An evolutionary game models the strategic interactions over time in terms of one or more populations of players. However, the population of suppliers and manufacturers is not completely homogeneous in reality, because suppliers mighty not satisfy the requirements for the upgraded material of green technology. To facilitate the model’s establishment and solution, we assumed that each player has its game partner. In other words, any supplier can be matched with any manufacturer. Based on the analysis above, the investment strategies of suppliers and manufacturers during the adjustment and dynamic process have the salient features of an evolutionary game.

4.1.1. Payoff Matrix

If none of the game players choose “invest”, the original profits of suppliers from selling raw material can be define as . The original profits of manufacturers are defined as .

In the supply chains of low carbon investment, suppliers invest for energy saving, renewable energy and offer low carbon raw material to manufacturers. On the other hand, manufacturers invest for low carbon process re-engineering and low carbon technology research. In order to cover investment costs, the prices of low carbon raw material and products are higher. In this paper, we assume that consumers who have sustainable consciousness are willing to pay more for low carbon products.

If only suppliers choose “invest”, carbon emissions can be reduced upstream of supply chains. Suppliers will provide low carbon material to manufacturers, and consumers are willing to pay more for low carbon products. Therefore, the profits from low carbon investment can be defined as , where is the profit growth coefficient. Similarly, if only manufacturers choose “invest”, carbon emissions can be reduced downstream of supply chains. Consumers are also willing to pay more for low carbon products. The profits from low carbon investment can be defined as , where is the profit growth coefficient. If both participants choose “invest”, the low carbon development strategy can be implemented at a higher level. Consumers are willing to pay more than in the last scenario. The profits of suppliers and manufacturers can be defined as and , respectively, where and .

In the evolutionary game model, the strategic choices of game players have significant impacts on the other side. Therefore, the behavior features of free riding should be considered. If only suppliers invest in low carbon development upstream of supply chains, manufacturers can get the low carbon material and claim that the product is green and environmentally friendly. They can sell their products at a higher price and obtain extra profits from free riding, without any investment costs. Additionally, their free riding behavior cannot be recognized precisely due to limited budgets and technological support.

On the other hand, if only manufacturers invest in low carbon technology and green engineering downstream of supply chains, the products can also be improved and sold at a higher price. Our interview of several consumers found that they believe that low carbon raw material plays a significant role in the final products. Therefore, we can conclude that suppliers obtain recessive profits by free riding the manufacturers’ investment, such as market reputation and advertisement effects.

The profits from the free riding of suppliers and manufacturers can be defined as

and

, respectively. Most of the key notations that occur in this paper are listed in

Table 1 for easy reference.

Additionally, we assume game players have the same level of bargaining power. Furthermore, the variation of model parameters is relatively small during the evolutionary process and has no significant impact on the evolutionary trend.

Considering the cooperative relationship between suppliers and manufacturers, the payoff matrix is shown in

Table 2.

4.1.2. Equilibrium Analysis

In the initial stage of the evolutionary game, is defined as the population of suppliers making the strategic choice of “invest”. In contrast, represents the population making the strategic choice of “not invest”. Similarly, represents the population of manufacturers making the strategic choice of “invest”, and represents the population making the strategic choice of “not invest”.

Based on the payoff matrix, it is assumed that

represents the expected payoff of suppliers that make the strategic choice of “invest”,

represents the expected payoff of suppliers that make the strategic choice “not invest”, and

represents the average expected payoff. Therefore:

Thus, the average expected payoff can be written as follows:

Similarly, it is assumed that

represents the expected payoff of manufacturers that make the strategic choice of “invest”;

represents the expected payoff of manufacturers that make the strategic choice of “not invest”; and

represents the average expected payoff. Therefore:

According to the Malthusian dynamic equation [

58], the replication dynamic equation of suppliers is:

The replication dynamic equation of manufacturers is:

When the dynamic equations equal 0, an equilibrium point has been reached, and the equations will no longer evolve. This results in five equilibrium points: (0, 0), (0, 1), (1, 0), (1, 1), and (

A,

B). The term (

A,

B) is a mixed equilibrium point where

,

. The stability of equilibrium points can be analyzed using the Jacobian matrix as follows:

Therefore, we can compute the values of equilibrium points that are shown in

Table 3.

