Old Age Support in Urban China: The Role of Pension Schemes, Self-Support Ability and Intergenerational Assistance

Abstract

1. Introduction

2. Public Pension Scheme, Intergenerational Assistance and Self Support

2.1. Pension Reform in China

2.2. Intergenerational Assistance and Self Support Ability

3. Materials and Methods

3.1. Data and Variables

3.1.1. Dependent Variable

3.1.2. Explanatory Variables

Public Pension and Pension Inequality

Intergenerational Assistance and Self Support Ability

Control Variables

3.2. Analysis

4. Results and Discussion

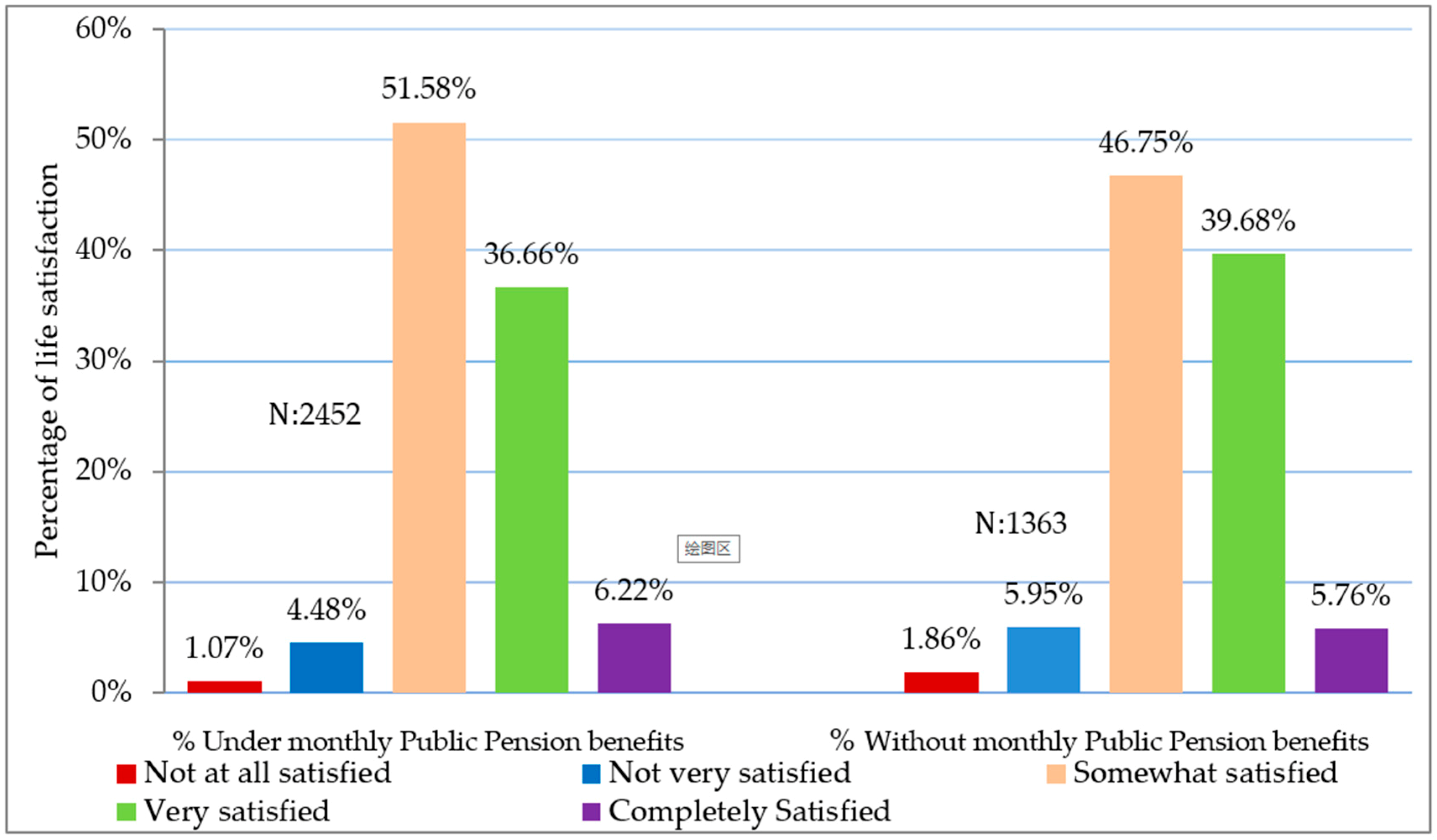

4.1. Ordered Logit Analysis

4.1.1. Effect of Pension and Pension Inequality on Life Satisfaction of Retired Urban Elderly

4.2.2. Effect of Intergenerational Support and Self Support on the Life Satisfaction of Retired Urban Elderly

4.2.3. Effect of Old Age Support on Life Satisfaction among Pension Beneficiaries and Non-Beneficiaries

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

Appendix B

| Variables | VIF | 1/VIF |

|---|---|---|

| Education | 1.44 | 0.69 |

| Age | 1.43 | 0.70 |

| Hukou Status | 1.42 | 0.70 |

| Pension benefit from EEBP | 1.42 | 0.70 |

| Communication with children | 1.38 | 0.72 |

| Marital status | 1.38 | 0.73 |

| Residence Ownership | 1.38 | 0.73 |

| Pension benefit from GIP | 1.29 | 0.77 |

| Cohabiting with children | 1.29 | 0.78 |

| Gender | 1.26 | 0.79 |

| Public Pension | 1.24 | 0.81 |

| Financial assistance from children | 1.16 | 0.86 |

| Personal Finance | 1.16 | 0.86 |

| Education2 | 1.14 | 0.88 |

| Have at least one child | 1.13 | 0.88 |

| Pension Income Inequality | 1.12 | 0.90 |

| Pension benefit from URRSP | 1.09 | 0.92 |

| Health status based on ADL and IADL | 1.09 | 0.92 |

| Pension Income Inequality × Hukou Status | 1.04 | 0.96 |

| Health status based on chronic disease | 1.04 | 0.96 |

| Pension Inequality × Gender | 1.06 | 0.97 |

