Carbon Emission Reduction with Capital Constraint under Greening Financing and Cost Sharing Contract

Abstract

1. Introduction

2. Literature Review

2.1. Sustainable Supply Chain

2.2. Capital-Constrained Supply Chain

2.3. Greening Financing

3. Model Framework and Notations

4. Mathematical Models

4.1. Benchmark Models: Unlimited Funds for Carbon Emission Reductions

4.1.1. No Cost Sharing

- (1)

- The profit function of the retailer in the no cost sharing caseis concave in. Moreover, the optimal carbon promotional effort level is

- (2)

- If we assume that, the profit function of the manufacturer in the no cost sharing caseis concave in. Moreover, the optimal carbon emission reduction is

4.1.2. Cost Sharing

- (1)

- The profit function of the retailer in the cost sharing caseis concave in. Moreover, the optimal carbon promotional effort level is

- (2)

- If we assume that, the profit function of the manufacturer in the cost sharing caseis concave in. Moreover, the optimal carbon emission reduction is

4.2. Model of Case A1

- (1)

- The profit function of the retailer in Case A1is concave in. Moreover, the optimal carbon promotional effort level is

- (2)

- Given that the manufacturer has limited greening funds for carbon emission reduction, the optimal carbon emission reduction is

- (i)

- ;;.

- (ii)

- ;;; when,; when,.

4.3. Model of Case A2

- (1)

- The profit function of the retailer in Case A2is concave in. Moreover, the optimal carbon promotional effort level is

- (2)

- If we assume that, the profit function of the manufacturer in Case A2is concave in. Moreover, the optimal carbon emission reduction is

- (i)

- ;;;.

- (ii)

- ; when,; when,.

- (iii)

- ;.

4.4. Model of Case B1

- (1)

- The profit function of the retailer in Case B1is concave in. Moreover, the optimal carbon promotional effort level is

- (2)

- The manufacturer has limited greening funds for carbon emission reduction; thus, the optimal carbon emission reduction is

- (i)

- ;; when,; when,.

- (ii)

- ;;; when,; when,.

- (iii)

- ;.

4.5. Model of Case B2

- (1)

- The profit function of the retailer in Case B2is concave in. Moreover, the optimal carbon promotional effort level is

- (2)

- Assume that, the profit function of the manufacturer in Case B2 is concave in. Moreover, the optimal carbon emission reduction is

- (i)

- ;;;.

- (ii)

- When,; when,; when,; when,.

- (iii)

- When,; when,; when,; when,.

- (iv)

- ; when,; when,.

5. Comparison Analysis

5.1. Comparing Cases A1 and B1

- (i)

- ;.

- (ii)

- When,; when,.

- (iii)

- When,; when,.

