Quality of Life and Health: Influence of Preparation for Retirement Behaviors through the Serial Mediation of Losses and Gains

Abstract

1. Introduction

1.1. Antecedents of Retirement Adjustment

- (1)

- Variables related to the transition to retirement;

- (2)

- psychological predispositions;

- (3)

- changes in resources.

1.2. Individual Retirement-Related Features

1.3. Retirement Preparation Behaviors

1.4. Gains and Losses of Resources

1.5. Adjustment to Retirement: Amplitude of the Indicators

2. Materials and Methods

2.1. Instruments

2.2. Procedure

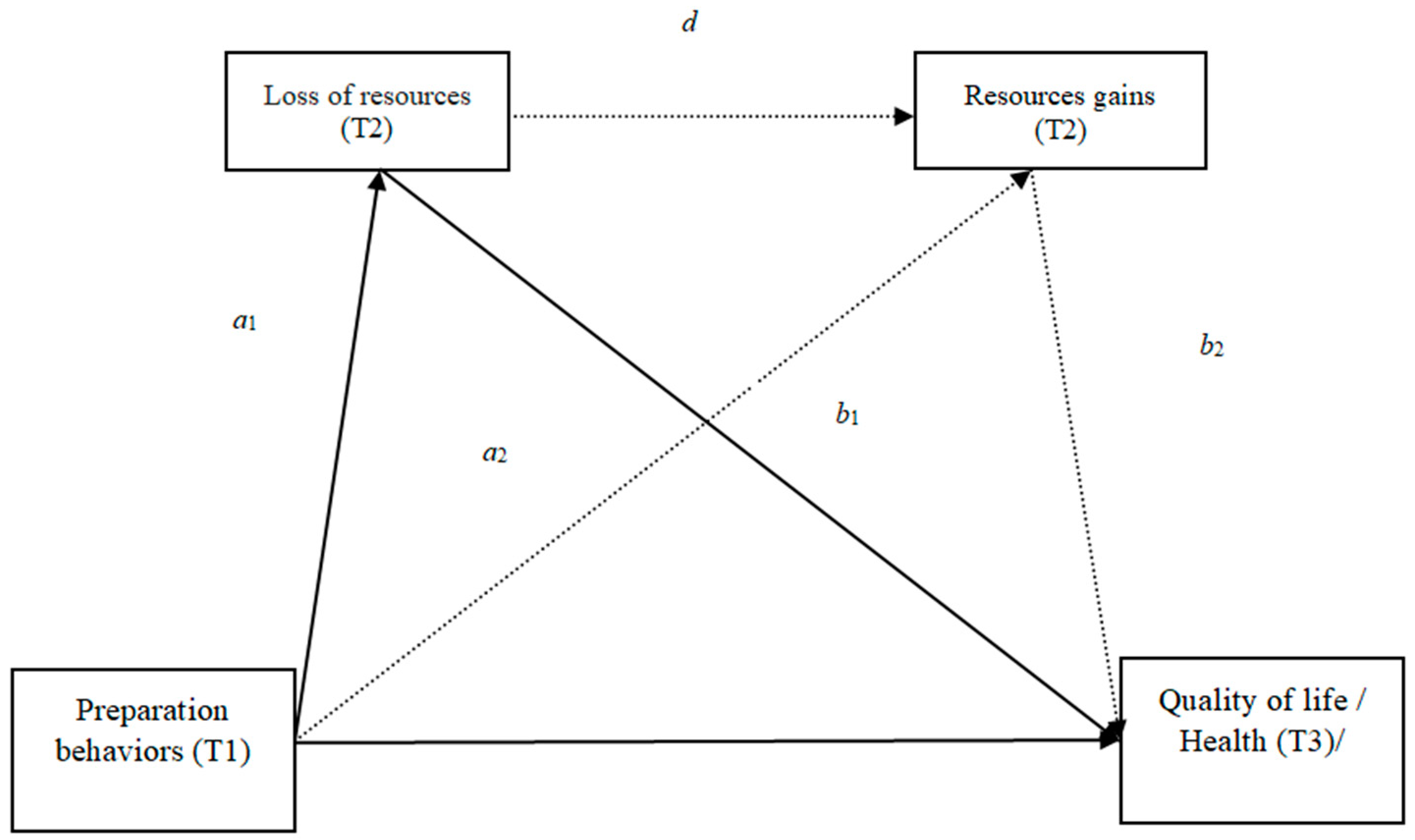

3. Results

3.1. Hypothesis Testing

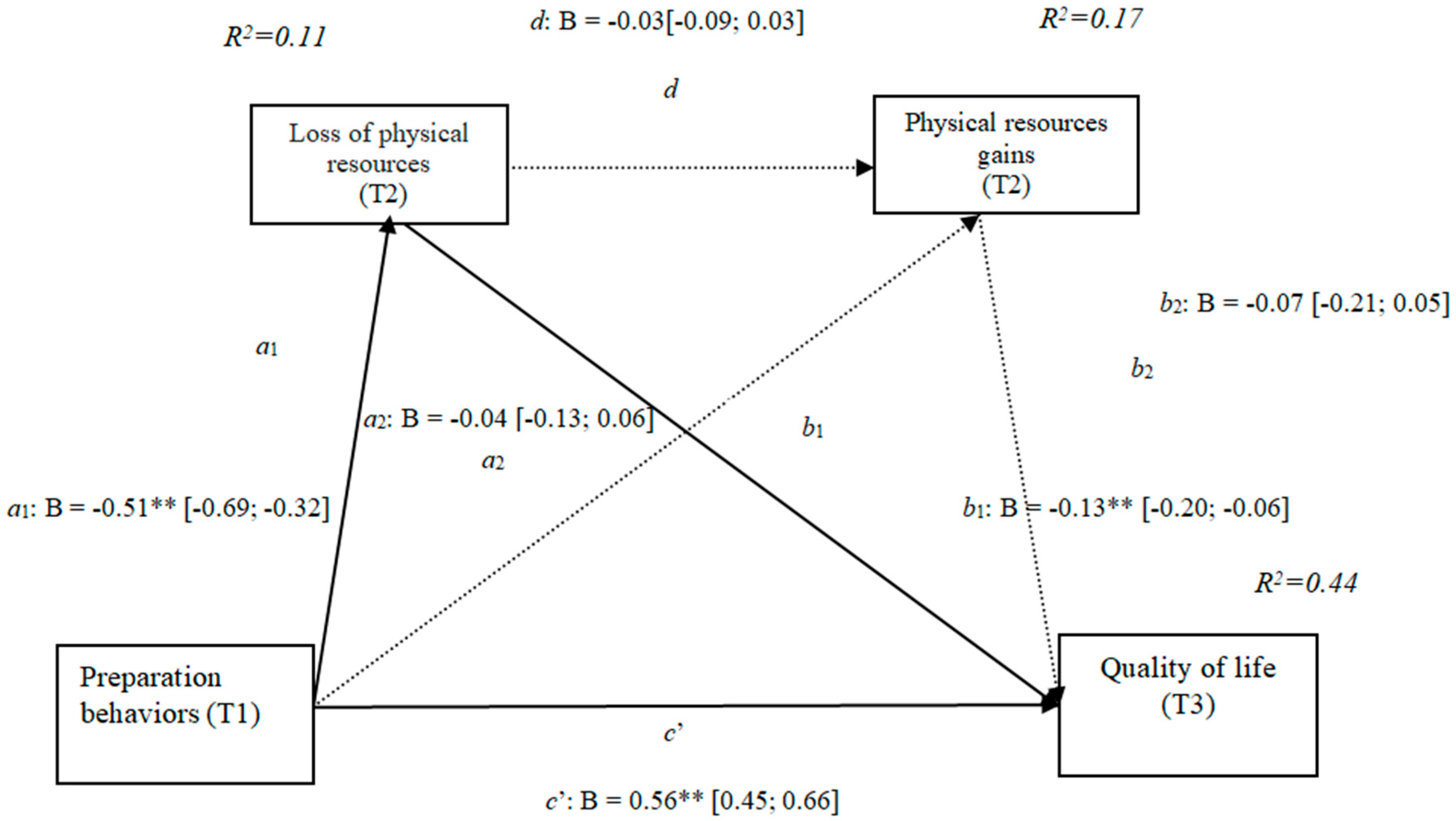

3.2. Losses and Gains of Physical Resources (h3a)

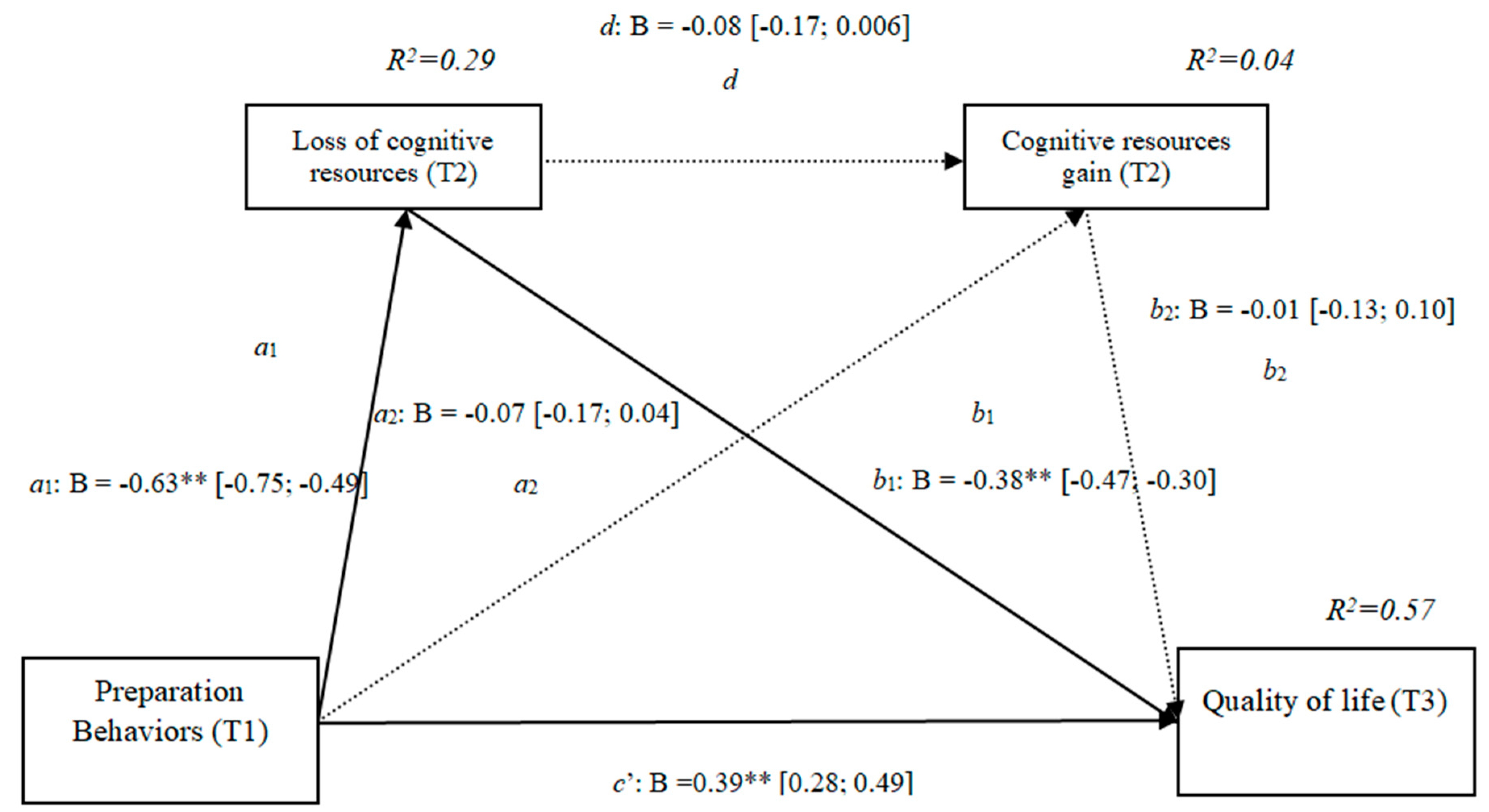

3.3. Gains and Losses of Cognitive Resources (h3b)

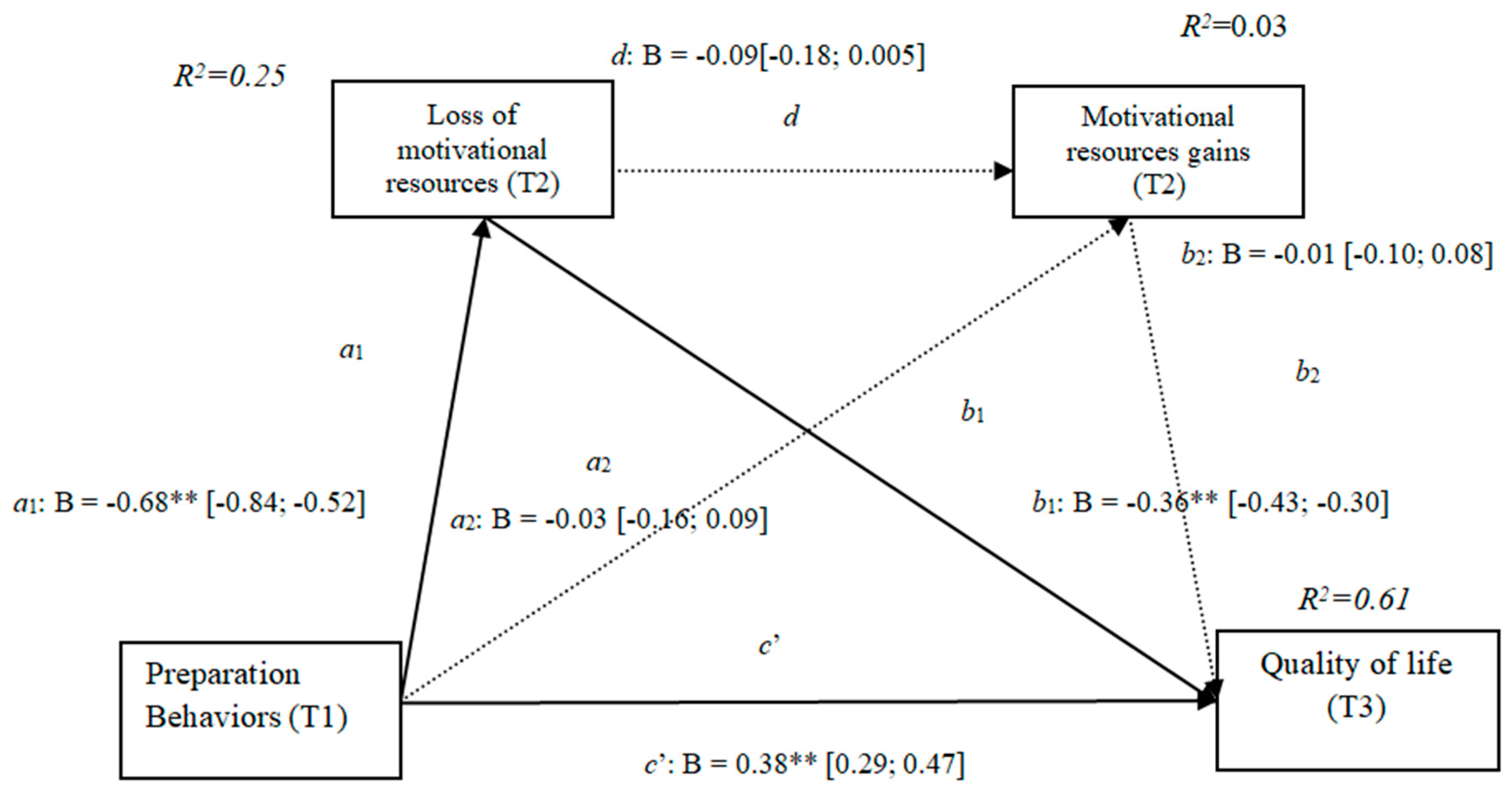

3.4. Losses and Gains of Motivational Resources (h3c)

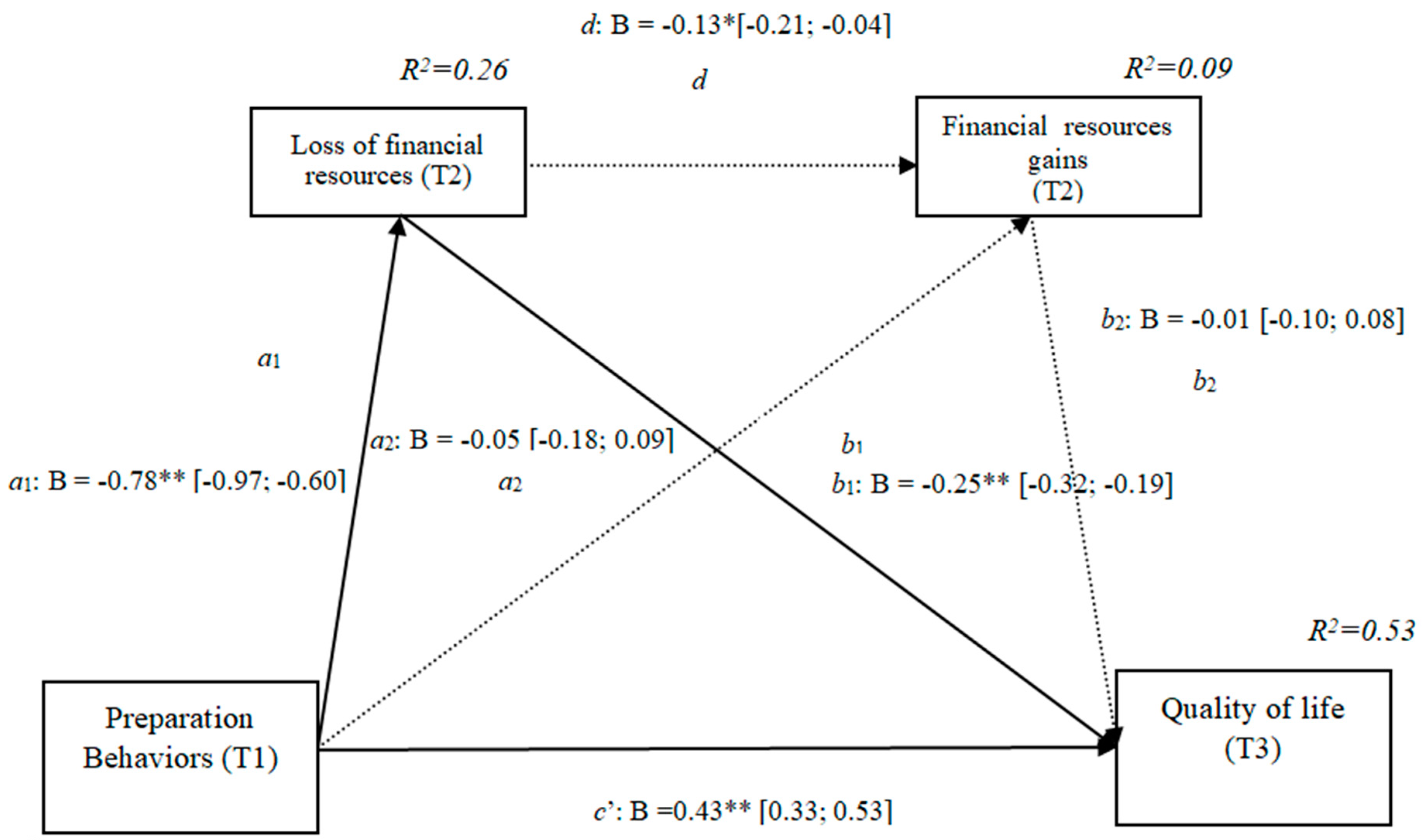

3.5. Losses and Gains of Financial Resources (h3d)

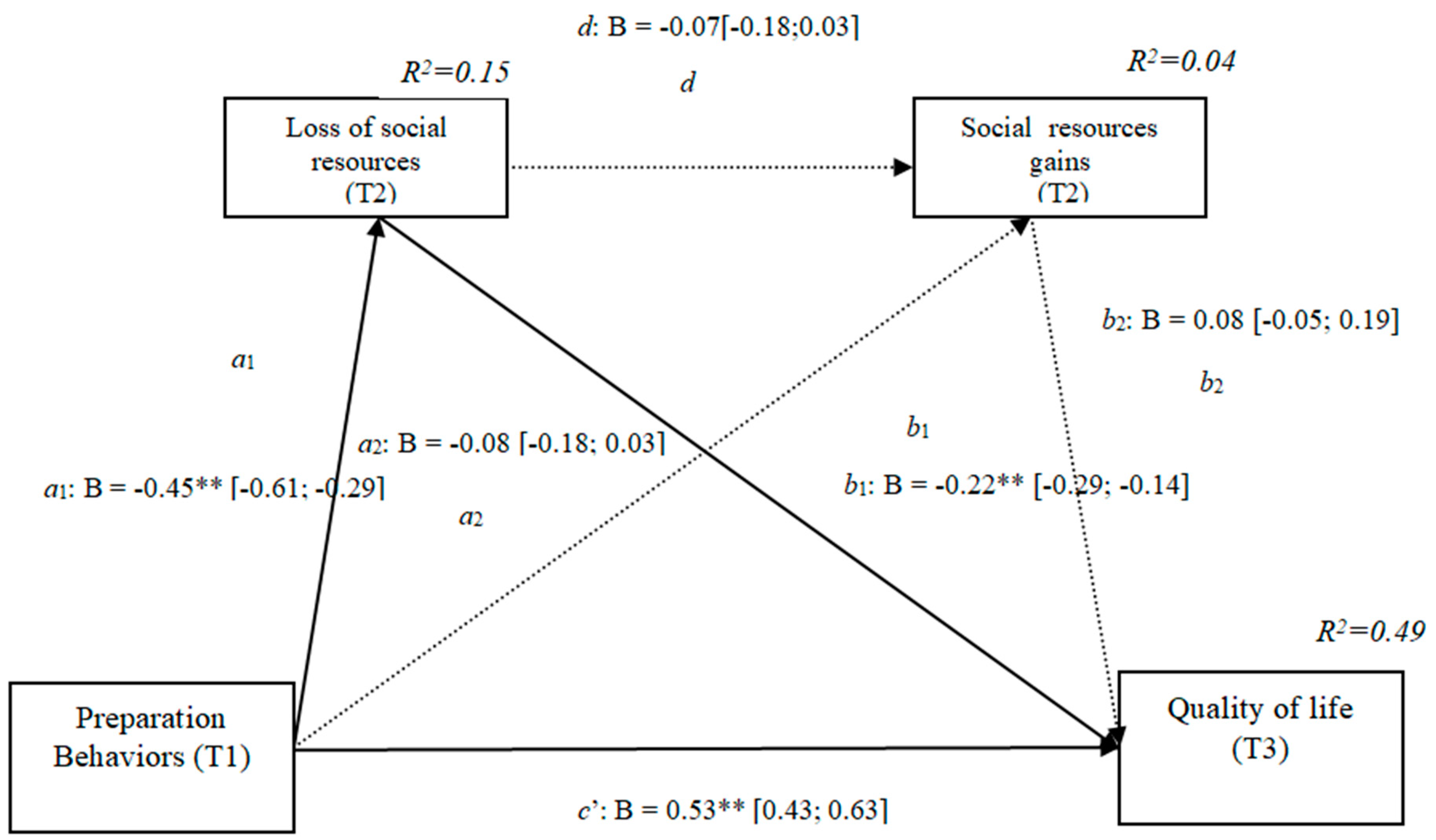

3.6. Losses and Gains of Social Resources (h3e)

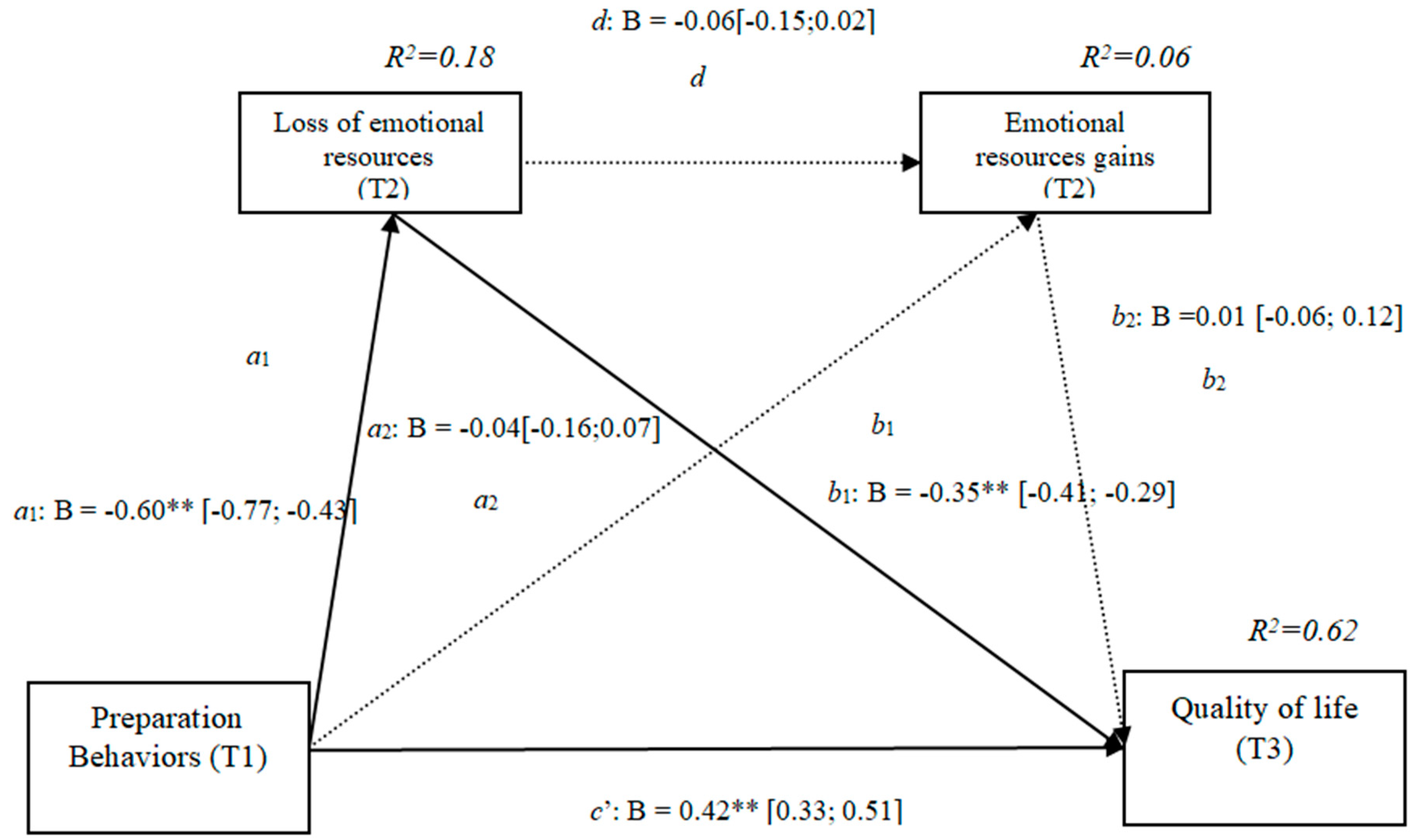

3.7. Losses and Gains of Emotional Resources (h3f)

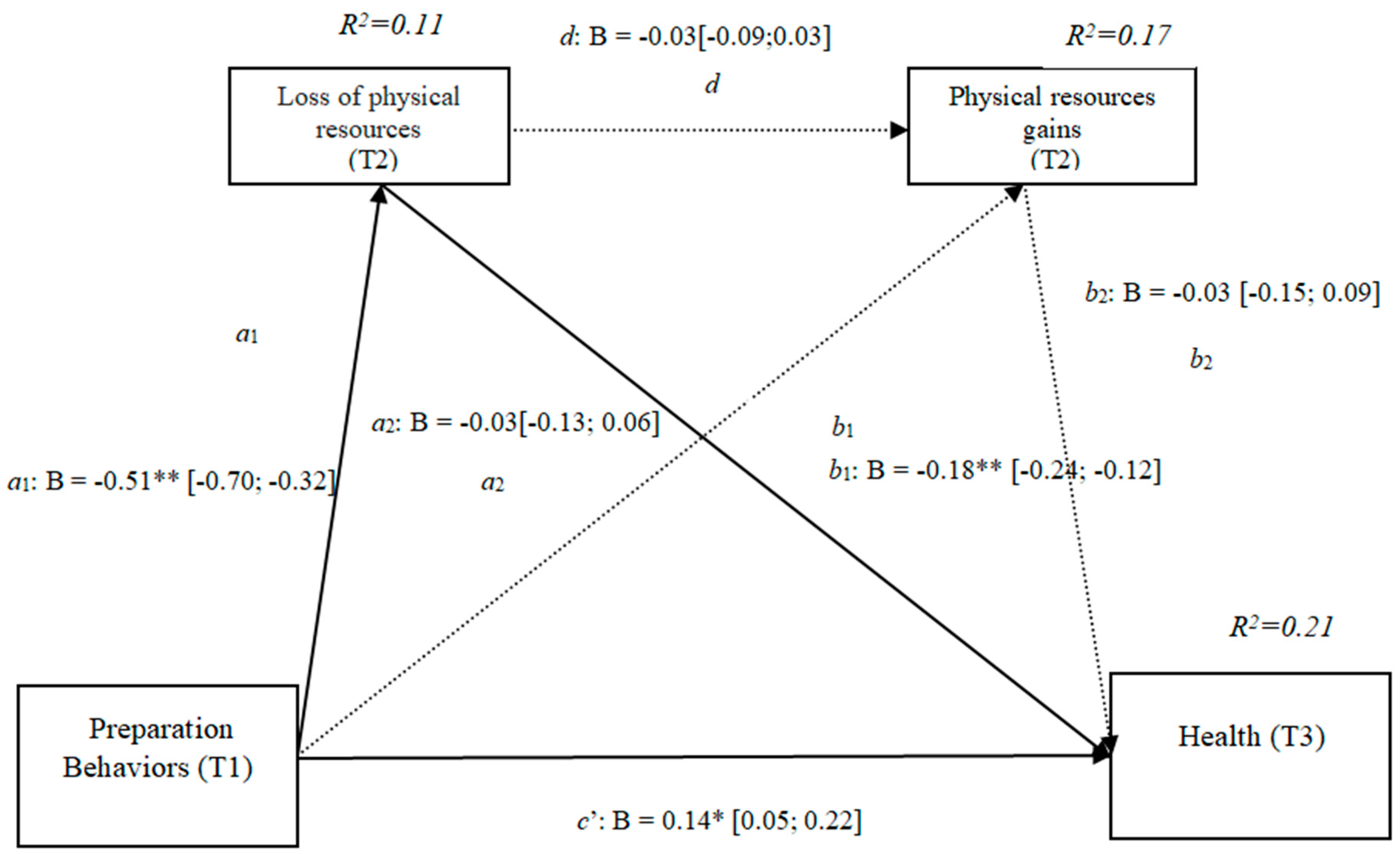

3.8. Losses and Gains of Physical Resources (h4a)

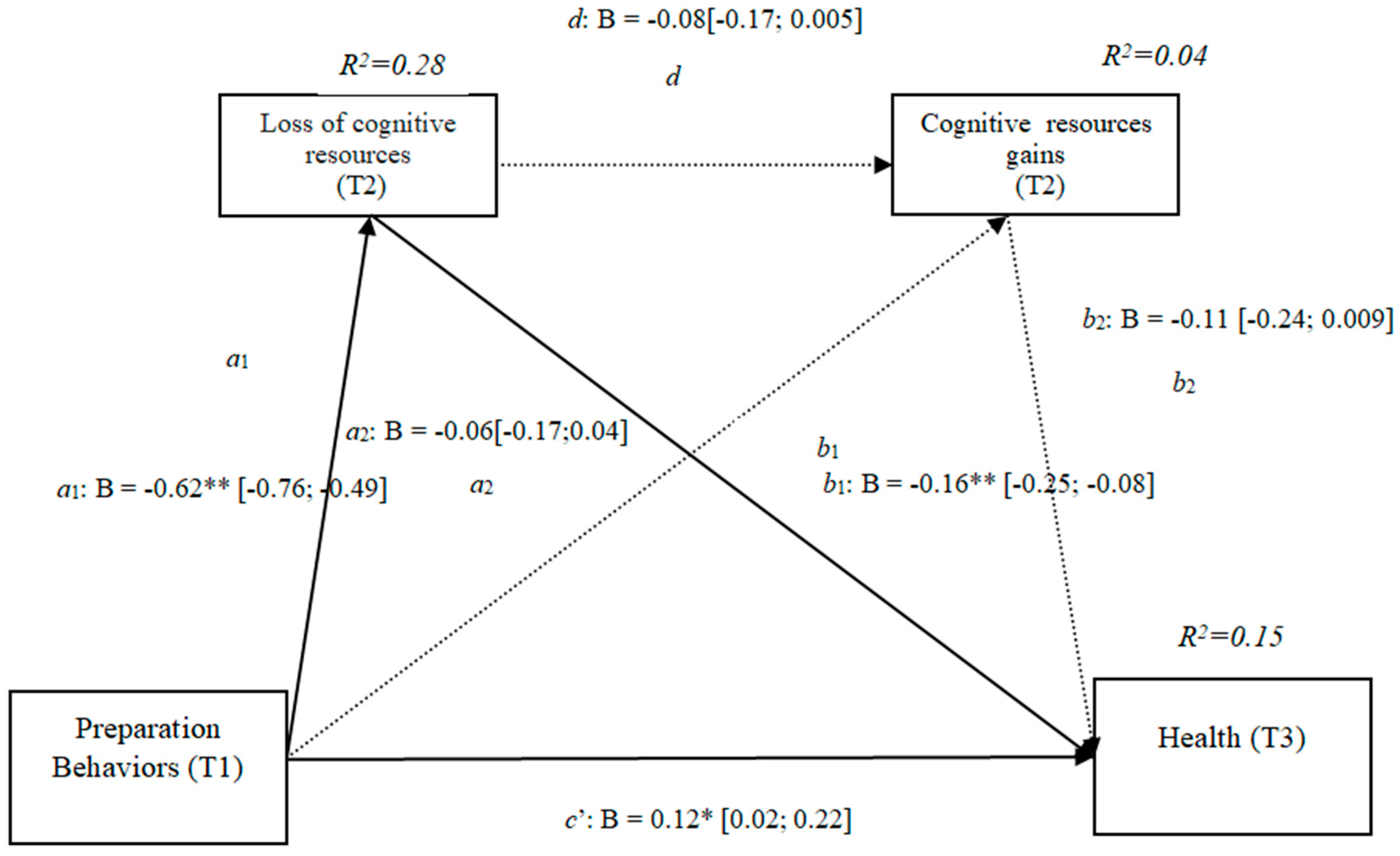

3.9. Gains and Losses of Cognitive Resources (h4b)

