Time-Discrete Hedging of Down-and-Out Puts with Overnight Trading Gaps

Abstract

:1. Introduction

2. The Hedging Problem

2.1. Mean-Variance Hedging

2.2. Hedging Situation and Strategies

- Standard delta hedging with the underlying model;

- Static hedging with the strike spread approach of Carr and Chou (1997);

- Mean-variance hedging with obtained by (2) using the underlying;

- Mean-variance hedging with obtained by (3) using vanilla call options with the following maturities:

- (a)

- 1 day (best case, when available);

- (b)

- 5 days (normal case, weekly options are available for major stock indices);

- (c)

- 20 days (worst case, time to maturity identical to dop).

- No hedging.

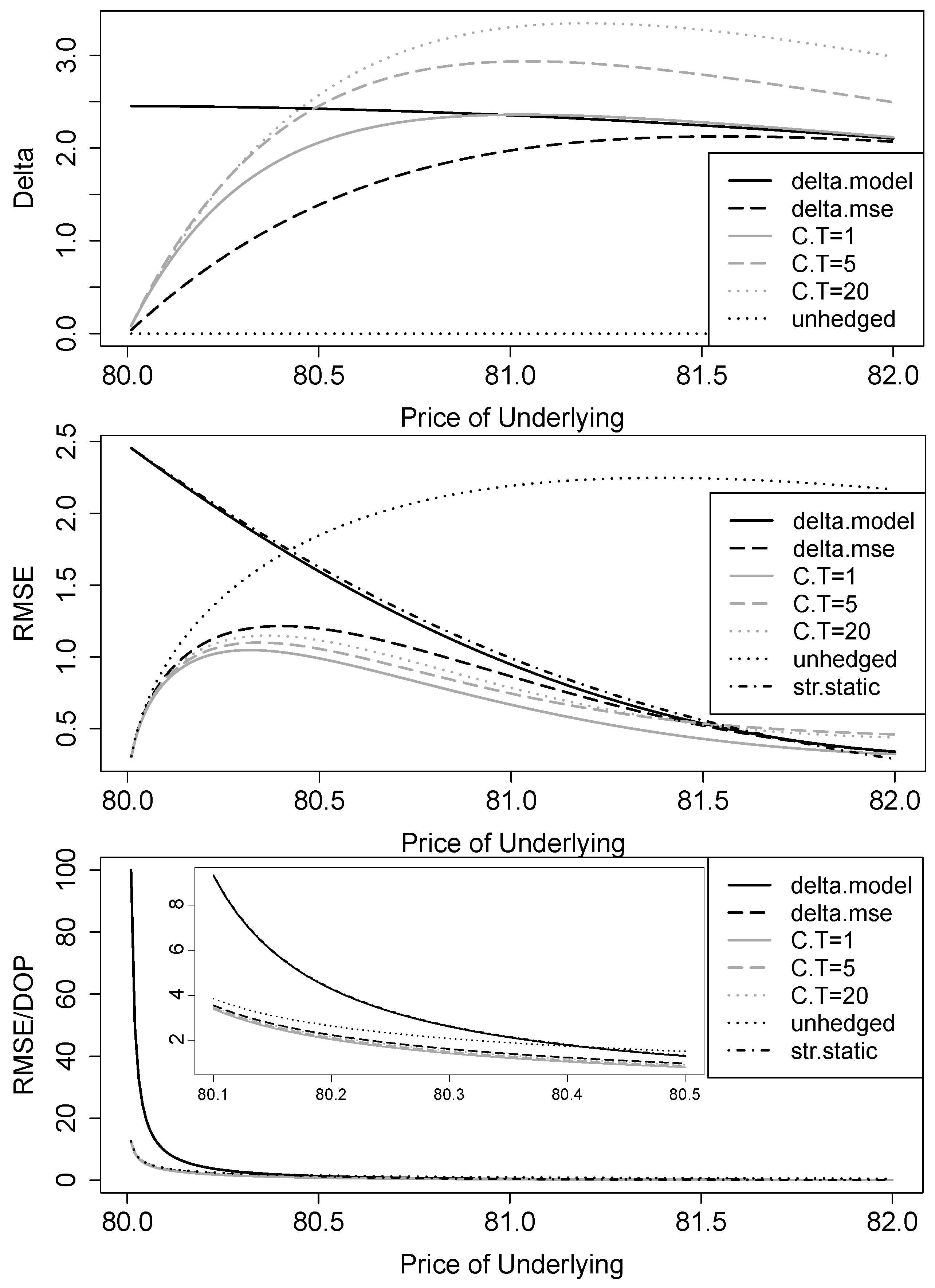

3. Hedging under Geometric Brownian Motion

3.1. Model and Parameters

3.2. Continuous Trading

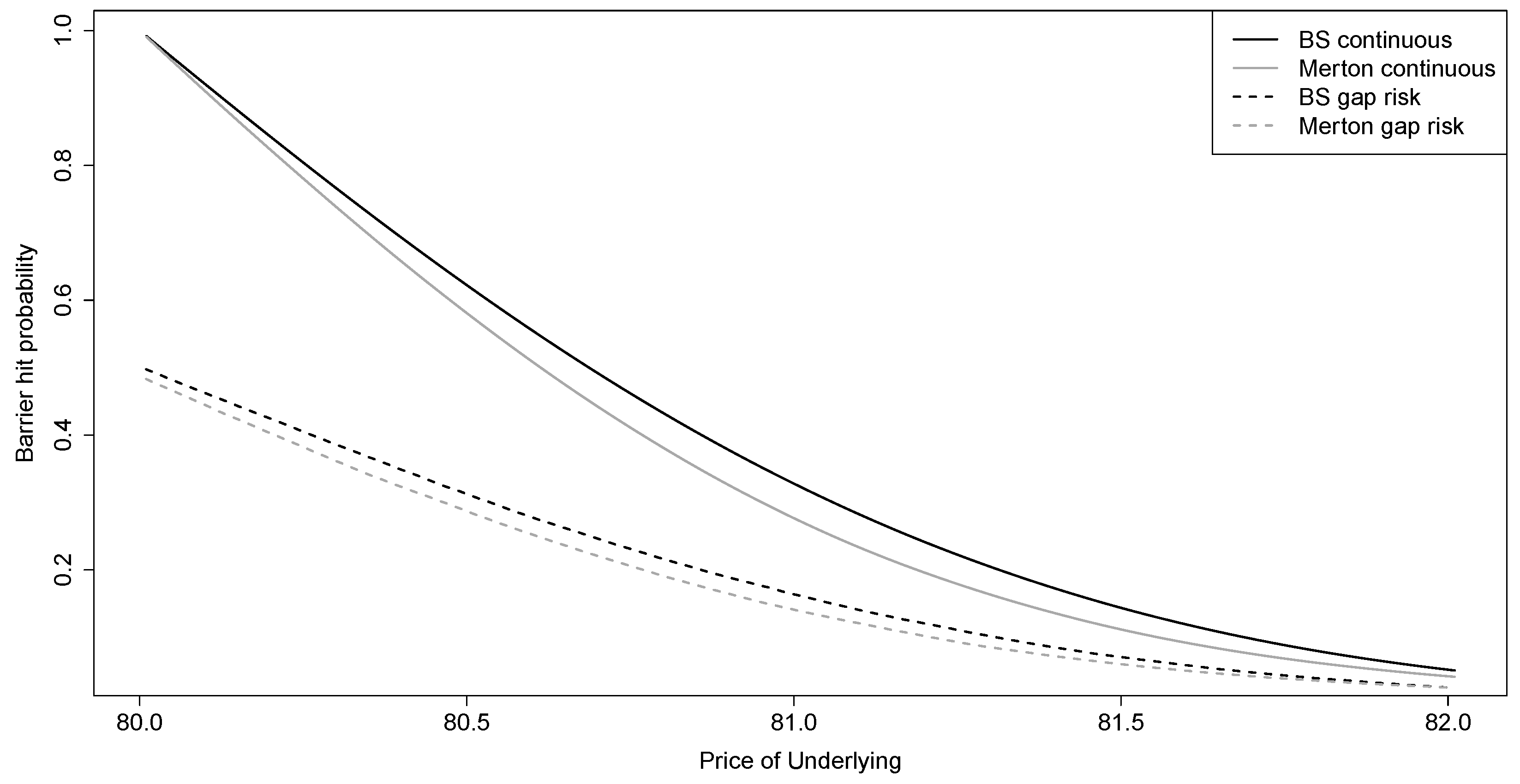

3.3. Overnight Trading Gaps