5.2. Comparing Cases A2 and B2

6. Numerical Analysis

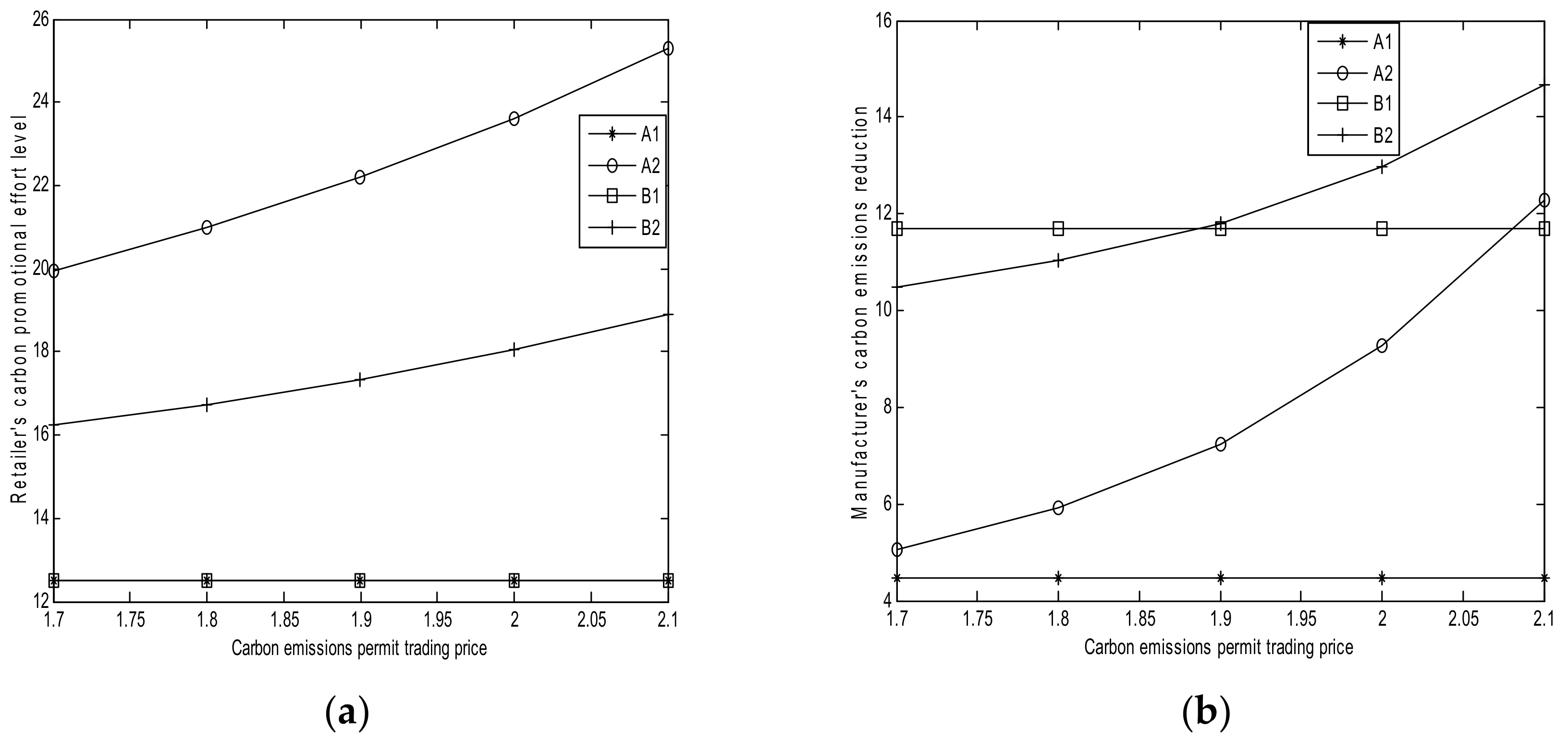

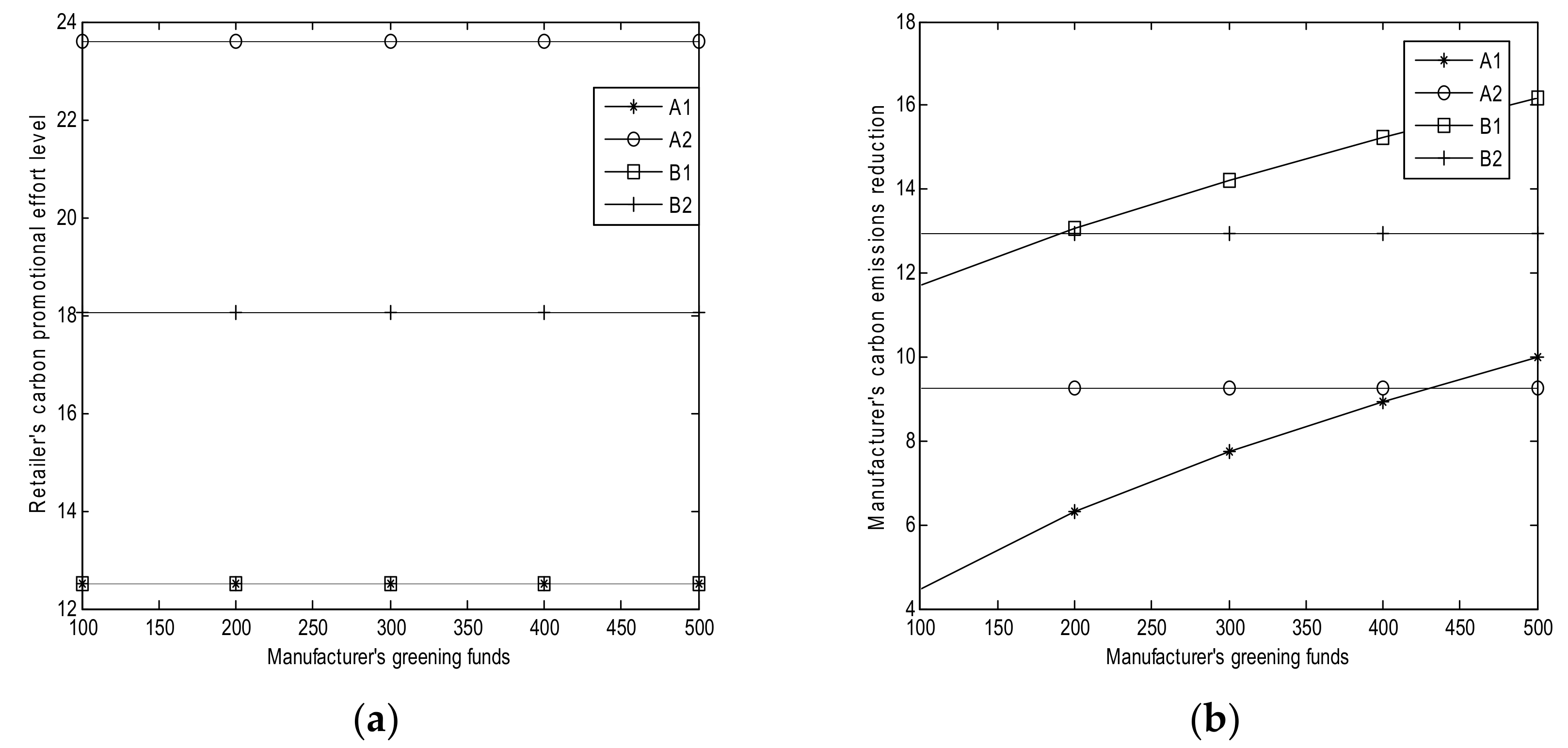

6.1. Effect of Carbon Trading Price

- (1)

- Based on Figure 1a, as the carbon trading price increases, the retailer’s carbon promotional effort levels in Cases A1 and B1 remain the same (Corollaries 1 (ii) and 3 (ii)). The retailer’s promotional effort level in Case A2 increases with (Corollary 2 (ii)). The retailer’s promotional effort level increases with in Case B2 when its cost sharing is small (Corollary 4 (ii)). The promotional level in Case A2 is larger than that in Case B2, which is consistent with Theorem 8. This finding implies that the high carbon trading price can lead to high retailer’s promotional effort levels in Cases A2 and B2. However, does not affect the retailer’s carbon promotional effort levels in Cases A1 and B1.

- (2)

- Based on Figure 1b, the manufacturer is a polluting one in Case A2 and its carbon emission reduction increases with (Corollary 2 (ii)). In Case B2, the manufacturer is a clean one and its carbon emission reduction increases with (Corollary 4 (ii)). Moreover, the manufacturer’s carbon emission reduction in Case B2 is larger than that in Case A2 due to the high interest rate of greening financing, as shown in Theorem 8. This observation implies that the carbon trading price can encourage the manufacturer to reduce carbon emissions. However, as increases, the manufacturer’s carbon emission reduction in Cases A1 and B1 remains the same (Corollaries 1 (ii) and 3 (ii)). The manufacturer’s carbon emission reduction in Case B1 is larger than that in A1, as shown in Theorem 7 (i). This finding implies that does not affect the manufacturer’s carbon emission reduction.

