The Effects of Age, Priming, and Working Memory on Decision-Making

Abstract

:1. Introduction

1.1. Cognitive Resources and the GDT

1.2. Working Memory, Age, and GDT

1.3. Personality and the GDT

1.4. Risky Primes and the GDT

2. Experimental Section

2.1. Participants

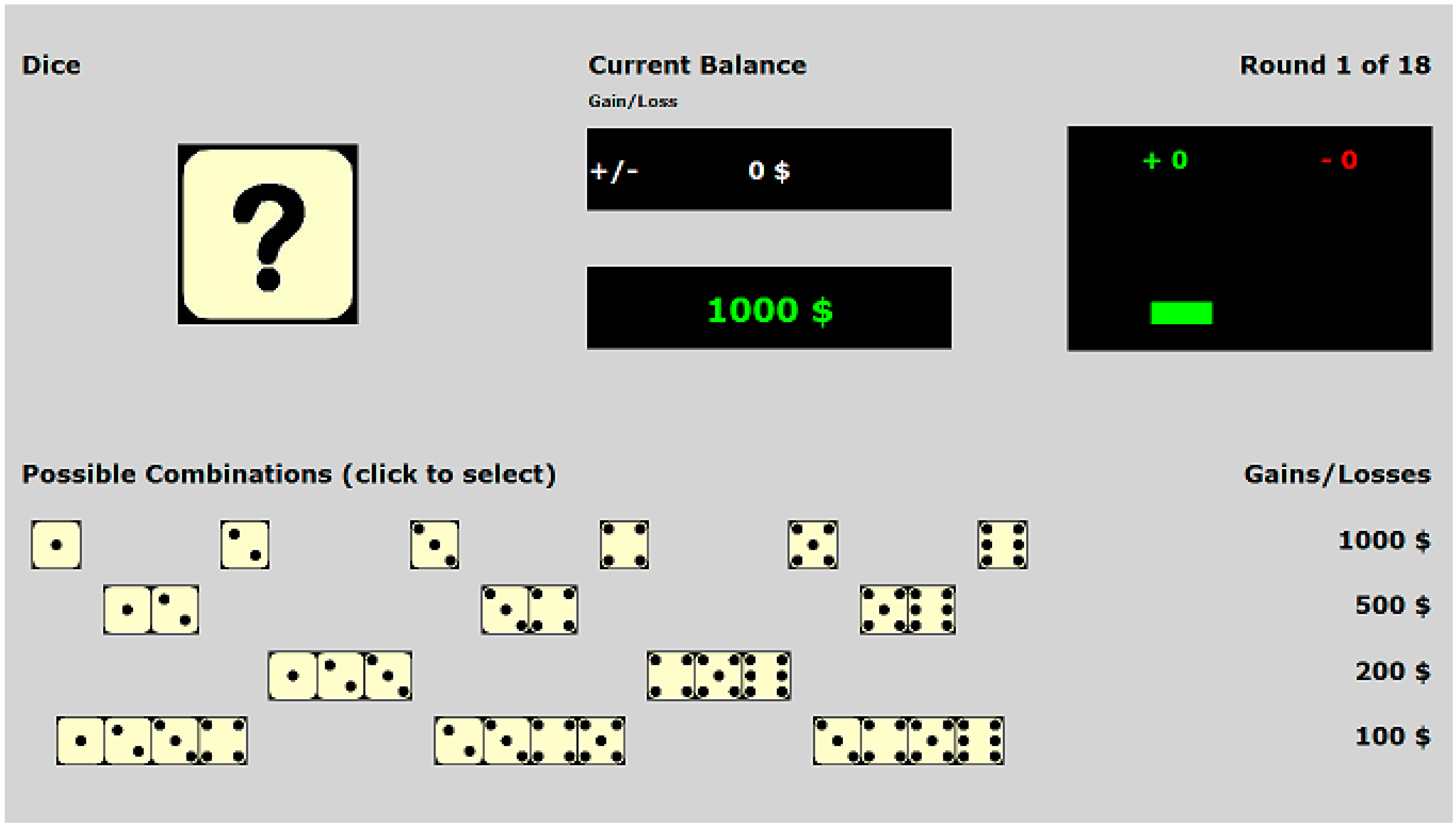

2.2. Materials

2.3. Procedure

3. Results and Discussion

3.1. Prime and Risk-Taking

| Age Group | Risk-Seeking | Risk-Aversive | Control | Total |

|---|---|---|---|---|

| Young Adults | M = 16.50 | M = 20.33 | M = 19.44 | M = 18.77 |

| SD = 12.29 | SD = 13.02 | SD = 12.24 | SD = 12.45 | |

| Older Adults | M = 14.90 | M = 15.00 | M = 10.89 | M = 13.69 |

| SD = 10.87 | SD = 13.62 | SD = 20.48 | SD = 15.16 | |

| Total | M = 15.77 | M = 17.91 | M = 15.86 | |

| SD = 11.56 | SD = 13.41 | SD = 16.54 |

3.2. Money Total on the GDT

| Age Group | Risk-Seeking | Risk-Aversive | Control | Total |

|---|---|---|---|---|

| Young Adults | M = −795.83 | M = −416.67 | M = −76.00 | M = −424.66 |

| SD = 4531.58 | SD = 3355.42 | SD = 2708.52 | SD = 3562.29 | |

| Older Adults | M = −800.00 | M = −345.00 | M = −2538.89 | M = −1182.76 |

| SD = 3095.67 | SD = 2832.24 | SD = 5367.78 | SD = 3916.64 | |

| Total | M = −797.73 | M = −384.09 | M = −1106.98 | |

| SD = 3901.07 | SD = 3093.20 | SD = 4167.24 |

3.3. Personality

| Measure | GDT | Money Total | Age | WM | Extraversion | Conscietousness | Openness | Agreeableness | Neuroticism |

|---|---|---|---|---|---|---|---|---|---|

| GDT | 1 | 0.707 ** | −0.195 * | 0.264 ** | −0.013 | −0.152 | −0.111 | 0.047 | −0.093 |

| Money Total | 1 | −0.098 | 0.212 * | −0.109 | −0.156 | −0.106 | −0.077 | −0.083 | |