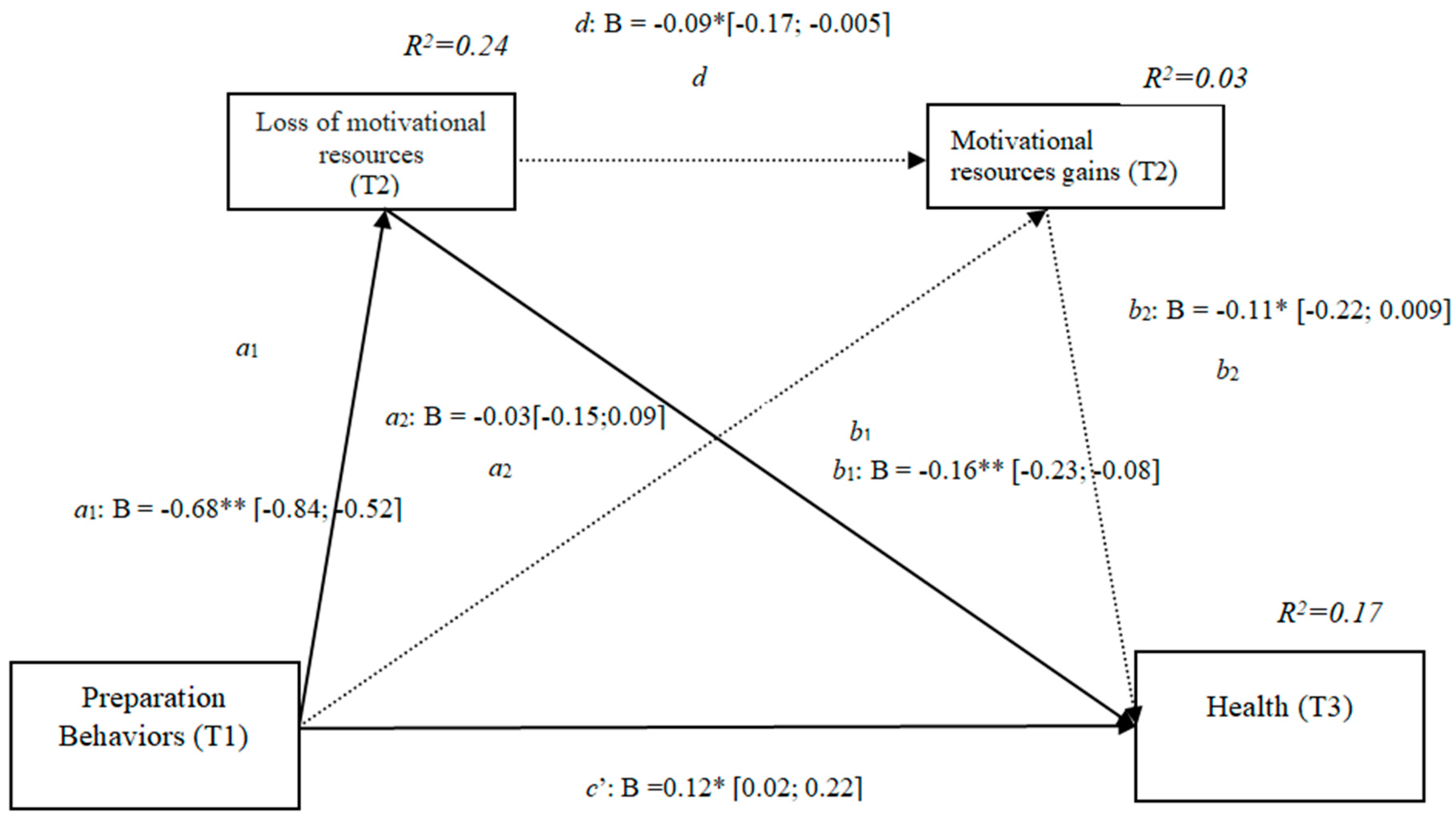

3.10. Losses and Gains of Motivational Resources (h4c)

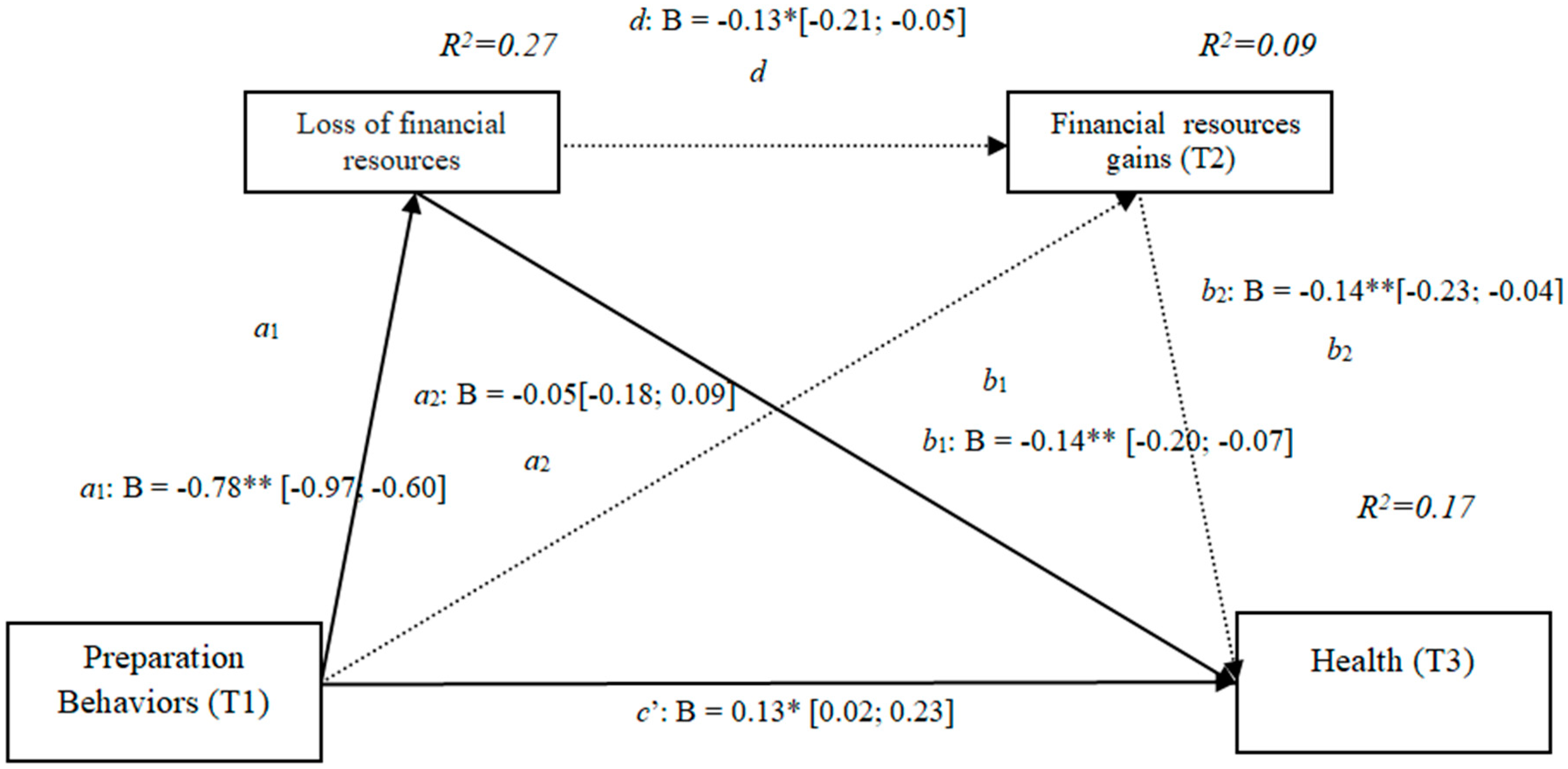

3.11. Losses and Gains of Financial Resources (h4d)

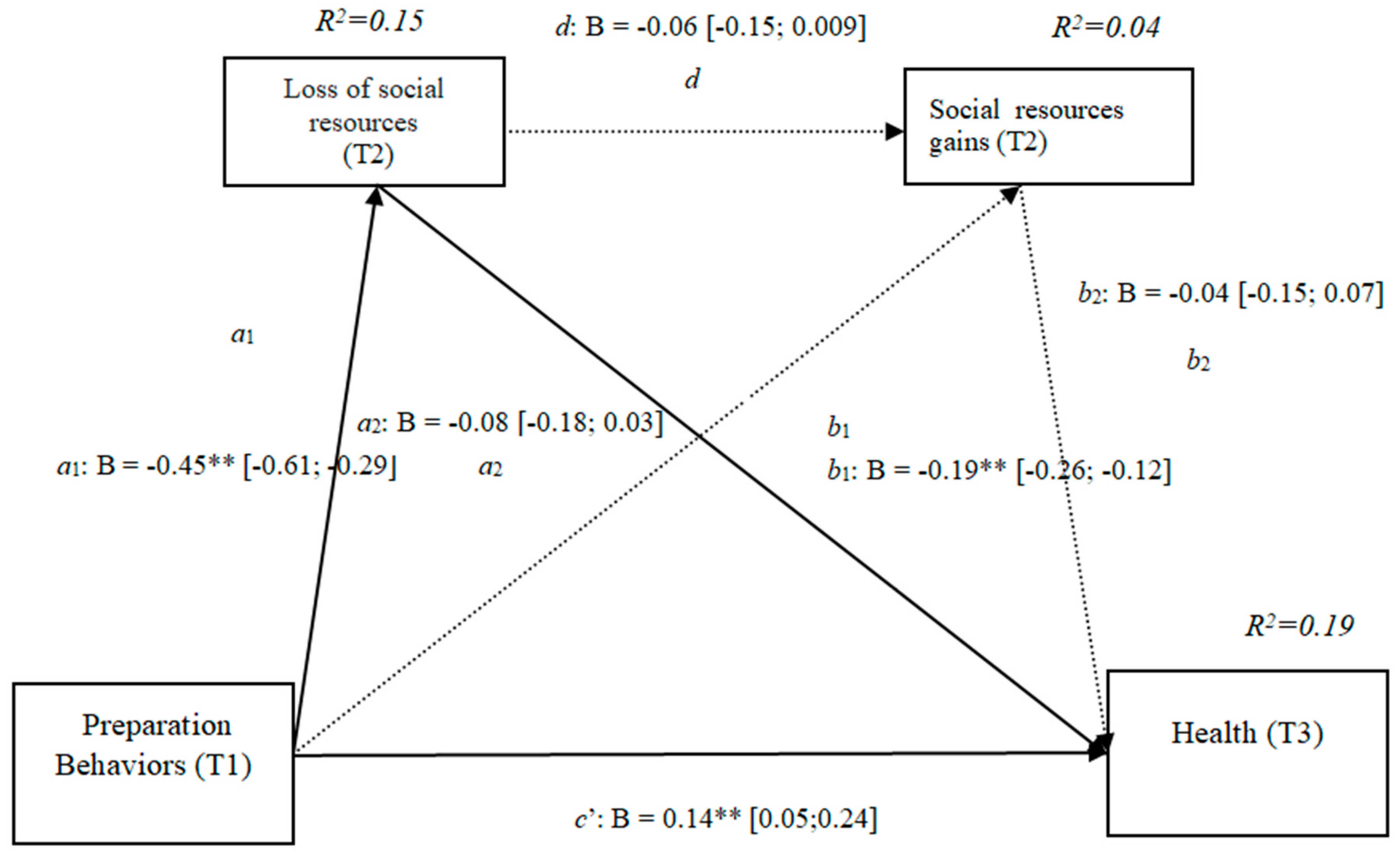

3.12. Losses and Gains of Social Resources (h4e)

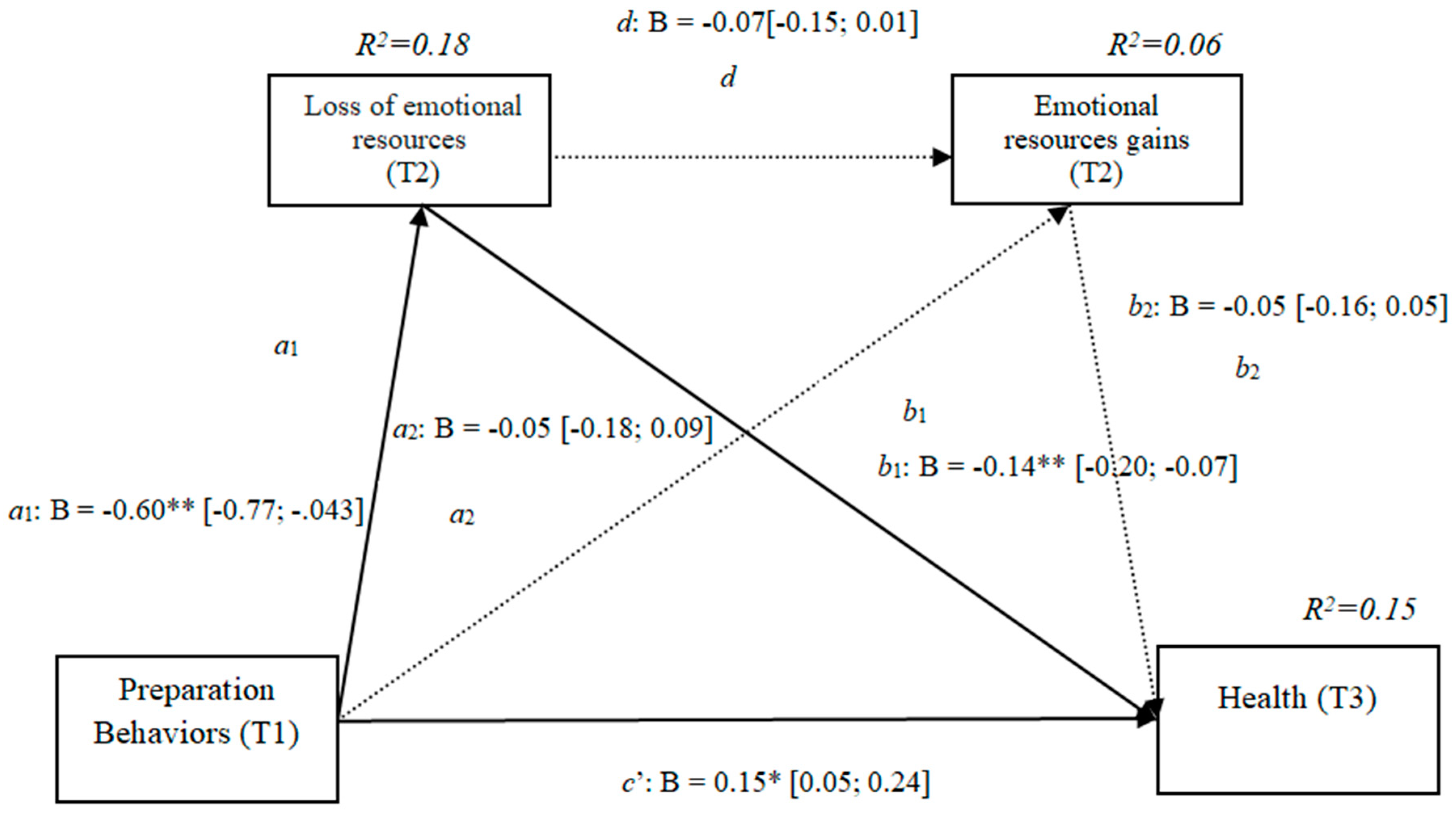

3.13. Losses and Gains of Emotional Resources (h4f)

4. Discussion

5. Practical Implications

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Van Solinge, H. Adjustment to Retirement. In The Oxford Handbook of Retirement Oxford; Wang, M., Ed.; Oxford University Press: Oxford, UK, 2013; pp. 311–324. [Google Scholar]

- Wang, M.; Henkens, K.; van Solinge, H. Retirement adjustment: A review of theoretical and empirical advancements. Am. Psychol. 2011, 66, 204. [Google Scholar] [CrossRef]

- Dingemans, E.; Henkens, K. How do retirement dynamics influence mental well-being in later life? A 10-year panel study. Scand. J. Work Environ. Health 2015, 41, 16–23. [Google Scholar] [CrossRef]

- Wang, M. Profiling retirees in the retirement transition and adjustment process: Examining the longitudinal change patterns of retirees’ psychological well-being. J. Appl. Psychol. 2007, 92, 455. [Google Scholar] [CrossRef] [PubMed]

