Spatial Effects of Technological Progress and Financial Support on China’s Provincial Carbon Emissions

Abstract

:1. Introduction

2. Literature Review

2.1. Factors Affecting Carbon Emissions: Openness of Trade, Population Size, Environment, Human Capital, Output Per Capita, Industrial Structure, Gross Output, Energy Structure, and Energy iIntensity

2.2. Energy Consumption

2.3. The Impact of Transportation, Highway Construction, Construction, and Tourism Development on Carbon Emissions

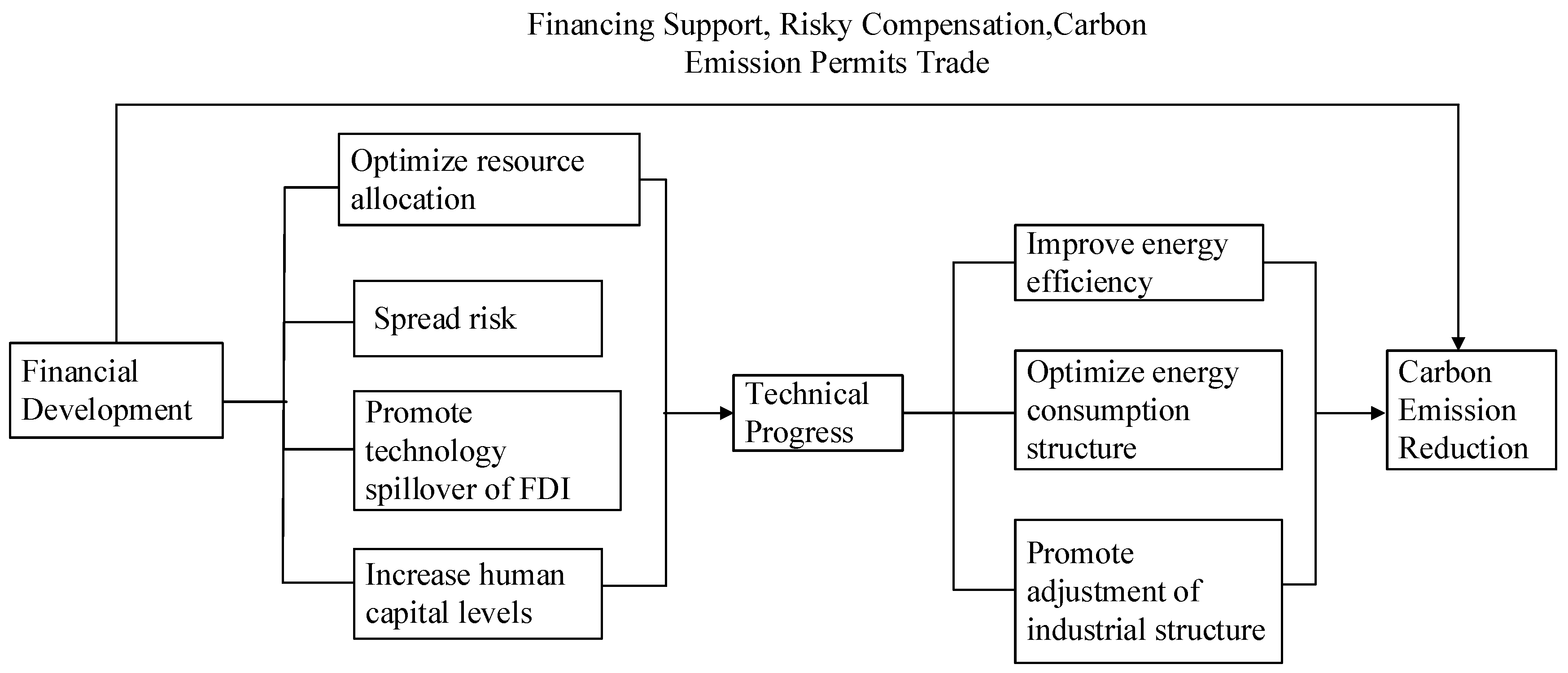

2.4. The Impacts of Financial Support and Technological Progress on Carbon Emissions