- (3)

- Based on Figure 1c, as increases, the retailer’s profits in Cases A1 and B1 remain the same (Corollaries 1 (ii) and 3 (ii); the former is always lower than the latter, which indicates that the retailer’s cost sharing for the manufacturer is small, as shown in Theorem 7. This condition implies that does not affect the retailer’s profits in Cases A1 and B1. The retailer’s profit in Case B2 increases along with . Moreover, the retailer’s profit in Case A2 initially decreases, and then increases with the increase of . This condition implies that increasing may increase or decrease the retailer’s profit. Furthermore, the retailer’s profit in Case B2 is more than that in Case A2.

- (4)

- Based on Figure 1d, the manufacturer’s profits in Cases A1 and B1 increase with , but they decrease in Cases A2 and B2. Moreover, the manufacturer’s profit in Case A1 is less than that in Case B1, and the manufacturer’s profit in Case A2 is less than that in Case B2.

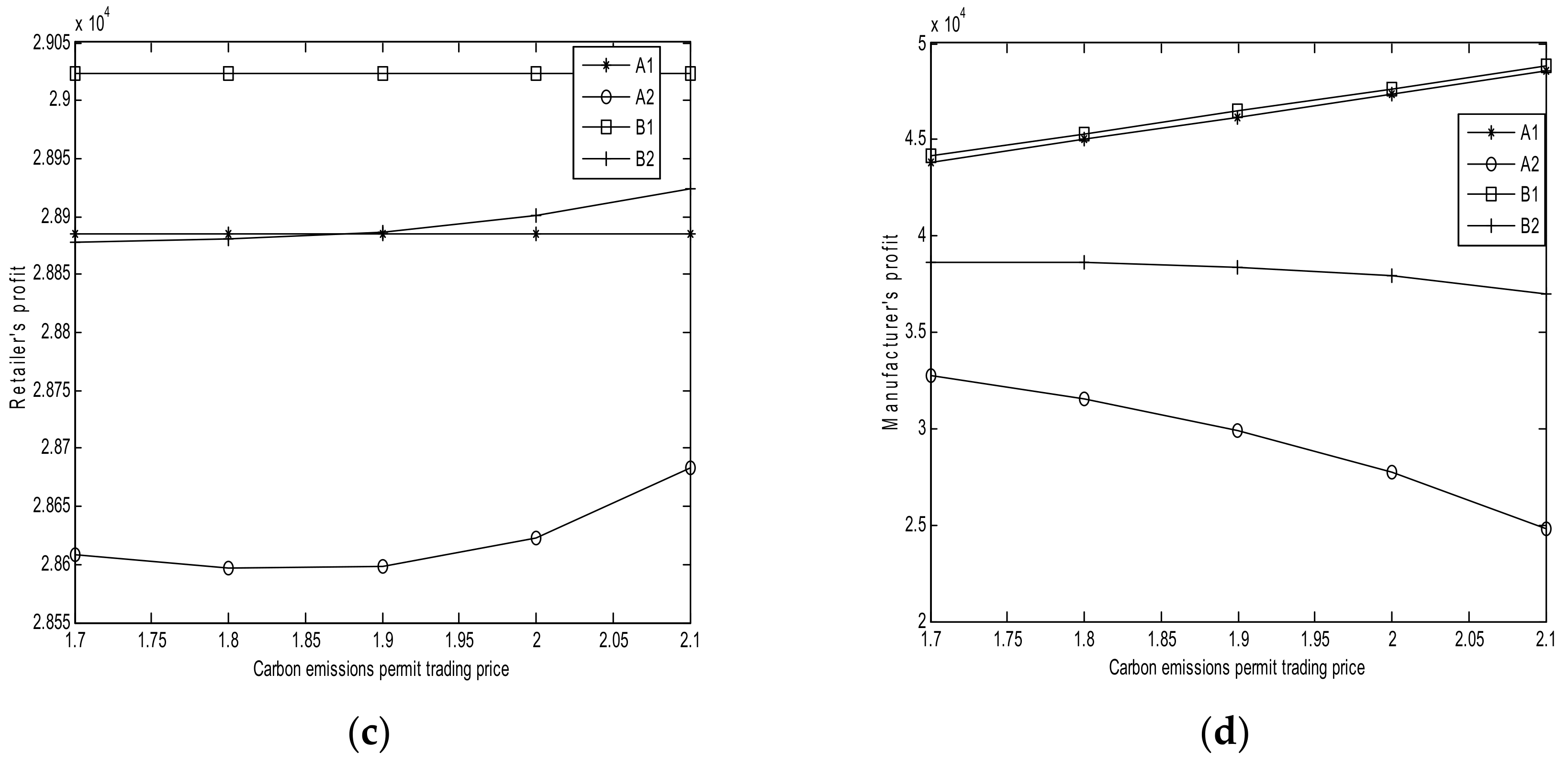

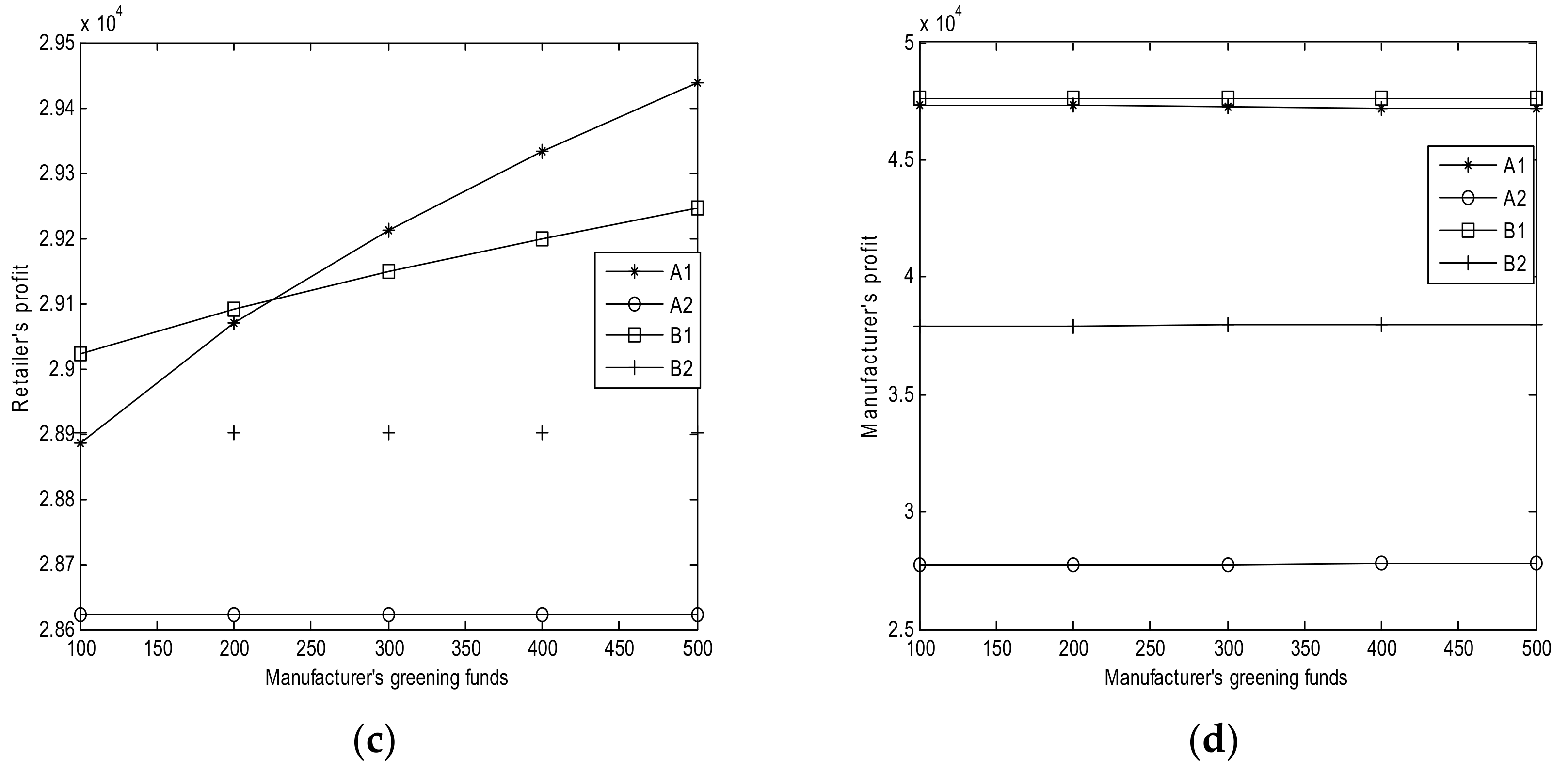

6.2. Effect of Manufacturer’s Greening Funds B

- (1)

- Based on Figure 2a, the retailer’s carbon promotional effort levels in Cases A1, A2, B1, and B2 remain the same with the manufacturer’s greening funds B (Corollaries 1 (i), 2 (i), 3 (i), and 4 (i)). This condition implies that B does not affect the retailer’s carbon promotional effort level whether in Case A1, A2, B1, or B2.

- (2)

- Based on Figure 2b, the manufacturer’s carbon emission reductions in Cases A2 and B2 remain the same with the increase in B (Corollaries 2 (i) and 4 (i). The manufacturer’s carbon emission reductions increase with B in Cases A1 and B1, which is consistent with Corollaries 1 (i) and 3 (i). The interest rate of greening financing is high and the carbon emission reduction in Case A2 is less than that in Case B2, as shown in Theorem 8. Moreover, the carbon emission reduction in Case A1 is less than that in Case B1, as shown in Theorem 7 (i). Therefore, the more greening funds that the manufacturer has, the more carbon emission reductions in Cases A1 and B1. However, B does not affect the manufacturer’s carbon emission reductions in Cases A2 and B2.

- (3)

