Mapping in the Topic of Mathematical Model in Paddy Agricultural Insurance Based on Bibliometric Analysis: A Systematic Review Approach

Abstract

:1. Introduction

2. Materials and Methods

2.1. Materials

2.2. Methods

- Search stage. The database source used for the initial data search is Google Scholar, with the help of Publish or Perish (PoP) software, Science Direct, and Dimensions used in scientific journal searches. The bibliographic search in this study was limited to several aspects, including the bibliography, titles used, and keywords. The years of the search for this study was limited the six years from 2015–2020.

- Bibliographic screening stage. This selection is done to sort or select the journals to be analyzed. The selected bibliography comes from journal articles and conference papers.

- Checking bibliographic attribute stage. The application for analysis is included in the Mendeley_02.ris bibliography file. To analyze the filtered bibliography, the bibliographic metadata is thoroughly examined. The examination includes the author’s name, article title, author’s keywords, abstract, year, volume, issue number, page, affiliation, country, number of citations, article links, and publisher, which is then carried out by bibliometric analysis.

- Bibliometric analysis stage. Bibliometric analysis was carried out based on seven aspects, namely the formulation of the proposed problem.

3. Results

3.1. Search and Selection Stage

3.2. Filtering Stage

3.3. Checking Attribute Stage

3.4. Refinement

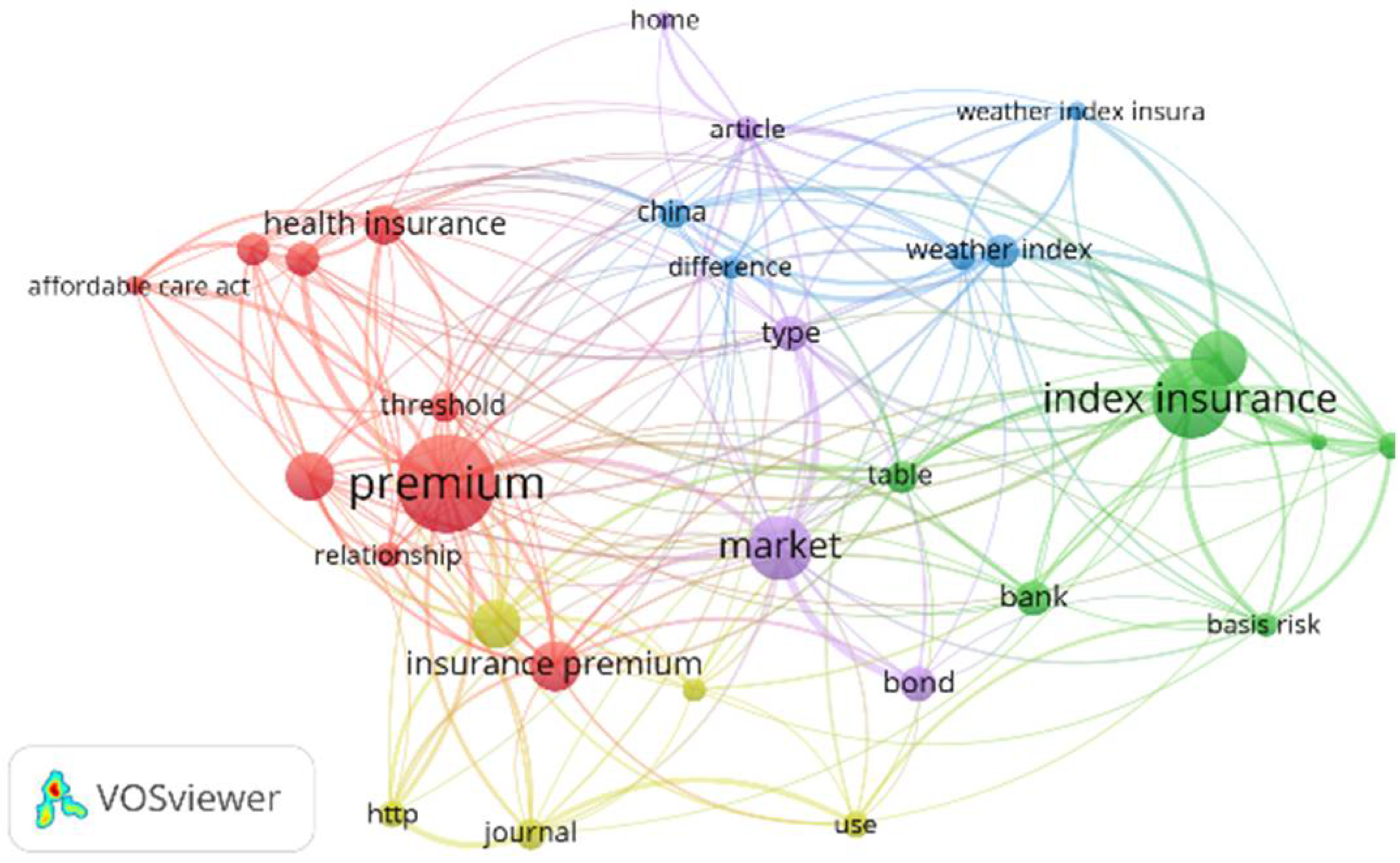

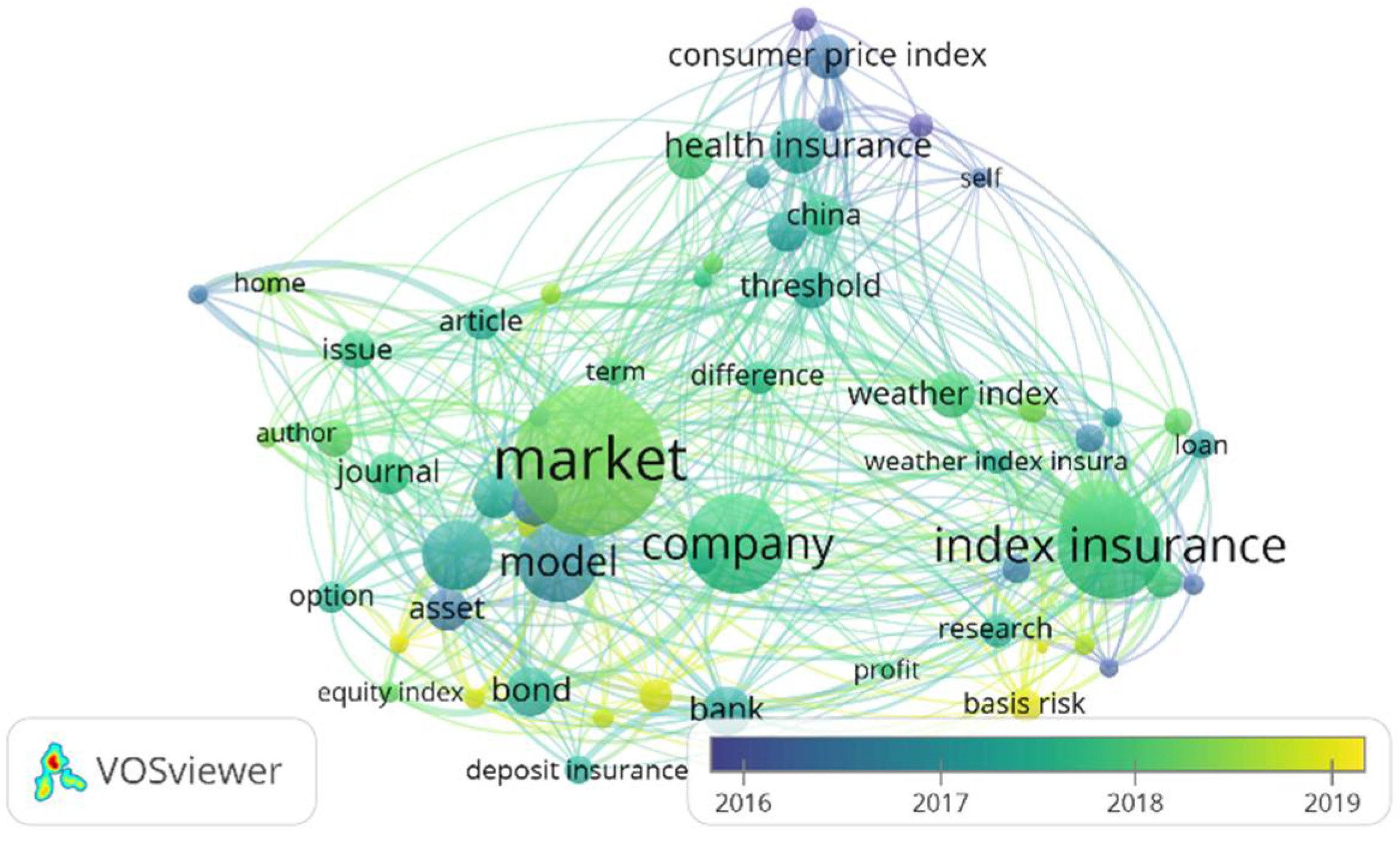

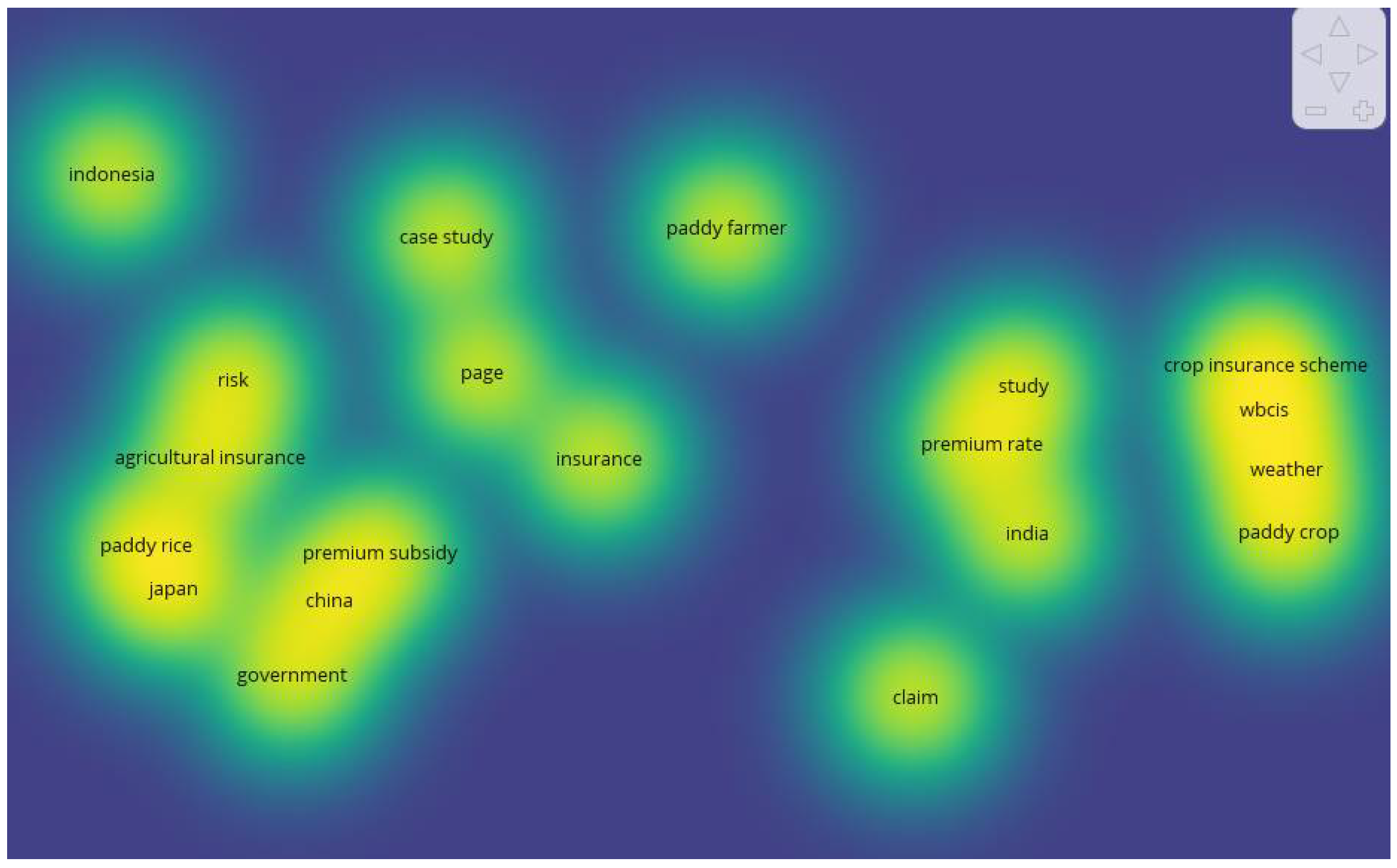

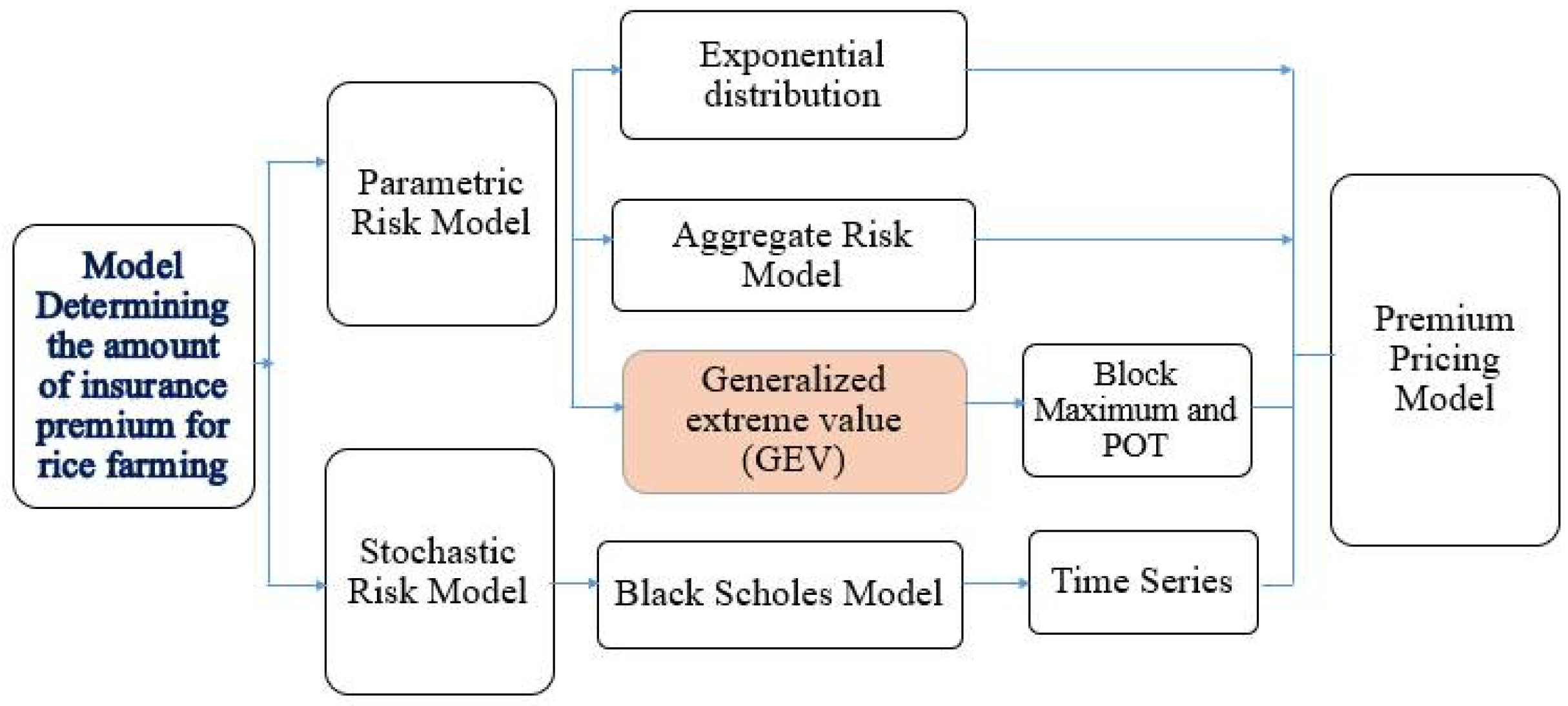