2.5. Conclusions from the Literature Review

3. Model Setting and Data Description

3.1. Model Setting

3.2. Variable Selection and Data Description

4. Empirical Analysis

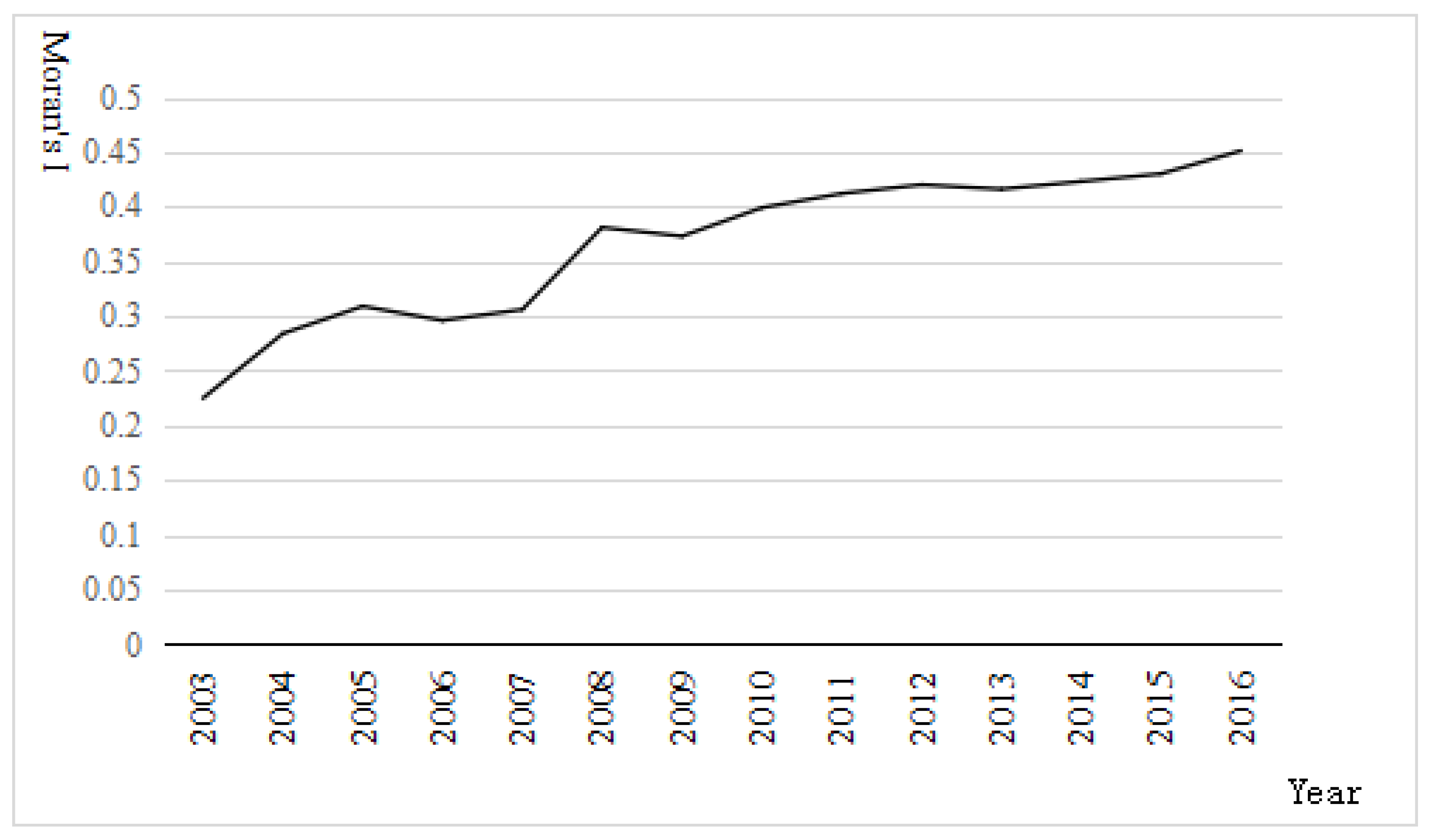

4.1. Provincial Spatial Autocorrelation Test of Carbon Emissions

4.2. Analysis of the Spatial Durbin Model Estimation Results

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Tan, D. Correlation Analysis and Comparison of Economic Development and Carbon Emission in Eastern, Central and Western China. China Popul. Resour. Environ. 2008, 18, 54–57. [Google Scholar]

