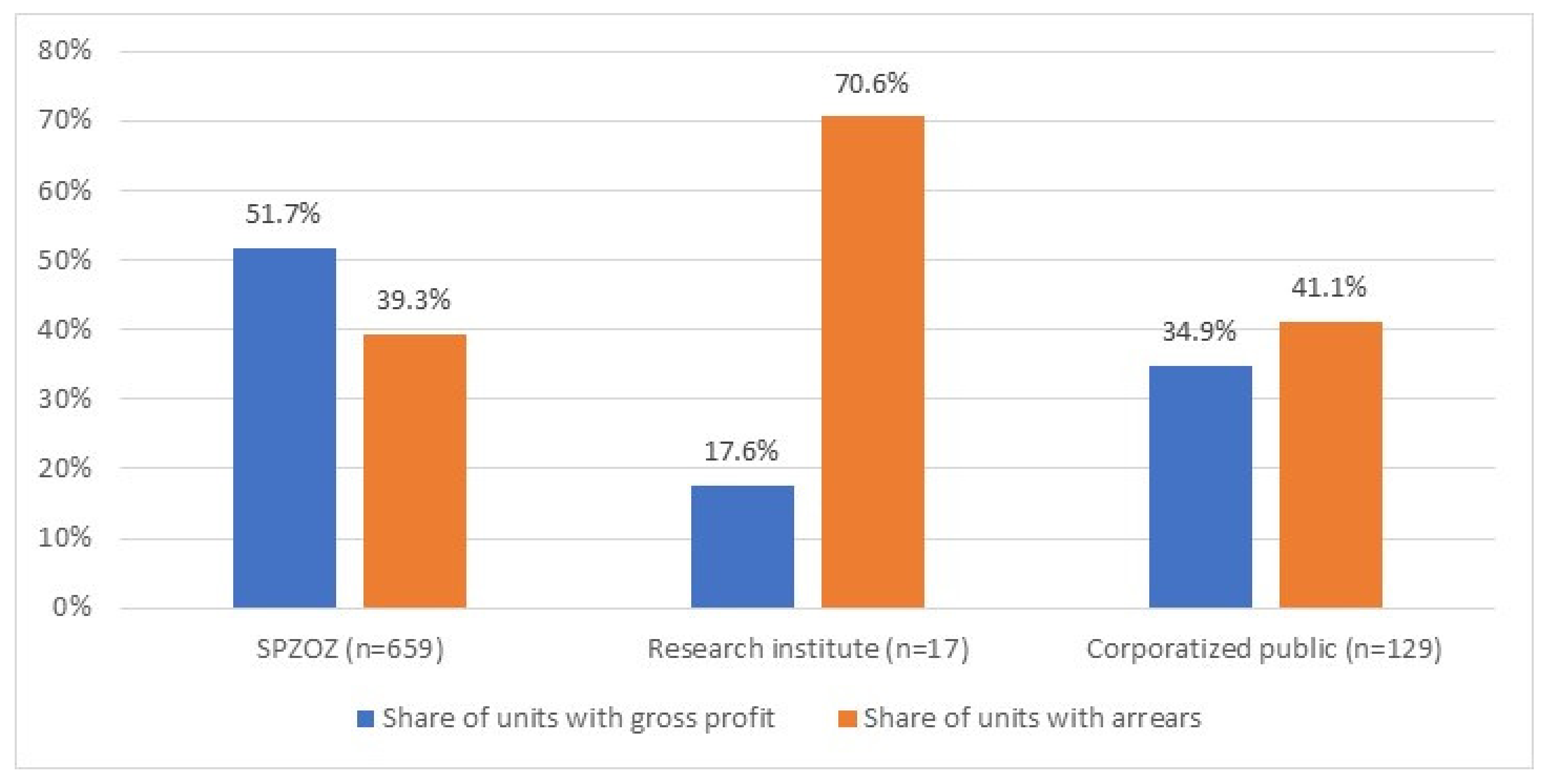

3.3. Financial Performance per Hospital Organizational Form

3.4. Factors Associated with Hospitals’ Financial Performance

4. Discussion

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Akinleye, D.D.; McNutt, L.A.; Lazariu, V.; McLaughlin, C.C. Correlation between hospital finances and quality and safety of patient care. PLoS ONE 2019, 14, e0219124. [Google Scholar] [CrossRef]