3.5. Bibliometric Analysis Stage

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Estiningtyas, W. Climate Index-Based Agricultural Insurance: Options for Empowerment and Protection of Farmers Against Climate Risk (Asuransi Pertanian Berbasis Indeks Iklim: Opsi Pemberdayaan dan Perlindungan Petani Terhadap Risiko Iklim). J. Sumberd. Lahan 2015, 9, 51–64. [Google Scholar]

- Stutley, C. Agricultural Insurance in Asia and the Pacific Region; United Nations Food and Agricultural Organization: Bangkok, Thailand, 2011. [Google Scholar]

- Aguiton, S.A. Fragile Transfers: Index Insurance and the Global Circuits of Climate Risks in Senegal. Nat. Cult. Berghahn J. 2019, 14, 282–298. [Google Scholar] [CrossRef]

- Zhang, J.; Zhang, Z.; Tao, F. Performance of temperature-related weather index for agricultural insurance of three main crops in China. Int. J. Disaster Risk Sci. 2017, 8, 78–90. [Google Scholar] [CrossRef] [Green Version]

- Ariyanti, D.; Riaman, R.; Irianingsih, I. Application of Historical Burn Analysis Method in Determining Agricultural Premium Based on Climate Index Using Black Scholes Method. JTAM (J. Teor. Dan Apl. Mat.) 2020, 4, 28–38. [Google Scholar] [CrossRef]

- Hazell, P.B. The Appropriate Role of Agricultural Insurance in Developing Countries. J. Int. Dev. 1992, 4, 567–581. [Google Scholar] [CrossRef]

- Diop, A.N. Agricultural Risk Pricing in Senegal. J. Math. Financ. 2019, 9, 182–201. [Google Scholar] [CrossRef] [Green Version]

- Mutaqin, A.K.; Kudus, A.; Karyana, Y. Metode Parametrik untuk Menghitung Premi Program Asuransi Usaha Tani Padi di Indonesia. Ethos J. Penelit. Dan Pengabdi. Masy. 2016, 4, 318–326. [Google Scholar] [CrossRef] [Green Version]