- Leng, X. Research on the Relationship Between Carbon Emissions and China’s Economic Development; Fudan University: Shanghai, China, 2012. [Google Scholar]

- Wang, L. The Impact of Changes in Economic Development Mode on China’s Carbon Emission Intensity. Mod. Econ. Inf. 2016, 15, 15. [Google Scholar]

- Li, K.; Qi, S.Z. Trade Openness, Economic Growth and China’s Carbon Dioxide Emissions. Econ. Res. 2011, 11, 60–72. [Google Scholar]

- Bassem, K. The Short and Long run Causality Relationship among Economic Growth, Energy Consumption and Financial Development: Evidence from South Mediterranean Countries (SMCs). Energy Econ. 2017, 68, 19–30. [Google Scholar]

- Yang, Y.; Chen, F.F. Research on Carbon Emissions Embodied in Trade between China and South Korea. Atmos. Pollut. Res. 2017, 8, 56–63. [Google Scholar]

- Sun, B. Analysis on the Influencing Factors of Low-carbon Economy and Its Mitigation Countermeasures in Sichuan Province. Meteorol. Environ. Res. 2011, 2, 49–52. [Google Scholar]

- Wang, C.; Chen, J.I.; Zou, J. Decomposition of energy-related CO2, emission in China: 1957–2000. Energy 2005, 30, 73–83. [Google Scholar] [CrossRef]

- Chang, Y.F.; Lewis, C.; Lin, S.J. Comprehensive Evaluation of Industrial CO2, Emission (1989–2004) in Taiwan by Input–output Structural Decomposition. Energy Policy 2008, 36, 2471–2480. [Google Scholar] [CrossRef]

- Soytas, U.; Sari, R. Energy Consumption, Economic Growth, and Carbon Emissions: Challenges Faced by an EU Candidate Member. Ecol. Econ. 2009, 68, 1667–1675. [Google Scholar] [CrossRef]

- Ohlan, R. The Impact of Population Density, Energy Consumption, Economic Growth and Trade Openness on CO2 Emissions in India. Nat. Hazards 2015, 79, 1–20. [Google Scholar] [CrossRef]

- Magazzino, C. Energy Consumption, CO2 Emission, and Economic Growth: Evidence from Chile. Int. J. Green Energy 2015, 12, 543–550. [Google Scholar]

- Freitas, L.C.D.; Kaneko, S. Decomposing the Decoupling of CO2, Emissions and Economic Growth in Brazil. Ecol. Econ. 2011, 70, 1459–1469. [Google Scholar] [CrossRef]

- Chen, S. Energy Consumption, Carbon Dioxide Emissions and Sustainable Development of Chinese Industry. Econ. Res. 2009, 4, 41–55. [Google Scholar]

- Sadia, B.; Zhao, Y.H.; Wang, S.; Liu, Y. Identifying the Impacts of Human Capital on Carbon Emissions in Pakistan. J. Clean. Prod. 2018, 183, 1082–1092. [Google Scholar]

- Ou, Y.M.; Zhou, S.F. Study on Provincial Carbon Emission Based on Spatial Panel STIRPAT Model. Ind. Technol. Econ. 2015, 34, 58–65. [Google Scholar]

- Lu, W.B.; Qiu, T.; Du, L. Research on Factors Affecting Carbon Emissions in Different Economic Growth Stages in China. Econ. Res. 2013, 4, 106–118. [Google Scholar]

- Lu, X.L.; Lv, X.F. Impact Factors Research for Carbon Emissions of Transportation Industry Based on Shapley Decomposition Method-an Analysis of Liaoning Province. In Proceedings of the 2015 AASRI International Conference on Industrial Electronics and Applications (IEA 2015), London, UK, 27–28 June 2015; Information Engineering Research Institute: Texas, TX, USA, 2015. [Google Scholar]

