Appendix A.1

The model is subject to . The Hessian matrix of is negative definite and the profit function of is concave of and . Solving KKT conditions , , and , we can get three feasible decisions according to Complementary Slackness Theorem.

Decision MA: and .

Solving and the first order conditions give , and . and give and . . Therefore, Decision MA exists when .

Decision MB: and .

Solving the first order conditions gives and . gives , , and , respectively. . . Therefore, Decision MB exists when .

Decision MC: and .

Solving and the first order conditions give , and . and give and , respectively. Therefore, Decision MC exists when .

Appendix A.2

The supplier’s profit function is .

Let , and . .

Decision SA:

When the supplier anticipates that the manufacturer will adopt decision MA, then the corresponding profit function of the supplier is , which subjects to . The Hessian matrix is negative definite and the profit function is concave. Solving KKT conditions , , and , we get one feasible decision according to Complementary Slackness Theorem.

and . Solving the first order conditions gives and . and give and , respectively. . Therefore, Decision S-A exists when .

Decision SB:

When the supplier anticipates that the manufacturer will adopt decision MB, then the corresponding profit function of the supplier is , which subjects to . The Hessian matrix is negative definite and the profit function is concave. Solving the KKT conditions , , and , we get three feasible decisions according to Complementary Slackness Theorem.

Decision SB-1: and .

Solving the first order conditions gives , and . and give and , respectively. . Therefore, Decision SB-1 exists when .

Decision SB-2: and .

Solving the first order conditions gives and . and give and , respectively. . Therefore, Decision SB-2 exists when .

Decision SB-3: and

Solving the first order conditions gives , and . and give and , respectively. . Therefore, Decision SB-3 exists when .

Decision SC:

When the supplier anticipates that the manufacturer will adopt decision MC, then the corresponding profit function of the supplier is , which subjects to . The Hessian matrix is negative definite, and the profit function is concave. Solving the KKT conditions , , and , we get one feasible decision according to Complementary Slackness Theorem.

and . Solving the first order conditions gives and . and give and , respectively. . Therefore, Decision S-C exists when .

Substitute the supplier’s optimal interchangeable level of key component and wholesale price into the profits, then we can obtain the supplier’s and manufacturer’s profits (

Table A1).

Table A1.

The optimal profits.

Table A1.

The optimal profits.