| Mean VIF | 1.23 |

References

- Queisser, M.; Reilly, A.; Hu, Y. China’s pension system and reform: An OECD perspective. Econ. Polit. Stud. 2016, 4, 345–367. [Google Scholar] [CrossRef]

- Zhu, H.; Walker, A. Pension system reform in China: Who gets what pensions? Soc. Policy Adm. 2018, 52, 1410–1424. [Google Scholar] [CrossRef]

- Liu, Z. Institution and inequality: The hukou system in China. J. Comp. Econ. 2005, 33, 133–157. [Google Scholar] [CrossRef]

- Liu, T.; Sun, L. Pension Reform in China. J. Aging Soc. Policy 2016, 28, 15–28. [Google Scholar] [CrossRef] [PubMed]

- Kuang, L.; Liu, L. Discrimination against Rural-to-Urban Migrants: The Role of the Hukou System in China. PLoS ONE 2012, 7. [Google Scholar] [CrossRef]

- Huang, Y.; Guo, F. Welfare Programme Participation and the Wellbeing of Non-local Rural Migrants in Metropolitan China: A Social Exclusion Perspective. Soc. Indic. Res. 2017, 132. [Google Scholar] [CrossRef]

- Ng, S.T.; Tey, N.P.; Asadullah, M.N. What matters for life satisfaction among the oldest-old? Evidence from China. PLoS ONE 2017, 12, 1–16. [Google Scholar] [CrossRef]

- Van Dullemen, C.E.; Nagel, I.; de Bruijn, J.M. Are the Chinese Saving for Old Age? J. Popul. Ageing 2017, 10, 287–310. [Google Scholar] [CrossRef]

- Dong, K.; Wang, G. China’s pension system: Achievement, challenges and future developments. Econ. Polit. Stud. 2016, 4, 345–367. [Google Scholar] [CrossRef]

- Pozen, R.C. Tackling the Chinese Pension System; Paulson Institute: Chicago, IL, USA, 2013. [Google Scholar]

- Zhao, L. Issues and options for social security reform in China. In China’s Soial Development and Policy: Into the Next Stage? Zhao, L.T., Ed.; Routledge: Abingdon-on-Thames, UK, 2013; pp. 52–81. ISBN 9781135046873. [Google Scholar]

- Ringen, S.; Ngok, K. What Kind of Welfare State is Emerging in China? Palgrave Macmillan: London, UK, 2013. [Google Scholar]