- Xie, R.; Fang, J.Y.; Liu, C.J. The Effects of Transportation Infrastructure on Urban Carbon Emissions. Appl. Energy 2017, 196, 199–207. [Google Scholar] [CrossRef]

- Peng, B.; Fan, X.Y.; Wang, X.J. Key Steps of Carbon Emission and Low-carbon Measures in the Construction of Bituminous Pavement. Int. J. Pavement Res. Technol. 2017, 10, 476–487. [Google Scholar] [CrossRef]

- Wang, K.; Shao, H.Q.; Zhou, T.; Deng, C.X. Analysis of the Impact of Tourism Development on Regional Carbon Emission Based on EKC Framework—Based on China’s Provincial Panel Data from 1995 to 2015. Geogr. Res. 2018, 37, 742–750. [Google Scholar]

- Wang, Q.; Shuang, X.; Huang, R. Analysis of Financial Functions in the Development of Low Carbon Economy. J. Soc. Sci. 2012, 1, 116–119. [Google Scholar]

- Gu, H.M.; He, B. Research on China’s Provincial Financial Development and Carbon Emissions. China Popul. Resour. Environ. 2012, 22, 22–27. [Google Scholar]

- Zhu, W.L. Research on the Effect of Financial Support for Carbon Emission Reduction from the Perspective of Circular Economy—Based on Data from 1995 to 2012 in Gansu Province. Product. Res. 2015, 6, 25–29. [Google Scholar]

- Hao, L. Research on the Correlation Effect between Carbon Emission Market and Provincial Financial Development—An Empirical Analysis Based on Bayesian Spatial Alienation Model. Shanghai Financ. 2016, 9, 64–69. [Google Scholar]

- Jiang, H. The Spatial Spillover Effect of Financial Efficiency on Energy Efficiency under Carbon Emissions—An Empirical Analysis Based on Spatial Dubin Model and SDM Model. J. Liaoning Tech. Univ. (Soc. Sci. Ed.) 2018, 20, 182–188. [Google Scholar]

- Song, M. Intermediate Effects of Financial Development and Industrial Restructuring on Carbon Emissions. Times Financ. 2016, 9, 303–309. [Google Scholar]

- Zhang, Y.J. The Impact of Financial Development on Carbon Emissions: An Empirical Analysis in China. Energy Policy 2011, 39, 2197–2203. [Google Scholar] [CrossRef]

- Li, L.; Liu, D.; Hou, J. The Study of the Impact of Carbon Finance Effect on Carbon Emissions in Beijing-Tianjin-Hebei Region—Based on Logarithmic Mean Divisia Index Decomposition Analysis. Sustainability 2019, 11, 1465. [Google Scholar] [CrossRef]

- Ibrahim, M.H. Trade–finance Complementarity and Carbon Emission Intensity: Panel Evidence from Middle-income Countries. Environ. Syst. Decis. 2018, 38, 489–500. [Google Scholar] [CrossRef]

- Guo, J.J.; Liu, C.Y.; Liu, Y.P. The Impact of Financial Development on Carbon Dioxide (CO2) Emissions—An Empirical Study Based on Cross-country Data. Investig. Res. 2012, 7, 41–53. [Google Scholar]

- Chen, B.Q.; Zhang, L.L. Analysis of the Influence of Financial Development on Carbon Emissions from the Perspective of Dynamic Space. Soft Sci. 2014, 28, 140–144. [Google Scholar]

- Xiong, L.; Qi, S.Z. Financial Development and Carbon Emissions in China’s Provinces—Based on STIRPAT Model and Dynamic Panel Data Analysis. J. China Univ. Geosci. (Soc. Sci. Ed.) 2016, 2, 63–73. [Google Scholar]

- Zhang, L.; Ren, J.; Wang, R. Financial Development, Regional Innovation and Carbon Emissions—Based on Inter-Provincial Dynamic Panel Data Analysis. East China Econ. Manag. 2017, 31, 84–90. [Google Scholar]