- Based on Figure 2c, the retailer’s profits remain the same in Cases A2 and B2 with the increase in B (Corollary 2 (i)). The retailer’s profit increases with B in Case A1 (Corollary 1 (i)). When the retailer’s cost sharing for the manufacturer in Case B1 is small, then the retailer’s profit increases with B (Corollary 3 (i)). The retailer’s profit in Case B2 is higher than that in Case A2. When the carbon emission reduction fund is low, the retailer’s profit in Case B1 is higher than that in Case A1; when the carbon emission reduction fund is high, then the profit in Case B1 is lower than that in Case A1, as shown in Theorem 7 (iii). This observation implies that increasing B can lead to a high retailer’s profits in Cases A1 and B1; however, B does not affect the retailer’s profit in Cases A2 and B2.

- (4)

- Based on Figure 2d, the manufacturer’s profits decrease with B in Cases A1 and B1, whereas the profits increase with B in Cases A2 and B2 (Corollaries 2 (ii) and 4 (ii)). This observation implies that increasing B leads to small manufacturer’s profits in Cases A1 and B1. However, increasing B leads to a large manufacturer’s profits in Cases A2 and B2.

6.3. Effect of Interest Rate r

- (1)

- Based on Figure 3a, the retailer’s carbon promotional effort levels remain the same in Cases A1 and B1 with the increase of greening financing rate, whereas it decreases in Case A2 (Corollary 2 (iii)). When the retailer’s cost sharing for the manufacturer is small, then the retailer’s promotional effort level decreases in Case B2 (Corollary 4 (iii)). This observation implies that a high rate of greening financing leads to small carbon promotional effort level.

- (2)

- Based on Figure 3b, the manufacturer’s carbon emission reductions in Cases A1 and B1 remain unchanged with r. The reduction decreases in Case A2 with r (Corollary 2 (iii)). When the manufacturer is clean in Case B2, the carbon emission reduction decreases with r, as shown in Corollary 4 (iii). This condition implies that a higher interest rate causes less emission reduction. Moreover, when the interest rate is low, the carbon emission reduction in Case A2 is more than that in Case B2; when the interest rate is high, and the carbon emission reduction in Case A2 is less than that in Case B2 (Theorem 8).