- Feldstien, M. Social Security Pension Reform in China. China Econ. Rev. 1999, 10, 99–107. [Google Scholar] [CrossRef]

- Zhao, Y.; Xu, J. China’s Urban Pension System: Reform and Problems. Cato 2002, 21, 961–981. [Google Scholar]

- Wang, Y. Understanding the Implementation Gap of China’s Urban Pension Scheme at the Level of Rural-Urban Migrant Workers; University of Queensland: Brisbane, Australia, 2016. [Google Scholar]

- Xiqing, G. China’s Pension System: Its History and Future. In Reinventing Retirement Asia: Enhancing the Opportunity of Aging; Xiqing, G., Ed.; National Council for Social Security Fund: Beijing, China, 2015; pp. 1–24. [Google Scholar]

- Vilela, A. Pension Coverage in China and the Expansion of the New Rural Social Pension. Available online: https://www.refworld.org/pdfid/5301df5d4.pdf (accessed on 4 February 2019).

- Ministry of Finance The People’s Republic of China; Ministry of Finance Japan. Joint Research Report on the Chinese and Japanese Pension Systems; Ministry of Finance The People’s Republic of China: Beijing, China; Ministry of Finance Japan: Tokyo, Japan, 2018.

- Organization for Economic Co-operation and Development. Pension at A Glance 2017: Country Profile-China; OECD: Paris, France, 2016; pp. 1–3. [Google Scholar]

- Gorry, A.; Gorry, D.; Slavov, S. Does retirement improve health and life satisfaction? Health Econ. 2018, 27, 2067–2086. [Google Scholar] [CrossRef] [PubMed]

- Coe, N.B.; Zamarro, G. Retirement effects on health in Europe. J. Health Econ. 2011, 30, 77–86. [Google Scholar] [CrossRef]

- Smith, J.P. Work, Retirement and Depression. J. Popul. Ageing 2013, 2, 1–13. [Google Scholar]

- Charles, K.K. Is Retirement Depressing? Labor Force Inactivity and Psychological Well-Being in Later Life; Emerald Group Publishing Limited: Bingley, UK, 2002. [Google Scholar]

- Fonseca, R.; Kapteyn, A.; Lee, J.; Zamarro, G.; Feeney, K. A longitudinal Study of Well-being of Older Europeans: Does Retirement Matter? J. Popul. Ageing 2013, 6, 21–41. [Google Scholar] [CrossRef]

- Kapteyn, A.; Lee, J.; Zamarro, G. Does Retirement Induced Through Social Security Pension Eligibility Influence Subjective Well-Being? A Cross-Country Comparison. Mich. Retire. Res. Cent. Res. Pap. 2013, 301, 22. [Google Scholar] [CrossRef][Green Version]

- Li, S.; Zhang, J.; Shan, L. How Life Satisfaction and Income Moderate the Effects of Endowment Insurance Policy Values on the Retirement Life Support Perceived by Employees in Private Firms. Acta Psychol. Sin. 2018, 12–14. [Google Scholar] [CrossRef]

- Calvo, E. The impact of pension policy on older adults’ life satisfaction: An analysis of longitudinal multilevel data. Diss. Abstr. Int. Sect. A Humanit. Soc. Sci. 2010, 70, 2754. [Google Scholar]

- Hye-Won Kim, E. Public Support, Family Support, and Life Satisfaction of the Elderly: Evidence from A New Government Old-Age Pension in Korea; Duke University: Durham, NC, USA, 2012. [Google Scholar]

- De Grip, A.; Lindeboom, M.; Monitizan, R. Shattered dreams: The effect of changing the pension system late in the game. Econ. J. 2011, 122, 1–25. [Google Scholar] [CrossRef]

- Cong, Z.; Silverstein, M. Intergenerational support and depression among elders in rural China: Do daughters-in-law matter? J. Marriage Fam. 2008, 70, 599–612. [Google Scholar] [CrossRef]

- Guo, M.; Aranda, M.P.; Silverstein, M. The impact of out-migration on the inter-generational support and psychological wellbeing of older adults in rural China. Ageing Soc. 2009, 29, 1085–1104. [Google Scholar] [CrossRef]

- National Academy of Sciences Intergenerational Transfers. Preparing for An Aging World; National Academies Press: Washington, DC, USA, 2001; pp. 1–34. [Google Scholar]