- Shafik, N.; Bandyopadhyay, S. Economic Growth and Environmental Quality: Time-Series and Crosscountry Evidence; World Bank Publications: Washington, DC, USA, 1992. [Google Scholar]

- Wang, D.; Nie, R. Analysis and Comparison of Influencing Factors on Energy Saving and CO2 Reductions for Jiangsu Province. Resour. Sci. 2010, 32, 1252–1258. [Google Scholar]

- Zuo, K.G. Dynamic Decomposition of Industrial Carbon Emission Reduction Performance and Its Influencing Factors. J. Nat. Resour. 2014, 9, 1576–1588. [Google Scholar]

- Ren, J.L. Research on Industrial Structure Adjustment and Carbon Emission Reduction Countermeasures in High-efficiency Ecological Economic Zone of the Yellow River Delta. China Popul. Resour. Environ. 2015, 25, 35–42. [Google Scholar]

- Yao, X. Technological Progress, Structural Change and Carbon Dioxide Emission Intensity in Manufacturing Industry. J. Jinan Univ. Sci. Technol. 2013, 35, 59–65. [Google Scholar]

- Wang, B.; Du, M.Z. The Marginal Abatement Cost of Low Carbon Technology and the Win-win of Industrial Economy. South. Econ. 2015, 2, 17–36. [Google Scholar]

- Zhang, W.; Zhu, Q.G.; Li, H.W. Energy use, Carbon Emissions and Efficiency of China’s total Factor Carbon Emission Reduction. Econ. Res. 2013, 10, 138–150. [Google Scholar]

- Su, W.S.; Liu, Y.Y.; Wang, S.J.; Zhao, Y.B.; Su, Y.X.; Li, S.J. Regional Inequality, Spatial Spillover Effects, and the Factors Influencing City-level Energy-related Carbon Emissions in China. J. Geogr. Sci. 2018, 28, 495–513. [Google Scholar] [CrossRef]

- Li, K.J.; Qu, R.X. The Impact of Technological Progress on China’s Carbon Emissions—An Empirical Study Based on Vector Error Correction Model. China Soft Sci. 2012, 6, 51–58. [Google Scholar]

- Liu, H.G.; Liu, W.D.; Fan, X.M. Impact of Trade on Carbon Emissions from Industrial Energy Activities in China. Geogr. Res. 2011, 30, 590–600. [Google Scholar]

- Linares, P.; Perez-Arriaga, I. Promoting Investment in Low-carbon Energy Technologies. Eur. Rev. Energy Mark. 2009, 3, 1–23. [Google Scholar]

- Gouvello, D.C. Executive Summary from World Bank’s “Brazil’s Low Carbon Country Case Study”; The World Bank: Washington, DC, USA, 2010. [Google Scholar]

- Beck, T.; Levine, R.; Loayza, N. Finance and the sources of growth. J. Financ. Econ. 2000, 58, 261–300. [Google Scholar] [CrossRef]

- Hanson, D.; Laitner, J.A.S. An Integrated Analysis of Policies that Increase Investments in Advanced Energy efficient/low-carbon Technologies. Energy Econ. 2004, 26, 739–755. [Google Scholar] [CrossRef]

- Fuente, A.D.L.; Marín, J. Innovation, Bank Monitoring, and Endogenous Financial Development. J. Monet. Econ. 1995, 38, 269–301. [Google Scholar] [CrossRef]

- Tamazian, A.; Chousa, J.P.; Vadlamannati, K.C. Does Higher Economic and Financial Development Lead to Environmental Degradation: Evidence from BRIC Countries. Energy Policy 2009, 37, 246–253. [Google Scholar] [CrossRef]

- Yan, C.L.; Li, T.; Lan, W. Financial Development, Innovation and Carbon Dioxide Emissions. Financ. Res. 2016, 1, 14–30. [Google Scholar]

- Levine, R. The Corporate Governance of Banks: A Concise Discussion of Concepts and Evidence. Policy Res. Work. Pap. 2004, 3, 91–107. [Google Scholar]

- Birdsall, N.; Wheeler, D. Trade Policy and Industrial Pollution in Latin America: Where Are the Pollution Havens? J. Environ. Dev. 1993, 2, 137–149. [Google Scholar] [CrossRef]