- Barnes, M.; Oner, N.; Ray, M.N.; Zengul, F.D. Exploring the Association between Quality and Financial Performance in U.S. Hospitals: A Systematic Review. J. Health Care Financ. 2017, 44, 2017. [Google Scholar]

- Bazzoli, G.J.; Chen, H.F.; Zhao, M.; Lindrooth, R.C. Hospital financial condition and the quality of patient care. Health Econ. 2008, 17, 977–995. [Google Scholar] [CrossRef]

- Beauvais, B.; Wells, R. Does money really matter? A review of the literature on the relationships between healthcare organization finances and quality. Hosp. Top. 2006, 84, 20–28. [Google Scholar] [CrossRef]

- Dong, G.N. Performing well in financial management and quality of care: Evidence from hospital process measures for treatment of cardiovascular disease. BMC Health Serv. Res. 2015, 15, 45. [Google Scholar] [CrossRef] [PubMed]

- Encinosa, W.E.; Bernard, D.M. Hospital Finances and Patient Safety Outcomes. Inq. J. Health Care Organ. Provis. Financ. 2005, 42, 60–72. [Google Scholar] [CrossRef]

- Suarez, V.; Lesneski, C.; Denison, D. Making the case for using financial indicators in local public health agencies. Am. J. Public Health 2011, 101, 419–425. [Google Scholar] [CrossRef] [PubMed]

- Cho, N.-E.; Hong, K. A Kitchen with too Many Cooks: Factors Associated with Hospital Profitability. Sustainability 2018, 10, 323. [Google Scholar] [CrossRef]

- Schwierz, C. Cost-Containment Policies in Hospital Expenditure in the European Union. European Commission. European Economy Discussion Paper 037. September 2016. Available online: https://ec.europa.eu/info/publications/economy-finance/cost-containment-policies-hospital-expenditure-european-union_en (accessed on 17 February 2020).

- Eurostat Database 2020. Available online: https://ec.europa.eu/eurostat/data/database (accessed on 15 February 2020).

- Clemens, T.; Michelsen, K.; Commers, M.; Garelb, P.; Dowdeswellc, B.; Brand, H. European hospital reforms in times of crisis: Aligning cost containment needs with plans for structural re-design? Health Policy 2014, 117, 6–14. [Google Scholar] [CrossRef]

- Dubas-Jakóbczyk, K.; Albreht, T.; Behmane, D.; Bryndova, L.; Dimova, A.; Džakula, A.; Scîntee, S.G.; Smatana, M.; Velkey, Z.; Quentin, W.; et al. Hospital reforms in 11 Central and Eastern European countries between 2008 and 2019: A comparative analysis. Health Policy 2020, in press. [Google Scholar] [CrossRef]

- Rejestr Podmiotów Wykonujących Działalność Leczniczą. Register of health care providers. Data on 31.12.2018. Available online: https://rpwdl.csioz.gov.pl/ (accessed on 15 February 2020).

- Sowada, C.; Sagan, A.; Kowalska-Bobko, I.; Badora-Musiał, K.; Bochenek, T.; Domagała, A.; Dubas-Jakobczyk, K.; Kocot, E.; Mrozek-Gasiorowska, M.; Sitko, S.; et al. Poland: Health system review. Health Syst. Transit. 2019, 20, 1–256. [Google Scholar]

- Główny Urząd Statystyczny. Zdrowie i Ochrona Zdrowia w 2017. Health and health care in 2017. Warszawa 2019. Available online: https://stat.gov.pl/obszary-tematyczne/zdrowie/zdrowie/zdrowie-i-ochrona-zdrowia-w-2017-r-,1,8.html (accessed on 15 February 2020).

- Ustawa z Dnia 27 Sierpnia 2004r. o Świadczeniach Opieki Zdrowotnej Finansowanych ze Środków Publicznych. Bill on Medical Services Financed form Public Sources. (Dz.U. 2004 nr 210, poz. 2136 z póżn. zm). Available online: http://prawo.sejm.gov.pl/isap.nsf/download.xsp/WDU20042102135/U/D20042135Lj.pdf (accessed on 21 March 2020). (In Polish)

- Ministerstwo Finansów. Wskaźniki Dochodów Podatkowych dla Poszczególnych Jednostek Samorządu Terytorialnego. Tax Revenues Indicators Per Local Government Units. (In Polish). Available online: https://www.gov.pl/web/finanse/wskazniki-dochodow-podatkowych-dla-poszczegolnych-jednostek-samorzadu-terytorialnego-gmin-powiatow-i-wojewodztw (accessed on 21 March 2020).