| Decision | | |

|---|

| DA | | |

| DB-1 | | |

| DB-2 | | |

| DB-3 | | |

| DC | | |

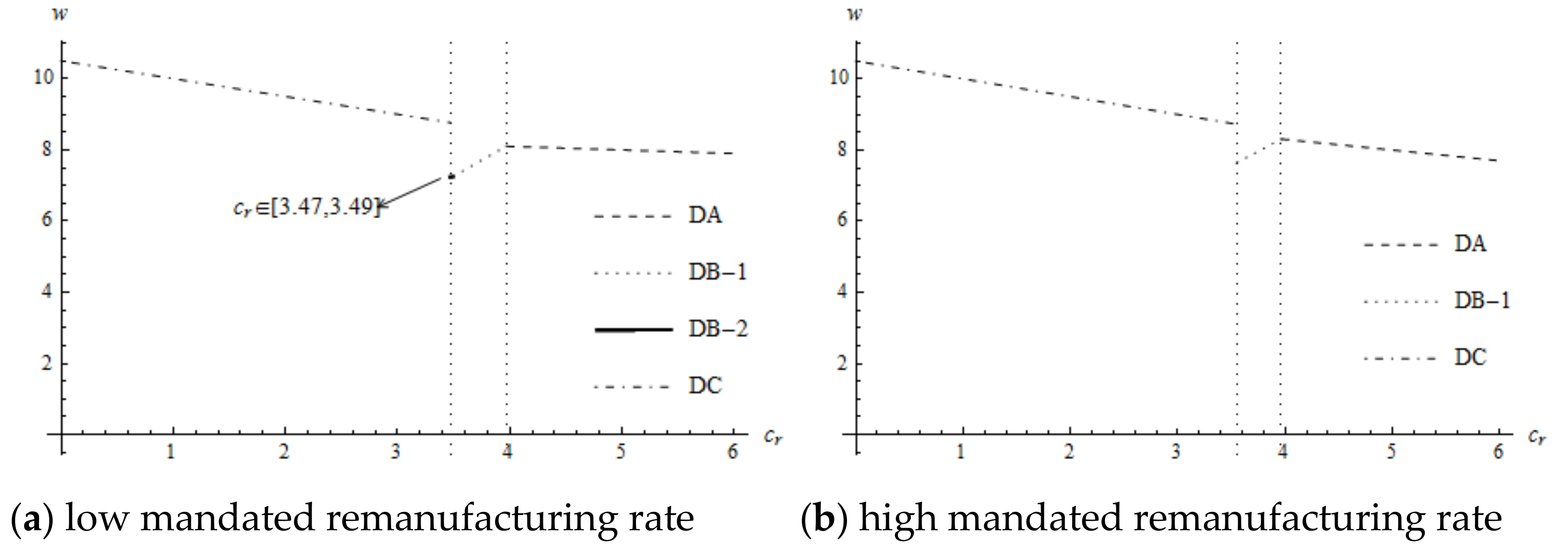

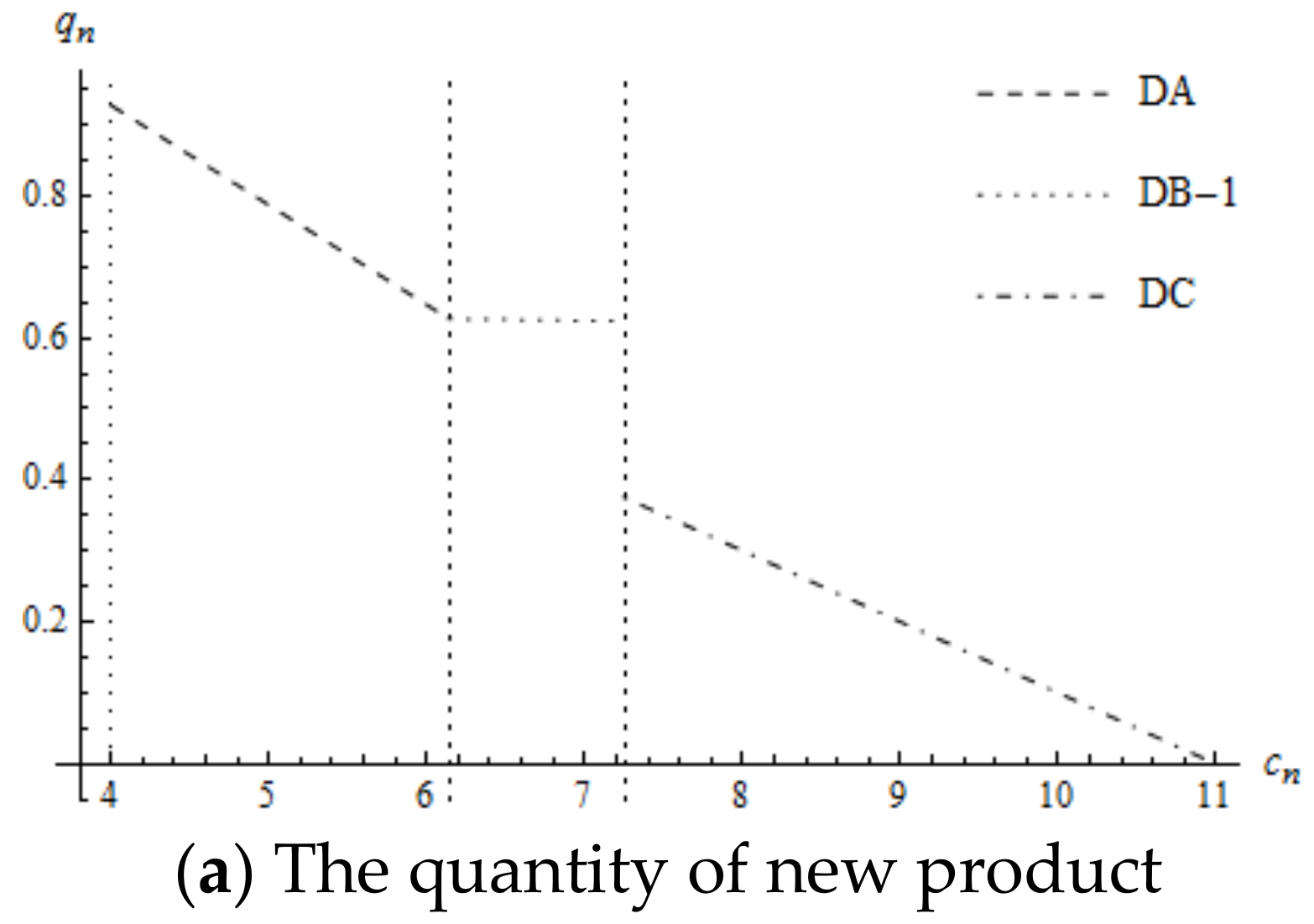

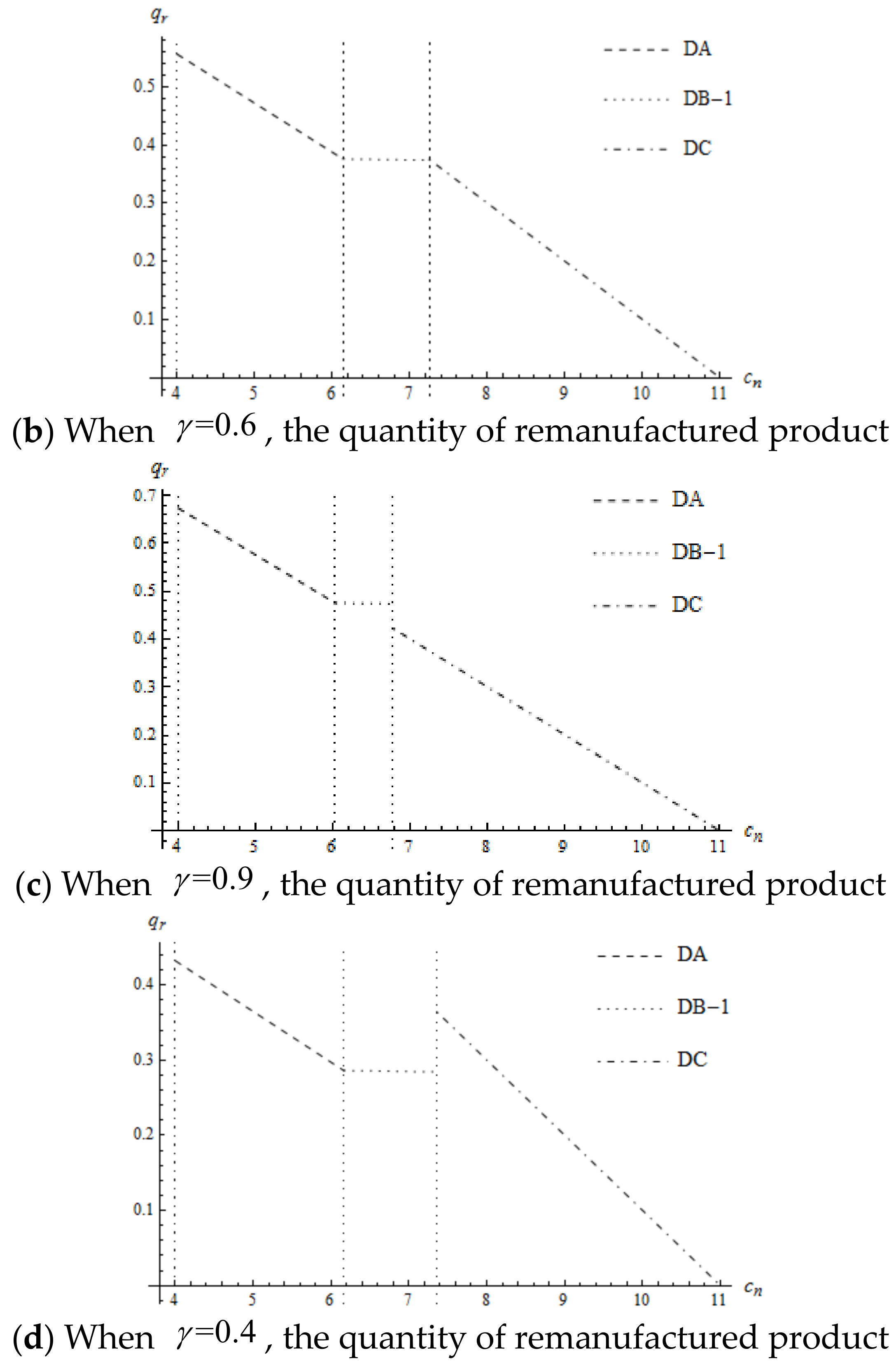