- Topa, G.; Moriano, J.A.; Depolo, M.; Alcover, C.; Morales, J.F. Antecedents and consequences of retirement planning and decision-making: A meta-analysis and model. J. Vocat. Behav. 2009, 75, 38–55. [Google Scholar] [CrossRef]

- Noone, J.H.; Stephens, C.; Alpass, F. The process of Retirement Planning Scale (PRePS): Development and validation. Psychol. Assess. 2010, 22, 520. [Google Scholar] [CrossRef]

- Feldman, D.C. Feeling like it’s time to retire: A fit perspective on early retirement decisions. In The Oxford Handbook of Retirement; Oxford University Press: New York, NY, USA, 2013. [Google Scholar]

- Atchley, R.C.; Robinson, J.L. Attitudes toward retirement and distance from the event. Res. Aging 1982, 4, 299–313. [Google Scholar] [CrossRef]

- Mourao, P.R.; Vilela, C. ‘No country for old men’? The multiplier effects of pensions in Portuguese municipalities. J. Pension Econ. Financ. 2018, 1–15. [Google Scholar] [CrossRef]

- Lo, R.; Brown, R. Stress and adaptation: Preparation for successful retirement. Aust. N. Z. J. Ment. Health Nurs. 1999, 8, 30–38. [Google Scholar] [CrossRef]

- Wong, J.Y.; Earl, J.K. Towards an integrated model of individual, psychosocial, and organizational predictors of retirement adjustment. J. Vocat. Behav. 2009, 75, 1–13. [Google Scholar] [CrossRef]

- Wang, M.; Liao, H.; Zhan, Y.; Shi, J. Daily customer mistreatment and employee sabotage against customers: Examining emotion and resource perspectives. Acad. Manag. J. 2011, 54, 312–334. [Google Scholar] [CrossRef]