When the equilibrium point satisfies

and

, this equilibrium point is an ESS. We can find that

is not satisfied under these conditions because

. Other equilibrium points will be ESSs, whereas the values of

,

,

and

are satisfied under different conditions. The propositions are elaborated as follows:

Proposition 1. When the profit growth coefficients of low carbon investment are small, which are given as,and,, (0, 0) is an evolutionarily stable point, while suppliers and manufacturers will not invest because of the low profit.

In this case, the increased profits from low carbon investment are so small that they cannot even cover the investment costs . From a business perspective, consumers’ expenditure on low carbon products will remain fixed within a certain period. Therefore, the profit growth coefficients are decided by the investment costs. If the investment costs are high, both suppliers and manufacturers are willing to choose “not invest”, especially when there are no governmental subsidies.

Proposition 1 also presents the business implications from the perspective of an evolutionary analysis. We assume there are several suppliers and manufacturers in supply chains. Supplier may choose “invest” at first because of information asymmetry and bounded rationality. Then, finds (another supplier) which chooses “not invest” and gets higher profits. Therefore, adjusts and improves its choices by imitating the strategy of for profit maximization. We can conclude that the strategy of will have an impact on the strategic decisions of . Moreover, the investment strategies of manufacturers also impact the strategic decisions of suppliers. Their interactions with each other will result in the evolution of strategic choices.

