Can FinTech Development Curb Agricultural Nonpoint Source Pollution?

Abstract

1. Introduction

2. Literature Review

2.1. Research on FinTech

2.2. Research on Agricultural NPS Pollution Control

3. Research Methods

3.1. The Theoretical Model

3.2. The Empirical Model

4. Variables and Data

4.1. Variable Description

4.1.1. Dependent Variables

4.1.2. Independent Variables

4.1.3. Threshold Variables

4.2. Data Description and Processing

5. Results and Discussion

5.1. The Effect of FinTech under the “STIRPAT” Model

5.2. Nonlinear Characteristics of the Impact of FinTech on Agricultural NPS Pollution

5.3. Threshold Effect of FinTech on Agricultural NPS Pollution

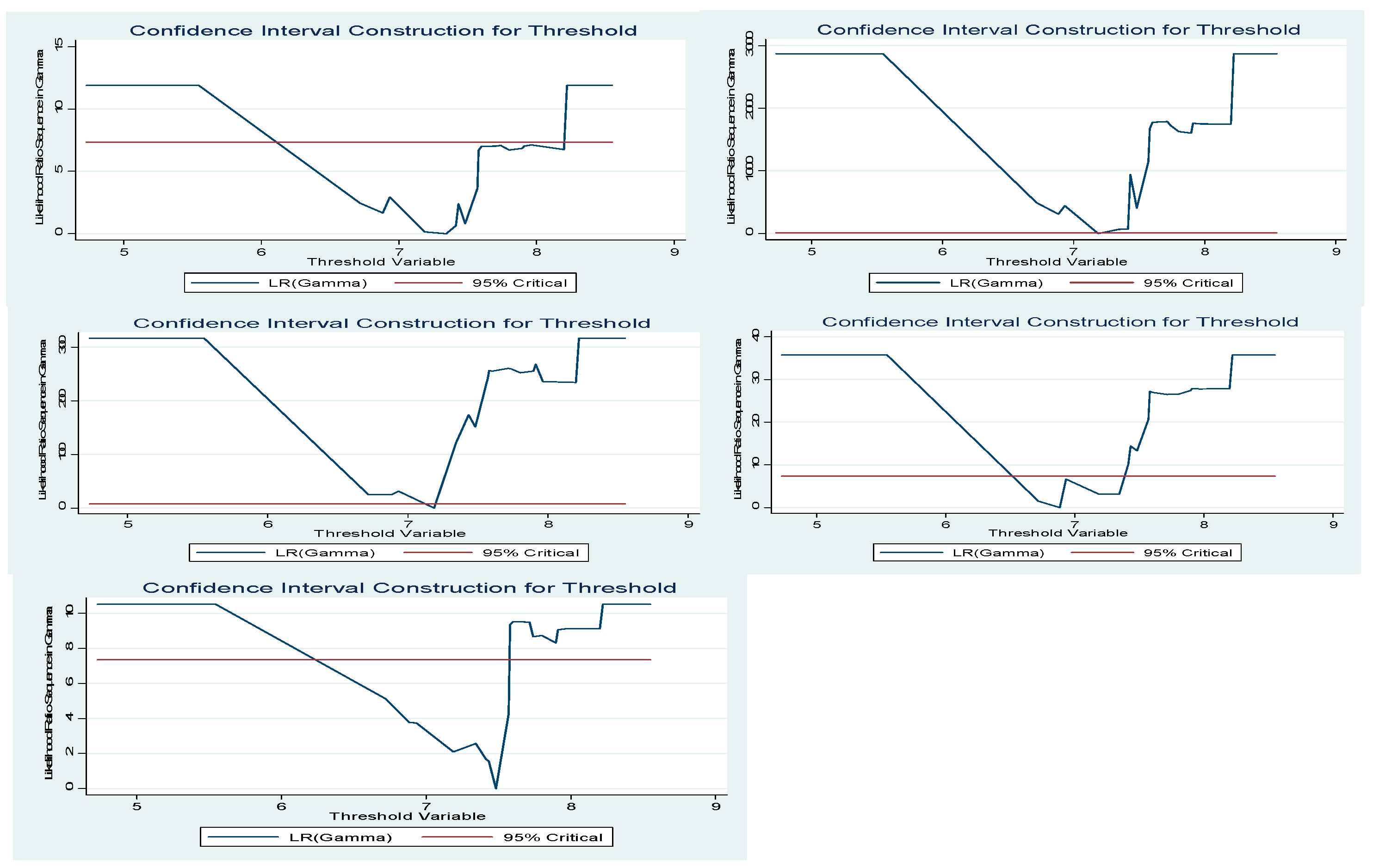

5.3.1. Threshold Effect Test

5.3.2. Estimation of the Threshold Effect

6. Conclusions

- (1).