- Taib, C.M.I.C.; Benth, F.E. Pricing of temperature index insurance. Rev. Dev. Financ. 2012, 2, 22–31. [Google Scholar] [CrossRef] [Green Version]

- Filiapuspa, M.H.; Sari, S.F.; Mardiyati, S. Applying Black Scholes method for crop insurance pricing. AIP Conf. Proc. 2019, 2168, 020042. [Google Scholar]

- Hazell, P.; Hess, U. Beyond hype: Another look at index-based agricultural insurance. In Agriculture and Rural Development in a Globalizing World 2017; Routledge: London, UK, 2007; Chapter 11; pp. 211–226. [Google Scholar]

- Pribadia, D.M.; Sukonob, R. Robust model of the combination of expectations and conditional valueat-risk from paddy farming risk management based on climate variability. Int. J. Innov. Creat. Change 2019, 9, 1–15. [Google Scholar]

- Qosim, S.; Dharmawan, K.; Harini, L.P. Penentuan Harga Premi Asuransi Pertanian Berbasis Indeks Curah Hujan Dengan Menggunakan Metode Pembangkit Distribusi Eksponensial Campuran. E-J. Mat. 2018, 7, 141–147. [Google Scholar] [CrossRef] [Green Version]

- Erfiana, D.; Prabowo, A.; Tripena, A.; Riyadi, S. Penentuan Harga Premi Asuransi Pertanian Berbasis Indek Curah Hujan Dengan Model Black-Scholes. Prosiding 2020, 10, 95–107. [Google Scholar]

- Kath, J.; Mushtaq, S.; Henry, R.; Adeyinka, A.; Stone, R. Index insurance benefits agricultural producers exposed to excessive rainfall risk. Weather. Clim. Extrem. 2018, 22, 1–9. [Google Scholar] [CrossRef]

- Kath, J.; Mushtaq, S.; Henry, R.; Adeyinka, A.A.; Stone, R.; Marcussen, T.; Kouadio, L. Spatial variability in regional scale drought index insurance viability across Australia’s wheat growing regions. Clim. Risk Manag. 2019, 24, 13–29. [Google Scholar] [CrossRef]

- Janzen, S.; Magnan, N.; Mullally, C.; Garbero, A.; Hughes, K.; Oduol, J.; Palmer, B.; Shin, S. Experimental Games to Teach Farmers about Weather Index Insurance in Kenya. Int. Initiat. Impact Eval. (3ie) 2020. [Google Scholar] [CrossRef]

- Jensen, N.D.; Barrett, C.B.; Mude, A.G. Cash transfers and index insurance: A comparative impact analysis from northern Kenya. J. Dev. Econ. 2017, 29, 14–28. [Google Scholar] [CrossRef]

- Jensen, N.D.; Barrett, C.B.; Mude, A.G. Index insurance quality and basis risk: Evidence from northern Kenya. Am. J. Agric. Econ. 2016, 98, 1450–1469. [Google Scholar] [CrossRef] [Green Version]

- Jensen, N.; Barrett, C. Agricultural index insurance for development. Appl. Econ. Perspect. Policy 2017, 39, 199–219. [Google Scholar] [CrossRef]

- Yu, J.; Vandeveer, M.; Volesky, J.D.; Harmoney, K. Estimating the basis risk of rainfall index insurance for pasture, rangeland, and forage. J. Agric. Resour. Econ. 2019, 44, 179–193. [Google Scholar]

- Sibiko, K.W.; Veettil, P.C.; Qaim, M. Small farmers’ preferences for weather index insurance: Insights from Kenya. Agric. Food Secur. 2018, 7, 1–14. [Google Scholar] [CrossRef] [Green Version]

- Ellegaard, O.; Wallin, J.A. The bibliometric analysis of scholarly production: How great is the impact? Scientometrics 2015, 105, 1809–1831. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Noman, M.A.; Nasr, E.S.; Al-Shayea, A.; Kaid, H. Overview of predictive conditionbased maintenance research using bibliometric indicators. J. King Saud Univ.-Eng. Sci. 2019, 31, 355–367. [Google Scholar]

- Russell, J.M.; Rousseau, R. Bibliometrics and institutional evaluation. Encycl. Life Support Syst. (EOLSS). Part. 2010, 19, 42–64. [Google Scholar]

- De Bellis, N. Bibliometrics and Citation Analysis: From the Science Citation Index to Cybermetrics; Scarecrow Press, Inc.: Lanham, MD, USA; Washington, DC, USA, 2009; Volume 9. [Google Scholar]

- Pilkington, A. Bibexcel-Quick Start Guide to Bibliometrics and Citation Analysis; World Scientific Publishing: London, UK, 2018. [Google Scholar] [CrossRef]