- Shahbaz, M.; Solarin, S.A.; Mahmood, H.; Arouri, M. Does Financial Development Reduce CO2 Emissions in Malaysian Economy? A Time Series Analysis. Econ. Model. 2013, 35, 145–152. [Google Scholar] [CrossRef]

- Fisher-Vanden, K.; Jefferson, G.H.; Liu, H.; Tao, Q. What is Driving China’s Decline in Energy Intensity? Resour. Energy Econ. 2004, 26, 77–97. [Google Scholar] [CrossRef]

- Li, L.S.; Zhou, Y. Can Technological Progress Improve Energy Efficiency? Manag. World 2010, 10, 82–89. [Google Scholar]

- Zhu, Y.F.; Teng, Y. Technological Progress, Technological Efficiency and Regional Energy Efficiency. Dongyue Trib. 2010, 31, 42–46. [Google Scholar]

- Pan, X.; Peng, X.; Li, B. Market Distortion, Technical Progress and Energy Efficiency: Policy Choice Based on the Provincial Heterogeneity. J. World Econ. 2017, 40, 91–115. [Google Scholar]

- Dong, F.; Tan, Q.; Zhou, D.; Li, X. The Effect of Technological Progress, Industrial Structure and Opening-up Degree on Chinese Energy Consumption: An Empirical Study Based on the Two-step Method, the Grey Relational Analysis and Co-integration Test, China Population. Resour. Environ. 2010, 20, 22–27. [Google Scholar]

- Zheng, S.; Huang, M. Analysis of Factors Affecting Regional Financial Development Based on Bayes Space Model. Bus. Res. 2015, 57, 62–69. [Google Scholar]

- Wang, K.; Meng, X.; Yang, L.; Cheng, Y. Production Technology Heterogeneity and Regional Green Total Factor Productivity Growth—Based on the Common Frontier and the Analysis of China’s Provincial Panel Data from 2000 to 2012. J. Beijing Inst. Technol. (Soc. Sci. Ed.) 2015, 17, 23–31. [Google Scholar]

- Bai, Q. Comparative Banking; Henan People’s Publishing House: Zhengzhou, China, 1989. [Google Scholar]

- Goldsmith, R.W. Financial Structure and Development; Yale University Press: New Haven, CT, USA, 1969. [Google Scholar]

- Cao, H.G.; Chen, K.; Tong, X. Study on the Spatial Spillover and Influencing Factors of China’s Provincial Carbon Emission Based on the Spatial Panel Data Model. J. Northeast. Univ. (Soc. Sci.) 2015, 6, 573–578. [Google Scholar]

- Niu, H. Empirical Test of China’s Urbanization Carbon Emission Effect. Stat. Decis. 2019, 35, 138–142. [Google Scholar]

- LeSage, J.P.; Pace, R.K. Introduction to Spatial Econometrics; CRC Press Taylor & Francis Group: Boca Raton, FL, USA, 2009. [Google Scholar]

- Yao, L.; Liu, J. Research on Carbon Emission Transfer among Eight Regional Regions in China. China Popul. Resour. Environ. 2010, 20, 16–19. [Google Scholar]

- Peng, L. An Empirical Analysis of Inter-Regional Industrial Linkages and Spillover Effects of Economic Growth in China: Based on the Perspective of Inter-Regional Input-Output Analysis. J. Jishou Univ. (Soc. Sci. Ed.) 2008, 3, 70–77. [Google Scholar]

- Mi, G. The Impact of Financial Development on Carbon Emissions; Dalian University of Technology: Dalian, China, 2017. [Google Scholar]