3.4. Other Parameters

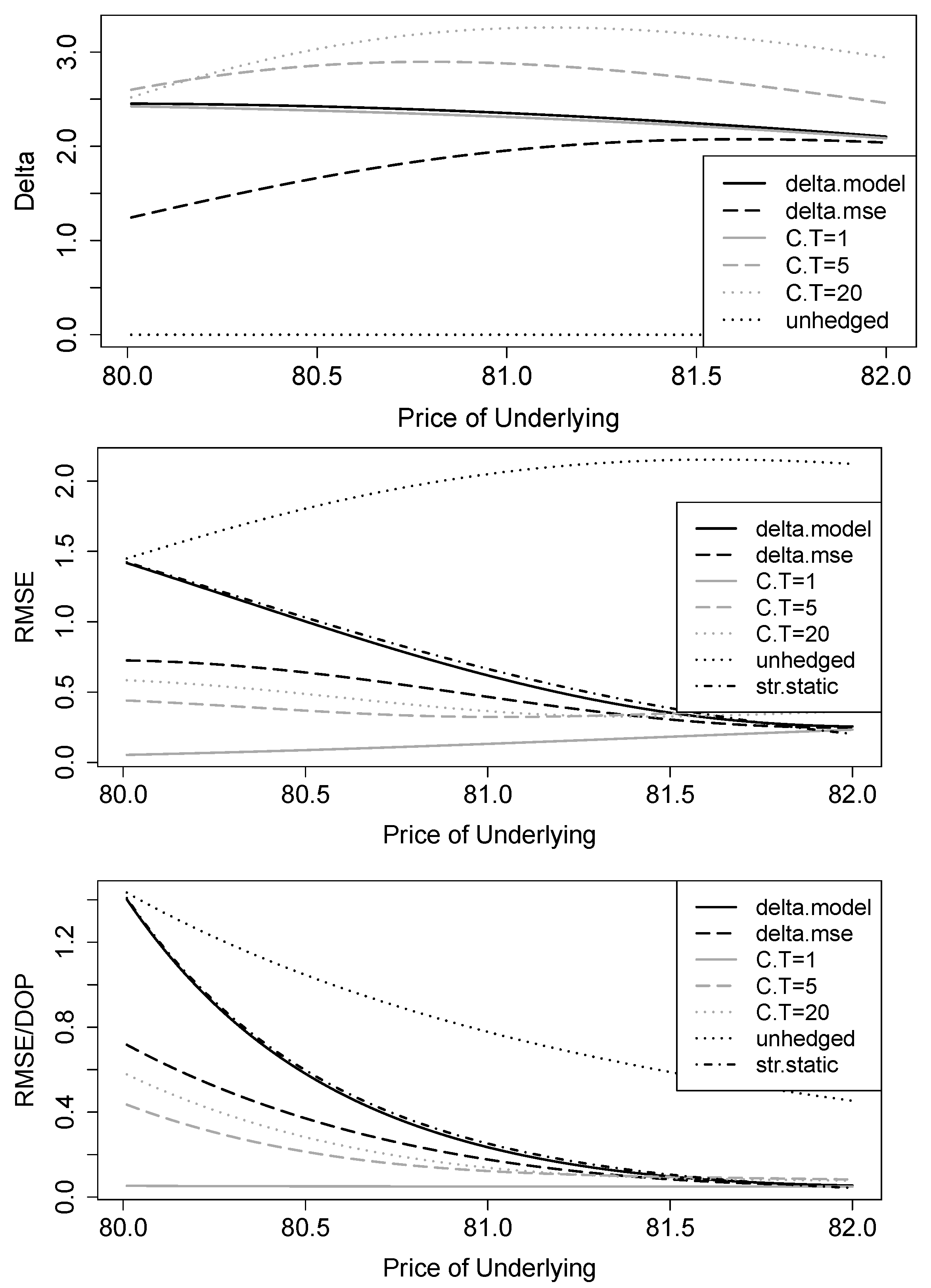

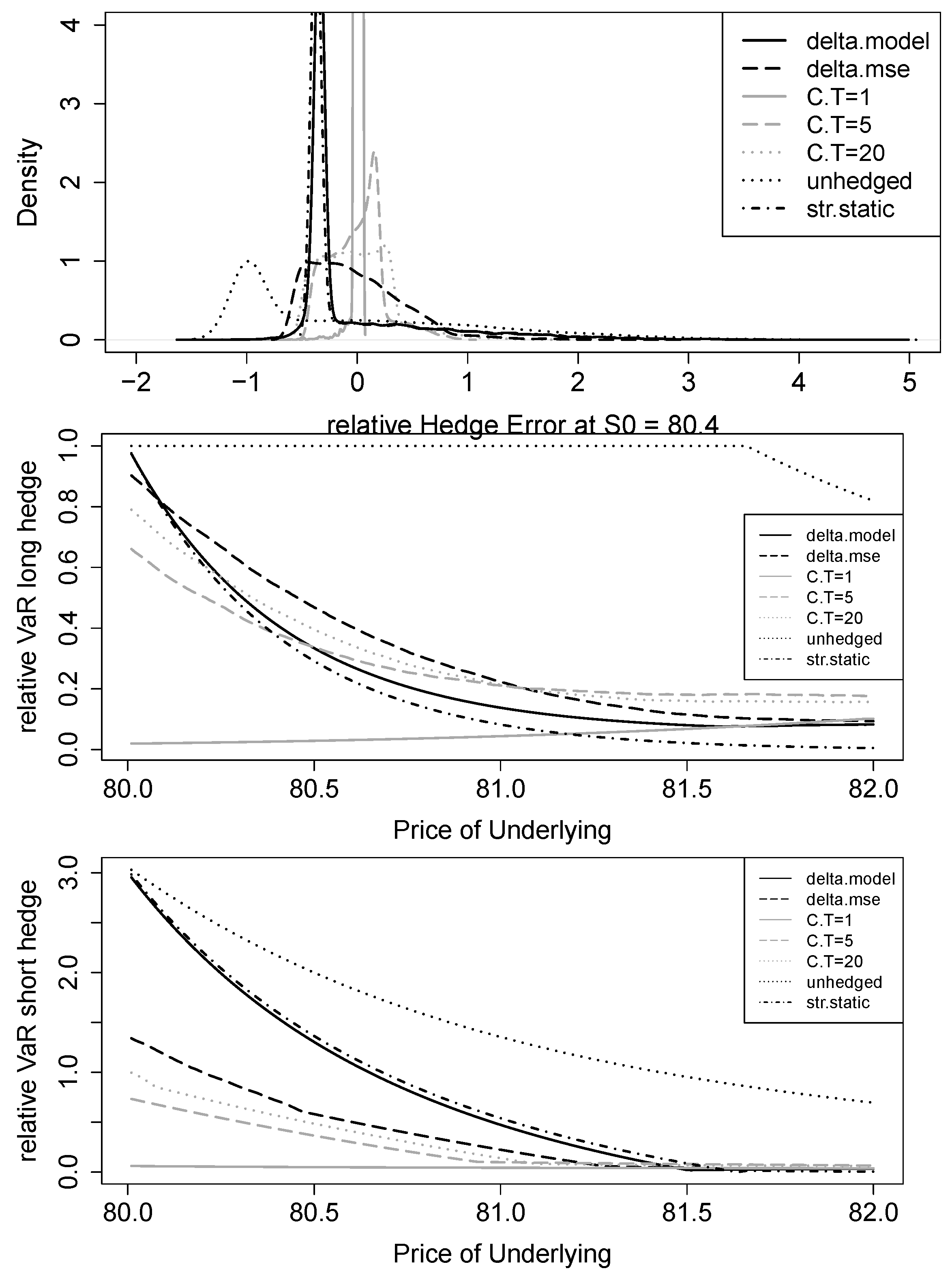

4. Robustness for Other Underlying Processes

4.1. Jump-Diffusion Model

4.2. Simple Formulas in a Complex Model

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

| 1 | See Derman et al. (1995) and Carr and Chou (1997) for the first approaches to static hedging in the Black-Scholes model and Nalholm and Poulsen (2006b) for a unification and extension to general asset dynamics. |

| 2 | The overnight gap risk has been studied in the case of leverage certificates by Entrop et al. (2009) and Baller et al. (2016). In contrast to the down-and-out puts we consider in this paper, leverage certificates feature embedded up-and-out puts with continuous payoffs, which are much easier to hedge. |

| 3 | Cont et al. (2005) used a vanilla put in addition to the underlying to hedge a barrier put. |