- Piotrowski, C. Bibliometrics and citation analysis for the psychologist-manager: A review and select readings. Psychol.-Manag. J. 2013, 16, 53. [Google Scholar] [CrossRef]

- Julia, J.; Supriatna, E.; Isrokatun, I.; Aisyah, I.; Nuryani, R.; Aminat, O.A. Moral Education (2010–2019): A Bibliometric Study (Part 1). Univers. J. Educ. Res. 2020, 8, 2554–2568. [Google Scholar] [CrossRef]

- Julia, J.; Supriatna, E.; Isrokatun, I.; Aisyah, I.; Aminat, O.A.; Hakim, A. Moral Education (2010–2019): A Bibliometric Study (Part 2). Univers. J. Educ. Res. 2020, 8, 2954–2968. [Google Scholar] [CrossRef]

- Yao, F.; Wen, H.; Luan, J. CVaR Measurement and Operational Risk Management in Commercial Banks According to The Peak Value Method of Extreme Value Theory. Math. Comput. Model. J. 2013, 58, 15–27. [Google Scholar] [CrossRef]

- Putri, I.A.; Dharmawan, K.; Tastrawati, N.K. Perhitungan harga premi asuransi pertanian yang berbasis indeks curah hujan menggunakan metode black scholes. E-J. Mat. 2017, 6, 161–167. [Google Scholar] [CrossRef] [Green Version]

- Sari, Y.W. Penentuan Batas Maksimum Premi Asuransi Pertanian. J. Data Anal. 2018, 1, 64–69. [Google Scholar] [CrossRef]

- Riaman, R.; Sukono, S.; Supian, S.; Ismail, N. Analysing the decision making for agricultural risk assessment: An application of extreme value theory. Decis. Sci. Lett. 2021, 10, 351–360. [Google Scholar] [CrossRef]

- Riaman, R.; Sukono, S.; Supian, S.; Ismail, N. Paddy Harvest Failure Risk Analysis using Extreme Value Theory Based on Weather Index as Information Supply Chain for Agricultural Business. Int. J. Supply Chain. Manag. (IJSCM) 2020, 9, 636–646. [Google Scholar]

- Clarke, D.J. A theory of rational demand for index insurance. Am. Econ. J. Microecon. 2016, 8, 283–306. [Google Scholar] [CrossRef] [Green Version]

- Zhang, J.; Tan, K.S.; Weng, C. Index insurance design. ASTIN Bull. J. IAA 2019, 49, 491–523. [Google Scholar] [CrossRef]

- Guo, J.; Jin, J.; Tang, Y.; Wu, X. Design of Temperature Insurance Index and Risk Zonation for Single-Season Paddy in Response to High-Temperature and Low-Temperature Damage: A Case Study of Jiangsu Province. Int. J. Environ. Res. Public Health 2019, 16, 1187. [Google Scholar]

- Singh, P.; Agrawal, G. Efficacy of weather index insurance for mitigation of weather risks in agriculture. Int. J. Ethics Syst. 2019, 35, 584–616. [Google Scholar] [CrossRef]

- Jindrová, P.; Pacáková, V. Natural Catostrophe Models for Insurance Risk Management. WSEAS Trans. Bus. Econ. 2019, 16, 1–9. [Google Scholar]

- Rohanda, R.; Winoto, Y. Bibliometric Analysis of Collaboration Level, Author Productivity, and Profile of Information & Library Studies Journal Articles 2014–2018. PUSTABIBLIA (Analisis Bibliometrika Tingkat Kolaborasi, Produktivitas Penulis, Serta Profil Artikel Jurnal Kajian Informasi & Perpustakaan Tahun 2014-2018. PUSTABIBLIA). J. Libr. Inf. Sci. 2019, 3, 1–15. [Google Scholar]

- Erwina, W.; Kurniasih, N.; Setianti, Y. Citation Analysis of Fikom Lecturers’ Works on the GDL (Database Analisis Sitasi Karya Dosen Fikom pada Database GDL); Unpad Press: Bandung, Indonesia, 2010. [Google Scholar]

- Hoepner, A.G.; Kant, B.; Scholtens, B.; Yu, P.S. Environmental and ecological economics in the 21st century: An age adjusted citation analysis of the influential articles, journals, authors and institutions. Ecol. Econ. 2012, 77, 193–206. [Google Scholar] [CrossRef]

- Whorf, B.L. Language, Thought, and Reality: Selected Writings of Benjamin Lee Whorf; MIT Press: Cambridge, MA, USA, 2012; p. 20. [Google Scholar]

- Rahayu, S.; Saleh, A.R. Studi bibliometrik dan sebaran topik penelitian pada Jurnal Hayati terbitan 2012–2016. Pustakaloka 2017, 9, 201–218. [Google Scholar] [CrossRef]