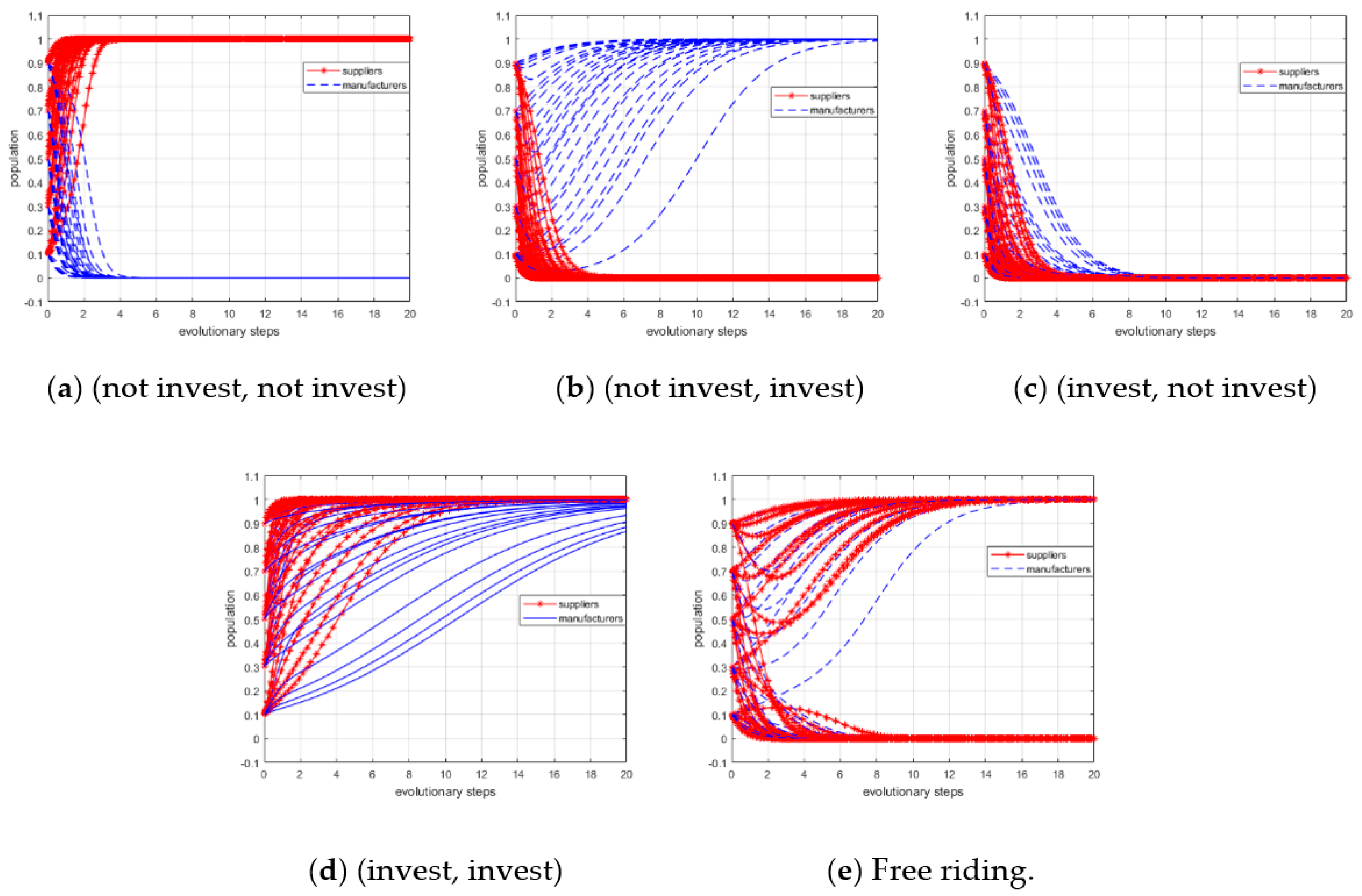

Panel (a) in

Figure 2 displays the evolution of the dynamic model when the profit growth coefficients are small. We can see that the evolutionary model will eventually converge at (0, 0) no matter which strategies are initially used by game players. Therefore, (0, 0) is the evolutionarily stable point; (0, 1) and (1, 0) are saddle points; and (1, 1) is the unstable point. The ESS profile is (not invest, not invest).

Proposition 2. As the profit growth coefficients of manufacturers increase, which are given as,and, (0, 1) is an evolutionarily stable point, and manufacturers will prefer to invest to get higher profits, while supplier still choose “not invest” because of the low profits.

In this case, the increased profits of the manufacturers from the low carbon investment are higher than the investment costs. From the business perspective, the increased profits can be brought about by the reduced costs and by selling the low carbon products at a higher price. As stated already, the profits from free riding are only possible when at least one side of game players chooses “invest”. Therefore, manufacturers are willing to choose “invest” to give themselves a better reputation and profit maximization. From the perspective of evolutionary analysis, it is assumed that manufacturer may choose “not invest” at first because of the investment costs. Then, finds that chose “invest” and achieved higher profits. Therefore, will improve its choice by imitating the strategy of . Moreover, the investment strategies of suppliers have no significant impacts on the strategic decisions of manufacturers, because manufacturers cannot free ride on the other side of game players.

Panel (b) in

Figure 2 depicts the dynamic evolution model. As shown, the model will eventually converge at (0, 1) no matter which strategies are initially used by game players. Therefore, (0, 1) is the evolutionarily stable point; (0, 0) and (1, 0) are saddle points; and (1, 1) is the unstable point. The ESS profile is (do not invest, invest).

Proposition 3. As the profit growth coefficients of the suppliers increase, which are given asand,, (0, 1) is an evolutionarily stable point, and suppliers will prefer to choose “invest” to get higher profits, while manufacturers choose “not invest”.

In this case, the increased profits of suppliers from low carbon investment are higher than the investment costs. From the business perspective, the increased profits can be brought about by the use of low carbon material. Therefore, suppliers are willing to choose “invest” to attract more consumers. From the perspective of evolutionary analysis, supplier may choose “not invest” at first because of bounded rationality. Then, finds that chose “invest” and achieved higher profits. Therefore, adjusts its strategic choice by imitating the strategy of . Similarly, the investment strategies of manufacturers have no significant impacts on the strategic decision of suppliers, because suppliers cannot free ride on the other side of game players.