| Age | 1 | −0.703 ** | −0.198 | 0.345 ** | 0.104 | 0.124 | 0.070 | ||

| WM | 1 | 0.027 | −0.236 ** | −0.014 | −0.141 | −0.030 | |||

| Extraversion | 1 | 0.075 | 0.117 | 0.116 | −0.252 ** | ||||

| Conscientiousness | 1 | 0.168 | 0.453 ** | −0.243 ** | |||||

| Openness | 1 | 0.134 | −0.124 | ||||||

| Agreeable-ness | 1 | −0.464 ** | |||||||

| Neuroticism | 1 |

| Measure | GDT | Money Total | WM | Extraversion | Conscietousness | Openness | Agreeableness | Neuroticism |

|---|---|---|---|---|---|---|---|---|

| GDT | 1 | 0.763 ** | 0.279 * | −0.286 * | −0.010 | −0.017 | 0.073 | −0.176 |

| Money Total | 1 | 0.235 * | −0.269 * | −0.080 | −0.063 | 0.026 | −0.181 | |

| WM | 1 | −0.222 | −0.018 | 0.007 | −0.093 | 0.106 | ||

| Extraversion | 1 | 0.195 | 0.144 | 0.154 | −0.232 * | |||

| Conscientiousness | 1 | 0.009 | 0.424 ** | −0.208 | ||||

| Openness | 1 | 0.103 | −0.108 | |||||

| Agreeable-ness | 1 | −0.460 ** | ||||||

| Neuroticism | 1 |

| Measure | GDT | Money Total | WM | Extraversion | Conscietousness | Openness | Agreeableness | Neuroticism |

|---|---|---|---|---|---|---|---|---|

| GDT | 1 | 0.651 ** | 0.073 | 0.177 | −0.204 | −0.179 | 0.062 | −0.023 |

| Money Total | 1 | 0.154 | 0.016 | −0.198 | −0.138 | −0.176 | 0.048 | |

| WM | 1 | −0.051 | 0.020 | 0.212 | −0.116 | −0.075 | ||

| Extraversion | 1 | 0.104 | 0.132 | 0.125 | −0.247 | |||

| Conscientiousness | 1 | 0.343 ** | 0.480 ** | −0.414 ** | ||||

| Openness | 1 | 0.156 | −0.164 | |||||

| Agreeable-ness | 1 | −0.502 ** | ||||||

| Neuroticism | 1 |

| Measure | GDT | Money Total | Age | WM | Ethical | Social | Finanical | Health/Safety | Recreational |