- Lakitan, B.; Hadi, B.; Herlinda, S.; Siaga, E.; Widuri, L.I.; Kartika, K.; Lindiana, L.; Yunindyawati, Y.; Meihana, M. Recognizing farmers’ practices and constraints for intensifying rice production at Riparian Wetlands in Indonesia. NJAS-Wagening. J. Life Sci. 2018, 85, 10–20. [Google Scholar] [CrossRef]

- Fadhliani, Z.; Luckstead, J.; Wailes, E.J. The impacts of multiperil crop insurance on Indonesian rice farmers and production. Agric. Econ. 2019, 50, 15–26. [Google Scholar] [CrossRef]

- Bellman, L.; Ekholm, S.; Giritli Nygren, K.; Hemmingsson, O.; Jarnkvist, K.; Kvarnlöf, L.; Lundgren, M.; Olofsson, A. Climate Change, Insurance, and Households: A Literature Review. RCR (Risk Crisis Res. Cent.) Work. Pap. Ser. Mid Swed. Univ. 2016, 1, 1–46. [Google Scholar]

- Linh, T.N.; Long, H.T.; Chi, L.V.; Tam, L.T.; Lebailly, P. Access to rural credit markets in developing countries, the case of Vietnam: A literature review. Sustainability 2019, 11, 1468. [Google Scholar] [CrossRef] [Green Version]

- Dethier, J.J.; Effenberger, A. Agriculture and development: A brief review of the literature. Econ. Syst. 2012, 36, 175–205. [Google Scholar] [CrossRef] [Green Version]

- Ismail, N.; Husin, M.M.M.; Ishak, I.; Manaf, N.A. Insurance Awareness: A Literature Review. Int. J. Asian Soc. Sci. 2018, 8, 28–33. [Google Scholar] [CrossRef] [Green Version]

| Stage | A | B | C | D |

|---|---|---|---|---|

| Keywords | “paddy insurance” or “paddy insurance” | “index insurance” or “weather index insurance” or ”mpci” | “extreme value theory” or “generalized pareto distribution” or “block maxima” or “peak over threshold” | A and C |

| Science Direct | 395 | 157 | 125 | 27 |

| Publish or Perish | 450 | 221 | 231 | 50 |

| Google Scholar | 1850 | 205 | 190 | 53 |

| Dimensions | 1966 | 241 | 227 | 25 |

| Total | 4461 | 824 | 773 | 155 |

| Publication Year | Selected Articles | Number of Citations |

|---|---|---|

| 2020 | 9 | 11 |

| 2019 | 23 | 110 |

| 2018 | 24 | 292 |

| 2017 | 21 | 281 |

| 2016 | 18 | 561 |

| 2015 | 14 | 257 |

| Total | 109 | 1512 |

| Average | 18 | 252 |

| A | B | C | D | ||||

|---|---|---|---|---|---|---|---|

| Publication years: | 2015–2020 | Publication years | 2015–2020 | Publication years | 2015–2020 | Publication years | 2015–2020 |

| Citation years: | 6 | Citation years: | 6 | Citation years: | 6 | Citation years: | 6 |

| Papers: | 450 | Papers: | 231 | Papers: | 221 | Papers: | 50 |

| Citations: | 3717 | Citations: | 2417 | Citations: | 1080 | Citations: | 768 |

| Cites/year: | 619.50 | Cites/year: | 402.83 | Cites/year: | 180.00 | Cites/year: | 178.00 |

| Cites/paper: | 8.26 | Cites/paper: | 10.46 | Cites/paper: | 4.89 | Cites/paper: | 141.36 |

| Author/paper: | 2.84 | Author/paper: | 3.48 | Author/paper: | 2.28 | Author/paper: | 3.28 |

| h-index: | 27 | h-index: | 25 | h-index: | 16 | h-index: | 36 |

| g-index | 51 | g-index | 41 | g-index | 27 | g-index | 50 |

| hI-norm: | 18 | hI-norm: | 13 | hI-norm: | 10 | hI-norm: | 25 |

| hI-annual: | 3.00 | hI-annual: | 2.17 | hI-annual: | 1.67 | hI-annual: | 4.17 |

| Papers with ACC ≥ 1,2,5,10,20: | 194,113,56,26,5 | Papers with ACC ≥ 1,2,5,10,20: | 128,94,49,18,5 | Papers with ACC ≥ 1,2,5,10,20: | 69,39,21,7,2 | Papers with ACC ≥ 1,2,5,10,20: | 50,50,45,40,27 |