Panel (c) in

Figure 2 illustrates the evolution of the dynamic model. The figure shows it will eventually converge at (1, 0) no matter what strategies are initially used by game players. Therefore, (1, 0) is the evolutionarily stable point; (0, 0) and (0, 1) are saddle points; and (1, 1) is the unstable point. The ESS profile is (invest, not invest).

Proposition 4. If both the profit growth coefficients of suppliers and manufacturers increase to a certain level, which are given asand, (0, 1) and (1, 0) are evolutionarily stable points. There are two ESSs, while suppliers and manufacturers are not sure whether they will choose “invest” or not. Game players will always adjust and improve their strategic choice during the evolution process because they want to free ride off others.

In this case, both the increased profits of suppliers and manufacturers from low carbon investment are higher than the investment costs, but lower than the profits from free riding . From the business perspective, the increased profits can be brought about by reduced costs as well as technological development and market expansion, which was mentioned above. Moreover, free riding can bring higher profits due to its better reputation, greater number of consumers and low cost. From the perspective of evolutionary analysis, Supplier and manufacturer may choose “invest” at first because of the higher profits from low carbon investment. Then, finds that it can get higher profits if it can free ride off . For example, if chooses “invest”, there will be more consumers to use low carbon products. Therefore, can get extra profits from a larger market without any investment costs. However, it is not the end of evolution process. will also choose “not invest” and want to free ride on . Thus, and will always adjust their strategy by imitation for profit maximization.

Panel (d) in

Figure 2 depicts the evolution of the dynamic model. As shown, the model will eventually converge at (0, 1) or (1, 0). Therefore, (1, 0) and (0, 1) are the evolutionary stable points;

is the saddle point; (1, 1); and (0, 0) are the unstable points. The ESS profiles are (not invest, invest) and (invest, not invest).

Proposition 5. As the profit growth coefficients of increase continually, which are given asand, (1, 1) is an ESS, both suppliers and manufacturers will choose “invest”.

In this case, both the increased profits of suppliers and manufacturers from low carbon investment are not only higher than the investment costs , but also higher than the profits from free riding . Therefore, suppliers and manufacturers are willing to invest and can get appropriate profits, and (invest, invest) is the optimal strategy.

From the perspective of evolutionary analysis, even if or chooses “not invest” at first, they will find that “invest” can bring higher profits sooner or later. Therefore, both players will adjust their strategic choice by imitating others’.

Panel (e) in

Figure 2 shows the evolution of the dynamic model. As shown, it will eventually converge at (1, 1) regardless of strategies initially taken by OSN service providers and online platforms. Therefore, (1, 1) is the evolutionarily stable point; (0, 1) and (1, 0) are saddle points; and (0, 0) is the unstable point. The ESS profile is (invest, invest).