- Boulhol, H.; Sowa, A.; Golinowska, S.; Sicari, P. Improving the Health-Care System in Poland, OECD Working Paper No. 957. 2012. Available online: https://www.oecd-ilibrary.org/economics/improving-the-health-care-system-in-poland_5k9b7bn5qzvd-en (accessed on 15 February 2020).

- World Bank. Poland—Improving the Financial Sustainability of the Hospitals Sector—Towards a Systemic Approach, April 2014. Available online: http://documents.worldbank.org/curated/en/200981468092357399/pdf/882630PRIORITY0aper0Poland020140ENG.pdf (accessed on 15 February 2020).

- Najwyższa Izba Kontroli. Restrukturyzacja Wybranych SPZOZ Korzystających ze Środków Publicznych. SPZOZs Restructuration Processes. Supreme Audit Office. Warszawa 2016. (In Polish). Available online: https://www.nik.gov.pl/plik/id,11697,vp,14057.pdf (accessed on 15 February 2020).

- Najwyższa Izba Kontroli. Raport: System Ochrony Zdrowia w Polsce—Stan Obecny i Pożądane Kierunki Zmian. Warszawa 2019. Supreme Audit Office. Report: Health care system in Poland—Current Situation and Recommended Changes. Warszawa 2019. (In Polish). Available online: https://www.nik.gov.pl/plik/id,20223,vp,22913.pdf (accessed on 15 February 2020).

- Regionalna Izba Obrachunkowa. Informacja o Wynikach Kontroli Koordynowanej: Kontrola Zadłużenia SPZOZ, dla Których Podmiotem Tworzącym są Jednostki Samorządu Terytorialnego. Regional Accountancy Committee. Audit Results—Debts of SPZOZ Owned by Local Governments. Kraków 2018. (In Polish). Available online: https://www.rio.gov.pl/modules/Uploader/upload/kontrola_koordynowana_zadluzenie_spzoz_www.pdf (accessed on 15 February 2020).

- Ministerstwo Zdrowia. Wartość Zobowiązań Wymagalnych SPZOZ wg Stany na 31.12.2018. Value of Arrears. (In Polish). Available online: https://www.gov.pl/web/zdrowie/zadluzenie-spzoz (accessed on 21 March 2020).

- Klinger, K. Wzrosły Długi Szpitali, a Zmiany w Systemie nie Dadzą Szans na ich Cięcie. Obserwator Finansowy 2017. (In Polish). Available online: https://www.obserwatorfinansowy.pl/forma/rotator/wzrosly-dlugi-szpitali-a-zmiany-w-systemie-nie-dadza-szans-na-ich-ciecie/ (accessed on 15 February 2020).

- Ustawa z Dnia 15 Kwietnia 2005 r. o Pomocy Publicznej i Restrukturyzacji Publicznych Zakładów Opieki Zdrowotnej. Bill on Public Support and Restructuration of Health Care Providers. (Dz.U. 2005 nr 78 poz. 684). (In Polish). Available online: http://prawo.sejm.gov.pl/isap.nsf/DocDetails.xsp?id=WDU20050780684 (accessed on 15 February 2020).

- Plan, B. Uchwała Nr 58 /2009 Rady Ministrów z Dnia 27 Kwietnia 2009 r. w Sprawie Ustanowienia Programu Wieloletniego pod Nazwą “Wsparcie Jednostek Samorządu Terytorialnego w Działaniach Stabilizujących System Ochrony Zdrowia”; Regulation on Supporting Local Governments in Activities Aimed at Health System Stabilization; Rada Ministrów: Warszawa, Poland, 2009.

- Ustawa z Dnia 15 Kwietnia 2011 r. o Działalności Leczniczej. Bill on Therapeutic Activities. (Dz.U. 2011 nr 112 poz. 654). (In Polish). Available online: http://prawo.sejm.gov.pl/isap.nsf/DocDetails.xsp?id=WDU20111120654 (accessed on 15 February 2020).