- (3)

- Based on Figure 3c, r does not affect the retailer’s profits in Cases A1 and B1, whereas the retailer’s profits decrease with r in Cases A2 and B2. The profit in B2 is initially lower than that in Case A2 and then the profit in B2 becomes higher than that in Case A2. This observation also implies that a high interest rate of greening financing leads to a small retailer’s profits in Cases A2 and B2.

- (4)

- Based on Figure 3d, the interest rate of greening financing does not affect the manufacturer’s profits in Cases A1 and B1. The manufacturer’s profits increase with r in Cases A2 and B2, and the profit in Case B2 is considerably higher than that in Case A2. This observation implies that a high interest rate can lead to a high manufacturer’s profit.

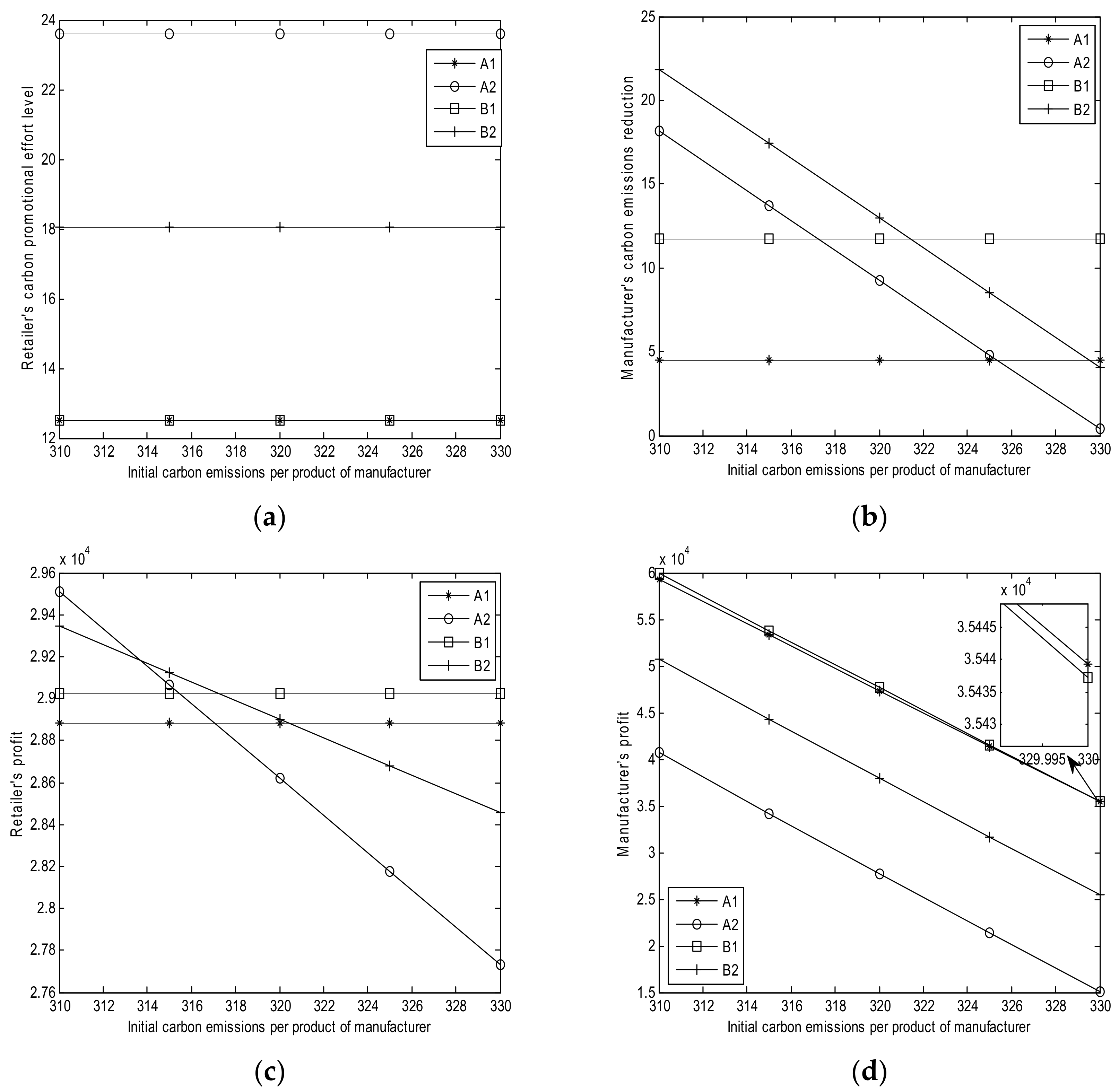

6.4. Effect of Initial Carbon Emissions per Product of Manufacturer

- (1)

- Based on Figure 4a, the retailer’s carbon promotional effort levels remain unchanged with in Cases A1, A2, B1, and B2. This observation implies that does not affect the retailer’s promotional effort level.

- (2)

- Based on Figure 4b, the manufacturer’s carbon emission reductions remain unchanged in Cases A1 and B1 with the increase of . The emission reductions decrease along with in Cases A2 and B2. This observation implies that a high value of leads to low carbon emission reductions in Cases A2 and B2.

- (3)

- Based on Figure 4c, the retailer’s profits in Cases A1 and B1 remain the same with the increase of . The retailer’s profits in Cases A2 and B2 decrease with . Meanwhile, when the initial carbon emission is low, the retailer’s profit in Case A2 is higher than that in Case B2; when the initial carbon emissions is high, the retailer’s profit in Case A2 is lower than that in Case B2. This condition implies that a high value of leads to low retailer’s profits in Cases A2 and B2.

- (4)

- Based on Figure 4d, the manufacturer’s profits decrease with in Cases A1, A2, B1, and B2. This observation implies that a lower value of indicates more manufacturer profit.