- Overall, the development of FinTech is a “double-edged sword”, and the effect of FinTech development on agricultural NPS pollution presents a typical inverted “U” type feature. That is, in the developing stage of an agricultural economy, the impact of FinTech development on agricultural NPS pollution is significantly positive. This will cause the agricultural production to expand in scale, resulting an aggravation in agricultural pollution emissions and an increase in agricultural NPS pollution. Only when the development of FinTech crosses the threshold value, its impact on agricultural NPS pollution will be significantly negative.

- (2).

- At the structural level, the effects of FinTech service availability and FinTech infrastructure on agricultural NPS pollution also present an inverted “U” type relationship. This is consistent with the results at the overall level. However, the impacts of FinTech service use and FinTech service quality on agricultural NPS pollution are inconsistent with those obtained at overall level. Among them, the effect of FinTech service quality on agricultural NPS pollution has a “U” type relationship. Combined with the results from the overall level and the structural level, this indicates that achieving high-quality FinTech services will be the key for FinTech to support agricultural NPS pollution control in the future.

- (3).

- From the perspective of the threshold effect, in the developing stage of an agricultural economy, the impact of FinTech development on agricultural NPS pollution also presents an inverted “U” type characteristic. In the developed stage of an agricultural economy, the influence of FinTech development and its second power on NPS pollution is insignificant. The influences of FinTech service use, FinTech service availability and FinTech infrastructure on agricultural NPS pollution also have an inverted “U” type features in developing stage of an agricultural economy. However, their effects become insignificant. Therefore, in the developing stage of an agricultural economy, it is even more important to popularize the use of FinTech, promote the availability of farmers’ FinTech services, and improve FinTech infrastructure to help control agricultural NPS pollution.

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Malik, A.S.; Letson, D.; Crutchfield, S.R. Point/Nonpoint Source Trading of Pollution Abatement: Choosing the Right Trading Ratio. Am. J. Agric. Econ. 1993, 75, 959–967. [Google Scholar] [CrossRef]

- Chen, L.; Liu, R.M.; Huang, Q.; Chen, Y.X.; Gao, S.H.; Sun, C.C.; Shen, Z.Y. Integrated assessment of nonpoint source pollution of a drinking water reservoir in a typical acid rain region. Int. J. Environ. Sci. Technol. 2013, 10, 651–664. [Google Scholar] [CrossRef][Green Version]

- Li, C.C.; Indrajeet, C.; Nien, M.H. Implementation of BMP Strategies for Adaptation to Climate Change and Land Use Change in a Pasture-Dominated Watershed. Int. J. Environ. Res. Public Health 2012, 9, 3654–3684. [Google Scholar]

- Corwin, D.L.; Loague, K.; Ellsworth, T.R. GIS-based Modeling of Nonpoint Source Pollutants in the Vadose Zone. J. Soil Water Conserv. 1998, 53, 34–38. [Google Scholar]

- Duda, A.M. Addressing nonpoint sources of water pollution must become an international priority. Water Sci. Technol. 1993, 28, 1–11. [Google Scholar] [CrossRef]

- Dagne, H.; William, O.; Paul, T. Impact of Animal Waste Application on Runoff Water Quality in Field Experimental Plots. Int. J. Environ. Res. Public Health 2005, 2, 314–321. [Google Scholar]

- Kim, H.; Amatya, D.M.; Broome, S.W.; Hesterberg, D.L.; Choi, M. Sensitivity analysis of the DRAINWAT model applied to an agricultural watershed in the lower coastal plain, North Carolina, USA. Water Environ. J. 2012, 26, 130–145. [Google Scholar] [CrossRef]

- Lee, K.C.; Teo, E.G.S. Emergence of FinTech and the Lasic Principles. J. Financ. Perspect. 2015, 3, 1–17. [Google Scholar] [CrossRef]