|---|---|---|---|---|---|---|---|---|---|

| GDT | 1 | 0.707 ** | −0.195 * | 0.264 ** | −0.105 | 0.127 | −0.064 | 0.073 | 0.145 |

| Money Total | 1 | −0.098 | 0.212 * | −0.080 | 0.110 | −0.135 | 0.069 | 0.089 | |

| Age | 1 | −0.703 ** | −0.483 ** | −0.088 | −0.373 ** | −0.656 ** | −0.581 ** | ||

| WM | 1 | 0.382 ** | 0.188 * | 0.259 ** | 0.497 ** | 0.510 ** | |||

| Ethical | 1 | 0.313 ** | 0.380 ** | 0.623 ** | 0.332 ** | ||||

| Social | 1 | 0.132 | 0.283 ** | 0.272 ** | |||||

| Financial | 1 | 0.387 ** | 0.488 ** | ||||||

| Health/Safety | 1 | 0.635 ** | |||||||

| Recreational | 1 |

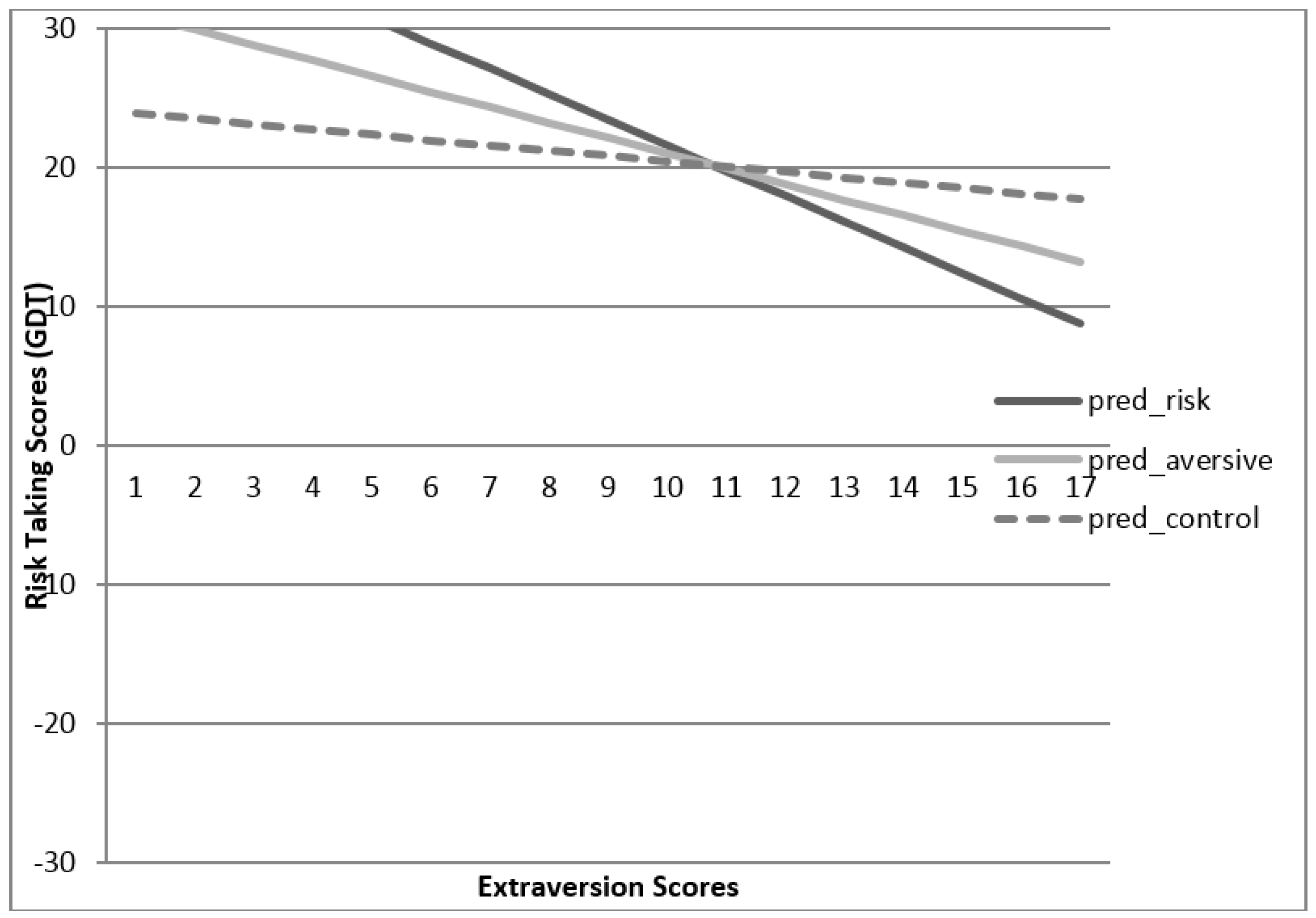

Younger Adults and Moderation Analyses

3.4. Dospert

3.5. Working Memory

4. Discussion

4.1. Game of Dice Task (GDT)

4.2. GDT and Working Memory

4.3. Working Memory and Age Differences in the GDT

4.4. Personality and the GDT

4.5. Priming Scenario

4.6. Moderation Effects in Prime Susceptibility

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of interest

References

- Brand, M.; Schiebener, J. Interactions of age and cognitive functions in predicting decision making under risky conditions over the life span. J. Clin. Exp. Neuropsychol. 2013, 35, 9–23. [Google Scholar] [CrossRef] [PubMed]

- Brand, M.; Recknor, E.; Grabenhorst, F.; Bechara, A. Decisions under ambiguity and decisions under risk: Correlations with executive functions and comparisons of two different gambling tasks with implicit and explicit rules. J. Clin. Exp. Neuropsychol. 2007, 29, 86–99. [Google Scholar] [CrossRef] [PubMed]

- Brand, M.; Markowitsch, H.J. Aging and decision-making: A neurocognitive perspective. Gerontology 2010, 56, 319–324. [Google Scholar] [CrossRef] [PubMed]

- Brand, M.; Laier, C.; Pawlikowski, M.; Markowitsch, H.J. Decision making with and without feedback: The role of intelligence, strategies, executive functions, and cognitive styles. J. Clin. Exp. Neuropsychol 2009, 31, 984–998. [Google Scholar] [CrossRef] [PubMed]