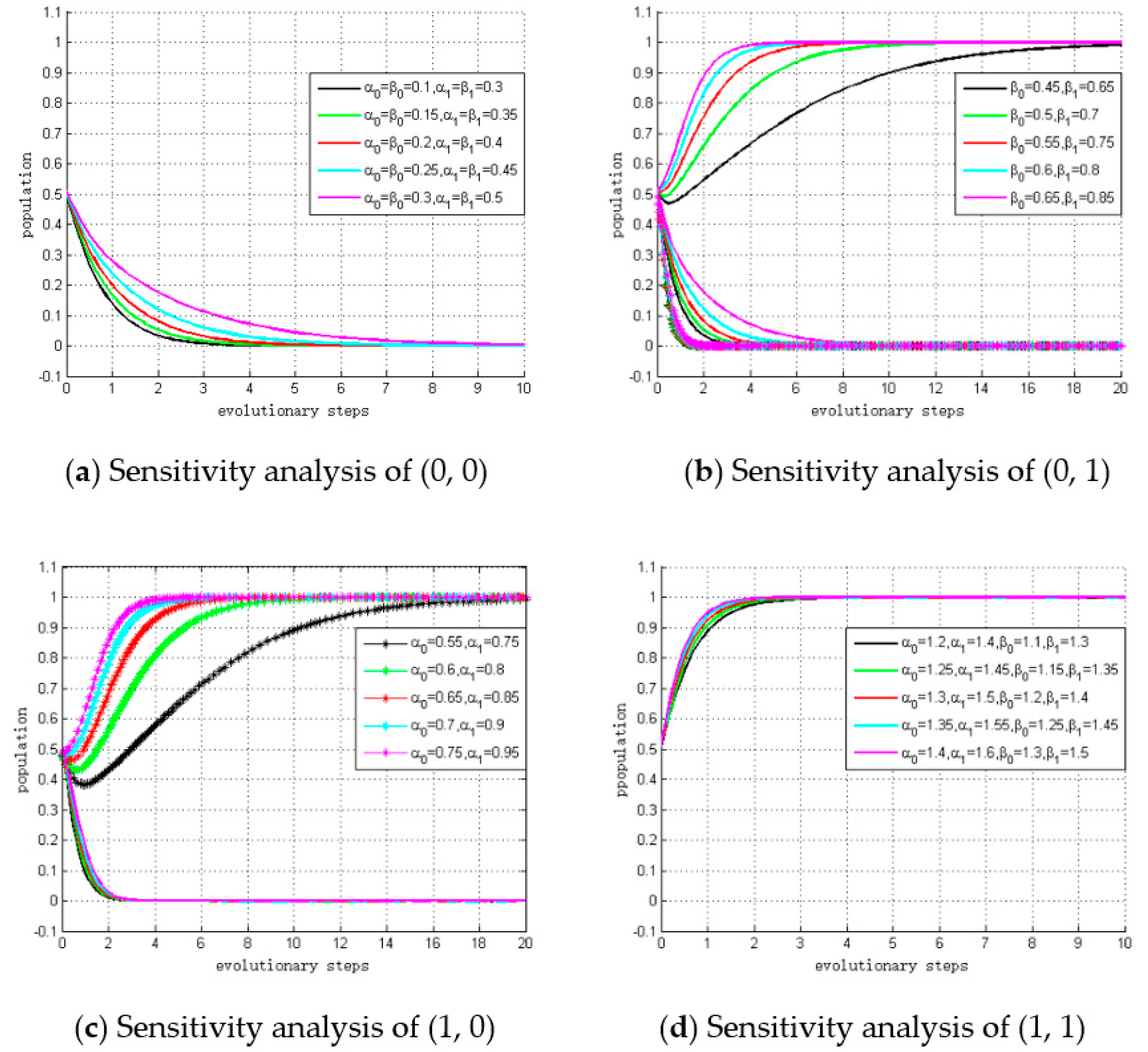

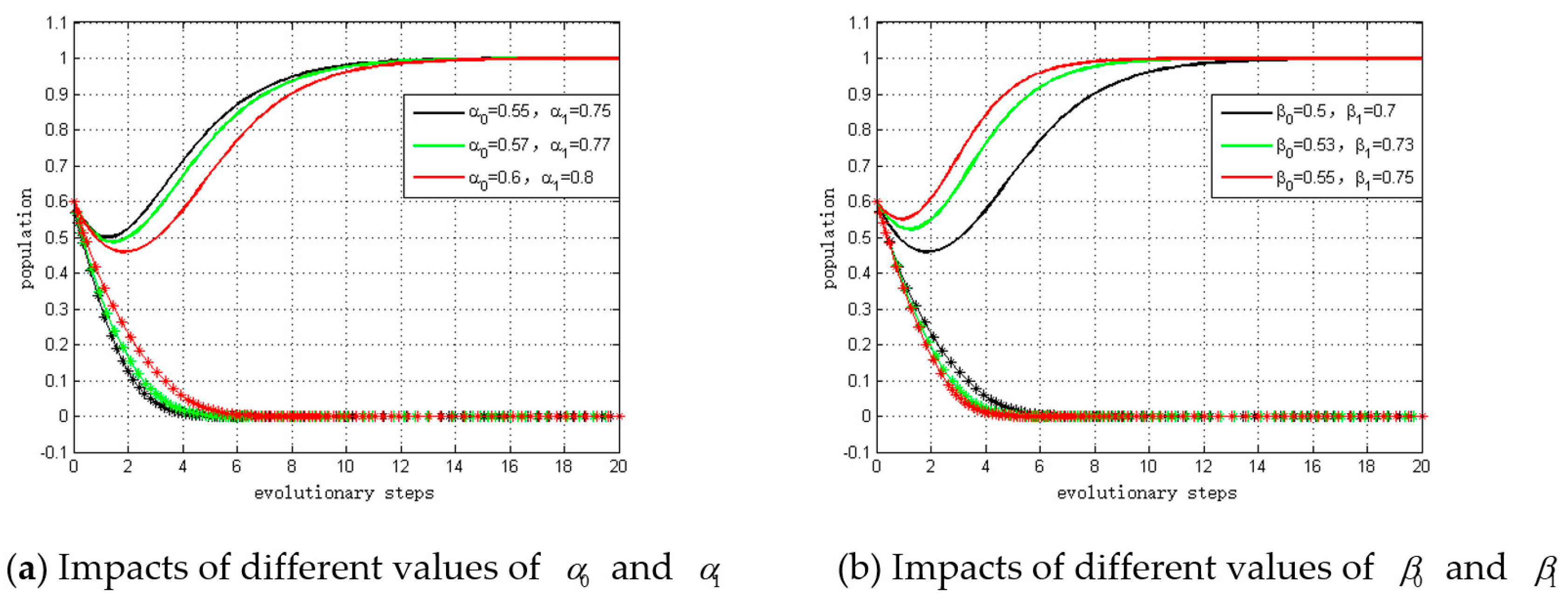

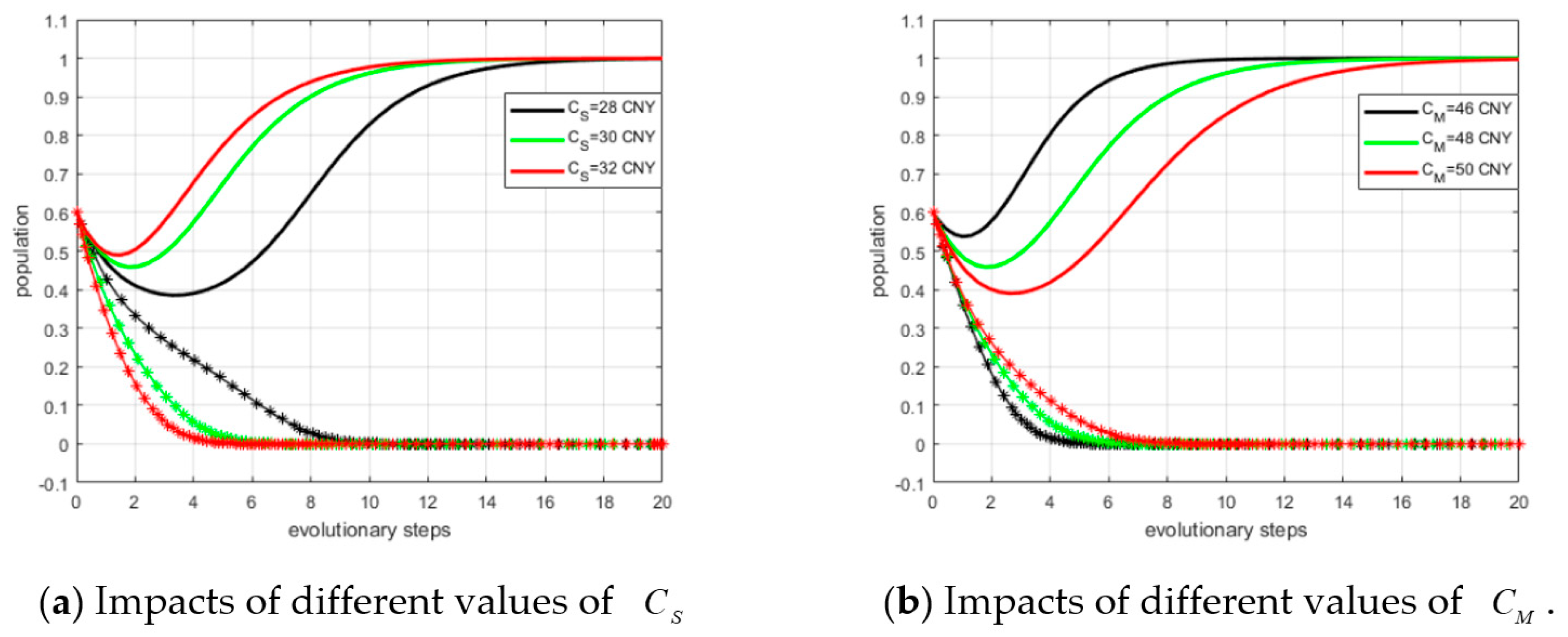

4.1.3. Impact of different variables on ESS

According to Proposition 4, the ESS can be either (invest, not invest) or (not invest, invest) when free riding is present. The strategic choice depends on the area sizes of regions

M and

N which can be written, as

, respectively. The probability of choosing (invest, not invest) is greater if

, while the probability of choosing (not invest, invest) is higher if

.

. This can be defined as follows:

According to Equation (10), there are 10 variables that influence the ESS, and further conclusions can be drawn, as shown in

Table 4.

Conclusion 1. The smaller the profit growth coefficients of suppliers are, the higher the probability of them converging to the equilibrium point (0, 1) is. In this case, suppliers and manufacturers will choose (not invest, invest). The larger the profit growth coefficients of suppliers are, the higher the probability of them converging to equilibrium point (1, 0) is. Suppliers and manufacturers will choose (invest, not invest).