- Leung, C.S.; Earl, J.K. Retirement Resources Inventory: Construction, factor structure and psychometric properties. J. Vocat. Behav. 2012, 81, 171–182. [Google Scholar] [CrossRef]

- Topa, G.; Valero, E. Preparing for retirement: How self-efficacy and resource threats contribute to retirees’ satisfaction, depression, and losses. Eur. J. Work Organ. Psychol. 2017, 26, 811–827. [Google Scholar] [CrossRef]

- Topa, G.; Pra, I. Retirement adjustment quality: Optimism and self-efficacy as antecedents of resource accumulation. Appl. Res. Qual. Life 2017, 13, 1–21. [Google Scholar] [CrossRef]

- Shore, L.M.; Cleveland, J.N.; Goldberg, C.B. Work attitudes and decisions as a function of manager age and employee age. J. Appl. Psychol. 2003, 88, 529. [Google Scholar] [CrossRef] [PubMed]

- Bayl-Smith, P.H.; Griffin, B. Age discrimination in the workplace: Identifying as a late-career worker and its relationship with engagement and intended retirement age. J. Appl. Soc. Psychol. 2014, 44, 588–599. [Google Scholar] [CrossRef]

- Maurer, T.J.; Barbeite, F.G.; Weiss, E.M.; Lippstreu, M. New measures of stereotypical beliefs about older workers’ ability and desire for development: Exploration among employees age 40 and over. J. Manag. Psychol. 2008, 23, 395–418. [Google Scholar] [CrossRef]