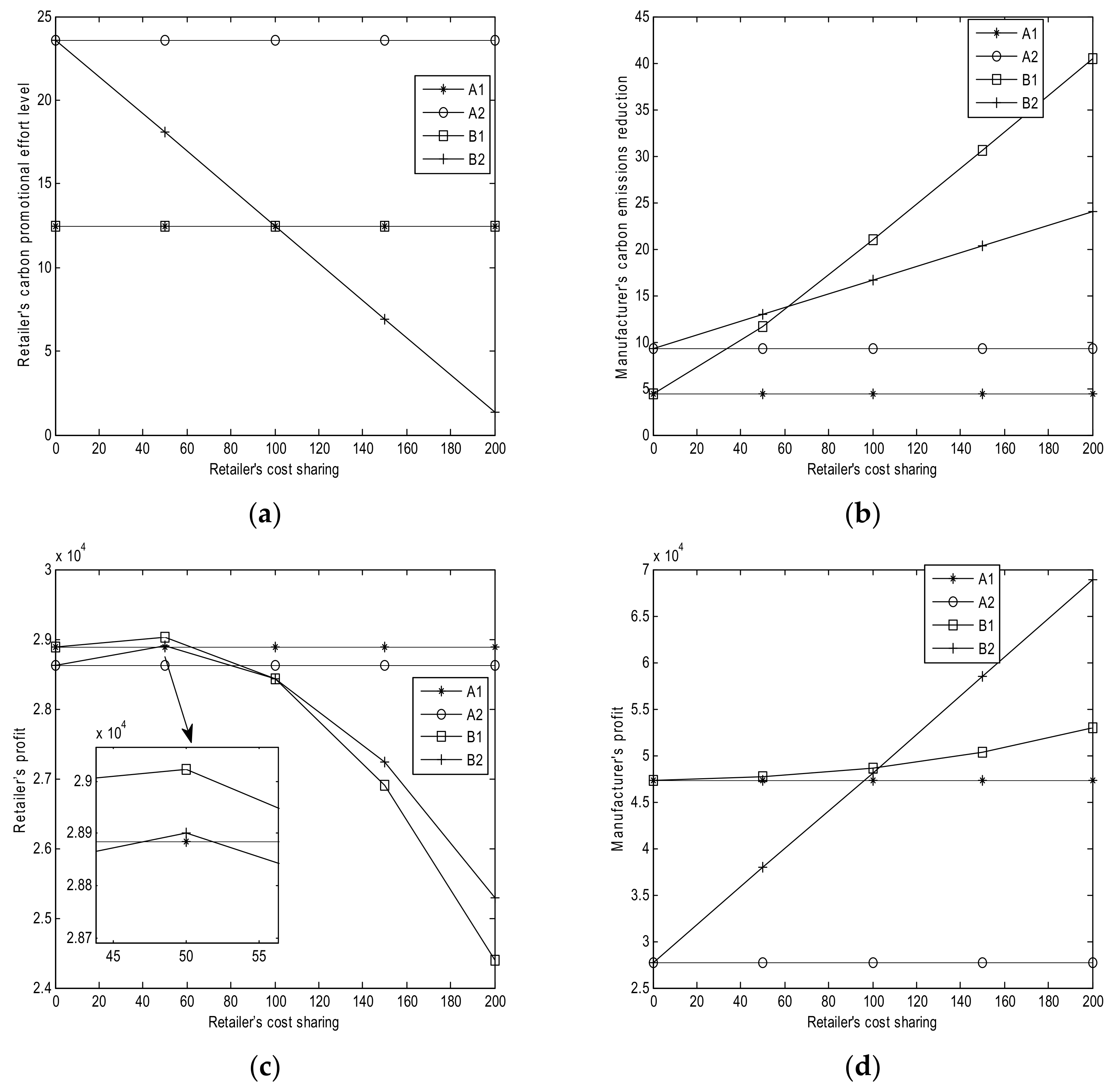

6.5. Effect of Retailer’s Cost Sharing θ

- (1)

- Based on Figure 5a, the retailer’s carbon promotional effort levels remain the same in Cases A1, A2, and B1 with the increase of its cost sharing from zero (Corollary 3 (iii)). Thus, θ does not affect the promotional effort level of the three cases. The retailer’s carbon promotional effort level in Case A2 is equal to that in Case B2 when there is no cost sharing from the retailer. The promotional level in Case A2 remains unchanged, whereas that in Case B2 decreases along with θ (Corollary 4 (iv)). This condition implies that a high cost sharing causes low retailer’s profit in Case B2.

- (2)

- Based on Figure 5b, the manufacturer’s carbon emission reductions remain the same in Cases A1 and A2 with the increase in θ. This finding indicates that θ has no effect on emission reduction. The emission reduction increases with θ in Case B1, as shown in Corollary 3 (iii). In Case B2, the emission reduction increases with θ when the retailer is a low-efficient one, which is consistent with Corollary 4 (iv). Moreover, when the cost sharing is low, the carbon emission reduction in Case B2 is higher than that in Case B1; when the cost sharing is high, the carbon emission reduction in Case B2 is lower than that in Case B1. This condition implies that increasing θ can also increase the manufacturer’s emission reduction.

- (3)

- Based on Figure 5c, the retailer’s profits remain unchanged with θ in Cases A1 and A2. The retailer’s profit initially increases and then decreases in Cases B1 and B2 with the increase in θ. When the cost sharing is low, the retailer’s profit in Case B1 is more than that in Case B2; when the cost sharing is high, the retailer’s profit in Case B1 is less than that in Case B2. This observation implies that increasing θ may increase or decrease the retailer’s profit. Thus, the retailer should choose a reasonable cost sharing.

- (4)

- Based on Figure 5d, θ does not affect the manufacturer’s profits in Cases A1 and A2. Moreover, the manufacturer’s profits in Cases B1 and B2 continuously increase with the increase in θ. When the cost sharing is low, the manufacturer’s profit in Case B1 is more than that in Case B2; when the cost sharing is high, the manufacturer’s profit in Case B1 is less than that in Case B2.

7. Conclusions

7.1. Main Conclusions

7.2. Managerial Insights

7.3. Research Limitations and Future Work

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A

Appendix B

Appendix C

Appendix D

Appendix E

Appendix F

Appendix G

Appendix H

Appendix I

Appendix J

Appendix K

Appendix L

Appendix M

References

- Intergovernmental Panel on Climate Change. Climate Change 2007: The Physical Science Basis. Available online: http://www.ipcc.ch/ report/ar5/wg1/ (accessed on 13 November 2017).