- Schiebener, J.; Zamarian, L.; Delazer, M.; Brand, M. Executive functions, categorization of probabilities, and learning from feedback: What does really matter for decision making under explicit risk conditions? J. Clin. Exp. Neuropsychol. 2011, 33, 1025–1039. [Google Scholar] [CrossRef] [PubMed]

- Starcke, K.; Tuschen-Caffier, B.; Markowitsch, H.J.; Brand, M. Dissociation of decisions in ambiguous and risky situations in obsessive-compulsive disorder. Psychiatry Res. 2010, 175, 114–120. [Google Scholar] [CrossRef] [PubMed]

- Zamarian, L.; Benke, T.; Brand, M.; Djamshidian, A.; Delazer, M. Impaired information sampling in mild dementia of Alzheimer’s type but not in healthy aging. Neuropsychology 2015, 29, 353–367. [Google Scholar] [CrossRef] [PubMed]

- Cohen, G. Language comprehension in old age. Cognit. Psychol. 1979, 11, 412–429. [Google Scholar] [CrossRef]

- Daneman, M.; Carpenter, P.A.; Just, M.A. Cognitive processes and reading skills. Adv. Reading Lang. Res. 1982, 1, 83–124. [Google Scholar]

- Peters, E. Beyond comprehension the role of numeracy in judgments and decisions. Curr. Dir. Psychol. Sci. 2012, 21, 31–35. [Google Scholar] [CrossRef]

- Bender, A.R.; Raz, N. Age-related differences in recognition memory for items and associations: Contribution of individual differences in working memory and metamemory. Psychol. Aging 2012, 27, 691–700. [Google Scholar] [CrossRef] [PubMed]

- Hamm, V.P.; Hasher, L. Age and the availability of inferences. Psychol. Aging 1992, 7, 56–64. [Google Scholar] [CrossRef] [PubMed]

- Oosterman, J.M.; Vogels, R.L.C.; van Harten, B.; Gouw, A.A.; Poggesi, A.; Scheltens, P.; Kessels, R.P.C.; Scherder, E.J.A. Assessing mental flexibility: Neuroanatomical and neuropsychological correlates of the trail making test in elderly people. Clin. Neuropsychol. 2010, 24, 203–219. [Google Scholar] [CrossRef] [PubMed]

- Salthouse, T.A.; Babcock, L. Decomposing adult age differences in working memory. Dev. Psychol. 1991, 27, 763–776. [Google Scholar] [CrossRef]