- Parry, E.; Urwin, P. Generational differences in work values: A review of theory and evidence. Int. J. Manag. Rev. 2011, 13, 79–96. [Google Scholar] [CrossRef]

- Noone, J.; O’Loughlin, K.; Kendig, H. Australian baby boomers retiring ‘early’: Understanding the benefits of retirement preparation for involuntary and voluntary retirees. J. Aging Stud. 2013, 27, 207–217. [Google Scholar] [CrossRef] [PubMed]

- Hesketh, B.; Griffin, B.; Loh, V. A future-oriented retirement transition adjustment framework. J. Vocat. Behav. 2011, 79, 303–314. [Google Scholar] [CrossRef]

- Lee, W.K.M.; Law, K.W. Retirement planning and retirement satisfaction: The need for a national retirement program and policy in Hong Kong. J. Appl. Gerontol. 2004, 23, 212–233. [Google Scholar] [CrossRef]

- Yeung, D.Y. Is pre-retirement planning always good? An exploratory study of retirement adjustment among Hong Kong Chinese retirees. Aging Ment. Health 2013, 17, 386–393. [Google Scholar] [CrossRef] [PubMed]

- Hershey, D.A.; Henkens, K.; Van Dalen, H.P. Aging and financial planning for retirement: Interdisciplinary influences viewed through a cross-cultural lens. Int. J. Aging Hum. Dev. 2010, 70, 1–38. [Google Scholar] [CrossRef] [PubMed]

- Koposko, J.L.; Kiso, H.; Hershey, D.A.; Gerrans, P. Perceptions of retirement savings relative to peers. Work Aging Retire. 2015, 2, 65–72. [Google Scholar] [CrossRef]