- Dubas-Jakóbczyk, K.; Kowalska-Bobko, I.; Sowada, C. The 2017 reform of the hospital sector in Poland—The challenge of consistent design. Health Policy 2019, 123, 538–543. [Google Scholar] [CrossRef] [PubMed]

- Siedlecki, R.; Bem, A.; Ucieklak-Jeż, P.; Prędkiewicz, P. Rural Versus Urban Hospitals in Poland. Hospital’s Financial Health Assessment. Procedia Soc. Behav. Sci. 2016, 220, 444–451. [Google Scholar] [CrossRef]

- Dubas-Jakóbczyk, K. Ocena sytuacji finansowej szpitali uniwersyteckich na podstawie sprawozdań finansowych za rok 2014. University Hospitals Financial Situation Assessment—Based on Financial Statements for the Year 2014. Zeszyty Naukowe Politechniki Śląskiej Seria Organizacja i Zarządzanie, 2017 nr 100/2017. (In Polish). Available online: https://www.polsl.pl/Wydzialy/ROZ/ZN/Documents/z%20100/Dubas-Jak%C3%B3bczyk.pdf (accessed on 15 February 2020).

- Krzeczewski, B.; Krzeczewska, O.; Pluskota, A.; Pastusiak, R. Does the agglomeration effect occur in the hospital sector? The impact of agglomeration economies on the financial performance of hospitals—An evidence from Poland. Int. J. Health Plan. Mgmt. 2019, 34, 553–571. [Google Scholar] [CrossRef] [PubMed]

- Najwyższa Izba Kontroli. Działalność Szpitali Samorządowych Przekształconych w Spółki Kapitałowe. In Functioning of Corporatized Hospitals; Supreme Audit Office: Warszawa, Poland, 2015. Available online: https://www.nik.gov.pl/plik/id,8411,vp,10488.pdf (accessed on 15 February 2020). (In Polish)

- Najwyższa Izba Kontroli. Funkcjonowanie Wybranych Instytutów Badawczych Nadzorowanych Przez Ministra Zdrowia; Functioning of Research Institutes Supervised by the Ministry of Health; Supreme Audit Office: Warszawa, Poland, 2018. Available online: https://www.nik.gov.pl/kontrole/R/17/003/KZD/ (accessed on 15 February 2020). (In Polish)

- Główny Urząd Statystyczny. MZ-03—Sprawozdanie o Finansach Samodzielnych Publicznych Zakładów Opieki Zdrowotnej. MZ-03 Financial Reporting of Independent Health Care Units. 2018. Available online: https://bip.stat.gov.pl/dzialalnosc-statystyki-publicznej/badania-statystyczne/pbssp-na-2018/czesc-druga/259,zestaw.html (accessed on 15 February 2020).

- Das, D. Factor analysis of financial and operational performance measures of non-profit hospitals. J. Health Care Financ. 2009, 36, 13–23. [Google Scholar]

- Burkhardt, J.H.; Wheeler, J. Examining Financial Performance Indicators for Acute Care Hospitals. Health Care Financ. 2013, 39, 1–13. [Google Scholar]

- Shen, Y.; Eggleston, K.; Lau, J.; Schmid, C. Hospital Ownership and Financial Performance: What Explains the Different Findings in the Empirical Literature. Inq. J. Health Care Organ. Provis. Financ. 2007, 44, 41–68. [Google Scholar] [CrossRef]

- Oner, N.; Zengul, F.; Ozaydin, B.; Pallotta, R.A.; Weech-Maldonado, W. Organizational and Environmental Factors Associated with Hospital Financial Performance: A Systematic Review. J. Health Care Financ. 2016, 43, 2016. [Google Scholar]

- Dubas-Jakóbczyk, K.; Domagała, A.; Mikos, M. Impact of the doctor deficit on hospital management in Poland: A mixed-method study. Int. J. Health Plan. Mgmt. 2019, 34, 187–195. [Google Scholar] [CrossRef]

- Biardzki, M. Zmierzch Szpitali Powiatowych. Fall of the County Hospitals. Menedżer Zdrowia 2018, 4-5/2018. (In Polish). Available online: https://www.termedia.pl/Zmierzch-szpitali-powiatowych-,12,33158,1,0.html (accessed on 15 February 2020).