- Adams, A.E.; Rogers, W.A.; Fisk, A.D. Prior knowledge involved in inferencing information from warnings for younger and older adults. J. Commun. Healthc. 2011, 4, 246–259. [Google Scholar] [CrossRef]

- Franks, B.A. Logical inference skills in adult reading comprehension: Effects of age and formal education. Educ. Gerontol. 1998, 24, 47–68. [Google Scholar] [CrossRef]

- Baddeley, A.D. How does acoustic similarity influence short-term memory? Q. J. Exp. Psychol. 1968, 20, 249–264. [Google Scholar] [CrossRef] [PubMed]

- Daneman, M.; Merikle, P.M. Working memory and language comprehension: A meta-analysis. Psychon. Bull. Rev. 1996, 3, 422–433. [Google Scholar] [CrossRef] [PubMed]

- Finucane, M.L.; Slovic, P.; Hibbard, J.H.; Peters, E.; Mertz, C.K.; MacGregor, D.G. Aging and decision-making competence: An analysis of comprehension and consistency skills in older versus younger adults considering health-plan options. J. Behav. Decis. Mak. 2002, 15, 142–164. [Google Scholar] [CrossRef]

- Craik, F.I.M. A Functional Account of Age Differences in Memory. In Human Memory and Cognitive Capabilities, Mechanisms, and Performances; Lix, F., Hagendorf, H., Eds.; Elsevier Science: Amsterdam, The Netherlands, 1986. [Google Scholar]

- Craik, F.I.M.; Byrd, M. Aging and Cognitive Deficits: The Role of Attentional Resources. In Aging and Cognitive Processes; Craik, F.I.M., Trehub, S.E., Eds.; Plenum Press: New York, NY, USA, 1982. [Google Scholar]

- Dirkx, E.; Craik, F.I. Age-related differences in memory as a function of imagery processing. Psychol. Aging 1992, 7, 352–358. [Google Scholar] [CrossRef] [PubMed]

- Nicholson, N.; Soane, E.; Fenton-O’Creevy, M.; Willman, P. Personality and domain-specific risk taking. J. Risk Res. 2005, 8, 157–176. [Google Scholar] [CrossRef]

- Brand, M.; Altstötter-Gleich, C. Personality and decision-making in laboratory gambling tasks—Evidence for a relationship between deciding advantageously under risk conditions. Personal. Individ. Differ. 2008, 45, 226–231. [Google Scholar] [CrossRef]

- Chapman, A.L.; Lynch, T.R.; Rosenthal, M.Z.; Cheavens, J.S.; Smoski, M.J.; Krishnan, K.R. Risk aversion among depressed older adults with obsessive compulsive personality disorder. Cognit. Ther. Res. 2007, 31, 161–174. [Google Scholar] [CrossRef]

- Figner, B.; Weber, E.U. Who takes risks when and why? determinants of risk taking. Curr. Dir. Psychol. Sci. 2011, 20, 211–216. [Google Scholar] [CrossRef]

- Dislich, F.X.; Zinkernagel, A.; Ortner, T.M.; Schmitt, M. Convergence of direct, indirect, and objective risk-taking measures in gambling. J. Psychol. 2015, 218, 20–27. [Google Scholar] [CrossRef]

- Kusev, P.; van Schaik, P.; Aldrovandi, S. Preferences induced by accessibility: Evidence from priming. J. Neurosci. Psychol. Econ. 2012, 5, 250–258. [Google Scholar] [CrossRef]

- Bucciol, A.; Zarri, L. The shadow of the past: Financial risk taking and negative life events. J. Econ. Psychol. 2015, 48, 1–16. [Google Scholar] [CrossRef]

- Gilad, D.; Kliger, D. Priming the risk attitudes of professionals in financial decision making. Rev. Financ. 2008, 12, 567–586. [Google Scholar] [CrossRef]

- Israel, A.; Rosenboim, M.; Shavit, T. Using priming manipulations to affect time preferences and risk aversion: An experimental study. J. Behav. Exp. Econ. 2014, 53, 36–43. [Google Scholar] [CrossRef]

- Higgins, E.T.; Rholes, W.S.; Jones, C.R. Category accessibility and impression formation. J. Exp. Soc. Psychol. 1977, 13, 141–154. [Google Scholar] [CrossRef]