- Chen, J.; Jordan, L.P. Intergenerational support and life satisfaction of young-, old- and oldest-old adults in China. Aging Ment. Heal. 2016, 22, 412–420. [Google Scholar] [CrossRef]

- Schwarz, B.; Albert, I.; Trommsdorff, G.; Zheng, G.; Shi, S.; Nelwan, P.R. Intergenerational Support and Life Satisfaction: A Comparison of Chinese, Indonesian, and German Elderly Mothers. J. Cross. Cult. Psychol. 2010, 41, 706–722. [Google Scholar] [CrossRef]

- Liang, J.; Zhang, P.; Zhu, X.; Qiao, Y.; Zhao, L.; He, Q. Effect of intergenerational and intragenerational support on perceived health of older adults: A population-based analysis in rural China. Fam. Pract. 2014, 31, 164–171. [Google Scholar] [CrossRef] [PubMed]

- Krause, N.; Ar, H.; Baker, E. Providing support to others and well-being in later life. J. Gerontol. Psychol. Sci. 1992, 47, 300–311. [Google Scholar] [CrossRef]

- Krause, N. Anticipated Support, Received Support, and Economic Stress Among Older Adults. J. Gerontol. Geriatr. Res. 1997, 52, 284–293. [Google Scholar] [CrossRef] [PubMed]

- Chen, X.; Silverstein, M. Intergenerational Social Support and the Psychological Well-Being of Older Parents in China. Res. Aging 2000, 22, 43–65. [Google Scholar] [CrossRef]

- Brasher, M.S. Living arrangements of older adults in China: The interplay among preferences, realities, and health. Res. Aging 2011, 33, 172–204. [Google Scholar]

- Silverstein, M.; Cong, Z.; Li, S. Intergenerational Transfers and Living Arrangements of Older People in Rural China: Consequences for Psychological Well-Being. J. Gerontol. Ser. B Psychol. Sci. Soc. Sci. 2006, 61, S256–S266. [Google Scholar] [CrossRef]

- Chyi, H.; Mao, S. The Determinants of Happiness of China’s Elderly Population. J. Happiness Stud. 2012, 13, 167–185. [Google Scholar] [CrossRef]

- Zhang, Y.; Shi, L. East Asia Forum; Crawford School of Public Policy: Canberra, Australia, 2011; pp. 3–5. [Google Scholar]

- McKernan, S.-M.; Sherraden, M. Asset Building and Low-Icome Families; Urban Institute Press: Washngton, DC, USA, 2008. [Google Scholar]

- Caner, A.; Wolff, E.N. Asset Poverty in the United States, 1984–1999: Evidence from the Panel Study of Income Dynamics. Rev. Income Wealth 2004, 50, 493–519. [Google Scholar] [CrossRef]

- Brown, S.; Gray, D. Household Finances and Well-Being: An Empirical Analysis of Comparison Effects; University of Sheffield: Sheffield, UK, 2014. [Google Scholar]

- Wolff, E.N.; Zacharias, A. Household wealth and the measurement of economic well-being in the United States. J. Econ. Inequal. 2009, 83, 83–115. [Google Scholar] [CrossRef]

- Cheng, Z.; Prakash, K.; Smyth, R.; Wang, H. Housing Wealth and Happiness in Urban China. Available online: https://www.researchgate.net (accessed on 5 February 2019).

- Headey, B.; Muffels, R.; Wooden, M. Money Doesn’t Buy Happiness.... Or Does It? A Reconsideration Based on the Combined Effects of Wealth, Income and Consumption; IZA: Bonn, Germany, 2004. [Google Scholar]

- Landiyanto, E.A.; Ling, J.; Puspitasari, M.; Irianti, S.E. Wealth and Happiness: Empirical Evidence from Indonesia. In Proceedings of the 10th Indonesian Regional Science Association (IRSA) International Conference, Surabaya, Indonesia, 28–29 July 2010; pp. 1–19. [Google Scholar]

- Li, J.; Li, H.; Gan, L. Household Assets, Debt and Happiness: An Explanation to “Happiness-Income” Puzzle. Nankai Econ. Stud. 2015, 5, 1–22. [Google Scholar]

- Deng, S.; Huang, J.; Sherraden, M.; Jin, M. Asset opportunity for the poor: An asset-based policy agenda towards inclusive growth in China. China J. Soc. Work 2013, 6, 40–51. [Google Scholar] [CrossRef]