- Ogólnopolski Związek Pracodawców Szpitali Powiatowych. National Association of County Hospitals. Warszawa 2019. (In Polish). Available online: http://ozpsp.pl (accessed on 15 February 2020).

- Koenig, L.; Dobson, A.; Ho, S.; Siegel, J.M.; Blumenthal, D.; Weissman, J.S. Estimating the mission-related costs of teaching hospitals. Health Aff. 2003, 22, 112–122. [Google Scholar] [CrossRef] [PubMed]

- Lee, M. Financial Analysis of National University Hospitals in Korea. Osong Public Health Res. Perspect. 2015, 6, 310–317. [Google Scholar] [CrossRef] [PubMed]

- Safarani, S.; Ravaghi, H.; Raeissi, P.; Maleki, M. Financial challenges of teaching hospitals and providing solutions. J. Educ. Health Promot. 2018, 7, 155. [Google Scholar] [CrossRef] [PubMed]

- Najwyższa Izba Kontroli. Funkcjonowanie Szpitali Klinicznych; Functioning of Clinical Hospitals; Supreme Audit Office: Warszawa, Poland, 2015; (In Polish). Available online: https://www.nik.gov.pl/plik/id,9304,vp,11527.pdf (accessed on 15 February 2020). (In Polish)

- Harding, A.; Preker, A. Understanding Organizational Reforms. The Corporatization of Public Hospitals. HNP Discussion Paper. September 2000. Available online: http://documents.worldbank.org/curated/en/905371468780563628/pdf/288770Harding11Organizational1whole.pdf (accessed on 15 February 2020).

- Najwyższa Izba Kontroli. Funkcjonowanie Wybranych Instytutów Badawczych Nadzorowanych Przez Ministra Zdrowia; Functioning of research institutes supervised by the Ministry of Health; Supreme Audit Office: Warszawa, Poland, 2012; (In Polish). Available online: https://www.nik.gov.pl/plik/id,4233,vp,5394.pdf (accessed on 15 February 2020).

- Najwyższa Izba Kontroli. Efekty działalności Instytutów Badawczych; Functioning of Research Institutes; Supreme Audit Office: Warszawa, Poland, 2016. Available online: https://www.nik.gov.pl/plik/id,10114,vp,12426.pdf (accessed on 15 February 2020). (In Polish)

- Kuntz, L.; Scholtes, S.; Vera, A. Incorporating efficiency in hospital-capacity planning in Germany. Eur. J. Health Econ. 2007, 8, 213–223. [Google Scholar] [CrossRef] [PubMed]

- Saltman, R.; Duran, A.; Dubois, H. (Eds.) Governing Public Hospitals; European Observatory on Heath System and Policies: Copenhagen, Denmark, 2011. [Google Scholar]

- Centrum Systemów Informacyjnych Ochrony Zdrowia. Biuletyn Statystyczny Ministerstwa Zdrowia. Ministry of Health Statistical Bulletin. 2019; (In Polish). Available online: https://bip.stat.gov.pl/dzialalnosc-statystyki-publicznej/badania-statystyczne/pbssp-na-2018/czesc-druga/259,zestaw.html (accessed on 15 February 2020).

- EVIPNet Europe. Situation Analysis on Evidence Informed Health Policy Making. Poland. Copenhagen: WHO Regional Office for Europe. 2019. Licence: CC BY NC SA 3.0 IGO. Available online: http://www.euro.who.int/__data/assets/pdf_file/0020/414164/WHO-EVIPNet-Europe-SA2-Poland-Sep-2019.pdf?ua=1 (accessed on 15 February 2020).