- Hess, T.M.; McGee, K.A.; Woodburn, S.M.; Bolstad, C.A. Age-related priming effects in social judgments. Psychol. Aging 1998, 13, 127–137. [Google Scholar] [CrossRef] [PubMed]

- Hess, T.M.; Waters, S.J.; Bolstad, C.A. Motivational and cognitive influences on affective priming in adulthood. J. Gerontol. 2000, 55, P193–P204. [Google Scholar] [CrossRef]

- Hess, T.M.; Popham, L.E.; Emery, L.; Elliott, T. Mood, motivation, and misinformation: Aging and affective state influences on memory. Aging Neuropsychol. Cognit. 2012, 19, 13–34. [Google Scholar] [CrossRef] [PubMed]

- Unsworth, N.; Engle, R.W. The nature of individual differences in working memory capacity: Active maintenance in primary memory and controlled search from secondary memory. Psychol. Rev. 2007, 114, 104–132. [Google Scholar] [CrossRef] [PubMed]

- Conway, A.R.; Kane, M.J.; Bunting, M.F.; Hambrick, D.Z.; Wilhelm, O.; Engle, R.W. Working memory span tasks: A methodological review and user’s guide. Psychon. Bull. Rev. 2005, 12, 769–786. [Google Scholar] [CrossRef] [PubMed]

- Brand, M.; Pawlikowski, M.; Labudda, K.; Laier, C.; von Rothkirch, N.; Markowitsch, H.J. Do amnesic patients with Korsakoff’s syndrome use feedback when making decisions under risky conditions? An experimental investigation with the game of dice task with and without feedback. Brain Cognit. 2009, 69, 279–290. [Google Scholar] [CrossRef] [PubMed]

- John, O.P.; Naumann, L.P.; Soto, C.J. Paradigm Shift to the Integrative Big Five Trait Taxonomy. In Handbook of Personality: Theory and Research; Guilford Press: New York, NY, USA, 2008; pp. 114–158. [Google Scholar]

- John, O.P.; Srivastava, S. The Big Five Trait Taxonomy: History, Measurement, and Theoretical Perspectives. In Handbook of Personality: Theory and Research; Guilford Press: New York, NY, USA, 1999; pp. 102–138. [Google Scholar]

- Blais, A.; Weber, E.U. A domain-specific risk-taking (DOSPERT) scale for adult populations. Judgm. Decis. Mak. 2006, 1, 33–47. [Google Scholar]

- Lauriola, M.; Levin, I.P. Personality traits and risky decision-making in a controlled experimental task: An exploratory study. Personal. Individ. Differ. 2001, 31, 215–226. [Google Scholar] [CrossRef]

- Schwebel, D.C.; Ball, K.K.; Severson, J.; Barton, B.K.; Rizzo, M.; Viamonte, S.M. Individual difference factors in risky driving among older adults. J. Saf. Res. 2007, 38, 501–509. [Google Scholar] [CrossRef] [PubMed]

- Rolison, J.J.; Hanoch, Y.; Wood, S.; Liu, P.J. Risk-taking differences across the adult life span: A question of age and domain. J. Gerontol. B Psychol. Sci. Soc. Sci. 2014, 69, 870–880. [Google Scholar] [CrossRef] [PubMed]

- Baron, R.M.; Kenny, D.A. The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Pers. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef] [PubMed]

- Finucane, M.L.; Gullion, C.M. Developing a tool for measuring the decision-making competence of older adults. Psychol. Aging 2010, 25, 271–288. [Google Scholar] [CrossRef] [PubMed]

- Reyna, V.F.; Nelson, W.L.; Han, P.K.; Dieckmann, N.F. How numeracy influences risk comprehension and medical decision making. Psychol. Bull. 2009, 135, 943–973. [Google Scholar] [CrossRef] [PubMed]

- Finucane, M.L. Emotion, affect, and risk communication with older adults: Challenges and opportunities. J. Risk Res. 2008, 11, 983–997. [Google Scholar] [CrossRef] [PubMed]

- Del Missier, F.; Mäntylä, T.; Hansson, P.; Bruine, D.B.; Parker, A.M.; Nilsson, L. The multifold relationship between memory and decision making: An individual-differences study. J. Exp. Psychol. Learn. Mem. Cognit. 2013, 39, 1344–1364. [Google Scholar] [CrossRef] [PubMed]