- Howell, C.J.; Howell, R.T.; Schwabe, K.A.; Howell, J.; Kurt, A. Does Wealth Enhance Life Satisfaction for People Who Are Materially Deprived? Exploring the Association among the “Orang Asli” of Peninsular Malaysia. Soc. Indic. Res. 2014, 76, 499–524. [Google Scholar] [CrossRef]

- Han, C.-K. Song-lee Hon Assets and Life Satisfaction Patterns Among Korean Older Adults: Latent Class Analysis. Soc. Indic. Res. 2011, 100, 225–240. [Google Scholar] [CrossRef]

- Hong, S.; Han, C. Asset Impacts on Life Satisfaction in an Asset- Rich Country: Focusing on Older Adults in Singapore. Soc. Indic. Res. 2014, 118, 125–140. [Google Scholar] [CrossRef]

- Puvill, T.; Lindenberg, J.; Craen, A.J.M.; De Slaets, J.P.J.; Westendorp, R.G.J. Impact of physical and mental health on life satisfaction in old age: A population based observational study. BMC Geriatr. 2016, 16, 1–9. [Google Scholar] [CrossRef] [PubMed]

- Sabatini, F. The relationship between happiness and health: Evidence from Italy 1. Soc. Res. Med. 2014, 114, 178–187. [Google Scholar] [CrossRef]

- Easterlin, R.A. Life cycle happiness and its sources. J. Econ. Psychol. 2006, 27, 463–482. [Google Scholar] [CrossRef]

- Zhao, Y.; Hu, Y.; Smith, J.P.; Strauss, J.; Yang, G. Cohort profile: The China health and retirement longitudinal study (CHARLS). Int. J. Epidemiol. 2014, 43, 61–68. [Google Scholar] [CrossRef] [PubMed]

- CHARLS China Health and Retirement Longitudinal Study. Available online: http://charls.pku.edu.cn/en/page/data/2015-charls-wave4 (accessed on 23 January 2019).

- Frey, S.B.; Stutzer, A. Happiness Research: State and Prospects. Rev. Soc. Econ. 2005, 62, 207–228. [Google Scholar] [CrossRef]

- Agresti, A. Analysis of Ordinal Categorical Data, 2nd ed.; John Wiley & Sons, Inc.: Hoboken, NJ, USA, 2012; ISBN 978-0-470-08289. [Google Scholar]

- Yin, X.; Abruquah, L.A.; Ding, Y. Dynamics of Life Satisfaction Among Rural Elderly in China: The Role of Health Insurance Policies and Intergenerational Relationships. Sustainability 2019, 11, 701. [Google Scholar] [CrossRef]

| Variables | Definitions | Mean | Standard Deviation (SD) | Min | Max |

|---|---|---|---|---|---|

| Age | Age of the respondents | 68.72 | 7.02 | 60 | 105 |

| Education2 | The square of educational level | 16.47 | 15.23 | 1 | 100 |

| Personal Financing | Individual assets including past year wages, income from self-employed activities of past year, proceeds from renting out owned apartment, savings of this household (deposit, cash) and financial capitals (market value of stocks and mutual funds, value of government bonds, value of public housing funds) measured in 1000 RMB | 22.70 | 6.83 | 0 | 576 |

| Health status based on ADL and IADL | Health status measured by the weighted sum of ADL and IADL ranging from 1 to 4 | 3.10 | 0.49 | 1.05 | 3.81 |

| Communication with children | Frequency of communication with non-cohabiting children within a year. | 20 | 12.80 | 0 | 56 |

| Financial assistance from children | Financial support from non-cohabiting children with in a year (1000 RMB) | 3.40 | 6.98 | 0 | 40 |

| Pension Income Inequality | The Gini coefficient of monthly pension income on provincial level | 0.73 | 0.11 | 0.18 | 0.89 |

| Pension benefit from GIP | Amount of monthly benefits respondent receives from the Government and Institution Pension scheme (1000 RMB). | 3.71 | 3.25 | 0.45 | 51.2 |

| Pension benefit from EEBP | Amount of monthly benefits respondent receives from the Enterprise Employee Basic Pension scheme (1000 RMB). | 2.43 | 0.91 | 0.14 | 8 |