- Petkoska, J.; Earl, J.K. Understanding the influence of demographic and psychological variables on retirement planning. Psychol. Aging 2009, 24, 245. [Google Scholar] [CrossRef] [PubMed]

- Muratore, A.M.; Earl, J.K. Predicting retirement preparation through the design of a new measure. Aust. Psychol. 2010, 45, 98–111. [Google Scholar] [CrossRef]

- Hobfoll, S.E. The Plenum Series on Stress and Coping. Stress, Culture, and Community: The Psychology and Philosophy of Stress; Plenum Press: New York, NY, USA, 1998. [Google Scholar] [CrossRef]

- Hobfoll, S.E. Conservation of resources theory: Its implication for stress. In The Oxford Handbook of Stress, Health, and Coping; Folkma, S., Ed.; Oxford University Press: New York, NY, USA, 2010; pp. 127–147. [Google Scholar]

- Hobfoll, S.E. Conservation of resource caravans and engaged settings. J. Occup Organ. Psychol. 2011, 84, 116–122. [Google Scholar] [CrossRef]

- Hobfoll, S.E.; Lilly, R.S. Resource conservation as a strategy for community psychology. J. Community Psychol. 1993, 21, 128–148. [Google Scholar] [CrossRef]

- Staudinger, U.M.; Marsiske, M.; Baltes, P.B. Resilience and reserve capacity in later adulthood: Potentials and limits of development across the life span. Dev. Psychopathol. 1995, 2, 801–847. [Google Scholar]

- Freund, A.M.; Riediger, M. What I Have and What I Do the Role of Resource Loss and Gain Throughout Life. Appl. Psychol. 2001, 50, 370–380. [Google Scholar] [CrossRef]

- Heckhausen, J.; Dweck, C.S. Motivation and Self-Regulation across the Life Span; Cambridge University Press: Cambridge, UK, 1998. [Google Scholar]

- Freund, A.M.; Baltes, P.B. Selection, optimization, and compensation as strategies of life management: Correlations with subjective indicators of successful aging. Psychol. Aging 1998, 13, 531. [Google Scholar] [CrossRef]

- Freund, A.M.; Baltes, P.B. The Orchestration of Selection, Optimization and Compensation: An Action-Theoretical Conceptualization of a Theory of Developmental Regulation. In Control of Human Behavior, Mental Processes, and Consciousness: Essays in Honor of the 60th Birthday of August Flammer; Perrig, W., Grob, A., Eds.; Lawrence Erlbaum: Mahwaj, NJ, USA, 2000; pp. 35–58. [Google Scholar]

- Davidson, K.W.; Mostofsky, E.; Whang, W. Don’t worry, be happy: Positive affect and reduced 10-year incident coronary heart disease: The Canadian Nova Scotia Health Survey. Eur. Heart J. 2010. [Google Scholar] [CrossRef]

- Wells, J.D.; Hobfoll, S.E.; Lavin, J. When it rains, it pours: The greater impact of resource loss compared to gain on psychological distress. Person. Soc. Psychol. Bull. 1999, 25, 1172–1182. [Google Scholar] [CrossRef]

- Hobfoll, S.E.; Wells, J.D. Conservation of resources, stress, and aging. In Handbook of Aging and Mental Health; Springer: Boston, MA, USA, 1998; pp. 121–134. [Google Scholar]

- Topa, G.; Jiménez, I.; Valero, E.; Ovejero, A. Resource loss and gain, life satisfaction, and health among retirees in Spain: Mediation of social support. J. Aging Health 2017, 29, 415–436. [Google Scholar] [CrossRef]

- Segel-Karpas, D.; Bamberger, P.A.; Bacharach, S.B. Income decline and retiree well-being: The moderating role of attachment. Psychol. Aging 2013, 28, 1098. [Google Scholar] [CrossRef]

- Ekerdt, D.J.; DeViney, S. Evidence for a preretirement process among older male workers. J. Gerontol. 1993, 48, S35–S43. [Google Scholar] [CrossRef] [PubMed]

- Fletcher, W.L.; Hansson, R.O. Assessing the social components of retirement anxiety. Psychol. Aging 1991, 6, 76. [Google Scholar] [CrossRef] [PubMed]

- Gibson, C.H. A concept analysis of empowerment. J. Adv. Nurs. 1991, 16, 354–361. [Google Scholar] [CrossRef] [PubMed]

- Neuhs, H.P. Retirement self-efficacy: The effects of socioeconomic status, life satisfaction, health, and readiness for retirement. J. N. Y. State Nurses Assoc. 1990, 21, 15–20. [Google Scholar] [PubMed]

- Thériault, J. Retirement as a psychosocial transition: Process of adaptation to change. Int. J. Aging Hum. Dev. 1994, 38, 153–170. [Google Scholar] [CrossRef]

- Calasanti, T.M. Gender and life satisfaction in retirement: An assessment of the male model. J. Gerontol. Ser. B Psychol. Sci. Soc. Sci. 1996, 51, S18–S29. [Google Scholar] [CrossRef]

- Gall, T.L.; Evans, D.R.; Howard, J. The retirement adjustment process: Changes in the well- being of male retirees across time. J. Gerontol. Ser. B: Psychol. Sci. Soc. Sci. 1997, 52, P110–P117. [Google Scholar] [CrossRef]

- Quick, H.E.; Moen, P. Gender, employment and retirement quality: A life course approach to the differential experiences of men and women. J. Occup. Health Psychol. 1998, 3, 44. [Google Scholar] [CrossRef]

- Richardson, V.; Kilty, K.M. Adjustment to retirement: Continuity vs. discontinuity. Int. J. Aging Hum. Dev. 1991, 33, 151–169. [Google Scholar] [CrossRef]

- Kim, J.E.; Moen, P. Retirement transitions, gender, and psychological well-being: A life- course, ecological model. J. Gerontol. Ser. B Psychol. Sci. Soc. Sci. 2002, 57, P212–P222. [Google Scholar] [CrossRef]

- Van Solinge, H. Health change in retirement: a longitudinal study among older workers in the Netherlands. Res. Aging 2007, 29, 225–256. [Google Scholar] [CrossRef]

- Ringle, C.M.; Wende, S.; Will, A. Customer segmentation with FIMIX-PLS. In Proceedings of the PLS-05 International Symposium, SPAD Test&go, Paris, France; 2005; pp. 507–514. [Google Scholar]

- Hyde, M.; Wiggins, R.D.; Higgs, P.; Blane, D.B. A measure of quality of life in early old age: The theory, development and properties of a needs satisfaction model (CASP-19). Aging Ment. Health 2003, 7, 186–194. [Google Scholar] [CrossRef]

- Kim, G.R.; Netuveli, G.; Blane, D.; Peasey, A.; Malyutina, S.; Simonova, G.; Kubinova, R.; Pajak, A.; Croezen, S.; Bobak, M.; et al. Psychometric properties and confirmatory factor analysis of the CASP-19, a measure of quality of life in early old age: The HAPIEE study. Aging Ment. Health 2015, 19, 595–609. [Google Scholar] [CrossRef]

- Ware, J. SF-36 health survey update. Spine 2000, 25, 3130–3139. [Google Scholar] [CrossRef]

- Vilagut, G.; Valderas, J.M.; Ferrer, M.; Garin, O.; López-García, E.; Alonso, J. Interpretación de los cuestionarios de salud SF-36 y SF-12 en España: Componentes físico y mental. Med. Clín. 2008, 130, 726–735. [Google Scholar] [CrossRef]

- Barnes-Farrell, J.L. Beyond health and wealth: Attitudinal and other influences on retirement decision-making. In Retirement: Reasons, Processes, and Results; Springer: Berlin, Germany, 2003; pp. 159–187. [Google Scholar]

- Zaniboni, S. The interaction between older workers’ personal resources and perceived age discrimination affects the desired retirement age and the expected adjustment. Work Aging Retire. 2015, 1, 266–273. [Google Scholar] [CrossRef]

- Vanhercke, D.; Kirves, K.; De Cuyper, N.; Verbruggen, M.; Forrier, A.; De Witte, H. Perceived employability and psychological functioning framed by gain and loss cycles. Career Dev. Int. 2015, 20, 179–198. [Google Scholar] [CrossRef]

- Barbosa, L.M.; Monteiro, B.; Murta, S.G. Retirement adjustment predictors—A systematic review. Work Aging Retire. 2016, 2, 262–280. [Google Scholar] [CrossRef]

- Funkhouser, A.; Würmle, O.; Carnes, K.; Locher, P.; Ramseyer, F.; Bahro, M. Boundary Questionnaire results and dream recall among persons going through retirement. Int. J. Dream Res. 2008, 1, 34–38. [Google Scholar]

- Budowski, M.; Schief, S.; Sieber, R. Precariousness and quality of life—a qualitative perspective on quality of life of households in precarious prosperity in Switzerland and Spain. Appl. Res. Qual. Life 2016, 11, 1035–1058. [Google Scholar] [CrossRef]

- Di Fabio, A.; Blustein, D.L. From Meaning of Working to Meaningful Lives: The Challenges of Expanding Decent Work. Front. Psychol. 2016, 7, 1119. [Google Scholar] [CrossRef]

- Navascués, A.; Calvo-Medel, D.; Bombin-Martín, A. Efectos del bienestar subjetivo y psicológico en los resultados terapéuticos de un hospital de día. Acción Psicológica 2016, 13, 143–156. [Google Scholar] [CrossRef]

- Leandro-França, C.; Van Solinge, H.; Henkens, K.; Murta, S.G. Effects of three types of retirement preparation program: A qualitative study of civil servants in Brazil. Educ. Gerontol. 2016, 42, 388–400. [Google Scholar] [CrossRef][Green Version]

- Fisher, G.G.; Chaffee, D.S.; Sonnega, A. Retirement timing: A review and recommendations for future research. Work Aging Retire. 2016, 2, 230–261. [Google Scholar] [CrossRef]

- Topa, G.; Depolo, M.; Alcover, C. Early retirement: A meta-analysis of its antecedent and subsequent correlates. Front. Psychol. 2018. [Google Scholar] [CrossRef] [PubMed]

- Yeung, D.Y.; Zhou, X. Planning for retirement: Longitudinal effect on retirement resources and post-retirement well-being. Front. Psychol. 2017, 8, 1300. [Google Scholar] [CrossRef]

- Lawless, M. Determinants of Early Withdrawal and of Early Withdrawal by Reason of Disability from the Irish labour Force in the Third Age 2016. Available online: http://hdl.handle.net/10197/8543 (accessed on 30 April 2019).