- United Nations Framework Convention on Climate Change. 1992. Available online: http://legal.un.org/avl/ha/ccc/ccc.html (accessed on 28 March 2018).

- United Nations Framework Convention on Climate Change. Kyoto Protocol to the United Nations Framework Convention on Climate Change. 1998. Available online: http://unfccc.int/kyoto_protocol /items/2830.php (accessed on 28 March 2018).

- United Nations Framework Convention on Climate Change. Copenhagen According 2009. Available online: http://unfccc.int/meetings/copenhagen_dec_2009/meeting/6295.php (accessed on 28 March 2018).

- United Nations Framework Convention on Climate Change. Doha Amendment. 2012. Available online: http://unfccc.int/kyoto_protocol/doha_amendment/items/7362.php (accessed on 28 March 2018).

- United Nations Framework Convention on Climate Change. Paris Agreement. 2015. Available online: http://unfccc.int/paris_agreement/items/9485.php (accessed on 28 March 2018).

- Toptal, A.; Özlü, H.; Konur, D. Joint decisions on inventory replenishment and emission reduction investment under different emission regulations. Int. J. Prod. Res. 2014, 52, 243–269. [Google Scholar] [CrossRef]

- He, P.; Zhang, W.; Xu, X.; Bian, Y. Production lot-sizing and carbon emissions under cap-and-trade and carbon tax regulations. J. Clean. Prod. 2015, 103, 241–248. [Google Scholar] [CrossRef]

- Qin, J.; Bai, X.; Xia, L. Sustainable Trade credit and replenishment policies under the cap-and-trade and carbon tax regulations. Sustainability 2015, 7, 16340–16361. [Google Scholar] [CrossRef]

- Stock, J.R.; Boyer, S.L.; Harmon, T. Research opportunities in supply chain management. JAMS 2010, 38, 32–41. [Google Scholar] [CrossRef]

- De Albuquerque, G.A.; Maciel, P.; Lima, R.M.F.; Magnani, F. Strategic and tactical evaluation of conflicting environment and business goals in green supply chains. IEEE Trans. Syst. Man Cybern. 2013, 43, 1013–1027. [Google Scholar] [CrossRef]

- Li, X.; Li, Y. Chain-to-chain competition on product sustainability. J. Clean. Prod. 2016, 112, 2058–2065. [Google Scholar] [CrossRef]

- Xia, L.; He, L. Game Theoretic Analysis of Carbon Emission Reduction and Sales Promotion in Dyadic Supply Chain in Presence of Consumers’ Low-Carbon Awareness. Discret. Dyn. Nat. Soc. 2014, 2, 1–13. [Google Scholar] [CrossRef]

- Zhou, Y.; Bao, M.; Chen, X.; Xu, X. Co-op advertising and emission reduction cost sharing contracts and coordination in low-carbon supply chain based on fairness concerns. J. Clean. Prod. 2016, 133, 402–413. [Google Scholar] [CrossRef]

- Pourhejazy, P.; Pourya; Kwon, O.K. The new generation of operations research methods in supply chain optimization: A review. Sustainability 2016, 8, 1033. [Google Scholar] [CrossRef]

- Masi, M.; Steven, D.; Janet, G. Supply chain configurations in the circular economy: A systematic literature review. Sustainability 2017, 9, 1602. [Google Scholar] [CrossRef]

- Xiao, S.; Sethi, S.P.; Liu, M.; Ma, S. Coordinating contracts for a financially constrained supply chain. Omega 2017, 72, 71–86. [Google Scholar] [CrossRef]

- Zhan, J.; Chen, X.; Hu, Q. The value of trade credit with rebate contract in a capital-constrained supply chain. Int. J. Prod. Res. 2018, 1–18. [Google Scholar] [CrossRef]

- Centobelli, P.; Cerchione, R.; Esposito, E. Developing the WH2 framework for environmental sustainability in logistics service providers: A taxonomy of green initiatives. J. Clean. Prod. 2017, 165, 1063–1077. [Google Scholar] [CrossRef]

- Centobelli, P.; Cerchione, R.; Esposito, E. Environmental Sustainability and Energy-Efficient Supply Chain Management: A Review of Research Trends and Proposed Guidelines. Energies 2018, 11, 275. [Google Scholar] [CrossRef]

- Liu, W.; Bai, E.; Liu, L.; Wei, W. A framework of sustainable service supply chain management: A literature review and research agenda. Sustainability 2017, 9, 421. [Google Scholar] [CrossRef]

- Du, S.; Zhu, L.; Liang, L.; Ma, F. Emission-dependent supply chain and environment-policy-making in the ‘cap-and-trade’ system. Energy Policy 2013, 57, 61–67. [Google Scholar] [CrossRef]

- Cao, K.; Xu, X.; Wu, Q.; Zhang, Q. Optimal production and carbon emission reduction level under cap-and-trade and low carbon subsidy policies. J. Clean. Prod. 2017, 167, 505–513. [Google Scholar] [CrossRef]

- Li, X.; Shi, D.; Li, Y.; Zhen, X. Impact of Carbon Regulations on the Supply Chain with Carbon Reduction Effort. IEEE Trans. Syst. Man Cybern. 2017. [Google Scholar] [CrossRef]

- Xu, X.; He, P.; Xu, H.; Zhang, Q. Supply chain coordination with green technology under cap-and-trade regulation. Int. J. Prod. Econ. 2017, 183, 433–442. [Google Scholar] [CrossRef]

- Bai, Q.; Chen, M.; Xu, L. Revenue and promotional cost-sharing contract versus two-part tariff contract in coordinating sustainable supply chain systems with deteriorating items. Int. J. Prod. Econ. 2017, 187, 85–101. [Google Scholar] [CrossRef]

- Xia, L.; Guo, T.; Qin, J.; Yue, X.; Zhu, N. Carbon emission reduction and pricing policies of a supply chain considering reciprocal preferences in cap-and-trade system. Ann. Oper. Res. 2017, 1–27. [Google Scholar] [CrossRef]