- Bartlett, R.; Morse, A.; Stanton, R.; Wallace, N. Consumer Lending Discrimination in the FinTech Era; Social Science Electronic Publishing: Waltham, MA, USA, 2017; Volume 7, pp. 1–49. [Google Scholar]

- Conrad, E. Gaming the System. World Chin. 2018, 72, 77–78. [Google Scholar]

- Dhar, V.; Stein, R. FinTech Platforms and Strategy. Commun. ACM 2017, 60, 32–35. [Google Scholar] [CrossRef]

- Eyal, I. Blockchain Technology: Transforming Libertarian Cryptocurrency Dreams to Finance and Banking Realities. Computer 2017, 50, 38–49. [Google Scholar] [CrossRef]

- Jagtiani, J.; Lemieux, C. Do FinTech Lenders Penetrate Areas That Are Underserved by Traditional Banks? J. Econ. Bus. 2018, 100, 43–54. [Google Scholar] [CrossRef]

- Gabor, D.; Brooks, S. The digital revolution in financial inclusion: International development in the FinTech era. New Political Econ. 2017, 22, 1–14. [Google Scholar] [CrossRef]

- Gomber, P.; Kauffman, R.J.; Parker, C.; Weber, B.W. On the FinTech Revolution: Interpreting the Forces of Innovation, Disruption, and Transformation in Financial Services. J. Manag. Inf. Syst. 2018, 35, 220–265. [Google Scholar] [CrossRef]

- Fenwick, M.; McCahery, J.A.; Vermeulen, E.P.M. FinTech and the Financing of Entrepreneurs: From Crowdfunding to Marketplace Lending; Social Science Electronic Publishing: Waltham, MA, USA, 2017. [Google Scholar]

- Ryu, H.S.; Chang, Y. What makes users willing or hesitant to use FinTech? The moderating effect of user type. Ind. Manag. Data Syst. 2018, 2, 1–38. [Google Scholar] [CrossRef]

- Tsai, C.H.; Peng, K.J. The FinTech Revolution and Financial Regulation: The Case of Online Supply-Chain Financing. Asian J. Law Soc. 2017, 4, 109–132. [Google Scholar] [CrossRef]

- Dunn, J.W.; Shortle, J.S. Agricultural Nonpoint Source Pollution Control in Theory and Practice. Mar. Resour. Econ. 1988, 5, 259–270. [Google Scholar] [CrossRef]

- Stavins, R.N. What Can We Learn from the Grand Policy Experiment? Lessons from SO2 Allowance Trading. J. Econ. Perspect. 2001, 12, 69–88. [Google Scholar] [CrossRef]

- Griffin, R.C.; Bromley, D.W. Agricultural Runoff as a Nonpoint Externality: A Theoretical Development. Am. J. Agric. Econ. 1982, 64, 547–552. [Google Scholar] [CrossRef]

- Shortle, J.S.; Dunn, J.W. The Relative Efficiency of Agricultural Source Water Pollution Control Policies. Am. J. Agric. Econ. 1986, 68, 668–677. [Google Scholar] [CrossRef]

- Segerson, K. Uncertainty and incentives for nonpoint pollution control. J. Environ. Econ. Manag. 2006, 5, 87–98. [Google Scholar] [CrossRef]

- Larry, K. Nonpoint Source Pollution Taxes and Excessive Tax Burden. Environ. Resour. Econ. 2005, 31, 229–251. [Google Scholar]

- Rabotyagov, S.S.; Valcu, A.M.; Kling, C.L. Reversing Property Rights: Practice-Based Approaches for Controlling Agricultural Nonpoint-source Water Pollution When Emissions Aggregate Nonlinearly. Am. J. Agric. Econ. 2012, 96, 397–419. [Google Scholar] [CrossRef]

- Ribaudo, M.O. Policy Explorations and Implications for Nonpoint Source Pollution Control: Discussion. Am. J. Agric. Econ. 2004, 86, 1220–1221. [Google Scholar] [CrossRef]

- Griesinger, D.H. Where not to install a reverberation enhancement system. J. Acoust. Soc. Am. 2017, 141, 3852–3853. [Google Scholar] [CrossRef]

- Egan, B.A.; Mahoney, J.R. Applications of a Numerical Air Pollution Transport Model to Dispersion in the Atmospheric Boundary Layer. J. Appl. Meteorol. 2010, 11, 1023–1039. [Google Scholar] [CrossRef]