- Paul, K.I.; Batinic, B. The need for work: Jahoda’s latent functions of employment in a representative sample of the German population. J. Organ. Behav. 2010, 31, 45–64. [Google Scholar] [CrossRef]

- Gordon, L.; Walker, S.; Mervin, M.; Lowe, A.; Smith, D.; Gardiner, R.A.; Chambers, S.K. Financial toxicity: A potential side effect of prostate cancer treatment among Australian men. Eur. J. Cancer Care 2017, 26, e12392. [Google Scholar] [CrossRef]

- Mehnert, A. Employment and work-related issues in cancer survivors. Crit. Rev. Oncol. Hematol. 2011, 77, 109–130. [Google Scholar] [CrossRef] [PubMed]

- Bates, N.; Callander, E.; Lindsay, D.; Watt, K. Labour force participation and the cost of lost productivity due to cancer in Australia. BMC Public Health 2018, 18, 375. [Google Scholar] [CrossRef] [PubMed]

- Kim, S.; Feldman, D.C. Working in retirement: The antecedents of bridge employment and its consequences for quality of life in retirement. Acad. Manag. J. 2000, 43, 1195–1210. [Google Scholar]

- Muratore, A.M.; Earl, J.K. Improving retirement outcomes: The role of resources, pre- retirement planning and transition characteristics. Ageing Soc. 2015, 35, 2100–2140. [Google Scholar] [CrossRef]

- Chou, K.; Chi, I. Reciprocal relationship between social support and depressive symptoms among Chinese elderly. Aging Ment. Health 2003, 7, 224–231. [Google Scholar] [CrossRef] [PubMed]

- Van Solinge, H.; Henkens, K. Adjustment to and satisfaction with retirement: Two of a kind? Psychol. Aging 2008, 23, 422. [Google Scholar] [CrossRef] [PubMed]

- Layne, D.M.; Nemeth, L.S.; Mueller, M.; Martin, M. Negative Behaviors among Healthcare Professionals: Relationship with Patient Safety Culture. Healthc. Multidiscip. Digit. Publ. Inst. 2019, 7, 23. [Google Scholar] [CrossRef] [PubMed]

- Horstmeier, C.A.; Homan, A.C.; Rosenauer, D.; Voelpel, S.C. Developing multiple identifications through different social interactions at work. Eur. J. Work Organ. Psychol. 2016, 25, 928–944. [Google Scholar] [CrossRef]

- Zhan, Y.; Wang, M.; Shi, J. Retirees’ motivational orientations and bridge employment: Testing the moderating role of gender. J. Appl. Psychol. 2015, 100, 1319. [Google Scholar] [CrossRef] [PubMed]

- De los Ríos Carmenado, I.; Reyes, A.; Torres, J.G. Complejidad en la dirección de proyectos: Análisis conceptual desde el modelo working with people. Revista DYNA 2015, 90, 23. [Google Scholar] [CrossRef]

- Maestas, N. Back to work expectations and realizations of work after retirement. J. Hum. Resour. 2010, 45, 718–748. [Google Scholar] [CrossRef] [PubMed]

- Fehr, R. Is retirement always stressful? Potential Impact Creat. 2012. [Google Scholar] [CrossRef]

- Zacher, H.; Yang, J. Organizational climate for successful aging. Front. Psychol. 2016, 7, 1007. [Google Scholar] [CrossRef]

- Kim, J.; Chun, S.; Heo, J.; Lee, S.; Han, A. Contribution of leisure-time physical activity on psychological benefits among elderly immigrants. Appl. Res. Qual. Life 2016, 11, 461–470. [Google Scholar] [CrossRef]

- Petrou, P.; Bakker, A.B.; den Heuvel, M. Weekly job crafting and leisure crafting: Implications for meaning-making and work engagement. J. Occup. Organ. Psychol. 2017, 90, 129–152. [Google Scholar] [CrossRef]

- Fitzpatrick, M.D.; Moore, T.J. The mortality effects of retirement: Evidence from Social Security eligibility at age 62. J. Public Econ. 2018, 157, 121–137. [Google Scholar] [CrossRef]

| M | SD | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. Age (T1) | 62.08 | 4.88 | 1 | |||||||||||||||||

| 2. Gender (T1) | (a) | (a) | 0.01 | 1 | ||||||||||||||||

| 3. Seniority in employment(T1) | 29.9 | 9.3 | 0.28 ** | −0.02 | 1 | |||||||||||||||

| 4. Number dependent(T1) | 1.43 | 1.48 | −0.09 | 0.00 | −0.14 * | 1 | ||||||||||||||

| 5. Behaviors Retirement Preparation (T1) | 3.33 | 0.65 | 0.04 | 0.01 | 0.05 | −0.09 | 1 | |||||||||||||

| 6. Physical R. Losses(T2) | 2.24 | 1.00 | −0.00 | 0.05 | 0.01 | 0.01 | −0.31 ** | 1 | ||||||||||||

| 7. Earnings R. Physical (T2) | 3.47 | 0.49 | −0.07 | −0.38 ** | −0.10 | −0.01 | −0.04 | −0.07 | 1 | |||||||||||

| 8. Losses R. Cognitive (T2) | 2.10 | 0.80 | −0.02 | −0.06 | 0.07 | 0.14 * | −0.50 ** | 0.42 ** | −0.02 | 1 | ||||||||||

| 9. Earnings R. Cognitive(T2) | 3.62 | 0.47 | −0.04 | 0.01 | −0.04 | −0.12 * | −0.02 | −0.02 | 0.55 ** | −0.11 | 1 | |||||||||

| 10. Losses R. Motivational(T2) | 2.21 | 0.93 | −0.01 | −0.07 | 0.08 | 0.08 | −0.47 ** | 0.42 ** | −0.00 | 0.80 ** | −0.11 | 1 | ||||||||

| 11. Earnings R. Motivational (T2) | 3.48 | 0.56 | −0.05 | 0.01 | −0.02 | −0.09 | 0.04 | −0.01 | 0.44 ** | −0.13 * | 0.85 ** | −0.14 * | 1 | |||||||

| 12. Losses R. Financial (T2) | 2.63 | 1.05 | −0.01 | 0.01 | −0.01 | 0.17 ** | −0.48 ** | 0.30 ** | −0.01 | 0.61 ** | −0.06 | 0.62 ** | −0.08 | 1 | ||||||

| 13. Earnings R. Financial (T2) | 3.09 | 0.63 | 0.09 | −0.16 ** | −0.01 | −0.11 | 0.06 | −0.02 | 0.45 ** | −0.16 * | 0.52 ** | −0.12 * | 0.55 ** | −0.20 ** | 1 | |||||

| 14. Losses R. Social (T2) | 2.02 | 0.87 | −0.01 | −0.02 | 0.11 | 0.14 * | −0.33 ** | 0.37 ** | 0.02 | 0.65 ** | 0.00 | 0.58 ** | −0.04 | 0.45 ** | −0.06 | 1 | ||||

| 15. Earnings R. Social (T2) | 3.74 | 0.51 | 0.06 | −0.06 | −0.03 | −0.10 | −0.05 | −0.07 | 0.53 ** | −0.11 | 0.72 ** | −0.08 | 0.63 ** | −0.08 | 0.48 ** | −0.11 | 1 | |||

| 16. Losses R. Emotional (T2) | 2.27 | 0.93 | −0.05 | −0.03 | 0.01 | 0.09 | −0.42 ** | 0.42 ** | −0.00 | 0.71 ** | −0.11 | 0.80 ** | −0.11 | 0.55 ** | −0.20 ** | 0.50 ** | −0.10 | 1 | ||

| 17. Earnings R. Emotional (T2) | 3.39 | 0.56 | −0.17 ** | −0.02 | −0.06 | −0.12 | 0.00 | −0.04 | 0.56 ** | −0.12 | 0.75 ** | −0.11 | 0.74 ** | −0.09 | 0.52 ** | −0.03 | 0.62 ** | −0.09 | 1 | |

| 18. Health (T3) | 3.86 | 0.49 | −0.01 | −0.05 | 0.03 | 0.00 | 0.29 ** | −0.42 ** | 0.00 | −0.32 ** | −0.09 | −0.34 ** | −0.08 | −0.32 ** | −0.10 | −0.37 ** | −0.01 | −0.32 ** | −0.03 | 1 |

| 19. Quality of life (T3) | 3.51 | 0.65 | 0.01 | 0.08 | −0.07 | −0.10 | 0.62 ** | −0.37 ** | −0.07 | −0.67 ** | 0.04 | −0.70 ** | 0.08 | −0.61 ** | 0.10 | −0.48 ** | 0.06 | −0.68 ** | 0.08 | 0.39 ** |

| Criterion | Variable: Quality of Life (T3) | B | Boot | BootL | BootU | |

|---|---|---|---|---|---|---|

| Indirect Effects of Preparation Behaviors (T1) | SE | LLCI | ULCI | |||

| Total: | 0.07 | 0.04 | 0.01 | 0.17 | ||

| Ind1: Preparation behavior (T1) → lost resources physical (T2) → Quality of life (T3) | 0.07 | 0.04 | 0.02 | 0.19 | ||

| Ind2: Preparation behavior (T1) → lost resources physical (T2) → earnings resources physical (T2) → Quality of life (T3) | −0.00 | 0.00 | −0.01 | 0.00 | ||

| Ind3: Preparation behavior (T1) → earnings resources physical (T2) → Quality of life (T3) | 0.00 | 0.01 | 0.00 | 0.02 | ||

| (C1) Ind1 | Less | Ind2 | 0.07 | 0.04 | 0.02 | 0.17 |

| (C2) Ind1 | Less | Ind3 | 0.06 | 0.04 | 0.02 | 0.16 |

| (C3) Ind2 | Less | Ind3 | 0 | 0.05 | −0.03 | 0.00 |

| Criterion | Variable: Quality of Life (T3) | B | Boot | BootL | BootU | |

|---|---|---|---|---|---|---|

| Indirect Effects of Preparation Behaviors (T1) | SE | LLCI | ULCI | |||

| Total: | 0.23 | 0.04 | 0.15 | 0.33 | ||

| Ind1: Preparation behavior (T1) →lost resources cognitive (T2) → Quality of life (T3) | 0.23 | 0.04 | 0.15 | 0.33 | ||

| Ind2: Preparation behavior (T1) →lost resources cognitive (T2) → earnings resources cognitive (T2) → Quality of life (T3) | −0.00 | 0.00 | −0.01 | 0.00 | ||

| Ind3: Preparation behabior (T1) → earnings resources cognitive (T2) → Quality of life (T3) | 0.00 | 0.00 | −0.01 | 0.01 | ||

| (C1) Ind1 | Less | Ind2 | 0.24 | 0.04 | 0.15 | 0.33 |

| (C2) Ind1 | Less | Ind3 | 0.23 | 0.04 | 0.16 | 0.33 |

| (C3) Ind2 | Less | Ind3 | −0.00 | 0.01 | −0.02 | 0.01 |

| Criterion | Variable: Quality of life (T3) | B | Boot | Boot | Boot | |

|---|---|---|---|---|---|---|

| Indirect Effects of Preparation Behaviors (T1) | SE | LLCI | ULCI | |||

| Total: | 0.24 | 0.04 | 0.16 | 0.34 | ||

| Ind1: Preparation behavior (T1) lost resources motivational (T2) → Quality of life (T3) | 0.24 | 0.04 | 0.17 | 0.34 | ||

| Ind2: Preparation behavior (T1) lost resources motivational (T2) → earnings resources motivational (T2) → Quality of life (T3) | −0.00 | 0.00 | −0.01 | 0.00 | ||

| Ind3: Preparation behavior (T1) earnings resources motivational (T2) → Quality of life (T3) | 0.00 | 0.00 | −0.00 | 0.01 | ||