- Chao, X.L.; Chen, J.; Wang, S.Y. Dynamic inventory management with cash flow constraints. Nav. Res. Logist. 2008, 55, 758–768. [Google Scholar] [CrossRef]

- Lai, G.; Debo, L.G.; Sycara, K. Sharing inventory risk in supply chain: The implication of financial constraint. Omega 2009, 37, 811–825. [Google Scholar] [CrossRef]

- Caldentey, R.; Chen, X. The role of financial services in procurement contracts. In Handbook of Integrated Risk Management in Global Supply Chains; Kouvelis, P., Boyabatli, O., Dong, L., Li, R., Eds.; John Wiley & Sons, Inc.: Hoboken, NJ, USA, 2010. [Google Scholar]

- Kouvelis, P.; Zhao, W. Financing the newsvendor: Supplier vs. bank, and the structure of optimal trade credit contracts. Oper. Res. 2012, 60, 566–580. [Google Scholar] [CrossRef]

- Kouvelis, P.; Zhao, W. Who Should Finance the Supply Chain? Impact of Credit Ratings on Supply Chain Decisions. Manuf. Serv. Oper. Manag. 2018, 20, 19–35. [Google Scholar] [CrossRef]

- Wang, Y.; Zhi, Q. The Role of Green Finance in Environmental Protection: Two Aspects of Market Mechanism and Policies. Energy Procedia 2016, 104, 311–316. [Google Scholar] [CrossRef]

- Li, K.; Liu, C. Construction of carbon finance system and promotion of environmental finance innovation in China. Energy Procedia 2011, 5, 1065–1072. [Google Scholar]

- Fischer, C. Environmental protection for sale: Strategic green industrial policy and climate finance. Environ. Resour. Econ. 2017, 66, 553–575. [Google Scholar] [CrossRef]

- Soundarrajan, P.; Vivek, N. Green finance for sustainable green economic growth in India. Agric. Econ. (Zemed. Ekon.) 2016, 62, 35–44. [Google Scholar] [CrossRef]

- Laroche, M.; Bergeron, J.; Barbaro-Forleo, G. Targeting consumers who are willing to pay more for environmentally friendly products. J. Consum. Mark. 2001, 18, 503–520. [Google Scholar] [CrossRef]

- Liu, Z.L.; Anderson, T.D.; Cruz, J.M. Consumer environmental awareness and competition in two-stage supply chains. Eur. J. Oper. Res. 2012, 218, 602–613. [Google Scholar] [CrossRef]

- Jones, R.; Mendelson, H. Information goods vs. industrial goods: Cost structure and competition. Manag. Sci. 2011, 57, 164–176. [Google Scholar] [CrossRef]

- Ghosh, D.; Shah, J. A comparative analysis of greening policies across supply chain structures. Int. J. Prod. Econ. 2012, 135, 568–583. [Google Scholar] [CrossRef]

- He, L.; Zhao, D.; Xia, L. Game Theoretic Analysis of Carbon Emission Abatement in Fashion Supply Chains Considering Vertical Incentives and Channel Structures. Sustainability 2015, 7, 4280–4309. [Google Scholar] [CrossRef]

| Cost Sharing or Not | No Cost Sharing | Cost Sharing | |

|---|---|---|---|

| Financing or Not | |||

| No greening financing | A1 | B1 | |

| Greening financing | A2 | B2 | |

| j | Case j, j = A1, A2, B1, B2 |

| Demand for Case j | |

| Manufacturer’s carbon emission reduction per product for case j | |

| Retailer’s carbon promotional effort level per product for case j | |

| Initial demand for the product when there is no carbon emission reduction and carbon promotional effort | |

| Coefficient of manufacturer’s carbon emission reduction on increasing the demand, | |

| Coefficient of retailer’s carbon promotional effort on increasing the demand, | |

| Manufacturer’s carbon emission reduction cost | |

| Retailer’s promotional cost | |

| Manufacturer’s coefficient of carbon emission reduction cost, | |

| Retailer’s coefficient of promotional effort cost, | |

| Manufacturer’s marginal revenue of the product | |

| Retailer’s marginal revenue of the product | |

| Manufacturer’s carbon emission cap | |

| Manufacturer’s initial emissions per product | |

| Carbon trading price | |

| Manufacturer’s owed specialized capital for carbon emission reduction | |

| Interest rate of greening financing | |

| Cost sharing for the manufacturer’s emissions reduction, | |

| Manufacturer’s profit for case j | |

| Retailer’s profit for case j |

| Cp | B | r | es | θ |

|---|---|---|---|---|

| 1.70–2.10 | 100 | 0.25 | 320 | 50 |

| 2.00 | 100–500 | 0.25 | 320 | 50 |

| 2.00 | 100 | 0.20–0.40 | 320 | 50 |

| 2.00 | 100 | 0.25 | 310–330 | 50 |

| 2.00 | 100 | 0.25 | 320 | 0–200 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Qin, J.; Zhao, Y.; Xia, L. Carbon Emission Reduction with Capital Constraint under Greening Financing and Cost Sharing Contract. Int. J. Environ. Res. Public Health 2018, 15, 750. https://doi.org/10.3390/ijerph15040750

Qin J, Zhao Y, Xia L. Carbon Emission Reduction with Capital Constraint under Greening Financing and Cost Sharing Contract. International Journal of Environmental Research and Public Health. 2018; 15(4):750. https://doi.org/10.3390/ijerph15040750

Chicago/Turabian StyleQin, Juanjuan, Yuhui Zhao, and Liangjie Xia. 2018. "Carbon Emission Reduction with Capital Constraint under Greening Financing and Cost Sharing Contract" International Journal of Environmental Research and Public Health 15, no. 4: 750. https://doi.org/10.3390/ijerph15040750

APA StyleQin, J., Zhao, Y., & Xia, L. (2018). Carbon Emission Reduction with Capital Constraint under Greening Financing and Cost Sharing Contract. International Journal of Environmental Research and Public Health, 15(4), 750. https://doi.org/10.3390/ijerph15040750