| 4 | Practitioners often use a local-volatility model to price barrier options. However, for hedging purposes, a local-volatility model has been found to perform worse in some cases (e.g., Dumas et al. (1998); Hagan et al. (2002)). Additionally, Baule and Shkel (2021) showed empirically that issuers in the German market for bonus certificates (where down-and-out puts are embedded) prefer models with stochastic volatility, whereas local-volatility is not likely to be used. Since jumps are more important in the case of overnight trading gaps, we additionally used a model with jumps. To be consistent with the literature (e.g., An and Suo (2009) and Jessen and Poulsen (2013)), we applied the SVJ model with stochastic volatility and jumps. Since the hedging results for the overnight gap period with this model are not substantially different from the Black-Scholes results, this is a good reason to believe that the results with a local-volatility model would also be very similar. |

| 5 | Theoretically, (2) has to be evaluated under the physical measure. However, as we only consider a small time period , the drift term has a negligible impact on hedging errors compared to the stochastic part. This is why we follow Nalholm and Poulsen (2006a) and evaluate (2) under the risk-neutral measure. |

| 6 | |

| 7 | Note that for the underlying, the integrals are directly given by and . |

| 8 |

References

- Ait-Sahalia, Yacine, and Jean Jacod. 2009. Testing for jumps in a discretely observed process. Annals of Statistics 37: 184–222. [Google Scholar] [CrossRef]

- Alexander, Carol, Alexander Rubinov, Markus Kalepky, and Stamatis Leontsinis. 2012. Regime-dependent smile-adjusted delta hedging. Journal of Futures Markets 32: 203–29. [Google Scholar] [CrossRef]

- An, Yunbi, and Wulin Suo. 2009. An empirical comparison of option-pricing models in hedging exotic options. Financial Management 38: 889–914. [Google Scholar] [CrossRef]

- Bakshi, Gurdip, and Dilip Madan. 2000. Spanning and derivative-security valuation. Journal of Financial Economics 55: 205–38. [Google Scholar] [CrossRef]

- Bakshi, Gurpid, Charles Cao, and Zhiwu Chen. 1997. Empirical performance of alternative option pricing models. Journal of Finance 52: 2003–49. [Google Scholar] [CrossRef]

- Baller, Stefanie, Oliver Entrop, Michael McKenzie, and Marco Wilkens. 2016. Market makers’ optimal price-setting policy for exchange-traded certificates. Journal of Banking & Finance 71: 206–26. [Google Scholar]

- Bates, David S. 1996. Jumps and stochastic volatility: Exchange rate processes implicit in Deutsche Mark options. Review of Financial Studies 9: 69–107. [Google Scholar] [CrossRef]

- Baule, Rainer, and Christian Tallau. 2011. The pricing of path-dependent structured financial retail products: The case of bonus certificates. Journal of Derivatives 18: 54–71. [Google Scholar] [CrossRef]

- Baule, Rainer, and David Shkel. 2021. Model risk and model choice in the case of barrier options and bonus certificates. Journal of Banking & Finance 133: 106307. [Google Scholar]

- Baule, Rainer, Philip Rosenthal, and David Shkel. forthcoming. Barrier option pricing with trading and non-trading hours. Wilmott Magazine.

- Bemporad, Alberto, Laura Puglia, and Tommaso Gabbriellini. 2011. A stochastic model predictive control approach to dynamic option hedging with transaction costs. Paper presented at 2011 American Control Conference, San Francisco, CA, USA, June 29–July 1; pp. 3862–867. [Google Scholar]

- Bemporad, Alberto, Leonardo Bellucci, and Tommaso Gabbriellini. 2014. Dynamic option hedging via stochastic model predictive control based on scenario simulation. Quantitative Finance 14: 1739–751. [Google Scholar] [CrossRef]

- Bemporad, Alberto, Tommaso Gabbriellini, Laura Puglia, and Leonardo Bellucci. 2010. Scenario-based stochastic model predictive control for dynamic option hedging. Paper presented at 49th IEEE Conference on Decision and Control (CDC), Atlanta, GA, USA, December 15–17; pp. 6089–94. [Google Scholar]

- Black, Fischer, and Myron Scholes. 1973. The pricing of options and corporate liabilities. Journal of Political Economy 81: 637–54. [Google Scholar] [CrossRef] [Green Version]

- Bollerslev, Tim, and Hao Zhou. 2002. Estimating stochastic volatility diffusion using conditional moments of integrated volatility. Journal of Econometrics 109: 33–65. [Google Scholar] [CrossRef] [Green Version]