- Feitelson, E. An alternative role for economic instruments: Sustainable finance for environmental management. Environ. Manag. 1992, 16, 299–307. [Google Scholar] [CrossRef]

- Howe, C.W. Taxes versus, tradable discharge permits: A review in the light of the U.S. and European experience. Environ. Resour. Econ. 1994, 4, 151–169. [Google Scholar] [CrossRef]

- Clara, V.P.; Jessica, C. On the interaction between imperfect compliance and technology adoption: Taxes versus tradable emissions permits. J. Regul. Econ. 2010, 38, 274–291. [Google Scholar]

- Tanaka, M. Multi-Sector Model of Tradable Emission Permits. Environ. Resour. Econ. 2012, 51, 61–77. [Google Scholar] [CrossRef]

- Perkis, D.F.; Cason, T.N.; Tyner, W.E. An Experimental Investigation of Hard and Soft Price Ceilings in Emissions Permit Markets. Environ. Resour. Econ. 2016, 63, 703–718. [Google Scholar] [CrossRef]

- Caffera, M.; Chávez, C. The Regulatory Choice of Noncompliance in the Lab: Effect on Quantities, Prices, and Implications for the Design of a Cost-Effective Policy. BE J. Econ. Anal. Policy 2016, 16, 727–753. [Google Scholar] [CrossRef]

- Ehrlich, P.R.; Holdren, J.P. Impact of population growth. Science 1971, 171, 1212–1217. [Google Scholar] [CrossRef] [PubMed]

- York, R.; Rosa, E.A.; Dietz, T. STIRPAT, IPAT and ImPACT: Analytic tools for unpacking the driving forces of environmental impacts. Ecol. Econ. 2003, 46, 351–365. [Google Scholar] [CrossRef]

- Dai, H.; Sun, T.; Zhang, K.; Guo, W. Research on Rural Nonpoint Source Pollution in the Process of Urban-Rural Integration in the Economically-Developed Area in China Based on the Improved STIRPAT Model. Sustainability 2015, 7, 782–793. [Google Scholar] [CrossRef]

- Godfrey, L.G. Testing for Higher Order Serial Correlation in Regression Equations when the Regressors Include Lagged Dependent Variables. Econometrica 1978, 46, 1303–1310. [Google Scholar] [CrossRef]

- Breusch, T.S.; Pagan, A.R. A Simple Test for Heteroscedasticity and Random Coefficient Variation. Econometrica 1979, 47, 1287–1294. [Google Scholar] [CrossRef]

- Harvey, A.C.; Phillips, G.D.A. Testing for heteroscedasticity in simultaneous equation models. J. Econom. 1981, 15, 311–340. [Google Scholar] [CrossRef]

- Glejser, H. A New Test for Heteroskedasticity. J. Am. Stat. Assoc. 1969, 64, 316–323. [Google Scholar] [CrossRef]

- Bera, A.K.; Ra, S. A test for the presence of conditional heteroskedasticity within arch-m framework. Econom. Rev. 1995, 14, 473–485. [Google Scholar] [CrossRef]

- White, H. A Heteroskedasticity-Consistent Covariance Matrix Estimator and a Direct Test for Heteroskedasticity. Econometrica 1980, 48, 817–838. [Google Scholar] [CrossRef]

- Hansen, B.E. Sample splitting and threshold estimation. Econometrica 2000, 68, 575–603. [Google Scholar] [CrossRef]

- Sagar, A.D.; Najam, A. The human development index: A critical review. Ecol. Econ. 1998, 25, 249–264. [Google Scholar] [CrossRef]

- Stern, D.I. Environmental Kuznets Curve. Encycl. Energy 2004, 22, 517–525. [Google Scholar]

- Zhang, Y.J. The impact of financial development on carbon emissions: An empirical analysis in China. Energy Policy 2011, 39, 2197–2203. [Google Scholar] [CrossRef]

- Ali, S.; Waqas, H.; Ahmad, N. Analyzing the dynamics of energy consumption, liberalization, financial development, poverty and carbon emissions in Pakistan. J. Appl. Environ. Biol. Sci. 2015, 5, 166–183. [Google Scholar]

- Boutabba, M.A. The impact of financial development, income, energy and trade on carbon emissions: Evidence from the Indian economy. Econ. Model. 2014, 40, 33–41. [Google Scholar] [CrossRef]