| (C1) Ind1 | Less | Ind2 | 0.24 | 0.04 | 0.16 | 0.34 |

| (C2) Ind1 | Less | Ind3 | 0.24 | 0.04 | 0.16 | 0.34 |

| (C3) Ind2 | Less | Ind3 | −0.00 | 0.01 | −0.01 | 0.01 |

| Criterion | Variable: Quality of Life (T3) | B | Boot | Boot | Boot | |

|---|---|---|---|---|---|---|

| Indirect Effects of Preparation Behaviors (T1) | SE | LLCI | ULCI | |||

| Total: | 0.19 | 0.04 | 0.12 | 0.29 | ||

| Ind1: Preparation behavior (T1) →lost resources financial (T2) → Quality of life (T3) | 0.19 | 0.04 | 0.12 | 0.29 | ||

| Ind2: Preparation behavior (T1) → lost resources financial (T2) → earnings resources financial (T2) → Quality of life (T3) | 0.00 | 0.00 | −0.01 | 0.01 | ||

| Ind3: Conductas de preparación(T1) → earnings resources financial (T2) → Quality of life (T3) | −0.00 | 0.00 | −0.01 | 0.01 | ||

| (C1) Ind1 | Less | Ind2 | 0.19 | 0.04 | 0.12 | 0.29 |

| (C2) Ind1 | Less | Ind3 | 0.19 | 0.04 | 0.12 | 0.29 |

| (C3) Ind2 | Less | Ind3 | 0.00 | 0.01 | −0.01 | 0.01 |

| Criterion | Variable: Quality of Life (T3) | B | Boot | Boot | Boot | |

|---|---|---|---|---|---|---|

| Indirect Effects of Preparation Behaviors (T1) | SE | LLCI | ULCI | |||

| Total: | 0.09 | 0.04 | 0.03 | 0.19 | ||

| Ind1: Preparation behavior (T1) → lost resources social (T2) → Quality of life (T3) | 0.09 | 0.03 | 0.04 | 0.19 | ||

| Ind2: Preparation behavior (T1) → lost resources social (T2) → earnings resources social (T2) → Quality of life (T3) | 0.00 | 0.00 | −0.00 | 0.01 | ||

| Ind3: Preparation behavior (T1) →earnings resources social (T2) →Quality of life (T3) | −0.01 | 0.01 | −0.02 | 0.00 | ||

| (C1) Ind1 | Less | Ind2 | 0.09 | 0.03 | 0.04 | 0.19 |

| (C2) Ind1 | Less | Ind3 | 0.10 | 0.03 | 0.04 | 0.19 |

| (C3) Ind2 | Less | Ind3 | 0.01 | 0.01 | −0.00 | 0.03 |

| Criterion | Variable: Quality of Life (T3) | B | Boot | Boot | Boot | |

|---|---|---|---|---|---|---|

| Indirect Effects of Preparation Behaviors (T1) | SE | LLCI | ULCI | |||

| Total: | 0.20 | 0.04 | 0.12 | 0.31 | ||

| Ind1: Preparation behavior (T1) → lost resources emotional (T2) → Quality of life (T3) | 0.20 | 0.04 | 0.12 | 0.31 | ||

| Ind2: Preparation behavior (T1) → lost resources emotional (T2) → earnings resources emotional (T2) → Quality of life (T3) | 0.00 | 0.00 | −0.00 | 0.01 | ||

| Ind3: Preparation behavior (T1) → earnings resources emotional (T2) → Quality of life (T3) | −0.00 | 0.00 | −0.02 | 0.00 | ||

| (C1) Ind1 | Less | Ind2 | 0.20 | 0.04 | 0.12 | 0.31 |

| (C2) Ind1 | Less | Ind3 | 0.21 | 0.04 | 0.12 | 0.31 |

| (C3) Ind2 | Less | Ind3 | 0.00 | 0.01 | −0.00 | 0.02 |

| Criterion | Variable: Health (T3) | B | Boot | Boot | Boot | |

|---|---|---|---|---|---|---|

| Indirect Effects of Preparation Behaviors (T1) | SE | LLCI | ULCI | |||

| Total: | 0.09 | 0.04 | 0.04 | 0.17 | ||

| Ind1: Preparation behavior (T1) → lost resources physical (T2) → Health (T3) | 0.09 | 0.04 | 0.04 | 0.17 | ||

| Ind2: Preparation behavior (T1) → lost resources physical (T2) → earnings resources physical (T2) → Health (T3) | −0.00 | 0.00 | −0.01 | 0.00 | ||

| Ind3: Preparation behavior (T1) → earnings resources physicists (T2) → Health (T3) | 0.00 | 0.00 | −0.00 | 0.01 | ||

| (C1) Ind1 | less | Ind2 | 0.09 | 0.04 | 0.04 | 0.18 |

| (C2) Ind1 | less | Ind3 | 0.09 | 0.04 | 0.04 | 0.17 |

| (C3) Ind2 | less | Ind3 | −0.00 | 0.00 | −0.02 | 0.00 |

| Criterion | Variable: Health (T3) | B | Boot | Boot | Boot | |

|---|---|---|---|---|---|---|

| Indirect Effects of Preparation Behaviors (T1) | SE | LLCI | ULCI | |||

| Total: | 0.10 | 0.03 | 0.04 | 0.17 | ||

| Ind1: Preparation behavior (T1) → lost resources cognitive (T2) → Health (T3) | 0.10 | 0.03 | 0.04 | 0.17 | ||

| Ind2: Preparation behavior (T1) → lost resources cognitive (T2) → earnings resources cognitive (T2) → Health (T3) | −0.01 | 0.01 | −0.02 | 0.00 | ||

| Ind3: Preparation behavior (T1) → earnings resources cognitive (T2) → Health (T3) | −0.01 | 0.01 | −0.00 | 0.03 | ||

| (C1) Ind1 | less | Ind2 | 0.11 | 0.03 | 0.05 | 0.17 |

| (C2) Ind1 | less | Ind3 | 0.09 | 0.03 | 0.03 | 0.16 |

| (C3) Ind2 | less | Ind3 | −0.01 | 0.01 | −0.05 | 0.00 |

| Criterion | Variable: Health (T3) | B | Boot | Boot | Boot | |

|---|---|---|---|---|---|---|

| Indirect Effects of Preparation Behaviors (T1) | SE | LLCI | ULCI | |||

| Total: | 0.10 | 0.026 | 0.06 | 0.16 | ||

| Ind1: Preparation behavior (T1) → lost resources motivational (T2) → Health (T3) | 0.11 | 0.026 | 0.06 | 0.16 | ||

| Ind2: Preparation behavior (T1) → lost resources motivational (T2) → earnings resources motivational (T2) → Health (T3) | −0.01 | 0.01 | −0.02 | −0.00 | ||

| Ind3: Preparation behavior (T1) → earnings resources motivational (T2) → Health (T3) | 0.00 | 0.01 | −0.01 | 0.02 | ||

| (C1) Ind1 | Less | Ind2 | 0.11 | 0.03 | 0.07 | 0.17 |

| (C2) Ind1 | Less | Ind3 | 0.10 | 0.03 | 0.05 | 0.16 |

| (C3) Ind2 | Less | Ind3 | −0.01 | 0.01 | −0.04 | 0.00 |

| Criterion | Variable: Health (T3) | B | Boot | Boot | Boot | |

|---|---|---|---|---|---|---|

| Indirect Effects of Preparation Behaviors (T1) | SE | LLCI | ULCI | |||

| Total: | 0.10 | 0.03 | 0.04 | 0.16 | ||

| Ind1: Preparation behavior (T1) → lost resources financial (T2) → Health (T3) | 0.10 | 0.03 | 0.05 | 0.16 | ||

| Ind2: Preparation behavior (T1) → lost resources Financial (T2) → earnings resources financial (T2) → Health (T3) | −0.01 | 0.01 | −0.03 | −0.00 | ||

| Ind3: Preparation behavior (T1) → earnings resources financial (T2) → Health (T3) | 0.00 | 0.01 | −0.01 | 0.03 | ||

| (C1) Ind1 | Less | Ind2 | 0.12 | 0.03 | 0.06 | 0.18 |

| (C2) Ind1 | Less | Ind3 | 0.10 | 0.03 | 0.04 | 0.16 |

| (C3) Ind2 | Less | Ind3 | −0.02 | 0.01 | −0.06 | −0.00 |

| Criterion | Variable: Health (T3) | B | Boot | Boot | Boot | |

|---|---|---|---|---|---|---|

| Indirect Effects of Preparation Behaviors (T1) | SE | LLCI | ULCI | |||

| Total: | 0.09 | 0.03 | 0.05 | 0.15 | ||

| Ind1: Preparation behavior (T1) → lost resources social (T2) → Health (T3) | 0.08 | 0.03 | 0.05 | 0.15 | ||

| Ind2: Preparation behavior (T1) → lost resources social (T2) → earnings resources social (T2) → Health (T3) | −0.00 | 0.00 | −0.01 | 0.00 | ||

| Ind3: Preparation behavior (T1) → earnings resources social (T2) → Health (T3) | 0.00 | 0.01 | −0.00 | 0.02 | ||

| (C1) Ind1 | menos | Ind2 | 0.09 | 0.03 | 0.05 | 0.15 |

| (C2) Ind1 | menos | Ind3 | 0.08 | 0.02 | 0.04 | 0.14 |

| (C3) Ind2 | menos | Ind3 | −0.00 | 0.01 | −0.03 | 0.01 |

| Criterion | Variable: Health(T3) | B | Boot | Boot | Boot | |

|---|---|---|---|---|---|---|

| Indirect Effects of Preparation Behaviors (T1) | SE | LLCI | ULCI | |||

| Total: | 0.08 | 0.03 | 0.03 | 0.15 | ||

| Ind1: Preparation behavior (T1) → lost resources emotional (T2) → Health (T3) | 0.08 | 0.03 | 0.03 | 0.15 | ||

| Ind2: Preparation behavior (T1) → lost resources emotional (T2) → earnings resources emotional (T2) → Health (T3) | −0.00 | 0.03 | −0.01 | 0.00 | ||

| Ind3: Preparation behavior (T1) → earnings resources emotional (T2) → Health (T3) | 0.00 | 0.00 | −0.00 | 0.02 | ||

| (C1) Ind1 | Less | Ind2 | 0.08 | 0.03 | 0.03 | 0.15 |

| (C2) Ind1 | Less | Ind3 | 0.08 | 0.03 | 0.03 | 0.15 |

| (C3) Ind2 | Less | Ind3 | −0.00 | 0.01 | −0.02 | 0.00 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hurtado, M.D.; Topa, G. Quality of Life and Health: Influence of Preparation for Retirement Behaviors through the Serial Mediation of Losses and Gains. Int. J. Environ. Res. Public Health 2019, 16, 1539. https://doi.org/10.3390/ijerph16091539

Hurtado MD, Topa G. Quality of Life and Health: Influence of Preparation for Retirement Behaviors through the Serial Mediation of Losses and Gains. International Journal of Environmental Research and Public Health. 2019; 16(9):1539. https://doi.org/10.3390/ijerph16091539

Chicago/Turabian StyleHurtado, María Dolores, and Gabriela Topa. 2019. "Quality of Life and Health: Influence of Preparation for Retirement Behaviors through the Serial Mediation of Losses and Gains" International Journal of Environmental Research and Public Health 16, no. 9: 1539. https://doi.org/10.3390/ijerph16091539

APA StyleHurtado, M. D., & Topa, G. (2019). Quality of Life and Health: Influence of Preparation for Retirement Behaviors through the Serial Mediation of Losses and Gains. International Journal of Environmental Research and Public Health, 16(9), 1539. https://doi.org/10.3390/ijerph16091539