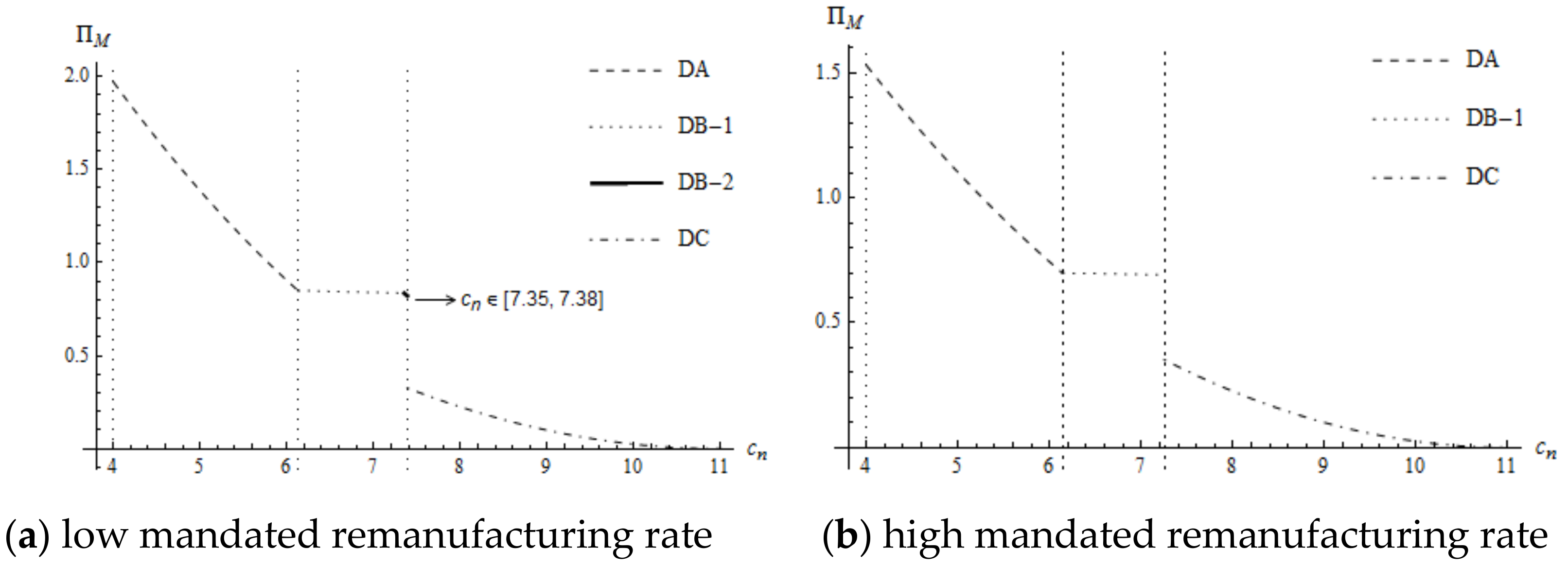

Compare boundary points of each decision, the results are as follows:

When , then .

When , then .

When , then .

(i)

When , .

When , let , . When , ; , .

When , .

When , .

(ii)

When , .

When , .

When , if , . When , ; ,.

When , .

When , .

(iii)

When , .

When , .

When , if , . If , if . When , ; , .

When , if , . if , if , . When , ; , .

When , .

When , .