- Holvoet, K.; Sampers, I.; Seynnaeve, M.; Jacxsens, L.; Uyttendaele, M. Agricultural and Management Practices and Bacterial Contamination in Greenhouse versus Open Field Lettuce Production. Int. J. Environ. Res. Public Health 2014, 12, 32–63. [Google Scholar] [CrossRef]

- Carter, E.D. Population control, public health, and development in mid-twentieth-century Latin America. J. Hist. Geogr. 2018, 62, 96–105. [Google Scholar] [CrossRef]

| Variable | Mean | Median | Maximum | Minimum | Standard Deviation |

|---|---|---|---|---|---|

| I | 3.803 | 4.352 | 5.366 | 1.131 | 1.159 |

| TF | 4.168 | 4.159 | 4.557 | 3.782 | 0.183 |

| TU | 2.818 | 2.758 | 4.565 | 0.000 | 0.917 |

| TG | 2.881 | 2.907 | 4.542 | 0.536 | 0.859 |

| TI | 3.139 | 3.168 | 4.557 | 1.194 | 0.803 |

| TQ | 3.991 | 4.089 | 4.377 | 2.457 | 0.350 |

| A | 9.413 | 9.379 | 10.147 | 8.917 | 0.297 |

| P | 7.21 | 7.385 | 8.499 | 5.451 | 0.935 |

| q | 7.241 | 7.582 | 8.551 | 4.732 | 1.155 |

| Variable | Model | ||||||

|---|---|---|---|---|---|---|---|

| FinTech Inclusive Financial Index (TF) | FinTech Service Use Index (TU) | FinTech Service Availability Index (TG) | FinTech Infrastructure Index (TI) | FinTech Service Quality Index (TQ) | |||

| (1) | (2) | (3) | (4) | (5) | |||

| Constant | −6.51 (−15.53) ** | −10.722 (−37.44) *** | −9.612 (−38.33) *** | −0.031 (−0.09) | −8.214 (−11.63) *** | ||

| T | −1.185 (−4.94) *** | −0.233 (−30.88) *** | −0.183 (−6.40) *** | 0.256 (15.0) *** | −0.002 (−0.11) | ||

| A | 0.732 (8.75) *** | 0.676 (13.23) *** | 0.561 (14.04) *** | 0.544 (−11.33) *** | 0.353 (4.87) *** | ||

| P | 1.162 (53.34) *** | 1.221 (53.26) *** | 1.198 (112.93) *** | 1.134 (103.04) *** | 1.20 (31.34) *** | ||

| R2 | 0.999 | 0.999 | 0.999 | 0.998 | 0.976 | ||

| Adjusted R2 | 0.999 | 0.999 | 0.999 | 0.997 | 0.973 | ||

| F-statistic | 13,561.21 | 22,573.21 | 54,332.30 | 4743.787 | 366.6 | ||

| Heteroskedasticity Test | Breusch-Pagan-Godfrey | 0.216 | 1.512 | 0.017 | 2.675 | 8.2 | |

| Harvey | 8.139 | 5.527 | 0.395 | 7.601 | 5.158 | ||

| Glejser | 0.788 | 2.388 | 0.395 | 5.702 | 7.794 | ||

| ARCH | 1.135 | 0.177 | 0.127 | 0.125 | 0.269 | ||

| White | 0.470 | 50.187 | 7.831 | 1.202 | 34.41 | ||

| Variable | Model | |||||

|---|---|---|---|---|---|---|

| FinTech Inclusive Financial Index (TF) | FinTech Service Use Index (TU) | FinTech Service Availability Index (TG) | FinTech Infrastructure Index (TI) | FinTech Service Quality Index (TQ) | ||

| (6) | (7) | (8) | (9) | (10) | ||

| Constant | −134.25 (−9.89) *** | −207.745 (−9.17) *** | −177.496 (−5.92) *** | −302.183 (−11.16) *** | −167.82 (−9.98) *** | |