- Ding, W. Research on the Impact of Financial Development on Carbon Emissions in China’s Industrial Sector; Lanzhou University: Lanzhou, China, 2018. [Google Scholar]

| Variables | Definition and Measurement |

|---|---|

| Carbon intensity Y | Y = CO2/GDP, in tons/ten thousand yuan. |

| Scale variables that reflect financial support FGM | FGM = Total financial assets/GDP = (Total financial resources used by financial institutions + Stock market value + Bond balance + Premium balance)/GDP |

| Structural variables that reflect financial support FJG | FJG = Financial institution loan balance at the end of the year/Total financial assets = Financial institution loan balance at the end of the year/(Total financial resources used by financial institutions + Stock market value + Bond balance + Premium balance) |

| Efficiency variable that reflects financial support FXL | FXL = Total loans of financial institutions/Total financial institutions deposits |

| R&D expenditures internal expenditures RD | Measured by the internal expenditures of R&D expenditures in various regions; the unit is 100 million yuan. |

| Per capita patent applications PAT | PAT = Patent authorization number/Year-end population; the unit for which is 10,000 people. |

| Adjacency weight matrix | , that is, if two regions are geographically adjacent, let , otherwise 0. |

| Geographic weight matrix | , Dij is the distance between the two capital cities calculated by latitude and longitude. |

| Economic weight matrix | , GDP as per region GDP per capita during the sample period |

| Variable | Spatial Fixed Effect | Timed Fixed Effect | Two-Way Fixed Effect |

|---|---|---|---|

| lnFJG | 0.584253 *** (4.106919) | 0.240464 *** (4.033609) | −0.015657 *** (9.649219) |

| lnFGM | 0.639430 *** (6.340458) | −0.030902 (0.928114) | −0.057254 *** (5.085647) |

| lnFXL | 0.029533 (0.238726) | −0.213918 *** (−4.530700) | 0.250308 *** (−4.509987) |

| lnRD | 0.160020 *** (−5.350509) | −0.058099 *** (−3.242875) | −0.145259 ** (−2.382171) |

| lnPAT | −0.056001 ** (−2.321551) | −0.272632 *** (−2.716159) | −0.212585 *** (−2.716159) |

| R2 | 0.1914 | 0.3983 | 0.8030 |

| Log-likelihood | 304.6192 | −248.4110 | 201.5277 |

| LMlag | 3.7554 * | 95.1616 *** | 18.3844 *** |

| Robust-LMlag | 1.8364 | 22.6243 *** | 5.9763 ** |

| LMerror | 2.6604 | 72.5769 *** | 14.3132 * |

| Robust-LMerror | 0.7414 | 0.0396 | 1.9051 |

| Variables | Two-Way Fixed Effect | Random Effect | ||||

|---|---|---|---|---|---|---|

| Adjacency Matrix | Economic Matrix | Geographic Matrix | Adjacency Matrix | Economic Matrix | Geographic Matrix | |

| lnFJG | 0.425188 *** | 0.566384 *** | 0.603039 *** | 0.245802 *** | 0.682680 *** | 0.444862 *** |

| lnFGM | 0.419447 *** | 0.623021 *** | 0.613533 *** | 0.201089 ** | 0.730343 *** | 0.481504 *** |

| lnFXL | −0.013464 * | 0.024588 | −0.047724 ** | 0.057773 * | −0.050647 * | 0.194269 * |

| lnRD | −0.14500 *** | −0.172148 *** | −0.169546 *** | 0.057233 *** | 0.140653 *** | 0.128634 *** |

| lnPAT | −0.017683 ** | −0.044200 * | −0.035167 *** | −0.090255 ** | −0.121580 *** | −0.051648 * |

| W*lnFJG | 0.039356 * | 0.303015 * | 1.080740 *** | −0.016419 * | −0.551633 *** | 0.295951 |

| W*lnFGM | 0.148659 | −0.344371 * | 0.282024 | −0.055532 * | −0.617813 *** | −0.316510 ** |

| W*lnFXL | 0.134168 | −0.196592 ** | −1.245640 *** | −0.193713 ** | 0.097805 | −0.625544 *** |

| W*lnRD | −0.115651 ** | −0.081394 * | −0.187231 * | 0.020980 * | −0.045078 *** | 0.024865 |

| W*lnPAT | −0.042882 ** | −0.141555 ** | −0.130469 * | −0.134885 *** | −0.166242 *** | −0.217064 *** |

| W*lnY | 0.304158 *** | 0.586095 *** | 0.276900 *** | 0.602980 *** | 0.505000 *** | 0.566995 *** |