- Daneman, M.; Carpenter, P.A. Individual differences in integrating information between and within sentences. J. Exp. Psychol. Learn. Mem. Cognit. 1983, 9, 561–584. [Google Scholar] [CrossRef]

- Daneman, M.; Carpenter, P.A. Individual differences in working memory and reading. J. Verbal Learn. Verbal Behav. 1980, 19, 450–466. [Google Scholar] [CrossRef]

- McNamara, D.S.; Scott, J.L. Working memory capacity and strategy use. Mem. Cognit. 2001, 29, 10–17. [Google Scholar] [CrossRef] [PubMed]

- Marsiske, M.; Lang, F.B.; Baltes, P.B.; Baltes, M.M. Selective Optimization with Compensation: Life-span Perspectives on Successful Human Development. In Compensating for Psychological Deficits and Declines: Managing Losses and Promoting Gains; Lawrence Erlbaum Associates, Inc.: Mahwah, NJ, USA, 1995. [Google Scholar]

- Hess, T.M.; Rosenberg, D.C.; Waters, S.J. Motivation and representational processes in adulthood: The effects of social accountability and information relevance. Psychol. Aging 2001, 16, 629–642. [Google Scholar] [CrossRef] [PubMed]

- Ennis, G.E.; Hess, T.M.; Smith, B.T. The impact of age and motivation on cognitive effort: Implications for cognitive engagement in older adulthood. Psychol. Aging 2013, 28, 495–504. [Google Scholar] [CrossRef] [PubMed]

- Hess, T.M.; Leclerc, C.M.; Swaim, E.; Weatherbee, S.R. Aging and everyday judgments: The impact of motivational and processing resource factors. Psychol. Aging 2009, 24, 735–740. [Google Scholar] [CrossRef] [PubMed]

- Hess, T.M. Selective engagement of cognitive resources motivational influences on older adults’ cognitive functioning. Perspect. Psychol. Sci. 2014, 9, 388–407. [Google Scholar] [CrossRef] [PubMed]

- Kim, S.; Goldstein, D.; Hasher, L.; Zacks, R.T. Framing effects in younger and older adults. J. Gerontol. B Psychol. Sci. Soc. Sci. 2005, 60, 215–218. [Google Scholar] [CrossRef]

- Petty, R.E.; Cacioppo, J.T. Source factors and the elaboration likelihood model of persuasion. Adv. Consum. Res. 1984, 11, 668–672. [Google Scholar]

- Brand, M.; Franke-Sievert, C.; Jacoby, G.E.; Markowitsch, H.J.; Tuschen-Caffier, B. Neuropsychological correlates of decision making in patients with bulimia nervosa. Neuropsychology 2007, 21, 742–750. [Google Scholar] [CrossRef] [PubMed]

- Fischer, P.; Greitemeyer, T.; Kastenmüller, A.; Vogrincic, C.; Sauer, A. The effects of risk-glorifying media exposure on risk-positive cognitions, emotions, and behaviors: A meta-analytic review. Psychol. Bull. 2011, 137, 367–390. [Google Scholar] [CrossRef] [PubMed]

- Denburg, N.L.; Cole, C.A.; Hernandez, M.; Yamada, T.H.; Tranel, D.; Bechara, A.; Wallace, R.B. The orbitofrontal cortex, real-world decision making, and normal aging. Ann. N. Y. Acad. Sci. 2007, 1121, 480–498. [Google Scholar] [CrossRef] [PubMed]

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons by Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wood, M.; Black, S.; Gilpin, A. The Effects of Age, Priming, and Working Memory on Decision-Making. Int. J. Environ. Res. Public Health 2016, 13, 119. https://doi.org/10.3390/ijerph13010119

Wood M, Black S, Gilpin A. The Effects of Age, Priming, and Working Memory on Decision-Making. International Journal of Environmental Research and Public Health. 2016; 13(1):119. https://doi.org/10.3390/ijerph13010119

Chicago/Turabian StyleWood, Meagan, Sheila Black, and Ansley Gilpin. 2016. "The Effects of Age, Priming, and Working Memory on Decision-Making" International Journal of Environmental Research and Public Health 13, no. 1: 119. https://doi.org/10.3390/ijerph13010119

APA StyleWood, M., Black, S., & Gilpin, A. (2016). The Effects of Age, Priming, and Working Memory on Decision-Making. International Journal of Environmental Research and Public Health, 13(1), 119. https://doi.org/10.3390/ijerph13010119