| Category | [39] | [47] | [37] | [7] |

| Review purpose | Optimal index insurance design under the expected utility maximization framework | The optimal policy combination results from the highest levels of coverage and subsidies, offering the largest expected net insurance payouts and equal certainty | Risk management of insurance and reinsurance companies | Determine the pure premium |

| Review domain | The optimal compensation function of agricultural insurance and index-based disaster insurance. | Multiperil crop insurance policy for risk-averse | Statistical unexpected and there have huge impact on the whole society | health risks, locusts (wild locusts), wild animals |

| Review scope | Prove the existence and uniqueness of optimal contracts, and develop effective numerical procedures to calculate optimal solutions | Multiperil crop insurance policy for risk-averse Indonesian rice farmers located in Tuban and Gresik Regencies of the East Java Province. | Statistical unexpected and there have huge impact on the whole society | This segmentation will determine the correct premium |

| Research context | This method is illustrated by a numerical example in protection against adverse crop yields using indexes. | Numerically simulated to quantify the effects of different coverage levels and subsidy rates on input use, expected net insurance payments, and certainty equivalents. | Not discussed | This segmentation will determine the correct premium |

| Research Objective | The purpose of this paper is to provide an in-depth analysis of index indemnity insurance, or simply index insurance | Analysis the effect of multi-hazard crop insurance policies for risk-averse Indonesian rice farmers located in Tuban and Gresik Regencies, East Java Province | The aim of this article is to present two of the useful methods-block maxima method and peaks over threshold method | The aim of the study is to determine the pure premium that must be paid by Senegalese farmers who are insured against conventional risk |

| Variable | Temperature and precipitation | coverage levels and subsidy rates on input use, expected net insurance payments, and certainty equivalents. | Historical data about insured losses of natural catastrophes | health risks, locusts (wild locusts), wild animals and ducks have higher claims than climatic events (rainfall deficit, floods) |

| Method | Utility function | Comparative static results are mostly ambiguous and are left as empirical questions | Risk management of insurance and reinsurance companies | to consider the type of risk to which each insured is most exposed and determine the corresponding premium. |

| Model Design | Exponential utility and quadratic utility function | Yield-Based MPCI Crop Insurance Policy in Indonesia | Catastrophic events | general linear model (GLM) |

| Result/Model | Optimal index insurance significantly outperforms linear type index insurance contracts in terms of reducing underlying risk | The optimal policy combination results from the highest coverage level and subsidy, which offer the largest expected net insurance payments and certainty equivalent | estimates future insured losses | better pricing, the insurance company |

| Metric | Score |

|---|---|

| Publication years | 2015–2020 |

| Citation years | 2 (2018–2019) |

| Papers | 4 |

| Citations | 9 |

| Cites/year | 4.50 |

| Cites/paper | 2.25 |

| Authors/paper | 2.75 |

| h-index | 2 |

| g-index | 2 |

| hI-norm | 1 |

| hI-annual | 0.33 |

| No | Authors | Title | Year | Publish in |

|---|---|---|---|---|

| 1 | [39] | Index Insurance Design | 2019 | The Journal of the IAA, ASTIN Bulletin, 49(2) |

| 2 | [47] | The impacts of multiperil crop insurance on Indonesian rice farmers and production | 2019 | Journal of Agricultural Economics, 50(1), 15–26. |

| 3 | [37] | Natural Catastrophe Models for Insurance Risk Management | 2019 | WSEAS Transactions on Business and Economics, 16(1), 1-9. |

| 4 | [7] | Agricultural Risk Pricing in Senegal | 2019 | Journal of Mathematical Finance, 2019, 9, 182–201. |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Riaman; Sukono; Supian, S.; Ismail, N. Mapping in the Topic of Mathematical Model in Paddy Agricultural Insurance Based on Bibliometric Analysis: A Systematic Review Approach. Computation 2022, 10, 50. https://doi.org/10.3390/computation10040050

Riaman, Sukono, Supian S, Ismail N. Mapping in the Topic of Mathematical Model in Paddy Agricultural Insurance Based on Bibliometric Analysis: A Systematic Review Approach. Computation. 2022; 10(4):50. https://doi.org/10.3390/computation10040050

Chicago/Turabian StyleRiaman, Sukono, Sudradjat Supian, and Noriszura Ismail. 2022. "Mapping in the Topic of Mathematical Model in Paddy Agricultural Insurance Based on Bibliometric Analysis: A Systematic Review Approach" Computation 10, no. 4: 50. https://doi.org/10.3390/computation10040050

APA StyleRiaman, Sukono, Supian, S., & Ismail, N. (2022). Mapping in the Topic of Mathematical Model in Paddy Agricultural Insurance Based on Bibliometric Analysis: A Systematic Review Approach. Computation, 10(4), 50. https://doi.org/10.3390/computation10040050