- Carr, Peter, and Andrew Chou. 1997. Breaking barriers. Journal of Risk 10: 139–45. [Google Scholar]

- Cont, Rama, and Peter Tankov. 2004. Financial Modelling with Jump Processes. London: Chapman & Hall/CRC Press. [Google Scholar]

- Cont, Rama, Peter Tankov, and Ekaterina Voltchkova. 2005. Hedging with options in models with jumps. In Stochastic Analysis and Applications. Edited by Fred Espen Benth, Giulia Di Nunno, Tom Lindström, Berntöksendal and Tusheng Zhang. Berlin and Heidelberg: Springer, pp. 197–217. [Google Scholar]

- Cont, Rama. 2001. Empirical properties of asset returns: Stylized facts and statistical issues. Quantitative Finance 1: 223–36. [Google Scholar] [CrossRef]

- Derman, Emanuel, Deniz Ergener, and Iraj Kani. 1995. Static options replication. Journal of Derivatives 2: 78–95. [Google Scholar] [CrossRef] [Green Version]

- Dumas, Bernard, Jeff Fleming, and Robert E. Whaley. 1998. Implied volatility functions: Empirical tests. Journal of Finance 53: 2059–106. [Google Scholar] [CrossRef] [Green Version]

- Engelmann, Bernd, Matthias R. Fengler, Morten Nalholm, and Peter Schwendner. 2006. Static versus dynamic hedges: An empirical comparison for barrier options. Review of Derivatives Research 9: 239–64. [Google Scholar] [CrossRef]

- Entrop, Oliver, Hendrik Scholz, and Marco Wilkens. 2009. The price-setting behavior of banks: An analysis of open-end leverage certificates on the German market. Journal of Banking & Finance 33: 874–82. [Google Scholar]

- Föllmer, Hans, and Dieter Sondermann. 1986. Hedging of non-redundant contingent claims. In Constributions to Mathematical Economics. Edited by Werner Hildenbrand and Andreu Mas-Colell. Amsterdam: Elsevier, pp. 205–23. [Google Scholar]

- Föllmer, Hans, and Martin Schweizer. 1988. Hedging by sequential regression: An introduction to the mathematics of option trading. ASTIN Bulletin: The Journal of the IAA 18: 147–60. [Google Scholar] [CrossRef] [Green Version]

- Glasserman, Paul. 2004. Monte Carlo Methods in Financial Engineering. New York: Springer. [Google Scholar]

- Graf Plessen, Morgens, Laura Puglia, Tommaso Gabbriellini, and Alberto Bemporad. 2019. Dynamic option hedging with transaction costs: A stochastic model predictive control approach. International Journal of Robust and Nonlinear Control 29: 5058–77. [Google Scholar] [CrossRef]

- Hagan, Patrick S., Deep Kumar, Andrew S. Lesniewski, and Diana E. Woodward. 2002. Managing smile risk. Wilmott Magazine 1: 84–108. [Google Scholar]

- Hernández, Rodrigo, and Pu Liu. 2014. An option pricing analysis of exotic bonus certificates—The case of bonus certificates PLUS. Theoretical Economics Letters 4: 331–40. [Google Scholar] [CrossRef] [Green Version]

- Hernández, Rodrigo, Jorge Brusa, and Pu Liu. 2008. An economic analysis of bonus certificates—Second-generation of structured products. Review of Futures Markets 16: 419–51. [Google Scholar]

- Hernández, Rodrigo, Yingying Shao, and Pu Liu. 2014. Valuation of flex bonus certificates—Theory and evidence. Academy of Economics and Finance Journal 5: 47–57. [Google Scholar]

- Hu, Guanglian, and Yuguo Liu. forthcoming. The pricing of volatility and jump risk in the cross-section of index option returns. Journal of Financial and Quantitative Analysis. [CrossRef]

- Hull, John C., and Alan White. 2017. Optimal delta hedging for options. Journal of Banking & Finance 82: 180–90. [Google Scholar]

- İlhan, Aytaç, and Ronnie Sircar. 2006. Optimal static-dynamic hedges for barrier options. Mathematical Finance 16: 359–85. [Google Scholar] [CrossRef]

- İlhan, Aytaç, Mattias Jonsson, and Ronnie Sircar. 2008. Optimal static-dynamic hedges for exotic options under convex risk measures. Stochastic Processes and Their Applications 119: 3608–632. [Google Scholar] [CrossRef] [Green Version]