| Pension benefit from URRSP | Amount of monthly benefits respondent receives from the Urban-Rural Social Residents Pension scheme (1000 RMB). | 0.32 | 0.54 | 0.058 | 4 |

| N (%) | Min | Max | |||

| Life satisfaction | 1 = “not at all satisfied”; 2 = “not very satisfied”; 3 = “somewhat satisfied”; 4 = “very satisfied”; 5 = “completely satisfied” | 1 (1.66%) 2 (5.05%) 3 (49.50%) 4 (37.74%) 5 (6.05%) | 1 | 5 | |

| Education (Edu) | The highest level of education the respondent received; 1 = “illiterate”, 10 = “Master’s degree” | 1 (19.45%) 2 (14.50%) 3 (21.68%) 4 (18.22%) 5 (14.76%) 6 (4.51%) 7 (3.80%) 8 (1.86%) 9 (1.21%) 10 (0.03%) | 1 | 10 | |

| Gender | Gender of respondent, 1 = male, 0 = female | 0 (51%) 1 (49%) | 0 | 1 | |

| Marital Status | Marital status of respondent; 1 = “single”, 0 = “with alive partner” | 0 (77.30%) 1 (22.70%) | 0 | 1 | |

| Hukou Status | Residence status of respondent, where 1 denotes having urban residence status and 0 otherwise. | 0 (45.16%) 1 (54.84%) | 0 | 1 | |

| Residence Ownership | Ownership of current living house, with 1 representing ‘the current living house is entirely or partly owned by the respondent’ and 0 ‘otherwise’ | 0 (39.79%) 1 (60.21%) | 0 | 1 | |

| Health status based on Chronic disease | Whether the respondent suffers from any chronic disease (physical, mental and cognitive), with 1 ‘denoting suffers from a chronic disease’ and 0 ‘otherwise’ | 0 (33.11%) 1 (66.89%) | 0 | 1 | |

| Have at least one child | Whether the respondent has a at least one child, where 1 measures the respondent has children and 0 otherwise | 0 (5.06%) 1 (94.94%) | 0 | 1 | |

| Cohabiting with children | Whether the respondent lives in the same house with children or not, where 1 represents the respondent shares the same roof with their children and 0, otherwise. | 0 (77%) 1 (23%) | 0 | 1 | |

| Public Pension | Whether or not the respondent receives regular monthly benefits from any of the pension schemes. | 0 (35.3%) 1 (64.27%) | 0 | 1 |

| Variables | Model 1 | Model 2 | Model 3 |

|---|---|---|---|

| Pension Inequality | |||

| Pension Income Inequality | −0.8576 *** (0.3262) | −1.0176 *** (0.3275) | −1.5752 *** (0.3542) |

| Pension Income Inequality × Gender | 1.1582 * (0.6551) | 1.3759 ** (0.6774) | |

| Pension Income Inequality × Hukou status | 1.3493 ** (0.7982) | ||

| Pension | |||

| Public Pension | 0.4123 *** (0.0963) | 0.4339 *** (0.0953) | 0.3374 *** (0.0946) |

| Pension benefit from GIP | 0.2163 *** (0.0298) | 0.2180 *** (0.0300) | 0.2571 *** (0.0290) |

| Pension benefit from EEBP | 0.2177 *** (0.0389) | 0.2157 *** (0.0394) | 0.2916 *** (0.0387) |

| Pension benefit from URRSP | 0.0436 (0.0982) | 0.0266 (0.0994) | 0.0310 (0.0990) |

| Self_Support_Ability | |||

| Personal Finance | 0.0012 *** (0.0004) | 0.0011 ** (0.0004) | 0.0012 ** (0.0004) |

| Residence Ownership | 0.4238 *** (0.0758) | 0.4387 *** (0.0757) | 0.4266 ** (0.0759) |

| Health status based on ADL and IADL | 0.4505 *** (0.1501) | 0.4249 ** (0.1489) | 0.4497 *** (0.1463) |

| Health status based on chronic disease | −0.2989 *** (0.0669) | −0.2952 *** (0.0673) | −0.3109 *** (0.0675) |

| Intergenerational_Support | |||

| Have at least one child | 0.3910 ** (0.2125) | 0.3856 ** (0.2122) | 0.5368 ** (0.2145) |

| Cohabiting with children | −0.0828 (0.0865) | −0.0915 (0.0867) | −0.1156 (0.0873) |