| A | 27.72 (9.73) *** | 42.687 (8.813) *** | 36.078 (5.62) *** | 62.908 (11.02) *** | 34.709 (9.76) *** | |

| A2 | −1.447 (−9.64) *** | −2.228 (−8.61) *** | −1.872 (−5.45) *** | −3.303 (−11.05) *** | −1.831 (−9.76) *** | |

| T | −0.443 (−4.21) *** | −0.135 (−5.52) *** | −0.1 (−4.67) *** | −0.07 (−1.79) *** | 0.042 (4.09) *** | |

| P | 1.026 (80.85) *** | 1.066 (90.63) *** | 1.103 (62.88) *** | 0.965 (55.63) *** | 1.0 (167.15) *** | |

| R2 | 0.999 | 0.999 | 0.999 | 0.998 | 0.999 | |

| Adjusted R2 | 0.999 | 0.999 | 0.999 | 0.998 | 0.999 | |

| F-statistic | 12,834.47 | 10,057.9 | 21,194.11 | 6239.518 | 24,790.43 | |

| Heteroskedasticity Test | Breusch-Pagan-Godfrey | 0.564 | 1.673 | 0.589 | 0.530 | 3.464 |

| Harvey | 3.349 | 4.063 | 2.56 | 2.686 | 8.722 | |

| Glejser | 1.245 | 2.978 | 0.625 | 1.214 | 2.775 | |

| ARCH | 0.448 | 3.601 | 0.007 | 0.65 | 2.704 | |

| White | 0.278 | 241.958 | 0.089 | 173.514 | 1.394 | |

| Variable | Model | |||||

|---|---|---|---|---|---|---|

| FinTech Inclusive Financial Index (TF) | FinTech Service Use Index (TU) | FinTech Service Availability Index (TG) | FinTech Infrastructure Index (TI) | FinTech Service Quality Index (TQ) | ||

| (11) | (12) | (13) | (14) | (15) | ||

| Constant | −120.743 (−3.137) *** | −12.987 (−33.56) *** | −16.995 (−13.01) *** | −9.04 (−6.947) *** | −6.366 (−3.535) *** | |

| T | 53.238 (2.89) *** | −0.352 (−1.94) * | 1.88 (5.15) *** | 2.066 (7.13) *** | −0.781 (−1.96) * | |

| T2 | −6.519 (−2.997) *** | −0.01 (−0.247) | −0.405 (−6.613) *** | −0.342 (−7.542) *** | 0.124 (2.057) ** | |

| A | 0.943 (1.34) * | 0.982 (21.83) *** | 1.345 (9.59) *** | 0.283 (2.29) ** | 0.314 (2.41) ** | |

| P | 1.003 (9.223) *** | 1.202 (81.20) *** | 0.892 (54.42) *** | 1.01 (45.79) *** | 1.159 (36.71) *** | |

| R2 | 0.851 | 0.999 | 0.998 | 0.993 | 0.998 | |

| Adjusted R2 | 0.827 | 0.999 | 0.998 | 0.992 | 0.998 | |

| F-statistic | 35.775 | 3733930 | 5316.719 | 924.264 | 3851.973 | |

| Heteroskedasticity Test | Breusch-Pagan-Godfrey | 1.34 | 0.591 | 0.127 | 22.421 | 0.594 |

| Harvey | 1.845 | 7.909 | 7.780 | 11.673 | 24.838 | |

| Glejser | 1.663 | 0.741 | 0.361 | 12.490 | 1.493 | |

| ARCH | 1.329 | 2.212 | 0.033 | 0.297 | 1.407 | |

| White | 0.848 | 0.347 | 0.176 | 21.958 | 0.412 | |

| Bootstrap | Model | ||||

|---|---|---|---|---|---|

| FinTech Inclusive Financial Index (TF) | FinTech Service Use Index (TU) | FinTech Service Availability Index (TG) | FinTech Infrastructure Index (TI) | FinTech Service Quality Index (TQ) | |

| (16) | (17) | (18) | (19) | (20) | |

| 1000 | 12.053 (0.02) | 12.043 (0.02) | 9.945 (0.093) | 13.054 (0.012) | 12.26 (0.033) |

| 2000 | 12.053 (0.022) | 12.043 (0.024) | 9.945 (0.113) | 13.054 (0.016) | 12.26 (0.027) |

| 3000 | 12.053 (0.019) | 12.044 (0.019) | 9.945 (0.100) | 13.054 (0.014) | 12.26 (0.028) |

| 4000 | 12.053 (0.018) | 12.044 (0.021) | 9.945 (0.09) | 13.054 (0.015) | 12.26 (0.024) |

| 5000 | 12.053 (0.024) | 12.044 (0.019) | 9.945 (0.106) | 13.054 (0.015) | 12.26 (0.024) |