- Chawla, M. Controlling Health Expenditures. In Current Issues in Fiscal Reform in Central Europe and the Baltic States 2005; La Ursen, T., Ed.; World Bank: Washington, DC, USA, 2006; pp. 99–134. [Google Scholar]

- Kutzin, J. Conceptual Framework for Analysing Health Financing Systems and the Effects of Reforms. In Implementing Health Financing Reform: Lessons from Countries in Transition; Kutzin, J., Cashin, C., Jakab, M., Eds.; WHO Regional Office for Europe: Copenhagen, Denmark, 2010; Available online: http://www.euro.who.int/__data/assets/pdf_file/0014/120164/E94240.pdf (accessed on 15 February 2020).

| Legal Form | Legal Consequences of Financial Deficit | Owners | Share of Units in Total Number of Public Hospitals Beds in 2018c |

|---|---|---|---|

| Independent health care units (samodzielny publiczny zakład opieki zdrowotnej—SPZOZ) | • Do not have bankruptcy capacity; • If the hospital cannot cover the financial lossa the owner has to cover it or make a decision about hospital liquidationb | • Local governments (counties/cities; voivodships) • Medical universities • Ministries | 80.2% (per owner: 29.9% counties/cities; 34.5% voivodeships; 11.5% medical universities; 4.3% ministries) |

| Research institutes | • Do not have bankruptcy capacity; • In case of liquidation the liabilities are taken over by the state | • Ministry of Health (supervisory body) | 3.5% |

| Corporatized public hospitals (commercial companies with the majority of/all shares belonging to public body) | • Subject to regulations applicable to commercial code companies (incl. bankruptcy capacity) | • Local governments (counties/cities; voivodships) | 16.3% |

| Hospitals Classification: | n | Median (q1–q3), Million PLN | ||||||

|---|---|---|---|---|---|---|---|---|

| Total Assets | Total Revenues | Total Costs | Gross Profit/Loss | Total Liabilities | Arrears | |||

| Owner | County or city County | 309 | 24.7 (7.7–49.0) | 36.5 (11.9–62.7) | 37.4 (11.9–63.8) | −0.2 (−2.4–0.2) | 8.0 (1.4–17.9) | 0.0 (0.0–1.5) |

| Voivodeship | 236 | 34.0 (10.8–82.4) | 36.8 (12.3–121.2) | 36.2 (12.2–121.4) | 0.4 (−2.6–0.3) | 5.6 (1.2–26.3) | 0.0 (0.0–0.06) | |

| Medical university | 40 | 138.2 (81.6–211.3) | 224.4 (115.1–353.8) | 231.6 (117.5–358.7) | −0.5 (−6.9–0.7) | 42.6 (16.4–85.6) | 0.0 (0.0–11.7) | |

| Ministry | 91 | 22.2 (6.1–80.4) | 19.3 (6.6–60.8) | 18.7 (6.3–65.5) | 0.9 (−0.6–0.4) | 2.3 (0.5–12.2) | 0.0 (0.0–0.0) | |

| ALL owners | 676 | 28.4 (9.4–70.2) | 36.3 (12.1–87.3) | 36.6 (12.2–89.8) | 1.4 (−2.6–0.3) | 6.7 (1.3–22.6) | 0.0 (0.0–1.0) | |

| Legal form | SPZOZ | 659 | 27.9 (9.2–68.3) | 35.9 (11.5–85.6) | 35.9 (11.5–86.8) | 0.0 (−2.4–0.3) | 6.4 (1.2–21.3) | 0.0 (0.0–0.9) |

| Research institute | 17 | 141.9 (34.2–282.8) | 133.9 (35.0–281.2) | 137.8 (35.5–284.8) | −3.1 (−7.3–(−0.7)) | 40.7 (6.5–92.4) | 4.3 (0.0–11.6) | |

| Corporatized public | 129 | 26.0 (10.7–50.2) | 33.9 (20.1–60.3) | 35.0 (21.3–61.6) | −0.7 (−3.7–0.2) | 5.9 (2.9–14.7) | 0.0 (0.0–0.9) | |

| ALL legal forms | 805 | 27.9 (9.8–68.2) | 35.8 (12.8–81.1) | 36.5 (12.9–84.5) | −0.1 (−2.8–0.3) | 6.4 (1.4–20.9) | 0.0 (0.0–1.0) | |

| Variable (Percentage, Median, q1-q3)/Owner | ‘A’ County or City County | ‘B’ Voivodeship | ‘C’ Medical University | ‘D’ Ministry | H-Value | p-Value |

|---|---|---|---|---|---|---|

| n | 309 | 236 | 40 | 91 | ||

| Gross profit margin | −1.2 (−5.6–1.2) | 0.0 (−4.1–0.9) | −0.7 (−2.8–0.4) | 1.0 (−1.3–3.6) | 23.3 | <0.001 |