| Financial assistance from children | 0.0008 (0.0051) | 0.0009 (0.0051) | 0.0006 (0.0051) |

| Communication with children | 0.0130 ***(0.0028) | 0.0117 *** (0.0028) | 0.0101 *** (0.0028) |

| Control Variable | |||

| Age | YES | YES | YES |

| Education Education2 | YES YES | YES YES | YES YES |

| Marital status | YES | YES | YES |

| Gender | YES | YES | YES |

| Hukou status | YES | YES | YES |

| Regression Index | |||

| Wald Chi2 | 501.40 | 512.46 | 459.60 |

| Prob > Chi2 | 0.00 | 0.00 | 0.00 |

| Pseudo R2 | 0.06 | 0.06 | 0.05 |

| Observations | 3815 | 3815 | 3815 |

| Variables | Pension Beneficiaries | Non-Beneficiaries |

|---|---|---|

| Pension Inequality and Pension Types | ||

| Pension income Inequality | −0.8856 ** (0.4012) | −1.0397 * (0.6474) |

| Pension benefit from GIP | 0.1902 *** (0.0464) | |

| Pension benefit from EEBP | 0.0959 *** (0.0539) | |

| Pension benefit from URRSP | 0.0198 (0.1167) | |

| Pension benefits from GIP × financial assistance from children | 0.0066 (0.0069) | |

| Pension benefits from EEBP × financial assistance from children | 0.0086 (0.0053) | |

| Pension benefits from URRSP × financial assistance from children | 0.0024 (0.0245) | |

| Self_Support Ability | ||

| Personal Finance | 0.0015 *** (0.0006) | 0.0021 ** (0.0010) |

| Residence ownership | 0.4115 *** (0.0940) | 0.5483 *** (0.1446) |

| Health status based on ADL and IADL | 0.6539 *** (0.2649) | 0.3486 ** (0.1714) |

| Health status based on chronic disease | −0.2583 ** (0.0884) | −0.4493 *** (0.1427) |

| Health status based on ADL_IADL × Cohabiting with children | −0.7450 (0.6264) | −0.6879 (0.3444) |

| Health status based on chronic disease × Cohabiting with children | −0.2769 (0.0918) | −0.0126 (0.2921) |

| Intergenerational_Support | ||

| Have at least one child | 0.4117 *** (0.2632) | 0.4205 ** (0.2398) |

| Cohabiting with children | −0.3353 ** (0.6953) | −0.1976 (0.3629) |

| Financial assistance from children | 0.0052 (0.0093) | 0.0305 *** (0.0101) |

| Communication with children | 0.0078 ** (0.0035) | 0.0149 *** (0.0048) |

| Cohabiting with children × Marital Status | 0.4639 *** (0.2231) | 0.7304 *** (0.2969) |

| Control Variables | YES | YES |

| Wald Chi2 | 404.15 | 219.07 |

| Prob > Chi2 | 0.00 | 0.00 |

| Pseudo R2 | 0.08 | 0.06 |

| Observations | 2452 | 1363 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Abruquah, L.A.; Yin, X.; Ding, Y. Old Age Support in Urban China: The Role of Pension Schemes, Self-Support Ability and Intergenerational Assistance. Int. J. Environ. Res. Public Health 2019, 16, 1918. https://doi.org/10.3390/ijerph16111918

Abruquah LA, Yin X, Ding Y. Old Age Support in Urban China: The Role of Pension Schemes, Self-Support Ability and Intergenerational Assistance. International Journal of Environmental Research and Public Health. 2019; 16(11):1918. https://doi.org/10.3390/ijerph16111918

Chicago/Turabian StyleAbruquah, Lucille Aba, Xiuxia Yin, and Ya Ding. 2019. "Old Age Support in Urban China: The Role of Pension Schemes, Self-Support Ability and Intergenerational Assistance" International Journal of Environmental Research and Public Health 16, no. 11: 1918. https://doi.org/10.3390/ijerph16111918

APA StyleAbruquah, L. A., Yin, X., & Ding, Y. (2019). Old Age Support in Urban China: The Role of Pension Schemes, Self-Support Ability and Intergenerational Assistance. International Journal of Environmental Research and Public Health, 16(11), 1918. https://doi.org/10.3390/ijerph16111918