| Variable | Model | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| FinTech Inclusive Financial (TF) | FinTech Service Use Index (TU) | FinTech Service Availability Index (TG) | FinTech Infrastructure Index (TI) | FinTech Service Quality Index (TQ) | ||||||

| (21) | (22) | (23) | (24) | (25) | ||||||

| q ≤ 7.346 | q > 7.346 | q ≤ 7.189 | q > 7.189 | q ≤ 7.482 | q > 7.482 | q ≤ 6.885 | q > 6.885 | q ≤ 7.188 | q > 7.188 | |

| Constant | −143.787 ** [−233.18, −87.97] | −95.016 [−183.3, 13.65] | −17.8 [−37.95, 2.35] | −6.01 [−18.57, 6.55] | −25.882 ** [−76.66, −13.17] | −17.834 [−27.89, 3.86] | −53.723 ** [−81.41, −23.63] | −3.401 [−14.6, 6.96] | 186.728 ** [27.81, 345.65] | −1.967 [−13.85, 9.91] |

| T | 59.83 ** [ 30.38, 103.76] | 43.265 [−13.01, 83.29] | 0.854 ** [0.29,1.42] | 0.20 [−1.45, 1.86] | 1.684 ** [0.92, 2.40] | 0.423 [−1.14, 4.3] | 9.196 ** [0.71, 15.4] | 0.927 [−0.326, 3.23] | −97.6 ** [−179.09, −16.11] | −0.1291 [−4.35, 4.09] |

| T2 | −7.557 ** [−12.73, −4.16] | −5.162 [−9.89, 1.31] | −0.258 ** [−0.33, −0.18] | −0.057 [−0.28, 0.16] | −0.418 ** [−0.61, −0.31] | −0.146 [−0.75, 0.11] | −1.576 ** [−2.56, −0.24] | −0.144 [−0.52, 0.07] | 12.413 ** [1.91, 22.92] | 0.025 [−0.62, 0.67] |

| A | 2.224 [−1.087, 4.39] | 0.54 [−0.69, 2.62] | 1.422 [−0.43, 3.27] | 0.671 [−0.55,1.9] | 2.06 ** [0.90, 7.01] | 1.514 [−0.34, 2.48] | 4.033 ** [1.97, 6.47] | 0.205 [−1.04, 1.28] | 0.143 [−0.54, 0.82] | 0.3198 [−0.54, 1.18] |

| P | 1.236 ** [0.30, 1.84] | 0.495 ** [0.12, 1.31] | 1.1 ** [0.45, 1.74] | 0.528 ** [0.06, 1.00] | 1.333 ** [0.79, 2.47] | 1.031 ** [0.105, 1.40] | 0.943 ** [0.69, 1.58] | 0.581 ** [0.17, 0.96] | 0.931 ** [0.715, 1.15] | 0.458 ** [0.11, 0.81] |

| R2 | 0.915 | 0.377 | 0.898 | 0.315 | 0.943 | 0.613 | 0.9 | 0.474 | 0.833 | 0.284 |

| Heteroskedasticity Test | 0.336 | 0.389 | 0.587 | 0.338 | 0.892 | |||||

| Joint R2 | 0.919 | 0.916 | 0.937 | 0.92 | 0.899 | |||||

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jiang, S.; Qiu, S.; Zhou, H.; Chen, M. Can FinTech Development Curb Agricultural Nonpoint Source Pollution? Int. J. Environ. Res. Public Health 2019, 16, 4340. https://doi.org/10.3390/ijerph16224340

Jiang S, Qiu S, Zhou H, Chen M. Can FinTech Development Curb Agricultural Nonpoint Source Pollution? International Journal of Environmental Research and Public Health. 2019; 16(22):4340. https://doi.org/10.3390/ijerph16224340

Chicago/Turabian StyleJiang, Song, Shuang Qiu, Hong Zhou, and Meilan Chen. 2019. "Can FinTech Development Curb Agricultural Nonpoint Source Pollution?" International Journal of Environmental Research and Public Health 16, no. 22: 4340. https://doi.org/10.3390/ijerph16224340

APA StyleJiang, S., Qiu, S., Zhou, H., & Chen, M. (2019). Can FinTech Development Curb Agricultural Nonpoint Source Pollution? International Journal of Environmental Research and Public Health, 16(22), 4340. https://doi.org/10.3390/ijerph16224340