| Debt ratio | 24.5 (14.2–51.2) | 17.9 (9.9–33.7) | 30.6 (19.1–51.5) | 9.8 (5.1–19.5) | 60.9 | <0.001 |

| Share of arrears in total liabilities | 0.0 (0.0–10.4) | 0.0 (0.0–2.3) | 0.0 (0.0–13.6) | 0.0 (0.0–0.1) | 22.3 | <0.001 |

| Variable (Percentage, Median, q1-q3)/Organizational Form | ‘A’ SPZOZ | ‘B’ Research Institute | ‘C’ Corporatized Public | H-Value | p-Value |

|---|---|---|---|---|---|

| n | 659 | 17 | 129 | ||

| Gross profit margin | 0.0 (−4.0–1.4) | −2.5 (−7.9– (−0.4)) | −2.1 (−9.1–0.9) | 17.2 | <0.001 |

| Debt ratio | 19.6 (10.6–39.8) | 26.1 (15.1–73.5) | 28.0 (13.5–48.3) | 9.3 | 0.01 |

| Share of arrears in total liabilities | 0.0 (0.0–5.6) | 6.5 (0.0–20.4) | 0.0 (0.0–7.8) | 9.2 | 0.01 |

| Variable | Generation/Existence of Gross Profit | Generation/Existence of Arrears | ||

|---|---|---|---|---|

| Adjusted OR (95% CI) | p-Value | Adjusted OR (95% CI) | p-Value | |

| Ownership group: | ||||

| Country or city | 1 | 1 | ||

| Voivodeship | 1.73 (1.21–2.47) | 0.003 | 0.38 (0.26–0.55) | <0.001 |

| Medical university | 4.05 (1.74–9.46) | <0.001 | 0.30 (0.13–0.70) | 0.005 |

| Ministry | 3.29 (1.94–5.60) | <0.001 | 0.34 (0.20–0.58) | <0.001 |

| Revenues (10 million PLN) | 0.93 (0.90–0.95) | <0.001 | 1.08 (1.05–1.10) | <0.001 |

| AUC | 0.70 (0.66–0.74) | 0.71 (0.67–0.75) | ||

| Variable | Generation/Existence of Gross Profit | Generation/Existence of Arrears | ||

|---|---|---|---|---|

| Adjusted OR (95% CI) | p-value | Adjusted OR (95% CI) | p-Value | |

| Organizational form: | ||||

| SPZOZ | 1 | 1 | ||

| Research institute | 0.31 (0.08–1.13) | 0.077 | 2.31 (0.75–7.09) | 0.144 |

| Corporatized public | 0.46 (0.31–0.68) | <0.001 | 1.17 (0.79–1.73) | 0.446 |

| Revenues (10 million PLN) | 0.94 (0.92–0.96) | <0.001 | 1.06 (1.04–1.08) | <0.001 |

| AUC | 0.69 (0.65–0.72) | 0.71 (0.67–0.74) | ||

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dubas-Jakóbczyk, K.; Kocot, E.; Kozieł, A. Financial Performance of Public Hospitals: A Cross-Sectional Study among Polish Providers. Int. J. Environ. Res. Public Health 2020, 17, 2188. https://doi.org/10.3390/ijerph17072188

Dubas-Jakóbczyk K, Kocot E, Kozieł A. Financial Performance of Public Hospitals: A Cross-Sectional Study among Polish Providers. International Journal of Environmental Research and Public Health. 2020; 17(7):2188. https://doi.org/10.3390/ijerph17072188

Chicago/Turabian StyleDubas-Jakóbczyk, Katarzyna, Ewa Kocot, and Anna Kozieł. 2020. "Financial Performance of Public Hospitals: A Cross-Sectional Study among Polish Providers" International Journal of Environmental Research and Public Health 17, no. 7: 2188. https://doi.org/10.3390/ijerph17072188

APA StyleDubas-Jakóbczyk, K., Kocot, E., & Kozieł, A. (2020). Financial Performance of Public Hospitals: A Cross-Sectional Study among Polish Providers. International Journal of Environmental Research and Public Health, 17(7), 2188. https://doi.org/10.3390/ijerph17072188