| teta | 0.072218 | 0.054061 | 0.057969 | |||

| Wald_spatial_lag | 21.5664 *** | 19.0941 *** | 16.9135 *** | 12.9903 *** | 13.8764 *** | 20.0609 *** |

| LR_spatial_lag | 23.1102 *** | 22.0631 *** | 24.3116 *** | |||

| Wald_spatial_error | 28.4327 *** | 21.8123 *** | 22.6681 *** | 16.2104 *** | 12.0887 *** | 16.6862 *** |

| LR_spatial_error | 26.8217 *** | 18.0258 *** | 20.766 | |||

| Variables | Effect | Adjacency Weight Matrix | Economic Weight Matrix | Geographic Weight Matrix |

|---|---|---|---|---|

| lnFJG | Direct Effect | −0.270553 ** (2.572870) | −0.567431 *** (4.776008) | −0.667972 *** (5.532768) |

| Indirect Effect | 0.314399 (0.934393) | −0.229892 (−0.792254) | 1.720065 *** (3.258294) | |

| Total Effect | 0.043846 * (1.775649) | −0.797323 (1.079492) | 1.052093 *** (4.241222) | |

| lnFGM | Direct Effect | −0.212548 ** (2.146843) | −0.622376 *** (5.445147) | −0.638185 *** (5.449312) |

| Indirect Effect | 0.252683 (0.588840) | −0.269054 (0.588840) | 0.924663 (1.453559) | |

| Total Effect | 0.040135 * (1.859323) | −0.89143 (1.198610) | 0.286478 *** (2.774347) | |

| lnFXL | Direct Effect | −0.024885 * (1.906190) | −0.023065 * (−1.870949) | 0.111247 (−0.777147) |

| Indirect Effect | −0.369290 *** (−2.736349) | −0.241266 ** (2.359365) | −1.739281 *** (−2.961039) | |

| Total Effect | −0.394175 * (−1.961541) | −0.264331 (0.638459) | −1.628034 *** (−2.797616) | |

| lnRD | Direct Effect | 0.069459 ** (2.290024) | −0.168532 *** (4.304425) | 0.163037 *** (4.028740) |

| Indirect Effect | −0.130082 ** (2.304254) | −0.057522 (−0.452338) | −0.186815 (−1.286994) | |

| Total Effect | −0.060623 *** (3.396772) | −0.226054 (0.838887) | −0.023778 (0.838887) | |

| lnPAT | Direct Effect | −0.440598 *** (−8.745832) | −0.157121 ** (2.012049) | −0.191621 * (−1.928890) |

| Indirect Effect | −0.128854 *** (−5.546450) | −0.040166 * (−1.935555) | −0.042469 * (−1.99295) | |

| Total Effect | −0.569452 *** (−10.708107) | −0.197287 (1.255859) | −0.234090 ** (−2.322743) |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhou, Y.; Xu, Y.; Liu, C.; Fang, Z.; Guo, J. Spatial Effects of Technological Progress and Financial Support on China’s Provincial Carbon Emissions. Int. J. Environ. Res. Public Health 2019, 16, 1743. https://doi.org/10.3390/ijerph16101743

Zhou Y, Xu Y, Liu C, Fang Z, Guo J. Spatial Effects of Technological Progress and Financial Support on China’s Provincial Carbon Emissions. International Journal of Environmental Research and Public Health. 2019; 16(10):1743. https://doi.org/10.3390/ijerph16101743

Chicago/Turabian StyleZhou, Yingying, Yaru Xu, Chuanzhe Liu, Zhuoqing Fang, and Jiayi Guo. 2019. "Spatial Effects of Technological Progress and Financial Support on China’s Provincial Carbon Emissions" International Journal of Environmental Research and Public Health 16, no. 10: 1743. https://doi.org/10.3390/ijerph16101743

APA StyleZhou, Y., Xu, Y., Liu, C., Fang, Z., & Guo, J. (2019). Spatial Effects of Technological Progress and Financial Support on China’s Provincial Carbon Emissions. International Journal of Environmental Research and Public Health, 16(10), 1743. https://doi.org/10.3390/ijerph16101743