Conclusion 2. The smaller the profit growth coefficients of manufacturers are, the higher the probability of them converging to equilibrium point (1, 0) is. In this case, suppliers and manufacturers will choose (invest, not invest). The larger the profit growth coefficients of manufacturers are, the higher the probability of them converging to equilibrium point (0, 1) is. Suppliers and manufacturers will choose (not invest, invest).

Conclusion 3. The smaller the original profits of suppliers are and the larger the original profits of manufacturers are, the higher the probability of them converging to equilibrium point (0, 1) is. In this case, suppliers and manufacturers will choose (not invest, invest). The larger is and smaller is, the higher the probability of them converging to (1, 0) is, and they will choose (invest, not invest).

Conclusion 4. The smaller the investment costs of manufacturers are and the larger the investment costs of suppliers are, the higher the probability of converging them to equilibrium point (0, 1) is. In this case, suppliers and manufacturers will choose (not invest, invest). The larger is and the smaller is, the higher the probability of them converging to (1, 0) is, and they will choose (invest, not invest).

Conclusion 5. The smaller the profits of manufacturers from free riding are and the larger the profits of suppliers from free riding are, the higher the probability of them converging to equilibrium point (0, 1) is. In this case, suppliers and manufacturers will choose (not invest, invest). The larger is and the smaller is, the higher the probability of them converging to (1, 0) is, and they will choose (invest, not invest).

In summary, during the evolutionary process of low carbon investment for suppliers and manufacturers, the investment desire is affected by the original profits, investment costs, profit growth coefficients, and profits from free riding. Moreover, the evolutionary path of free riding and the final result of both investors’ decision-making processes are also affected by the initial strategic choices.