- Jessen, Cathrine, and Rolf Poulsen. 2013. Empirical performance of models for barrier option valuation. Quantitative Finance 13: 1–11. [Google Scholar] [CrossRef] [Green Version]

- Kou, Steve G. 2007. Jump-diffusion models for asset pricing in financial engineering. In Handbooks in Operations Research and Management Science. Edited by John R. Birge and Vadim Linetsky. Amsterdam: Elsevier, vol. 15, pp. 73–116. [Google Scholar]

- Leung, Tim, and Matthew Lorig. 2015. Optimal static quadratic hedging. Quantitative Finance 16: 1341–355. [Google Scholar] [CrossRef] [Green Version]

- Maruhn, Jan H., and Ekkehard W. Sachs. 2009. Robust static hedging of barrier options in stochastic volatility models. Mathematical Methods of Operations Research 70: 405–33. [Google Scholar] [CrossRef]

- Maruhn, Jan H., Morten Nalholm, and Matthias R. Fengler. 2011. Static hedges for reverse barrier options with robustness against skew risk: An empirical analysis. Quantitative Finance 11: 711–27. [Google Scholar] [CrossRef] [Green Version]

- Matsuda, Kazuhisa. 2004. Introduction to Merton Jump Diffusion Model. Working Paper. New York: Graduate Center of the City University of New York. [Google Scholar]

- Merton, Robert C. 1973. Theory of rational option pricing. Bell Journal of Economics and Management Science 4: 141–83. [Google Scholar] [CrossRef] [Green Version]

- Merton, Robert C. 1976. Option pricing when underlying stock returns are discontinuous. Journal of Financial Economics 3: 125–44. [Google Scholar] [CrossRef] [Green Version]

- Nalholm, Morten, and Rolf Poulsen. 2006a. Static hedging and model risk for barrier options. Journal of Futures Markets 26: 449–63. [Google Scholar] [CrossRef]

- Nalholm, Morten, and Rolf Poulsen. 2006b. Static hedging of barrier options under general asset dynamics: Unification and application. Journal of Derivatives 13: 46–60. [Google Scholar] [CrossRef]

- Nian, Ke, Thomas F. Coleman, and Yuying Li. 2018. Learning minimum variance discrete hedging directly from the market. Quantitative Finance 18: 1115–128. [Google Scholar] [CrossRef]

- Pham, Huyên. 2000. On quadratic hedging in continuous time. Mathematical Methods of Operations Research 51: 315–39. [Google Scholar] [CrossRef]

- Reiner, Eric, and Mark Rubinstein. 1991. Breaking down the barriers. Risk 4: 28–35. [Google Scholar]

- Schoutens, Wim, Erwin Simons, and Jurgen Tistaert. 2004. A perfect calibration! Now what? Wilmott Magazine, 66–78. [Google Scholar] [CrossRef]

- Schoutens, Wim. 2003. Lévy Processes in Finance—Pricing Financial Derivatives. New Jersey: Wiley. [Google Scholar]

- Schweizer, Martin. 2001. A guided tour through quadratic hedging approaches. In Option Pricing, Interest Rates and Risk Management. Edited by Elyès Jouini, Jakša Cvitanić and Marek Musiela. Cambridge: Cambridge University Press, pp. 538–74. [Google Scholar]

- Tompkins, Robert G. 2002. Static versus dynamic hedging of exotic options: An evaluation of hedge performance via simulation. Journal of Risk Finance 3: 6–34. [Google Scholar] [CrossRef]

- Vähämaa, Sami. 2004. Delta hedging with the smile. Financial Markets and Portfolio Management 18: 241–55. [Google Scholar] [CrossRef]

- Wallmeier, Martin, and Martin Diethelm. 2009. Market pricing of exotic structured products: The case of multi-asset barrier reverse convertibles in Switzerland. Journal of Derivatives 17: 59–72. [Google Scholar] [CrossRef] [Green Version]

| Hedge: | Standard | MSE | None | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Underlying | Underlying | Call (1 day) | Call (5 days) | ||||||

| SVJ | BS | SVJ | BS | SVJ | BS | SVJ | BS | ||

| Panel A: Deltas | |||||||||

| 80.01 | 3.69 | 3.72 | 1.68 | 1.89 | 3.28 | 3.67 | 3.58 | 3.94 | 0 |

| 80.40 | 3.21 | 3.39 | 2.10 | 2.33 | 3.16 | 3.33 | 3.80 | 4.01 | 0 |

| 80.80 | 2.89 | 3.15 | 2.38 | 2.60 | 3.00 | 3.09 | 3.76 | 3.86 | 0 |

| 81.80 | 2.26 | 2.59 | 2.38 | 2.52 | 2.52 | 2.57 | 3.03 | 3.01 | 0 |

| Panel B: RMSEs | |||||||||

| 80.01 | 2.15 | 2.17 | 1.00 | 1.02 | 0.38 | 0.44 | 0.70 | 0.72 | 1.87 |

| 80.40 | 1.41 | 1.54 | 0.93 | 0.96 | 0.40 | 0.42 | 0.68 | 0.69 | 2.20 |

| 80.80 | 0.95 | 1.10 | 0.81 | 0.84 | 0.43 | 0.44 | 0.67 | 0.67 | 2.41 |

| 81.80 | 0.64 | 0.66 | 0.63 | 0.65 | 0.50 | 0.51 | 0.70 | 0.70 | 2.39 |

| Panel C: Variance Reduction | |||||||||

| 80.01 | 0 | −0.02 | 0.78 | 0.78 | 0.97 | 0.96 | 0.89 | 0.89 | 0.24 |

| 80.40 | 0 | −0.20 | 0.56 | 0.54 | 0.92 | 0.91 | 0.77 | 0.76 | −1.43 |

| 80.80 | 0 | −0.33 | 0.26 | 0.21 | 0.79 | 0.79 | 0.50 | 0.50 | −5.43 |

| 81.80 | 0 | −0.07 | 0.03 | −0.02 | 0.38 | 0.38 | −0.18 | −0.18 | −12.85 |

| Hedge: | Standard | MSE | None | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Underlying | Underlying | Call (1 day) | Call (5 days) | ||||||

| SVJ | BS | SVJ | BS | SVJ | BS | SVJ | BS | ||

| Panel A: Value at risk long hedge | |||||||||

| 80.01 | 1.72 | 1.76 | 1.19 | 1.18 | 0.08 | 0.36 | 0.90 | 0.88 | 1.32 |

| 80.40 | 0.86 | 1.06 | 1.09 | 1.00 | 0.15 | 0.29 | 0.83 | 0.79 | 2.04 |

| 80.80 | 0.56 | 0.72 | 0.88 | 0.72 | 0.24 | 0.32 | 0.81 | 0.78 | 2.91 |

| 81.80 | 0.80 | 0.56 | 0.68 | 0.57 | 0.58 | 0.50 | 1.08 | 1.09 | 4.32 |

| Panel B: Value at risk short hedge | |||||||||

| 80.01 | 4.19 | 4.23 | 1.80 | 1.78 | 0.37 | 0.17 | 1.04 | 1.08 | 4.02 |

| 80.40 | 2.77 | 3.04 | 1.48 | 1.49 | 0.44 | 0.34 | 0.94 | 0.96 | 4.33 |

| 80.80 | 1.45 | 1.84 | 1.06 | 1.06 | 0.51 | 0.46 | 0.86 | 0.84 | 4.33 |

| 81.80 | 0.72 | 0.60 | 0.66 | 0.61 | 0.64 | 0.62 | 0.85 | 0.85 | 3.69 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Baule, R.; Rosenthal, P. Time-Discrete Hedging of Down-and-Out Puts with Overnight Trading Gaps. J. Risk Financial Manag. 2022, 15, 29. https://doi.org/10.3390/jrfm15010029

Baule R, Rosenthal P. Time-Discrete Hedging of Down-and-Out Puts with Overnight Trading Gaps. Journal of Risk and Financial Management. 2022; 15(1):29. https://doi.org/10.3390/jrfm15010029

Chicago/Turabian StyleBaule, Rainer, and Philip Rosenthal. 2022. "Time-Discrete Hedging of Down-and-Out Puts with Overnight Trading Gaps" Journal of Risk and Financial Management 15, no. 1: 29. https://doi.org/10.3390/jrfm15010029

APA StyleBaule, R., & Rosenthal, P. (2022). Time-Discrete Hedging of Down-and-Out Puts with Overnight Trading Gaps. Journal of Risk and Financial Management, 15(1), 29. https://doi.org/10.3390/jrfm15010029